Opening Comments

Lots to cover today, so shorter opening comments. I am going to be changing the format of the podcast to interviews, rather than just be going over the report. Remember, there are anchor links in the Table of Contents to take you to the section you want to go to.

Markets

JPM’s Marko Kolanovic Negative on Stocks

Work From Home Issues

CA Wealth Tax Proposal-Bad Idea

GS Four Worst Housing Markets in 2023

10 Best Cities to Buy in 2023

Europe Housing Market Slowdown

NYCHA Rent Collection Plummeting

Video of the Day-Hero Wrestles gun from CA Shooter

I believe 11 people were killed in California at a Chinese New Year celebration. The shooter was a 72-year-old Asian man who later killed himself. This 30 second video shows the hero, Brandon Tsay, wrestling the gun away from the shooter.

Eye on the Market-American Gothic-Mike Cembalest

I have written extensively about the growing Federal Debt and upcoming Debt Ceiling issues. Mike has great charts and explains it much better than I did in his latest piece, American Gothic.

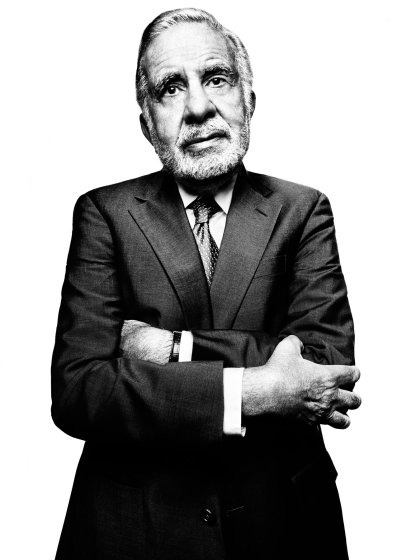

My Memorable Dinner with Legendary Investor, Carl Icahn

I have had many meetings, lunches, and dinners with powerful people over the past 25 years. The list includes Jamie Dimon, Jimmy Lee, Ron Perelman, Ben Bernanke, Tim Geithner, Dan Loeb, John Paulson, Coach K, Mary Ann Tighe, Anshu Jain, Bill Gross, Mohamed El-Erian, Tony Ressler, Mary Erdoes, Rick Rieder, Senator Frank Lautenberg, Rupert Murdoch, David Einhorn, Jeff Aronson and many others. One of my fondest memories was my dinner with Carl Icahn early in 2012.

For those who do not know Icahn, he is indeed an icon in the business and finance world who continues to shake things up even though he is now 86-years-old. He started his career as a stock broker, bought a seat on the NY Stock Exchange and then started doing takeovers in the late 1970s/early 1980s. He famously acquired TWA in the mid-1980s and began selling assets to pay down debt. He became known as a “corporate raider.” He bought large stakes in US Steel, Texaco, Western Company, Marvel Comics, RJR Nabisco and many others which can be found in this link. He made billions on Netflix and Apple more recently. He is famous for his aggressive approach to shareholder activism. Icahn’s net worth is in the $20bn range and is viewed as one of the most successful investors of all time.

I had been speaking with Carl about trade ideas, and helped him hedge his portfolio when I was running Fixed Income at UBS. Many of the trades we put on worked out quite well in 2011, given the 20% draw down in the S&P between July and October. The market volatility was in part due to the Debt Ceiling Crisis and S&P downgrading the US sovereign debt from AAA to AA+.

I went to dinner with Carl at a Midtown Chinese restaurant, but don’t recall the name. The purpose of the dinner was to get to know each other better and potentially work out a deal for me to work for him. Carl must have been 76-years-old at the time. I barely could take a bite out of my food between listening intently and my hysterical laughter at Carl’s stories. Carl was witty, articulate, sharp and recalled details of deals from 30 years prior with clarity. I have been around a lot of people this age and do not recall one being this sharp, or even close. His stories about battles with boards, CEOs, corporate lawyers and vivid negotiations were amazing. Icahn’s delivery was world class, and I was riveted. I am not convinced I learned more about deals or had a better time at any other dinner in my life.

I don’t recall receiving a formal offer, but believe I could have gone for a 10% deal, which we discussed after dinner. This means I could have kept 10% of the profits made for the ideas I generated, but needed to be approved by Carl. I would have had access to the Icahn calling card (Amazing) and his personal capital. I could size-up positions as his son, Brett, did (Netflix & Apple) if Carl approved. In hindsight, I regret not pushing to go work for the great investor, as I know I would have learned so much from and had a great time in the process. My biggest fear is I would have wanted to listen to him talk all-day, and it would have been hard for me to focus on work. In the end, I decided to launch a hedge fund, Reef Road Capital, but often wondered how much better of an investor I would have become had I ended up learning from one of the all-time investing greats for a few years.

He has a ton of great quotes with some in this link.

“Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

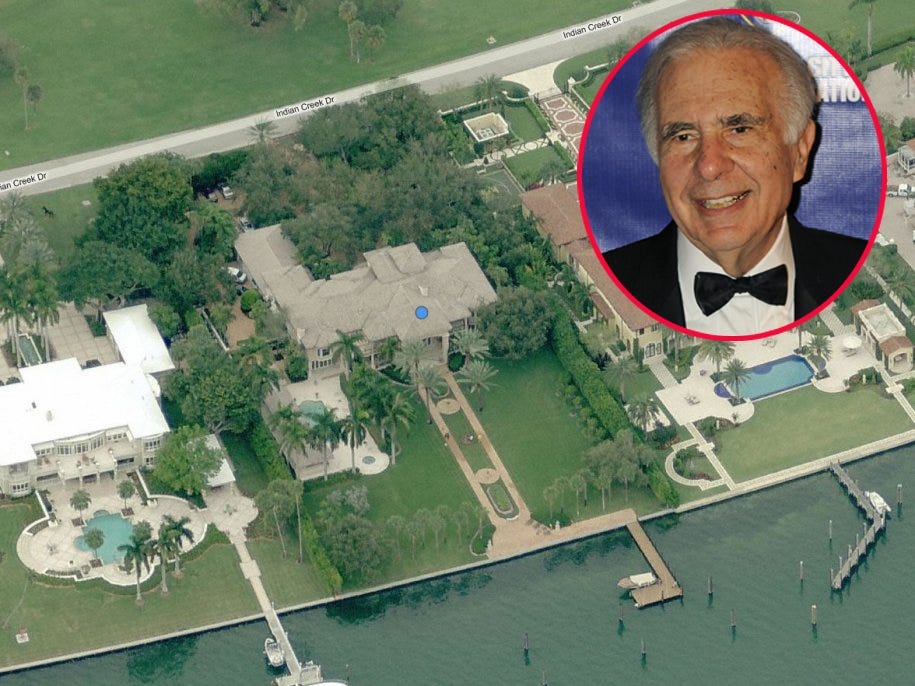

As an aside, Carl took his tens of billions and left NYC for Miami a few years ago. Think of the budget deficit he left in NYC when he took his money, employees (personal and professional) with him to South Florida. Carl is a sharp investor with a great track record and although he has a reputation for being a hard-ass negotiator, I found him to be incredibly friendly and funny. In one report, Icahn compounded between 1968-2011 at a whopping 31%. Nothing but respect for his investment prowess and his story telling is as good as it gets. Carl is philanthropic and has signed the “Giving Pledge” supporting education initiatives. If I could have a dinner with anyone, it would be Musk, but number two would be dining with Ichan again, as it was that much fun and so interesting.

Quick Bites

After a substantial rally Monday, market sentiment cooled slightly with earnings and growing recession fears. MSFT exceeded earnings, but offered lackluster guidance and the stock fell nearly 4% before rallying back later in the day. So far, 90 out of 500 S&P companies have reported and 86% beat expectations. The Nasdaq closed lower Wednesday for a second day as investors studied the latest batch of corporate earnings, and assessed how the largest companies are faring amid rising rates and mounting recession fears. The tech-heavy index dipped 0.18% to close at 11,313, while the S&P 500 dipped 0.02% to settle at 4,016. The Dow eked out a small gain, rising 10 points to end at 33,744. Stocks pared their losses during afternoon trading, with the Dow bouncing back from a more than 460-point tumble. At its lows, the Nasdaq shed 2.34%. After the close, TSLA reported and was up slightly after beating on revenues and earnings. I did not have time to get through the earnings report. However, Musk warned of challenges including higher rates, stronger competition and diminished brand popularity.

JPMorgan’s Marko Kolanovic is abstaining from the early 2023 rally.

Instead, the Institutional Investor hall-of-famer is bracing for a 10% or more correction in the first half of this year, telling investors he’s “outright negative” on the market. “Fundamentals are deteriorating. And, the market has been moving up. So, that has to clash at some point,” the firm’s chief market strategist and global research co-head told CNBC Tuesday. Kolanovic has had some very good calls and has been #1 on the Institutional Investor Strategist Ranking. He lists positive developments including China’s reopening from Covid-19 lockdowns and a weaker dollar for market enthusiasm. “I just don’t think that at 5% rates we can have this economy functioning,” said Kolanovic, who noted private equity and venture capitalists can’t exist in this kind of environment. “Something will have to give, and the Fed will need to flinch.” I have talked about a Fed pause and pivot for a couple months and written my view numerous times. Blackrock Strategist, Gargi Chaudhuri thinks the recent rally is a head-fake.

There are a great deal of benefits of Work From Home (WFH), but there are drawbacks too. Dimon Says Remote Work ‘Doesn’t Work’ for Younger Staff, Management. The benefits of WFH include reduced commute time, better work/life balance, more flexibility, less cost (commuting, eating out, work clothes), less stress, helps keep parents with childcare responsibilities employed… However, the drawbacks are lost productivity, reduced collaboration, and it is challenging to develop younger talent. I’ve mentored a great number of college students and young professionals and have heard from many that they are not learning and are miserable about the lack of mentorship and development due remote work. One of the young professionals I mentored recently quit his remote job and now is in an office and LOVES it. He has learned a great deal in a few short months. I do think a hybrid model of a few days a week works well in many instances, but for some, you really need to be in the office more frequently.

I have written many times that I do not believe you can tax your way to prosperity, and when you look at the numbers leaving high-tax states such as CA, NYC and IL, it is evident. Despite this fact, CA is proposing another Wealth Tax of 1.5% on worldwide net worth above $1bn starting in January 2024. In 2024, the threshold would drop to $50mm and would be a 1% annual tax on wealth, but the $1bn will remain at 1.5%. The tax will remain in effect years after you leave the state! CA is also working on raising the top marginal tax rate to 14.05% on earnings above $5mm. There are bad ideas and really bad ideas. The ramifications and costs of implementing a wealth tax are massive. Think of the impact on Musk and Zuck who lost $100-250bn, but would have had to pay billions in taxes. I am adamantly opposed to such a stupid idea. It is unclear if Newsom is supportive of these proposed tax changes. If you want to bring wealth and business back to CA, use a carrot, not a stick and lower taxes for the wealthy. CA now faces a projected $22-24bn deficit, in part due to high profile departures. Remember, LA County passed a bill effective April which imposes a 4% flip tax on any property over $5bnn and a 5.5% flip tax over $10mm. I was looking at buying a vacation home in Tahoe, but due to the stupidity of proposals, I’m out. The top 1% of NY and CA residents pay approximately 50% of the taxes.

Other Headlines

Bank of America, JPMorgan and other banks reportedly team up on digital wallet to rival Apple Pay

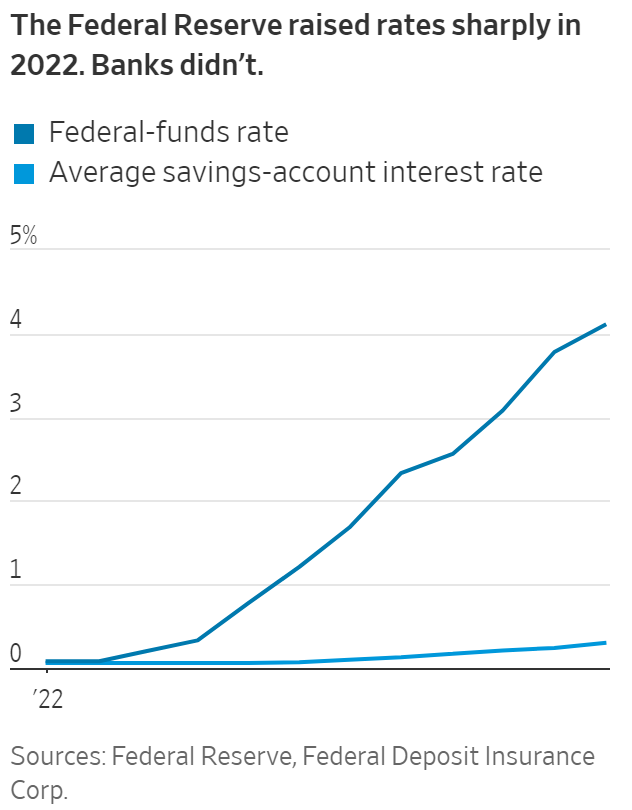

Rich Customers Pull Money From Banks Offering Paltry Interest Rates

I have written about this topic multiple times and given various higher yielding alternatives. The article suggests the wealthy are moving into Treasuries and money market funds as I had suggested.

Citadel Makes $16 Billion to Top Paulson’s ‘Greatest Trade Ever’

I believe Griffin is the CEO of 2022 between performance of his funds, Securities business and his move from Chicago to Florida. He is a true genius and leader.

DOJ files second antitrust suit against Google, seeks to break up its ad business

Convenient Timing: Pelosi Sold $3 Million of Google Stock Weeks Before DOJ Launched Antitrust Probe

This is both a Left and Right issue. These politicians should NOT BE ABLE TO TRADE STOCKS. PERIOD. The stock is up since she sold it because the broader market has rallied sharply. I am adamantly opposed to politicians trading stocks.

Microsoft announces new multibillion-dollar investment in ChatGPT-maker OpenAI

Former Vice President Mike Pence discovered classified documents in Indiana home

It seems every senior politician in the history of DC has confidential documents at home. What a clown show.

Santos’s financial woes pile up, threatening his political career

This is embarrassing for Congress and the Republican Party. 49% of those surveyed suggest he should resign and I don’t know why it is not 100%. I am convinced he has never told one truth in his life. The stories are so absurd, you almost cannot believe it. How did he get picked for two committees? A reader sent me this awesome Bill Maher take--down of Santos. Hysterical. Time for Santos to be taken out of office.

Biden Approval Rating to 41% according to American Research Group

Facebook and Instagram to end Trump's suspension from platforms

The former FBI official busted Monday for allegedly taking illegal foreign payments played a key role in the bureau’s controversial “Russiagate” probe of former President Donald Trump — and a “defensive briefing” of ex-rival Hillary Clinton’s lawyers. You cannot make it up. He was involved in Russiagate while at the FBI and is arrested for collusion with Russia.

Japan ‘on the Verge’ of Societal Collapse Due to Plummeting Birth Rate, Prime Minister Says

I was shocked by some of the statistics in this article. In Japan, only 3% of its population is foreign-born, but in America, approximately 25% is born outside of the USA. When the average # of children born to each woman drops below 2.1, a society begins to shrink. In Japan, the rate is 1.36 in 2022. The fertility rate in China has crashed down to 1.08 from 2.7 in 1980.

Midriff bulge linked to later physical decline, study says

Given my father’s death at 39, I try to take my health pretty seriously between diet and excessive. At 53, the battle is getting more challenging, especially since I am always injured.

Philadelphia needs lifeguards -- so they're hiring non-swimmers

What could possibly go wrong here? They better have a sign up to tell swimmers the lifeguard is new to swimming.

Earth’s Core Has Stopped and May Be Reversing Direction, Study Says

Fascinating article about the earth’s core and spinning pattern cycles which last 60-70 years. The suggestion is it impacts the climate and geological phenomena.

Scientists Have Just Created a Black Hole in The Lab, And It Has Unexpectedly Started to Glow

COVID was created in a lab in Wuhan. What could possibly go wrong?

Spaceship of 'non-human origin' spotted near US-Mexico border: UFO expert

For all my new readers, many Rosen Report followers like UFO stories. I believe we are not alone. Unfortunately, I have never knowingly been abducted. I have spoken with multiple pilots who claim they have seen object which are not possible with technology available today. The image below was enhanced with Artificial Intelligence from the link above.

We have always known Ukraine was corrupt, but Come on, Man.

U.S. will send Abrams tanks to Ukraine ahead of expected Russian offensive

Crime Headlines

Fox News weatherman Adam Klotz beaten on NYC subway train

Until there are consequences for crime and the DAs take crime more seriously, these crimes will continue.

Wild melee erupts at NYC migrant shelter as residents throwing bottles are stabbed

It was at the Stewart Hotel on 31st and 7th which is now a shelter. Two brothers were stabbed. Note to self, let’s not stay at the Stewart when we go to NYC.

Vandal jumps out of SUV to damage NYC synagogue in suspected hate crime

I would like to see Hate Crimes have harsher mandatory sentencing.

Spoiled children of privilege trying to burn Atlanta down

Antifa was involved as well.

Real Estate

As interest rates continue to skyrocket, home prices across the country have continued to plummet — and Goldman Sachs says the declines will only worsen and extend through 2023. In a note to clients earlier this month, Goldman Sachs forecasted that four American cities in particular should gear up for a seismic decline compared to that of the 2008 housing crash. San Jose, California; Austin, Texas; Phoenix, Arizona; and San Diego, California will likely see boom and bust declines of more than 25%. Such declines would rival those seen around 15 years ago during the Great Recession. Home prices across the United States fell around 27%, according to the S&P CoreLogic Case-Shiller index.

The 10 best cities to buy a home in 2023 are all in the South

I am not convinced I could live in any of these places. The article shows the median priced home in each location.

Sandy Springs-Marietta, GA

Raleigh, NC

Arlington, TX

Fayetteville, AK

Greenville, SC

Charleston, SC

Huntsville, AL

Jacksonville, FL

San Antonio, TX

Knoxville, TN

Great Bloomberg article entitled, “Europe Is Bracing for a Sharp, Abrupt Real Estate Reversal.” Good charts and quotes from the piece as well. “Europe is going to go through the great unwind of 10 years of easy money,” said Skardon Baker, a partner at private equity firm Apollo Global Management. “The amount of distress and dislocation is off the spectrum.” Loans, bonds and other debt totaling about €1.9 trillion ($2.1 trillion) — nearly the size of the Italian economy — are secured against commercial property or extended to landlords in Europe and the UK, according to the European Banking Authority.

Cash-strapped NYCHA’s (Housing Authority) rent collection is crashing to a record low. The public housing agency reportedly collected just 65% of the rent it charged during the 12 months leading up to December — the lowest in NYCHA’s history. The alarming cash drain — figured at about a half-billion dollars — is the lowest in NYCHA’s history, and a stunning slide from annual pre-pandemic numbers of 90% or better, the New York Times reported. The money loss could also hobble the agency’s performance of essential services — like repairing elevators or addressing mold growth at 177,569 apartments within 335 developments around the city. The NYCHA’s operating costs per unit are up 50% since 2013 and has cut 150 jobs earlier this month.

Other R/E Headlines

Chicago mayor candidate reveals tax-the-rich plan that will make the suburbs 'pay their fair share'

The progressive candidate seeks to create $800 million in new government revenue to help pay for his proposed $1 billion in new spending.

Madison Avenue tower adding 'multi-faceted' dining concept by celebrated COTE creator Midtown needs more good eats, so this is a positive.

Land in Bel-Air Hits Auction Block at 70% Discount. Bids Start at $39 Million.

It’s a ‘last shot’ to find a buyer for property that was listed in 2013 at $125 million. The deal must close prior to April 1st to avoid the 5.5% newly imposed flip tax I have written about. The 260 acre property accounts for 6% of the land in Bel-Air. Once you own it, good luck getting everything approved.

Weekly mortgage demand jumps 7% as interest rates drop to lowest level since September

Virus/Vaccine

Data improving across the board.

Follow me on Linkedin