Opening Comments

Podcast-25 minutes. I believe I solved a mic issue and the sound is improved. There a ton of good charts in this piece, so even if you listen, you should check them out as well.

I hope everyone had a safe and joyous holiday. Happy New Year to all the Rosen Report readers out there. We stayed local and froze for a couple days in the 40s in very unseasonably cold weather, but other than that it was fantastic.

Reminder that in coming weeks, I will be updating the outline of the report and podcast with the help of an outside consultant. There may be some asks of my readers to help me improve the format and distribution.

I listened to a podcast of Jeff Gundlach (CEO of DoubleLine) and he thinks there is a 75% chance of a Fed cut in 2023 and also believes there will be a recession in early 2023. I have repeatedly made these statements in prior reports. I recommended 2-3 year Treasuries 2-months ago, and the market is telling us something with the rally in prices. Jeff did make some damaging comments on the lack of liquidity in bond markets, namely in Treasuries which is quite concerning. Jeff would not buy China stocks either and explains why in an interesting take.

If you focus on only a few things today, I would look at the Picture of the Day and my 1st bullet in Quick Bites on the market, as I put together some informative charts to explain various markets. Also in that section, the last bullet is about a concerning trend of “equity” in schools and hiring. Lastly, the R/E section is substantial with much to see.

Pictures of the Day-Fed Tightening Cycle

An Offer You CAN Refuse

Quick Bites

Markets

US Crashing Savings Rate

Global Fossil Fuel Reliance

Equity in Education is Hurting Those Who Work Hard

Other Headlines

Crime Headlines

Real Estate-BIG R/E Section Today

Moody’s on R/E

Cap Rate Pressures

Palm Beach Updated Pricing

$31mm Miami Compound

Office REIT Chart-Yikes

Virus/Vaccine-New Variant

Picture of the Day-Fed Tightening Cycles in Picture

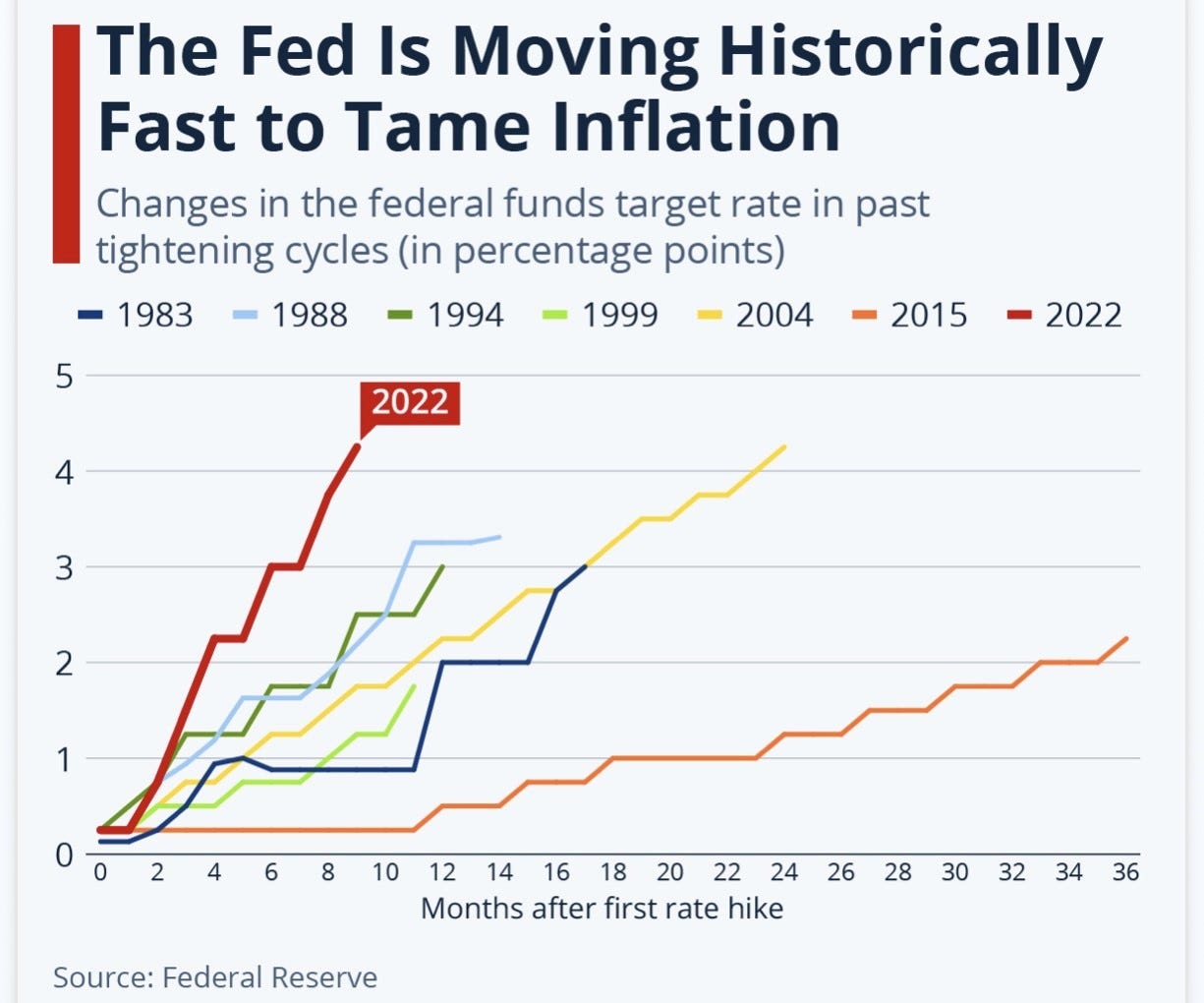

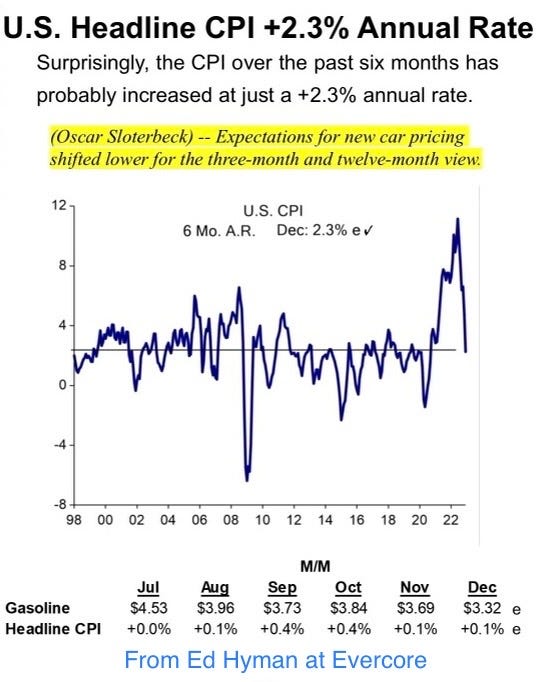

As you can see in the picture below, the Fed’s actions in this tightening cycle are unprecedented. In 8 months, the Fed has raised rates over 4% and in 1994, the same move took 24 months, or 3 times longer. I do not believe we have felt all of the impacts of these moves yet, and of the opinion that the Fed will pause and pivot in 2023, as inflation is coming down quickly (2nd chart). Powell missed the boat suggesting inflation was “transitory,” but my readers knew better as I was crushing Powell and the Fed for the bad policies which contributed significantly to our inflation issues in 2022. I do believe the speed of the rate increases in this cycle will reduce the time it generally takes to see a bottom in housing relative to previous cycles.

An Offer You CAN Refuse

My readers know that two years ago, I bought a 2021 Kia Tellruide “Nightfall” SUV for $52k (all taxes and fees). I love the car, and it has had zero issues. I received a letter in the mail suggesting the dealer “needs” used cars and the need “won’t last.” I was surprised by the letter given Cox Automotive said US inventory rose by another 150k vehicles in November to hit 1.61mm, which is the most of 2022. That is up almost 80% from November last year but still remains under the pre-COVID level. Used car prices are crashing and inventory is building, which should not suggest a dealer wants to pay a premium for my vehicle. I feel I am a commercial business person who can find a lot of ways to get a deal done. So let’s see how this one played out.

I called the manager’s number on the letter and let him know I was open to considering a trade-in if the deal was favorable but was not in a rush to do anything. He said, “If that is your position, we will have a deal to do. I have 10 new Kia Telluride vehicles in stock and feel we will make you an offer you can’t refuse.”

Mistakenly, in my mind, I was thinking about the great deal I was going to get by trading in my car with 23k miles for a brand new one with limited expense. I went to the dealer as coincidentally, my car needed oil and tire rotation. The manager showed me the new cars and 5 out of 10 were a vile green. I asked, “With so many new cars in stock, why do you care about mine?”

He responded, “We need more used SUVs in good shape in the lot, and if we can move a new one, even better. Go find the car you want, and I will make you a deal you can’t refuse.”

I found a fully loaded 2023 model in the blue below with all the bells and whistles. It was a slight upgrade in features from my model. I said, “This is the only car I would consider. If you make me a deal, I will do it now and pay the difference in cash. If not, I really don’t care.”

As usual, the dealers need to “Run the numbers.” They put down a sheet of paper in front of me in dramatic fashion and suggested they can do the trade if I pay $23k+. I started laughing and said, “This is a deal I can’t refuse? Is this a joke?” I told him I would pay $5k, and he was upset. I don’t know what he said, as I was walking out the door. It was a strong negotiating tactic, but maybe a little too strong as he did not follow me out. Maybe the lack of a deal has to do with crashing used car prices as outlined in the Manheim Index chart below which is -18% YTD.

My car in “Nightfall” is below and they no longer offer this attractive package for some dumb reason. It has blacked out letters and no chrome which I think makes it look nicer than the new models.

The manager did a poor job of managing my expectations and was disappointed I did not take his crap offer. Just don’t set my expectations so high that I am disappointed. Make me a reasonable offer. I like the aesthetic of my version much better, but the “new” factor and improved features would have had me pay up $8-10k if there was a deal to be had. It was clearly a deal I CAN refuse.

Quick Bites

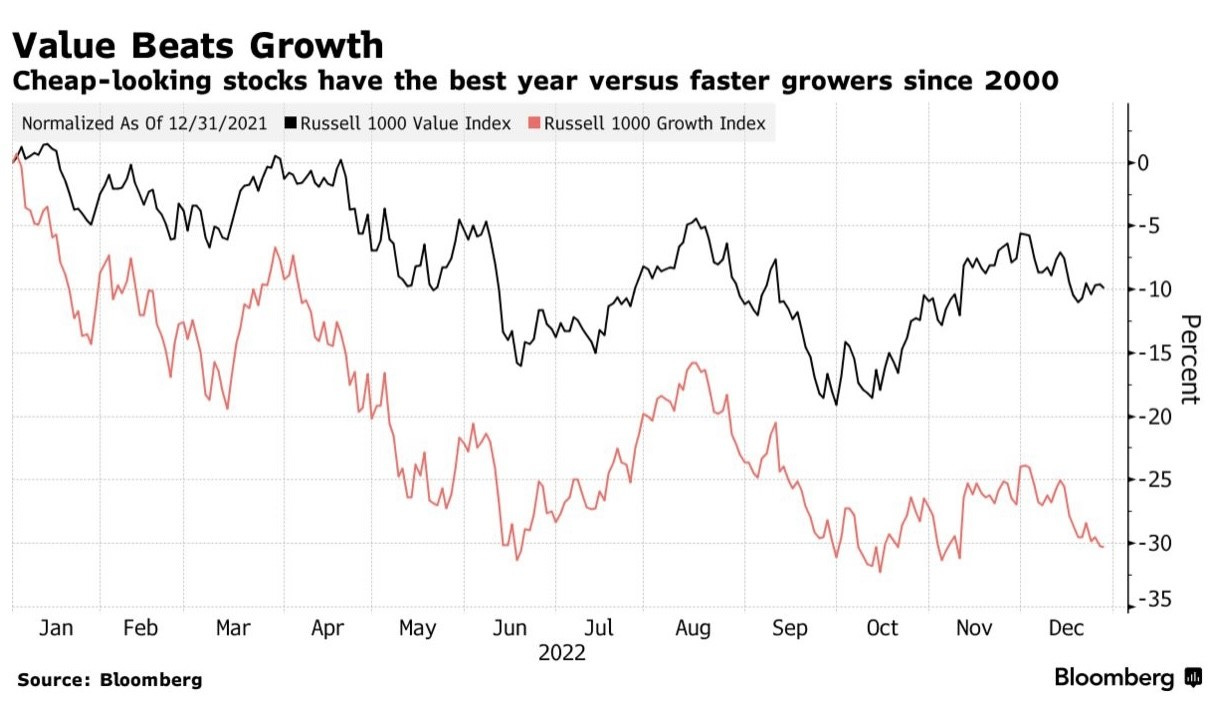

Almost 80% of the time, the final week of the year sees a rally called the “Santa Claus Rally,” but not in 2022. This year was the worst performing year for stocks since 2008. Obviously the hawkish Fed played a huge part, but the war in Ukraine, China lock-downs, crypto crash and inflation all played a roll. In 2022, a balanced portfolio of 60/40 US Stocks/Bonds was -17.5%, the worst year since 1937 (2nd chart). I have a chart of select stocks, indices, sectors, commodities and crypto which shows Month to Date and Year to Date performance and is sorted by YTD by type. Tech was crushed on the back of higher rates and slowing growth. Value sharply outperformed growth (4th chart). Energy was the huge winner and coal knocked it out of the park in an ironic twist as the world continues to hate on fossil fuels. Many coal stocks were up over 100% on the year. Big banks like JPM and Goldman outperformed in the higher rate environment despite the sharp fall off in investment banking activity. TSLA fell almost 70% on the year and According to this article, global stocks lost $18 trillion in 2022, and trillions more were lost in fixed income markets. The 5th chart outlines the largest YTD losses from a market capitalization perspective and the top were Apple, Amazon, Microsoft, Tesla and Meta. On bonds, the 2-Year Treasury went from .74% to 4.28% YTD and the 10-Year Treasury from 1.51% to 3.88% in conjunction with the Fed’s aggressive moves to fight inflation. The US Dollar rallied sharply against the basket most of the year before a substantial reversal as inflation is heading down, and the Fed is closer to the end of rate hikes (6th chart). The US High Yield market was down 10.61% YTD through the 29th, and investment grade bonds were -15.8% on the year. YTD stock IPO proceeds were -94.6% and -82.1% in terms of the number of deals. Couple this with the massive slowdown in banking fees between M&A and fixed income underwriting and Investment Bank fees were down sharply leading to lower bonuses and layoffs.

I have written extensively on the savings rate crashing and appreciate these charts from the Fed showing it graphically. Given high inflation, wages not keeping up and many choosing not to work, you have a massive dip in savings after a huge run-up with free government handouts. In 2022, US household savings was $4.9 trillion and today it is approximately $500bn and are now below pre-pandemic levels. The savings rate was 33.8% in April 2020 and is down to 2.4% today. As credit card debt is rising, losses on stocks and fixed income rising, housing prices tipping over and a reluctance to go back to work with over 10mm open jobs, something has got to give in my opinion. I fear the consumer will be pulling back more aggressively in 2023.

To be clear, I am a Tesla owner for 6 years and would love to see more EVs and less reliance on fossil fuels. However, as I have written multiple times, the world will be reliant on fossil fuels for decades. According to Brian Gitt, 83% of the world's energy comes from fossil fuels. That's down 3% from 20 yrs ago. He believes the world will consume more fossil fuels in 2050 than today based on projected growth in the developing world. I am not sure about his 2050 prediction. I hope he is wrong. The US Energy Information Administration (EIA) also agrees that fossil fuels will dominate in 2050 despite all the vilification of the industry, but wind and solar will be growing quickly. The EIA believes world energy consumption will rise 50% by 2050.

This story is quite upsetting to me. The title is, “Top U.S. High School Deprived Students of National Merit Awards as Part of ‘Equity’ Policy,” and discussed administrators who purposely held back National Merit Awards from deserving students for years. “We want to recognize students for who they are as individuals, not focus on their achievements,” TJ’s director of student services, Brandon Kosatka, reportedly told a parent concerned about the delayed distribution of the awards. The deserving students lost out on scholarships and were rejected from top schools due to not having the awards on their applications. The principal is Ann Bonitaibus, and how this woman has a job is beyond me. For the sake of equity, I feel the distinguished principal should have the same salary as the cafeteria workers. Thomas Jefferson High School for Science and Technology in Virginia was the scene of the crime. US News and World Reports named it the best high school in the nation in 2022. More on the subject here. I want to be clear; participation trophies are for losers. When you have a real job, the boss does not give everyone the same pay or promotions. Your body of work, effort contribution matter in life. We are teaching kids the wrong things in school, and this is a perfect example. Parents should consider suing the school and the administrators individually. Think of the lost income for those who might have been admitted to Harvard, Stanford or MIT if not for the bad acts of the administration. America is on the wrong path if people want to suggest hard work and dedication are not rewarded. This article suggests some companies now don’t want to know where you went to college in the name of equity and will no allow resumes with colleges. Show me a public company who does this and I will short it.

Other Headlines

David Tepper 'leaning short' on stocks into 2023 due to global rate tightening

“The upside/downside just doesn’t make sense to me when I have so many ... central banks telling me what they are going to do.”

Dow headed below 30,000, slim chance of soft landing for economy: CFOs

This is definitely concerning along with blue collar wage growth, but just about everything else is coming down in price. Egg prices rose 49% in 2022.

Instacart cuts internal valuation another 20%

That valuation is down 20% from an October valuation of $13 billion, and even further off the $39 billion valuation reported last year. Let’s think about all those private company valuations at funds and how they may be a wee bit too high unless they slashed them recently.

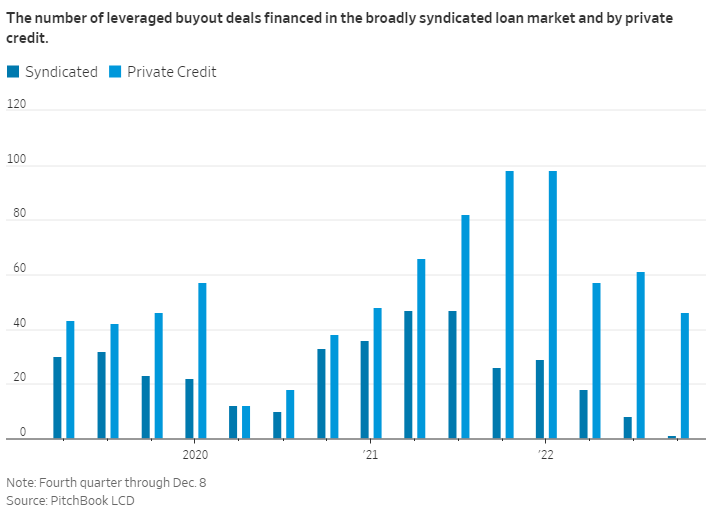

Credit Deals Are Going Private, Leaving Wall Street in the Cold

PitchBook LCD tracked 46 leveraged buyouts financed by private credit in the fourth quarter through Dec. 8, versus just one financed by the broadly syndicated loan market.

Sam Bankman-Fried used $546M in Alameda funds to buy Robinhood stake

Every article gets worse. He needs to plea out or could end up in prison for life.

Twitter Files expose government influence on suppressing COVID messages that contradicted WH

"The United States government pressured Twitter and other social media platforms to elevate certain content and suppress other content about COVID-19," Zweig said. Musk announced his new policy below and some are freaking out about it. Also of note, Fidelity marked down its equity stake in Twitter by 56% and I think that is still too high based on where things stand today. I would love to know where the banks are marking the loans.

Please watch Elon Musk on the All-in Podcast from 12/24. Musk starts at 59:30 minutes and talks about product innovation, Freedom of Speech, employees, the Twitter files at 1hr:21min. Elon Musk is incredibly impressive despite being a bit of a lose cannon. “Almost every conspiracy theory people thought about Twitter turned out to be true,” according to Musk." The FBI involvement is quite troubling for Free Speech.

Tesla used car price bubble pops, weighs on new car demand

When I bought a TSLA in 2021 due to my wife’s car being totaled, it was a disaster with a 6 month wait for a new car and very high used prices. That is no longer the case. The average price for a used Tesla in November was $55,754, down 17% from a July peak of $67,297. This makes wanting to spend so much for a new one a bit more challenging in a higher rate environment likely going into a recession. Almost 1/3rd of used TSLA models for sale were from 2022, suggesting people bought them to flip.

We are a long way away from having EVs be the only cars on the road for a host of reasons including lack of rare earths, power grids, cost, range, and apparently charging ability in adverse conditions.

Joe Rogan podcast guest explains ‘heart-wrenching’ source of electric vehicle, iPhone batteries

A Harvard professor exposed he horrific conditions of the cobalt mining industry in the Congo with child labor and inhumane conditions which is the source of 75% of cobalt.

Liar Rep.-elect George Santos admits fabricating key details of his bio

Santos said, “My sins here are embellishing my resume. I’m sorry.” He should not hold office. For a career in politics, lying is normal, but I am not convinced anything on his resume is true (education, work experience, charity work) and his claims of Jewish heritage. There are also lots of questions on his campaign expenses. On Fox News, Tulsi Gabbard EVISCERATES Santos. More unbiased reporting like this needs to happen in the media. Watch this video. It should be noted, the current President has misrepresented many facts on his life and continues to do so.

Florida Leads US Population Growth for First Time in 65 Years

Florida’s population increased by 1.9% to 22.2 million between 2021 and 2022, the data show, surpassing Idaho, which led last year.

NYU's emergency room gave special treatment to donors and VIPs including Chuck Schumer, report says

Let me get this right, someone who donated hundreds of millions of dollars and raised BILLIONS of dollars for a hospital to help saves thousands of lives was given special treatment (Ken Langone)? Would you rather he not give the money to improve the state of healthcare?

How Many Attended Brittney Griner's Welcome Home Party?

According to various articles, 20 people showed up. I wrote about this prisoner swap extensively and was adamantly opposed.

Thousands Lose Power After Three Substations Targeted in Washington State, Sheriff Says

The best new Miami restaurants for 2022

5 readers are bragging about “Hiden,” an 8 seat Omakase restaurant in Miami for $300/person. I am yet to try it.

Chinese jet came within 20 feet of American military aircraft, U.S. military says

Crime Headlines

Roland Codrington charged in NYC slashing spree that left doctor dead

Rookie cop attacked by alleged Islamic extremist with machete near Times Square

First day on the job for the officer. Another article suggested multiple officers were attacked.

Serial NYC shoplifter who's dodged jail nabbed for NEW 27 heists

No explanation for this criminal will make it ok with me. He is damaging the community with no consequences. Two prison stints for rape and robbery on top of countless dozens of shoplifting arrests.

Idaho student murders: Suspect in custody in connection with investigation

Los Angeles prosecutor pens scathing exit letter to progressive DA George Gascon: ‘Managerial dumpster fire’ READ THIS ARTICLE

Bail group shuts down amid lawsuit for helping release serial offender

A-list celebrities sprung this maniac from jail and less than a week later he tried to murder a waiter by shooting him with 7-rounds. The more I read the news, the more scared I become with the direction this country is going and what people deem to be fair and equitable.

Twice-deported, MS-13 gang suspect on El Salvador's most wanted list arrested in Virginia

5mm have come into the US illegally in 2 years and clearly some of these people are criminals, terrorists, drug dealers. We need a better policy.

Look at this moron. Attempted robbery gone awry. I just watched Home Alone for the 100th time and it never gets old.

Real Estate

Moody's chief economist Mark Zandi said Friday that US existing home sales have bottomed out. The combination of high mortgages and expensive homes have kept buyers out of the market, but US incomes also play a role, he said. Meanwhile, mortgage rates have fallen for six consecutive weeks, the longest drop since 2008. Typical home prices are far higher now than they were a year ago, according to Moody's Analytics' chief economist, Mark Zandi, and three things need to happen together to restore affordability and boost home-buying demand.

1. Lower mortgage rates

2. lower house prices

3. Rising incomes

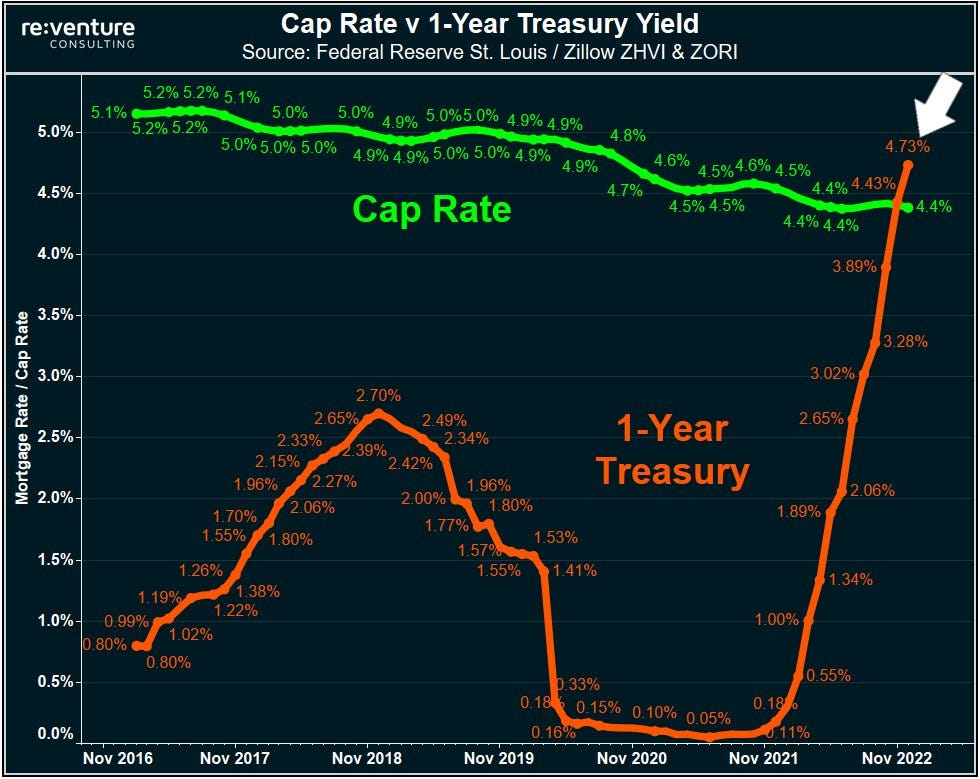

I thought this chart was interesting about cap rates relative to the 1-year-Treasury yield. Given cap rates fell so low relative to the rising in Treasury yields, landlords have a problem. Couple this with rising vacancies and rents no longer growing and it means that prices need to fall.

A record-high sale at The Bristol condominium in West Palm Beach is not just a benchmark for the sparkling tower on the Lake Worth Lagoon but also a top price for a condo in the city at-large, according to luxury real estate agents who handled the deal. A deed signed Dec. 15 puts the total price for unit 1403 at a recorded $12.025 million, but it’s the cost per square foot of livable space — $3,364 — that is the record breaker, said Samantha Curry, executive director of luxury sales for Douglas Elliman Palm Beach. The total sale price also is double the $5.7 million paid by the first buyer of the 15th-floor condominium when the building opened in 2019. In a related note, Robert Kraft bought a Palm Beach PH for $23.75mm; the priciest condo ever sold in Palm Beach according to the article. Lots of new condos going up in WPB and Miami, but I am not convinced they will hold their value as well as more sought after water-front homes on Palm Beach Island or in Miami. Here is a perfect example, a Palm Beach mansion just sold for $66mm after selling for $35.4mm in June of 2021. Limited supply of high-end homes and given the product NY, CT, NJ, IL, CA, MN… are giving residents, the trend of the wealth migration is likely to continue.

Check out this Miami home for sale: Real-Estate Power Brokers List Miami Beach Home for $31.5 Million. The owners bought the land in 2014 for $3.42mm and built and 11,500 foot estate. Great pictures in the link. I don’t care for the style of the home, given it is Mediterranean, but the property is nice and is on the intracoastal. When I moved to South Florida in 2017, you could have bought so many amazing properties for a fraction of the price today. I am clearly not that bright.

I love this chart and have recently written extensively on my concern about the office market and the upcoming major issues given vacancy rates, rent and large debt levels. This chart from Jim Bianco from Bloomberg data. Office REITs are below the March 2020 lows and he suggests no other index is below the 3/20 lows.

Other R/E Headlines

Miami is the least affordable housing market in the U.S.—see which other cities made the list

I don’t feel this is an accurate deception, as median household income was used relative to median price. You get so much more for your money in Miami relative to NYC. A friend has a child paying $7k a month in NYC for a 1 bedroom of 700 ft with zero amenities. Check what you get in Miami for that amount.

California county bans landlords from conducting criminal background checks for housing

A California county has passed an ordinance that will ban landlords from conducting criminal background checks on prospective tenants, a move made in an effort to make it easier to get housing and curb discrimination. Call me crazy, before I enter a 1 or 2 year contact with someone living in a home or apartment I own and want to check their criminal history. Do not be a landlord in certain cities and states.

How can this end poorly? About 100 ways.

The number of realtors in America hit 1.6mm, far more than in 2007. Not a good sign for markets.

Luxury Long Island Home Sales Plunge as Higher Mortgage Rates Hurt Demand

Virus/Vaccine

Data is going in the right direction, but the holidays skew it dramatically. Lets see how the data looks in 10 days.

Covid news: omicron XBB.1.5 is immune evasive, binds better to cells

Check out this article as the variant is now about 41% of cases in the US. The CNBC article suggests this new variant could result in a “surge of breakthrough infections.

Shares of Chinese funeral company rise as Covid infections leap

Happy New Year Eric,

The Rosen Report is always my favorite read of the day. Your true life adventure story at the Kia dealer was exceptional. Carol and I were public school educators for 45+ years in NJ, and we agree, TJHS is indeed "teaching kids the wrong things". Wishing you and your family peace of mind and good health in the new year. Jack