Lessons Learned From Bosses Good & Bad

12-11-22

Opening Comments

Today’s Podcast-27 minutes long. I speak about cash alternatives and the tens of billions being left on the table by consumers at the 14.30 minute mark.

I wrote a review on Contessa in Miami (Major Food Group) and there is an article on Major Foods expansion into Miami.

Jack and I are in Miami Sun-Tuesday for his golf tournament and due to early tee times, we are staying at the Thesis Hotel. I don’t think the tournament allows spectators, so I will be walking around looking for things to do.

I leave Wednesday am for NYC for a few holiday parties and meetings. As a result, the note Wednesday is likely to be shorter and without a podcast.

On a comical side note, the other day, I received an email from Jimmy Lee and almost crapped in my pants. It was on the heels of my Jimmy Lee piece. I had never deleted Jimmy Lee from my contacts, despite his death. I inserted his son as “Jimmy Lee Jr,” even though he goes by Jamie. When I received the email, it came over as Jimmy Lee. I thought for a brief moment it was my friend and mentor contacting me from the other side, and then I realized it was his son. My heart was beating at 200 bpm for a solid 2-minutes.

Pictures of the Day-Sunset Pictures

Lessons Learned From Bosses Good & Bad

Quick Bites

Markets

Marko Kolanovic/JPM on Markets

Inflation

Americans Leaving Tens of Billions on the Table-MUST READ

End of “at-will” in NYC?

Prisoner Swap

Other Headlines

Crime Headlines

Real Estate

Mortgage Rates Fell

Mortgage Delinquencies Rising

COVID Impact on Office Space

Other R/E Headlines

Virus/Vaccine-Bad Trends ACCELERATING

Pictures of the Day-Sunset Pictures

I love sunset pictures and found some amazing ones on line this week. The colors of sunsets on the west coast are fantastic.

Learn From Bosses Good & Bad

When I started my career in 1992, I was placed in the awful group, Large Corporates, in Continental Bank (Chicago) working for a man named Dan. He thought quite highly of himself and clearly not very highly of me given I did not go to an Ivy League school. I was not treated very well and disliked my job. I vowed that if I ever became a manager, I would treat my team differently than I was treated by Dan. I took notes about the things my bosses and colleagues did that I thought were good and bad and re-read them regularly. I learned I would treat junior people with respect and spend time developing talent. I learned a little attention can go a long way when I was longing for it and could not get it. Eventually, Dan warmed up to me and we ended on solid terms, but for me, the damage was done. I do believe my management skills are quite unique, and will put myself against virtually anyone in this vein, but it is due to learning from my good and bad bosses as well as other colleagues and taking copious notes. I emulated the skills I admired and threw away the bad actions.

From Jamie Dimon and John Steinhardt, I learned about the importance of response time, and it was the subject of a recent Rosen Report. John would respond in minutes to emails, even on a Saturday night and Dimon had a 24-hour rule that he would be sure to respond to anyone in that time. If Jamie, with hundreds of thousands of employees can do it, surely you can too. He is among the most important business leaders in the world, don’t forget. I learned a lot of other things from Jamie but will go over them in other reports.

From Peter Vaky from Continental Bank, I learned the adage, “Praise in public and chastise in private.” I was young and tried to make myself look good in front of my boss, but wrongly questioned him in front of a client. He waited until the meeting was over and pulled me aside to tell me why it was inappropriate, and I agreed and apologized. He could have done it publicly, but he did not. When I did something well, he made sure the world knew about it. A short email to the team highlighting a team or individual accomplishment goes a long way and costs you nothing but a minute of your time. Do it. John Steinhardt, Don Mcree, Peter Schmidt-Fellner and Walt Bloomenthal (Continental Bank) were good at this too.

From Walt Bloomenthal at Continental Bank. Always have potential candidates in mind for various roles in case someone leaves. He kept a list of people he would consider hiring if people left or were fired, which made it very efficient to find replacements. I was always taking competitors out for a drink to have lists of sales, traders, research… that I would go after, and it made transitions must faster. Also, Walt wanted his people to grow and if he could not give you more responsibility, he would support you going to a competitor. It is what he did with me. I recall a great analyst leaving my team who I did not want to lose, but it was a fantastic opportunity and suggested he take it. Let’s just say that most people know who he is now because he has become incredibly successful.

From Jimmy Lee at JPM, be intellectually curious and the power of the Rolodex. Have outside interests and be sure to not only be focused on work. It is important to be well rounded and Jimmy loved golf, guitar, motorcycles, fishing, and was a huge family man. Balance is important. No one appreciates hard work more than I do, but you need to have things other than work that drive you. I learned guitar at 40, cooking, surfing, golfing, tennis collecting art/furniture/wine, fishing and a host of activities which help me learn. I read voraciously and try to constantly challenge myself to learn new things. Jimmy had arguably the best network of all time and his contacts were big and deep. I feel I have developed an amazing network over the years by trying to do the right thing and giving honest feedback, even when it is not easy to do it. I also believe the growth in the Rosen Report has only improved my Rolodex with some amazingly talented, successful and well-connected people. Also, Jimmy is proof positive that if you love your job, you never work a day in your life. The picture below is of Jimmy fighting the last fish he ever caught. It was a prized 8lb+ bonefish in the Bahamas.

From Peter-Schmidt-Fellner at Chase, your career is a marathon, not a sprint. As a young go-getter, I wanted to be the youngest Managing Director in history and wanted to take on more responsibility. I felt Peter did a great job of helping me to get more, while managing expectations and not giving me too much leeway to get into trouble before I was ready to handle it.

From Mike Zarilli at Chase. When playing client golf, let the client believe whatever score they want. We played golf with a major client who literally lost over 2 dozen balls and if playing by the rules would have scored 30 on some holes. Each hole, Mike would ask him what he shot and he would say, “5, 6, 7 or 8” even though he got 12-30. At the end of the round, the client asked, “What did I shoot?” Mike responded, “112,” and the client had the audacity to suggest that was his lowest round ever. I swear he did not break 250 and I was irritated. Mike said, “Who cares, he paid us millions in fees. Let him believe whatever the hell he wants.” Because of Mike, I stopped caring about clients who cheat in golf.

Multiple bosses across firms talked about the fact that “NO ONE gets promoted at the annual holiday party or conferences.” There is only downside if you drink too much and act like a fool. I was always careful to pace myself at these events and was mindful it could be a long night. I had to get countless employees home given they were stumbling around acting like idiots. I vividly recall one incident at a conference where I had to get someone back to the hotel and it was quite uncomfortable. Don’t put yourself or others in this position. I have some crazy stories of holiday parties gone wrong with serious consequences.

From Daniel Pinto at JPM, I learned more about risk management. I felt that was a core competency of mine prior to meeting Daniel. My group had record results generating billions of revenues in the Global Financial Crisis when virtually all credit desks lost billions. However, Daniel took it a step further and his requests for specific statistics and information improved my game.

I always try to lift others up. I remember being early in my career and going to other floors to talk to people and learn about other departments. Some were quite approachable and appreciative and others were rude and unwilling to educate me. In a funny side note which clearly dates me, I would go to the file room at Continental Bank, and it was on the same floor as the “Work Out” group. I did not know what that meant early in my career and asked a man who had a desk outside the file room named Mike Bacevich who taught me about his division. We have now been friends for over 30 years, and he became a big client when he left the bank and have some fun stories together. I vowed to go out of my way to mentor, assist, develop and train anyone who wanted it. To this day, I continue to mentor young and more experienced people who call and look for help. Leading by example is important. At JPM, I was at my desk at 6:15am and wanted to send the message that I was there early and liked to turn on the lights. Sets the right tone and many times, younger people would come in to speak with me and I got to know them well.

I am a firm believer that work-ethic and social awareness can overcome intellect. I have found that the highest IQ does not always ensure success. Some of the smartest people I ever hired did not advance into management because a lack of social skills. They might have been good at a specific task or analytical ability but could never manage a team. On that front, the best salesperson does NOT always make the best sales manager.

Another boss asked me to hire a family friend as a summer intern. I did it, and the boss would regularly take out the intern for lunch and never once invited me out to lunch despite running a group generating big profits. I felt it was disrespectful and vowed to never treat people in this manner.

There are so many more examples of things I learned from bosses, colleagues and subordinates. Make mental notes and jot things down which resonate with you good and bad. This will improve your management skills. I learned a lot in 30 plus years, but clearly have more to learn, just like everyone else. Writing this segment reminded me that I do miss the interaction with colleagues and helping people develop. Maybe one day I put the cleats back on if the right opportunity presented itself.

Quick Bites

The Dow Jones Industrial Average shed 305 points, or 0.9%, to close at 33,476. The S&P tumbled 0.73% to end at 3,934, while the Nasdaq fell 0.7% to finish at 11,005. For the week, the Dow fell 2.77% to post its worst week since September. The S&P tumbled 3.37%, while the Nasdaq dropped 3.99%. Friday’s moves came after November’s producer price index showed higher-than-expected wholesale prices. Of note, the 10-year Treasury was 9bps higher in yield Friday and closed at 3.59%. On the week, oil fell sharply, -10% between fears of an economic slowdown in the US and issues in Europe and China.

JPM’s Marko Kolanovic spoke with CNBC on his market thoughts and he has turned more negative and believes recession risk is growing, while earnings expectations are coming down. Lower earnings and higher Fed Funds terminal rate should result in lower stocks. He believes the bottom will be re-tested or lower in the 1st or 2nd Q of next year and then the Fed folds and the market will price in rate cuts. I have repeatedly stated for a couple months that my belief is that the Fed will be forced to cut rates in 2023.

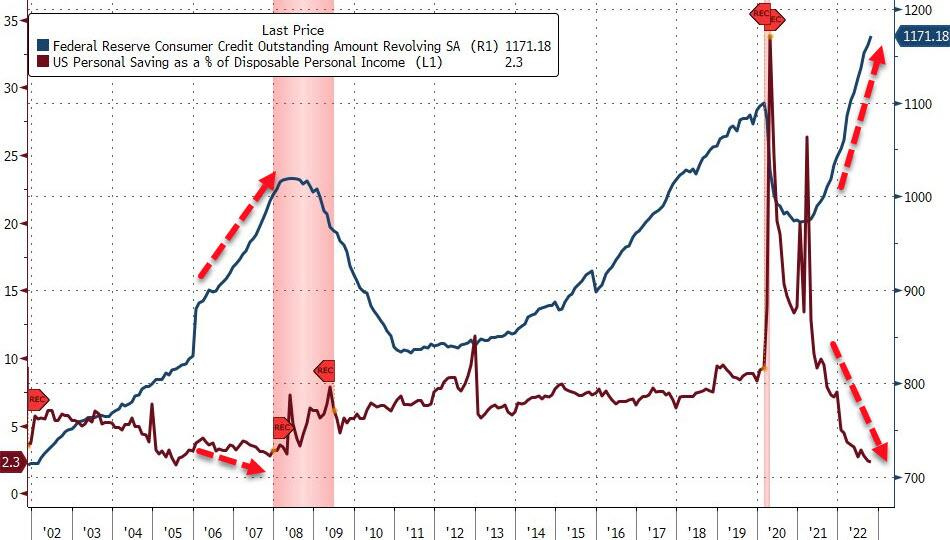

The producer price index, a measure of what companies get for their products in the pipeline, increased 0.3% for the month and 7.4% from a year ago. A 38% surge in wholesale vegetable prices helped push the food index up by 3.3%, offsetting an identical 3.3% decline in energy costs. Excluding food and energy, core PPI was up 0.4%, also against a 0.2% estimate. Core PPI was up 6.2% from a year ago, compared with 6.6% in October. Although the numbers were higher than expected, I still feel the trend is going the right way on inflation. Check out the 2nd chart with the consumer being squeezed. Also of note, increasing white collar layoffs in tech, finance and corporate America as well as trillions of losses in markets, suggests inflation will keep falling. Household wealth is down $13.2 trillion in 2022 between market losses and the impact of inflation according to this article. The impact of sharply higher rates is working itself through the system will keep inflation from going too far in the wrong direction.

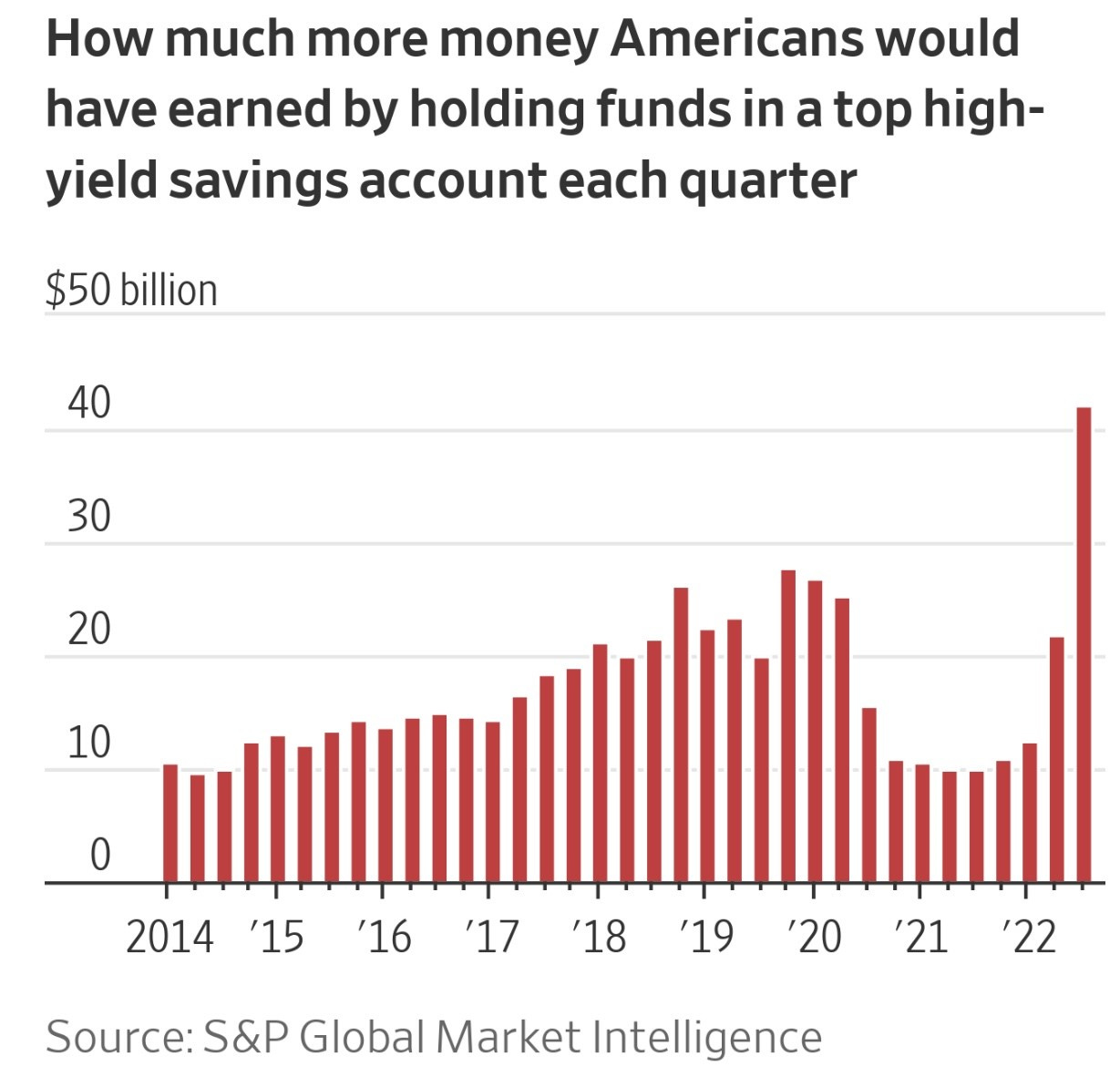

I have written multiple times about cash alternatives I have used to improve returns and found this WSJ article interesting. Americans are missing out on billions of dollars in interest by keeping their savings at the biggest U.S. banks. The Federal Reserve has raised interest rates to their highest level since early 2008, just before a near failure of the financial system plunged the American economy into recession. Yet the biggest commercial banks are still paying peanuts to savers. In theory, savers could have earned $42 billion more in interest in the third quarter if they moved their money out of the five largest U.S. banks by deposits to the five highest-yield savings accounts—none of which are offered by the big banks—according to a Wall Street Journal analysis of S&P Global Market Intelligence data. When rates were zero, there was little cost to inaction. Now, apparently, Americans left $219bn on the table since 2019. Take some time to generate more income on your cash.

A New York City lawmaker is trying to ban most companies from firing workers without good reason, which could transform the balance of power between bosses and their employees. Most US employees work “at-will,” allowing companies to legally terminate them for almost any reason, or for no reason at all. In contrast, under a bill being unveiled Wednesday, New York City employees’ jobs would be legally protected unless their boss could demonstrate misconduct, unsatisfactory performance or a genuine economic need to eliminate their position. Workers who believe they are terminated without “just cause” would be able to bring claims if the “Secure Jobs Act” passes. Just what NYC needs, another reason for companies to leave the city. As if high crime, high taxes, high cost of living was not enough. I am a firm believer of “at-will,” and during my time managing large teams, I have consistently weeded out people who did not make the cut. It was not always horrific performance. Sometimes, it was just not properly gelling with the team dynamic. Other times, I found a better candidate or just felt they were not contributing enough to the platform. I am against the proposed policy and have heard for dozens of readers with businesses in NYC who are not pleased with it either. If this law passes, managers will be much more scrutinizing in hiring decisions and will not give people without a perfect fit a chance in my opinion. The cost of making a wrong hiring decision would be huge.

Brittney Griner has been released from a Russian penal colony after the Biden White House was able to reach a deal with the Kremlin on a prisoner swap. Griner, the WNBA star imprisoned on marijuana-related drug charges in Russia, was returned to the US in exchange for arms dealer Viktor Bout, “The Merchant of Death.” In releasing Bout, the US freed a a former Soviet Army lieutenant colonel whom the Justice Department once described as one of the world's most prolific arms dealers. Bout was serving a 25-year sentence on charges that he conspired to sell tens of millions of dollars in weapons that U.S officials said were to be used against Americans. I want to begin with anytime an American is set free, I am happy for them and their loved ones. However, the “Merchant of Death” for a basketball player caught with a two vape cartridges with hash-oil seems like a slightly unfair swap. I am 100% against swapping a basketball player who broke the law for someone who was found guilty of conspiracy to kill Americans and US officials, delivering anti-aircraft-missiles and aiding a terrorist organization. In history, this could be one of the worst “swaps” of all-time, right behind Bo Berghdal (Army deserter) for 5 Guantanamo Bay terrorist detainees. The Biden Administration was unable to negotiate the release of Paul Whelan (former Marine), who was accused of spying as part of the deal. Of note, Trump shot down Russian attempts to trade Paul Whelan for Viktor Bout. I am concerned about the release of Bout, but even more concerned about the precedent this swap sets and the fact that it will put high-profile Americans in danger. The Pentagon is concerned Bout returns to his old business and a DEA agent who helped to arrest Bout is livid about the swap. Maybe you should abide by rules when visiting countries and not bring in illegal drugs. Just a thought. You can be given the death sentence in Singapore for drugs, for perspective.

Other Headlines

"There Is No Soft Landing" - RH CEO Warns Housing Market "Looks More Like A Crash-Landing"

Elon Musk’s Bankers Consider Tesla Margin Loans to Cut Risky Twitter Debt

Not sure why Musk would do this one month into the deal and take $13bn of debt effectively himself. It would significantly lower the interest burden.

Tesla's Troubles Are Piling Up While Elon Musk Is Distracted With Twitter

I love Musk and his impact on society. However, I feel one person can only do so much.

Sam Bankman-Fried Set to Testify to Congress About FTX Collapse

FTC looks to block Microsoft's blockbuster acquisition of Activision Blizzard

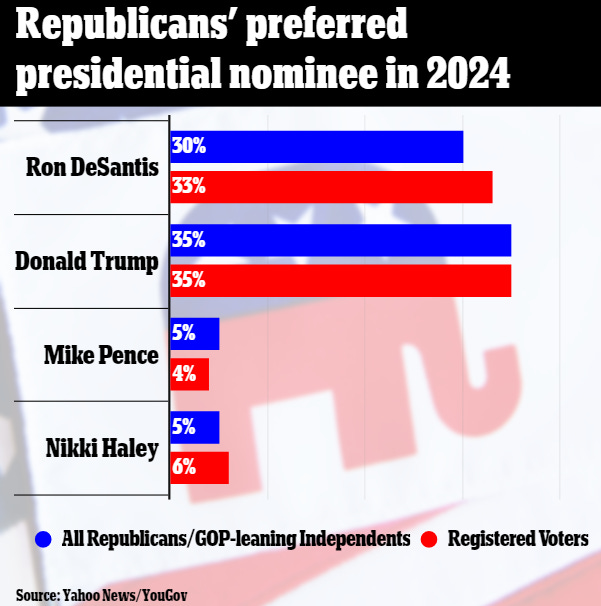

Majority of Americans don’t want Biden or Trump to run again in 2024, CNBC survey shows

I have been saying this for months and feel both parties need to find new talent that is not named Trump, Biden, Harris or Sanders.

Biden approval rating on Main Street rises for first time in presidency

Sen. Kyrsten Sinema leaves Democratic party to become independent

Elite Chicago prep school dean brags about kids handling sex toys in class

This is a top private school in Chicago, and I watched the scary video. The principal suggests the video is edited and twisted the dean’s words. I can only say that IF this is true, it is absolutely disgusting and again goes to what the hell are they teaching in school?

Roughly 60 Percent of Students Fear Expressing Their Views in Higher Education

So much for free speech. I speak with high school and college kids regularly who have told me they cannot express their views without feeling the teacher and other students will turn on them. Also of note, too many classroom discussions are turning to woke agendas according to the students and parents who contact me.

Elton John leaves Twitter, citing concerns 'misinformation' will 'flourish' under Musk

I love Elton John and have seem him in concert multiple times. However, I am troubled that he quit TWTR over Musk but is not critical of the FBI and Biden Team influencing elections using the social media platform?

FBI agent's testimony implicates headquarters brass in social media censorship

Please read this link which shows an FBI agent’s testimony about how broad based the FBI plot was in social media censorship. As Americans, we must condemn these acts and it violates the First Amendment.

Latest ‘Twitter Files’ reveal secret suppression of right-wing commentators

I don’t care for many of these commentators, but feel again that the insane bias of social media goes against the First Amendment. I wanted Musk to buy TWTR because of this bias, but it is becoming clear that it was incredibly blatant and coordinated. Independent journalist Bari Weiss detailed in a series of posts how Twitter used so-called “shadow banning” to limit the visibility of tweets coming from far-right users.

Hospitals in the US are the fullest they've been throughout the pandemic -- but it's not just Covid.

More than 80% of hospital beds are in use nationwide, jumping 8 percentage points in the past two weeks. Hospitals have been more than 70% full for the vast majority of that time. But they’ve been 80% full at only one other point: in January, during the height of the Omicron surge

A nutritionist shares the ‘underrated’ longevity food she eats every day to boost her immune system

Iconic NYC wine store Sherry-Lehmann may close after 88-year run

Based on the article, seems as though Sherry-Lehmann is in serious trouble with vendors questioning the business and Lehmann owes $3.1mm in back sales tax.

Indonesia Bans Sex Outside Marriage

The new code applies to foreign residents and tourists, and bans cohabitation before marriage, apostasy, and provides punishments for insulting the president or expressing views counter to the national ideology.

Crime Headlines

Chinese food deliveryman brutally mugged in broad daylight in NYC

NYC teen shoplifter, Target security guard fall down elevator shaft during tussle

Philadelphia gas station hires AR-15-toting guards in crime-spike

The fact that businesses need to do this is a major statement that the current crime policies are awful. Also of note, think about the cost and what it does to margins.

Real Estate

I had mentioned my sister is leaving Chicago after 63 years given crime and horrible policies in that city. She purchased a home in Boynton Beach, Florida and I find her mortgage rate story interesting. She had “locked-in” a rate of 6.89% weeks ago, much higher than her 2.75% rate in Chicago. However, the mortgage broker told her that given the lower rate environment in recent weeks, they can lower her rate to 5.99%, which allows for a nice monthly savings. For perspective, on a $500k mortgage, the savings would be $295/month.

I thought this chart was interesting and concerning. Clearly, the housing market is turning, and defaults will start rising.

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an "office real estate apocalypse." I have numerous substantial commercial real estate professionals as readers and have been getting increasing calls and emails of concern. The piece has some good charts as well.

Other R/E Headlines

Lennar Offers 5,000 Homes to Investors With Buyer Demand Sliding

Homebuilders are seeking to move inventory by selling discounted subdivisions to rental landlords.

Manhattan renters face sticker shock with average rent at $5,200

Monaco Yacht Club & Residences-Miami

I saw this link and felt these apartments were not offensively priced despite good amenities. I spoke with a couple people familiar with the building and they felt it was a “B,” but wanted to show a more reasonable price point with amenities in Miami.

Virus/Vaccine

The BAD trends continue. Look at this data! Cases +53% over two weeks and deaths +39%. On deaths, it almost seems like a mistake, because a few days ago the data was declining. I don’t understand how in a few days it could have flipped that much. I am not convinced the death data is correct.