Opening Comments

Today, I have some election thoughts outlined in the piece and I have a BIG R/E section with statistics and my own take on high-end South Florida. In short, I am getting concerned about the number of new developments at the high-end down here.

In the last note, “Wahoo are Chomping,” I put in a paragraph about a friend launching a $750mm fund inside a multi-manager platform. He is looking to round out his team and the note generated a handful of promising leads. If anyone missed it, check the link, and if interested, reach out to me.

Palm Beach Schools are cancelled Wednesday and Thursday due to Hurricane Nicole which with winds expected to reach 70-75mph. I have been through dozens of these storms as a kid, and in my 5+ years here in this stint. I don’t recall any storms this late in the season. Seas were up to 12-22 ft this week.

Today’s Podcast-23 minutes. The theme story might be better on the podcast given it is pretty funny.

Election Update

Picture of the Day-Interesting Charts on Various Subjects

Bad Idea Bunny

Quick Bites

Markets

Diesel Update

FTX Liquidity Crunch-Binance Pulled. Disaster

Historic Midterm Election Results-Cembalest Link as well

Ken Griffin on Florida-It Ain’t the Taxes

Other Headlines

Crime Headlines

Real Estate-BIG SECTION TODAY

Stats on South Florida from Cushman &Wakefield

South Flagler House in West Palm Beach-$10-70mm Condos

$849k House in Crime-Stricken Oakland with no Bedrooms

Seeking Alpha Negative Article on Housing Market

Other R/E Headlines

Virus/Vaccine

Election Update

Based on betting odds and polling, I felt the Republicans would get 51 Senate seats and pick up 15 seats in the house, and I was wrong. The Senate is still possible, but more likely 50/50 split. Last I saw it was 49/48 in favor of Republicans with three races still too close to call (AZ, NV, GA). The house looks like a potential increase of 8-12 Republican seats (small majority), far below most estimates and even my conservative ones. In a shocking election, Biden’s Democrats did far better than anticipated. GA will be in a runoff as neither Warnock or Walker have over 50%. We won’t know the final results until December 6th. I was surprised by a few elections. NY Governor went to Hochul (D) and based on crime alone, I thought Zeldin (R) had a better shot despite a firmly blue state. For PA Senate, I cannot believe Fetterman (D), who is clearly cognitively compromised, was able to beat Oz (R), who may have been out of touch with the voters. Newsom (D) easily won for Governor in CA. In Miami-Dade, which has historically been Blue, flipped to Red and both DeSantis (R) and Rubio (R) won easily and Florida is now solidly Red and DeSantis should get a lot of that credit. DeSantis won by .4% four years ago and basically 20% (59.4% to 40%) in 2022. Also of note, the Squad members cruised to victory as well. Kemp (R) beat Abrams (D) for Georgia Governor. In Quick Bites, I have a section on historic mid-term results and to me, this Democrat showing was very impressive and very disappointing for the Republicans. This article outlines 10 candidates who made history. Interestingly, Trump’s candidates for the most part did not have a good showing and hopefully, that sends the message to Trump that he should not throw his name in the ring. Trump was interviewed and said, "Well, I think if they (R) win, I should get all the credit. If they lose, I should not be blamed at all." Classic Trump. I do fear the better than expected Democratic showing emboldens Biden to run again. In exit polling, it seems abortion and democracy were mentioned a bit more than thought prior to the election when inflation, economy, crime, border were thought to be the key issues.

Pictures of the Day-Interesting Charts-One reader sent me all these charts.

The 1st chart is a bit concerning as “free money” from the government has stopped both in terms of pandemic hand-outs and zero rates, we have seen credit card debt explode, while savings has crashed. Clearly inflation has exacerbated the issue.

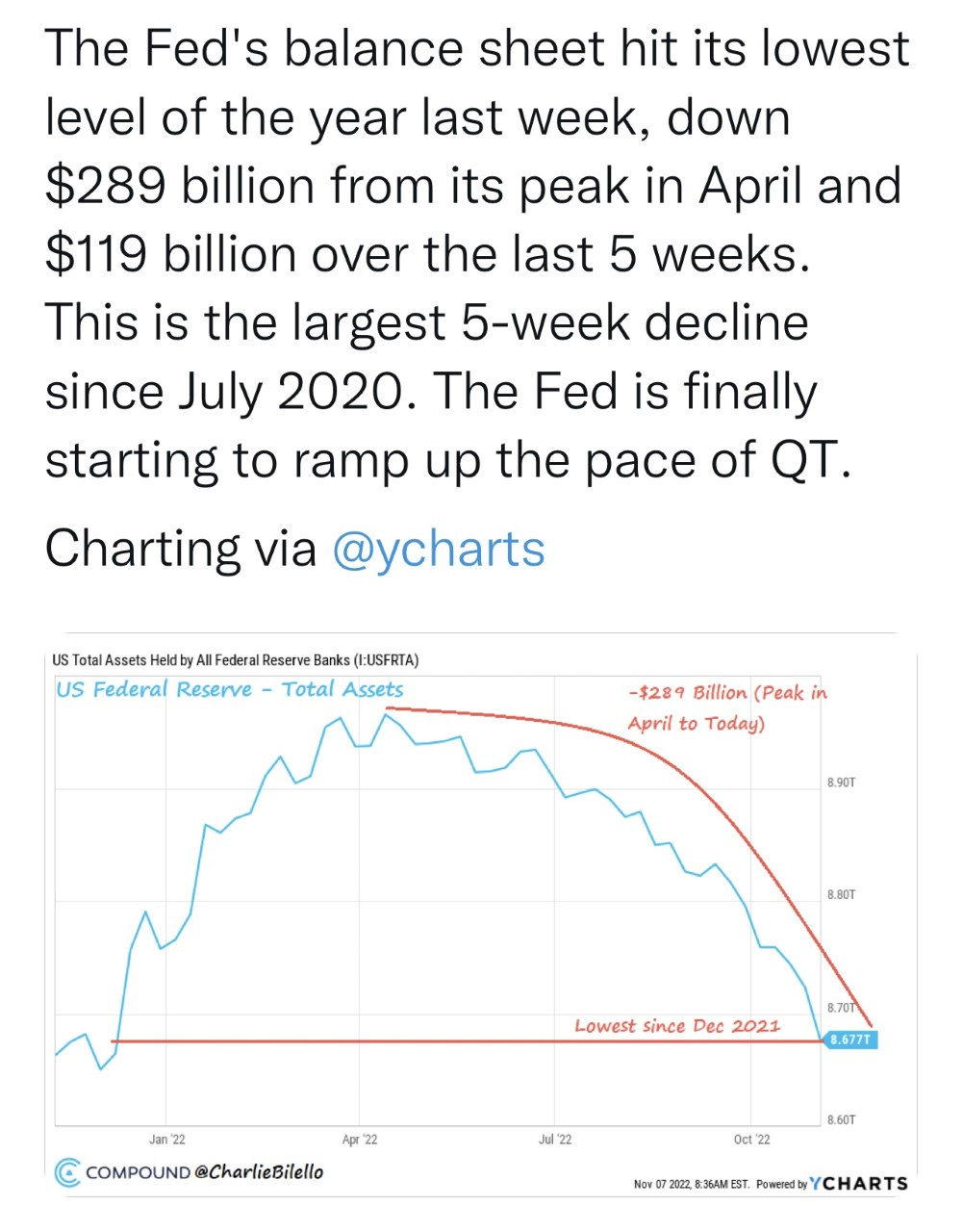

I had complained that the Fed balance sheet had not been coming down, and finally we are seeing progress as outlined below. Quantitative tightening has started.

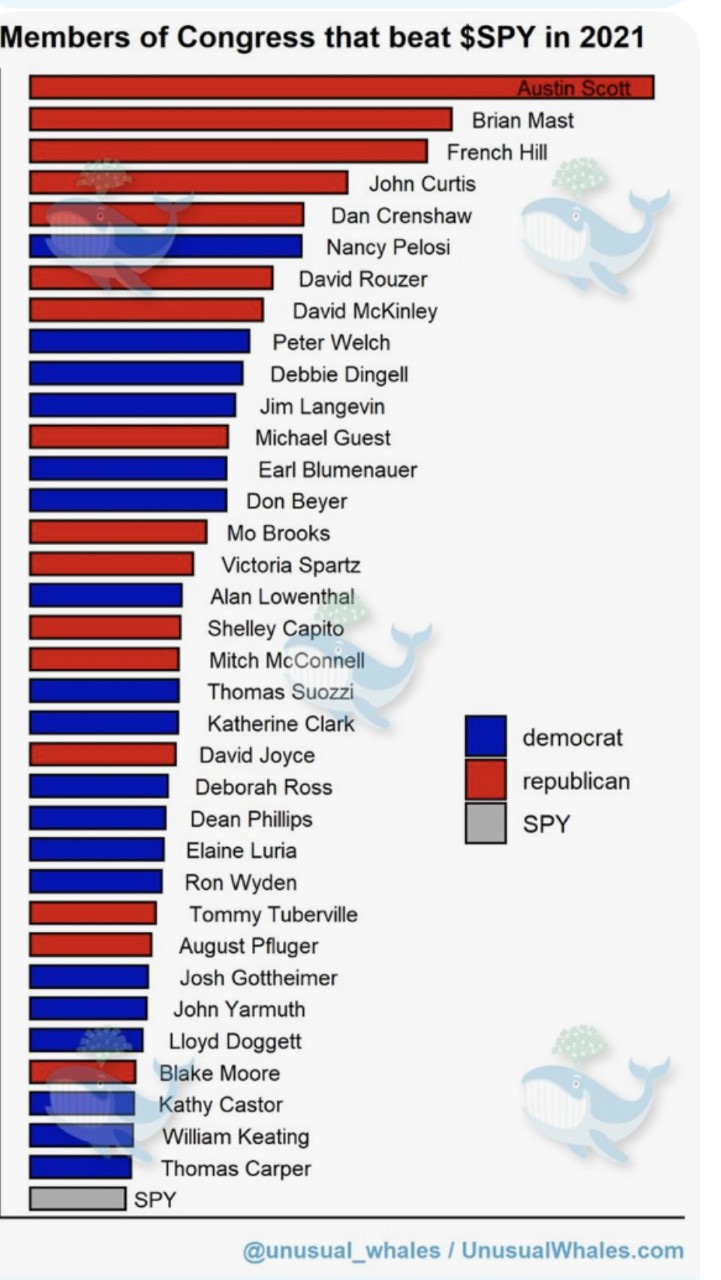

I have written about the insider trading of the Fed and politicians, and it is quite frustrating. This is for BOTH sides of the isle as outlined below.

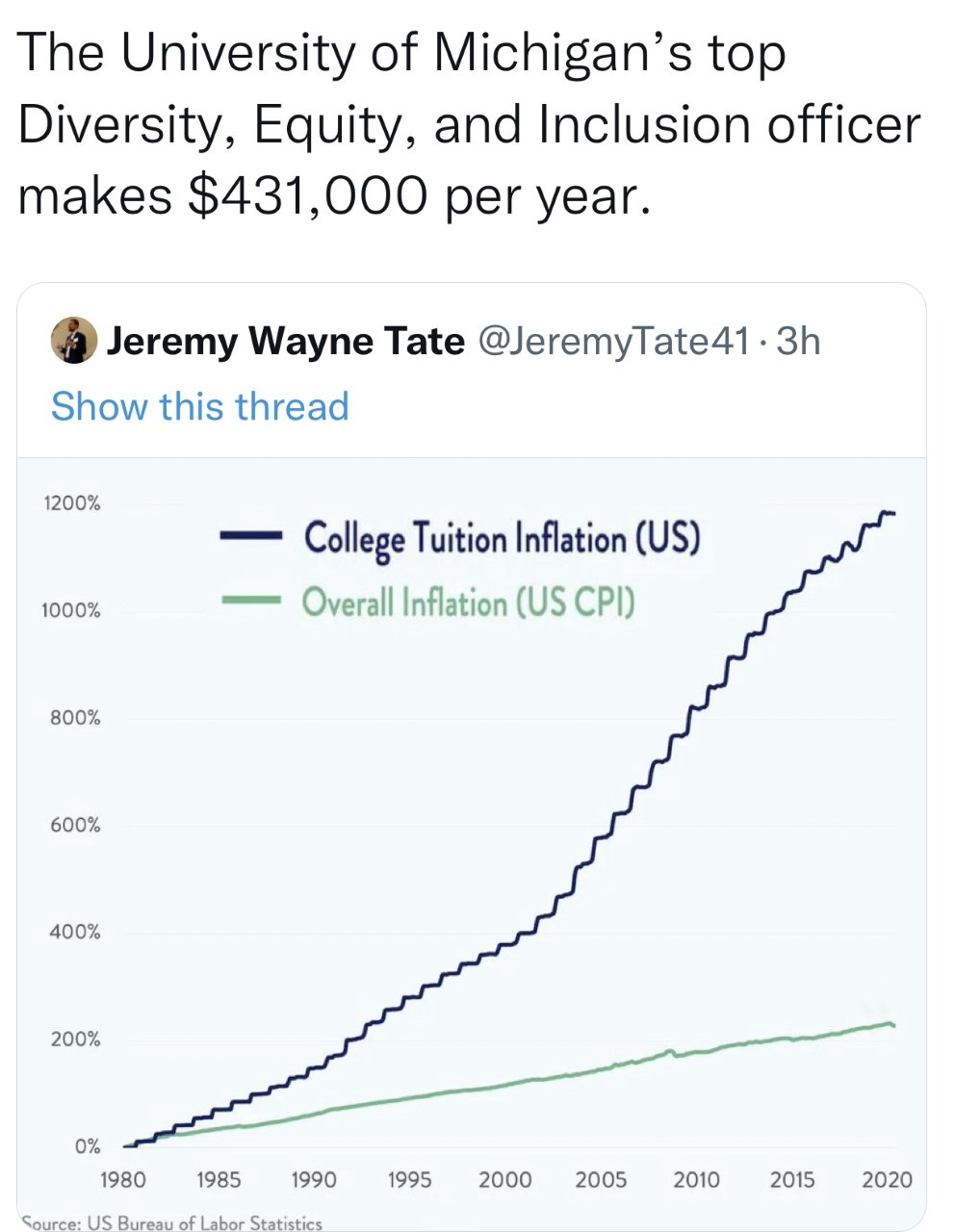

The University of Michigan has 163 Diversity Equity and Inclusion officers according to this article from 2021. The average university has 45 people in these seats. Clearly Michigan is a large school, but seems like a big number to me, and the head of the group sure gets paid a lot of money. The chart below reminds me that maybe 50% of college students should be in traditional four year schools given the massive costs relative to the benefits for many.

Bad Idea Bunny

I was 15-years-old and was dating an adorable girl we will call, “Suzy.” I did not drive yet, and it was that awkward stage where mom has to drive you on a date. It was just plain embarrassing when mom drops you off in a maroon Buick. Remember, I lived in Pembroke Pines, Florida at the time and went to public school which was a bit rough around the edges. It was the 1980s and not exactly an academic institution which bred greatness. I had not been exposed to a much culture at the time given our limited means. For perspective, I thought Bennigan’s and TGIF were Michelin Star restaurants, and the only art in my room was a Cheryl Tiegs poster that I bought at Spencer’s in the Hollywood Fashion Center. My have times changed. Patrick Nagel created this picture which was famous in the 1980s. This is really the only art I ever saw and it was in the mall. I thought this guy was basically Picasso before I learned about art.

Back to the story. My mom dropped me off on the other side of town at Suzy’s house. I recall the house being nicer than any I had seen around my neighborhood and was 6 or so miles from where I lived. I walked in and noted there was a lot of art on the walls. I had never been to a house with real art and thought it looked amazing. I had ZERO clue what any of the art was at the time, but do recall being a bit memorized by these paintings. Turns out it was a serious collection of major artists from the 1960s-80s which would be worth a fortune today. Artists included Warhol, Basquiat, Lichtenstein, Herring and many others. Back then, the art was not worth the fortune it is today. I would have had no clue anyway. Warhol and Basquiat in front of their work.

I was there for a few hours and was a bit confused and overwhelmed by what I saw. Suzy’s mom asked if I wanted to stay for dinner and I said, “Sure. That would be great. Thank you.” I was looking around trying to take everything in and a man in his 60s walked into the kitchen. Clearly, my IQ has jumped a few points since this story. I did not put it together that this was Suzy’s father, as he was considerably older than the mother who could have been a model and looked more like Suzy’s sister than her mom. I said, “How nice. Your grandfather lives with you.”

Everyone’s face turned red and Suzy said, “Eric. Meet my dad.” Son of a…. I felt like a moron. Don’t worry, I got used to sticking my foot in my mouth and did it again with her weeks later. I had never known anyone who was married to someone 20+ something years younger. That just was not happening in my neighborhood. My mother had to come pick me up after an embarrassingly uncomfortable situation once we finished the awkward dinner.

Fast forward the story. Suzy and I dated a little while, and she loved rabbits. In my infinite wisdom, it was Easter and I thought I would be a gentleman and buy her a bunny rabbit. Yes, a live rabbit to show Suzy that I adored her.

I gave Suzy the bunny, and she was glowing. I think she called the bunny Fluffy, but it was a big hit. Within a few days of the bad idea bunny, Suzy called me crying. I thought she was dumping me. Nope, not yet. She was calling me to tell me the bunny I bought her for $15 at the pet shop died. Given I was a busboy making maybe $4/hr, that was upsetting. At times, I had no inner monologue and try to make people laugh. I said something incredibly stupid in an effort to make her laugh. “Suzy, if you did not like the bunny, you did not have to kill it.” Well, that went over like a lead balloon. She never got over my hurtful comment and that basically ended our relationship. Those two incidents, calling her father her grandfather and suggesting she killed my bunny were the first two times I can recall sticking my foot in my mouth with a date.

What are the lessons learned? Don’t assume someone is the grandfather, especially today, and NEVER and I repeat NEVER buy a woman a live animal. Learn from my mistakes. Below is Anna-Nicole Smith marrying and 89-year old. I think Anna was 29 or 30 years old. Zero chance I would have gotten this one right if invited over for dinner.

Quick Bates

Stocks were lower on Wednesday — following recent market gains — as results of the midterm elections provided no clear answers about who would control Congress yet. Stocks are coming off three-straight days of gains into the election, where Wall Street was expecting Republicans to gain ground and block any future tax and spending plans. The Dow fell 647 points, or about 2.0%. The decline was led by Disney, which fell more than 11% after the entertainment giant missed analyst estimates on the top and bottom lines. The S&P 500 shed 2.1%, and the Nasdaq Composite slid 2.5%. The market sold off in the afternoon as it became clear the Red wave did not materialize. The 10 Year Treasury auction was weak, with a yield of 4.14% (4bps above when issued and 1 or 2 bps is considered soft). Dealers were left with 24.4% of the auction, the most since March 2021. Treasuries sold off until the last 30 minutes of trading and rallied, but not sure what drove it. The Lack of ‘red wave’ means market risk is to the downside, Evercore ISI says. Oil was -4% to $85.5 barrel.

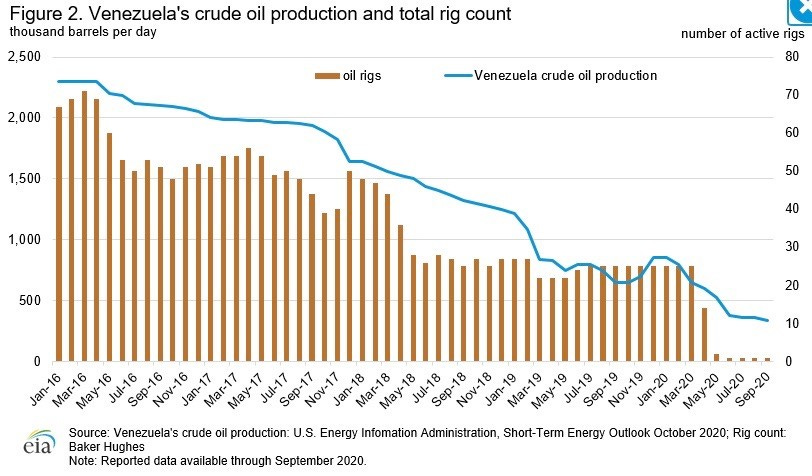

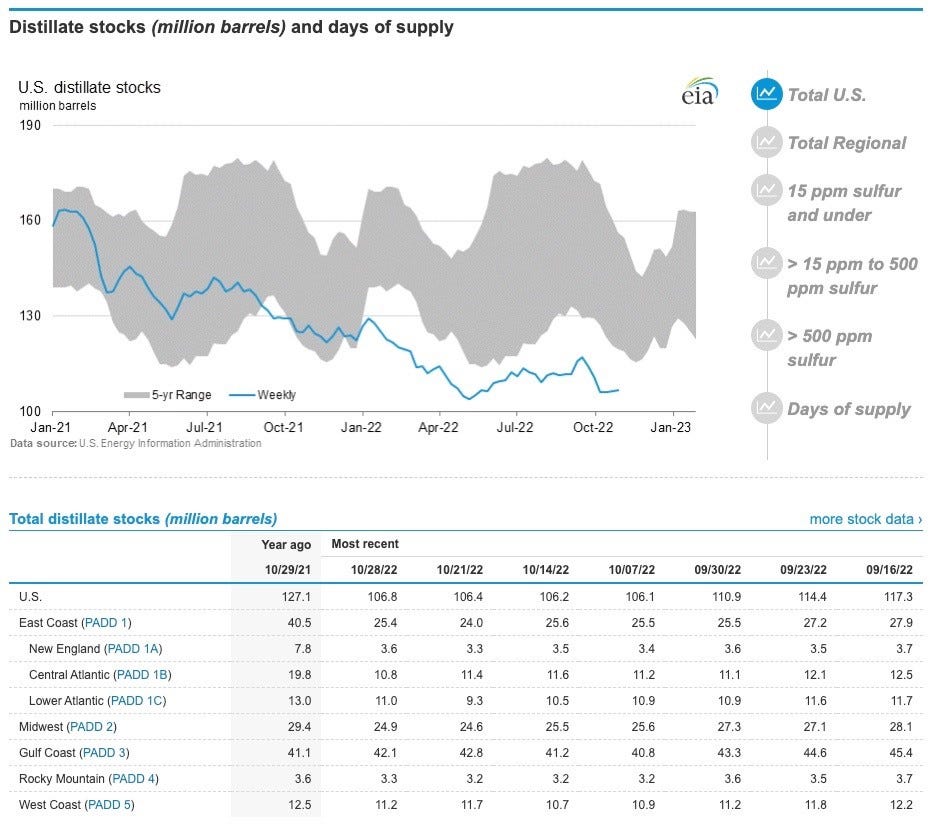

The world is running short on diesel fuel. This is a big problem as diesel runs the trucks and ships which are critical for logistics to get goods around the world. Diesel is also used by farmers for their equipment to plant and harvest crops. We have a President who yet again said, “NO MORE DRILLING,” while he is depleting our Strategic Petroleum Reserves to 40 year lows. Now, the US does not produce a lot of heavy oil used in diesel production, as the US oil tends to be lighter. We were getting the oil from Canada, Mexico and Venezuela, but Mexico and Venezuela production has slowed sharply, partially due to under-investment. Russia and Saudi can produce the oil needed for diesel, but given the Ukraine situation and now strained relations with Saudi Arabia, it will be harder to come by. Had the Keystone Pipeline not been cancelled, we could have had another 1mm barrels of heavy crude/day by early 2023 which would help to alleviate the shortage. Energy policy matters, and I am concerned about shortages in diesel driving up costs, just as headway is being made on inflation. Given all the window dressing in front of the election, don’t be surprised if we see a sharp spike in oil over the next 6 months or so. I am not sure how long lived it will be as demand destruction will set in with people driving and flying less.

Just weeks ago, Sam Bankman-Fried was considered crypto’s version of John Pierpont Morgan, willing to throw around his massive fortune to save the industry. The curly-haired 30-year-old known as SBF was everywhere. In the span of days, it became clear that Bankman-Fried and FTX were in the midst of a liquidity crunch and needed a bailout of their own. Changpeng Zhao’s Binance swept in to take over, but backed out just as I was hitting send tonight. The suggestion is FTX will collapse in a shocking turn of events. Hearing there could be billions of customer deposits which have issues, but did not confirm these #s. That might come as a shock to investors including Softbank Vision Fund, Singapore wealth fund Temasek and Ontario Teachers’ Pension Plan, who sunk $400 million into the exchange at a $32 billion valuation in January. It’s unclear exactly what the implosion of its international affiliate will have on the US-based exchange, but it shows “how fragile this world is,” said Paul Gulberg, a Bloomberg Intelligence analyst. It’s “very surprising, scary to some extent.” I am hardly the expert here, but this is awful news for the industry in my mind and makes the space hard for me to take seriously. FTX’s token fell 80% on the day at one point. SBF net worth was $26bn recently and now estimated at $900mm+. One article suggests the 94% overnight hit was the largest new worth loss of a billionaire ever. Bitcoin and ETH were down 12 and 17% respectively overnight. Robinhood fell 19%. From a “crypto expert.” It is worth bearing in mind that the core innovation of crypto is about decentralized, non-custodial funds and programmable money and the ‘companies’ that have blown up this year have been the complete antithesis of that. The “DeFi” protocols which actually adhere to the fundamental philosophies of decentralization have performed flawlessly during these gigantic upheavals. In addition, many partnerships have been launched recently that are enabling crypto tech to be used under the hood, in ways in which the user doesn’t even realize they are interacting with crypto or blockchain. This clear out in the industry of profiteers is probably a healthy thing that can enable the actual tech to flourish, much like the social media companies / Amazon built during the dot com bust and started to thrive much later.

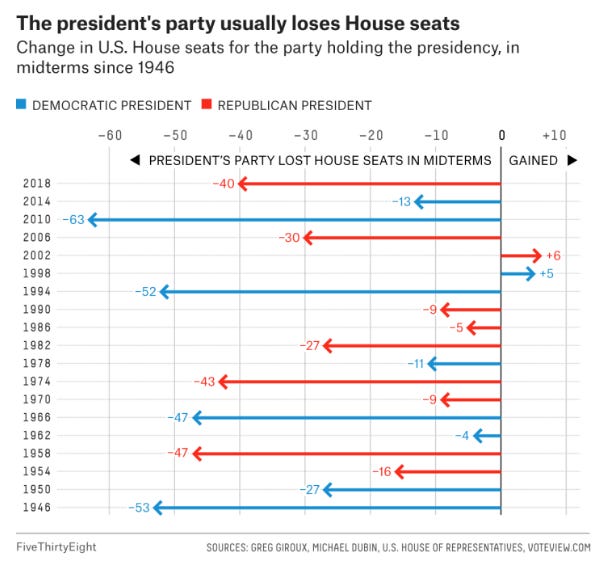

I found this very interesting article about mid-term election results since 1946. Many readers have asked my thoughts and feel this article does a nice job of explaining things and shows the Democrats sharply outperformed in 2022. One of the most ironclad rules in American politics is that the president’s party loses ground in midterm elections. Almost no president is immune. President George W. Bush’s Republicans took a “thumping” in 2006. President Barack Obama’s Democrats received a “shellacking” in 2010. President Donald Trump’s Republicans were buried under a blue wave in 2018. Since the end of World War II, the president’s party has consistently gotten a lower share of the national House popular vote in the midterm than in the prior presidential election. Indeed, in the 19 midterm elections between 1946 and 2018, the president’s party has improved upon its share of the House popular vote just once. And since 1994, when (we would argue) the modern political alignment took hold,1 the president’s party has lost the national House popular vote in six out of seven midterm elections — usually by similar margins (6 to 9 percentage points) to boot. Based on history, we should not be surprised by the Republican wins, but I am shocked the Democrats did so well in 2022 given the economy, inflation, gas prices, consumer confidence, Biden’s approval rating, the border and crime coupled with the polling and betting odds. The great migration from the Northeast, Midwest and CA clearly impacted these election results. Today, Mike Cembalest (JPM) published a great piece on the topic of mid-term elections which can be found here. Great charts.

This Newsweek article suggests 40% of Americans believe the 2020 election was stolen. I have seen other articles suggest an even higher number. How is it that in the greatest country in America we can have so many sloppy issues on something as simple as voting? I read that in 2020, in India, 600mm votes were counted in under 4 hours without any controversy. What the hell are we doing wrong? I don’t care if you are right or left, I feel it is unhealthy for such a large portion of the population not to believe in the voting process and accept the results. Why do we take so long to count votes and seem to have questions after elections? The politicians who are elected can be questioned when bad decisions are made, but we need a system which brings more confidence in elections. Arizona won’t have votes counted until Friday?

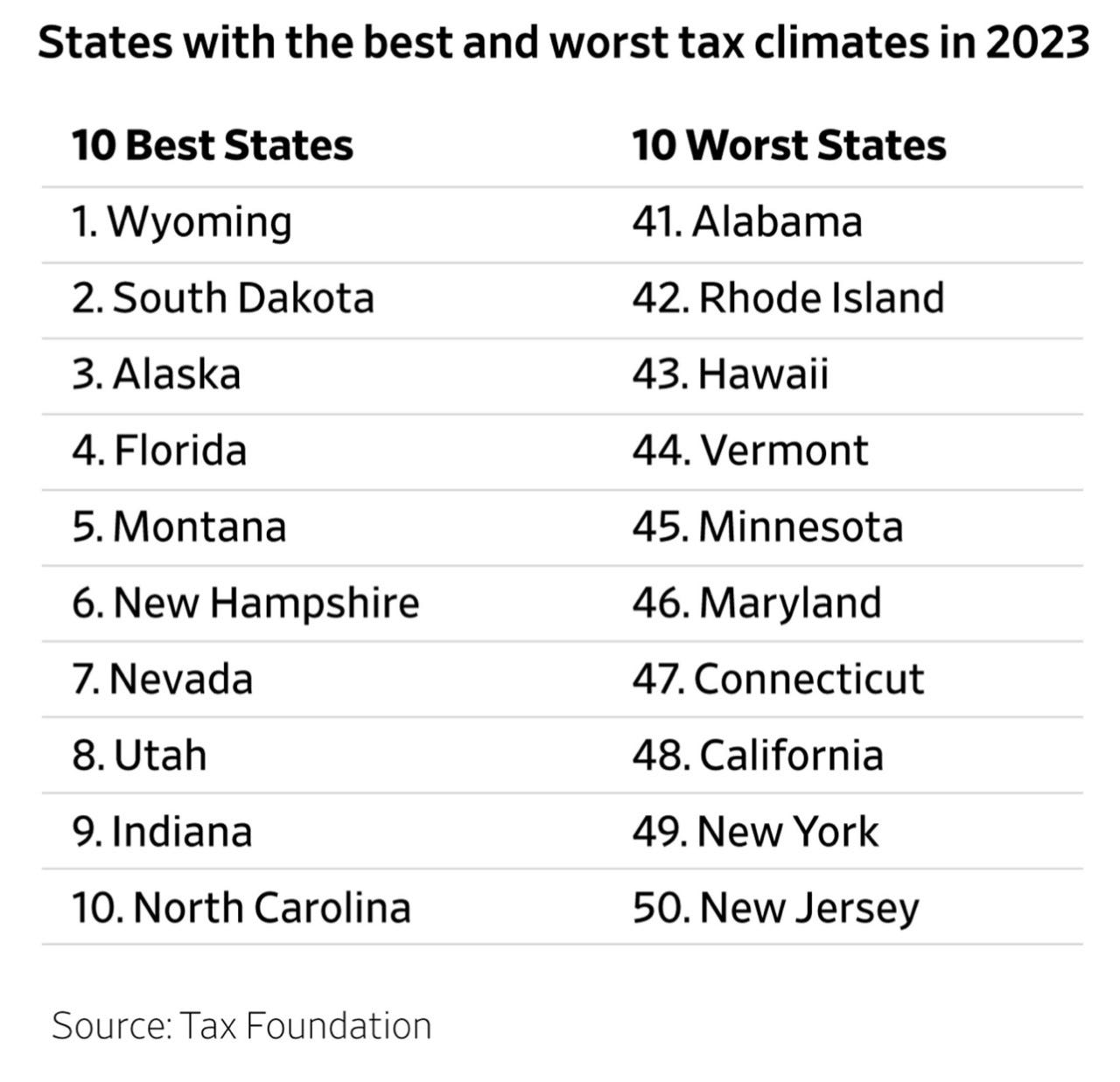

A good Bloomberg article about Ken Griffin’s move to South Florida is entitled, “Billionaire Ken Griffin Praises New Florida Home: It’s Not the Low Taxes.” He has been very critical of the politics and policies in Chicago which resulted in horrific crime. Unfortunately, my net worth is slightly less than Griffin’s who has an estimated $30bn. However, I left NYC over 5 years ago as I felt the “tax” to live in NYC (cost of living, taxes, weather, crime, quality of life) was too high relative to the alternatives and believe we made the right decision. My house in Florida is +150% and my Park Avenue place is -20% or more. Citadel’s billionaire founder, Ken Griffin, said low taxes didn’t bring him to Miami, his firm’s adopted home. “It’s gonna get me thrown out of here, but taxes weren’t part of our decision to come to Florida,” Griffin, now the state’s richest man, said Monday in a conversation with Francis Suarez, Miami’s Republican mayor. “When you’ve got great schools, a great environment and your streets are safe and clean, that’s when you’ve got a place you want to live in and call home.”

Other Headlines

Inflation to dampen holiday spending, retail trade group forecasts

Seasonal retail hiring is expected to be down from 2021 as well.

Inflation, Recession Fears Have Some Holiday Shoppers Trading Down

Consumers are swapping everything from Lululemon leggings to Natori underwear for cheaper alternatives

Twitter Files Paperwork to Enter Payments Business

Elon Musk, Twitter’s new owner, has been looking for ways to generate more revenue at the social media company.

Berkshire Hathaway’s operating earnings jump 20%, conglomerate buys back another $1 billion in stock

Apple warns Covid restrictions in China are hurting iPhone production

Disney misses on profit and key revenue segments, but sees strong streaming growth

Stock was -8% on the news.

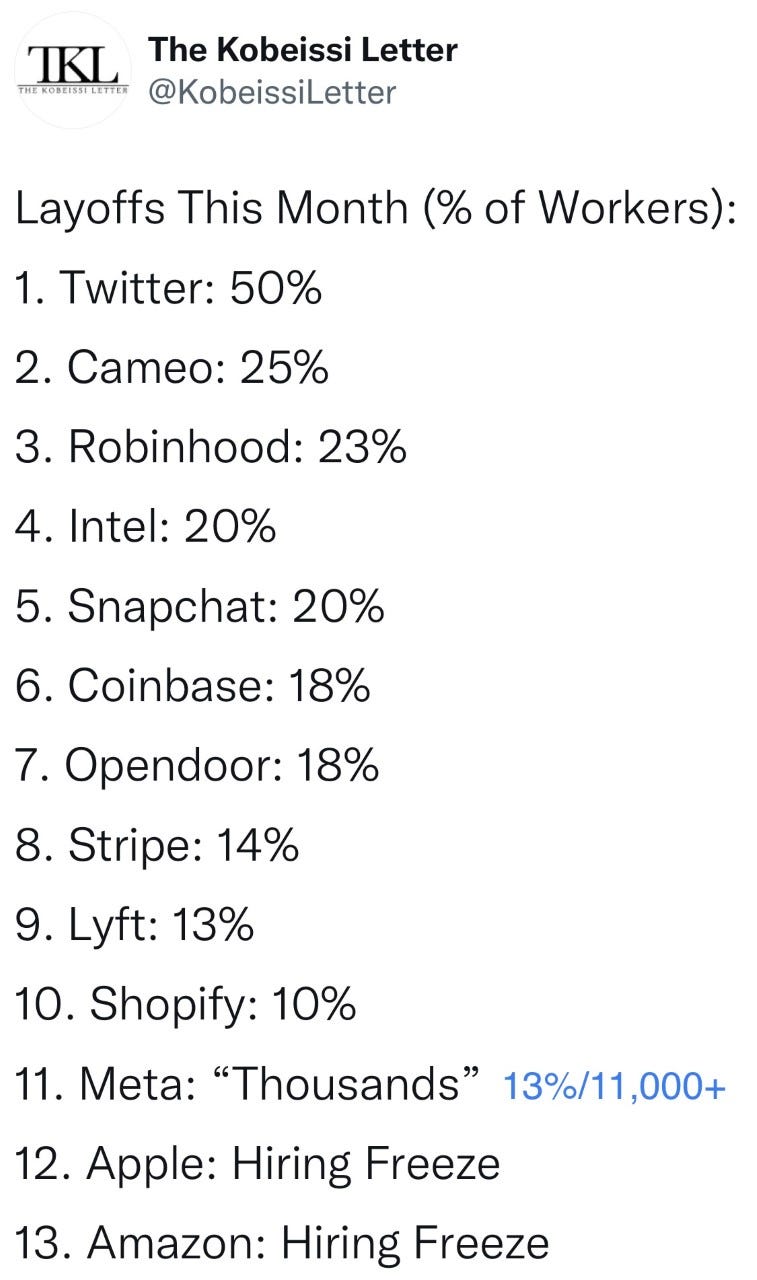

Facebook Parent Meta Is Preparing to Notify Employees of Large-Scale Layoffs This Week

The stock rallied on the news and estimates are 11k or 13% of staff.

Billionaire Chris Rokos Joins Macro Traders Heading for Record Year With 44% Surge

These are the top 25 enterprise tech startups powering digital economy

Washington Post fact-check blasts Biden with ‘Bottomless Pinocchio’ rating

Wells are running dry in drought-weary Southwest as farms guzzle water to feed cattle overseas

Read this story if you want to be upset. The Southwest is in the worst drought in centuries and a great deal of the aquifer is being used by Saudi Arabia to grow alfalfa. The Saudis banned growing water thirsty crops in their country, but are taking precious water from the Southwest to grow crops to feed cattle back in Saudi Arabia.

US citizens crossing border in record numbers — to live in Mexico

Venomous cobra dies after being bitten twice by eight-year-old boy

Cobra bit the boy and the boy bit it back. The boy lived.

Russia Says It Will Withdraw From Key City Of Kherson—Here's What It Means For The War In Ukraine

Crime Headlines

At least 6 straphangers attacked during violent day in NYC subway system

Nazi propaganda flier mailed to NYC pizzeria with Jewish owners

He blames Kanye and Kyrie Irving for spewing Jewish hate.

Man accused of hurling hard seltzer cans at Ted Cruz ID’d: ‘I’m an idiot’

Man knocks himself out trying to flee store with luxury stolen goods, video shows

Love this video. Stealing expensive purses and literally knocks himself out cold.

Real Estate

A reader sent me this market update about South Florida from Cushman, and Wakefeld, and there are amazing stats in here. How does this compare with NY, NJ, CT, IL, CA which has generally seen wealth leave the states. In June, the Wall Street Journal shared IRS data looking at the wealth migration during 2020. Florida lapped the field, attracting $23.7 billion in adjusted gross income to the state. The next biggest growth was Texas at a mere $6.3 billion. That has only accelerated, with Ken Griffin (and his nearly $30 billion in net worth) and Citadel Securities recently announcing a relocation of the company’s headquarters from Chicago to a new Miami tower that is estimated to cost $1 billion.

Seven out of the top eight markets for home price growth over the last year are in Florida. All of the markets have seen at least 18% price appreciation over the past year.

Over the last year, Florida has seen its total employment rise by about 5%, marking the third strongest performance among states behind Nevada and Texas. The current unemployment is 2.7%, nearly a full percentage point lower than the national average.

Venture capital continues to chase Florida as well. When analyzing data from Pitchbook, YTD Florida has seen nearly $6 billion in activity. That’s up more than 110% from 2019 levels, the second most in the country behind North Carolina.

There is a new condo development in West Palm Beach called the South Flagler House and will be completed by 2026. There will be two towers and 106 units over 27 floors. Condos will have 3 to 7 bedrooms and prices will range from $10-70mm. Robert Stern is the architect. Amenities will be amazing (listed below). There are a lot of these very high-end condos going up in Miami and Palm Beach. I am definitely starting to question the supply coming on line, as the economy is slowing and many who wanted to move to South Florida have already done so. Higher rates not helping. How many more people can afford these prices and carrying costs? Taxes and monthly maintenance on a $40mm condo ain’t cheap. A friend told me that he looked at the Bristol and there were more apartments for sale there today than a few months ago.

A 480-square-foot home in Oakland, California, with only one bathroom and no bedrooms can be one lucky buyer’s for a whopping $849,000. There is no view, and it is in Oakland, CA. Love to see what this awful home sells for, but hope it is no where close to ask. The estimated Redfin value is $854,268. In CA, taxes are high, gas is high, crime is high and natural disaster risk is high. I’m going to pass on this otherwise great opportunity. According to Neighborhood Scout, the Crime index is a 1, which means it is safer than 1% of US cities. 100 is the safest, but you can buy this crap box from 1914 for $849,000. I would not pay $100k for it.

I feel this Seeking Alpha article entitled, “Could This U.S. Housing Market Crash Be Worse Than 2008” is too negative. There are some compelling charts, but the chance of 2008 housing crash in this cycle is almost zero in my opinion. Banks are well capitalized today and there are trillions in home equity today. I do see a more meaningful correction coming with higher rates, higher unemployment, recession…but I don’t see 2008. Some charts from the piece.

Other R/E Headlines

Homeowners lost $1.5 trillion in equity since May, as home prices drop

Homeowners are up trillions since the start of the pandemic.

Real Housewives’ Star Nicole Martin Pays $21.5 Million for Miami-Area Home

Spending $10mm on renovations.

Virus/Vaccine

Absolutely loving your content Eric, would you be open to allowing us to share it with our 60k+ audience as well?