Opening Comments

Happy Father’s Day to all the dads out there and hopefully you will be spending time with the family.

The last note, I Love Taylor Swift was a big hit with the readers. The most opened link was regarding the ways the rich save on taxes. However, had I not mistakenly left of the Mike Cembalest link, that would have obviously been the most opened. Apologies. This Cembalest link is VERY informative and one of his better recent pieces.

It was a fun few days in NYC and the weather cooperated, especially relative to the heat in South Florida. I am in Marion, Mass until tomorrow, then NYC for a night and off to Philly for a tournament. I will be on the road for about 10 days.

I want to thank my readers for helping me and other readers in need. I wrote of an intern in need of a spot, a hedge fund job opening, and my friend who needed assistance with his wife’s medical condition. I received dozens of emails and calls of loyal readers willing to help. THANK YOU. Sounds like the intern is on his way to a role, the hedge fund manager has some good candidate leads and I am hopeful we got my friend in front of the right people to help his wife.

Markets

McKinsey on AI Disruption

Biden Payments?

NYC Commercial RE Stats-Chat with a RE Exeuctive

Florida Becoming Unaffordable

Musk Not Paying Rent

Pictures of the Day-NYC Taxi and Uber Fares are Ridiculous

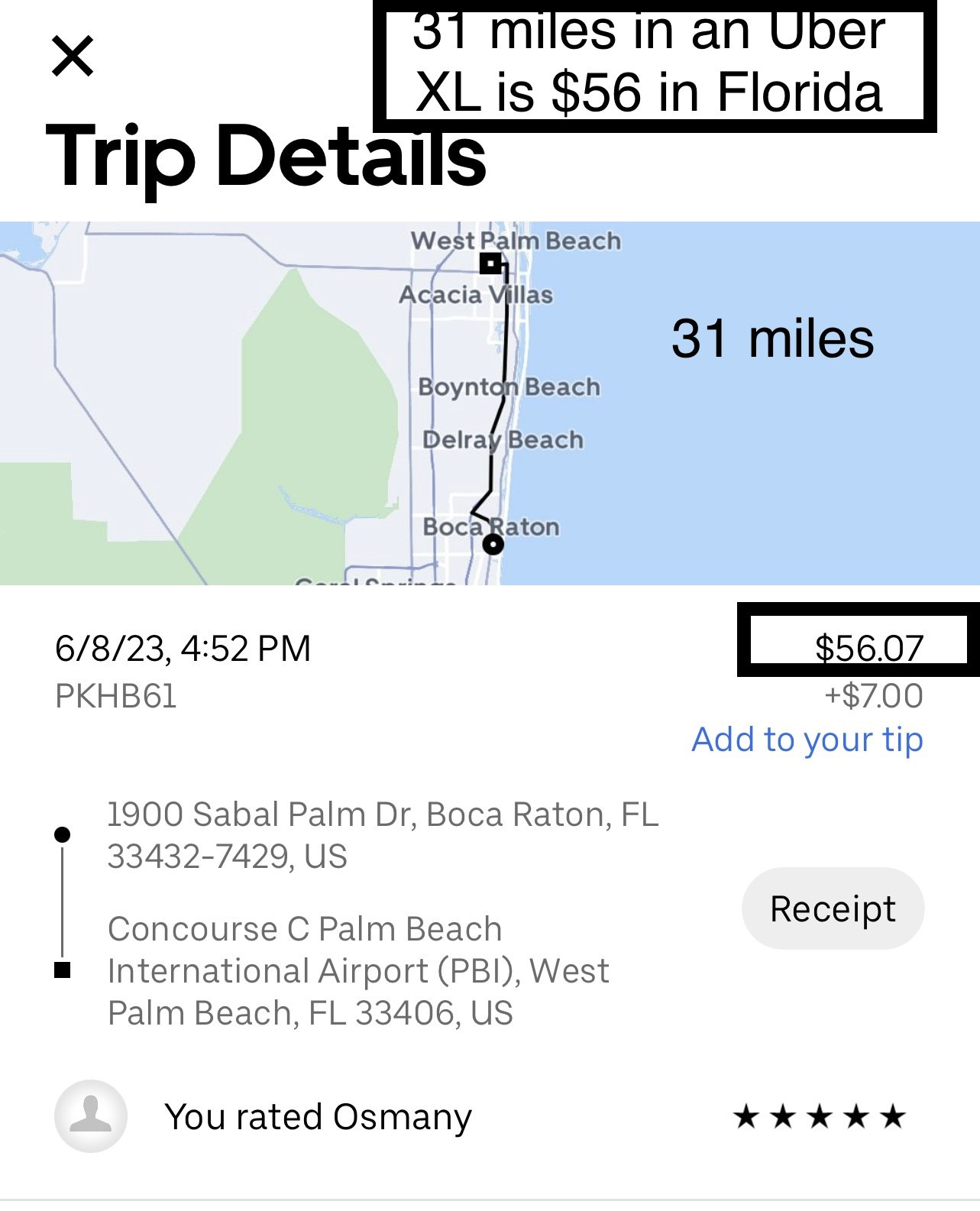

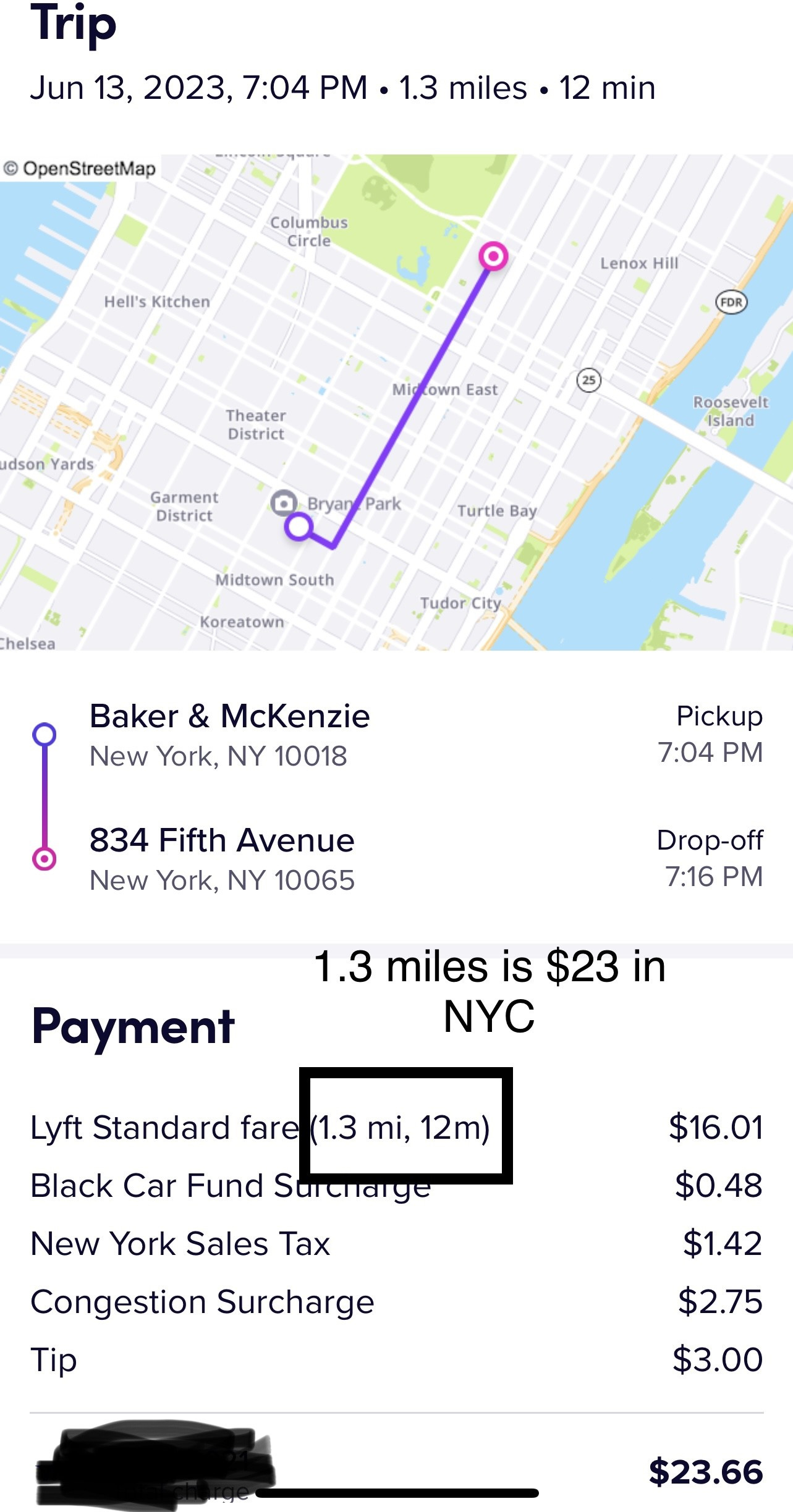

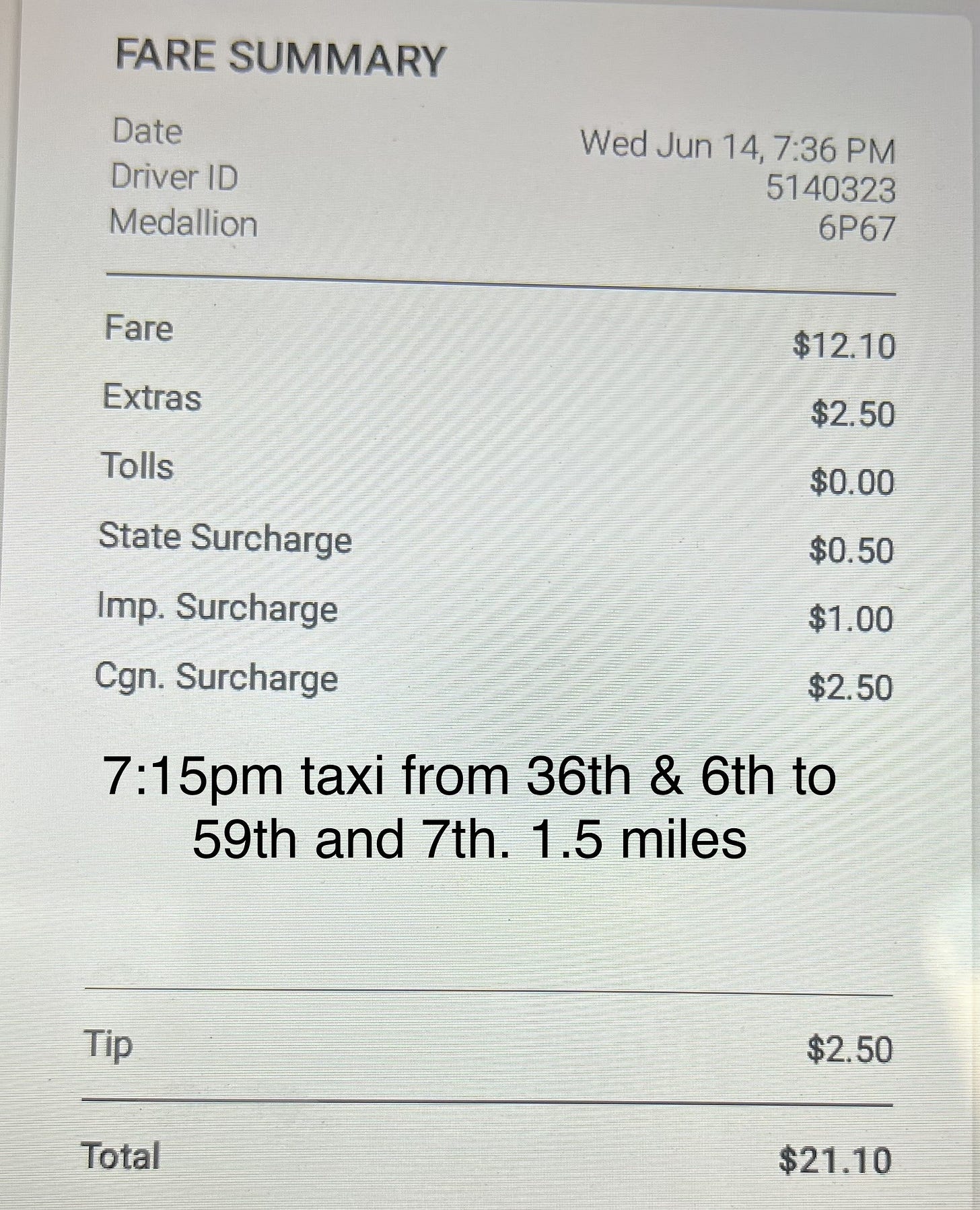

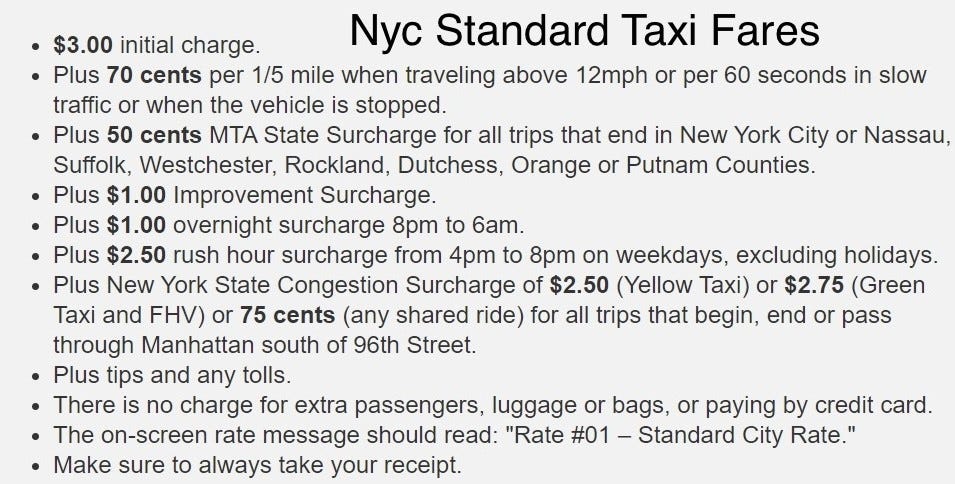

I was shocked at the prices for Taxis, Ubers and Lyft while in NYC, relative to Florida. Yes, pretty much everything is significantly cheaper in Florida but I was mortified at these price. The 1st picture is an Uber XL which Jack and I took from Boca to the Palm Beach Airport (31 miles) and it was $56. The 2nd picture is a 1.3 mile regular Lyft NYC trip for $22 (pre-tip). The third picture shows a 1.5 mile cab for $19 and the last picture outlines the standard taxi fares and surcharges today. It is approximately $7 just as the starting fare in a taxi today. Speaking with young people who feel unsafe on subways and are reliant on Ubers is eye-opening. One 22 year old told me she spends $800-1,000/month on Uber. Early on in the Uber days, I would take one from 74th and Park to LGA for $17 (10 miles). Unfortunately, the days of the big subsidies are long gone, and the prices are up sharply.

Bad Roman-The Most Thrilling New Restaurant in Town?

I have previously written about the importance of expectations management. In life, if you go in with low expectations you are generally pleasantly surprised, as the event (movie, dinner, date, trip, experience…) is better than you envisioned. When you go into a situation with very high expectations, there is generally only one way to go from there and that is to be somewhat disappointed. I had read countless reviews on Bad Roman and there was a NY Post article suggesting it was the most “Thrilling” new restaurant in town. Bad Roman was the #1 restaurant on my list that I wanted to try coming to NYC this summer. Given the culinary limitations (but improving) in South Florida, I get quite excited about my time in NYC to try hot, new eateries.

The new Italian restaurant from the Quality Branded group is decadent to say the least. The room is overwhelming with vibrant colors and action. I walked into Bad Roman and was overwhelmed. Lush greenery, pops of color and views of Central Park are all part of the flair. The room curves as does the bar and must have cost a fortune to create the fun atmosphere. With seating for 250 and a large bar, the place is impressive, and the décor is fun but a bit gimmicky. The ambience is fun, and the music is great but not too loud. We were able to have a nice conversation without screaming, which I enjoyed. The crowd was interesting and young. There were well dressed people as well as some younger guys in T-shirts with hats on backwards. I am hardly a formal person but think if you are going to a nice restaurant, a T-shirt and backwards hat is probably a little under-dressed.

The waitress was attentive and had strong opinions on the menu. We started with a handful of appetizers including meatballs, yellowtail crudo, shrimp cocktail, and fried calamari. I felt the meatballs and the yellowtail were the best of the bunch by far. The filet mignon meatballs and the sauce were very good topped with parmesan. Four came in an order and we could have crushed two more orders easily. The yellowtail crudo was light and delicious with grapefruit. Again, I found myself wanting more. The calamari was nothing special and the shrimp were solid, but nothing out of the ordinary.

It took an uncomfortable amount of time to get our entrees after a snappy delivery of drinks and appetizers. I ordered a lemon chicken which had solid flavor but was only barely warm and I did not feel like sending it back. The rock shrimp chitarra pasta was good as was the short rib pappardelle, but neither were amazing. Given the elevated expectations of the press, I was a bit underwhelmed by the food. The waitress made it clear that the pastas were the way to go. To me, there was very little which was remarkable apart from the room and ambiance. There was not one entrée dish I tried that I would rush to order again. However, the presentation of the food was solid and the restaurant checks off the fun and hip boxes.

We ordered sides of vegetables including the Brussels sprouts which were quite good, but I felt the rosemary sage fries were just average. The broccoli rabe was barely warm as well.

In a rarity, we did not try desserts, but understand they get some good reviews from folks who tried them. The tiramisu ice cream cake and cheesecake were ones I was told were best.

The wine list is ample and expensive, but not offensive. They also have good by the glass selections. The cocktail list was fun and they offered quite a few “mocktail” selections for kids.

Far too often, you go out to dinner and the prices turn out to be offensive. At Bad Roman, it is hardly cheap, but not obnoxiously priced.

In terms of Italian restaurants in NYC, there are others I would go to from a food perspective prior to Bad Roman. Here are my favorite Italian restaurants in NYC and they range from Italian seafood to Northern and Southern Italian-Rezdora, il Buco, Marea, Babbo, iSodi, Via Carota, Carbone, Lupa, Il Mulino, Laconda Verde.

Overall, I enjoyed the ambiance and crowd at Bad Roman and the food was good but not remarkable. I feel if I had not read all the reviews calling Bad Roman the “Best” and Thrilling,” I would have had lower expectations and they would have been met. Expectations management strikes again. If you go in with the view that it is a fun place with good food, you will leave happy. If you go in expecting for a culinary delight, you will leave disappointed. The right review title would be: Fun ambiance, quirky new Italian with solid food and flair.

Food-B+

Ambiance-A

Service-A-

Wine-Good by the glass selection and ample full list of Italians and American

Price-Fairly priced, but not inexpensive for high-end NYC

Quick Bites

The Dow on Thursday rallied more than 400 points and the S&P 500 touched a fresh 13-month high, as investors bet the Federal Reserve was close to done raising rates despite Powell’s commentary otherwise. I thought these were interesting major market milestones on the week:

The S&P 500 is up 2.6% on the week, its best performance since March.

It’s the S&P 500′s fifth positive week in a row, the first such streak since November 2021.

The benchmark is now up more than 26% from its bear market low.

The Nasdaq Composite is up about 3.3% on the week, its best week since March.

The Nasdaq is up eight weeks in a row, its best winning streak since 2019.

Both the Nasdaq and S&P 500 were up six days in a row through Thursday.

The Dow Jones Industrial Average was up nearly 1.3% for the week, its third positive week in a row.

The S&P 500 and Nasdaq have hit their highest levels since April 2022.

Treasury yields continue to climb despite the Fed pause. The 2-year yield was up 7bps to 4.72%. Cryptocurrencies climbed to end the week as investors digest BlackRock’s bitcoin ETF plans. Bitcoin ended the day higher by almost 4% at $26,355, while ether advanced 3% to $1,718.

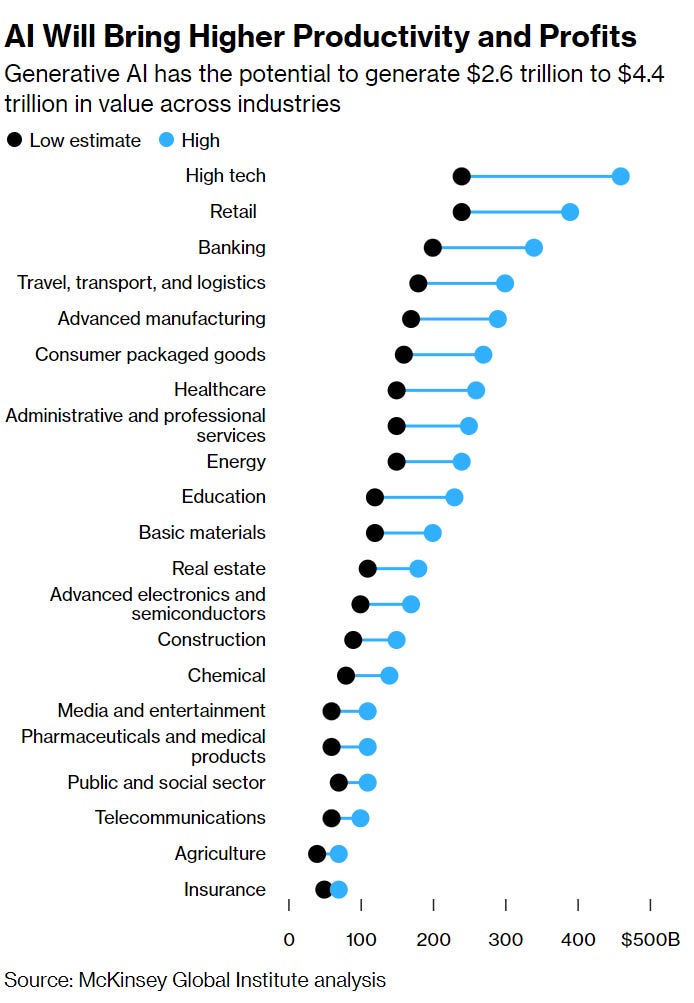

I was early on the AI train and write frequent pieces about the disruption that AI will cause. This Bloomberg article, “Biggest Losers of AI Boom Are Knowledge Workers, McKinsey Says,” is interesting. The worldwide boom in generative artificial intelligence will usher in an age of accelerated productivity and greater prosperity for some — and profound disruption for others, primarily knowledge workers, according to a new report by consultants McKinsey & Co.

Whole swaths of business activity, from sales and marketing to customer operations, are set to become more embedded in software — with potential economic benefits of as much as $4.4 trillion, about 4.4% of the world economy’s output — according to the study by McKinsey’s research arm. A few years ago, McKinsey had estimated that about half of worker hours worldwide were spent on tasks that could be automated. Now it’s raising the figure to as high as 60-70%. Employees could find that their time is reallocated — or that their jobs disappear. “Workers will need support in learning new skills,” the report said. “Some will change occupations.” Hard to argue with a world class consulting firm like McKinsey, but I fear the disruption time table is much shorter than the article suggests.

I have been extremely critical of both Trump and Biden. I am growing concerned about Biden and his involvement with the alleged material payments while VP under Obama. I have suspected it for some time and found the various interviews with Hunter’s former business partner, Tony Bobulinski (Former Navy Lieutenant), to be credible. Separately, the whistleblower who came forward suggesting Hunter and Joe Biden took millions is now gaining traction. Ted Cruz interrogated Deputy Director Abbate of the FBI and I must tell you, the answers left me uncomfortable. Cruz asked Abbate if the FBI will release the rumored 17 voice recordings of Hunter/Joe Biden Abbate refuses to discuss the topic. If no tapes exist of Hunter and Joe Biden discussing payments, why did Abbate not just say so? The chief accountant at Ukraine’s Burisma Energy, who offered to provide US authorities with damning evidence regarding financial crimes involving Joe and Hunter Biden, has been found dead before she could testify. The Bidens allegedly “coerced” a foreign national to pay them $10 million in bribes, according to individuals familiar with the investigation into the FBI’s handling of the FD-1023 confidential human source report. House Oversight Chairman James Comer revealed Thursday that he expects there is evidence of at least $20-$30 million being made in illegal payments by foreign nationals to the Biden family. Now it appears that Devon Archer (Hunter’s former business partner) will cooperate with the House. Devon is a convicted felon and served on the board of Burisma with Hunter. As Americans, we have the right to know if our then VP took millions in bribes. Why is the FBI not being more open and accommodating to Congressional Subpoenas and questions? Why can’t Congress see the fully unredacted whistleblower report form 1023? If 17 tapes exist of Hunter and Joe Biden as alleged, why can’t Congress listen to them? If there is no truth to any of these allegations, we should know that too. I just feel the American public has the right to know the truth about our President and remain concerned about the stonewalling by major government agencies. What would the public say if these agencies were acting in favor of the Right? I remain shocked and disappointed that the two leading candidates are elderly clowns, and Americans don’t seem to want either of them as President. A Marist poll shows 56% of Americans want Trump to drop out of the race and a recent poll shows that 70% of Americans don’t want Biden to run. How is the greatest country in the world in this situation? The Biden story is huge and should be getting far more media coverage.

Other Headlines

Goldman Says Markets Too Optimistic on Pace of US Inflation Drop

Mediterranean restaurant chain Cava stock soars as much as 112% in market debut

This should open the IPO market for others. Priced above the range and was up sharply.

Tesla’s U.S. electric vehicle market share will drop to 18% by 2026, BofA estimates

TSLA had a 62% market share in 2022.

Retailers start preparing for a deeply discounted, down holiday season

Lots of good charts.

Goldman Sachs board ‘starting to reevaluate’ David Solomon over talent exodus

Here are 5 key trends shaping the liquor industry as spirits overtake beer for the first time

Interesting industry developments. I remember when Pabst Blue Ribbon and Schlitz were popular.

Jordan selling majority ownership stake in Charlotte Hornets

Jordan bought the team in 2010 for $275mm and the rumored sale price is $3bn. 10 times your money in 13 years is not bad. The S&P 500 is up 3.8 times with dividends reinvested during that time.

U.S. Energy Dept gets two ransom notices as MOVEit hack claims more victims

Trump Promised ‘Food For Everybody’ At Miami Restaurant And Then Reportedly Skipped

Shocking. Trump lied. So unlike him.

Yet another Senator who should not be in office. What complete idiot wears shorts and a hoodie to introduce the PRESIDENT OF THE UNITED STATES? Unfortunately, his stroke left Fetterman with reduced capacity. Sorry, he should not be a Senator. Watch the 30 second video.

Good Samaritan's face slashed on subway after intervening in fight

Woman, kids flee as NYC shooter fires at cops and heads their way

Man found fatally stabbed aboard NYC subway train

He was found at Union Square (my subway stop for 10 years). He later died.

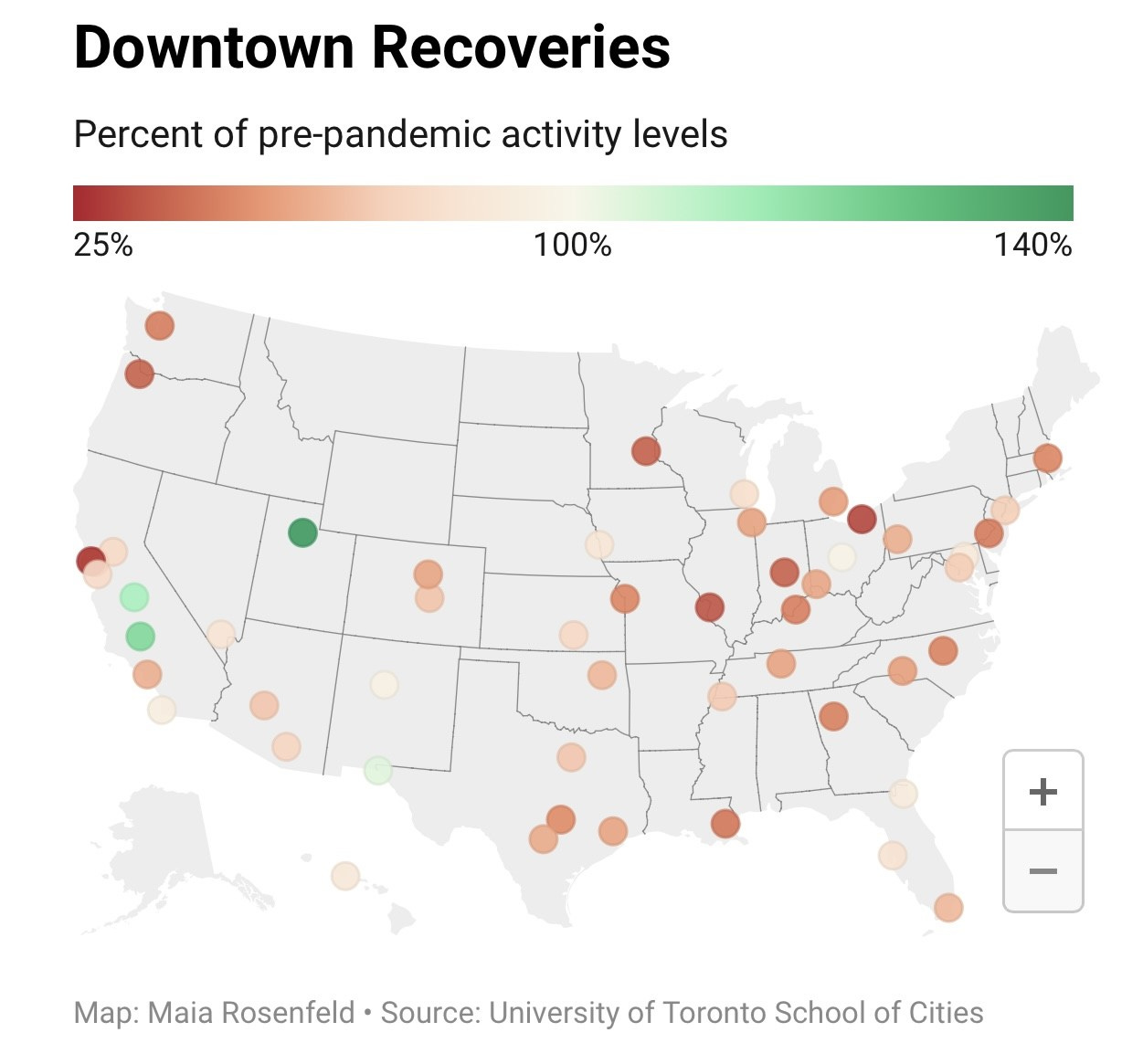

San Francisco ranks last among 63 US cities in downtown recovery, data shows

Good interactive chart in the link. Cell phone activity in San Fran is 29% of pre-pandemic levels.

'Good Morning America' won't film live from downtown San Francisco: 'Simply too dangerous'

Read this article. It is plain sad. I loved San Francisco 20 years ago.

Brave 10-year-old black boy delivers heartbreaking speech about how he was called ‘monkey’

This is a disgusting story about racism which impacted a 10-year old Oregon boy in school. What in the hell is wrong with people? If I were the school principal, those kids would be expelled with no chance to be reinstated. Send the right message.

Environment activists smear red paint on Monet artwork at Stockholm museum

I sure hope these idiots get real jail time.

Call me crazy, but I think it has more to do with the Okinawa Diet than 5-minute exercise.

I know a dozen people on these meds and they ALL lost a significant amount of weight. One friend lost 65 pounds in 7 months. Anyone who I have spoken with who has stopped taking it gains weight again. All tell me they just don’t have the appetite they once did and drink very little alcohol while taking the medicine.

Ozempic finger is diet drug’s latest side effect — forcing women to spend more money

We now know the first 3 people to get COVID worked in the Wuhan lab

Despite the fact that the media attempted to suggest the pandemic originated in a wet market, I think we all know where it really started. China has not had any consequences for TRILLIONS in damage globally. Millions of lives lost.

Putin says nuclear weapons transferred to Belarus; Ukraine ‘will be equal to NATO allies’

Real Estate

I met with a R/E executive in NYC last week, and he told me some interesting details about the commercial market which are outlined below.

Historically approx. $60-$80B of commercial sale transactions in NYC.

Worst years saw $12-$18B

YTD 2023 – less than $1B

Retail rents on 5th Ave, upper Madison and desired locations in SOHO historically were as high as $3,000/psf and inline retailers could expect $500-$800. Now hovering in the $200’s

While class A office buildings continue to push high rents for office space (1 Vanderbilt, 1 Madison, Hudson Yards) of high $100’s to $200/psf, there is an exodus from class B and class C office buildings.

New York office vacancy is reportedly 18% but more realistically closer to 28% when you factor in shadow vacancy. (space leased to tenants but not being occupied or used i.e. Deloitte, PWC, Meta who have reported space is being held as “non-operational” real estate on the statements.

The high-end class A office buildings, (aprox.) 60 buildings across the city, are a small percentage of the total inventory but represent 80% of all new office leases in the past two quarters.

Of the 475M Sq. Ft. of commercial space in NYC, there is likely 100-150M sq. ft. of obsolete office space.

The praised “residential conversation” play is only applicable to approximately 3% of this inventory given high costs for conversions, the continuous rise is construction costs and the regulatory environment.

Operating costs for office buildings continue to rise and taxes have risen an average 7-8% annually over the past 10 years, making base year adjustments for owners exponentially higher than any potential rent growth they could achieve. The higher taxes take place even with materially lower valuations.

Blackstone has handed back the keys to lenders on approximately $2.5B of office buildings across their portfolio. (NYC, Las Vegas, Chicago, California)

Brookfield has done the same.

There are now close to $1B worth of buildings being marketed by lenders as “deed in leu” or deed or escrow as the equity holders have handed back the keys. (see Metropolitan Tower, 61 Broadway (RXR), 1740 Broadway)

A stampede of Northeasterners in search of sunshine and cheaper living sent Florida’s housing market into a frenzy through the pandemic. The manic demand is finally starting to wane. Single-family home prices in Florida have flattened for the first time since 2011, after climbing almost 50% in the past three years. Inbound moves are slowing. And soaring mortgage rates and insurance premiums have eroded one of the Sunshine State’s most alluring attributes: affordability.

“The fact that Florida is getting more expensive is making it less attractive to homebuyers,” said Daryl Fairweather, chief economist for Redfin Corp. “It becomes a concern for people trying to fix their monthly housing expenses.” The pullback in Florida, while still moderate compared with downturns in once-hot Sun Belt areas like Phoenix and Austin, shows the limits of a pandemic boom that has priced out locals and inflated the cost of entry for newcomers. One top destination for New Yorkers heading South — Miami — is now the most-unaffordable metro area in the US, according to May data from RealtyHop on homeownership expenses relative to incomes. Despite the sharp increase in housing costs in South Florida, I still feel the cost of living, quality of life, pro-business policies… are much better than the major alternatives.

In a related note, a reader sent me this summary of Miami’s condos with the highest appreciation between 2018-2023. I think some of these numbers are low!

Elon Musk's decision not to pay rent on Twitter's offices is causing pain to Goldman Sachs' commercial-mortgage portfolio. Citing data from the Federal Deposit Insurance Corporation, the Financial Times reported this week that Goldman Sachs' banking arm saw the value of delinquent commercial-real-estate loans rise 612% to $840 million over the first quarter. That dwarfs the rise of commercial-real-estate delinquencies across the US banking industry, with bad commercial real-estate loans rising just 30% nationwide, notching $12 billion over the first quarter. Elon Musk is arguably the most important person in the world today. However, he does a lot of stupid things. How in the hell does he think it is ok not to pay rent? He is worth $230bn and controls TSLA, SpaceX, Boring, Neuralink, and Twitter.

It is very simple Eric. The Biden rumors are not gaining traction because there are baseless. Biden may be many things but he is not stupid. What VP would take a $10 million bribe from a foreign government while in office? Now Hunter is a different story. His involvement with Burisma is at best unethical if not illegal. Let's wait to see if he gets indicted.

If you want to talk about corruption consider Jared Kushner. He cozied up to the Saudis and MBS while in office and a few weeks after leaving the White House MBS overrules his advisors and the head of the Saudi sovereign wealth fund and orders them to invest $2 billion in Kushner's fund. As Chris Christy said last week: " Do you think he ( Kushner ) is some kind of an investment genius or do you think it was because he was sitting next to the president of the United States for 4 years doing favors for the Saudis?"