Opening Comments

The most opened link in the last report, Candy Kisses-And an Exclusive Hedge Fund Job Posting was the UFO video.

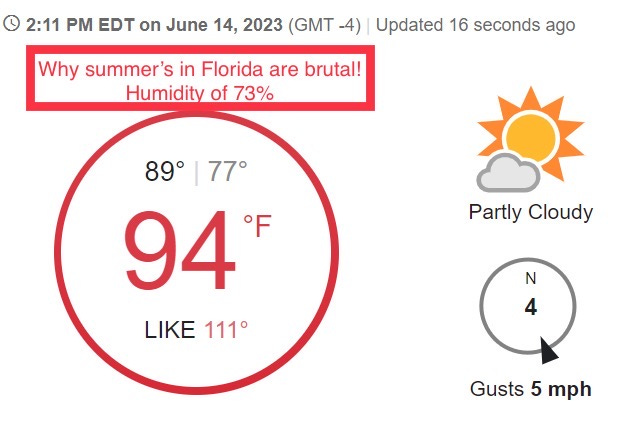

I’m in NYC and it is nice to be back. The weather has been incredible, and I have never had any smoke issues. Off to Bad Roman tonight, one of the hardest reservations in NYC. Summers in Florida are brutal and the picture below tells you all you need to know, and it is from today at 2:11pm. Feels like 111 degrees with the heat index.

I had one dinner at Le Bilboquet. The place is not my favorite, but one dish stands out is the cajun chicken which I have ordered EVERY SINGLE TIME I go there. I never leave one piece of food on the plate when I order it. If you go there and get anything else, we cannot be friends. I will say this about the people in NYC. There is a certain chicness that you don’t find in most other places and definitely don’t find in Boca. The way people dress in NYC is so stylish, it is nice to see, and the people in Le Bilboquet definitely have style.

On a serious note, I have a good friend who is in need of power of the Rosen Report network. His wife is hospitalized with pulmonary hypertension and is in need of a drug called Sotatercept by Acceleron/Merck which was approved by the FDA, but not available until August. It can be obtained by the compassionate use standard with the help of Merck/Acceleron. Any connections with Merck please advise. This is time sensitive.

Markets

Inflation Coming Down

Ways the Wealthy Save Taxes

US Rents Turning

Housing Affordability

US Housing Overvalued in Some Markets

NYC Coop Sells at Big Loss-Look at South Florida During the Same Time

Westfield Gave Back the Keys at a Major Mall in San Fran

Video of the Day-Silly Game

I am not sure why I found this video as funny as I did, but I was crying. It is a game where a man is blindfolded with a belt that he tries to hit the other players. The other players try to avoid being hit but have some kind of quaking ducks taped to their feet. The men try to tip-toe to avoid making the sound so the belt carrying blindfolded man cannot find them. I must be losing my marbles to find this so funny. It is a few minutes long, but you need to watch it to see how the guys are trying not to laugh and pushing each other to bear the brunt of the abuse. The blindfolded man takes it very seriously. I nearly wet my pants at the 3:20 mark when one man tries to use the other as a shield and the poor guy gets whacked.

Mike Cembalest-Letters to the Editor

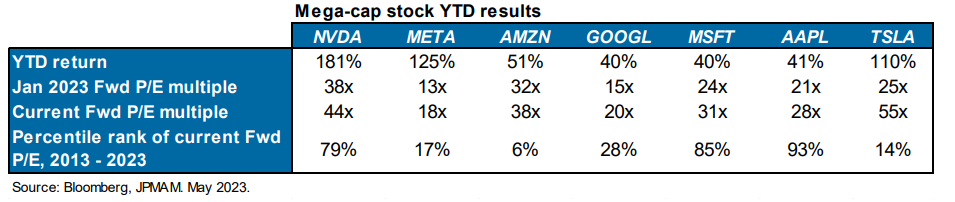

Mike has a unique ability to cover a lot of topics in great detail and although there are many in this piece, I will focus on market breadth, something I have written about frequently. It’s been another one of those years when US equity markets are dominated by mega-cap stocks. The average YTD return on Amazon, Apple, Google, Meta, Microsoft, NVIDIA and Tesla: 84%. The average YTD return for the rest of the S&P 500: just 3.7%. Apple’s market cap is now the same as the entire Russell 2000 Small Cap Index, the largest 7 companies represent the highest share of market cap on record (25%), and the percentage of stocks beating the S&P 500 on a trailing 3-month basis is just 11%, surpassing the March 2000 low of 20%. His section on AI is good too. This is one of my favorite reports of his in recent memory and always feel smarter having read it.

Why I Love Taylor Swift

It might sound a bit strange that a 53-year-old father of two teenagers loves Taylor Swift. When you hear the reasons why, I think you will agree. I want to start with a little background on Ms. Swift. She was born on December 13, 1989 in West Reading, PA, and was named after James Taylor (I love him too). She became interested in musical theater at age 9 and was taught guitar at age 12 by a computer repairman name Ronnie Cremer. She started working with a talent manager in 2003, and landed a modeling gig for Abercrombie & Fitch. She had an original song included on a Maybelline compilation CD. At 14 years old, she moved to Nashville with her family to pursue her music career.

This part of the story is truly why I love Taylor Swift. At 15 years-old, she was offered a recording contract by RCA records and TURNED IT DOWN. What 15-year-old dying to be in the music industry turns down a deal from a major label? Taylor Swift. Why would she do such a stupid thing? The record executives did not want her to write her own material and wanted her to do cover songs. "You don't just walk away from a big record label like that when you're an unsigned artist," Swift tells the Associated Press. "But I had a gut feeling about it, and some of the best decisions I've made in my career have been based on solely gut feelings and my instinct." Those instincts paid off. A year later, Swift signed with the independent Big Machine Records, releasing a debut album of songs all written or co-written by her. The album has sold almost 6mm copies. To be clear, this is the #1 reason I love Taylor. She had confidence in herself, her song writing, her story telling to turn down a large contract at 15. I am among the most confident people I have ever met. There is no way in hell I would have turned down a contract at 15.

Taylor Swift is an AMAZING songwriter. “I wrote songs in schools because I had no one to talk to” she said. Taylor Swift has revealed she was often isolated by her classmates in high school which caused her to start writing songs about her feelings as a way to cope with "loneliness." The 'We Are Never Ever Getting Back Together' singer is well known for the emotional content of her music, and says she started writing as a way to express how she was feeling because she didn't have many friends. I read an article years ago about a woman who helped Taylor in high school write songs and she basically said it was an “easy” job because Taylor would leave school and write about her struggles, troubles, loves, and disappointments. The assistant writer had to do little to help the high school songwriting prodigy. Taylor has written 30% of her songs SOLO and has collaborated on 70%. As of 2022, she wrote 54 of her songs alone and co-wrote all others. The simplicity of her story is remarkable. However, the story itself is amazing.

I love winners and Swift clearly qualifies. She has 12 Grammy Awards and 46 nominations. She has won HUNDREDS of awards across AMAs, VMAs, ACMs, Grammy, MMVAs, EMAs, CMAs, IHeart Radio, Teen Choice, BMI and many others. This site has her winning 540 awards as of January 2023. As of February, she has sold over 50 million albums and over 150 million singles worldwide. She became the first person to hold the entire Billboard Hot 100 Top 10 in 2022.

My wife, Jill, and daughter, Julia, went to a Swift concert in Tampa last month and were BLOWN away. Taylor Swift is a remarkable performer. My wife was a celebrity stylist and has been to hundreds of concerts across the world. Jill dressed Nirvana, Pearl Jam, Public Enemy, and countless others. When she came back from Taylor Swift, she said, “This was another level. Best concert I have ever seen. Taylor did not stop for 3 hours.” To me, Swift’s professionalism is at another level. I have no idea who the real Swift is, but what she has created is amazing. My 50-year-old friend took his daughter to a Swift concert and said, “It was remarkable. The entire crowd knows every word to every song and Swift never faulted. She was amazing. It was the best time.” Now don’t get me started on the fact that I spent $3,200 for two crappy tickets to a concert and a huge amount of that was for fees. This is another topic which I will address at some point.

There are not many solo acts can sell out 70,000+ seats night after night, but Taylor sure can and her loyal fans eat up her nearly 4-hour, 44 song performances.

My daughter had a Sweet Sixteen party a couple weeks ago, and 20 of her girlfriends showed up. When the DJ played Taylor Swift songs (90% of the time), the girls were screaming out EVERY word and danced. They LOVED every minute of EVERY Swift song.

With respect to business acumen, Taylor is yet another level. She is original, connects with fans, pays attention to detail, rewards superfans, partners with top brands… She also had the insight to pass on partnering with FTX while most other major celebrities jumped at the chance to earn a buck. She was offered $100mm from FTX to sponsor her tour but passed after asking critical questions. Tom Brady, Gisele, Steph Curry, Naomi Osaka, Big Papi , Kevin O’Leary, Shaq, and countless others did not ask the questions that Swift asked. This People article suggests Swift’s tour could generate $4.6bn for the US economy. WOW.

I am going to be slightly critical of Taylor. She is not the single best vocalist or musician on the planet. No, I don’t think her voice is as good as Adele, Ariana Grande, Whitney Houston, or Celine Dion. Her guitar and piano skills don’t compete with the best musicians, but the total Taylor Swift package of songwriting/story telling, singing, guitar, piano, performance, stage presence, insane desire for perfection, business acumen and willingness to pass up the RCA and FTX contracts make her stand out to me. I believe her songwriting talent is truly legendary. It is simple and something everyone can relate to.

As a result of all of the above, I LOVE TAYLOR SWIFT. I am not the only old man who feels this way as Paul Rudd and Aaron Rodgers seem to have a blast at the Swift concert too. This is a video of future Hall of Fame QB, Aaron Rodgers dancing at a concert.

Quick Bites

The Fed held off on a rate hike Wednesday, but surprised the market suggesting two more are coming this year. Powell said, the central bank has “a long way to go” to get inflation back to 2%, but monetary tightening has not fully worked its way into the system yet. Given inflation is down sharply (next bullet) and my view of the consumer, I believe this is the wrong call. The dots moved decidedly upward, pushing the median expectation to a funds rate of 5.6% by the end of 2023. Assuming the committee moves in quarter-point increments, that would imply two more hikes over the remaining four meetings this year. The 2-year Treasury yield rose by more than 4 basis points at 4.741%. Futures suggest a 72% chance of a 25bps hike in July. Stocks sold off on the news, but bounced into the close, with the Dow-.7%, S&P+.1% and Nasdaq was +.4%. The Russell was the big under performer -1.4%. For the past 5 days, the major indices are all up nicely other than the Russell which is largely unchanged. The VIX (measure of volatility of the S&P 500) has crashed down to 13.98 as of 3:39pm Wednesday. It was 34 in October 2022 and 66 in March 2020. The VIX seems too low to me here. Oil dropped 1.5% on the rate hike fears and is back to sub $67 and -14% YTD.

The consumer price index increased just 0.1% for the month and 4% from a year ago, the latter being the lowest level in about two years. Excluding food and energy, core CPI rose 0.4% and 5.3%, respectively. All the numbers were in line with consensus estimates. Following the release, markets priced in a nearly 100% chance that the Federal Reserve will not raise interest rates this week. Approximately one year ago I called that inflation had peaked and indeed it has as evidenced by the chart below. Given the banking issues and a stretched consumer, I feel we will continue to see inflation come down. The impact of the sharp rise in rates is really kicking in as well.

I found this article which highlights ways wealthy people save on taxes and feel a few of these are really good which I use myself. I will give the headlines and if you are interested, click on the link to get the details.

Using trusts to give away homes

Passing wealth to future generations with trusts that last up to 1,000 years

Giving to charity via trusts

Taking loans to pay R/E Taxes

Buying offshore life insurance policies

Transferring depressed assets during a market slump

Other Headlines

Most of the time this guy is bullish.

Ken Griffin Ramps Up Credit Bets, Anticipating US Recession

“We’re much more cautious about 2024,” the billionaire founder of Citadel said in an interview in Hong Kong, adding that the world’s largest economy is unlikely to avoid a downturn that year. “We’ll look at the credit markets as a source of opportunity. Credit should be a meaningful contributor later this year” and next for Citadel, he said.

JPMorgan prepared to pay $290 million in settlement with Jeffrey Epstein victims

AI firm Synthesia hits $1 billion valuation in Nvidia-backed Series C

Goldman Sachs Is at War With Itself

CEO David Solomon has come under fire from partners who complain about bonuses, strategy and that DJ side gig

FTC files to block Microsoft-Activision as deadline approaches

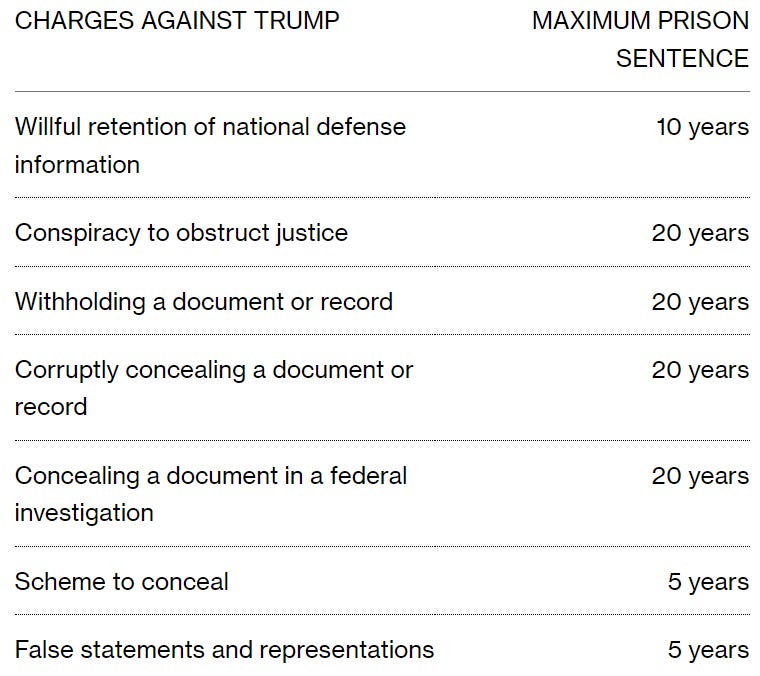

Trump Pleads Not Guilty to 37 Charges in Documents Case

The last link was Bloomberg and this is the CNN on the subject.

I can’t say it enough. New blood is needed on the 2024 ticket not named Trump, Biden or Harris. There are calls for the Trump-appointed judge to recuse herself. The former president was released under several conditions – including that he appear in court for future hearings. Trump did not have to surrender his passport and does not have any restrictions on his travel. This article suggests that Jack Smith may charge Trump in NJ as well, as he apparently showed confidential documents to others in Bedminster, NJ.

Corruption Case Against the Bidens is on the Verge of Exploding

I am concerned about the FBI’s continue bias. If the tapes of Hunter and President Biden exist, I sure hope to hear them. How is it possible that the FBI won’t release unclassified documents in full to congress after a subpoena or the Deputy Director of the FBI won’t answer if he has the Biden tapes? This is a good video and story about the alleged bribery scheme during Biden’s Vice Presidency. My the FBI looks awful here and you can see Senator Cruz eviscerate the Deputy Director of the FBI. Must watch TV. If the 17 tapes don’t exist, why does the FBI just say that?

Press secretary Karine Jean-Pierre violated Hatch Act when using the phrase 'mega MAGA Republicans'

Posh Miami Enclave to Become US Soccer Hub With FIFA, Messi Set to Move In

FIFA set to make city its long-term US base after World Cup

Argentine superstar Messi is close to joining Inter Miami

Microsoft alarmed at doctors using CHATGPT to tell patients bad news

NYC straphanger casually shoots up during morning commute in disturbing video

Why do we not have mandatory sentencing for hate crimes of any kind? The assailant said he would do it again. Give him life in Rikers and send a message.

Manhattan street-brawl murder is a surreal sign of what's to come

8am on 7th Ave and 30th Street. Concerning pictures and video.

Companies Quiet Diversity and Sustainability Talk Amid Culture War Boycotts

Target stores see more bomb threats over Pride merchandise

The threats Saturday in parts of Oklahoma, New York, New Hampshire, Vermont and Louisiana mirror those made in recent weeks in Ohio, Utah and Pennsylvania. As of Wednesday afternoon, TGT stock is -16% since May 17th.

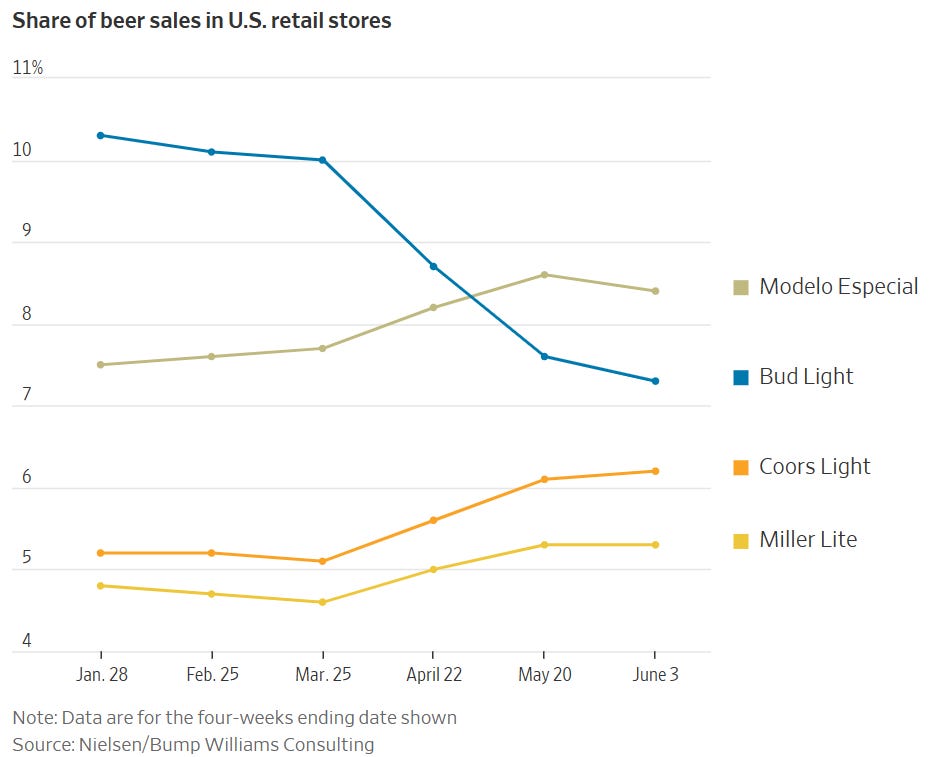

Bud Light Loses Title as Top-Selling U.S. Beer

Think of how many years of work and millions of ad spending it took to get 10%+ market share and look at how quickly it fell to 7%+.

The Great Grift: How billions in COVID-19 relief aid was stolen or wasted

An Associated Press analysis found that fraudsters potentially stole more than $280 billion in COVID-19 relief funding; another $123 billion was wasted or misspent. Combined, the loss represents 10% of the $4.2 trillion the U.S. government has so far disbursed in COVID relief aid. I recently wrote an article, “I’m From the Government and I’m Here to Help,” about government waste and this AP story does nothing to alleviate my concerns.

Longevity doctor shares the new diet he follows to 'beat diseases and live longer'

Article goes into detail on fruits, vegetables, legumes, oils, seafood and liquids.

‘I’m joining the coolest company on the planet’: Elon Musk’s newest SpaceX employee is just 14

SpaceX’s newest staffer, 14-year-old Kairan Quazi, is graduating later this week with Santa Clara University (SCU)’s Class of 2023, which will see him become the youngest graduate in the institution’s 172-year history.

Texas Is Expected to Break The Power-Demand Record as Heat Intensifies This Week

Another fragile power grid which can easily lead to disaster.

Americans Say They Need $2.2 Million to Be Considered Wealthy

NBA Finals: Nikola Jokić, Nuggets survive Heat to secure franchise's 1st NBA championship

I am a HUGE fan of Jokic’ and believe he is an all-time great at 28 years-old. He was finals MVP by a mile and averaged 30.2 points, 14 rebounds, 7.2 assists and 1.4 steals/game while shooting 59.3% from the field, 42.1% for 3s and 83.8% from the free throw line. Those are mic dropping stats.

AI helps create 'final' Beatles song with John Lennon: Paul McCartney

McCartney calls artificial intelligence ‘kind of scary, but exciting’

The three scientists were engaged in “gain-of-function” research on SARS-like coronaviruses when they fell ill. I said very early this was from a lab and received much hate mail about that view. In my opinion, there is no chance this was a wet market and Jon Stewart’s comments on this were spot on and hysterical.

Real Estate

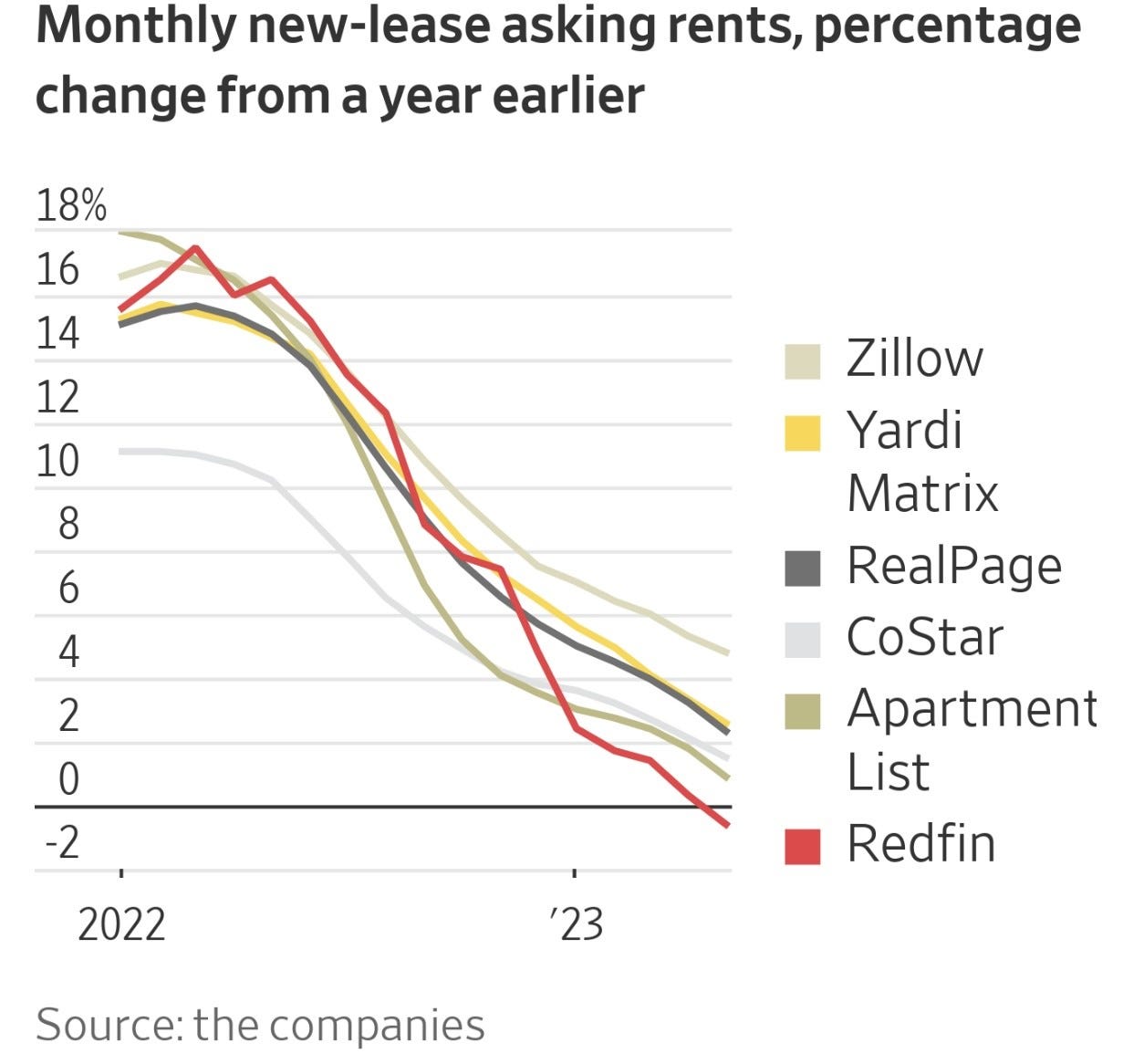

Interesting WSJ article, “Renters Are About to Get the Upper Hand,” on rents which are showing signs of turning over after an epic run. The average of six national rental-price measures from rental-listing and property data companies shows new-lease asking rents rose just under 2% over the 12 months ending in May. That is down from the double-digit increases of a year ago and represents the largest deceleration over any year in recent history, according to data firm CoStar Group and rental software company RealPage. In some markets, such as Miami and Riverside, Calif., monthly rents are up 35% or more over the past three years. But the high prices started to weaken demand from renters in the second half of 2022, many of whom were pushed to their financial limits by higher rents. Some are moving back in with parents, taking on roommates or relocating to cheaper cities.

The housing affordability crisis has priced middle-income buyers from a majority of homes on the market. Buyers earning up to $75,000 could only afford 23% of properties listed for sale in the US. Affordability has been crimped by low inventory and mortgage rates at multi-decade highs. The US housing market is so unaffordable, over 75% of homes on the market are too expensive for middle class buyers. That's largely due to the shortage of housing supply, which has hit middle income buyers the hardest. Thanks to elevated mortgage rates, the housing market is missing around 320,000 homes priced at or below $256,000 – the maximum price a middle-income buyer earning up to $75,000 can afford.

There are some good charts in this real estate article about how homes in many cities are overvalued. I am inserting one, but others are good too. Sean Dobson, founder and CEO of property powerhouse Amherst, manages $16.8 billion in capital for investors. Amherst oversees a portfolio of roughly 44,000 residences across 32 metros in 19 states. Although Dobson feels housing is over valued, he does not see another Global Financial Crisis scenario.

Eight years after first listing his Fifth Avenue duplex, celebrity hair stylist Frédéric Fekkai has finally sold it for $4.5 million — far less than its original asking price of $12 million. He bought the home for $7.4 million in 2006.

The third- and fourth-floor duplex, at 953 Fifth Ave., was designed by Robert Couturier, and comes with a dramatic red-and-blue color scheme. At 3,500 square feet, it features four bedrooms and 4½ baths. In 2006, pre-construction, you could have bought in the Apogee in South Beach for 800 ft and today it goes for $4,000. In my community, you could have bought two amazing intracoastal lots for a total of closer to $6mm and they would be worth $21mm+ today. NYC R/E has really underperformed South Florida in recent years. I did not get a Palm Beach quote, but imagine during that time, it would be up 5-6 times or more. Some are up 10 times during that period, which is in sharp contrast to NYC.

Not that San Fran needed yet another blow to its real estate market, but Westfield walked away from its Union Square mall property this week. The property was in the heart of downtown and it was handed back to lenders. There is $558mm of outstanding debt affiliated with the property. Sales at the Westfield Centre fell to $298mm from $455mm in 2019, while foot traffic fell 43%. Other Westfield properties saw increases during this time according to the article. The city has seen a combination of wealthy individuals and major companies leave as well as numerous store closings over the past 18 months. More owners of hotels, retail, office buildings are turning the keys over to the lenders. Unfortunately, bad policies are mostly to blame for the situation.