Opening Comments

Flying to Memphis is not easy from Boca. Limited direct flights made us take Allegiant from Ft. Lauderdale direct to Memphis or you need to leave out of Miami. Allegiant is a small step above Spirit (worst airline ever). I have written about my impressive narcoleptic tendencies when I get on planes in my recent piece, “Narcoleptic When Needed.” I fell asleep on the plane to Memphis, and it had not taken off yet. The idiot flight attendant came by with drinks and snacks to buy (nothing free) and woke me up by tapping me to ask if I was hungry. I did not fall back asleep the entire flight. I can’t escape the heat. Of course, the temp drops sharply the day after I leave. We are on a 4:45pm flight Wednesday to Miami. Shockingly, I am at gate #2, it is something which never happens. I am playing Powerball this week.

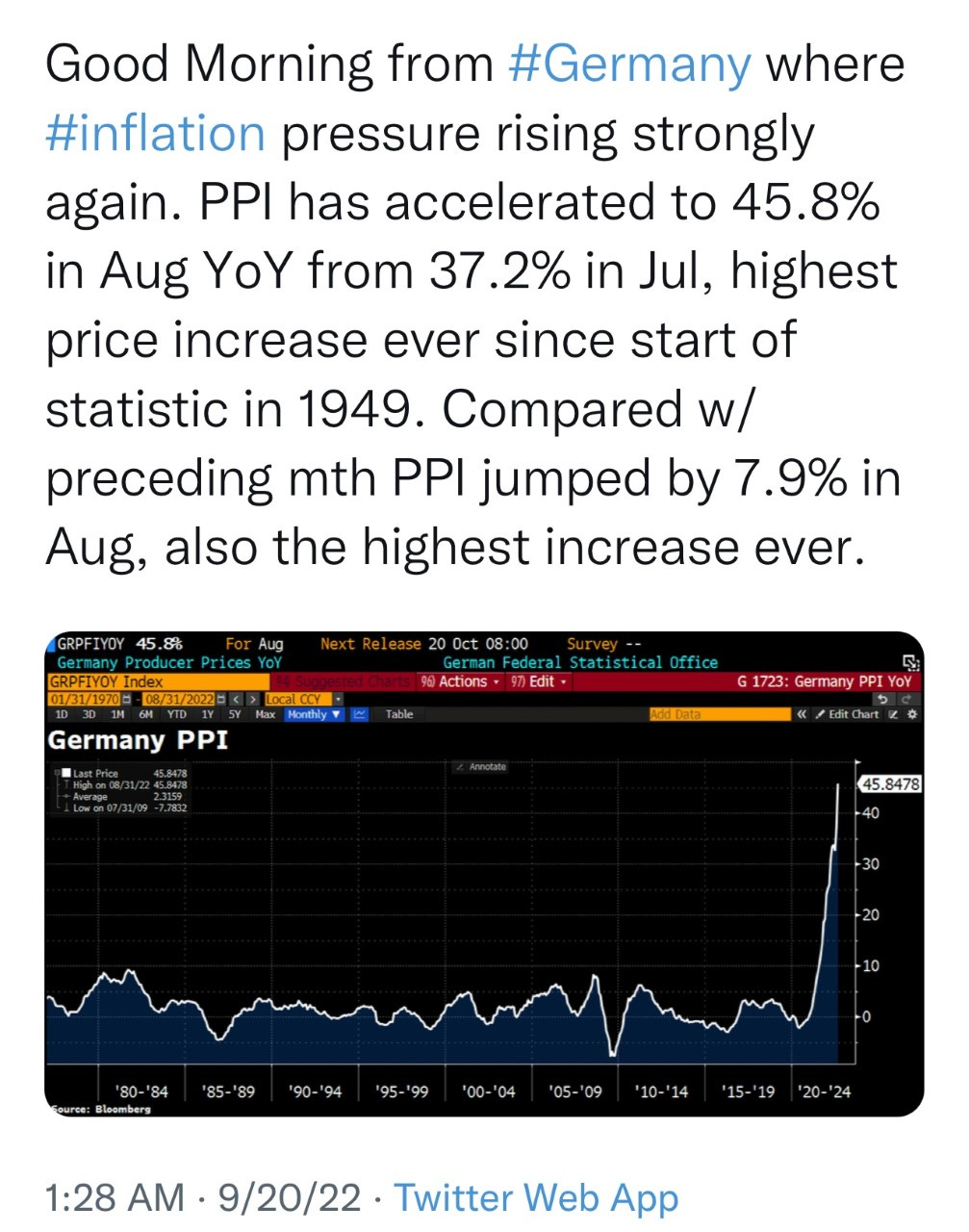

In a follow up to my last piece “Will the Fed Screw Up Again,” I thought this picture was a perfect complement. We need to hold Fed officials accountable for massive policy mistakes.

Today’s piece is normal length, but lots of photos/charts which make it seem longer. Some truly crazy stories in the world recently. I am taking off now, so I did not get to digest everything today, but have some up to date charts in the markets section.

Pictures of the Day-Queen Elizabeth II Funeral

Coffee is for Closers

Quick Bites

Markets

Strong Dollar Issues

Consumer Debt Levels

NY Cannabis Licenses to Criminals?

Stampede from NY to FL Continues

Other Headlines

Crime Headlines

Virus/Vaccine

Real Estate

General Comments-Cushman & Wakefield Report on South Florida Multi-Family

Bloomberg on Griffin in Miami

NYC Office Occupancy

Homebuilder Sentiment Falling

Other R/E Headlines

Picture of the Day-Queen Elizabeth II Funeral

I was travelling and did not get to watch any of the funeral on Monday. This link has a couple dozen great pictures from the Associated Press, and I included a few of them here. Over 4.1 BILLION people watched the funeral, a staggering number in my mind. For perspective, Lady Di’s funeral was watched by 2.5bn, and her wedding to Prince Charles had 750mm views. 112mm people watched the last Super Bowl.

Coffee is for Closers

I turn 53-years-old on November 25th, and I have never tasted a cup of coffee. Ever! According to Alec Baldwin in Glengarry Glen Ross, “Coffee is for closers,” in an incredibly memorable scene. The full scene gets pretty aggressive, so I only included a short blurb (contains language). Great movie and acting-Baldwin, Spacey, Lemmon, Arkin, Harris…

There is actually a silly story behind the fact that I never had a cup of coffee. When I was young, I was called, “The Candy Kid.” I loved sugar and going to the five and dime to buy junk.

In our house in Chicago, my mother had a coffee table with a candy dish. I was about 5 years old and I snuck to the living room dish to unwrap what I thought was a tasty candy and it turned out to be coffee candy. I spit it out on the rug. I thought it was vile.

I convinced myself coffee tasted horrible and stayed away from it. As I got older, everyone was drinking coffee. My cumulative spend at Starbucks is not $50, and it was spent on water or hot chocolate. I have no idea what a latte or vente means and really don’t care. Despite my thousands of hours of cooking, I have never used the fancy coffee maker in my kitchen and don’t know how.

My readers know I have ADHD and am a bit “high-strung.” The other factor is I have been told by hundreds of people something along the lines of: “It is a good thing you don’t drink coffee, as you would bounce off the walls. Maybe it is best you stay away from it after all.”

What made me tell this story? I am in Memphis, TN with my son for his golf lessons we went out to dinner with his two coaches to a steak restaurant on Sunday night. Jeff said, “The best thing on the menu is the “coffee-cured” filet mignon.” I never really order steak, given I make it at home better than any restaurant, but I thought I would give it a try. I must tell you that the “coffee-cured” filet was actually pretty darn good with a nice medium-rare cook on it. So although I have never had a cup of coffee, I actually kind of tasted it for the first time since the infamous candy incident nearly 50 years ago.

No, I will never have a cup of coffee, but I am not opposed to having that steak once in a while. This is a link to the recipe. I am yet to make it myself.

Quick Bites

Stocks fell in volatile trading Wednesday after the Federal Reserve raised rates by 75 basis points and forecast more sizable rate hikes ahead in its fight to tame surging inflation. The Dow slid 522 points, or 1.7%, to close at 30,184. The S&P 500 shed 1.71% to 3,790, and the Nasdaq Composite slumped 1.79% to 11,220. The S&P ended Wednesday’s session down more than 10% in the past month and 21% off its 52-week high. Even before the rate decision, stocks were pricing in an aggressive tightening campaign by the Fed that could tip the economy into a recession. The terminal rate is now 4.6% and suggests no rate cuts next year. Markets/Fed/Rates rising. The two-year Treasury yield hit 4.10% on Wednesday. Remember, it was 76bps in January. The 2nd and third charts are telling with the 2-year Treasury widening substantially while the S&P fell 20%+. The US Dollar closed at 111.29 against the DXY basket, a high for the year. The Dollar is now up almost 16% YTD. I continue to believe inflation has peaked as I suggested weeks ago. However, I never suggested it will crash. I do feel a few items such as wages, food and rent will be sticky, but most others will start falling more sharply.

The U.S. dollar is experiencing a once-in-a-generation rally, a surge that threatens to exacerbate a slowdown in growth and amplify inflation headaches for global central banks. The dollar’s role as the primary currency used in global trade and finance means its fluctuations have widespread impacts. The currency’s strength is being felt in the fuel and food shortages in Sri Lanka, in Europe’s record inflation and in Japan’s exploding trade deficit. At the European Central Bank’s meeting on Sept. 8, President Christine Lagarde expressed concerns about the euro’s 12% slide this year, saying it has “added to the buildup of inflationary pressures.” U.S. Treasury Secretary Janet Yellen acknowledged that the appreciation of the dollar could pose challenges for emerging economies, particularly ones with large dollar-denominated debts. I have written on this topic 20 times or more for a reason, I want to be sure my readers know that a strong dollar is not all-good. The 2nd chart was prior to this week’s rate hike in the US.

I am growing frustrated by the continued idiotic policies in woke states around crime, education, police, immigration, homeless, guaranteed income… This Fortune article appeared to be a joke to me, but it is not. Why New York’s First Cannabis Licenses Will Go To People With Pot Convictions. New York will give its first cannabis dispensary licenses to people who were convicted of marijuana-related offenses in the state. The New York State Cannabis Control Board voted unanimously on Thursday to propose the regulations to allow the first couple hundred retail licenses to be given to people who have been convicted of pot-related crimes. So, it seems to me that criminals get out bail free for heinous crimes, don’t tend to serve time and then get the benefit of being drug dealers by getting choice cannabis licenses. From what I read, crime actually does pay with little consequence. Maybe I teach my kids to be drug dealers rather than attend college. After all, that seems to be the best path to a lucrative cannabis license and saves me $350k in college costs. Maybe the people coming up with these dumb policies are smoking too much dope. How else could you come up with such dumb policy?

According to an Aug. 30 report from the Federal Reserve Bank of New York, credit card balances increased by $46 billion from last year, becoming the second-biggest source of overall debt last quarter. And so it comes as no surprise from Bloomberg that more US consumers are saddled with credit card debt for longer periods of time. According to a survey by CreditCards.com released on Monday, 60% of credit card debtors have been holding this type of debt for at least a year, up 50% from a year ago, while those holding debt for over two years is up 40%, from 32%, according to the online credit card marketplace. Yes, inflation remains high, but starting to crack. Consumers have been resilient, but I am growing worried that it will not last. Rates going higher, layoffs mounting and economy will slow. I expect unemployment to rise decently from low levels over the next year. With rising consumer debt levels, expect defaults.

The COVID-driven rush of New Yorkers into Florida has turned into a stampede — with no end in sight. A record-breaking number of Empire State residents switched their driver’s licenses to the Sunshine State version last month, according to a Post analysis of Florida Department of Highway Safety and Motor Vehicles data. A total of 5,838 New Yorkers made the switch in August — the highest recorded number for a single month in history, the numbers show. Year to date, 41,885 New Yorkers have handed over their licenses after moving south, a torrid pace that’s pointing to a new annual record. Some observers had speculated that the outbound flow would ease with COVID receding and cities opening back up. Nothing to see here folks. I just wish I could get access to more granular data on income/wealth levels of those leaving for Florida. What is the biggest driver for the leavers: crime, quality of life, cost of living, weather, taxes, mandates, homeless? I am not suggesting for a minute South Florida is without fault. Plenty wrong with it, but relative to NYC, Chicago, SFO, LA, DC… it is hard to beat on most fronts. So many bright, young and interesting people coming down. I am going to Miami on Thursday for an event. Will be 40 people. All successful South Florida residents who left major cities in recent years for Florida. Unheard of for groups like this when I moved 5 years ago, and now I am going constantly.

Other Headlines

Lithium Resumes Insane Gains to Add Pressure on Automakers

Remember, more states have aggressive EV mandates, things like lithium prices will be crucial in making such mandates achievable. Since 2020, lithium prices are up 8-fold.

Twilio announces 11% of employees will lose jobs in 'Anti-Racist' layoffs

Gap eliminating about 500 corporate jobs as sales fall

I have mentioned dozens of large companies with layoffs. Many were aggressively hiring in 2021 and now laying people off. Keep an eye on it.

‘Ultra high net worth’ individuals with $50M or more spike to record high

Credit Suisse’s Global Wealth Report found that the number of UHNW individuals globally grew by 46,000 in 2021 to a total of 218,200. A 27% increase in one year seems crazy to me.

Clearly he was hungry for some meat and tired of plant burgers.

Mark Zuckerberg’s US$71 billion wealth wipeout puts focus on Meta’s woes

Switzerland's Environment Minister Suggests People Shower Together To Save Energy

You cannot make this stuff up. Europe is screwed. US politicians, please do not follow suit trying to go green before the technology is ready.

I keep writing about the European energy issues. We are complaining about 8% inflation. Check out Germany.

Biden says U.S. forces would defend Taiwan in the event of a Chinese invasion

White House back-tracked the statement.

Denver is set to provide 140 homeless people with $12,000 cash - no strings attached

School defends ‘gender rights’ of trans teacher with giant prosthetic breasts

The absurdity here is amazing. This is a biologically male high school teacher. Does anyone think this would be distracting to high school students?

Federal Court rules Big Tech has no 'freewheeling First Amendment right to censor'

Cleveland auto mechanic becomes doctor at age 51, inspires others to pursue their dreams

Love this story!

Rainfall from deadly Hurricane Fiona tops 30 inches in Puerto Rico

For perspective, Las Vegas rains 5.4”/year and Phoenix rains 8”/year

Lake Powell: Water from upstream reservoirs can't save reservoir indefinitely, officials say

This is a fun short video of Eli going under cover to make a college team. Anyone who likes football will get a kick out of it.

Crime Headlines

McDonald's ax-attack suspect Michael Palacios freed without bail

Did you see the video? Seems unstable and violent, perfect to be put back on the NYC streets.

Texas border town business owner sells family BBQ restaurant after multiple migrant break ins

Porous borders which result in high crime have a cost for law-abiding, tax-paying citizens. Another business closed due to crime. Is this fair?

Border Patrol agents nab a dozen people on terror watchlist at southern border in August

Border Patrol have now encountered 78 individuals on terror watchlist this fiscal year alone. The Biden Administration has done an AWFUL job on the border. In fiscal 2022 (ends September). Almost 2.5mm illegal immigrants will come to the US. We need a better plan. We cannot handle the volume and too many bad actors are getting through the system.

Virus/Vaccine

Improvement continues across the board. The positivity rate was as high as 19% and is now down to 11%.

NYC fires another 850 teachers and teaching aides after they failed to get COVID vaccine by Sept 5 (total of 2,000 now)

Real Estate

A loyal reader, John, sent me this AMAZING link to a Cushman & Wakefield report on multi-family buildings in South Florida. Remarkable data on apartments per foot price and valuations. Here are some charts from Dade, Broward and Palm Beach counties. A friend who owns and manages tens of thousands of apartments across the country told me a new apartment building in Boca just sold for $650k/unit in Central Boca west of I-95. Five years ago, he tried to buy a building for $185k/unit and was unable to secure financing at that price. Yes, times have changed dramatically on multi-family housing in South Florida and elsewhere.

Great Bloomberg article on Ken Griffin/Citadel, and the move to Miami is entitled, “Citadel’s Griffin Brings Billions to Miami With Political Winds at His Back-The Citadel founder worth $29.6 billion has ditched Chicago for Wall Street South. Not everyone in Miami is so welcoming.” “We’re not sort of in — we’re all in,” Griffin said in an interview in Miami. The article goes over a lot of topics, and he reiterated the horrible crime in Chicago as being a reason for leaving. Bad policies have consequences, and the wealthy people can dictate terms by voting with their feet. Griffin is building a 1,000 foot tower in Miami and plans on recruiting major tech firms to the building. He is big on education and will partner schools. Ken will be a great addition to Miami. I believe he donated over $700mm to Chicago. I will reiterate for the 100th time that getting kids into school who move to Miami is hard, and many families with school aged kids cannot move down unless Griffin builds them a school. Of note, Ken appears to be considering Treasury Secretary if DeSantis were President.

The report by Partnership for New York City surveyed more than 160 major Manhattan office employers and found that 49% of office workers are currently at the workplace on an average weekday, up from just 38% in April. However, just 9% of employees are in the office five days a week. The share of fully remote employees dropped from 28% in April to 16% by mid-September, and by June 2023, 54% of workers are expected to be in the office on an average weekday. The survey found that 77% of employers intend to keep a hybrid office schedule post-pandemic, largely in response to employee preference. Think of the impact on retailers, restaurants and service providers in the city. How can they stay in business with 50% of the foot traffic?

From Peter Boockvar. The September NAHB home builder sentiment survey saw its index fall another 3 pts m/o/m to 46 after dropping by 6 pts in August, 12 in July and in the 6 months prior. It’s now declined each month this year not surprisingly considering the steep rise in mortgage rates on top of the sharp home price increases. The estimate was 47. Present conditions fell 3 pts to 54 while the Future outlook was down by 1. The survey was almost 80 in early 2021 and now 31 (chart below). This is a follow on article, “More homebuilders lower prices as sentiment falls for ninth straight month.”

Other R/E Headlines

Home-Flipper Opendoor Hit With Losses in Echo of Zillow Collapse

Company lost money on 42% of its August resales after it failed to anticipate slide in housing demand.

Single-family rent increases cool for the third straight month