Opening Comments

Jack and I are heading to Memphis Sunday afternoon for his golf lessons and will return on Wednesday night. Of course the high temperature will be 100 degrees during our stay, as I cannot get a break from the heat. Jeff Smith is his coach who is arguably one of the most knowledgeable swing coaches around. He coaches multiple top PGA Tour players including Viktor Hovland, Aaron Wise, Patrick Rodgers, Davis Riley, Dylan Wu and others. We joined Spring Creek Ranch in Memphis so Jack can play when he takes lessons, and the course is shockingly good.

I again want to thank all the readers who contribute to the Rosen Report. I get hundreds of emails some days from my loyal readers giving me story ideas, feedback and connecting me with “experts” to help me hone my stories. My biggest contributors are Robert, Ed, Billy, Beau, Mike, Gene, Rich, Ara, Joe, Howard, Bob, Brian, Peter, Rob, Val, Devin, Jared, Jamiel, Blair, Debbie and many others.

Picture of the Day-Biden Strategic Petroleum Reserve Clown show

Inflation/Deflation-Will the Fed Screw It Up Again?

Quick Bites

Markets

Euro Energy Crisis Continues

Twitter/Musk Hedge Fund Bets

Facebook Spying

Magnus Carlsen Lost in Chess to a Cheat?

Roger Federer Retires

Other Headlines

Crime Headlines

Virus/Vaccine

Real Estate

General Comments-Palm Beach Commercial

Rents Declining?

Greenwich, CT Update

Other Headlines

Picture of the Day-Biden Strategic Petroleum Reserve Clown show

My readers know I like to call out hypocrisy and this is a perfect example. When oil was crushed during the pandemic, Trump wanted to buy it to fill the Strategic Petroleum Reserves (SPR), but the Democrats blocked it despite the $24/barrel price. Now, Biden wants to top up the SPR around $80/barrel. Nothing to see here folks. The Dept of Energy suggested that there is no “trigger price” finalized at this time. The clown show of DC continues to waste taxpayer money. I am so opposed to the high taxes because I have less than ZERO faith the government gets to the right answer with my hard earned dollars. The waste around all these idiotic free money giveaways is staggering. Articles suggested billions of fraud a lot of the money ended up overseas. Remember Ronald Reagan’s comment that the nine most terrifying words in the English language are, “I am from the government and here to help.”

Will the Fed Screw It Up Again?

For anyone who has regularly read the Rosen Report, you know that I have been incredibly critical of the Fed. I wrote countless times over the past 18 months on the topic in countless reports and in at least three themed pieces in May and July of 2021 and June of 2022, “Druckenmiller vs the Basket Regarding Inflation-I Take Druck,” There Ain't No Such Thing As A Free Lunch and “There Ain’t No Such Thing As a Free Lunch Part II.” It is not just how the Fed handled the pandemic with over stimulus, but it has been their ineptitude around the Global Financial crisis and countless other disasters. Remember, in 2007 when Fed Chairman, Bernanke, said, “Subprime is contained,” or “there wont be an economic slowdown?” It has largely been an embarrassment despite fancy PhD degrees from top colleges. Remember how many times Powell and Yellen screamed the word, “TRANSITORY,” when others were sounding the inflation alarm bells including my countless reports of concern?

I was adamantly opposed to the zero rate policy and aggressive Quantitative Easing last year and felt it would lead to runaway inflation, something that proved true. The Fed bought $40bn of mortgage bonds a month with housing in short supply and prices at all-time highs, despite the fancy PhDs within the Fed. The $1.5 trillion+ Fed Balance Sheet expansion from the Jan 2021 until the spring of 2022 (see chart below) was unnecessary and a major policy error. Couple this with the constant fiscal stimulus programs and that outlines a major portion inflation debacle. I have to mention supply chain as a contributor as well, but again, the US leadership handled it shockingly poorly.

Very smart investors are coming to the conclusion the Fed will again get it wrong by raising rates too quickly. Barry Sternlicht, Elon Musk, Jeff Gundlach & Cathie Wood are now more worried about deflation, and I am beginning to feel queasy. Yes, inflation remains too high (food, wages, rent, medical), but I am seeing so many assets fall in price (homes, cars, commodities, gasoline, appliances, clothes, gas, ….). Sternlicht says, “the economy is breaking hard, and CEO confidence is miserable and a serious recession is imminent (4th Q).” Musk is concerned that higher rates will send prices down dramatically and lead to consumers delaying purchases. Gundlach has similar concerns and is calling for a sharp decline in stocks and likes longer term Treasuries due to deflation risks. Wood’s angle is a bit different citing technology and disruptive innovation as deflationary pressures.

The fear is the Fed has gotten it wrong so frequently that they will raise rates too much too fast. Higher rates take time to work through the system in many cases, and I am beginning to worry that the inept Fed who seems to have a bias against real-world work experience, will get it wrong yet again.

The markets are telling us the Fed is going at least 75 bps next meeting, and we are looking at basically a 4.5% terminal Fed funds rate according to the futures market. It suggests over 200bps of additional tightening from today’s levels. Given my lack of faith in the Fed, don’t be surprised if the Fed misses the mark yet again. Fed Ex announced earnings Thursday and they disappointed pushing the stock -21.4%, a big move for a market cap of over $50bn. The CEO says he expects the economy to enter an “worldwide recession,” given weekly declines in volumes since June, but I do believe some of the FedEx issues are self-inflicted. The World Bank echoed the Fed Ex CEO sentiment and suggested a global recession due to rising rates which is chilling economic activity.

One thing people are not discussing and should be is the $31 trillion (debt clock) in debt which is now going to cost a lot more with rising rates. This does not included unfunded liabilities including Medicare and Social Security which is close to $100 trillion. High debt levels, higher rates, growing subsides… will cause more damage to the Federal debt levels. In 2021, the US paid an average of 1.61% for the interest rate. I presume it goes up sharply for 2023, and it may result in over $1 trillion of interest expense for the year. I think the rest of the year could lead to a bumpy ride. Let’s get more Fed Presidents who live in the real world and not just academia!

Check out this WSJ Opinion, “Rising Interest Rates Will Crush the Federal Budget,” which goes into details on the scary numbers around growing debt and rates. I hope the Fed gets it right, but if history is any indication, brace for a hard landing.

Quick Bites

Stocks fell Friday as Wall Street wrapped up one of its worst weeks in months and traders reacted to an ugly earnings warning from FedEx about the global economy. The Dow dropped 139 points, or 0.45%, to close at 30,822. The S&P 500 shed 0.72% to end the week at 3,873. The Nasdaq slid 0.90% to finish at 11,448. It was the worst week for the S&P 500 and Nasdaq since June with the Dow -4.2%, S&P-5.2, -6.0%. Year to Date, the Dow is -15.2%, S&P -18.7%, Nasdaq-26.8% after the challenging weak. Shares of FedEx plunged 21.4%, its worst daily drop ever, after the shipments company withdrew its full-year guidance and said it will implement cost-cutting initiatives to contend with soft global shipment volumes as the global economy “significantly worsened.” Some are suggesting a portion of the FedEx miss as a management issue and market share loss to Amazon and I concur after studying the data. Also of note, Scotts Miracle-Gro (-67% YTD) has cut 450 jobs and the business went from gangbusters to sales crashing in a hurry. To me, the FedEx news could be a telling sign of things to come as the CEO cited weakness each weak since June. Bonds sold off sharply this week on the stronger than expected CPI data and the 2-Year Treasury weaker by 35bps to 3.87%. I put the chart together on stock sectors from Fidelity data. Also, I have written quite a bit about the US $ strength. I want you to check out the 3rd picture which is Bloomberg data put together by the folks at MUFG. I have warned about US $ strength and the black and blue chart is concerning.

I had written extensively about Twitter/Musk, given I wanted him to buy the company so it would be less biased. As it has played out in public, Musk has accused Twitter of lying about the number of “bots” on the platform and is trying to get out of buying the company at $54.2/share or $44bn. I had the opportunity to invest in the deal and was a HARD PASS at that price given the fair value of the company is half or less of what Musk paid. Hedge funds including David Einhorn’s Greenlight Capital and Pentwater Capital Management are wagering that Elon Musk won’t get his way this time. Several hedge funds have purchased stock, options or bonds -- speculating that Musk will lose a trial scheduled to begin Oct. 17 in Delaware Chancery Court. Based on the structure of the deal, getting out of it would be a challenge for Musk.

I have been all over the story of the European energy crisis and the cost of “going green” too early coupled with reliance on Russia. This Reuters article is entitled, “Germany edges closer to nationalization of ailing gas importer Uniper.” This headline, EU seeks $140 billion to insulate consumers from energy crisis is another concerning one. Just Friday, the headline read, “Germany seizes control of 3 Russian-owned oil refineries ahead of looming EU deadline.” Check out this story, Europe will spiral into a severe recession as the energy crisis hikes inflation and weighs on GDP, BlackRock says. Businesses are closing as they cannot afford the electricity bills, which in some cases were up 10-fold. Now the Chevron CEO warns Americans to brace for higher natural gas prices this winter as well. The US has the natural resources to produce a great deal more, and we should to make sure we are never reliant on any other countries for energy. Learn from the European disaster. The good news for the short term is energy prices in Europe are off the crazy high levels from last month. However, I am not convinced they will stay down (still multiples higher from a year ago). The chart below was put together by MUFG and cites data from Bloomberg. This Bloomberg headline is telling: “France Denies It’s Mulling Halting Power Exports to Italy.” Given the crisis, will we see a growth of Nationalism within Europe?

The bias of social media needs a Congressional intervention. I have written about this extensively, and we should all be scared. What if this all went the other way and social media and the media were Right biased? This MUST STOP. Facebook has been spying on the private messages and data of American users and reporting them to the FBI if they express anti-government or anti-authority sentiments — or question the 2020 election — according to sources within the Department of Justice. Under the FBI collaboration operation, somebody at Facebook red-flagged these supposedly subversive private messages over the past 19 months and transmitted them in redacted form to the domestic terrorism operational unit at FBI headquarters in Washington, DC, without a subpoena. “Facebook provides the FBI with private conversations which are protected by the First Amendment without any subpoena.” Meta stock was -14% on the week and -57% YTD. I believe it is time for Zuck to step down. Too many major screw ups under his watch.

Governor DeSantis flew 50 migrants to Martha’s Vineyard and Democrats including Newsom are calling it “kidnapping,” and Hillary called it, “literally human trafficking.” Let me get this right, we have had over 3 million illegal immigrants come into the country since 2020 and Biden has flown them to various cities by the thousands and that is ok? DeSantis flies 50 illegal immigrants to a sanctuary city and it is bedlam? The NATIONAL GUARD was called over 50 people, but the hundreds of thousands in Texas, Arizona and Florida are fine? The “experts” suggest the migrants were told they were going to Boston and the “lie” is the issue. If the Biden Administration is so in love with the thought of over 3 million illegals, they should welcome them with open arms in NYC, Chicago, DC, SFO, LA, Seattle, Portland, St Louis, Minneapolis and sanctuary cities in general. I have no problem with legal immigration. After all, America is a melting pot, but over 3mm in less than 2 years is 1% of the US population. We cannot handle the volume, and our deficits are exploding. Cities do not have enough funds for basic services in some cases, yet are expected to fund illegal immigrants? Are you telling me all 3mm immigrants are good people? No gang members, criminals or drug dealers, terrorists in the mix? That is statistically impossible. If 1-2% of the people coming are not ideal citizens, that is 30-60k while police forces across the country are dwindling. A recent poll shows that a majority of Americans believe there is an “invasion” at the Southern border. The White House slammed Texas and Florida governors for sending migrants to other states. Maybe, we should have less porous borders and a better plan.

In NYC, Jack played in chess tournaments, and I think his highest ranking was 1,100 in 5th grade which was quite respectable. He actually played a match in 2014 against Magnus Carlsen, #1 in the world and rated 2,856. Let’s say, the match did not last long. Unfortunately, the South Florida education system does not believe in chess, and I am not aware of any school sponsored events unlike NYC where the worst public schools play. A cheating scandal is buzzing in the chess world with wild allegations of using technology — including vibrating “anal beads” — to signal winning moves after a teenage newcomer beat a world champion at a high-stakes tournament. Hans Niemann, 19, of San Francisco, Calif., caused a major upset when he defeated Norwegian grandmaster Magnus Carlsen, 31, at the Sinquefield Cup in St. Louis, Missouri, on Sept. 4, according to VICE news. In the wake of the stunning result, the chess world exploded into such an uproar that Niemann faced allegations of cheating, was banned from chess.com — and even billionaire Elon Musk weighed in with a tweet mocking online rumors that a rectally inserted device was used in the possible scam.

Roger Federer announced his retirement at 41-years-old after winning 20 Grand Slam titles and 103 total singles titles. He was ranked #1 in the world for 237 weeks and won over $130mm in career earnings. He won the Australian Open 6x, French 1x, Wimbledon 8x and the US Open 5x. He came in runner-up at 11 Grand Slam tournaments. Federer, Nadal, and Djokovic were DOMINANT. Let me put this into perspective. Between 2004-2021, there were a total of 75 Grand Slams (one cancelled due to Covid) and the BIG 3 won 62 of them or 83%! There were injuries and the ridiculous pandemic rules or the number would have been 90%. Roger, thank you for thrilling millions of tennis fans with your high-caliber tennis, poise and grace. You have been a great ambassador for the game and did it right. Please help Nick Kyrgios find his way. Let’s hit when you come to Boca. I am very similar to Nadal and Djoker only older, slower, not very good and hit the ball slightly softer.

Other Headlines

Ray Dalio Does the Math: Rates at 4.5% Would Sink Stocks by 20%

Interesting take that rates need to move sharply higher resulting in a sharp equity decline over time.

Retail sales growth sluggish in August as consumers fight to keep up with inflation

China Braces for a Slowdown That Could be Even Worse Than 2020

Median forecast is for China’s GDP to expand 3.5% this year. Great charts in link.

California Sees Warning Sign From Weak Tax Revenue Collections

Heavy reliance on tech/IPOs and wealthy leaving the state will impact the budget.

Biden White House just put out a framework on regulating crypto — here’s what’s in it

Adobe to acquire design platform Figma for $20 billion

Adobe stock fell approximately 20% on the news. Adobe lost effectively $30bn market cap in the past few days post the announcement making this acquisition quite pricey ($10bn cash/$10bn stock). Seems as though Figma would have substantially disrupted Adobe’s model. Great discussion on this topic on the All-In Podcast.

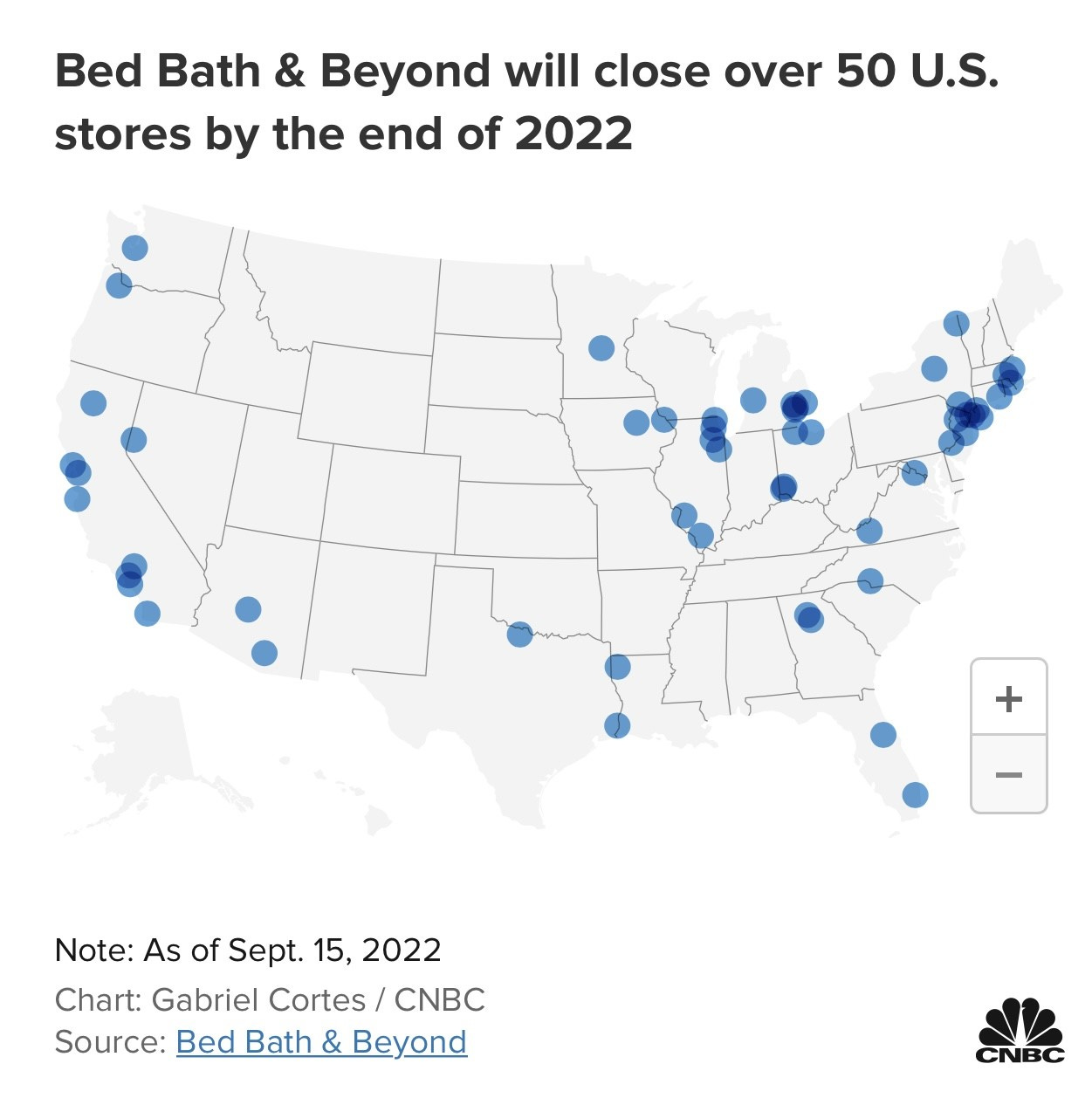

Bed Bath & Beyond is closing about 150 stores. Here’s a map of ones on the list so far

NYC taxi fares could get jump 23% under new proposal

I can tell you that NYC Taxi rates have gone up sharply in the past 10 years, as have UBER/Lyft. Taking a short taxi in NYC in the rain almost bankrupt me. Lots of new charges in the proposal.

More than 3.7M ride NYC subway in single day, most since COVID

Despite the safety risks, it is cost effective relative to taxi/Uber.

Queen's funeral to become 'most watched broadcast of all time' with 4.1billion viewers

More than half the world's population are expected to tune in next week to watch Queen Elizabeth II be put to rest in an emotional ceremony at Westminster Abbey.

Gavin Newsom challenges Ron DeSantis to debate: 'Name the time'

Biden approval rises sharply ahead of midterms: AP-NORC poll

Trump says he ‘can’t imagine’ being indicted, argues it wouldn’t deter running again

NY students allowed to graduate with lower test scores

NY spends billions on education, but cannot get it right.

Prince Harry, Meghan Markle 'furious' kids won't be HRH

They quit the royal family and moved to the US. No one should be sad for these people. I promise, if the royal family adopts me and gives me a title and healthy allowance, I would not disparage the ridiculous monarchy again. Harry and Meghan should be called, “Prince Cry Baby and Princess Tell-All.”

Patagonia founder donates entire company to fight climate change

The company will donate $100mm/year.

How social media is literally making teens mentally ill

I hate what social media does to kids. My wife takes away the phones from the kids at night. Clear connections between social media additional and mental health issues.

Daily multivitamin potentially linked with improved cognition in older adults in new study

MICHAEL JORDAN'S 1998 NBA FINALS JERSEY SELLS FOR $10.1 MILLION

A reader is a collector and he claims it was worth $100k 5 years ago. The price of high-end collectibles has gone parabolic in recent years. Of course, my baseball cards from 1960s-1980 are worthless.

Xi to Putin: ‘We are ready to team up with our Russian colleagues’

The Chinese leadership are bad apples which inflict harm. They are not to be trusted. Everyone knows Putin is a lunatic.

Crime Headlines

Owner robbed in NYC bodega where Jose Alba killed attacker

The suspect was set free without bail. Remember, the worker who stabbed and killed an attacker had a massive bail despite self-defense, but career criminals are regularly set free. Bragg and any DA like him must go.

Tourist shot in back after refusing robber in NYC (Upper West Side)

Axe-wielding wingnut runs amok in Bronx McDonald's

Video is crazy. Nothing good happens after midnight.

Homeless man slugs elderly woman, hits baby with bottle in NYC rampage

Armed Trump Lover Arrested at Dairy Queen Wanted to ‘Kill All Democrats’

Gunman followed 17-year-old walking dog before fatally shooting her in Philadelphia

New Orleans becomes murder capital of America, overtaking St. Louis

Virus/Vaccine

Data improving.

Real Estate

Palm Beach commercial real estate remains hot with many new buildings under construction. This WSJ article is about Related and the substantial development they are doing in the area. Demand has been so strong that Related said it is in the process of converting part of the parking garage in the building to accommodate more office tenants. Brokers I speak with are being contacted by a consistent stream of legitimate companies looking for space between Palm Beach and Miami.

Interestingly, the rental market has been red-hot with no inventory. Apartments.com said “After a 20-month run of positive monthly growth dating back to December 2020, the market finally witnessed negative asking rent growth on a monthly sequential basis from July to August, with rents down 0.1% in July,” said Jay Lybik, National Director of Multifamily Analytics, CoStar Group. “We’re seeing a complete reversal of market conditions in just 12 months, going from demand significantly outstripping available units to now new deliveries outpacing lackluster demand.” The ABC News story is similar suggesting rents are cooling. Virtually all assets are starting to tip over now and rents have been sticky. I suspect this will prove to continue to decline in coming months. The NY Fed's inflation expectations survey saw a drop in one yr inflation expectations to 5.7% from 6.2% and the 3 yr going to 2.8% from 3.2%, it's being attributed to lower expectations for gas, food, home prices and rental rates.

Other R/E Headlines

Canada Real estate slowdown continues, with average price down 22% since February. Another article suggests the same thing with different graphs.

Will Someone Pay $250 Million to Live Atop the World’s Tallest Condo Tower? The Developer Thinks So.

17,500 square feet, 7 bedrooms with ceiling heights up to 30ft with a 1,400ft terrace. Equates to approximately $15k/ft with outdoor space.

These Are the US Areas Most at Risk of Housing Downturn, According to Attom Report

Of the 50 counties most at risk, nine are in and around New York City, six are in the Chicago metropolitan area, and 13 are spread through California. These counties have high levels of unaffordable housing, underwater mortgages, foreclosures and unemployment.