Opening Comments

My last piece was about my birthday, lost phone and a canceled Black Friday sale. Many sympathetic readers offered a shoulder for me to cry on after the canceled sale. Thank you. The most opened links were the Musk video crushing advertisers and the population growth in Nashville.

I had a lot of people reach out about Casadonna, the hot new Miami restaurant and many were going or trying to get in. If you go, tell me what you think. A few pointed out that given it just opened there is hype and the crowds will thin out after the holidays. I am sure there is truth to the fact that grand openings and the impact of Art Basel have it more crowded than it will be soon. To be clear, the food was good, but not close to the best in Miami. But the overall experience was great.

I will be in Miami on Thursday and Friday for Art Basel. I am going to an event in Wynwood on Thursday and Art Basel Friday. Here is a link to Visit Art that outlines the different shows and events around Art Basel. I am likely staying down there Thursday night given the disastrous traffic. I will be around Thursday afternoon/evening and Friday morning if people are down there. If you go, leave yourself time. It took me one hour to go one-mile last year. Miami has become crazy from a traffic perspective, and there is always some event or holiday that adds fuel to the fire. Art Deco Weekend, South Beach Jazz Fest, Intl Chocolate Festival, Coconut Grove Arts Festival, Boat Show, South Beach Food and Wine Festival, Carnival Miami, Spring Break, Calle Ocho, Model Volleyball, Music Week, Miami Open, Seafood Festival, Miami Beach Pride, F1, Bitcoin Conference, Sizzle Miami, Fashion Week, Auto Show, Art Basel Winter Break and many more.

Let’s not forget about the traumatic picture of the day from two years ago that had me yelling at the gallery owner. Yes, it is awful; welcome to the new world of bad art and uneducated buyers. Look away if you can! They wanted $75k. If you paid me $750k, I would not hang it in my house. The artist should lose their license and never be allowed to paint again. What the hell is wrong with people?

On the Rosen Report Jobs front, I have a handful of candidates and a few companies already working with me as well as a good number of summer intern candidates. Sadly, the website I was working on for three weeks was scrapped as my developers were unable to give me the functionality I required. I started fresh today with a reader who is a website developer and hope to have a beta site shortly with the functionality I wanted. I am making connections now the old-fashioned way until the site is up. A few job openings are below:

I have a top-notch credit fund looking for credit analysts and quants if anyone has an interest. Not only are the positions with an amazing fund, they are in Florida and it is 70 and sunny now.

A multi-strategy is looking for an investment analyst with experience in oil, gas, industrials, metals, & mining preferred. 2-4 years of experience required. NYC.

I am working on internships with an asset manager in various locations for this summer as well. More to come soon.

Eye on the Market-Mike Cembalest-It's Mostly a Paper Moon: Alternative Investments Review

Markets

Gold and Bitcoin Up Sharply

Recent IPO Performance

2024 Election Odds

Crazy Deathbed Confession

Luxury Boca Raton Stats (Inventory Building)

Sam Altman’s $85mm R/E Spending

Sol Goldman Family Drama in NYC

San Fran House sells 50% less than 4 years Prior

Pictures of the Day

I liked Delray Beach (past tense). A handful of decent restaurants and shops make it for a fun walk and dinner once in a while. I met 3i friends for a fun lunch on Saturday at Rocco’s Tacos and it was BEDLAHM in town. There was a Christmas Tree event and a farmer’s market that resulted in limited parking spots. After 30 minutes of driving in circles, I found a spot. I pulled in, downloaded the app and parking for an hour was $25+ tax. Let me be crystal clear about something. Delray, ain’t that great. My 1 hour parking was akin to NYC rates and it was more than my lunch. I have no plans to go back to Delray anytime soon. Charge me something reasonable, but for lunch, $10 or less is fine, not $27. Who would go to Delray for 8 hours? There was no option for an hour in the parking app and you had to pay for 8 hours. I am not sure what one could do in that town for 8 hours, but I can think of 17,000 things I would rather do than be in Delray for 8 hours. Also, note the “convenience fee.” What the hell is that? To be clear, not all parking in Delray is that expensive, but none of it should be.

Eye on the Market-Mike Cembalest-It's Mostly a Paper Moon: Alternative Investments Review

In our biennial Alternative Investments Review, we analyze industry returns in private equity, venture capital, hedge funds, commercial real estate, infrastructure and private credit. While private equity and venture capital managers have outperformed public markets, a lot of the gains for vintages since 2015 are still on paper, leaving investors exposed to how managers mark positions and prices at which companies are sold in a world of higher interest rates. The performance of diversified hedge fund portfolios has been better than expected. There are many great charts in the link that can be found here. There is also a 20 min podcast where Cembalest explains everything.

Epic December Fishing Day in FL with Dust Must

Over 5 years ago, I met Dustin when he was a 19-year-old kid who loved to fish. We have since fished together on well over 150 days and have gone to the Bahamas over 15 times together (mostly on my boat). Dustin is an EXPERT fisherman and I always learn from him. He is now the captain of a 74’ Viking and rarely fishes with me anymore given his full-time job. He called me on Friday, December 1st, and asked me to fish on Saturday. Excitedly, I said, “YES.” The last time we had fished together was my July trip to the Bahamas where we caught some large Yellowfin Tuna.

Dustin is a beast at 5’11” and 220 lbs. He has benched almost 500 pounds for perspective. He eats a lot and I always make sandwiches for the day. He LOVES mustard. No matter how much mustard I use, it is never enough. As a result, I call him, “Dust Must,” and make the turkey and cheese with EXTRA mustard as seen below. I write “DM” on his sandwiches as I never want to accidentally take a bite of that much mustard.

Fishing in South Florida as in most places is seasonal. In December, the target species are Wahoo and Sailfish. On Saturday, December 2nd, we left the dock at 6:20am. Dustin and I caught the following: 40 lb Wahoo, 50 lb Sailfish, 18 lb Tuna, 2 small tuna, 13 lb Kingfish and a Cero Mackeral and we were back at the dock by 11 am. On the boat, we were never more than 2.5 miles from my house. Note that amazingly beautiful hat in all the pictures.

I reeled in the Wahoo while planer fishing and Dustin handlined in the last bit. It meant I had to gaff the beast. The most important thing is to land the fish, but you ideally do not want to gaff the meat (body( and want to hit it in the head. Given it was my first Wahoo of the season and the biggest I have caught in Florida (bigger in Bahamas), there was no way I was losing it. I purposely did not take a picture of the gaff job as it was not pretty, but we landed it. I always let go of all of my billfish and after posing for the picture, revived the Sailfish and made sure it was ready before letting her go. The big Tuna was large for December, but I caught a 32-pounder in May a few years ago.

It was a great day on the water with an old friend that sadly I don’t get to see too much anymore. We had a lot of fun. When I got home with all my fish, I spent well over an hour on a vacuum sealer to store the fish in the freezer. I entertained Saturday night and one of the dishes was Wahoo Ceviche; it does not get fresher than that! On Monday, I made Wahoo tacos, a fan favorite. Below was what I vacuumed sealed Saturday after giving away a lot of fish. The fresh fish poke bowl and tacos were tasty on Monday night.

Quick Bites

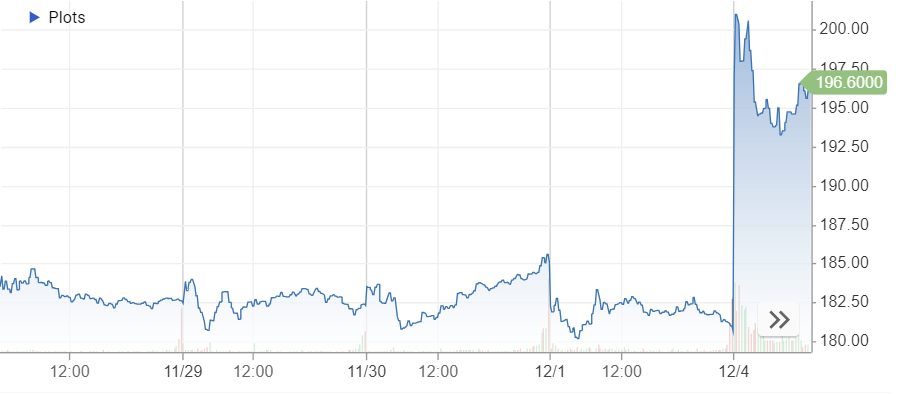

Stocks were down again on Wednesday, but remain up sharply on the year. The S&P is now +18.5% and NASDAQ + 35.2% YTD. Apple stock is +52% YTD and the market cap crossed $3 trillion on Tuesday. This is a scary headline from CNBC, “There’s now a juiced-up way to get 4 times the return of the S&P 500 — but it comes with many risks.” You think? Bad idea, Batman. People will get eviscerated on this one. After a big rally, you see these highly leveraged products which tend to end in tears for those who buy them. The 2-Year Treasury is yielding 4.6% and the 10-year is at 4.11%. Oil has been crushed in recent weeks and fell below $70/barrel as supply growth has been greater than expected. Oil is now -10% YTD. At one point, with the Middle East conflict, I feared oil could see $150. I was wrong. The good news is gas prices are down to $3.12 in the US for Unleaded. Biden, buy back the SPR now.

Gold prices have been up sharply recently according to this CNBC article.

Gold prices are on course to hit fresh highs next year and could remain above $2,000 levels, analysts said, citing geopolitical uncertainty, a likely weaker U.S. dollar and possible interest rate cuts. Prices of the yellow metal have risen for two consecutive months with the Israel-Palestinian conflict boosting demand for the safe-haven asset, while expectations of interest rate cuts have provided further support. Gold tends to perform well during periods of economic and geopolitical uncertainty due to its status as a reliable store of value. “The anticipated retreat in both the USD and interest rates across 2024 are key positive drivers for gold,” UOB’s Head of Markets Strategy, Global Economics and Markets Research, Heng Koon How, told CNBC via email. He estimated that gold prices could reach up to $2,200 by the end of 2024. Also of note, Bitcoin hit $44,000 and is up 163%+ YTD. This is a CNBC headline tonight: “Jamie Dimon lashes out against crypto: ‘If I was the government, I’d close it down.’” I do not agree with Dimon’s statement.

Good Bloomberg article on recent IPO stock performance. A rally across equity markets lifted Birkenstock Holding and other newly public firms, but Wall Street still isn’t welcoming initial public offerings with open arms. The maker of cork-soled sandals closed above its IPO price for the first time last week after a disappointing debut in October, while Klaviyo Inc. popped back above its initial share price when it listed on the NYSE. Still, the 25 companies that raised more than $250 million each via US IPOs this year have climbed an average of 9.2%. That’s against a backdrop where the S&P 500 has climbed 19% this year and the small-cap benchmark Russell 2000 Index has netted a 6.4% gain. Others in the venture capital world are taking a wait-and-see approach with the Renaissance IPO ETF still down more than 50% from a 2021 high and the majority of blockbuster IPOs from the bull market — think Bumble Inc. and Robinhood Markets Inc. — sharply lower.

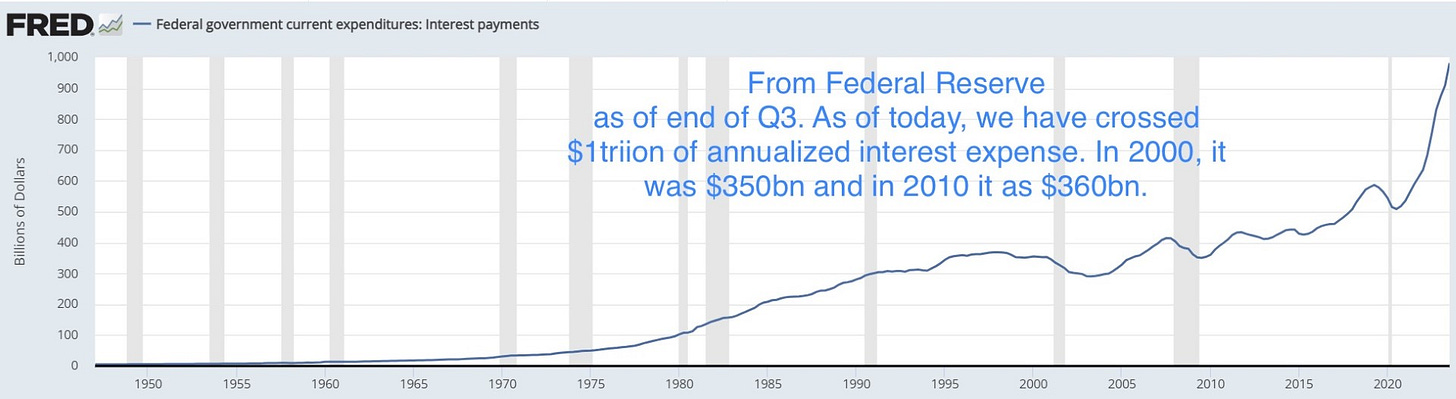

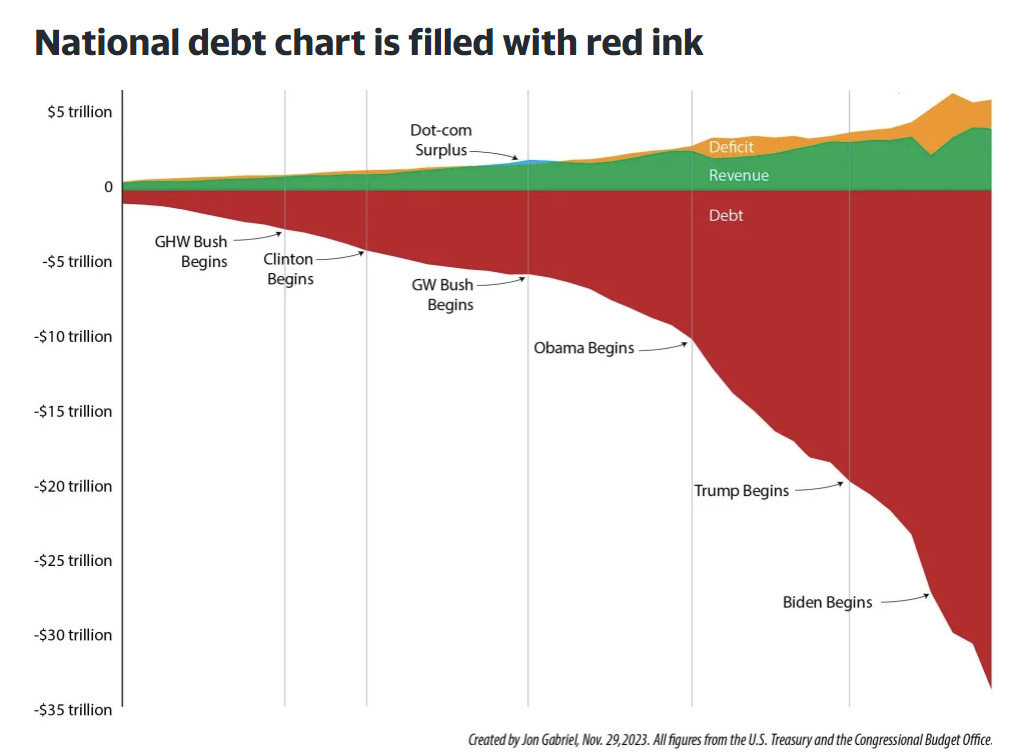

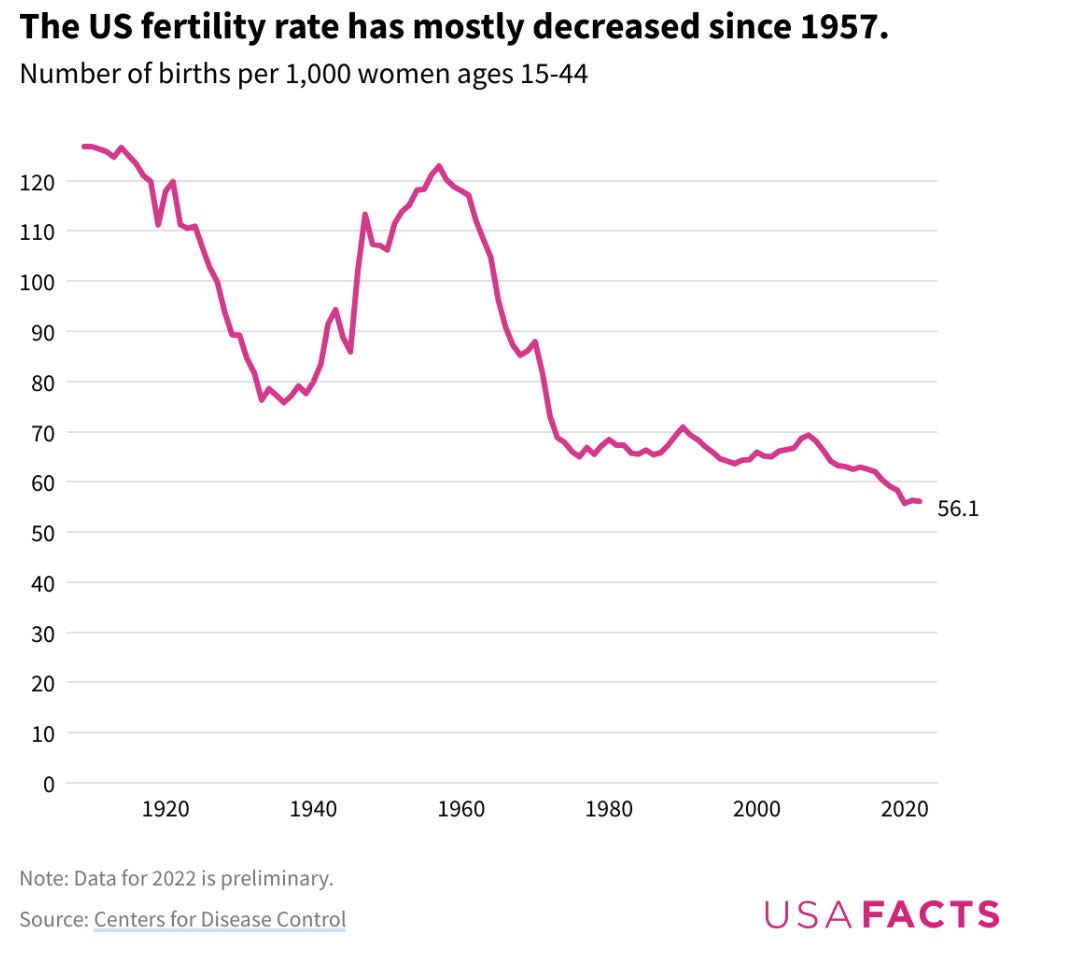

I am not sure anyone has written more about fiscal irresponsibility than I have over the past few years. I am very concerned about debt levels, entitlements, spending, interest burden, and the crowding out of discretionary spending for the Federal government. Politicians have one goal other than to enrich themselves and that is to be reelected. Warren Buffet said, ‘I Can End the Deficit in 5 Minutes.’ You just pass a law that says that anytime there is a deficit of more than 3% of GDP all sitting members of Congress are ineligible for reelection.” Although the comment was from 2011, I like the sound of it. I don’t feel we have a revenue problem, but do have a spending and free money giveaway problem. On this front, this story is concerning and the last chart is from the link: Cowards in Congress blame others for our national debt. Just fix it, already The charts below are from the Federal Reserve, but as of September. Sadly, they are both worse today. I want to see Entitlement reform which results in means testing (wealthy do not get social security) and the age of benefits needs to be raised to 70 over the next 10 years. When Social Security began in 1934, the average lifespan was 60. Today, it is 77 and we have lower birth rates. I expect life expectancy to be over 80 in coming years and our systems were not built to fund people for 15-20 years or more. This is more from Dalio on the topic: 'We are near that inflection point': Billionaire Ray Dalio warns that America is now 'borrowing money to pay debt service' — cautions that debt will accelerate just to maintain spending.

The website, PredictIt, allows you to bet on various outcomes. Check out the latest on the Presidential Election which shows a dead heat. Note that Newsome is tied with Haley for third and he is not officially running at this time. How in the hell is it possible that the BEST America has to offer is two geriatric men with major issues? Most of the polls have Trump over Biden in a head to head match up, but the lead is low to mid-single digits.

This is a crazy story about a father who told his daughter of his 50 year secret; he was a fugitive bank robber. Further, the name she knew him by was not real. He was inspired by the original movie, The Thomas Crown Affair from 1968 with Steve McQueen and Faye Dunaway. The dying father was a bank teller and stole $215k in 1969 ($1.7mm today) and then disappeared. The story is amazing and worth a read. I could not imagine my mother telling me such a thing on her deathbed.

Israel

The news and actions out of some of the best academic institutions in the world has been appalling. I hope you take a few minutes to watch the Congressional testimony in links in this section. You know it is bad when Penn is Sued by Students Claiming Antisemitism on Campus. At one point, Jews were highly regarded at Penn and gave BILLIONS. Now they are suing the school over antisemitism. I want you to listen to the President of Penn and her comments on antisemitism. If she has a job in 30 days, I will be in shock. The question asked was, “If someone speaks of the genocide of Jews, is it bullying or harassment?” The President of Penn responded, “ It is context-dependent.” She refused to answer yes or no. Let me be clear, if Penn does not fire this IDIOT, NO JEW SHOULD EVER STEP FOOT ON THAT CAMPUS. NO JEW SHOULD GIVE ONE DOLLAR TO THAT SCHOOL. Insert any other minority into the question asked and if you answered this way, you would be fired. Remember, .2% of the world population is Jews. To be clear, Harvard and MIT were hardly supporters of Jews in front of Congress. It is so bad that Bill Ackman is calling for all three presidents to resign in disgrace. Thank you Representative Stefanik for your direct questions to these cowards. All three female Presidents of these academic institutions refused to answer direct questions and answered, “it depends on the context.” Watch it for yourself. Here is yet another video of Representative Jim Banks crushing college presidents.

Israel says it uncovered 800 shafts to Hamas tunnels below Gaza

The tunnel shafts were in civilian areas (including schools, mosques, playgrounds.” Yes, Hamas should be annihilated by Israel. The link has some good pictures of the expansive and impressive tunnel network.

3 commercial ships hit by missiles in Houthi attack in Red Sea, US warship downs 3 drones

Warning, this is a DISTURBING and HORRIFIC story. If you want to see how awful Hamas is open and read it. This poor young woman was begging to be killed. Hamas needs to be destroyed. I just cannot fathom such hate. Remember, some of your favorite news agencies refuse to call Hamas a terrorist organization. Read this story and tell me what they are if not terrorists.

Israel says it killed Hamas commander in air strike

Good video included.

Erdogan Defends Hamas Amid US Concerns Over Turkey’s Support

Israeli girl reunited with classmates in heartwarming scene nearly 2 weeks after hostage release

Finally, a nice video to watch.

Ivy League slashes price of ‘donor door’ from $20M to $2M after antisemitism storm

I love seeing this. I could not send my kids to an Ivy today based on their hate of Jews. “If a billionaire has committed $50 million or $100 million a year and now they’re backing out, colleges need to figure out how to fill that gap,” Command Education founder Christopher Rim told The Post.

Unknown traders appear to have anticipated October 7 Hamas attack, research finds

Bets against the value of Israeli companies spiked in the days before the October 7th Hamas attacks, suggesting some traders may have had advance knowledge of the looming terror attack and profited off it.

Other Headlines

JPMorgan’s top chartist says the S&P 500 to tumble all the way back to 3,500, retesting bear lows

“Stocks should pull back, and in my base case on the technical side, the S&P 500 is gonna drop to 3,500,” Hunter told CNBC’s “Squawk Box.” That move represents a roughly 20% pullback from the benchmark’s current level.

Economists forecast 50% recession odds amid stark economic slowdown in 2024

I thought recession, but it is no longer my base case. A slew of headwinds will slow the current quarter’s Gross Domestic Product — a comprehensive measure of economic activity and performance — to a pace of 1.2%, according to the National Association for Business Economics’ latest Outlook Survey released on Monday. That’s versus a 5.2% annualized rate during the third quarter, the Commerce Department reported — the fastest rate of expansion since the end of 2021. Adjusted for inflation, real GDP increased 2.1%.

Indicators of restaurant activity continue to show signs of weakness in the US

The correlation with rate hikes is fascinating. However, I don’t see any slowdown in high end restaurants near me. You cannot get in from Miami to Palm Beach.

Elon Musk’s AI startup — X.AI — files to raise $1 billion in fresh capital

These are the Americans that got a lot richer during the pandemic

Interesting data points in this link.

Why wealthy investors put $125 billion into this new type of private-equity fund last year

Spotify jumps after saying it will cut 17% of workforce — read the full memo from CEO Daniel Ek

Wells Fargo CEO warns of severance costs of nearly $1 billion in fourth quarter as layoffs loom

“We’re looking at something like $750 million to a little less than a billion dollars of severance in the fourth quarter that we weren’t anticipating,” Scharf told investors.

How the Media Grinches Are About to Steal Christmas

Story about upcoming layoffs in media.

Virgin Galactic shares plunge after Branson rules out further investment

Biden 'not sure' he would seek re-election if Trump was not running

Here is a solution; neither should run.

Former US ambassador arrested, accused of secretly serving as agent to Cuba

Gold bars found in Sen. Bob Menendez’s home linked to 2013 armed robbery

Santos was expelled and Menendez should be as well.

Liz Cheney says she's ready to consider a third party, warns of 'grave' threat of Trump-led GOP

Macy’s security guard stabbed to death by man who returned 15 minutes after trying to steal hats

In Philly. Crazy story. They did not say how many prior arrests the suspect had, but I am going to say this was not his first foray into crime. If you can kill someone and go back to shoplift 15 minutes later, you have some serious issues.

Calif. retailers that refuse gender-neutral toy sections will be fined up to $500 under new law

Suspect confirmed dead after shooting at University of Nevada Las Vegas, multiple victims reported

Reading

I agree 100%. Please don’t ask about work-life balance.

How going to bed at the same time every night is more important than getting seven hours per night

Shocking study discovers bottlenose dolphins possess electric sixth sense

Electroreception

Former ‘Soprano’ Michael Imperioli opens upscale speakeasy Scarlet on Upper West Side

A New $10,000 Members-Only Sushi Restaurant Is Coming to Miami

Someone join and take me, please! Looks amazing.

Norman Lear, TV Legend, Dies at 101

He was responsible for All in the Family, Sanford and Sons, One Day at a Time, Different Strokes and so many more. He was a genius.

Venezuelans vote to claim sovereignty over a part of oil-rich nation Guyana

Real Estate

I can tell you that some markets in South Florida remain quite hot. New waterfront homes are in high demand in Miami and Palm Beach Island. Projects that require a lot of work are harder to sell, even there. In Boca, I am seeing high-end sit on the market longer while inventory is building. In many cases, it has turned from a seller’s market to a buyer’s market where the buyer can get deals done at decent discounts to asking prices. In my community, there are now 40 homes officially listed for sale relative to 71 when I moved in 2017, but 4 in December 2021. There is a lot of product coming to market and a lot off-market today. I have a handful of off-market opportunities for those interested as well. As you can see, since I moved in, the average sale price is +240%, but the flow of deals is down sharply from the 2021 peak. In 2023, 3 homes over $20mm sold, and 3 sold between $15-20 in Royal Palm. In 2022, one home sold over $20mm, and 2 sold between $11-20mm. For perspective, today, there are 10 homes listed over $20mm and 8 between $15-20mm, and I know of another half dozen off-market between $15-20mm. Additionally, a bunch of new homes are being built coming to market shortly over $15mm. The point is, that inventory is building at the high end. Given the limited number of sales at that price point, I expect prices to continue to tick down over the next year, especially as all the new product comes online. For perspective, on the 28 homes for sale over $10mm, 11 are builder homes and 17 are secondary homes. For the 12 homes under $10mm, ALL are secondary market homes.

An impressive spending spree for someone with a $58k salary. Before he was out and back in again, OpenAI CEO Sam Altman went on a real estate spending spree. Between early 2020 and mid-2021, Altman spent $85 million on residences in San Francisco, Napa, and an estate in Hawaii, Business Insider reported. Altman’s $43 million Hawaii property, acquired in July 2021, spans 12 bedrooms in Kailua-Kona on the Big Island, adjacent to a national landmark. Videos of the property showcase amenities like cliff jumping, motorboating, and scuba diving. In addition to his Hawaii estate, Altman’s real estate portfolio includes a $27 million San Francisco home purchased in March 2020, serving as the base for various investment vehicles. His weekend retreat is a $15.7 million working ranch in Napa, acquired in late 2020, covering 950 acres with five homes and vineyards.

The heirs to Sol Goldman’s fortune have declared war on each other, and in the process are spilling the secrets of one of New York real estate’s most private families. Jane Goldman, daughter of the late property mogul, is being sued by her sister and the three children of her recently deceased brother. They accuse her of a power grab and of maneuvering to muscle her relatives out of the family fortune. Her sister, Amy Goldman Fowler, and nephew Steven Gurney-Goldman claim in the lawsuit that when Steven’s father Allan died last year, Jane usurped power of the family company, which is supposed to be run jointly by four branches of the Goldman family. “Jane, however, had no intention of sharing control, let alone with her siblings,” reads the 134-page complaint. “Her father had presided over his empire without partners challenging his authority. As Jane saw it, she was naturally his heir apparent, even if her brother and sisters legally also had a claim to the estate.” I lived at 20 5th Avenue in Greenwich Village in a Sol Goldman building and wrote about it in a recent piece. A Goldman family member moved into my unit when I left in 2011. Today, the building rents 1 bedrooms for over $7,000/month as can be seen in the link.

A San Francisco home has been sold at half its original listing price, crystallizing the stark real estate climate in the city and in the U.S. The home in the Russian Hill neighborhood sold for $9,990,000 on November 9, after being listed in October 2022 at $19,995,000. The house sat on the market for almost a year before selling at almost half the original list price in a city that is becoming emblematic of the nationwide housing slump. I cannot think of a location in Florida where you could have spent $20mm 4 years ago and it would be worth $10mm today. If you spent $20mm, in Florida, it would have been worth some multiple of it.

© 2023 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #636 ©Copyright 2023 Written By Eric Rosen