Opening Comments

My last newsletter, “Pay By the Hair,” was well received and it was about my overpriced Hamptons haircut which forced me to get more taken off than I wanted. When paying full-price, I needed to go military style to get my money’s worth. The most opened link was the protests and the $1.3mm initiation fee golf course, Sebonack.

The Rosen Family is back in Marion, MA golfing. Julia’s high school team starts in a few weeks and she needs to get in some practice. Back to the Hamptons for the weekend. We head back to Florida on August 4th. I am not looking forward to the heat and rain but can guarantee you it is cooler than Vegas.

As a reminder to the growing readership of the Rosen Report. My readers send me story ideas, links and topic to discuss. Obviously, I cannot get to all of them, but at least 25% of my content is reader generated. Please email ideas to rosenreport@gmail.com.

I have been asked to moderate a panel for an audience of top commercial real estate professionals in NYC in the fall. I am looking for topics and talent you think will be most relevant to that crowd. Any ideas, shoot them over. One direction I am considering in the impact of AI on the world and specially the R/E market. If anyone has any ideas on talent here, let me know. The talent will be paid for the event.

Markets

JPM on Markets

Morgan Stanley Mea Culpa

Hedge Fund Brawling Over Commercial R/E

Robert Schiller on Housing Market

Best and Worst Office Markets for Absorption Rates

Cerberus and Highgate Miss Interest Payment on Hotels

Thor Buys Back Retail at a 68% Discount Within 9 Months

Video of the Day-Ken Griffey Junior on Discrimination

This is a powerful message about discrimination and how it stuck with Ken Griffey Jr due to an incident when his dad played for the Yankees. The event prevented Griffey Jr from ever signing with the Yankees. Ken Griffey Jr said in the documentary "Junior" that he never signed with the New York Yankees during his MLB career because he felt the team discriminated against him as a kid. (1 min video at bottom of link). Griffey said he was in the Yankees' dugout with his father, Ken Griffey Sr, when a security guard told him he had to leave because "George doesn't want anyone in the dugout." Griffey said his father told him to return to the locker room but to look at third base on his way out. "It's Graig Nettles' son taking ground balls at third base," Griffey said in the documentary which came out in 2020. Griffey Jr said he would retire rather than ever play for the Yankees. Actions have consequences and the Yankees lost out on an all-time great.

My Legendary Apartment Rental in Greenwich Village

After the horrific attacks on 9/11, the air quality downtown was awful and many people did not feel comfortable below 14th Street. Apartment vacancies were high downtown, and people were badly shaken by the terror attacks. Truth be told, I was a mess as well. It was the scariest day of my life.

In early 2002, my Upper West Side apartment lease was due and I wanted to move to where the “Cool Kids” lived, below 14th Street. The Upper West Side is not only boring, it is a true culinary wasteland unlike downtown.

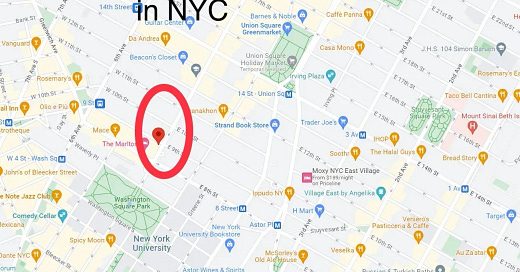

I found an apartment at 20 Fifth Avenue at 9th Street. In the heart of Greenwich Village and right around the NYU campus and just north of Washington Square Park. At the time, the park was beautiful, but now, it is a drug invested hell hole. The restaurants are AMAZING in this part of the city. I could walk to so many of the best places in the city within minutes (Babbo, Gotham, Striphouse, Blue Hill, Otto and so many others). The vibe is young and hip and the area is a lot of fun. It is centrally located and you can get uptown or downtown with ease. Also, there are great grocery stores within a few blocks (Whole Foods, Citarella and others). Just a short walk away is the West Village and Union Square is just around the corner. Of all the locations I lived in NYC, the Village was by far my favorite.

The apartment was occupied by a family of 6 and was a 3 bedroom+maid’s room, 3 bathroom penthouse with a nice terrace. High ceilings, a chefs kitchen and full laundry room were included. The family was so traumatized by the events of 9/11, they left never to return and the apartment was vacant. They had been paying $20k. I threw in a LOWBALL offer and requested a 3-year lease and it was accepted. I offered to pay the 1st year in cash upfront. However, I stole the place paying $7,000/month. Today, it would be at least $50k. Lesson: When there is no liquidity, any reasonable price is not offensive. Never be scared to make an offer in a vacuum at a price you are willing to pay. I have bought a shocking number of assets at lower than expected prices when no one else wanted them. Today, a reader is paying $7,200 for a 1-bedroom apartment on a low floor. Below is a rough idea of the apartment layout.

Given I was willing to live downtown, a location which had become unattractive due to 9/11, I got a deal. Don’t feel bad for the landlord, the Goldmans are billionaires. They were happy to have a tenant in the largest apartment in the building locked up for three years. Shockingly, they never increased my rent in an offensive manner, and I was significantly under paying when I left in 2011 to move back to the Upper East Side, my least favorite NYC location.

At the time of initial transaction, my mother was battling cancer in Florida, and I got her into Sloane Kettering (NYC) for treatment. I thought she would move in with me, and I could get a nurse to live with us. She had agreed which is why I took such a large apartment as a 32-year-old single guy.

Well, I called my mom to tell her I got the apartment, and she was eerily silent. She decided she would be more comfortable at home in Florida. I had just rented a massive apartment and I was kind of shocked. It worked out as a great party pad and many friends who needed a place to crash had plenty of room.

The apartment was so big, we lived there after we got married and had our two kids there with room to spare. Although the rent kept creeping up, and I was paying $20k when we moved out in 2011, it was under the market. In 2010, I got a call that someone was willing to sublet it from me for $40k. We had nowhere to go, so we passed on it, but I have fond memories of the place, and of all the locations in NYC I lived, 20 5th Avenue was far and away the best area. Greenwich Village RULES! At least it did, but with Washington Square Park a mess, I can’t vouch for it today. The biggest takeaway is do not be scared to provide liquidity at a price when there is no one else willing to do so.

Quick Bites

The Fed raised 25bps as expected bringing the Fed Funds rate to 5.25-5.5%, the highest level in more than 22 years. Powell suggested that rates could be steady for the next meeting as inflation is moderating, but still an issue. The Dow added 82 points on Wednesday. The 30-stock index extended its rally to 13 days, an advance it hasn’t achieved since January 1987. The S&P 500 was unchanged and the Nasdaq lost 0.1%. Alphabet rose 7% as cloud revenue helped propel a quarter which beat expectations, while Microsoft slid 3% after posting slowing cloud revenue. Snap shares fell 19% after giving weak guidance. Meta announced after the close and the stock was +6% post earnings after optimistic 3rd Q guidance. Treasuries rallied slightly with the 2-year -5bps to 4.85% and the 10-year -5bps to 3.87%.

JPM’s Marko Kolanovic has been a top rated strategist with very good calls. However, he has been negative in recent months and missed some of the rally (me too). He now is pushing for commodities over stocks. JPMorgan’s chief global markets strategist, Marko Kolanovic, advises investors to play commodities against recession risks. “It feels like a good entry point for a catch-up in commodities vs. equities — amidst a broad-based rally in risky assets, commodities price in by far the highest risk of recession and stand out as under-valued, under-owned, and backed by compelling fundamentals and technicals,” he wrote in a Monday note. Kolanovic named natural gas as his top pick within the commodities sector. Investors can look to the United States Natural Gas Fund LP (UNG) to gain exposure to the commodity; it’s down about 48% year to date. The strategist forecasts U.S. natural gas prices to undergo a 25% rally in the next few months on expectations of a supply growth reversal. His second favorite commodity investment choice are agricultural commodities. The Invesco DB Agriculture Fund (DBA), up nearly 11% in 2023, allows investors to play the sector. The fund offers exposure to a range of agricultural futures, including sugar, soybeans and corn. The strategist also called out oil as his third preferred area.

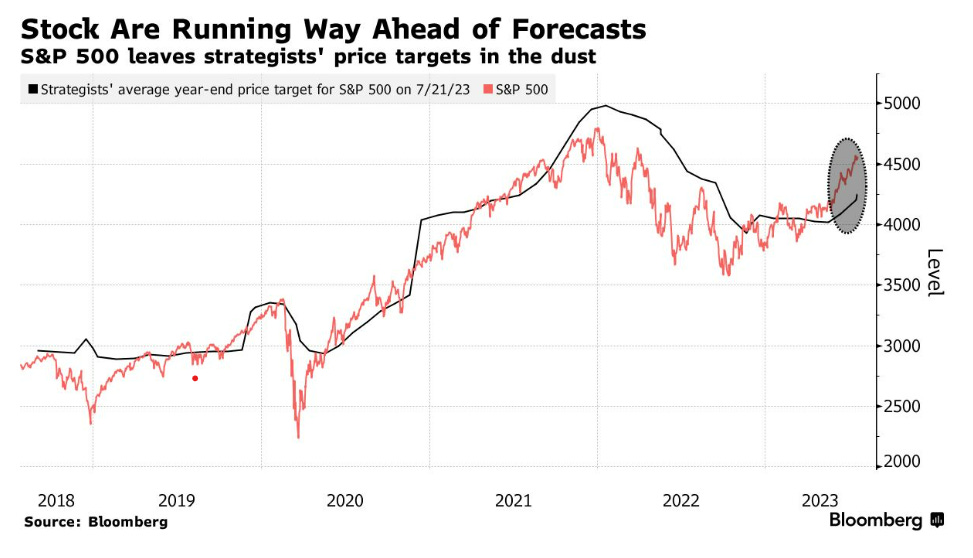

Last year’s plunge in the S&P 500 made uber bear Mike Wilson the most celebrated stock forecaster on Wall Street. It’s a role he has failed to reprise in 2023. The chief US equity strategist for Morgan Stanley on Monday conceded that he stuck with the pessimism for too long amid a rebound that has left equity benchmarks within spitting distance of erasing last year’s decline. His forecast for the S&P 500 remains 3,900, a level that has been left behind in the index’s 19% jump to around 4,560. “We were wrong,” Wilson wrote in a note to clients Monday. “2023 has been a story of higher valuations than we expected amid falling inflation and cost cutting.” His team has recently shifted the focus to June 2024, for which the price target is set at 4,200, about 8% below its current level. Wilson has spent most of 2023 warning the rally would reverse itself, sounding alarms on technology shares and arguing that March’s banking turmoil portended a “vicious” selling climax that was needed before shares could start rising again.

Other Headlines

Nikki Haley: ‘Every company needs to have a Plan B’ on China

I have incredible connections in China to make products inexpensively and well-made. However, I am concerned about any company having too much production there.

Israel in Political and Economic Tumult; Doctors Strike, Stocks Tumble

The Great M&A Slump Is Shaking Up Giants of Investment Banking

Wall Street firms are downsizing as deal volume craters. But some lower-ranked rivals are on a hiring spree, betting a boom is nigh.

Musk risks even more damage to Twitter’s business as the messaging app changes name to X

If true, reasonably priced and aesthetically pleasing, I am selling the TSLA for it.

Banc of California Agrees to Buy PacWest as Regional Lenders Seek Strength Together

PacWest fell 27%

Most Investors, Bankers Would Choose JPMorgan’s Dimon as Boss

I believe Jamie is the most important person in banking in the world. He is a great leader, takes responsibility and makes it happen. I have a great deal of fond memories of my time with Jamie at the helm. One my reader’s favorite newsletters is the famous bathroom incident entitled, “Dimon to the Rescue.” All those new readers should check out the hysterical interaction we had which was posted in June of 2022

Chipotle sales rise but fall short of Wall Street’s expectations

Bitcoin drops to $29,000, and OpenAI’s Sam Altman launches Worldcoin

NFT of Jack Dorsey's First Tweet Cost $2.9 Million, Now Auctioning for $2,000

I got crypto wrong putting 1% of my net worth in and losing 80%. I called NFTs stupid in numerous reports and suggest you avoid them. For $2k, I buy Jack’s first Tweet if I had the chance.

The Standoff Between Trump and Joe Rogan Over a Podcast Invite

Trump wants to get on Rogan and Rogan has no interest.

Youngkin approval rating at record high amid 2024 speculation

57% approval rating in Virginia.

McCarthy: Biden's Weaponization Of Government "Rising To The Level Of An Impeachment Inquiry"

Giuliani concedes he made defamatory statements about Georgia election workers

A couple years ago, I wrote that Giuliana’s best days were behind him and he had become a laughing stock after being an amazing Mayor. His leadership around 9/11 was remarkable. The comment suggesting he was now a clown resulted in quite a bit of hate mail. I stand by my original comments.

Hunter Biden pleads not guilty after plea deal is derailed

The judge raised concerns over two separate agreements that the president's son reached with prosecutors, but the agreement could ultimately be accepted. Hunter was given a sweetheart deal. I know people who did far less and served time. I just don’t feel he should get extra special treatment. After all, his track record is a train wreck.

We need a better plan around immigration. I believe we have seen approximately 6mm illegal immigrants since Biden took office. Systems are overwhelmed and billions are needed. Where will the money come from as these cities are running massive deficits already and not providing support for its citizens?

LA Will Vote in 2024 Whether to Require Hotels to Shelter Homeless People in Unbooked Rooms

What could possibly go wrong here? Your family goes on vacation to a hotel and homeless people are staying in the room next to you shooting up drugs? Could you imagine the pool at a fancy hotel? I would think this would not pass, but it is CA, so anything is possible.

‘This Is a Really Big Deal’: How College Towns Are Decimating the GOP

Very interesting article about the impact of college town voting has on elections. Amazing statistics showing the impact of college kids voting Left is having on elections.

IRS halts most unannounced visits to taxpayers, citing safety concerns

Shoplifting suspects casually roll out three carts of goods from California Burlington store

Check out the pictures in the link. The cost of theft and impact on the communities, shareholders, employees, and tax-paying/law-abiding residents is out of control. Store closures, lost jobs, higher prices, locked goods are impacting communities.

Carlee Russell admits ‘there was no kidnapping’ or baby on the highway in bombshell hoax confession

Last week, I included a story about a woman who claimed to see a toddler running on a highway and went to help and the woman went missing. The suggestion was the toddler was used as bait and the good Samaritan was kidnapped and tortured. The entire thing was a hoax. We correct our stories at the Rosen Report. Apologies.

Shocking video shows Ohio cop unleashing K-9 on black trucker with hands up, mauling man

AWFUL video of a suspect being attacked by a K-9 despite a trooper’s orders not to release the dog on the man. Yes, the man took the cops on a chase, but he was on his knees with his hands up. The video is concerning. I am supportive of the police. However, the officer who release the dog needs to face consequences.

I have a protein shake every day with some of the ingredients above, but not all.

Housing, transportation, healthcare and food.

Heart Attack Risk Rises Significantly on Extremely Hot, Polluted Days

I had Dengue 4 years ago and thought I was going to die. 103 fever and the most pain I can recall. I lost 20 lbs in two weeks. It is no joke.

Saudi Arabia Reportedly Offers $1.1 Billion for Kylian Mbappe

The money being spent by Saudi is incredible. The reported offer includes a $332M transfer fee and $776M salary, which would make Mbappe the highest-paid athlete. Saudi/PIF, if you are looking to purchase a newsletter, want a public speaker or a janitor, email me at rosenreport@gmail.com. I am available for slightly less than $1bn. I wrote a report entitled, “The Economics of Absurdity-Everyone Has a Price,” last month about the Saudi sports spend.

Triple-digit ocean temps in Florida could be a global record

INCREDIBLE. I have stated numerous times that we are not alone and this interview at the House Oversight Committee’s UFO Hearing Wednesday was earth shattering.

Real Estate

Good WSJ article entitled, “Hedge Fund Brawl Over Battered Commercial R/E.” Big fund managers that specialize in distressed investing have eagerly watched the yearlong selloff in commercial real estate. Now, they are snapping up battered shares of real-estate investment trusts, historically the province of mom-and-pop investors. The influx of these funds is lifting prices, benefiting individual investors who held on. It is also sparking conflict as hedge funds bid against one another for shares and butt heads with management teams. D.E. Shaw, Flat Footed, H/2 Capital Partners and Lonestar Capital purchased at least 20% of the shares in a REIT called Diversified Healthcare Trust this year, according to data from S&P Global Market Intelligence. In April, the management company that runs Diversified Healthcare announced plans to merge it with an ailing office REIT it also controls in a deal the funds said would tank their investments.

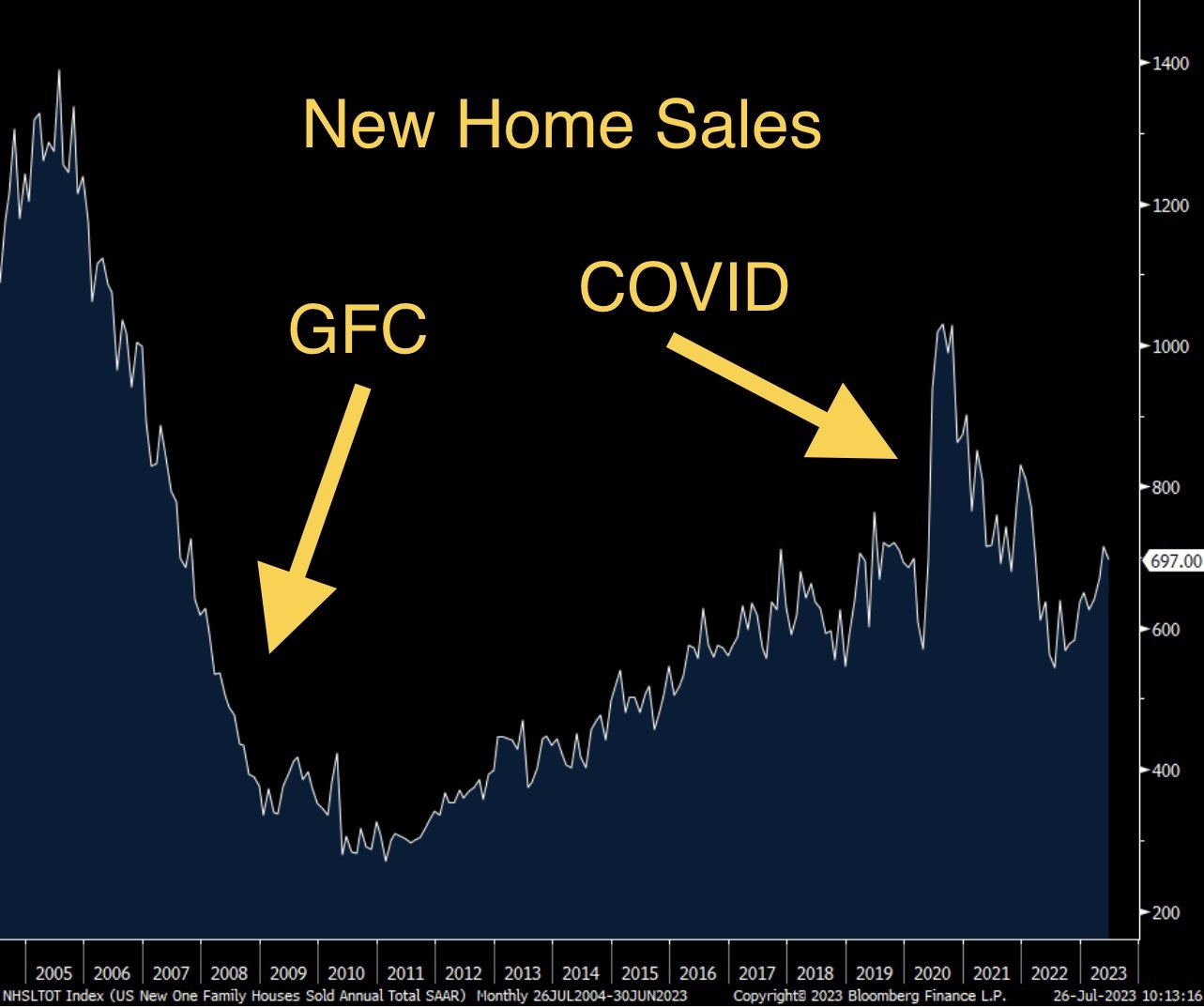

Yale University economist Robert Shiller released a book back in March 2000 titled Irrational Exuberance, which proclaimed that the stock market was a bubble. Soon afterward, the tech bubble burst. Then, in 2004, the Yale economics professor called attention to spiking house prices with a paper titled "Is There a Bubble in the Housing Market?" Finally, in 2007—just before U.S. home prices crashed—Shiller correctly predicted that house prices would soon crash. Fast-forward to 2023, and Shiller is once again closely watching the U.S. housing market after its period of exuberance during the pandemic, which included a 43% jump in U.S. home prices measured by the Case-Shiller National Home Price Index—a single-family index that Shiller helped to build many decades ago. Only this time around Shiller isn't predicting a national home price crash—or a sustained boom. Instead, Shiller went on CNBC last week and seemed to suggest that national house prices would go sideways for a bit.

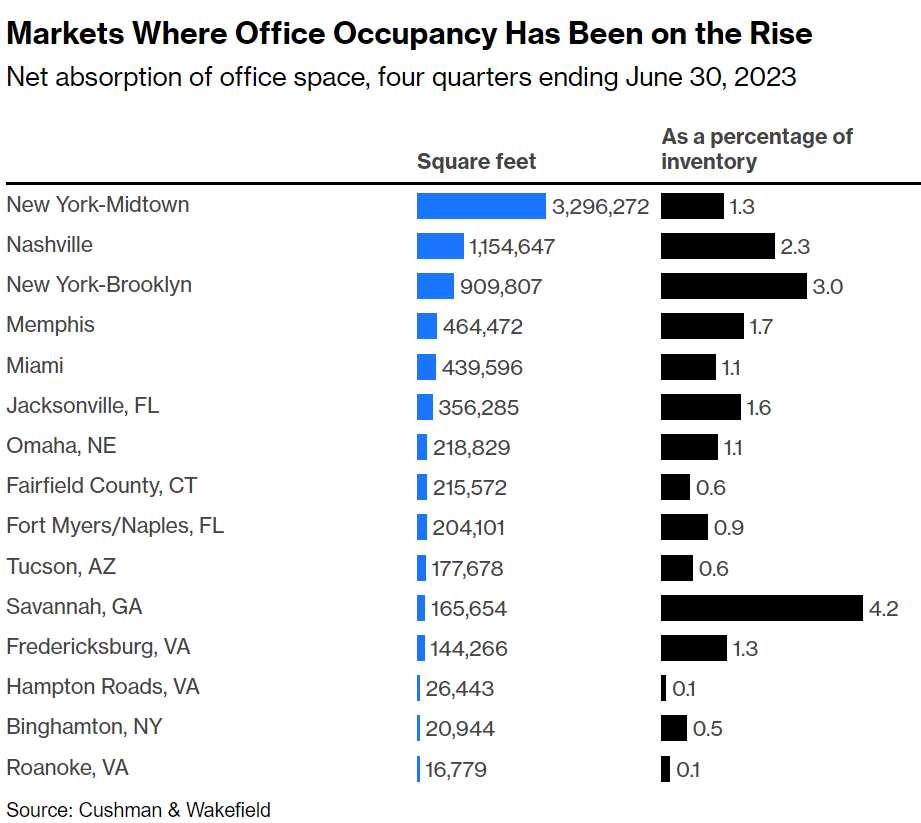

One key metric of the health of a commercial real estate market is net absorption: how many square feet are occupied at the end of a period compared with how many were occupied at the beginning. Not surprisingly, given the rise of remote and hybrid work, net absorption of office space nationwide is currently negative. In the US markets tracked by brokerage firm Cushman & Wakefield, 76.9 million fewer square feet were occupied in the second quarter of this year than in the second quarter of 2022, about 1.4% of office inventory. Only 15 of the 89 markets for which net absorption data is available for the past four quarters put up positive numbers. For NYC, based on 1.3% of inventory absorbed in the quarter, it would take 76 quarters or 19 years to absorb assuming no new inventory hits the market.

Cerberus Capital Management and Highgate missed two months of payments on a $415 million loan for 30 Courtyard by Marriott hotels, another sign of spreading trouble in commercial real estate. Cerberus and Highgate have requested an extension of the floating-rate loan, which matured in July, according to a servicer report. “Borrower stated that they do not have enough funds to cover the shortage and the regular monthly debt service,” according to the report. More commercial-property loans have become delinquent as borrowing costs increased. The delinquency rate on commercial mortgage-backed securities for hotels climbed to 5.35% in June from 4.4% six months earlier, according to Trepp, The delinquent Courtyard portfolio was facing a higher insurance payment following Hurricane Ian and Tropical Storm Nicole, which struck the US last year, according to the report. The combination of high rates, tighter lending standards, high cap rates and skyrocketing insurance premiums will lead to plenty more defaults.

Less than a year after Thor Equities turned 470 Broadway over to its lender as it was staring down the barrel of a foreclosure lawsuit, the company has reacquired the building for less than a third of its previous value. A Thor affiliate acquired 470 Broadway for less than $8.1M this month, according to city property records. The Joe Sitt-led firm in October transferred the deed to the two-story building to LNR Partners in a transaction valued at $25.4M. Retail has deteriorated in a big way in a short time. Thor bought back the asset in 9 months at a price 68% lower. I would say that is material.