Opening Comments

My last note received some of the most positive feedback of any Rosen Report thus far, but the open rates were down a touch given the July 4th holiday. It was entitled,” When Barry Manilow Gives Advice, Take It.” I received many nice emails, but one stood out from another famous saxophonist, Dave Koz, as I seem to have cornered the newsletter market for world class sax players:

Such a great story about Lington and Manilow. I can confirm all that as true, also as one who’s opened (and about to do it again next month) for Barry. He cares very deeply. And that is just one reason why we are still saying his name so much, this many years later.

Jack and I were in NYC Saturday night for 15 hours. Now in Hamptons for a few days for folks who want to buy me a much needed glass of wine. Very early send today as Jack is playing a practice round at Bethpage which is an unmitigated disaster for getting times. They suggest 9 holes will take 3 hours.

Apologies as this is a longer note which has been edited down by 30%.

Video of the Day-Gun Violence/Abe Assassination

Help Wanted…Desperately

Quick Bites

Markets/Jobs Report

Gasoline Futures Falling

Biden Approval Rating to 30% in new Poll

Liquidity Worsening in Treasuries and Credit

Workers Not Going Back to Cities

Italy/Eurozone Issues

Bodega Worker Arrested Despite Self-Defense

Other Headlines

Virus/Vaccine

Data-More Concerning News

Other Virus Headlines

Real Estate-Great Charts

My General Comments-R/E Slowing Everywhere

NYC, Miami, Austin, Toronto…

San Fran Office Market Issue

Other Headlines

Mortgage Rates Falling Sharply From Recent Highs

Affordability

Miami Growing Pains

Miami Article

Video of the Day-Gun Violence/Abe Assassination

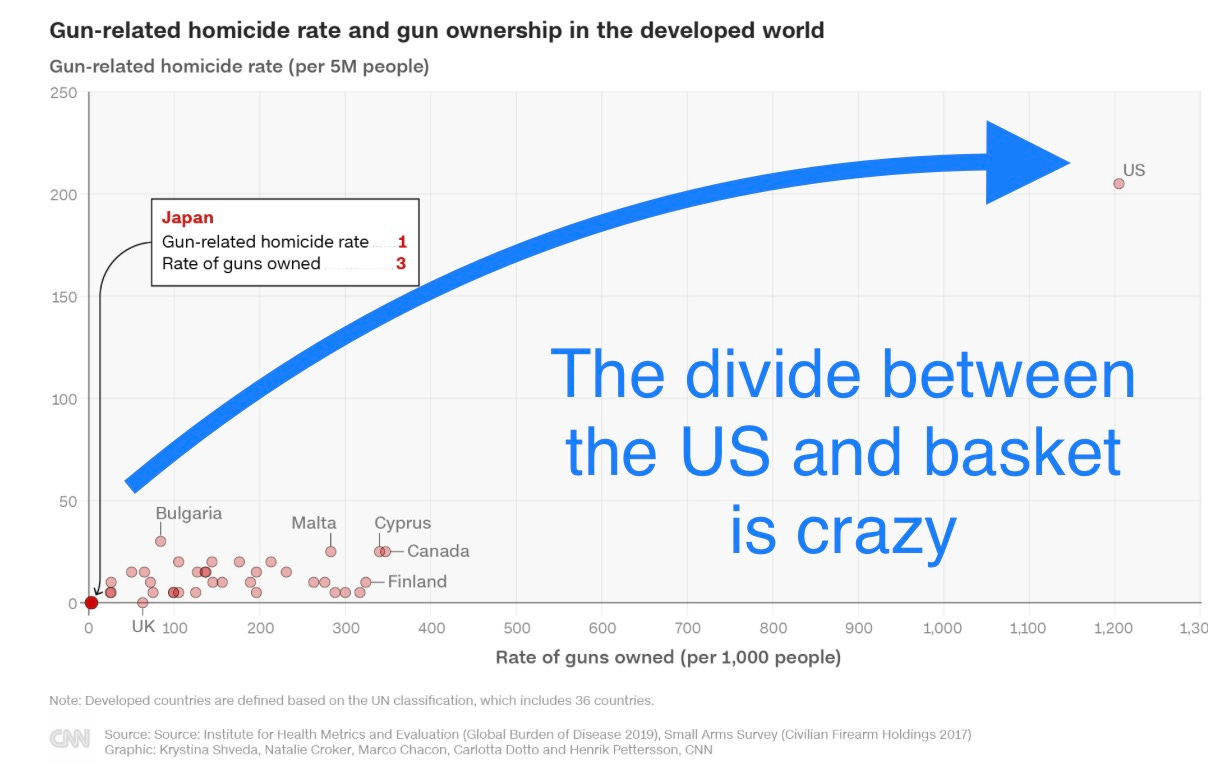

Japan's former PM Shinzo Abe died from injuries after being shot. Japan has very low gun violence and this incident is sending shockwaves through the country. I did not see any indication of the reason behind the assassination done with a home madegun by a former Navy man. Japan had only one gun-related death reported in 2021. The chart speaks for itself.

Help Wanted…Desperately

When I was a kid or a professional, I worked hard and wanted to add value. Obviously, earning money was important too. Starting at 11-years old, I washed dishes, bussed tables, waited tables, delivered newspapers, delivered pizza, valet parked cars, painted houses and did a ton of other jobs to make money. My mother always taught me about the importance of working hard and set a good example. She once got me an interview to be a busboy. I was 15-years-old and she screamed, “Don’t make the Rosen name mud in this town.” She wanted me knw to bust my tail to work hard and impress the manager (her friend) at the world famous, “Chubby’s Too” restaurant in the mall, which was famous for $4.95 massive early bird dinners.

One time early in my busboy role, I arrived at work 5 minutes late. The manager did not say anything, but my mother knew I was running late, and when I came home, my room was trashed with all my clothes thrown, closet emptied and mattress moved. She sent a message about the importance of taking responsibility seriously. I felt it was a bit of an over-reaction, but my mother’s craziness helped to give me a strong work-ethic and did my best to set an example by being in the office before 6:30am at JPM to set the tone.

When I took my first job at Continental Bank in Chicago in 1992 and earned $28k, I augmented my income by valet parking cars when I went on vacation to see my family in Florida. Not many bankers are valet parking cars on the side to earn more dough today. I enjoyed working hard and the benefits which came with it. For a host of reasons, many spurred by the pandemic, the work ethic and desire to work for millions of Americans ain’t what it used to be.

My training manager and long-time friend, Mike Rushmore, from Continental Bank sent me this email which gave me the idea of the piece today: I went to my local Home Depot store in Avon, Colorado. I asked an employee working in the lumber department - it’s a large section of the store - where the plywood was available. He looked at me quizzically. He asked me to repeat myself. “I’m looking for the plywood section.” His reply…”’I’m sorry, I don’t know what that is.” OMG. He was hired to work in a lumber department but does not know what plywood is.

Jack and I have been to PA, NY, NJ, WV, KY, MI, AL, LA, TN, MA in the past five weeks. I have seen help wanted signs in every location. Shockingly high hourly rates were offered and not many takers. We were in PA and went to a local restaurant and I asked the waitress why the menu was so limited. She said, "We generally have 8 cooks on staff and we are down to two. I have been here 12 years and it has never been this bad. I am in charge of the wait staff and I cannot find help. We hire someone and ask them to come at 4pm to help set up and they show up at 6:30pm disheveled and I cannot ask them to leave or question them out of fear they will quit. I need bodies so badly that we cannot afford to lose anyone willing to work. We are so understaffed that our patrons complain and it is costing us business we cannot afford to lose. We cannot handle more than 50% capacity and have reduced menu items and it is killing us.”

I am a member of various golf clubs, and everyone of them is searching for talent. Last summer, one in PA was over 150 people short for the summer which meant limited services at the remarkable 900 acre facility with 3 golf courses, numerous restaurants, pools, gym, tennis….. The single best item on the menu at Saucon Valley Country Club is the burger at the Weyhill golf course. Guess what, they cannot find any cooks this summer, so they no longer serve burgers. Cooking a burger does not exactly require an MIT engineering degree, yet they cannot find staff. Another club just emailed the members they are 22 people short this summer. “Quite simply, despite our best efforts, we have been unable to find and employ sufficient staff.” The manager suggested some of the staff had been working 90 hours/week to fill in the gaps. Pools all over the country are closing or cutting back hours given the lack of lifeguards. I thought this was a dream job for kids over the summer.

Even raising wages does not attract people to work. In Tennessee, they were offering cleaning people up to $25/hr and finding no takers. When they get hired, they rarely show up for work. A Ritz Hotel in CA generally has 550 employees and are short 125, which is forcing the hotel guests to have a different experience than normal. The manager cannot find talent and the high cost of living in the area coupled with limited mass transit makes it challenging to hire.

I am a bit at a loss. Almost 48mm people quit jobs in 2021. As a society, we need to get back to work to generate income to support ourselves. I always thought Americans were hard working people who cared about the output and making a difference. It seems we have lost our way. I speak with many younger people and there seems to be a growing number who don’t have the work ethic of prior generations. The US is losing ground to the competition on many fronts today and I fear what the forward looks like. Jamie Dimon was talking about long term policy and strategy for the country and he said, “The US is playing checkers and others are playing chess.” I found that comment to be on point and scary.

With the growth in computers, robotics, AI, self-driving cars and factory automation, more jobs will be displaced and for good reason, a growing number of people don’t want to get back to work.

More Americans were pushed into self-employment during the pandemic and the construction industry had the largest number of those workers. About 16.8 million people were classified as self-employed in June, according to Bloomberg calculations based on the latest data from the Bureau of Labor Statistics.

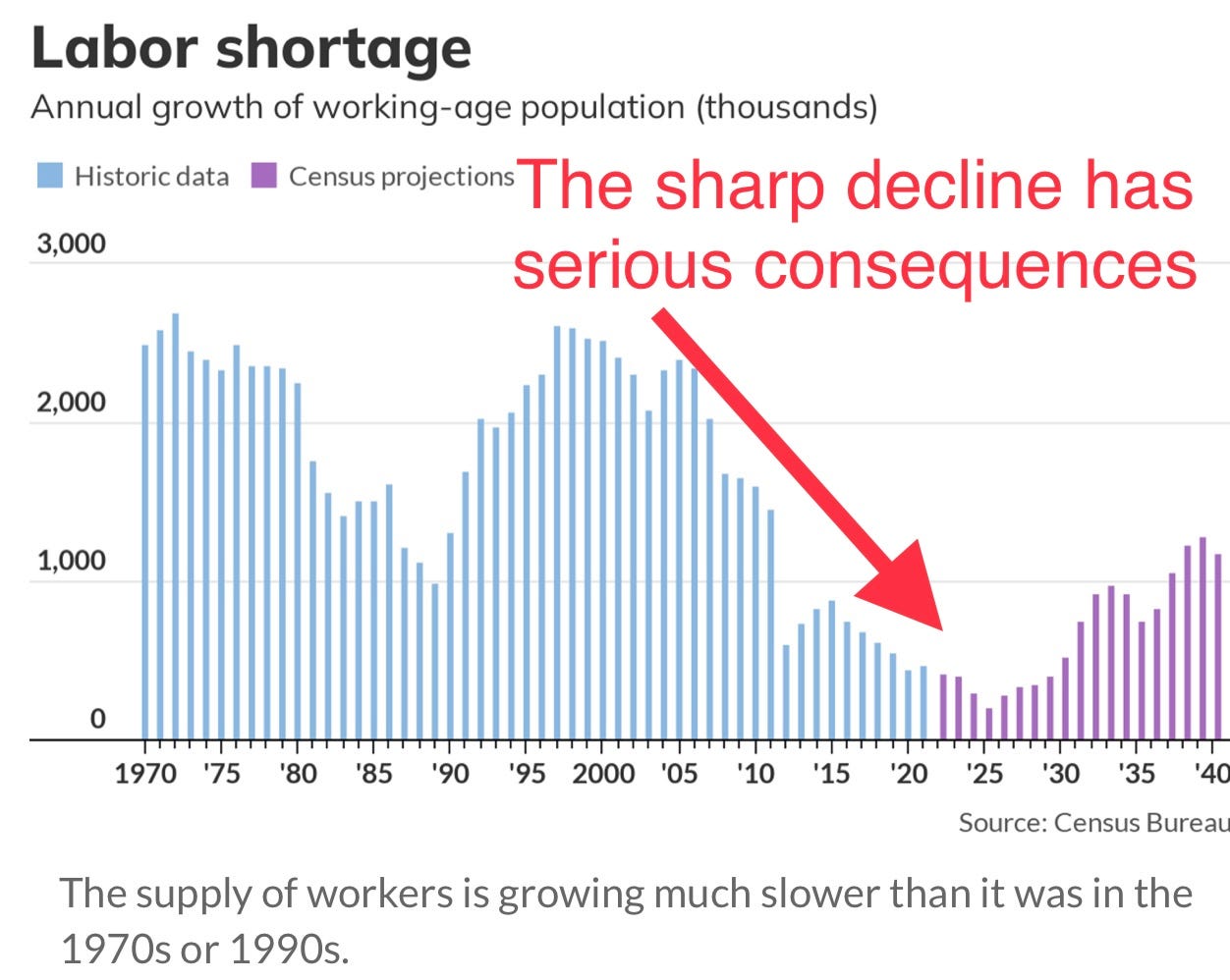

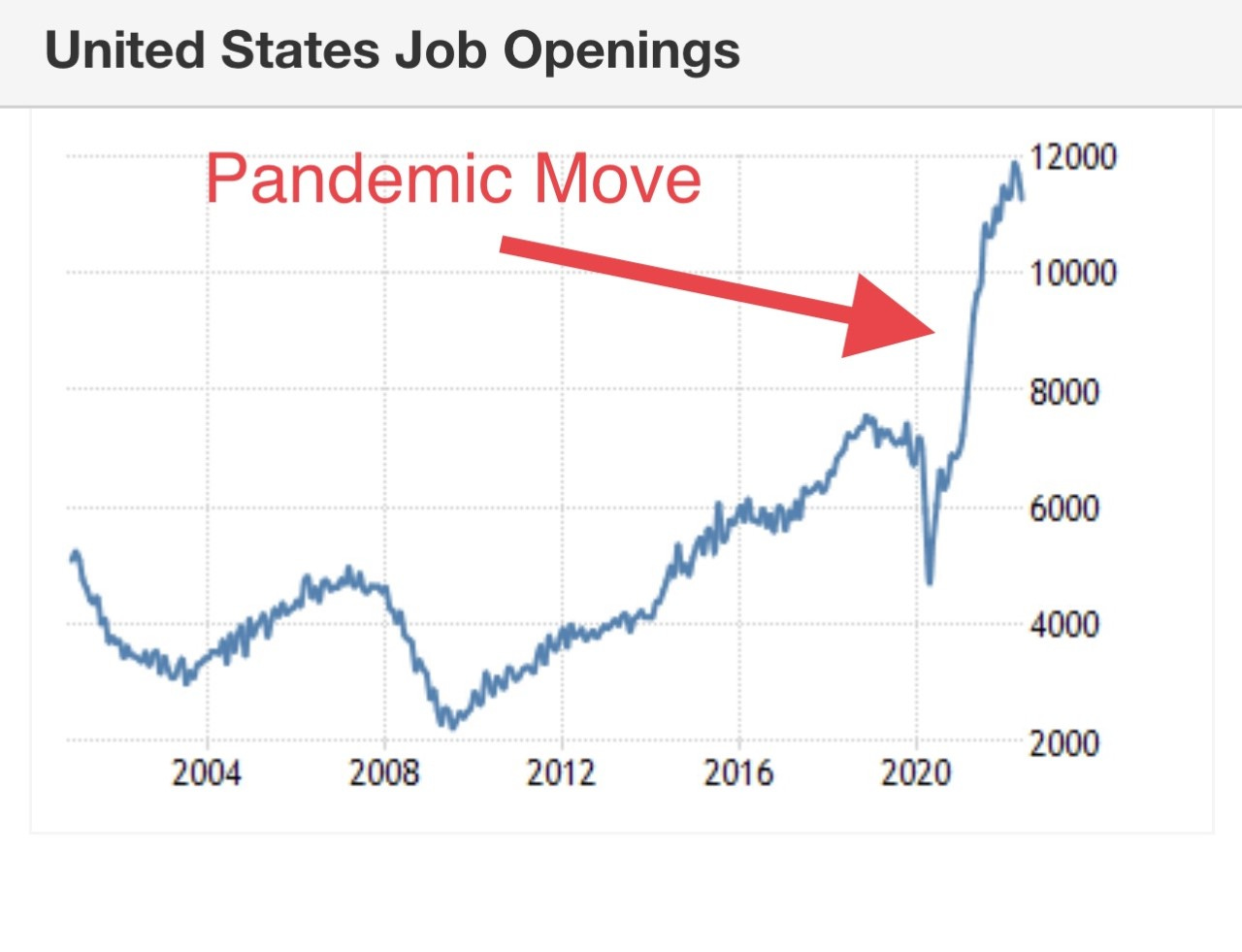

We need to find ways to get people back into the work-force and be productive people who earn a living. So many have fallen out of the workforce for a myriad of reasons. Companies need to be creative, but employees need to be willing to work! Check out the chart below. In 2012, there were roughly 4mm job openings in the US. Prior to the pandemic in late 2019, 7mm openings. We are at 11.3mm today. The free money given out by the government is running out and people are increasing debt levels. The answer is NOT more free money. I have a feeling many will want to return to work to support themselves soon. The 2nd chart shows growing household debt through which has increased as free money has stopped and people have not gone back to work. Tipping point is coming soon. There are currently two job openings for each person searching for work. One article suggests title inflation is popular to attract talent. One of my favorite Cheers episodes was about titles. Here is a 1 minute excerpt.

Now that I have been out of a formal job for almost 5 years, I am starting to consider options. When I worked at a high level, I felt my job helped to define who I was at the time. I hear there is a need for someone in the lumber department at Home Depot in Avon, CO. Maybe my calling is an orange apron? At least I know what plywood is, but as my readers know, “Some Assembly Required,” are my least favorite words in the English language, given my ineptitude at fixing anything. I’ll find you the wood, just don’t ask me what to do with it. Sounds like I am over-qualified. I need a raise before I start. How about CEO of Home Depot? Given title inflation, it seems plausible to me.

Quick Bites

The Nasdaq Composite rose in choppy trading on Friday as investors reacted to a stronger-than-expected jobs report that will likely keep the Federal Reserve on track for its aggressive rate hikes. The Nasdaq gained 0.1%, while the S&P 500 and Dow closed slightly lower. For the week, the Nasdaq closed up 4.6%, while the S&P 500 gained 1.9%. The Dow lagged but still gained about 0.8%. The U.S. job market was stronger than expected in June, with payrolls growing by 372,000 and several sectors vying for the leadership role. Health care and social assistance saw the biggest jump month over month, adding nearly 78,000 jobs, according to the Labor Department. Treasury yields jumped sharply after the jobs data was released, which may have limited gains for stocks. The 2-year Treasury yield held above the 10-year Treasury yield, an inversion that is seen by many as a recession indicator (-3bps as of Friday close). Bitcoin had a solid week (+12%) to $21.8k aver being approximately $17k at June low. Oil rallied back to $105 after going below $96 this week. However, oil was down slightly on the week with recession fears offset by supply concerns. The US $ continued to rally and it is sub $1.02 to the Euro after starting the year at $1.12. The strong dollar has consequences for multi-national earnings, trade, foreign debt denominated in dollars and many other aspects. This is something to watch.

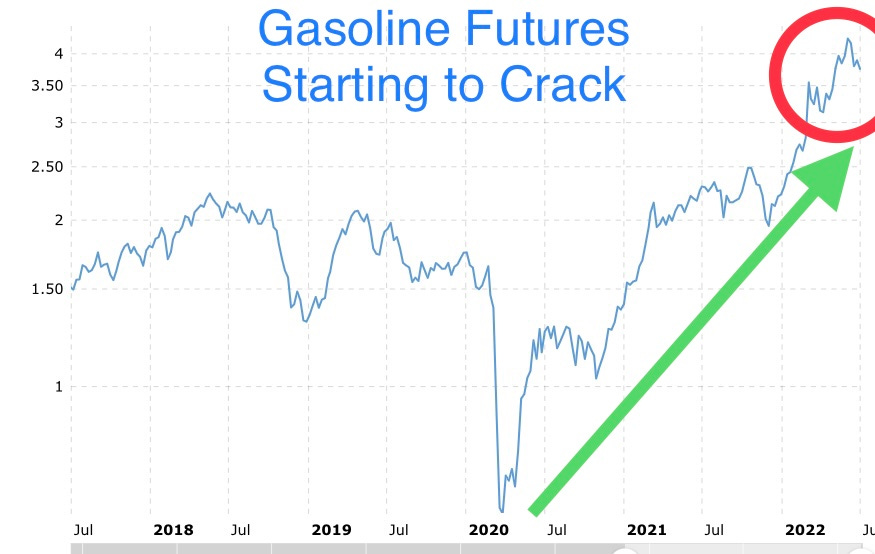

Prices at the pump have retreated from June’s never-before-seen levels but remain stubbornly high ($4.68 today vs $5.02 June high). US gas prices are up 100% since Biden took office and up 49% in the past year. Some relief could be in sight, with gasoline futures down 11% this week. This WSJ article is entitled, “Gas Prices Have Fallen for Three Weeks. The Relief May Be Temporary.” The suggestion is falling prices will lead to a sharp demand increase. There are numerous articles that Biden took 5mm barrels from the strategic reserve and sold them to other countries. It seems that 950k of the barrels were sold to Unipec, a trading arm of the China Petrochemical Corp. Further complicating matters is that Hunter Biden’s private equity firm held a stake in the Chinese company at one point. We need oil in the US, why sell millions of barrels of our reserves overseas? Biden is off to Saudi Arabia to beg for more oil. You know, we have plenty here in the USA.

This 2-minute Bloomberg Interview basically crushes the Biden recent energy/gasoline talk which Bezos also questioned. The answers are downright embarrassing by the Administration here. More of the media is turning on Biden, even the liberal media. The NYTimes is even getting more aggressive about Biden’s age.

On a related note, Biden’s approval ratings hit 30% in a new Civiqs poll. The same poll at the same point in his presidency had Trump at 44%. The poll reads horribly on all perspectives. The poll, released Friday, found Biden deep underwater with voters in every age bracket, every educational level, and both genders. Every one of those groups showed approval rates under 40%, with the youngest voters, age 18 to 34, among the most dissatisfied at a dismal 21%.

As a former Wall Street trader and Hedge Fund manager, I was closely following liquidity to help determine appropriate position sizing. I am hearing more frequently from those in the game that liquidity is drying up and this is something which needs to be watched. Check out the chart on Treasury market liquidity. I spoke with a senior High Yield (HY) person and this was their comment on the subject. Liquidity is certainty challenged away from portfolio trades in the Investment Grade Market. Depending on the portfolio, they command a lot of attention and are competitive. Liquidity is more broadly focused on the top tickers/most liquid issues in both the Investment Grade and High Yield markets. Loan liquidity remains strong. Some of the illiquidity is seasonal, but most of it is due to the broader market. The limited liquidity in the High Yield market is despite historically large cash positions. The HY market now trades at 9% and a spread to Treasuries of just under 600bps. YTD, the HY market is -12.3%.

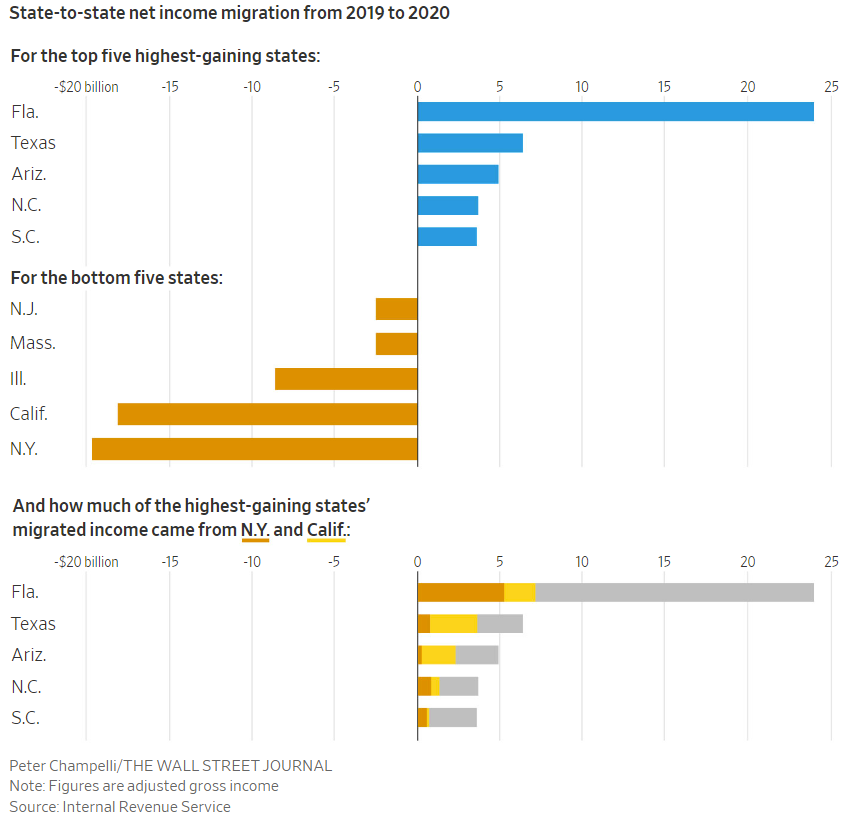

This WSJ article is entitled, “Big Cities Can’t Get Workers Back to the Office-Occupancy is especially low in cities like New York, where workers are the engine of local economies.” Nationally, office use hit a pandemic-era high of 44% in early June, while cities like Philadelphia, Chicago, San Francisco and New York have lagged behind, according to Kastle Systems, which collects data on how many workers swipe into office buildings each day. From April 2020 to March 2021, 26,300 New York City small businesses closed permanently, according to a report the mayor released in the spring. Available office space in New York has grown to about 125 million square feet, up from 90 million in the first quarter of 2020, according to data firm CoStar Group Inc. Retail rents in Manhattan have declined for 18 consecutive quarters. The article discusses safety concerns and a lack of willingness to take public transportation. I often speak of consequences for elections. Soft on crime policies can have a major economic impact. Look at Citadel leaving Chicago or the wealth leaving NYC, SFO, LA, Chicago and other cities.

Interesting article about Europe and contagion concerns around Italy. In 2008, we learned how very interconnected the world economy has become. This interconnectedness is why our economic policymakers would be well advised to pay careful attention to the economic troubles brewing beyond our shores. There is reason to be particularly concerned about another round of the eurozone sovereign-debt crisis. Unlike in 2010, when the eurozone debt crisis was centered on Greece, this time around it’s likely to be centered on Italy, whose economy is some 10 times the size of Greece’s. If in 2010 the Greek debt crisis shook US financial markets, how much more so would an Italian debt crisis do so today. In the wake of the pandemic, its budget deficit ballooned and its public debt skyrocketed to more than 150% the size of its economy — its highest level on record. Look at the 52-week range of yield on the Italian 10-year government bond (51bps to 4.2%).

The new NYC DA, Bragg, is a disgrace and needs to be recalled just like the SFO situation, where Chesa Boudin got the boot. Hardened criminals do not face real jail time, but hard working bodega workers who are acting in self-defense see sky-high bail. The video is crystal clear to me. The bodega worker tried to avoid confrontation. A Manhattan bodega clerk who was forced to grab a knife to fend off a violent ex-con, found himself sitting behind bars at the notorious Rikers Island jail charged with murder and unable to post $250,000 bail (since reduced to $50,000 and released). The sky-high bail for Jose Alba — who has no known criminal history — was just half of what Manhattan District Attorney Alvin Bragg’s office demanded, despite surveillance video showing the clerk being assaulted by his alleged victim in the bodega. It gets even worse. Simon’s girlfriend stabbed a worker during this incident and is facing NO CHARGES. WTF! Real criminals are let free with no or limited bail and hard working, law abiding citizens are in jail. I feel like I am in some zany 1980s backwards movie. Eventually, the bail was lowered from $250,000 to $50,000 and Alba is now out of prison. I want Bragg out of office for the good of the city.

Other Headlines

New York gun applicants will have to hand over social accounts

Love it. Longer waiting times, better background checks and guns should not go to people with criminal records. Social media checks are necessary.

FBI Director Wray, MI5 chief raise alarm over China spying

How the US continues to be so reliant on such a bad actor is beyond me. China is the worst partner ever, yet we need them because the US is too inept to manufacture efficiently.

Copper’s Slide Signals Mounting Recession Concern

In the last report, I went into detail on commodity price declines signaling a slowdown. In 2001, copper was $.65/pound and was $4.7 in March of 2022 for perspective. Now, $3.74/pound.

Musk abandons deal to buy Twitter; company says it will sue

I wrote about this extensively. I want Musk to buy Twitter, but it makes zero economic sense at the $44bn price and even less sense with all the fake accounts. I suggested fair value was in the high $20s. Not clear how easy it will be for Musk to walk. Stock to $35 from almost $50/share. Stock should be lower.

SoftBank’s Unicorn Herd Turns Vicious

Senior staff departures and widening signs of stress in private markets mean more trouble ahead for one of the tech boom’s leading cheerleaders. I have been critical of Softbank and their horrific investments. I know senior people there and am incredibly unimpressed with their track record, history, investing philosophy and have written about it repeatedly. Look at Klarna-Softbank led the round at $45.6bn one year go and it is raising money down 86% at $6.5bn today. The place is a clown show. How in the hell did they raise $100bn?

Germans Face ‘Enormous Wave’ of Energy Price Hikes, Uniper Says

Energy policy matters and the stupid decisions by the German government is absolutely crushing its citizens and I expect next winter to be an unmitigated disaster. Germany’s largest landlord suggested tenants can only turn their heat to 62.6 degrees between 11pm to 6am come autumn. Hey you brainiac Germans who laughed in Trump’s face when he warned you about relying on Russian energy, what say you now? (30 second clip). What does this do to German manufacturing costs? There are stories that the Germans are warming up to nuclear power again to get off the Russian energy train. Brilliant, but too late.

Crypto lender Celsius is a 'fraud' and 'Ponzi scheme', lawsuit claims

I agree 100%.

Startups Suffer Bleak Second Quarter

Global funding dropped 23% from the first quarter and totaled $108bn.

Kidnapping suspect Tzvi Allswang shot in head by police

I don’t see this often in BOCA RATON, FL. I have been told that I pick on NYC too much on crime, so I wanted to be sure people know crazy crap happens everywhere. A therapist diong a house call was bound and raped by this freak until he was shot in the head and she was rescued.

Pregnant woman beaten with wrench in broad-daylight NYC attack

I could not let this one go. Sorry. He beat her with a wrench.

Laughing Philly teens beat James Lambert to death with traffic cone: video

I want the death penalty for all involved regardless of age. Let’s get the streets back to the citizens who are law-abiding and want to thrive. If the Philly DA let’s these kids go after they are caught, I will start a petition to get him recalled.

NYPD shoots man who threatened to kill Gov. Kathy Hochul, police commissioner:

Liberal protest group offers 'bounties' for info on where conservative justices are located

Anyone else have a serious problem with this other than me? I would say the same thing if it were about anyone being stalked.

Sandra Douglass Morgan: Las Vegas Raiders hire first Black female president in NFL history

Nuclear war would trigger a new Ice Age, study warns

Article suggests global temps would fall by 13 degrees in one month.

Virus/Vaccine

The growth of at-home testing may be impacting the public data as at-home tests are not reported to the CDC generally. The positivity rate is exploding (18% from 2% in March), but the cases are holding steady. Hospitalizations are growing too. I mentioned noise in the data recently and this was what I was referring to at the time. The top 20 cities for case growth in the US have 14-day case growth of 300% or more for perspective.

Other COVID Headlines

NYC Neighborhoods Top 25% COVID Positivity as New Cases Surge Again

This New ‘Ninja’ COVID Variant Is the Most Dangerous One Yet

COVID Guidelines: CDC Says Wear Masks in NYC Amid New Variant Threat

Here we go again.

COVID Vaccine Booster Effectiveness Drops Quickly, Study Says

Real Estate

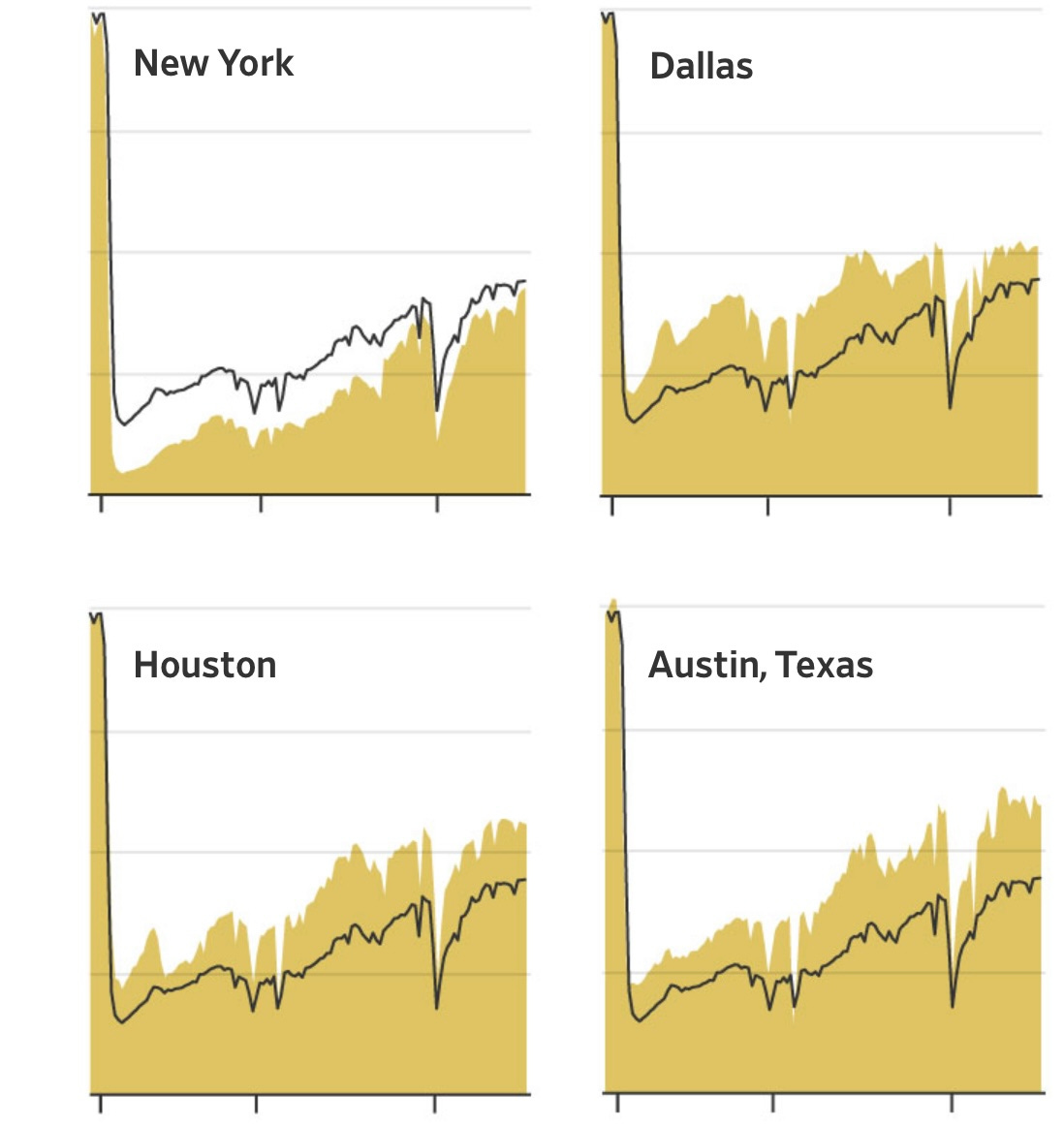

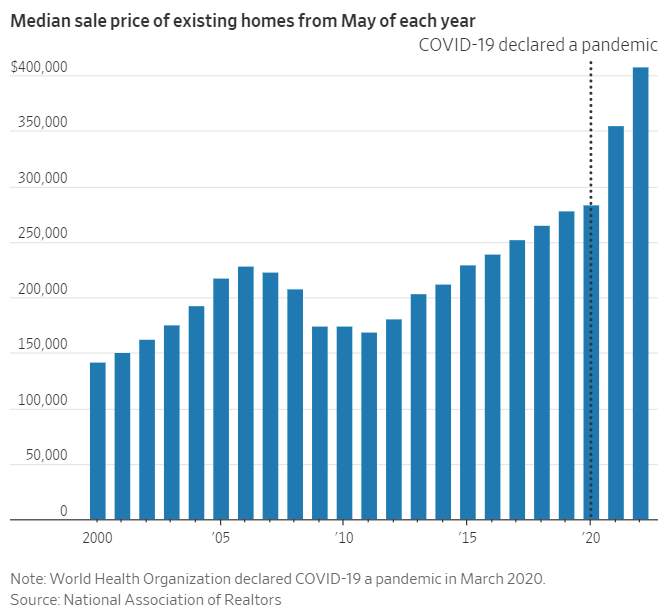

I have more headlines and pictures to suggest the slowdown in R/E is mounting. In Miami, a house is listed and is paying the BUYER’s commission of 5%, rather than the standard, 3%. This is to attract buyers. We have not seen this kind of promotion for years in Miami. Another Miami high-end condo is considering a 15% price reduction given lack of traffic and a seller who bought another home and is getting nervous. This article, Real-Time Indicator Shows Manhattan Housing Market Quickly Cooling,” shows data to suggest Manhattan R/E is changing from ultra-hot to cooling. I spoke with an R/E broker in NYC who suggested things were slower (part of it is seasonal), but still has showings in the city at all price points.

However, rental market is strong. I was told that a studio (450-500 ft) on 36th and Park went for $3,200 pre-pandemic. It fell to $2,100 during the pandemic and was just raised to $3,700 and one rented for $3,900 in the full-service building. One bedrooms in the building are up $1,000-1,500 from pre-pandemic levels and range from $4,800 to well over $5,500 and go quickly.

Austin, TX was viewed as one of the fastest growing cities in the world with a REDHOT real estate market. The picture below shows significant changes year over year.

This was an insanely heated market for too long.

I love the All-In Podcast and the most recent one covered a host of topics including jobs (my main piece) and commercial R/E. Here was part of the discussion on SFO office space and this part of discussion starts at 11:45 into the video. The jobs discussion is prior to it. By Year End, 30mm square feet of office vacancy=40% vacancy. Fire sales of commercial R/E in SFO and other major cities due to debt on buildings which can’t be serviced on new lower rent rolls according to the podcast, which I always find informative.

Other R/E Headlines

Mortgage rates see largest decline since 2008

The 30-year fixed-rate mortgage averaged 5.30% in the week ending July 7, down from 5.70% the week before, according to Freddie Mac. That is still significantly higher than this time last year when it was 2.90%. Fears of economic slowdown/recession have Treasuries rallying which lowers the yield and has helped mortgage rates decline.

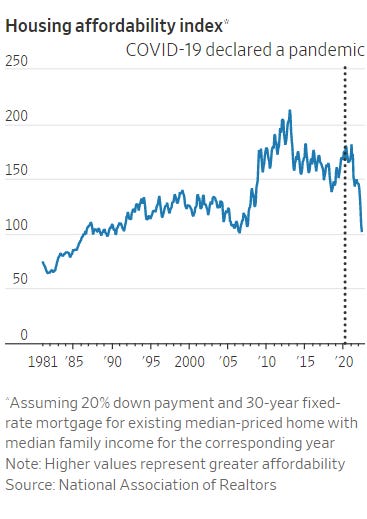

Housing-Affordability Index Drops to Lowest Level Since 2006

With rates, economic slowdown, layoffs…I expect to see a healthy pull-back in housing prices over the next year. Housing prices are lagging indicators.

This WSJ article, “Miami’s Gold Rush: Finance Firms and Crypto Move In, Bringing Strains,” is a good one and outlines some of the growing pains and issues due to the migration to Miami. High rents are pushing residents out, for example.

In Miami, a Pandemic-Fueled Boom

Interesting article about Miami restaurants, shopping, and life given the influx of people.