Opening Comments

The last Rosen Report was entitled, “Holy Grail of Cancer Detection,” and the open rates were down a touch probably due to summer holidays. It is a very important medical development which can save lives. Please read the subject piece about the cancer screening. Many readers reached out to tell me they have decided to take the test.

Off to Nantucket tomorrow for a day for the first time and I am quite excited to spend time with friends and check out the island. We are likely heading back to Florida in the next few days and quite frankly, I am ready to sleep in my own bed.

I have been very critical of President Biden for good reason, but do believe he has some recent wins which should give him a much needed boost after a disastrous 18 months. The passing of the semiconductor bill, bipartisan gun restrictions, the killing of Ayman al-Zawahiri (key 9/11 plotter) and the Manchin-Schumer deal show some movement in his agenda.

I appreciate the many contributors who email me regularly with story ideas. There are a handful of readers who go above and beyond sharing dozens of ideas a day and I really appreciate it. Also, if you like what you see, please forward it to help me grow the subscribers and also “like” the post by hitting the heart next to my name.

Picture of the Day-Asset Performance by Deutsche Bank

Hickory Sticks

Quick Bites

Markets

Job Openings

Household Debt Growing

Maersk Earnings/Supply Chain

Softbank

Pelosi Taiwan

Other Headlines

Virus/Vaccine

Data-Improvements

Real Estate

General Comments-Another big Palm Beach Estate

R/E Contracts Breaking

Other Headlines-Focused on R/E Weakness in US & China

Picture of the Day

DB’s Jim Reid came up with this interesting chart showing July and YTD performance of select assets.

Hickory Sticks

I played in a hickory stick three hole golf tournament. For those non-golfers, hickory sticks are old golf clubs generally from 1890-1935. The shafts are made of wood and although can be beautiful, they are quite challenging to hit. Some golf courses go “Old School” and do fun events bringing back the clubs from 100 years ago. I had never participated in one until this week. In short, modern golf technology from the ball to the shaft to the clubhead is night and day from these wooden relics.

Back in the day, rather than numbers on clubs, they had names as outlined below. In the picture above, the names can be seen under the #s as these are recreated to look old, but thought it would be helpful to see.

Driver=Driver

Spoon=3 Wood

Cleek=1 Iron

Mid Iron=4 Iron

Mashie=6 Iron

Mashie Niblick=8 Iron

Niblick=Pitching Wedge

I teed off on the 1st hole never having hit one of these clubs. Thankfully, we teed off from the most front tees, making the holes far shorter. If I had to play the back tees, it would have been impossible. I hit the ball probably 200 yards, but into the left rough. I had a consistent issue that the driver seemed to go left. The head of the woods seemed so heavy to me that it made it challenging. The irons were so hard to hit off the ground that it was frustrating. The highlight was the par I made on the 3rd hole. I kept wanting to use the Mashie because I liked the name. I hit my Mashie believing it was a little too much club and hit it over the green. I hit it far enough that I was on the #4 tee box (see below. I then hit my Niblick over the bunker into the wind to inside 5 feet, despite being short-sided and made the putt for par. I am not sure I have ever been more proud of a par in my life given how hard those hickory sticks are to hit. Thankfully, it was a 3 hole tournament, as the 4th hole gives me grief even with modern clubs.

To be clear, golf is hard enough and would be far happier and wealthier had I never played it. Although it was a fun afternoon to play with the hickory sticks, I surely would quit the game if I had to hit hickory sticks all the time. Remember, back in the day, the men golfers had to long sleeves and a tie like the great Bobby Jones pictured below. I am a firm pass on a combination of that outfit and hickory sticks if I wanted to shoot a decent score. How did they do it?

Quick Bites

After a couple days of slightly weaker tone, equities were up sharply Wednesday with ISM non-manufacturing purchase managers index at 56.7 for July vs expectations of 54 and June of 55.3. Also of note, St. Louis Fed President, Bullard make comments about the US not being in a recession and that rate hikes will tame inflation. Based on the saber rattling with China, I did not think the market would have been so positive today. The Dow rose 415 points, or 1.28%, to 32,812. The S&P 500 gained 1.56% to 4,155 hitting its highest level since June and wiping out losses from earlier in the week. The Nasdaq Composite increased 2.59% to 12,668 boosted by rising tech stocks. Oil fell 4% on higher than expected inventories. Gasoline is now averaging $4.16/gallon which is down 17% from $5.01 in June. Natural gas levels remain elevated at $8.3MMBTU, but off the recent highs of $9.3. Of note, the 2s/10s spread which I write about frequently is down to -31bps, a new recent low as the differential had been approximately -20bps. See chart below. The spread is most negative since 2000.

The total of employment vacancies fell to about 10.7 million through the last day of June, a decline of 605,000 or 5.4%, according to the Job Openings and Labor Turnover Survey released Tuesday by the Bureau of Labor Statistics. Markets had been looking for openings of 11.14 million, according to FactSet.

Even with the sharp decline, there were still 1.8 open jobs per available worker, with the total difference at nearly 4.8 million. More and more signs pointing to inflation having peaked. Robinhood, the once high flying company stock is -76% since the IPO one year ago and -90% from the $85 high one year ago. Robinhood announced layoffs of another 23% of the company after letting go 9% in April. Interesting headline: The confusing job market: Tech and finance brace for the worst, retail is mixed, travel can’t hire fast enough.

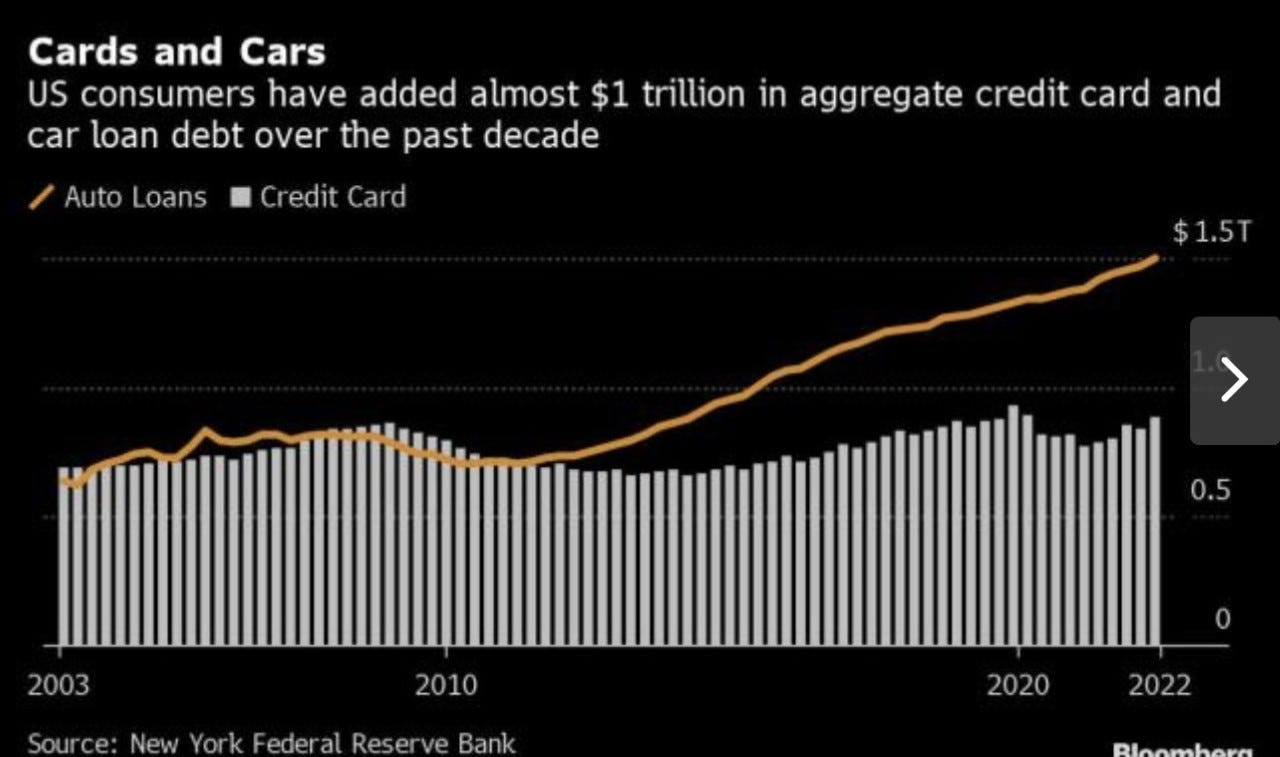

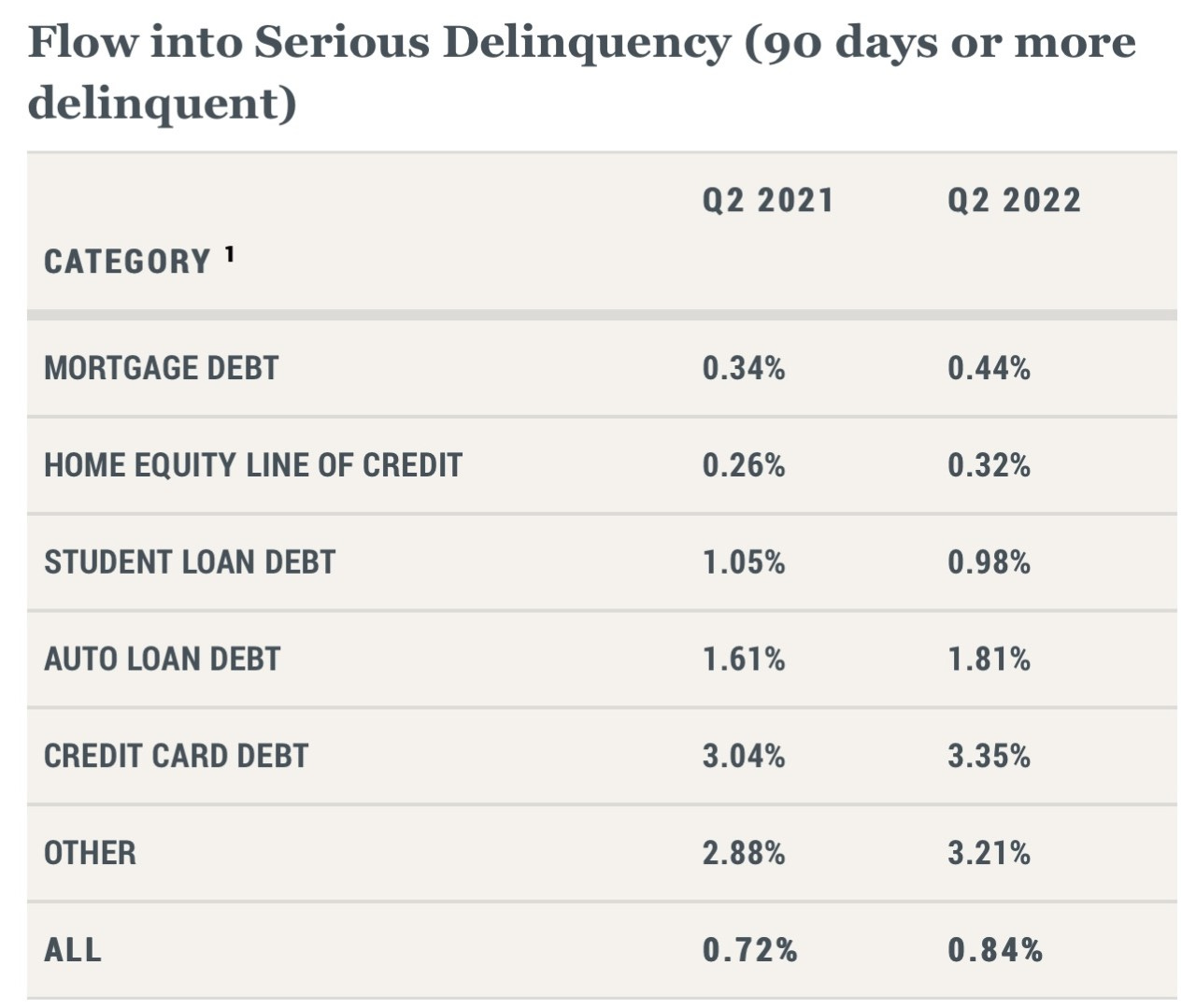

US household debt increased by 2% to $16.2 trillion in the second quarter, with mortgages, auto loans and credit-card balances all seeing sizable increases, according to a report by the New York Federal Reserve Bank. The main driver was mortgage debt, which accounted for two-thirds of the rise last quarter. And the 13% jump in credit-card debt year-over-year was the sharpest gain in more than 20 years, the New York Fed said in its quarterly report on household debt and credit. I had been frustrated with the Fed being overly accommodative for too long until recently and the inflationary handouts by the government. The reason many people have not jumped back to work is also due to the fact that they are borrowing at higher rates and these charts from the Federal Reserve Bank of NY show it. Check out the 2nd chart and the annual change in household debt year over year (2nd column). Given 123mm households, it suggests the average family debt grew by $9.7k over the past year. Also of note, more debt is delinquent (3rd chart).

Maersk is a container shipping giant with 17% market share and sees the global supply chain woes lasting longer. “Congestion in global supply chains leading to higher freight rates has continued longer than initially anticipated,” Maersk said in a statement. It now expects underlying earnings before interest, taxation, depreciation and amortization (EBITDA) of around $37 billion versus the $30 billion it forecast earlier. Maersk had initially expected full-year EBITDA at $24 billion.

I have been critical of Softbank as an investor and the leadership of the company. I have written about my views at least a dozen times in the past couple years. How the company has been able to raise so much money is beyond me and shows the ineptitude of investors willing to back these guys. Please read this WSJ, “Softbank Emerges as a Big Loser of the Tech Downturn. Again.” They invested $38bn into 183 companies in 2021, the most ever by a venture capital investor. Big losses are expected next week when the company reports according to the article. They have made many high-profile bad investments: Greensill Capital, Katerra, WeWork, BerkshireGrey, Klarna and others. On Klarna, Softbank invested $1.7bn at an average valuation of $35bn, and after trying to raise money at $50bn, the company raised money at $6.7bn valuation. In May, the WSJ article suggested that since inception, the $100bn fund trailed the S&P over the same time with the fund +40% and the S&P+72%. I expect the disappointments to continue. Remember, venture should result in a far higher return than the broader stock market based on the risk and locked up nature of capital. I suspect the gap will continue to widen between the underperformer of Softbank relative to the market.

Nancy Pelosi arrived in Taiwan Tuesday evening and had meetings on Wednesday despite threats from China suggesting there would be “consequences” for the trip. I applaud the courage of Pelosi for going, but I question the US involvement here. Officially, the US has so many issues on its plate right now, that I do not know why we are adding another one. Also of note was that Biden and the military were opposed to the trip publicly. It definitely does not make Biden look good in my opinion that Pelosi went anyway. Remember, I blame China for COVID, lies, stealing IP, labor camps, treatment of Uyghurs and many other things. China on Tuesday (Aug 2) slammed the United States' actions in Taiwan as "extremely dangerous", after US House Speaker Nancy Pelosi arrived on the island for a visit that has inflamed tensions between the superpowers. "The United States, for its part, has been attempting to use Taiwan to contain China," Beijing's foreign ministry said in a statement. "It constantly distorts, obscures and hollows out the 'One China' principle, steps up its official exchanges with Taiwan, and emboldens 'Taiwan independence' separatist activities. These moves, like playing with fire, are extremely dangerous. Those who play with fire will perish by it."

Other Headlines

Fed's James Bullard expresses confidence that the economy can achieve a 'soft landing

Bank of England set for biggest rate hike in 27 years as inflation soars

UK inflation is driven by food and energy prices.

Hedge Funds That Charge Most Tend to Perform Best, Barclays Study Shows

Barclays study examined about 290 hedge funds and their fees

Multi-manager funds that charge full pass-throughs fared best

Germany Has Three Months to Save Itself From a Winter Gas Crisis

Olaf Scholz’s government was slow to react when Russia squeezed gas supplies. Now cities are cutting back on lighting and hot water in a bid to avert disaster.

Unrelenting inflation is driving up costs, leaving more Americans living paycheck to paycheck

61% of Americans are living paycheck to paycheck vs 58% in May and 55% a year ago.

Dollar-Store Dinners and Vats of Shampoo Help Families Cope With Inflation

I went to a Dollar Store for the first time in years. Everything was $1.25 and nothing was $1.

Families of Haley, Clyburn got casino shares

This WaPo article does not read well and is one of the countless things wrong with politics.

Facebook censors top economist for defining recession

I have written extensively about media bias. Social media companies are extremally left leaning, and Facebook has been ridiculously left. If you question the administration, Facebook fact checked an article which defined recession.

Metaverse job postings plunge 81% as tech world ponders reality of recession

Does anyone else have a problem with this? Given the importance of educating our children, teachers should make more money. Our future depends on it.

NYPD officers pelted with bottles by Bronx Dominican Day parade partiers

I don’t understand the blatant disregard for authority or the new world in which the offenders do not face consequences. Please make it stop.

10 Career criminals rack up nearly 500 arrests since NY bail reform began

Please make it stop. No one can convince me this is the right thing to do.

Filipino American MMA fighter takes down NYC man accused of six separate unprovoked attacks

We need more of this. Great job on the MMA fighter. Happened in Soho to an area I have walked hundreds of times.

George Soros says it's not his fault violent crime is on the rise

For the life of me, I do not stand the Soros end-game here.

Militia member given longest prison sentence for U.S. Capitol attack

Kansans vote to uphold abortion rights in their state

The proposed amendment was the first time anywhere in the U.S. that voters cast ballots on abortion since the Supreme Court overturned Roe v. Wade in June.

Lyme disease epidemic? Tick-borne illness cases skyrocket 357% in rural America

Russian officials requested adding convicted murderer to Griner/Whelan prisoner swap

I was against the last proposal and am adamantly against this one.

Virus/Vaccine

Data is largely improving with cases shrinking slightly and other data growing at a slower pace. Only the positivity rate is going in the wrong direction and is now at 19% after being 17-18% for a few weeks.

California declares a state of emergency over monkeypox outbreak, following New York and Illinois

The CDC is horrible. They totally botched the COVID outbreak and appear to have done it again with Monkeypox.

Real Estate

I continue to get calls from successful people from CA, IL, NY, NJ, CT who want to move to Florida . Today, I spoke with a man who left NYC to become a Florida resident. When I asked him if he would move back to NYC, he said, “That would be akin to a freed Alcatraz prisoner swimming back to jail.” I had not heard that one, but liked it. He does keep an apartment in NYC, but is there rarely now.

Jeff Greene, the famous R/E investor who shorted the market prior to the 2008 crash and then bought up real estate after just listed adjacent properties in Manalapan, FL for $49.9mm. He purchased the first of the Manalapan properties in 2015 through a bankruptcy auction for $6.5 million, records show. He bought the second for $4.1 million in 2018. The property totals just over 3 acres and appears to be a tear down. Not many waterfront lots of 3 acres available in choice locations. I have met Greene a couple times and I must tell you, I was very impressed. His calls on the short and long side were legendary. The prices he paid for R/E during the Global Financial Crisis were remarkable. I am talking pennies on the dollar for amazing properties. Also of note, Ken Griffin from Citadel took 6 floors in 830 Brickell in Miami and rents have been going for $125-150/ft.

In yet another sign the R/E market continues to cool, data on home purchase agreements falling through continues to deteriorate. According to a new report from real estate brokerage Redfin, around 60,000 home-purchase agreements in the U.S. fell through last month. That equates to 14.9% of all homes that went under contract in June. To put things in perspective, cancellations were at 12.7% in May 2022 and 11.2% in June 2021. In fact, 14.9% was the highest cancellation rate since early 2020, when the COVID-19 outbreak brought real estate transactions to a near dead stop.

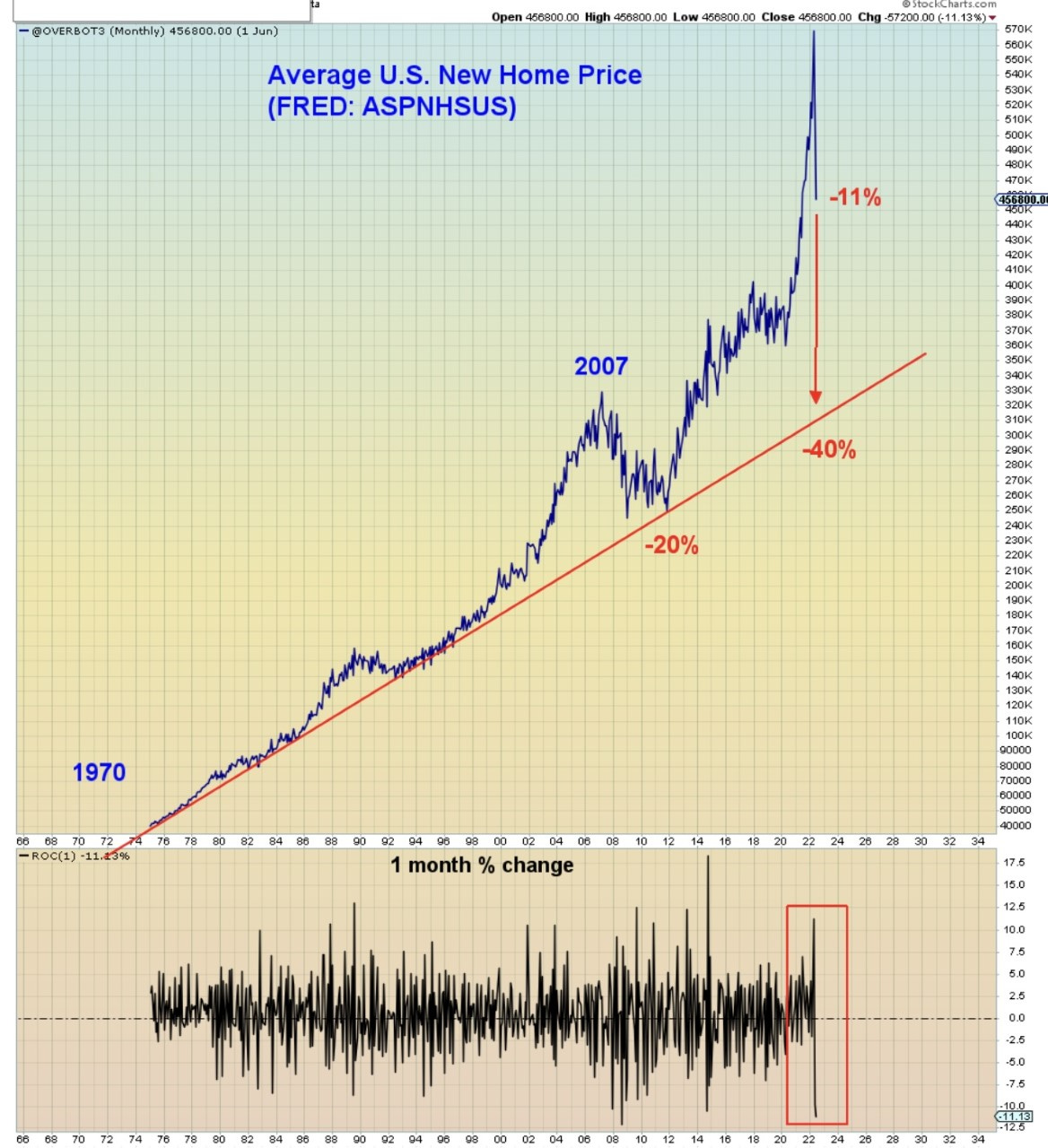

Check out this chart from FRED-Federal Reserve Economic Data which shows the second largest monthly decline in New Home Prices in 50 years. I think I have been pretty clear about home prices in the past few months. Will few exceptions, they are correcting in a hurry.

Other R/E Headlines

Home prices cooled at a record pace in June, according to housing data firm

Mortgage applications inch up for the first time in five weeks

They inched up 1-2% given the rate drop.

China Banks May Face $350 Billion in Losses From Property Crisis

Mortgage boycotts and slowing growth are rattling authorities

Pressure seen growing on China’s $56 trillion banking system