Opening Comments

I want to start by wishing all of of the Jewish readers Happy New Year. Today’s theme piece is a little longer given how fired up I am about the subject of my main article. I tried to cut other areas down. No crime headlines today, but do have a longer comment on crime statistics to be sure we are all on the same page.

I did get my skin checked at the dermatologist on Friday and highly suggest everyone do this once a year. A friend lost 1/3 rd of his ear due to skin cancer. Wear lots of sunscreen a good hat, and be smart. I am also giving my view on some short dated fixed income investments in Quick Bites based on the substantial rate move this year.

Podcast-Short Summary of Today’s Piece

Highway to Hell

Quick Bites

Markets

Cash Alternatives

Scott Minerd-Bearish on Market

US $ Strength

Other Headlines

Crime- Statistics

Virus/Vaccine

Real Estate

Luxury Market Slowing (Charts)

NYC Luxury Slowing

Florida Golf Course Update

Other R/E Headlines

Video of the Day-My Podcast Summarizing Today’s Piece

I am trying something new today and have an 18-minute video which summarizes Highway To Hell for approximately 11 minutes. It is a summary of the exchange between Rep. Tlaib and Dimon last week. Then I go over a couple of the articles in Quick Bites, Other Headlines, Crime and Real Estate. Looking for feedback. How long is the sweet spot for the podcast? How can I improve it? I used Riverside to record it and I am clearly not an expert on the platform…yet. I felt the microphone could have been a little closer and the lighting a little less bright. Work in progress. This is the link to the podcast. I am going to hire someone to help me with these.

Highway to Hell

The title, Highway to Hell is a great AC/DC song from 1979, and I felt it was appropriate for today’s piece which discusses Representative Rashida Tlaib (MI) and her interaction with Jamie Dimon this week. A long-time reader and friend, Rob, came up with the title.

This 2-minute video is something you need to watch. It is the “esteemed” representative Squad member, Rashida Tlaib, grilling bank CEOs on eliminating financing for energy companies. Dimon’s response is one of the best all-time. I am asking him to run for President for the 20th time, as America needs an adult in the room who gets to the right answer. I know Jamie would be amazing having worked for him for many years. Larry Kudlow said it brilliantly suggesting that Dimon’s answer warrants him receiving the Nobel Prize for Economics. Larry eviscerates Tlaib for good reason.

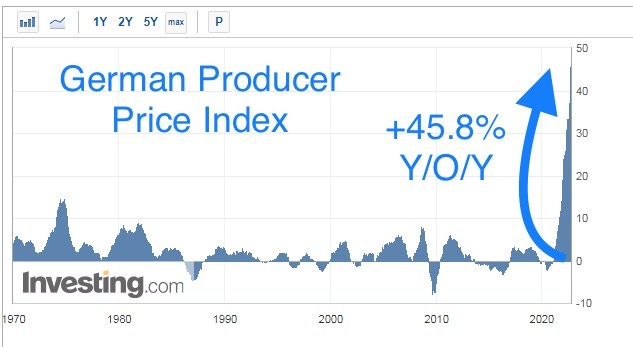

Let me start with explaining what bad energy policy created across the pond. Europe is cracking due to the horrific energy policies, desire to go “green” before they have the facilities in place and reliance on Russia. They shuttered countless nuclear and coal power plants in an effort to go green and are now paying a very high price for their horrible policies. They will burn more coal and firewood this winter doing more environmental damage because they tried to be green before they were ready to do so. How does Germany look with the producer price index approaching 50% year over year. Firewood prices in Germany are +85% year over year due to a lack of traditional alternatives for heat. The U.K. lifted its fracking ban given the crisis. Why do you think UK Consumer Confidence is at ALL-TIME lows and German Producer Price Index (PPI) is at ALL-TIME highs? A huge part of this is due to poor energy policy causing high gas, natural gas and electricity prices.

Apparently, Tlaib does not read the Rosen Report and has a limited understanding of finance or economics despite being on the Committee on Financial Services. She wants the US to follow the out of touch Europeans who will freeze to death this winter and face massive inflation issues. Tlaib, in her infinite wisdom, wants the banks to stop lending to the fossil fuel industry immediately. She asked the biggest bank CEOs, “Does your bank have a policy against funding new oil and gas projects, yes or no?”

My man, Dimon, responded, “Absolutely not, and that would be the road to hell for America.” Short and sweet. His response created the title for today’s piece. Tlaib went ballistic and had the audacity to suggest people should pull money out of JPM due to Dimon’s view on student loan forgiveness. “You know sir, everyone who got relief from student loans who has a bank account with your bank should probably take out their account and close their account.” WHAT? She needs to be investigated first for her lack of understanding of economics and next for trying to suggest a run on the bank. Jamie handled the Progressive attack beautifully, and his response emboldened the other CEOs.

I wish we were not reliant on fossil fuels. I was an early adopter to EVs with a Tesla for over 5 years. If Tlaib and the Progressives got their way and all lending to the fossil fuel industry ended today and we stopped drilling by 30%, oil will go to $250 or more. Countless jobs would be lost and we would plunge into a deep recession. High gas is a regressive tax which impacts poor people disproportionately. People would freeze and could not afford to get to work with $10+/gallon gasoline. Electricity prices would go up sharply. There is a great All-In Podcast from Friday which discusses Tlaib and her lack of knowledge on the subject we are discussing today. Please watch from 51 minute mark for approximately 5 minutes.

Tlaib is the Representative for the 13th congressional district in Michigan. Ironically, Tlaib’s Congressional district is in and around Detroit, our nation’s auto industry mecca. The median income is approximately $38k and almost 1/3 of the population lives below the poverty line. The median property value in her district in 2020 was $79.4k for perspective. Representative Tlaib, how do you suppose your constituents would fare if oil prices quadrupled or more and natural gas costs went up substantially? What would happen to electricity prices under your plan? Do you think lower income citizens would be disproportionately impacted by your desire to drive fossil fuel prices through the roof? Check out Dutch Natural Gas prices in the chart below.

Here are the facts. In the US, there are 289mm cars on the road, less than 1% being Electric Vehicles. In the US, we consume approximately 20mm barrels of oil per day. Approximately, 68% of the consumption is in transportation. Today, the US is largely energy independent based on oil, natural gas and bio fuel production, as we are rich in natural resources and invented fracking to efficiently extract it out of the ground. Thirty years ago, we were not energy independent and given fracking, we are now the world’s biggest producer. Could you imagine the deficits and the situation in the US if we did not invest in energy independence?

Here is my solution: The US should produce as much oil and gas as we possibly can while doing it responsibly. We should be 100% energy independent with substantial reserves and build more LNG facilities. This pressures Russia, Iran, Venezuela… At the same time, the government should be giving incentives to alternatives (solar, wind, wave, biofuels, EVs…) to bring down costs and bring more investment. If we pull the plug on fossil fuels before we have the alternatives in place, we have Europe or worse. EV production is reliant on natural resources such as lithium, cobalt, nickel which are in limited supply. We cannot get nearly enough of these resources to produce cars at the rate Tlaib and her friends expect. California was asking people to not charge their EVs at home last week due to power grid limitations, yet they no longer want to sell gas powered cars. If you lack the grid power and charging stations, how exactly will people get to work? Clearly, we are not ready for prime-time on EVs yet. Check out this short video of a long line of EVs waiting for a charging station in CA last week given massive grid issues.

Remember, today, 1% of the cars in the US are electric. The good news is 466k EVs were sold in the US in 2021, but 15mm+ total new cars were sold. This equates to 3% of all new cars sold in 2021. We are decades away from not relying on fossil fuels.

We have a lot of problems in the US. Unfortunately, many of them are self-inflected. Let’s not put violent criminals in jail. Let’s allow violent or repeat offenders out without bail. Let’s decriminalize shoplifting. Let’s allow homeless to over take major cities. Let’s vilify all police due to a few bad apples. Let’s indoctrinate children and push them to be gay or transsexual and teach them these things at 5-years old. Let’s fire White Teachers Before Black Teachers. Let’s allow children to take hormones and have sex change operations. Let’s glorify obesity. Let’s allow people to smoke weed anywhere. Let’s pay people to not work. Let’s allow 2.5mm illegal immigrants into the US and pay for them overwhelming cities. Let’s give participation trophies. Let’t not hire or accept students on merit. Let’s take away the classic works and replace them with books on BDSM. Let’s keep interest rates too low and keep QE too high for too long. The list is endless.

Now, our own politicians want to inflict incredible harm to the global economy by ending the fossil fuel industry. Enough is enough. We need to remain energy independent, as it is key to our best interests and national security. Also, we don’t have a viable option for the foreseeable future. There is no reason for high oil or gas prices in the US, given the abundance of reserves we can extract to control our own destiny and not be reliant on other nations. Let’s have a transition plan which is achievable and gets Representative Tlaib’ desired outcome down the road.

Quick Bites

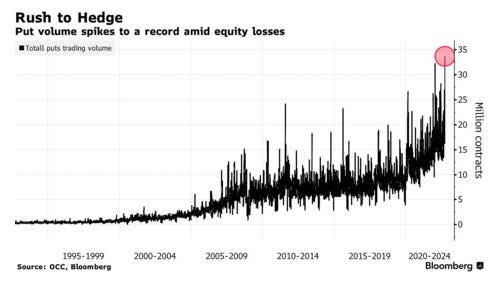

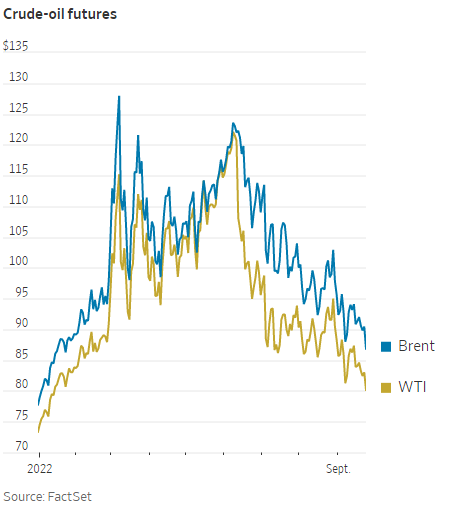

Stocks tumbled on Friday to close out a brutal week for financial markets as surging interest rates and foreign currency turmoil heightened fears of a global recession. The Dow closed down 486 points or 1.6%. The S&P 500 fell 1.7% and headed for a new 2022 closing low, while the Nasdaq Composite slid 1.8%. On the week, the Dow was -4.0%, the S&P-4.7% and the Nasdaq-5.1%. Over two weeks, the Nasdaq was -10.8%, the worst two-week performance since the start of the pandemic. The rapid rise in rates has pressured the high-growth stocks disproportionately. The Nasdaq YTD, the Dow is-18.6%, S&P-22.5% and Nasdaq-35.5%. The VIX (measure of S&P Volatility) was up almost 10% to 30. This Bloomberg article is entitled, “Spooked Traders Just Piled Into Stock Protection at Record Rate,” and shows Put volume spike over fear. To me, this coupled with the Jeremy Siegel rant below and an increasingly week investor sentiment could me a short-term bottom. I believe we end up lower, but these signs are telling. The Fed is largely to blame for the mess we are in. Clearly all the stimulus plans are contributing as well. I do not see how anyone could have any faith in Powell. Professor Jeremy Siegel lost it on the Fed Friday on CNBC. He is histrionically a bull-market guy. He went ballistic on the Fed for good reason. Of note, oil is crashing on growth concerns and the strong dollar and fell 5% on Friday. Oil fell below $80/barrel on Friday after being well above $120 in June. This would suggest that the Fed is getting too aggressive per my recent note “Will the Fed Get It Wrong Again.”

The move in rates has been substantial this year. It is important that everyone understand their cash positions and what they are yielding. There are various plays now with rates backing up. Money Market Funds, Treasuries, Munis, Term Deposits… I am not telling anyone what to do other than educate themselves on the alternatives which best suit their needs. We have all earned nothing in the bank for years and finally we have options. Banks differ in what they pay and offer different products. Do your homework. I have money in three major institutions and all offer decently different options for similar products, so spending a little time can result in surprisingly different rates. I decided to buy 3-Year Treasuries Friday at a yield of 4.22%. I am of the view the Fed will be forced to cut rates mid/late next year given the economy. I feel between 3 year Treasuries is a sweet spot.

A reader, Robert, sent me this video of Scott Minerd (Guggenheim Global CIO) being interviewed on 9/19/22 on CNBC about the markets. For the record, I find him to be a bit of a bear with respect to markets, but did call the Bitcoin crash, the GFC and others. Minerd is incredibly negative about the world and markets suggesting that the big opportunity will be in the distressed space. He said, “This will end in tears,” multiple times. “We have never had a bottom in the market while the Fed is still raising.” He believes later in the 4th quarter will be a good entry point for stocks, but believes the markets are heading sharply lower near term. He believes the multiples are too high based on the rate environment and that the earnings growth has been mostly out of energy. This is an interesting interview and gives a clear bearish perspective on the world. Real Estate was discussed as well and the impact of rising rates, but does not believe R/E is the driver as was the case in 2008. He believes the commercial R/E issue is a bigger issue than residential. On August 21st, I wrote I was not constructive on stocks and was shocked at the rally prior to it.

The US $ strength is impressive, but causing issues in the market. Check out the chart of the DXY (shows US $ strength). YTD, the US $ was up 18% YTD after a very strong week (+3.1%). The Pound got killed as well falling below $1.08, relative to January levels of 1.35. Huge move lower for a major currency. I have written on the currency topic frequently, because I believe it could lead to serious issues.

Other Headlines

Bond market plunge means the low for stocks is not in yet, Bank of America’s Hartnett says

British pound plunges, bonds crash after government announces tax cuts

The Pound is -20% against the US $ this year. That is a massive move. It fell 3.5% on Friday alone.

I just thought these headlines were interesting.

Italian Voters Appear Ready to Turn a Page for Europe

I don’t follow European politics closely enough, but feel the ramifications of a hard-right leader rising to power could be substantial.

Amazon To Close Its First Last-Mile Delivery Center In The Bronx

Bank of England Says UK Paper Banknotes Only Good for One More Week

Yikes, if you have paper banknotes, TRADE IT IN NOW. All those drug dealers and illegal money makers are in trouble.

Electric cars being charged at night making America’s power grid unstable

FBI hero paying the price for exposing unjust ‘persecution’ of conservative Americans

Matt Gaetz 'unlikely' to face charges for 'sex trafficking a 17-year-old girl'

Shocking to me. I thought this guy was toast. “Credibility questions” about the witness cited.

Adams asks feds for $500M over border crisis — in NYC — but won’t tell Biden to end surge

Bad immigration policy will cost countless billions. Who pays? You do.

City kids seeking therapy after unending exposure to vagrants and addicts

Scary stories of what children are being exposed to due to bad crime and homeless policies.

State delays public release of English, math and science test score results to later this year

CA is delaying test results. I am sure it is because the students crushed the tests despite remote schooling during the pandemic. Yeah right!

IAN TRACK SHIFTS, BUT SOUTH FLORIDA TOLD UNCERTAINTY HIGH

Aug-Oct are worst months in Florida due to weather (heat, rain, humidity & hurricanes). Storm will get to 140mph, but appears to be heading to the West Coast of FL and further north than originally expected.

Russian state TV tells viewers nuclear war is likely - 'Everyone dies'

The suggestion is Putin is threatening the West with nukes.

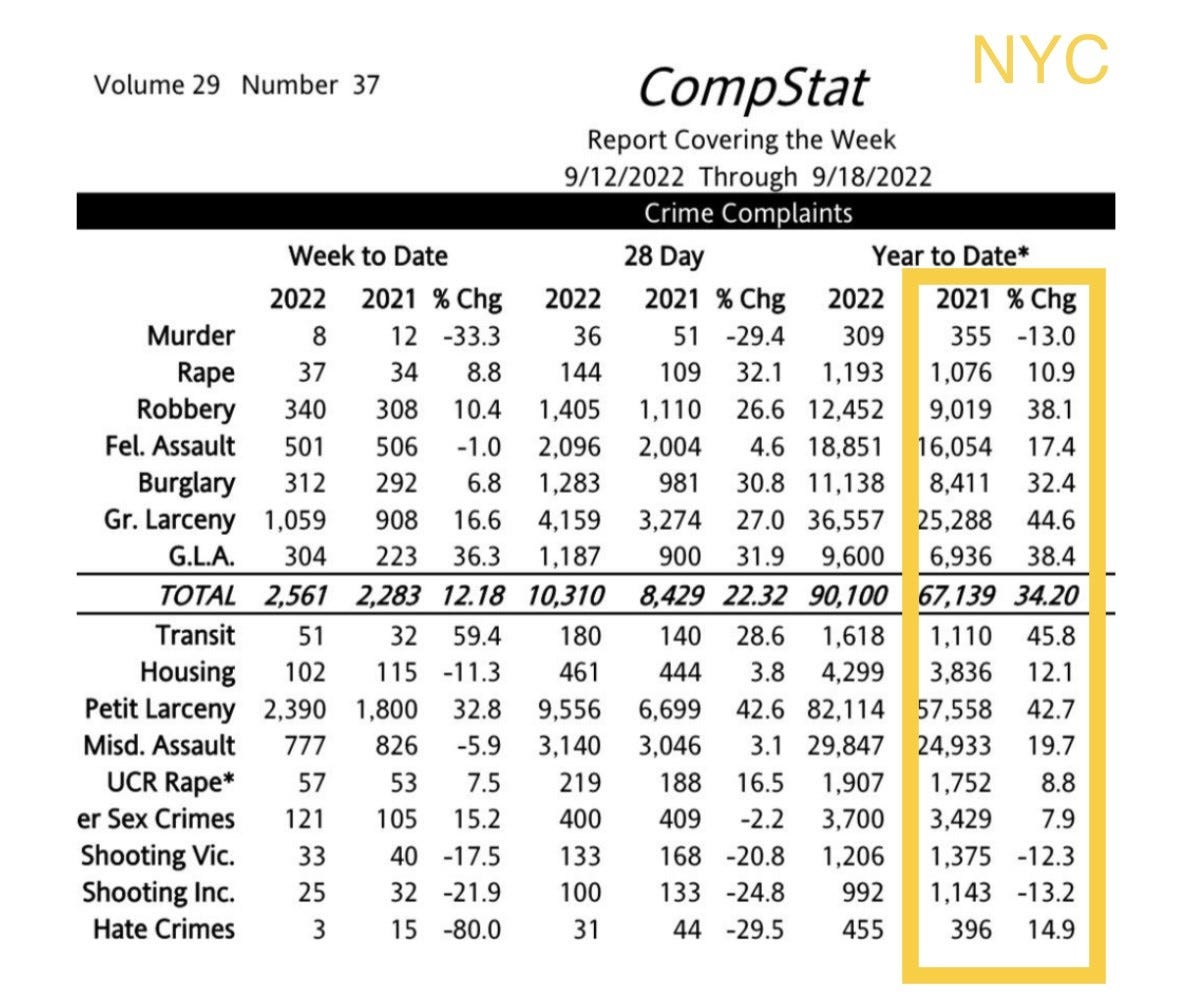

Crime-A reader wanted me to point out that in the US murder is down 4% in major cities this year and shootings are -2%. Clearly a small, but welcome improvement. The reader and I rarely agree on politics, but he is smart I always try to hear his perspective. Despite the drop in murder/shootings in the US, many other crimes such as robberies and property theft have risen sharply in the US. In NYC, murder is down 13%. However, since 2020, total crime is +34%, robbery+38%, burglary +32%, assault +18% according to the NYPD. In Chicago, murder is -16%, Sexual Assault-1% and Batter -5% from very high levels. However, Robbery +18%, Burglary +26%, Theft +63% and Vehicle theft is +69% bringing total crime +37% in the windy city. I write about crime because so many of my NYC, LA, SFO, Chicago…friends and readers are scared. Many have left their home cities citing crime as the major factor (Ken Griffin, my sister and many readers). I am not supportive of soft-on-crime DA's who allow violent criminals and repeat offenders out of jail. I write about crime to highlight the issue and hope that people make better decisions in the voting booth. Before you pull the lever on a Progressive DA (Chicago, NYC, Philly, SFO, LA….), I want to expose them for the damage they are doing. My nieces cannot go to the school bus stop alone on the UES of NYC due to safety concerns. Here is a perfect example of the issue with soft-on-crime DAs, “Sex fiend gets ‘sweet’ deal from Manhattan DA Bragg on teen rape charge — then attacks 5 others.” Innocent lives are being impacted in a negative fashion due to bad crime policies. The NYC Mayor, Police Chief and others who want to fight crime are outraged. Countless businesses are shutting due to shoplifting making it harder and more costly for law-abiding citizens. Check out the 2nd chart which outlines NYC crime and I have highlighted YTD. I would say pretty disappointing numbers despite the drop in murder/shootings.

Virus/Vaccine

Big improvements continue. Positivity was 19% in late July and now 10%. Cases and hospitalizations continue to fall, but deaths were up. Not sure the driver, but not overly concerned based on all other trends.

Real Estate

I have written extensively about my view that the real estate The WSJ article, “The Luxury Home Market Posts Its Biggest Decline in a Decade,” is informative. There is no doubt the R/E market is cooling. Sellers were asking insane prices and now are scrambling to find traction. I spoke with a reader who told me in May, they had two offers rescind due to rising rates and are yet to sell their $2mm home in Vegas. After a pandemic-induced bull run, the high-end market has finally faltered thanks to inflation, recession fears and rising interest rates. Redfin shows that in the three months ending Aug. 31, sales of luxury U.S. homes dropped 28.1%, from the same period last year. That marks the biggest decline since at least 2012, when Redfin’s records began, and eclipses even the 23.2% decrease recorded during the onslaught of the pandemic in 2020, the report said. Sales of nonluxury homes also fell during the same period, but that drop—19.5%– was smaller than the decline in the luxury market, which is defined as the top 5% of homes based on estimated market value, according to Redfin. “Six months ago, people were buying homes over-ask and with no appraisal,” said Ms. Lam’s real-estate agent, Herman Chan of Golden Gate Sotheby’s International Realty. “They didn’t even bat an eyelash. Now, it’s like crickets.”

Miller Samuel data came out for high end NYC. In August, signed contracts for apartments over $5mm fell by nearly 50% in NYC, while $10mm and up were down over 38%. Part of this may be explained by less inventory. I belive a big part of the decline is due to stocks, upcoming layoffs, lower bonuses, higher rates and recession fears.

Lots of readers ask about golf in South Florida. When I moved 5 years ago, EVERY course was looking for members. Now, some literally have close to 200 people on the waiting list. Prices have doubled or tripled for initiation fees as well. I am told Three Lakes, the new facility of two courses by the team from Sebonack is going for final approval in Martin County on 9/27 and I believe the Discovery property, Atlantic Fields was approved this week. Quite a few new courses are planned from Palm Beach to Hobe Sound in the next few years. Kenny Bakst (Friar’s Head), Panther National, Discovery, Three Lakes, Chris Shumway’s course, new track at McArthur by Core/Crenshaw…LaGorce in Miami and Emerald Dunes in Palm Beach have sharply increased initiation, and the wait list is long. I think when I moved down, LaGorce was $175k and no wait. Now, it is $500k and going to $700k. Even Boca Rio is full, and they were constantly looking for members. I believe Boca Rio has a long wait-list and is $275k. When I moved here there was almost no initiation at that club. The new course in Hallandale called, “Shell Bay,” (formerly called Sweet Bay) took in approximately 55 members at $550k and then some additional members at $750k. I am told the rest will be $1mm. Most high end courses in Florida were $75-150k when I moved down, and now there are a handful which will be asking $750k+. One person involved in the golf industry said, “In my career I don’t recall seeing a bigger supply/demand imbalance than for a high end private golf/country club in the Miami area.” A reader also shared with me this exciting golf project in Montana called Crazy Mountain Ranch which opens in 2025. Sounds special.

Other R/E Headlines

As 30-year mortgage rates hit 6.7%, homebuyers are facing ‘payment shock.’ Here are ways to save

The rate was 3.3% in January and 2.6% in December 2020. On a $1mm mortgage, the monthly payment went from $4k in December 2020 to $6.5k today.

Housing expert: Home sale cancellations 'have spiked tremendously'

Here’s What $2 Million Buys House Hunters in Miami, New York and Chicago

Billionaire CEO buys waterfront next-door Jupiter mansion

Ronald and Leeanne Clarke paid $15.7M for the mansion, after buying an adjacent home in 2007 for $4.7M