Today’s Podcast-19-minute audio.

Opening Comments

With a flare up in my back, I felt it best to delay our Bimini fishing excursion. Going 60 miles each way takes a beating on your back, and fishing for large Wahoo is not easy on the lower back either. I hope I can go in coming weeks. I wanted to catch one like this or bigger. 51 lb Wahoo. I have some incredibly fun upcoming reports which I think you are going to enjoy.

Given the holiday travels, I am putting in the link to my last note entitled, “I’ll Impress Ya With Contessa.” It was a review of a great new restaurant in the Design District in Miami, and many of those who read it sent positive feedback. In the piece, I wrote about how fake the internet/social media has become. A reader sent me a video about “Influencers Who Look Nothing Like Their Photos,“ as a follow up and below are more examples of the scam of “beauty.” The third photo was sent by another reader who was showing procedures available at a beauty bar including the “Kim K Package.”

Video of the Day-Robotic Parking Garage

Leftovers

Quick Bites

Markets

Tech-$7.4 Trillion Sell-Off

Goldman Sachs and El-Erain on Markets

Black Friday Disappoints?

Other Headlines

Crime Headlines

Real Estate

Housing Market Obliterated

New Steinway Building in NYC

Other R/E Headlines

Virus/Vaccine

Data Deteriorating

China Protests Gaining Momentum

Video of the Day-Robotic Parking Garage

When I lived in NYC, paying my monthly parking bill made me vomit. I lived on 74th and Park Ave and parked between Park and Lex on 76th Street. In the cold, snow or rain, it was miserable to walk back. Oh yeah, it cost over $1,000/month for the privilege and then pay healthy tips and holiday bonuses. A new technology has a robotic parking system which sounds amazing in some new condo buildings in NYC. Check out the video in the link. The system turns the car around for you. It is pretty incredible. Oh yeah, it costs an extra $50k for an EV plug, and you need to pay an incremental $150/month in maintenance fee for any spot. It takes 2:15 seconds to retrieve your car.

Leftovers

I have a problem, and it seems to be getting worse. I feel I am a solid chef, and can prepare a myriad of foods and desserts. I entertain a fair amount and when I do, I expect you to leave full and happy. On Monday, prior to Thanksgiving, I had a couple friends over for dinner, and I made 3 pounds of boneless Australian Wagyu skirt steak and 2 pounds of salmon with mashed potatoes, and veggies. I could not fathom that the food I prepared would be insufficient to feed a total of four people, but it was. People went up for third and fourth helpings and all the proteins were gone. I was upset, as it is a rarity for me to run out of food and leave people wanting more. There may be a little left, but not enough to satisfy my guests is unacceptable. Thankfully, I prepared major desserts to save the day.

So with Monday’s dinner fresh in my mind, I clearly over cooked for Thanksgiving. It was a small affair with a total of 10 people. A couple others were supposed to stop by as well. I feared one 15lb turkey would not be enough and bought a 2nd, 8 lb turkey breast. I made the following: the two turkeys, 7 pounds of mashed potatoes, 7 pounds of sweet potato pie, 36 ounces of cranberries for sauce, two loaves of sourdough bread for stuffing, and roast veggies with shallots, leeks, and garlic. For dessert, I made two pies and bought a 3rd as I was convinced another half dozen would show up for dessert and wanted to be sure I could feed them all. I also had made chocolate chip and oatmeal butterscotch cookies.

I need to make another admission. Carving the turkey and making it look professional is not super easy. The damn legs always screw me up. Carving the breast and presenting it well is easy, but the legs are the trouble. I had so many leftovers, I did not have the Tupperware to fit it all in and I was forcing guests to take home food. I think part of the issue is a religious one. I am hardly a religious Jew, but for some reason the culture is one of eating and entertaining. Not having enough food for guests can get you excommunicated from the Tribe. I had made two sweet potato pies and only 5% was left. I clearly could have done without the mashed potatoes. Below was after they already dug into the turkey. It is on a bed of fennel, carrots, celery, thyme, garlic, onions with a little chicken broth…

Prior to serving, I threw the stuffing into the warming drawer and forgot it until after the 1st helping of food was served. I ended up with over twice the food required for the dinner. The 15lb turkey alone would have sufficed and left more than we consumed. Note, to self, making homemade salted caramel is hard and messy. Not sure I try it again.

I am going to be eating Thanksgiving leftovers for breakfast, lunch and dinner for a week. Maybe there is a support group for my overcooking ailment?

Quick Bites

The Dow rose 153 points, or 0.45% to 34,347, marking the third consecutive session of gains. The S&P 500 fell 0.03% to end the day at 4,026. The Nasdaq slipped 0.52% to 11,226, weighed down by shares of Activision Blizzard, which fell 4% on news that the FTC could block Microsoft from taking over the gaming company. All three indexes ended the week higher. The Dow is up 1.78%, and the S&P 500 is up 1.53% during the short week. The Nasdaq is lagging the other two indexes but is still up 0.72% in the same time frame. Stocks were muted at the start of the week as traders waited for minutes from the Federal Reserve’s November meeting. The minutes showed that the central bank anticipates slowing the pace of interest rate hikes going forward, which gave stocks a boost into the end of the week even amid choppy sessions due to low trading volumes.

“A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate,” the minutes stated. Oil continued to fall on news out of China and ended at $76.5 or down 4% on the week. Remember, it was $122 in June. The 2-year Treasury yield is now 4.47% or about 8 bps lower on the week on the heels of the Fed commentary. The 2s/10s Treasury curve is now -74bps, which is a new low since 1981. Again, gray bars below are recessions, and every time we have gone negative since the 1970s, there has been a recession.

At this time in 2021, the Nasdaq Composite had just peaked, doubling since the early days of the pandemic. Rivian’s blockbuster IPO was the latest in a record year for new issues. Hiring was booming and tech employees were frolicking in the high value of their stock options. Twelve months later, the landscape is markedly different. Not one of the 15 most valuable U.S. tech companies has generated positive returns in 2021. Microsoft has shed roughly $700 billion in market cap. Meta’s market cap has contracted by over 70% from its highs, wiping out over $600 billion in value this year. In total, investors have lost roughly $7.4 trillion, based on the 12-month drop in the Nasdaq. Zero rates and QE helped create a bubble in technology shares. Add to it self-inflicted wounds at some of the larger companies such as Meta, TSLA, Rivian and others and you can see how $7.4 trillion has been erased. Substantial layoffs have started and more are expected after an unprecedented hiring spree in the tech sector. From the all-time highs in November of 2021, the Nasdaq is down 31%, while the S&P is -16% from its January 2022 all-time high.

Despite a parade of recession predictions from Wall Street this year, Goldman Sachs’ strategists still believe a “soft landing” is likely. The 153-year-old investment bank’s equity research team, led by chief U.S. equity strategist David Kostin, said this week that they believe the S&P 500 will drop roughly 10% to 3600 over the next three months as interest rates rise. After that, Kostin and his team made the case that the blue-chip index will finish 2023 at 4000—roughly the same level it closed at today. “Our economists expect by early 2023 it will become clear that inflation is decelerating and the Fed will reduce the magnitude of hikes and eventually cease tightening.” Mohamed El-Erain said, “The world isn’t just teetering on the brink of another recession,” he continued. “It is in the midst of a profound economic and financial shift.” The first transformational trend, El-Erian says, is the shift from insufficient demand to insufficient supply. The second is the end of boundless liquidity from central banks. And the third is the growing fragility of financial markets.

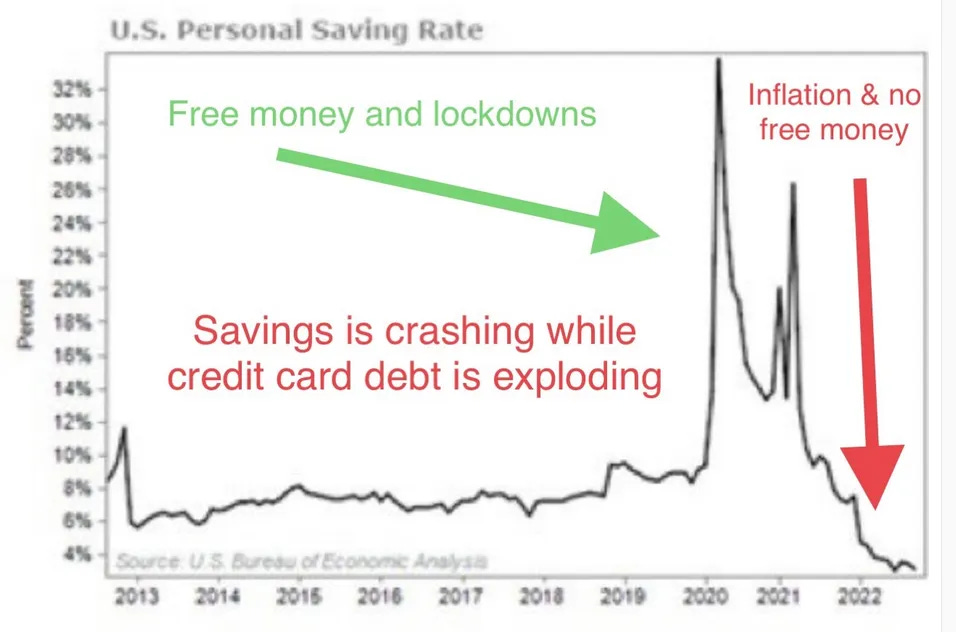

US retailers discounted heavily on Black Friday to clear out bloated inventories but customers responded with only modest traffic, leaving profitability in doubt for many chains. US consumers are still spending, but they’re growing more cautious after contending this year with the highest inflation rates in four decades. They’re also keeping a sharper lookout for deals, and retailers — many of them still heavy with inventory after misjudging an erosion in demand — are trying to stand out by dangling the deepest discounts since before the pandemic. Consumers spent a record $9.12 billion online shopping during Black Friday this year, according to Adobe, which tracks sales on retailers’ websites.

Overall online sales for the day after Thanksgiving were up 2.3% year over year, and electronics were a major contributor, as online sales surged 221% over an average day in October. The consumer is stretched with record credit card debt and having dipped into savings. Thank you Fed/Powell for your awful inflation call. Biden, all the free give outs ended up contributing to inflation as well. I needed some kitchen items and my sister pointed out a big sale at Sur La Table and I received 50-65% off on a bunch of items on line with free shipping. Buy now, pay later sales rose 13% in November not including Black Friday.

Other Headlines

Inflation boosts average household spending by $433 a month

I do notice a huge difference in the grocery store and restaurants when it comes to the bill. Publix had lemons for $1.29 each.

Ousted Disney CEO Bob Chapek Reportedly Cooked The Books To Hide Disney Plus Financial Losses

This headline seems shocking to me as there are major auditors who need to sign-off. Towards the bottom of the article, they outline the claims.

Twitter has lost 50 of its top 100 advertisers since Elon Musk took over

These advertisers spent $2bn since 2020 and $750mm in 2022 on Twitter. They had no problem with Farrakhan, Khomeini and others. Musk sent the charts below which are interesting:

Alyssa Milano Ripped for Trading Tesla for Volkswagen: 'Founded by Nazis'

This idiot proudly sold her TSLA to “defy hate and white supremacy.” She bought a VW not realizing VW was founded by Nazis. Clearly, Musk is much worse than Nazi’s for believing in free speech.

Musk said he would make his own smartphone if app stores ban Twitter

I am sure Musk could make a great phone, and I am not a fan of Apple’s antics. However, how thin can one man be spread? TSLA, TWTR, Neuralink, SpaceX, Boring and now a potential smartphone company?

Meta Gives Regulators a New Reason to Bite

The company appears not to know the full extent of what its systems do with users’ data.

How is this humanly possible. The company does not know what they do with user data? It just seems unrealistic to me.

Congress members tried to stop the SEC’s inquiry into FTX

Four Democrats and Four Republicans were dubbed the “Blockchain Eight,” and 5 of them received donations from FTX.

Its single branch had three employees until this year, and didn't offer online banking or even credit cards. It specialized in agricultural loans to farmers.

Was SBF trying to get a banking license? The stake was more than twice the bank’s previous net worth.

United Furniture Industries lays off 2,700 workers as they slept

Crazy story about laying off ENTIRE staff via text. No mention of what drove this action. Can’t wait to find out.

I keep saying the same thing. It is time for a new Republican leader, and am hopeful the powerful donors continue to run from Trump. Trump claims he did not know Ye was bringing Fuentes. To me, it does not matter. Yet another bad judgement call by the former President. Here is a like to an ADL site about Nick Fuentes.

Kevin McCarthy could face a floor fight for speaker. That hasn’t happened in a century.

Helium shortage: Doctors are worried that running out of the element could threaten MRIs

FDA approves most expensive drug in the WORLD - $3.5m therapy for hemophilia B

Secrets of ‘SuperAgers’ with superior memories into their 80s

A SuperAger is over 80 and goes through extensive cognitive testing to show the memory is as good or better than those in their 50s/60s.

Texas teacher interviews middle schoolers on non-binary identity

Fauci emailed friend saying masks were 'ineffective,' pushed for mandates anyway, Missouri AG says

‘All-knowing’ Tony Fauci’s memory suddenly vanishes when he has to testify

Fauci’s expiration date is long past due.

Crime Headlines

Man tries to rape woman onboard moving 4 train in lower Manhattan

NYC convictions plummet, downgraded charges surge under Manhattan DA Bragg

Idaho murders: Was Kaylee Goncalves the killer's main target? Police respond

Ga. man out on bond for rape then strangles man, sells another the drugs that killed him, DA says

Repeat offender faces up to 107 years in prison for brutal attack on Delaware jewelry store owner

Robots in San Francisco could be allowed to use ‘deadly force’

San Francisco Muni bus hijacked, suspect Rickey Dancy allegedly hits 10 vehicles

Real Estate

Interesting article entitled, “Housing Market Obliterated: Pending Home Sales Post Record Drop As Deal Cancelations, Price Cuts Hit Record High.” Good charts below and shows that Home-builder Confidence is now at the pandemic lows, while home-builder confidence is at lows since 1985. Pending home sales fell the most on record in October, while deal cancellations and price cuts hit record highs according to the article. Lots of other good charts in the link and one shows a record 24% of homes had a price drop in October.

The world's skinniest skyscraper is now complete — and its interiors are remarkable. Personally, I would never live on 57th street. Also, I do not want to live super high up. This building is not for me, but I must admit the views and interiors look nice.

$90 Million Asking Price for Fisher Island Penthouse Would Be a Record Sale

I could never live on Fisher Island. Need to take a boat to leave it. I lack the patience.

10 Markets Where Home Prices Are Plummeting (Austin tops the list)

41% of small businesses can't pay rent this month, report warns

A notable 57% of beauty salons said they couldn’t make rent as well as 45% of gyms, 44% of retail and 44% of restaurants. What are the ramifications for landlords? What about the banks who have loans against these assets?

Virus/Vaccine

Deterioration in data continues.

China's capital city Beijing battles Covid with more apartment lockdowns

Protests are happening and getting more aggressive shouting “CCP Step Down, F-You CCP, Xi step down,” leading to arrests. You can find the videos on Reddit, but could not seem to link them. This is a CNBC link suggesting Beijing is grinding to a halt. Some are suggesting these protests are “unprecedented.”

Don't be upset about running out of food. The salmon and the Wagyu were so good that we could leave any leftovers. I still need to get the salmon recipe. That was amazing. On a different note, the Wall Street Jornal released the same chart pointing to the 10 years - 2 years treasury only today at 5:30 am (https://www.wsj.com/articles/yield-curve-inversion-reaches-new-extremes-11669687278). So the Rosen Report is now faster than one of the most important financial news outlets...very soon you can follow Elon Musk's strategy for Twitter and charge a subscription.