My Favorite Dan Loeb Letters

3-5-23

Opening Comments

My last Rosen Report was entitled, “Rosen Depend Index. Yes, Those Depends,” which outlined the RDI and explained what it meant. In short, I was very concerned about the markets in 2007. I was asked for my view and told the Head of Risk Management I was going to buy Depends Undergarments and the RDI was born. It is on a scale of 1-10 with 10 being the collapse of Lehman and market doom. I am bringing back the RDI and will be noting it in the market section of my pieces going forward. RDI is back, baby!

I recently started reading CRE Daily, a free newsletter which combines a great deal of information, trends and transactions on the commercial real estate market. You can sign up for it here and suggest you do if CRE is of interest.

Remember, there are anchor links in the table of contents below to take you to the top of the underlined section. Another reminder, from Quick Bites on down if it is in Bold, it is my thought/opinion. If not, it is from the cited article. Opening comments are generally all me or will be cited.

Pictures of the Day-US Housing Market (Mortgage Rates/Affordability)

Markets

Pesky Inflation

Auto Debt Issues and Consumer Debt vs Savings

Spring Break Travel Disaster Costs

Boca House Sale Doubled Quickly Despite a 1964 Home

218mm Palm Beach Home for Sale

Older Miami Condos Under Pressure with Rising Insurance Costs

Higher Rates Pressuring Commercial Maturities

Retailers Leaving Cities

Pictures of the Day-US Housing Market (Mortgage Rates/Affordability)

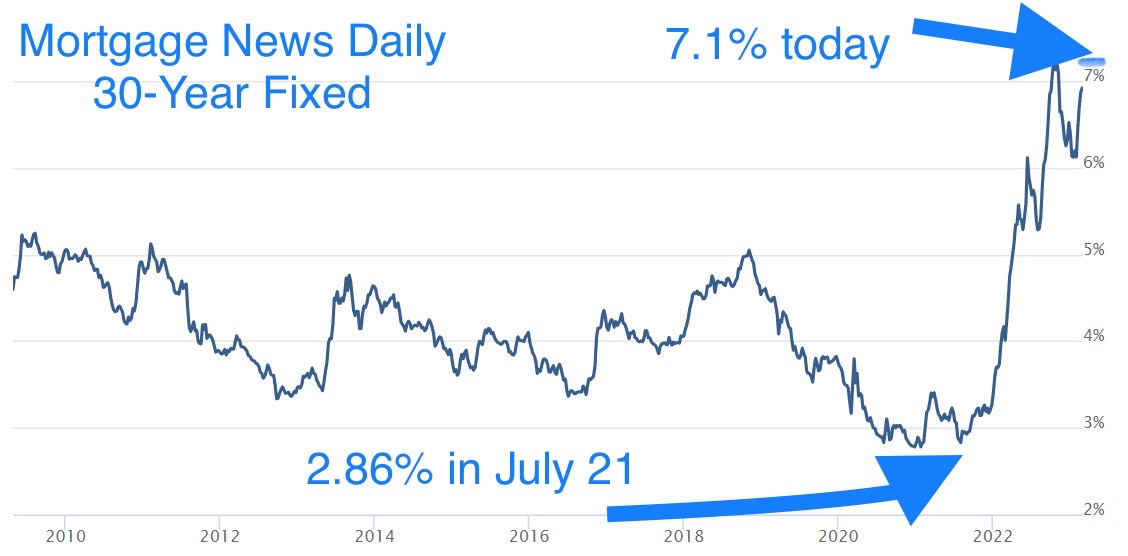

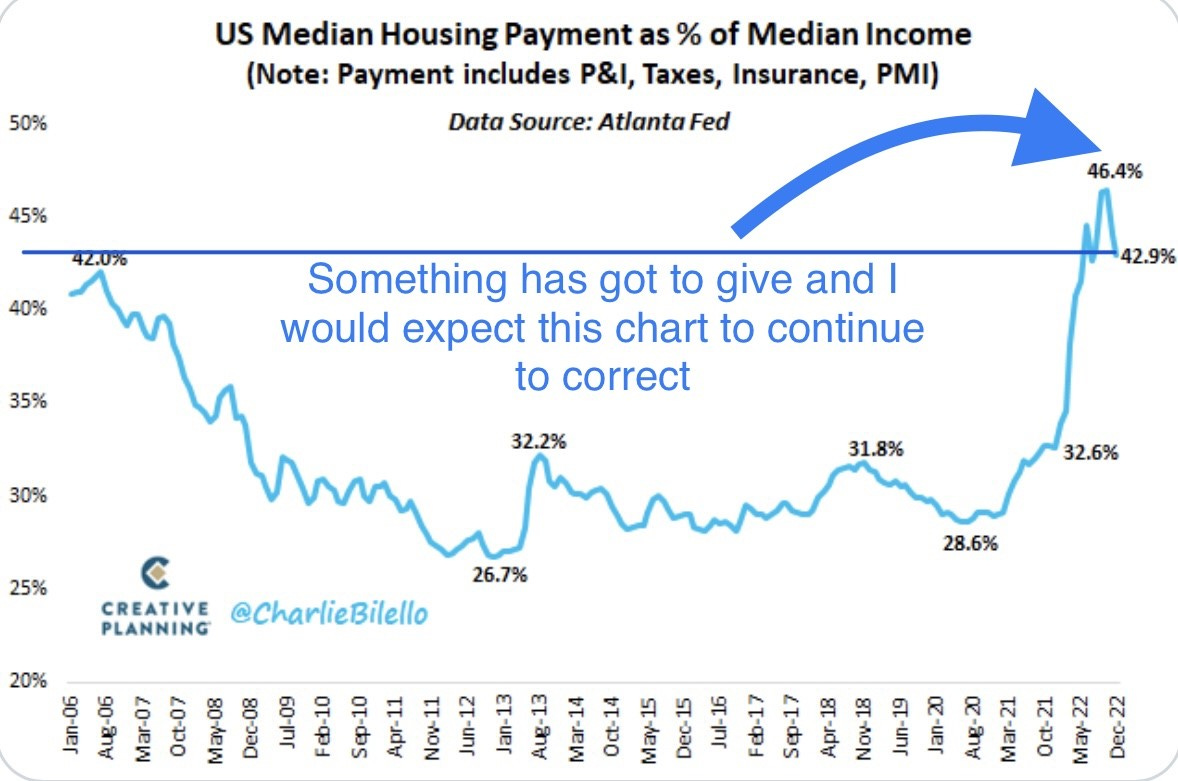

I saw on Thursday that CNBC reported the average 30-year fixed rate mortgage is now 7.1%. The data is from Mortgage News Daily and the interactive chart can be found here. For perspective, this averaged 2.86% in July 2021. This massive move can be seen on the chart below which is missing the last 24bps higher move in recent days, so I drew a dot in myself. The monthly cost for a $1mm mortgage went from $4,141 in July 2021to $6,720 or an increase of $2,570/month. In the real estate section, I discuss the impact on commercial properties. The second chart is a concerning one on affordability and despite some retrenchment, it remains higher than prior to the Global Financial Crisis. I will be surprised if due to rates, affordability and consumer pull-back, we don’t see the line continue to fall in 2023.

My Favorite Dan Loeb Letters

Dan Loeb of Third Point fame is a world class hedge fund manager who recently wrote a letter to Bath & Body Works (BBWI) as a 6% owner of the company. Dan has been a pioneer in shareholder activism, but has transitioned from his early days and is far less aggressive in his tone. His recent BBWI interactions got me thinking about my favorite Loeb letters, and I found a Vanity Fair article with good excerpts from his various missives. Wow, he has some zingers and the impressive fund manager is also a great writer. His descriptive style with wit and a careful choice of words make his letters fun to read. I have been friends with him for almost 20 years and he is one funny guy. The last one is the link to my all-time favorite, an email interaction with a candidate for a job at Third Point and dan eviscerates him.

Penn Virginia 2002

The ill conceived and poorly timed $112.0 million acquisition of Synergy Oil & Gas (“Synergy”) appears to bode poorly for this management team’s ability to complete accretive corporate transactions . . . . With all due respect, the sophisticated Texas oilmen (Synergy C.E.O., Eric Pitcher and the individuals at Natural Gas Partners) that sold their interest in Synergy saw the Appalachian coal men coming with aspirations to wear crocodile skin cowboy boots, silver spurs and ten-gallon hats. No doubt the folks at NGP who sold Synergy so near the top tick of the natural gas bubble had quite a hootenanny at Penn Virginia shareholders’ expense.

Potlatch 2003

"Since you ascended to your current role of Chief Value Destroyer (‘CVD’) when you assumed the formal title of CEO in 1999, the shares have dropped over 45 percent, a destruction of shareholder value in excess of $520 million.” Loeb wrote.

Star Gas 2005

We have also tried to reach you on innumerable occasions only to be told that your legal counsel advised you against speaking to bondholders and shareholders due to the torrent of shareholder litigation currently being brought against senior management and the Company. . . Sadly, your ineptitude is not limited to your failure to communicate with bond and unit holders. A review of your record reveals years of value destruction and strategic blunders which have led us to dub you one of the most dangerous and incompetent executives in America. (I was amused to learn, in the course of our investigation, that at Cornell University there is an “[Star Gas C.E.O.] Irik Sevin Scholarship.” One can only pity the poor student who suffers the indignity of attaching your name to his academic record.)

Pogo Producing 2006

"Do not confuse our $22 million stake as a vote of confidence in the Company's senior management or its Board of Directors. On the contrary, it is our view that your record in management, acquisitions and corporate governance is among the worst that we have witnessed in our investment career. It is further apparent that the current Board of Directors represents the narrow interests of the management instead of the shareholder base as the law requires of fiduciaries."

Sotheby’s 2013

Sotheby’s is like an old master painting in desperate need of restoration. Auctions, private and internet sales all need to be reinvigorated or revamped . . . . As with any important restoration, Sotheby’s must first bring in the right technicians. Third Point is not only Sotheby’s largest shareholder but also has significant experience and a successful track record of serving on public company boards. I am willing to join the board immediately.

My all time favorite Loeb letter is an exchange is from 2005 with a potential candidate, Alan Lewis, from Europe. The emails between Loeb and the Lewis are can be found here and will only take a couple minutes to read, but I laugh out loud every darn time I read it. Dan is a brilliant investor who has built up a huge business and made billions in the process. He happens to be incredibly bright, quick on his feet and one hell of a writer. He is very philanthropic and a great family man. No one can deny Dan’s success as an investor and the impact he has had on companies he has been active in. I just wish I put my net worth in Third Point 20 years ago when I met him.

To be clear, EVERYONE who I interviewed for a front office position in my fund or trading desks was asked the question Dan asked of Alan Lewis. “What are your best ideas and why?” I felt Dan’s line of questioning was perfectly in-line with what is customary and standard. Yes, I ran desks in Europe and did the same there. Dan has gone on to much success and I tried to look up Alan Lewis to see what he has been doing, but it is a common name and was unable to confirm his position today. Call me crazy, I have a funny feeling Alan Lewis has not had the success of Loeb, who is estimated to be worth $4bn. I believe Third Point has annualized approximately 500bps higher than the S&P since inception in 1996. This is a massive out performance. With compounding, Third Point has roughly tripled the return of the S&P since 1996.

Quick Bites

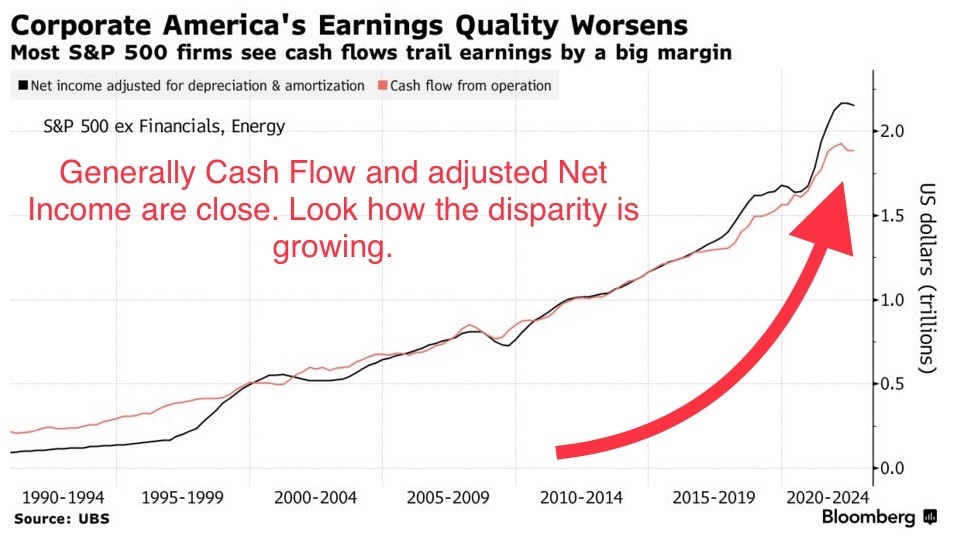

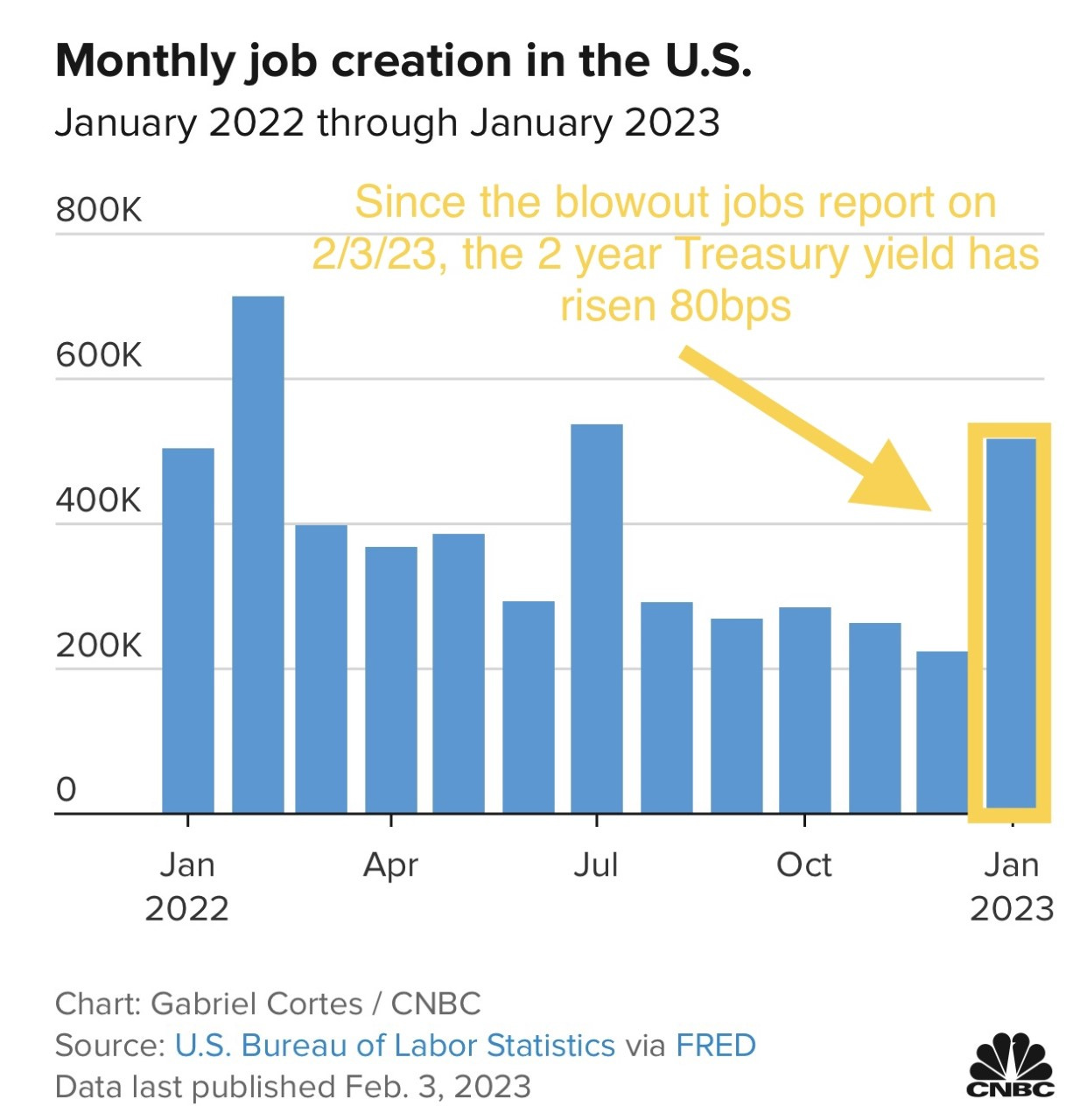

The Fed’s Waller is open to stiffer rate hikes as ‘Inflation is not coming down as fast as I thought.” However, Atlanta Fed President, Bostic, believes the central bank can keep hikes to 25bps. I remain surprised by the equity market strength in light of rates and the higher for longer mantra from the Fed. On the week, the Dow posted a 1.75% gain and snapped a four-week losing streak. The S&P 500 closed up 1.9% on the week and its first up week in the last four. The Nasdaq ended the week 2.04% higher. Interesting Bloomberg article, “Corporate America’s Earnings Quality Is the Worst in Three Decades,” and the 2nd chart outlines the concerning shift. Although Treasuries rallied on Friday, they sold off on the week with the 2-year +8bps and 10-year+3bps. On Thursday, the 10-year Treasury closed at 4.07%, but rallied 11bps on Friday. The 2s/10s yield curve hit -89bps on Friday, a low since 1981. Again, every time we have had a negative 2s/10s since 1980, we have had a recession (gray vertical bar in 3rd chart). Crypto remained under pressure around the solvency of Silvergate. Several crypto companies stopped accepting or initiating payments from Silvergate, which had become the go to bank for crypto business.

RDI is 4-I suspect it will be 7+ before year-end. Rates, inflation, debt ceiling, consumer, earnings quality, geo-political risk and my lack of faith in the Fed all playing a role. On the positive side, the consumer and jobs are doing far better than I anticipated, but contributing to elevated inflation.

Good CNBC article entitled, “A year after the first rate hike, the Fed still has a long way to go in the fight against inflation.” A Gallup poll in late 2022 showed that just 37% of the public had a favorable impression of the Fed, which not so long ago was one of the most trusted public agencies around. I did not think inflation would be 2-3% now, but did feel it would be lower than where it is today. The resilience of the consumer and tight labor markets are shocking to me. Great charts in the article.

I have written extensively about my concerns around the consumer. One of my points has been autos and growing debt levels to service cars worth less than the debt. This Bloomberg article is entitled, “Car Debt Is Piling Up as More Americans Owe Thousands More Than Vehicles Are Worth.” In January, severely delinquent auto loans hit their highest rate since 2006, based on Cox Automotive data. With rising rates, inflation, crashing savings, record credit card debt, rising auto delinquencies…I am not sure how this auto story can end well. People stretched to by a car in 2021 in a tight market, and now those car prices are down sharply with the loan balance exceeding the value of the vehicle in many situations. In a related matter, 36% of Americans have more debt than emergency savings according to Bankrate.com. The rate was 27% in 2021 and 22% in 22%.

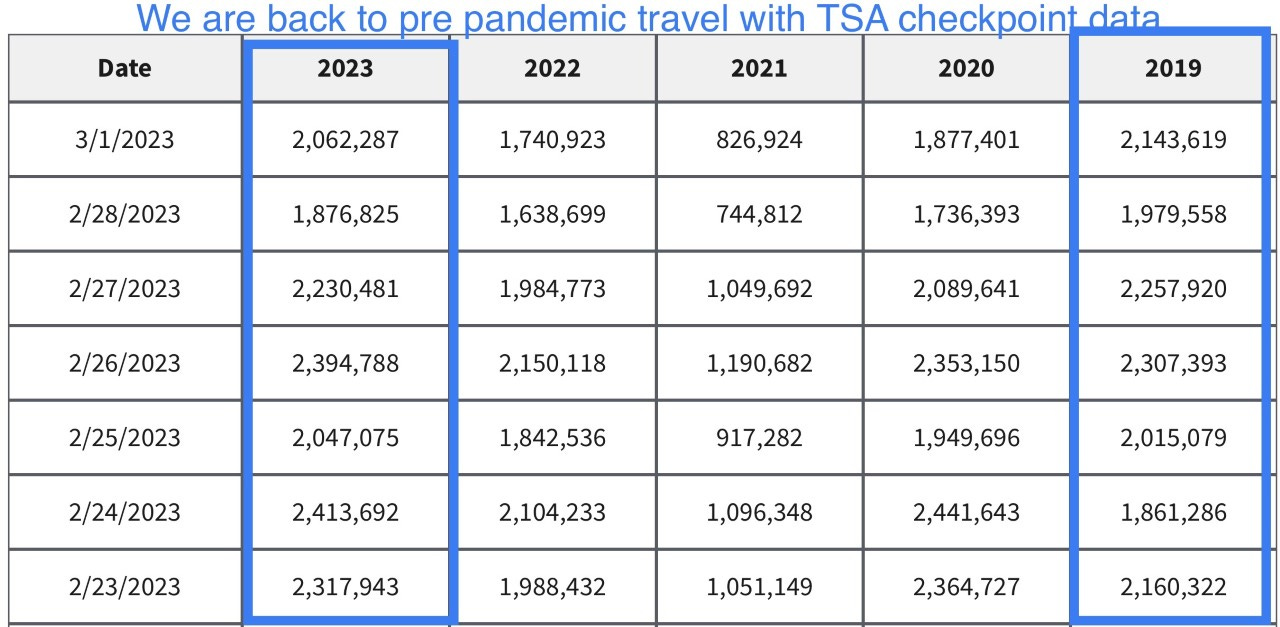

Last spring break, the Rosen family went on vacation for 5 nights, and I wrote a piece called, “Casa de Campo-Amenities and Great Value for a Luxury Vacation.” I reached out to my friends there to consider going back and almost died at the price change. Last year, we stayed in a villa for $9,500 ($1,900/night) for 5 nights and the same villa this year is $21,100 ($5,275/night) for 4 nights. To be fair, we were upgraded last year, but you get the point. We are seeing incredible demand for travel and experiences. AirBnB is doing well. Cruise line bookings are strong and apparently, Casa de Campo prices are up sharply over the past 12 months. The pandemic caused a lack of travel and experiences which has created pent-up demand. When Jack and I flew to Atlanta this week, we were in row 41 (never been that far back) and the plane was 100% full. Not one empty seat. This 7-day stretch of TSA checkpoint data saw 2023 4%+ higher than 2019 levels. Jeremy Kenter of Fly Biz (travel agent) told me the luxury travel market is especially tight with incredible demand.

Other Headlines

Biden says 'I'm gonna raise some taxes' in March budget proposal

Nordstrom earnings top expectations as retailer starts winding down Canada operations

They forecast negative 4-6% for revenues for the new fiscal year.

All Portland Walmart Stores To "Permanently Close" Amid Theft Wave

Portland new record of murders in 2022 and a surge in organized crime, burglary and larceny. A town of 650k with no WMT? There are only 25 cities in the country which have larger populations. Maybe these awful policies on crime are not so good for the law-abiding citizens of the community? "Theft is an issue. It’s higher than what it has historically been," Walmart CEO Doug McMillon said in December on CNBC. He added that "prices will be higher and/or stores will close" if authorities don’t crack down on prosecuting shoplifting crimes.

‘Bregret’? Many Brits are suffering from Brexit regret

Poll shows 53% felt it was wrong decision to leave the EU.

Car salespeople are replaced with AI as digital showrooms hit the metaverse

KIA and Fiat have introduced digital metaverse dealer showrooms so customers can more easily shop for cars from the comfort of their homes. This is the beginning, and AI is no joke in terms of efficiency and job disruption. I believe AI/Chat GPT is a game changer which will have a massive impact on the world over the next 10 years. Think order of magnitude of internet or mobile devices potentially.

Biden won't veto GOP-led resolution overriding DC crime law

The absences of Fetterman and Feinstein due to illness hurts the Dems chances. When you vote for a candidate, maybe consider ability to serve and age as factors.

Trump pledges to stay in 2024 presidential race even if he is criminally charged

U.S. House panel approves bill giving Biden power to ban TikTok

I hope TikTok is banned in the US. I do not trust the Chinese government and believe they are using it to spy and also damaging children. Let’s be clear that the playing field is uneven and we need to play much harder with the Chinese government on many fronts.

Florida bill would require bloggers who write about governor to register with the state

Dumb bill by FL Sen. Jason Brodeur who wants bloggers to register if they write about the Gov, Lieutenant Gov, a cabinet officer or any member of the Legislature and revoices a payment for doing so.

Ohio residents ordered to stay inside as another train derails

No hazardous materials were on this train according to the article.

Maryland mayor resigns after being arrested on more than 50 counts of child pornography (He visited the White House at least 6 times since June 2021).

New York City plans to dole out $21,500 each to 2020 Black Lives Matter protesters

The total would be approximately $5mm.

A Neo-Nazi Troll Network Is Making Money Abusing Jews

The article is quite concerning. Strong language.

Saadah Masoud sentenced to prison for 3 attacks on NYC Jews

I want higher mandatory sentencing for ANY hate crime.

NYC addict leaves items for possible meth cooking attempt on subway

Insane pictures in the link of dozens of boxes of pills spread across the benches.

Los Angeles police union proposes to stop sending armed officers to these calls

NYPD lowers fitness standard by scrapping timed, 1.5-mile run for new recruits

Shocking video shows black kids attack, force white kids to say ‘Black lives matter’ at Ohio school

Quite troubling story and video.

These are the highest- and lowest-paying college majors

They don’t list Finance. However, the 9 listed which have $100k or more for Median Wage Mid-Career are either Computer Science or some form of Engineering.

Columbia permanently drops SAT/ACT testing requirement

I expect others will follow suit, and this will become more widely accepted.

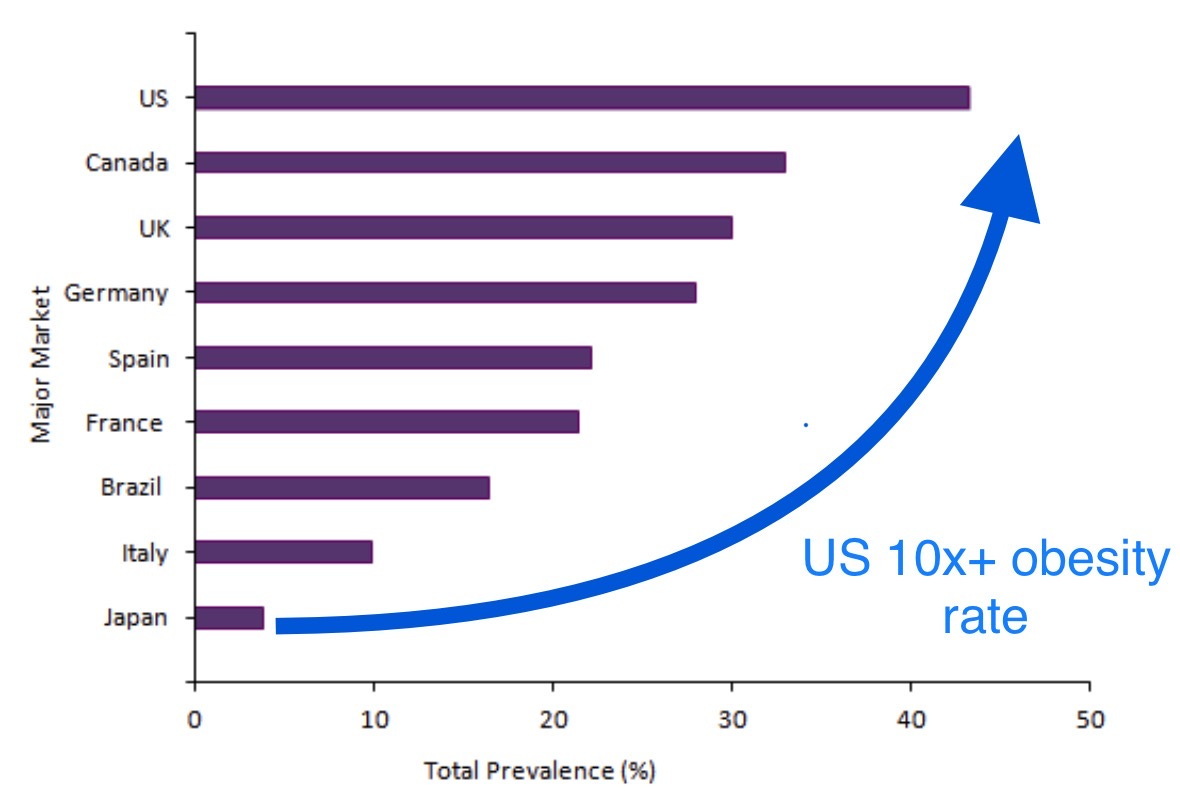

More Than Half of the World Will Be Overweight or Obese by 2035

The World Obesity Federation's 2023 atlas predicts that 51% of the world, or more than 4 billion people, will be obese or overweight within the next 12 years. I have written extensively about this topic and the costs associated with obesity. This is a link showing how US obesity rates have nearly tripled over the past 50 years.

List includes: Japanese Sweet Potatoes, Miso Soup, Daikon Radishes, Seaweed and Fish. Japan life-span is 84.6 years and US is 77.3 years. In the US, people are over 10x more likely to be obese than in Japan. This is the biggest health issue facing the US. I wonder of these diabetes drugs will make a dent over coming decades?

Harry and Meghan asked to leave Frogmore Cottage, spokesperson said

You are stunned that you were kicked out? How is that possible? You went nuclear on the Royal Family and went on every show to discuss your displeasure. Oh yeah, the book “Spare” was a great idea. I promise, if I am made a prince and given Frogmore Cottage, I will never complain. Price Eric just sounds regal.

Real Estate

A couple (readers) put their house on the market in Royal Palm (Boca) and sold it within 72-hours with no contingencies or inspections. They had purchased the 3,100 sq ft, 1964 home with a 12,000 ft lot in August of 2020 for $1.9mm. They just sold it for $4mm. In the past week, I have been contacted by 4 families all of which who live in NYC and all of which want to leave. There are all uber wealthy. I am a believer the great migration has just started and will continue. I think South Florida single family outperforms the basket. To be fair, I am seeing more high-end homes have price reductions in Boca. I think part of that was aspirational pricing and part is a slight slow down after a crazy run, which saw some of the high-end properties triple in a few years. Reminder, you must have your kids accepted into a school PRIOR to buying a house down here.

Friday, CNBC Palm Beach home sales are completed with cash 85% of the time. They are reporting on a $218mm home which is on its own private island which I had written about recently. The nearly 25,000 ft house requires a staff of 9. I believe the island is man-made from 1940s. I don’t know the property taxes, but assume $3.5mm/year and you must self-insure. CNBC is reporting if the developer gets his offer price, he will have made $100mm in 16 months. High-end Palm Beach inventory remains low and demand remains high. The average sale price in Palm beach is almost $13mm (+25% in Q4 2022) according to CNBC. The average price was $7mm in the 3rd Q of 2020. I am sure it was far lower in 2018/9, but could not find the data.

There is an interesting article in the Real Deal entitled, “Condo insurance crisis in South Florida could push owners to sell.” After the condo collapse in Surfside Miami in June of 2021, costs to insure older condos in Florida have skyrocketed. The article discusses a complex of 900 units which is paying 300% more than last year. The result is many of the older owners are scrambling to make the increased condo association fees. Adding to the pressure is a reduced number of insurers willing to insure the buildings. The result is condo owners selling at a discount to get out. The differential between older buildings and newer is growing as a result. The suggestion in the article is they can almost double again unless major corrective measures are taken to fix older buildings which are likely to require special assessments of the owners.

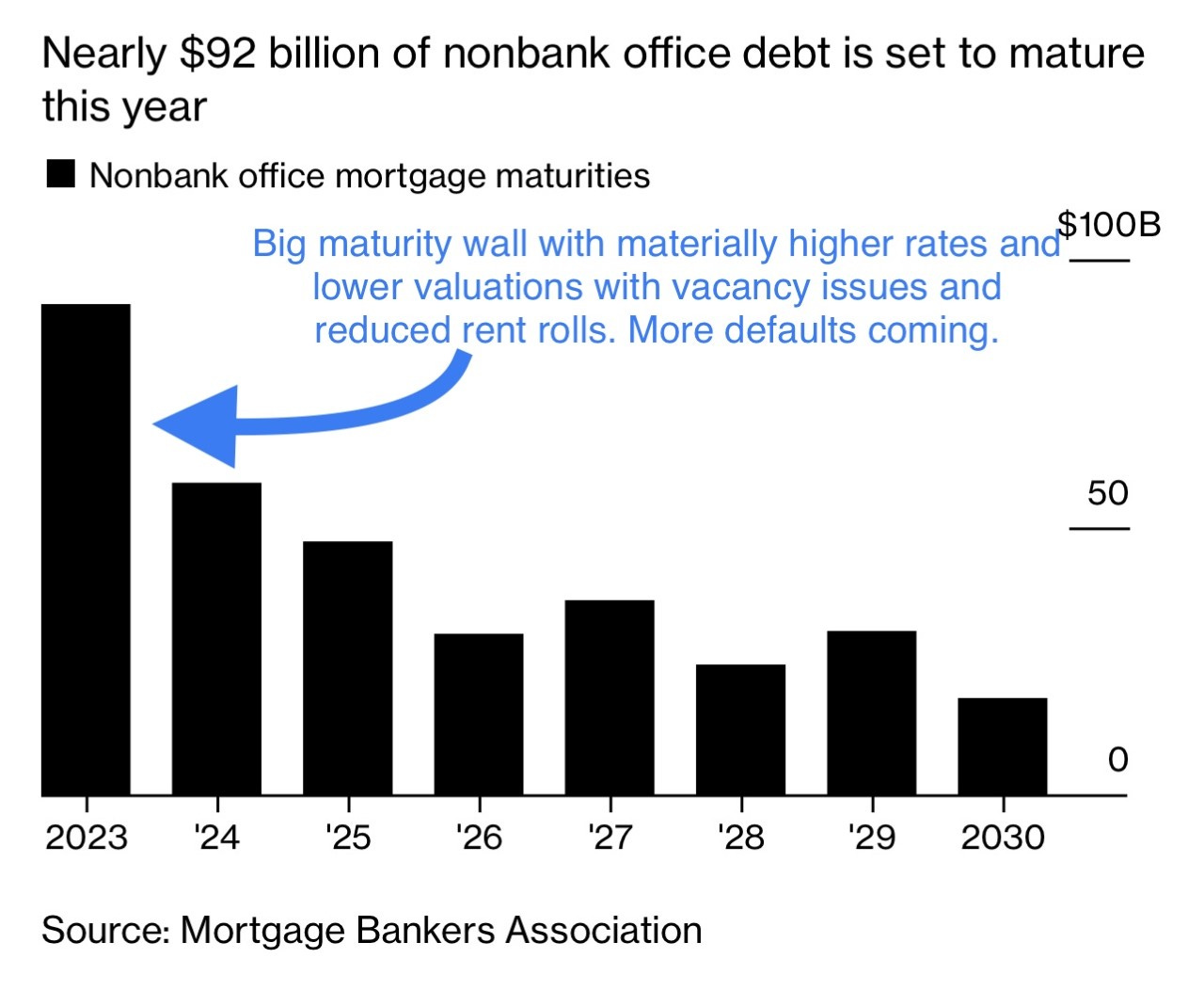

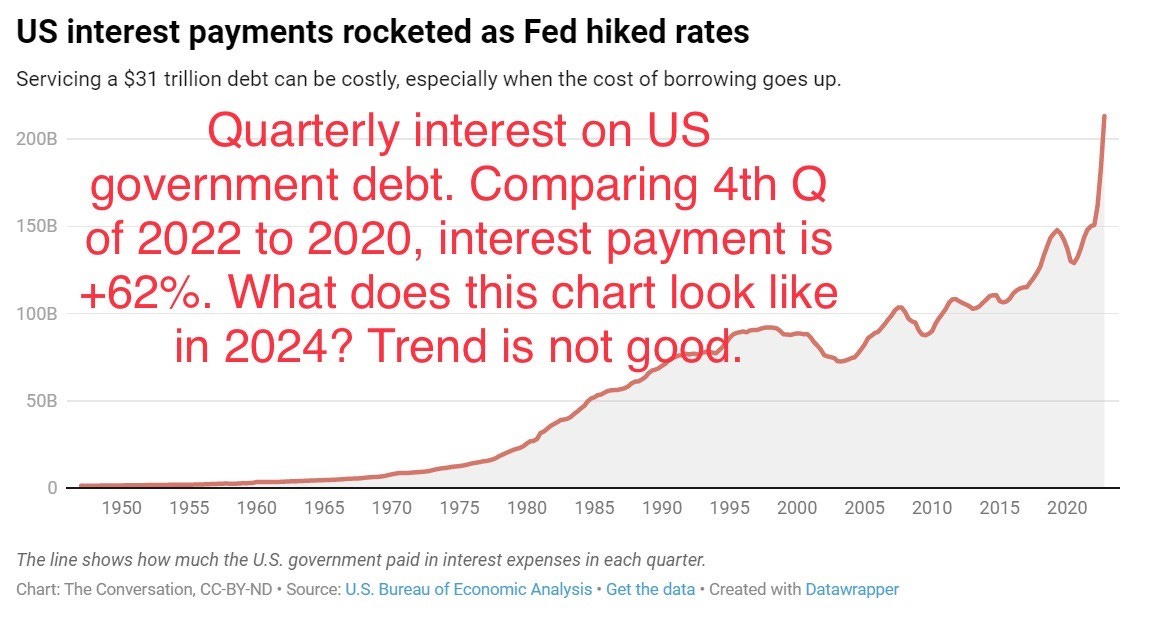

Good Bloomberg article entitled, “Two Office Landlords Defaulting May Be Just the Beginning.” For years, property owners have been grappling with the rise of remote work — a problem so large that one brokerage estimates roughly 330 million square feet of office space will become vacant by the end of the decade as a result. But low interest rates allowed the investors to muddle along more easily without worrying about the debt. Now, many office landlords are seeing borrowing costs skyrocket. When I think of the ramifications of the chart below, I am growing increasingly concerned. These loans maturing will need to be refinanced at SHARPLY higher rates and in most cases, lower underlying valuations. The result will be increasing defaults. I wrote a Rosen Report in September 2022 entitled, “Concern Growing & the R/E Double Whammy is Not Helping and unfortunately, it is playing out as described. Let’s also consider the rising cost of financing for the US Government which has seen debt explode to $32 trillion (2nd chart).

US retailers are abandoning malls and large-format stores in city centers in favor of neighborhood locations that aim to serve the work-from-home generation. Several big cities, including San Francisco, Los Angeles, New York, Seattle and Miami, had fewer retail establishments in the last quarter of 2021 than before the pandemic, JPMorgan reported. Abercrombie & Fitch, Macy’s, Kohl’s and others are moving from cities.

Other R/E Headlines

US home prices just did something they haven’t done since 2012

The average US home sold for $350,246 for the four weeks ending on Feb. 26, according to an analysis by real estate firm Redfin this week. The sale price fell by 0.6% compared to the same month one year ago — the first annual decline since February 2012.

World’s Rich Take Advantage as $1 Trillion Property Market Craters

Article outlines buying of commercial real estate as prices fall. One example was Zara founder, Amancio Ortega, Spain’s richest person, who bought at least 10 properties in the US and UK for more than $2bn.

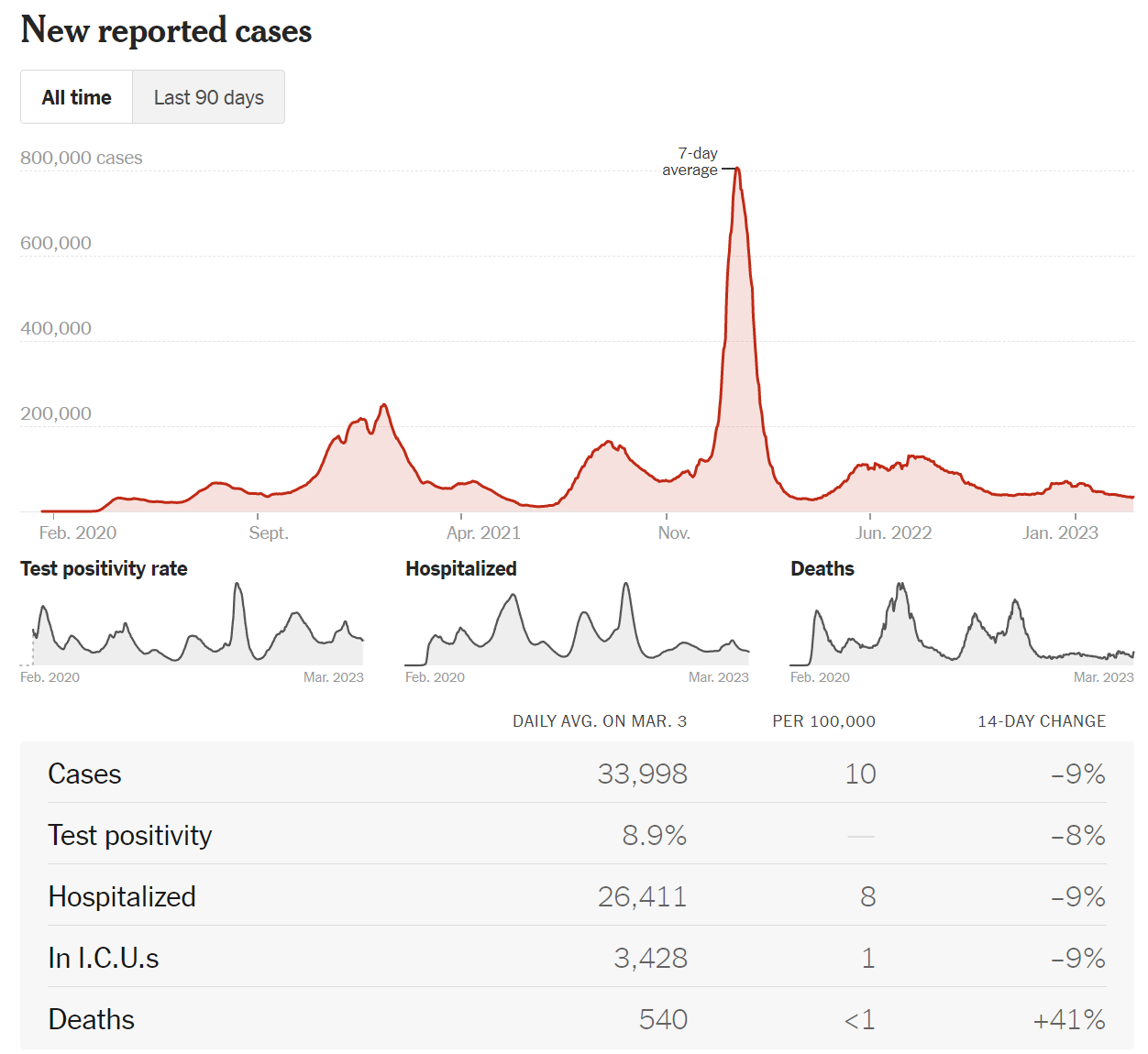

Virus/Vaccine

FBI director says COVID pandemic 'most likely' originated from Chinese lab

I wrote about this view extensively and was sent countless hate mail for suggesting the lab leak was my view.

Eric , Excellent writing ✍🏾 thank you 😊