Opening Comments

My last piece was a light on opens of the podcast likely due to the Jewish New Year holiday. Here is the link to the newsletter entitled, “Highway to Hell,” and this is a link to the 18-minute podcast which goes over some of the highlights of the newsletter. Good feedback on the podcast, but clearly, I need to get the volume and lighting improved. One loyal reader called me to tell me he felt he learned far more by listening rather than reading, as he was able to listen on the drive to work. I will try to do these more frequently as well, but am in desperate need of a new podcast recording application as Riverside is not user friendly. Any thoughts/experts who can help me, I am all ears.

No podcast today as I had intermittent internet and a cold so I sound like death.

Picture of the Day-Hurricane Ian

Mike Cembalest-Eye on the Market-Arrested Development

Concern Growing & The R/E Double Whammy is Not Helping

Quick Bites

Markets

Treasuries-TINA to TARA

Currency Issues

Inflation/Lumber/Wealth Destruction

Wall Street Layoffs

Sabotage on Nord Pipeline

Other Headlines

Crime

Virus/Vaccine

Real Estate

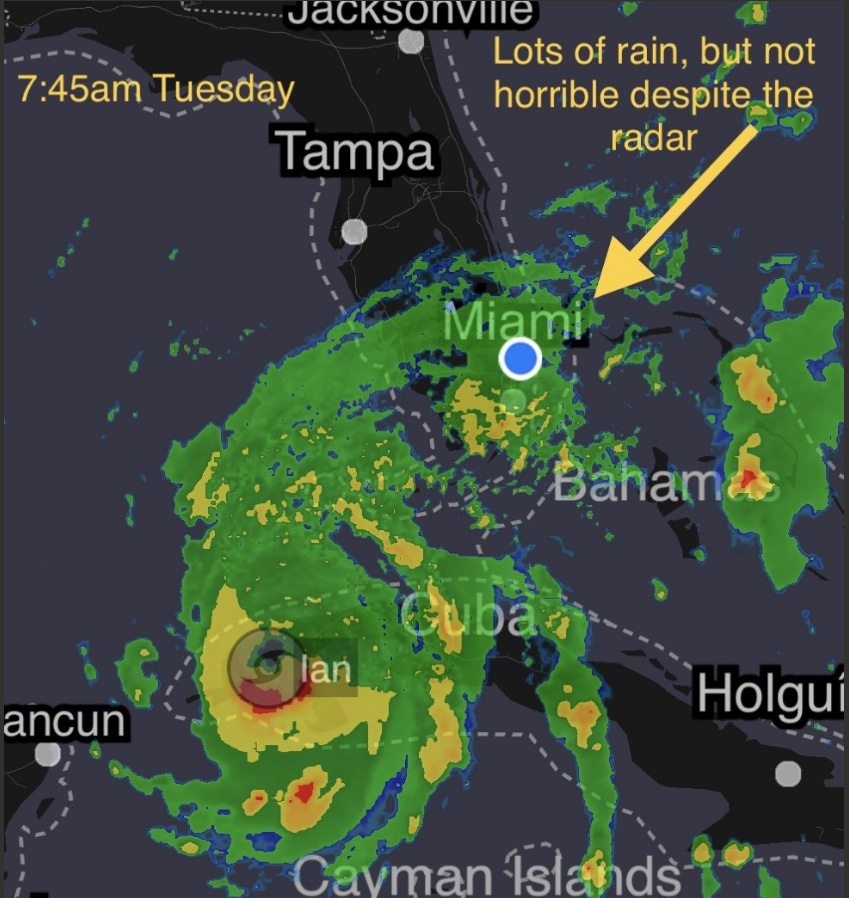

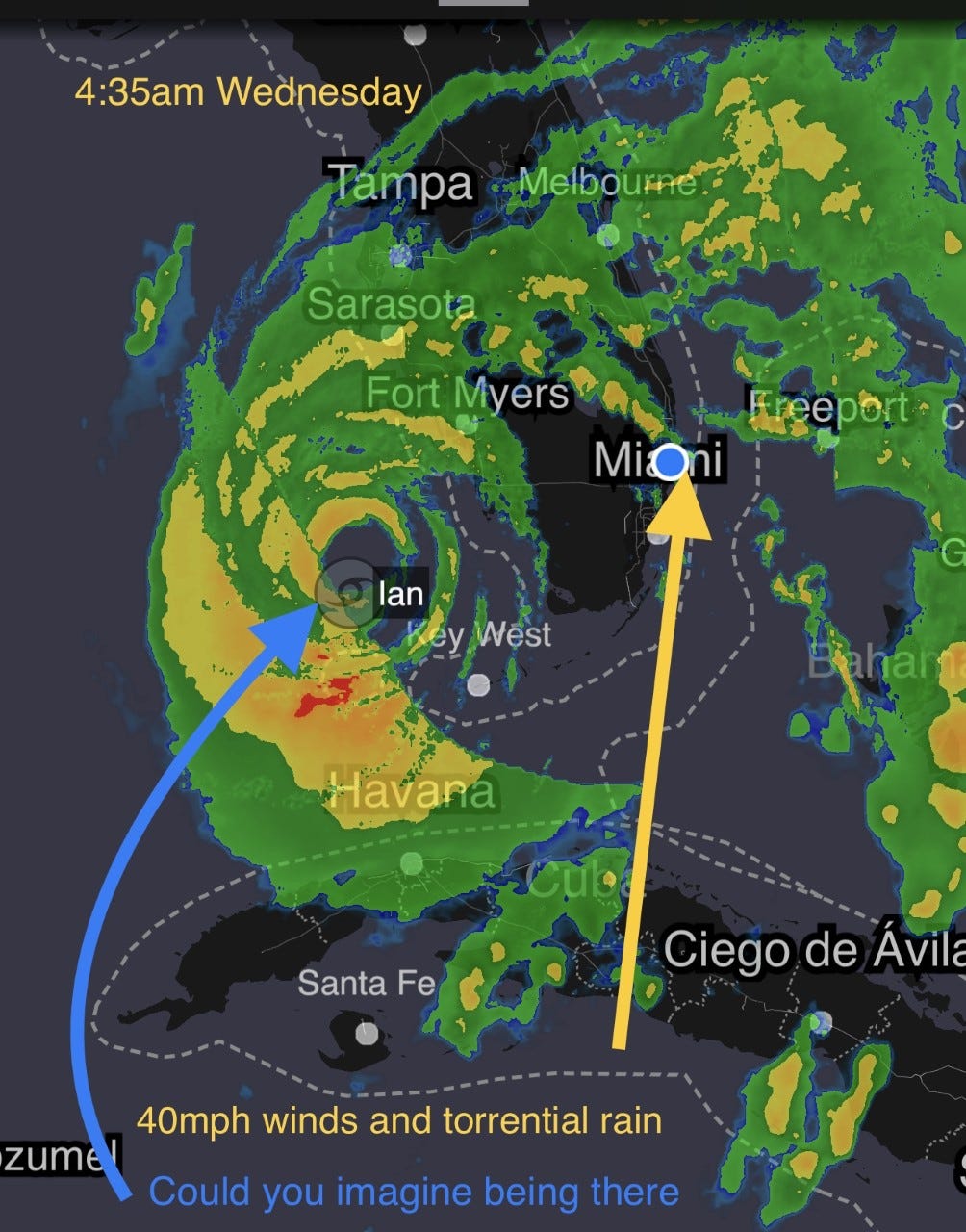

Picture of the Day-Hurricane Ian

Hurricane Ian is in the process of hitting the west coast of Florida above Cape Coral. It rained a bit on Monday and Tuesday in Boca, and I was surprised at the wind/rain on Tuesday night, which kept me up. Mind you, I have lived through over a dozen hurricanes. Wednesday is more rain and wind. Check out the pictures below, which were live radar taken from my phone for my location. The first one from Tuesday am looks bad, but during the 2nd picture Wednesday am, it was far worse from a rain and wind perspective, but the radar looks mild. I have some trees down as well. These storms are massive. I hope the people on the west cost of Florida were smart enough to evacuate such a substantial storm. Wind gusts were up to 155mph, which will cause catastrophic damage due to storm surge, wind and flooding. Also, over the last 20 years, the area over there has been built up substantially. One last thought, for all those with EVs, people can lose power for days or more with this storm. I have a full house, back up generator, but not everyone has those. You still need a traditional car down here if you need to leave due to a storm. I did read that Tampa is a large port for fertilizer, so keep an eye on that.

Mike Cembalest-Eye on the Market-Arrested Development

As usual, Cembalest does not disappoint with great information and charts with topics which include: The tightest labor markets in decades are pressuring the Fed; can “second chance” policies for those with criminal histories expand the labor force? Also: the Citrix canary and a COVID update. I am a bit concerned about “Second Chance” legislation which would make the path to employment for criminals easier, and it is outlined in the report. I believe as an employer, I should know about a candidates criminal history. I would suggest readers who are market watchers pay attention to the hung bond deal, Citrix which is outlined in the note. It is estimated that the bank underwriters lost approximately $1bn on the deal given the deteriorating market conditions.

Concern Growing & the R/E Double Whammy is Not Helping

For those readers who have known me for a long time, you will remember that I was among the first people to call for Armageddon in July of 2007 when Bernanke said, “Subprime is Contained.” I was screaming at the top of my lungs to anyone who would listen, and wrote a daily piece sent to thousands of people. It was the precursor to the Rosen Report of today. I connected the dots and alerted senior management at JPM of my views and positioned the desk accordingly resulting in record results in both 2008 and 2009, despite the distraction of the horrific Bear Stearns acquisition (I was adamantly opposed to going through with the transaction). One reader in the real estate business called me just this morning to remind me that I was “Screaming at the top of my lungs” at his home in the Hamptons in the summer of 2007 that the world was coming to an end and I did it again at a bar downtown in early 2008.

I am not at the level of anxiety I felt prior to the Global Financial Crisis for a host of reasons, but I do feel there are things that the markets may not be fully factoring in today which could create more havoc than most people are anticipating. I have written quite extensively about the US Dollar strength, the disaster in Europe-largely over a moronic energy policy, the US energy policy, but I have not written enough about my commercial real estate concerns. I have spoken with a dozen real estate investors, lawyers, brokers and bankers for this piece.

Let’s set the table with a chart of price moves in the R/E sector this year with major REITs Real Estate Investment Trusts -34-57% YTD relative to the S&P -23% YTD. Given many of these REITs have lower vacancies today, what is the stock market telling us about their future with performance which is down double the broader market? These stocks rallied a little on Wednesday, but close enough for these purposes.

There are going to be thousands of these stories in many cities across the country, given the sharp move in rates coupled with the substantial increase in vacancies in the office and retail markets. Multi-family will be impacted, as rents decline and refinancing is needed, but this will largely focus on retail and office.

The lockdowns and Work From Home exacerbated matters on the office/retail markets. Cities such as SFO who have been heavily reliant on the Tech industry are in out sized trouble given that industry has been hit hard. Also, Boston, NYC, Austin, Miami and others have started to see more tech flows. The venture capital spigot has turned sharply. On the tech/venture side, many companies have a hiring moratorium and many are laying off. One senior Commercial Broker sent me this with respect to venture which I found interesting which will also impact commercial R/E:

FOR THE PAST 15 YEARS THE MANTRA FROM THE VC’S TO THEIR FUND COMPANIES HAS BEEN:

GROW….SCALE UP

CREATE A COMMUNITY ..FOSTER CULTURE (BEAUTIFUL OFFICES, FREE LUNCHES AMENITIES ETC)

IT’S ALL ABOUT TEAM AND THE ECOSYSTEM

NOW THE DIRECTION IS :

CONSERVE CAPITAL….EXTEND THE RUNWAY

PROFITABILITY IS TANTAMOUNT

IF YOU CAN SURVIVE WITHOUT OFFICE SPACE AND THE OVERHEAD SO BE IT

High crime cities such has Chicago, SFO, LA, NYC… are also being impacted by more people not wanting to head to the city. Now the genius politicians in NYC are instituting a congestion pricing tax. Instead, they should be doing tax moratoriums to attract people to the city.

In one example, a NYC Upper East Side Lexington Avenue retail block has seen the valuation cut by almost 60% in five years, and now the debt is 40% more than the value of the property. The original loan was 5 years at 3.7% fixed with a substantial pre-payment penalty. Now the new rate is over 6%. One R/E investor was quoted 50bps higher in terms of a rate from last Friday to this Tuesday from two different lenders. When you want to refinance, you cannot cover your Debt Service Coverage Ratio (Net Operating Income/Debt Service) due to the sharply higher interest rate, even if the valuation was unchanged. If the property valuation is lower, which is clearly the case in retail and office, then you have a double whammy with a higher rate and lower valuation.

In another example in NYC, a reader owns apartment buildings. The loan comes due and he needs to refinance. The owner needs a 70% Loan To Value (LTV) and a debt service coverage ratio of 1.3x. Due to interest rates increasing so fast, you can no longer meet the debt service ratio even though the valuation of the apartment building is up in value, but so are costs to maintain it. The result is either the owner putting in more equity to cover the gap or playing hard ball by threatening to give the keys to the property back to the bank. The concern from the owner is the prices will start to fall to catch up with the higher rate environment and softening rents. After a great run in rents, things have cooled recently, and now when apartments come up they are not renting as quickly or at the elevated levels. He has been forced to lower rents to prevent vacancies. I spoke with another very successful NYC R/E developer and owner on Wednesday and he said, “A lot more defaults are coming in the space if you need to refinance near term. Why would the owner ever come up with equity given the backdrop.”

Also contributing is financial institutions are pulling back. This summer, regulators went to the banks and increased reserves on real estate loans which is driving large banks to pull back in lending. In another regulatory issue, the FDIC will be taking a look at growing bank-held commercial real estate loans, which will also likely make it harder to borrow in the space.

I have written that SFO is expected to have a 40% vacancy rate for office by December and cities across the globe are seeing a sharp increase in vacancies for office space (amazing interactive charts for NYC). In the article attached, it suggests the area on Third Avenue from 42nd-59th Streets in Midtown Manhattan have 29%. Coincidentally, my hedge fund was at 47th and Third Ave. A study this year by professors at Columbia University and New York University estimated that lower tenant demand because of remote work may cut 28%, or $456 billion, off the value of offices across the US. About 10% of that would be in New York City alone. Think about the impact on all the outstanding loans as they come due with lower valuations and higher rates largely driven by the move to Work From Home.

Everyone knows what retail is doing in cities like NY, Chicago and elsewhere. Chicago’s Magnificent Mile has a 29% vacancy rate on retail on North Michigan Mile. Brookfield handed over the keys on a Magnificent Mile mall back to MetLife. The vacancy rate is in Herald Square in NYC is 42.4% and 27.3% on Madison between 57th and 72nd Street. With high vacancy rates across many cities coupled with rising interest rates and changing traffic patterns (Work From Home), large problems are likely present themselves over the next 18 months.

I believe there will be some creative solutions to the office/retail dilemma over time, but between now and then, I expect some healthy repricing. The markets will need to withstand an increase in defaults on loans backed by retail and office space due to a combination of higher vacancy rates, lower rents, sharply lower valuations and higher rates. Blackstone gave the keys back to the lender to an office building 6 months ago, and I expect more of that to come.

Given the unprecedented increase in rates, I expect the real estate markets to start feeling impacts soon and the inept Fed will not be helping matters. On on a positive note, Blackstone and Brookfield raised approximately $40bn for R/E funds through July of 2022. Clearly, there is money on the sidelines to buy choice properties which will be sold. There will be money to be made by those lucky enough to have the capital to pounce on the opportunities which are likely coming down the line. For now, cash is king.

Quick Bites

I did suggest that we should see a temporary bounce in my report Sunday, and despite a small sell-off Monday, the market rallied sharply on Tuesday morning and again on Wednesday. Yes, it was oversold, but I am not convinced the selling is done, as the damage caused by the huge move in rates will reverberate for some time. Having said that, calling bottoms is challenging. Slowly legging in on big down days makes sense. The Dow mounted a big comeback from its 2022 low as the Bank of England said it would buy bonds to stabilize its financial markets, a stunning reversal in the monetary tightening policies implemented this year by most central banks to stifle inflation. he 30-Year Gilt finished -105bps to 3.93%, another massive move. The Dow jumped 546 points, or 1.88%, to 29,682. The S&P 500 rose 1.96% to 3,719, one day after notching a new bear market low. The Nasdaq Composite was up 2.05%. The Dow & the S&P snapped a six-day losing streak. The Dow is now 19.5% off its 52-week high, while the S&P 500 is 22.7% below its record. The Nasdaq is down 31.7%. Of note, Apple materially under performed market today on reports of limited demand on new iPhones. However, beaten down stock, Netflix, rallied over 9% on the day due to a new ad roll-out deemed material. The Treasury market stabilized on the Bank of England story, with the 10-year at 3.76% after going over 4%. The 10-year rallied almost 30bps in 24 hours. The 2-year went as wide as 4.31%, but settled at 4.1%. These moves in rates are quite frankly, insane and drove equities higher today.

I wrote that I bought 3-Year Treasuries late Friday afternoon, and it appears the Bond King, Jeff Gundlach followed suit? Jeff, are you a Rosen Report reader? Despite weakness Monday, the Treasury market has rallied sharply and the 3-year is actually lower in yield than when I bought Friday. Interesting Bloomberg article entitled, “Goldman and BlackRock Sour on Stocks as Recession Risk Rises.” The article outlines many other major firm’s bearish views as well. I believed the market was over-sold, but still feel the trend will be down. Chart below from TINA (There Is No Alternative) to TARA (There Is A Reasonable Alternative). Of note, my favorite investor of all time, Stan Druckenmiller, sees a “hard landing” in 2023.

The market remained under pressure and one driver was the sharp continued declines of the British Pound which took out the 1985 lows this week. Also of note, the Yuan is basically at 14 year lows and headed for the biggest annual decline since 1994. I keep writing about the strong US dollar as I believe there were will be severe ramifications we have not all considered based on the substantial moves in currency rates this year. This Yahoo Finance article is entitled, “Morgan Stanley Says Dollar Surge Tends to End in Crisis.” The US continues its Hawkish policy, but so do other countries. The US $ continues to rise against the basket making importing cheaper (deflationary) and puts pressure on profits of US companies bringing back foreign earnings. Conversely, the weaker currencies will be negatively impacted when importing putting upward pressure on inflation. Also, all the US $ demonstrated debt they raised just became sharply more expensive. Mohamend El-Erain suggested this type of move in the US Dollar can bankrupt developing nations as their Dollar denominated debt costs soar. If you borrow $1bn in US $ at 5% and your currency depreciates by 20%, your debt just got significantly more expensive. I cannot tell you all the second and third order impacts of the unprecedented US Dollar strength, but fear there will be serious ramifications.

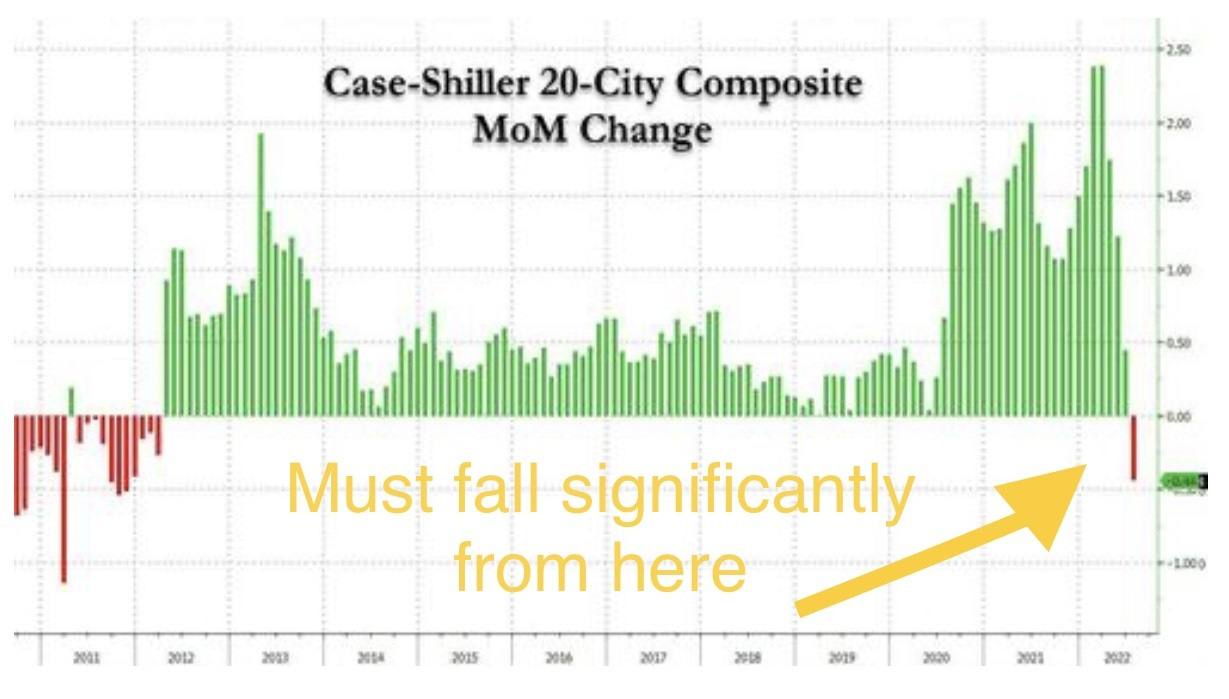

On the inflation front, I have been crystal clear with my view that I was opposed to the Fed’s actions in 2021 (rates too low and QE should have ended) and feel they were late to the party in 2022. I called for peak inflation two months ago and stand by that view. I wrote a piece a couple weeks ago, “Will the Fed Screw it up Again,” which questioned if we will actually see deflation. The US Dollar strength is deflationary as foreign goods are cheaper. We have seen so many commodities roll-over (denominated in US $). At one point, lumber prices were quoted daily on CNBC as they more than quadrupled in a year. They are now back to pre-pandemic levels of another sign of inflation cracking. Housing is slowing with the Case-Schiller Housing Index falling by the most in history (See R/E section). Oil was over $120 and is now below $80/barrel and the list continues. The wealth destruction across equities and fixed income products is in the many trillions, which will also reduce consumer spending. The 2nd chart shows $29 trillion has been erased from the Bloomberg Global Bond and World Equity Index since November 2021 (Almost $140 Trillion to $110 Trillion). Airfare, hotels, rental cars, butter, eggs and a host of other items which were flying in price are coming down again.

I have spoken with senior people at a half dozen banks/investment banks, and it is clear layoffs will be picking up steam. Couple this with a challenged bonus season and weak hedge fund performance, and NYC and surrounding areas should see a healthy pull-back in luxury R/E prices. Don’t forget a doubling of mortgage rates. This article from Business Insider is about GS and layoffs of bankers. This Bloomberg article, “Wall Street’s Bosses Reassert Themselves With the Return of Annual Culls,” is about the switch from a job market where employees held the cards (Work From Home, lots of demand for workers, solid bonuses) to a sharp change given the lack of M&A deals/IPOs, lower fees and struggling capital markets. Incentive pay for dealmakers handling debt and equity offerings may tumble more than 45% this year, while advisers on mergers and acquisitions see their bonuses drop 25%, according to a closely watched report released in August by compensation consultant Johnson Associates Inc. Remember, many of the large financial institutions hired aggressively in late 2020 and 2021, especially in banking which ballooned staff in some areas.

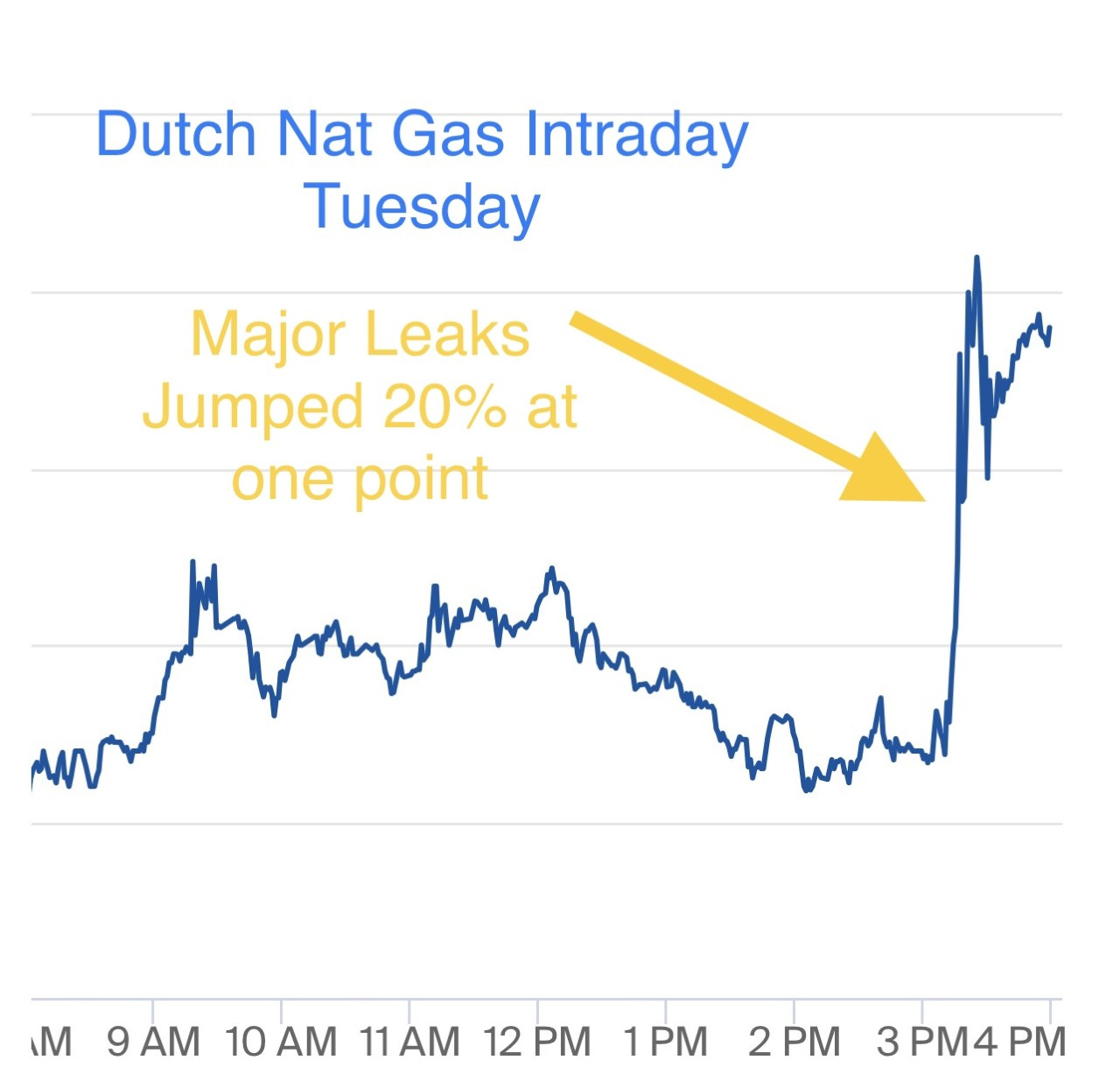

Germany suspects sabotage in the damage done to the Nor Stream Pipelines. According to a German security official, the evidence points to a violent act rather than a technical issue. Swedish seismologists detected two explosions in the area on Monday, when leaks appeared almost simultaneously in the Baltic Sea. There are multiple stories suggesting the US could have been involved in the sabotage, but I find this hard to believe. Biden was quoted in February as saying, “If Russia invades then there will be no longer a Nord Stream 2. We will bring an end to it,” which is helping to drive the speculation. In January, Victoria Nuland (US Diplomat) said similar comments to Biden. Poland’s ex-Foreign Minister thanked the US for the attack. I find it incredibly odd. On the news, Dutch Natural Gas Futures spiked again and are now approximately 10 times higher than the US levels. The Euro Gas futures are the equivalent of the low to mid $60s in mmBTU relative to the US at $6.8 mmBTU. Yes, energy independence is important for national security and to control your own energy destiny. Don’t listen to Tlaib and the Progressives. Remember Natural Gas is a big component in most electricity production.

Other Headlines

Traders Who ‘Just Want to Survive’ Sit on $5 Trillion Cash Pile

Billionaire investor Ray Dalio says UK’s economic plan ‘suggests incompetence’

Ken Griffin says Fed has not done enough, must continue on its path to reset inflation expectations

Everything-Selloff on Wall Street Deepens on 98% Recession Odds

Facebook ‘silencing’ activity related to FBI whistleblower Steve Friend

Chipotle Mexican Grill will test robotic tortilla chip maker

Given the cost of labor, cost of training, turnover… I expect far more “robots” to be involved in the service industry.

Damning report on Jew-hatred at NYC colleges reveals left's ugly anti-Semitic core

FBI misled judge who signed warrant for Beverly Hills seizure of $86 million in cash

The FBI is out of control. Too many stories of recklessness around too many topics.

Trump SPAC changes address to UPS Store as investors pull more than $130 million

Sanders leaves door open to 2024 White House run

Sanders would be 83 at inauguration. Makes complete sense. He is also a Socialist. ‘Rough Shape’: Bernie Trashes Biden Economy.

Eye-Opening Poll Shows GOP Far Ahead in Battleground States

Polls are notoriously wrong, but so many are showing the Dems make a sharp comeback, I wanted to show the other side as well.

Billionaire Art Collectors Circle as Megabucks Masterpieces Head for Auction

Crime Headlines

NYC vagrant pummels female straphanger in caught-on-video horror

Horrible video of a woman attacked by a homeless man she ignored on the train.

Women are rightly terrified of NYC subways — but our fears are ignored

NYC Uber Eats delivery man says 'nobody helped' during attack by 'super perp'

The perp had 103 priors. What the hell does it take to get life in jail? I can tell you now, if I were the DA in NYC, this would be cleaned up in 60 days.

Philadelphia armed carjacking of mother, teen daughter caught on video

Frightening video with chilling screams.

Virus/Vaccine

Real Estate

I have written extensively about the turnaround in housing, and this CNBC article outlines specifics. Home prices cooled in July at the fastest rate in the history of S&P Case-Shiller Index. The 10-City composite rose 14.9% year over year, down from 17.4% in June. The 20-City composite gained 16.1%, down from 18.7% in the previous month. Tampa, Miami and Dallas saw the highest annual gains among the 20 cities in July, with increases of 31.8%, 31.7% and 24.7%, respectively. I cannot fathom home prices rebounding near term given the move in rates, wealth destruction in equities/fixed income/commodities, economic slowdown, bonuses/layoffs. With few exceptions, I see residential real-estate going decently lower. I would not buy a home now.

Other R/E Headlines

Remote Work Drove Over 60% of House-Price Surge, Fed Study Finds

Aspen Mansion Sells for $69 Million in One of the Area’s Priciest-Ever Deals

This does not look like a $69mm home to me.

The breadth and incisiveness of your commentary is most impressive. I hope you keep it going.

Stay healthy.

Dick Nye

Rbn 908 329 5444