Opening Comments

My last note, "Lessons From My Mom” was well received. If you missed it, please check it out, as my mom had some good lessons. Readers sent me some of their parent’s life lessons. I will share only a few. Readers are always welcome to email me with comments which can be positive/supportive or constructive. From time to time, I will be inserting comments from readers.

Mom Quotes from Readers

“Friends may come and go, but enemies accumulate.“

“When considering your life partner, don’t be with someone you can live with, be with someone you can’t live without.”

“ALWAYS walk out the front door each morning with confidence. The confidence that you can accomplish anything you put your mind to. Never leave home without this.”

“Relationships are important, not just your spouse, your boss, your family or the important people in your life, but the people you interact with every day. The bank teller, the dry cleaning lady, the doorman at your office, your co-workers above and below you on the ladder. Treat everyone you meet as though they were important to you because they are.”

Next Sunday’s piece is entitled, “Memorable Client Entertainment Over the Years,” and outlines a bunch of fun events I was able to experience during my Wall Street Career.

Markets

Banking Conditions Tightening

Home Depot & Target Earnings

Life Expectancy is 21 Years Apart within Two Miles

Intergenerational Wealth Transfer Coming

Durham Report

Best and Worst States to Retire

Apartment Vacancy Rates Increasing

$37mm Miami House for Sale

Boca High-End More Signs of Slowing

San Fran PH at Millennium Tower-I’ll Pass

Pictures of the Day-Shoe Shopping for Julia-The Bad Shoes

My daughter is having her 16th birthday coming up in a few weeks and we are throwing her a party. She bought a new dress and wanted help picking out shoes to go with her outfit. I looked up size 8.5 women’s high heels on my work computer last week. I need to tell you that I am now RUN OVER with ads for women’s high-heel shoes. It is overwhelming. This aggressive ad campaign stuff works, but is oh, so irritating. I will say that a lot of women’s shoes are so ugly, I don’t understand who would buy them. Here are some of the awful shoes by some of the biggest names in women’s shoes such as Louboutin, Saint Laurent, Chloe, Off-White, Stella McCartney, Jill Sander, Prada, and Balmain among others. $2k for ugly shoes? I appreciate a beautiful pair of shoes, but these designers are just trying too hard, and I am not a fan of the bulky looks. I know women’s shoes are not inexpensive, but these prices are offensive. I went on Sak’s, Nordstrom and Neiman’s websites so I could see all the major brands. I don’t even know what to say about the first one; it looks like a black mouse. I might become a shoe designer and charge 50% less than these awful ones.

Penny Wise & Pound Foolish

I take responsibility for my mistakes, but on this one, honestly I am not to blame, and hope you will agree with me after reading what happened. When I moved to Florida almost 6 years ago, I loved the spec house we bought but not the patio pavers around the pool. The builder suggested I needed to call the paver installer and figure something out.

I wanted to remove the old concrete pavers and get some nicer-looking porcelain pavers. Peter, the paver guy, told me he had an amazing new paint to paint the pavers. Peter talked me out of replacing them, and that for $5k, all would be amazing. He proceeded to paint the pavers and they looked good…. for 3 days and the paint started peeling. He came and redid them no fewer than 7 times at his expense which was massive. He had to take the paint off of the impacted pavers and repaint them. Long story short, it never took and they looked awful. He just stopped responding to my calls.

So, I called up a new paver guy, Marcel, and again, I suggested ripping out the pavers and buy with new ones. Nope, he can make them amazing for $9k and the cost to rip out and put new would be $95k at the peak of the pandemic given labor and materials. So, I went with his new plan and it looked good, as advertised, but the cost to get the old paint off the pavers was more than he thought bringing the total cost above his initial estimate. It ended up being $19k. Shocker, a contractor who underestimated the cost of the job. Now, I am 5 years into this mess, and $25k was wasted with the same old pavers. Below is after the 2nd round of paver work.

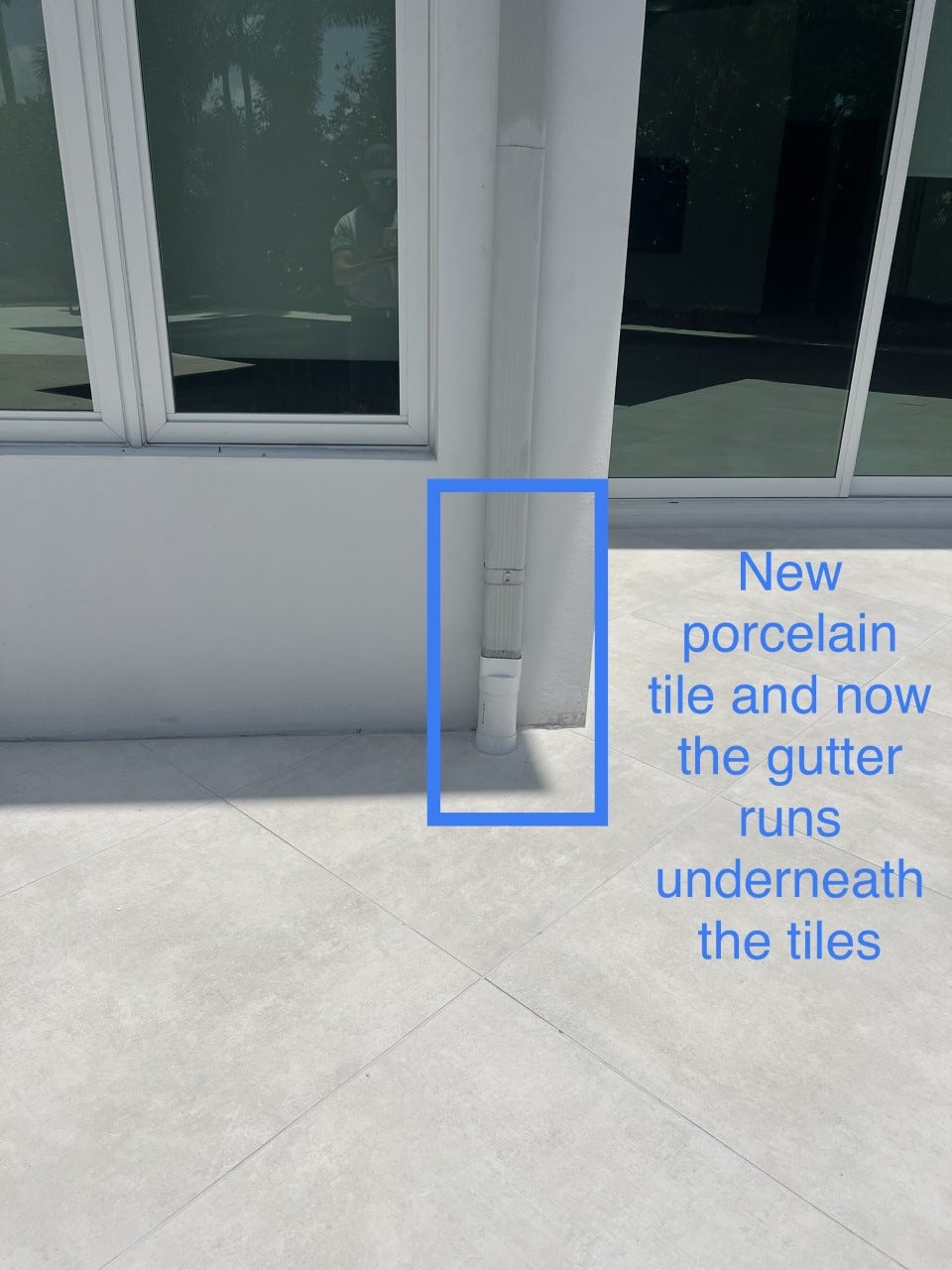

The other factor was the gutters were dumping water onto my pool deck at such a rapid rate that the water had nowhere to go. The result was standing water after rain which made me feel uncomfortable and brought out the mosquitos.

In order to fix it properly, I needed to rip out the pavers and have the gutters run underground to push the water away from the house. Now my initial forays into fixing the pavers appear to be for naught and needed to start again. I called two contractors and two were $75-85k to rip out old pavers, run the gutters underneath the pavers, and buy/install new pavers. They said 5-6 weeks with one week to rip out the old material.

I hired what is ABSOLUTELY the single best subcontractor I have ever seen (Thanks to Billy) and I have done some MAJOR projects. Silvio came in at 40% cheaper than the others and the ENTIRE job took 10 days. No typo here. If you need flooring done inside or out in South Florida, I will connect you with my guy. He is amazing.

Had I done what I wanted to do 6 years ago, I would have had what I wanted and done properly from the start. I let the lovely sound of saving money get me to the wrong outcome, not once, but twice. I just spent $47k to redo the pavers around the pool and it looks quite good.

However, I wish I would have done it when I moved in and saved $25k and lots of headaches along the way. Son of a… Penny wise and Pound Foolish. Please agree this one was not all on me, and Peter and Marcel should take 80% of the blame!

In general, I have learned that construction takes longer and costs more than estimates about 99.9999% of the time. In NYC, when we lived in a co-op, we were told the job would take 9 months and cost “X” dollars. Well, 4.5 years later and 3.5 “X” dollars later, the job was done. NEVER AGAIN. Reminder, never do structural work in NYC. Never live in a co-op, and the premium from condo to co-op seems high, but it is not high enough! However, this paver install came in right on budget and in a fraction of the time. He even did some extra work inside and did not charge more. Unheard of today. I just had the .00001% scenario play out on a construction project and it looks amazing and find myself staring out my windows now.

Quick Bites

Markets rallied sharply Wednesday as House Speaker McCarthy said that a “better process” is not in place for further talks. He also said, “it’s possible to get a deal by the end of the week,” and he does not believe the US will default. Biden canceled the second leg of an international trip to focus on negotiations. The Dow rallied 408 points, the S&P gained 1.2% and the Nasdaq+1/3% on the day. YTD, the Dow+.8%, S&P+8.3%, and Nasdaq+19.4%. Treasuries sold off causing rates to rise on the heels of the positive debt ceiling developments. The 2-Year Treasury was +10bps to 4.17% and the 10-Year was +4bps to 3.57%. As an aside, on the small chance of a default, I think Treasuries rally, at least initially. When the US was downgraded in 2011, Treasuries rallied. If it were prolonged, then all bets are off. Oil was +2.5% to almost $43/barrel on debt ceiling optimism.

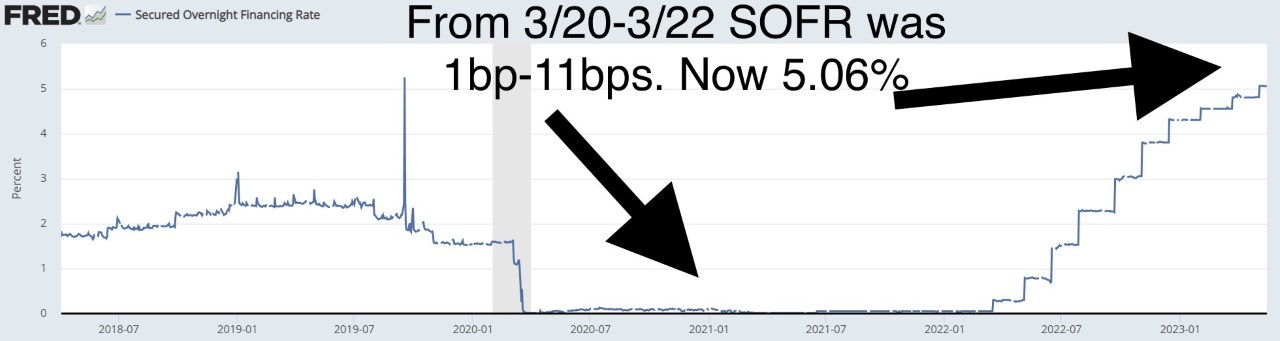

I have been adamant that the banking issues will impact the economy and the Dallas Fed just released its Banking Conditions Survey for data collected May 2-10. “Loan demand declined for the sixth period in a row amid further loan pricing increases and worsening general business activity. Overall loan volumes continued to decline as well, though at a decelerated pace.” In terms of standards, “Credit conditions tightened further; 48 percent of bankers said they tightened credit standards and terms over the past six weeks, the highest share since the survey began in 2017.” There was also some ‘special questions.’ The first one was asking what are the “top 3 concerns around your institution’s outlook over the next six months” and the winners were 1)Liquidity/deposit volume, 2)Financial/economic uncertainty and 3)Net interest margin. ‘Loan demand’ was in 6th place, ‘overall profitability’ in 7th and ‘unrealized losses on securities portfolio’ clocked in at 8th. I have a lot of bankers who read the Rosen Report, and even the largest banks are telling me how hard it is to get loans approved for the best clients. What was a slam dunk a couple of years ago and been done at SOFR+1.75% is now nearly impossible at SOFR+3%, and SOFR has gone up 500bps in a year (from 1-11bps up to 5.06%). Companies could borrow at 1.8% all in and now is 8% IF you can even get a loan. These dramatic rate increases coupled with tighter lending standards will impact consumers and corporations alike.

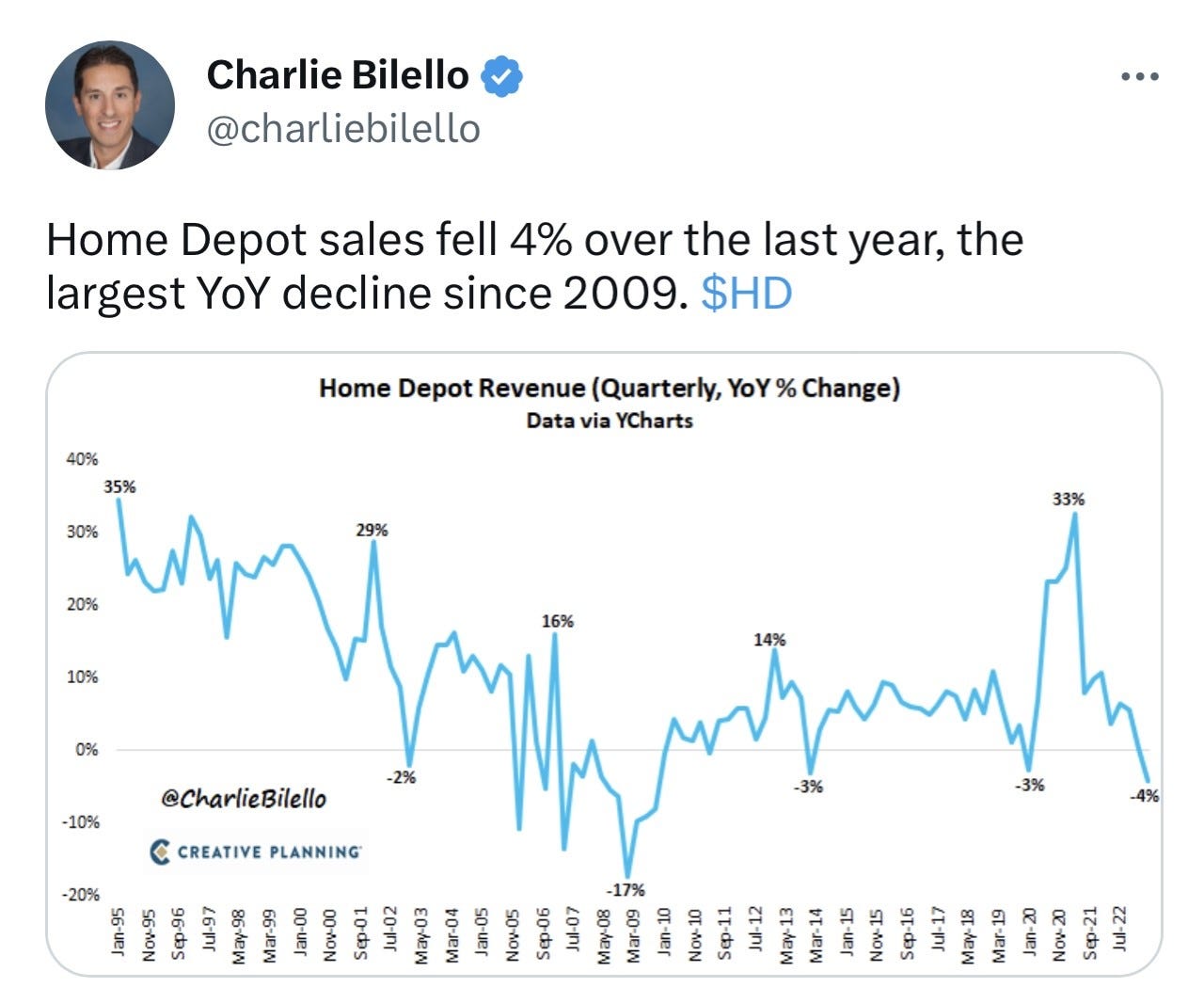

Home Depot’s EPS beat by 2 cents as a 3.9% reduction in SG&A costs helped a little. However, it is still the retailer’s first earnings decline since May 2020 (i.e., since the start of the Covid pandemic). But the real story is the demand destruction – as indicated by the company’s huge revenue miss. Sales were 2.7% below Wall Street’s expectations ($37.26B vs. $38.28B est. from Refinitiv). Comps came in down 4.5% vs. down 1.6% consensus estimate (StreetAccount), with transactions falling 4.8% and average ticket basically flat (slightly positive). In Q1 – extreme weather in California hurt. There’s also lumber deflation. But most importantly, as CEO Ted Decker flagged, “We also observed more broad-based pressure across the business compared to when we reported fourth-quarter results a few months ago.” The company has cut its FY EPS and revenue growth projections due to the weak Q1 as well as “further softening of demand relative to our expectations, and continued uncertainty regarding consumer demand. There are many signs of things slowing down and HD is just another one. Target topped Wall Street’s earnings expectations, even as the discounter’s sales barely grew year-over-year and its shoppers bought more necessities. Target said it expects sales to remain sluggish in the current quarter, marked by a single-digit decrease in comparable sales. The big-box retailer stuck with its full-year outlook. The stock was up slightly after earnings. Softness in discretionary spending was mentioned as was shoplifting/organized retail crime. Shrink will surpass $1bn this year and organized crime will fuel $500mm more in stolen merchandise than last year.

I felt this story about a material differential in life expectancy despite being only 2 miles apart was quite concerning. In Boston, a two-mile difference in where you live may mean a 23-year difference in life expectancy. That startling analysis from the Boston Public Health Commission shows the longest average life expectancy is nearly 92 years, for residents in a section of the Back Bay. Residents near Nubian Square in Roxbury have the shortest expected life span, just under 69 years. The median household income of the census tract within Roxbury is $42,211, versus $141,250 in the Back Bay tract. A vast majority, some 91%, of Back Bay residents over the age of 25 have a college degree, compared to 44% in Roxbury.

An intergenerational transfer of wealth is in motion in America — and it will dwarf any of the past. Of the 73 million baby boomers, the youngest are turning 60. The oldest boomers are nearing 80. Born in the midcentury as U.S. birthrates surged in tandem with an enormous leap in prosperity after the Depression and World War II, boomers are now beginning to die in larger numbers, along with Americans over 80. In 1989, total family wealth in the United States was about $38 trillion, adjusted for inflation. By 2022, that wealth had more than tripled, reaching $140 trillion. Of the $84 trillion projected to be passed down from older Americans to millennial and Gen X heirs through 2045, $16 trillion will be transferred within the next decade. I strongly suggest those with means of any kind speak with a trust and estates lawyer. I have some to recommend if you need them. I don’t care what you do with your money but don’t give it to the government, as politicians are idiots who cannot spend money wisely.

The Durham report came out, and there are many concerning findings. We have corruption everywhere, and you should be concerned. Given the report suggested the Trump-Russia investigation never should have been launched, Jake Tapper (CNN) said, “it is devastating to the FBI.” The media screamed about Russian collusion with Trump. The suggestions of the Durham report are quite different from the popular narratives we have been spoon-fed for years. The report found no evidence of collusion. The media cannot be trusted. Either side. The Pulitzer Prizes won by the NYT and WaPo must be returned and retractions must be made. “Based on the review of Crossfire Hurricane and related intelligence activities, we conclude that the (Justice) Department and FBI failed to uphold their important mission of strict fidelity to the law in connection with certain events and activities described in this report,” Durham wrote. The Durham report also mentions Hillary Clinton’s role and discusses the “Clinton Plan” to vilify Trump by stirring up a scandal. Seriously folks. The FBI relied on the Steele Dossier and unverified claims to support a FISA warrant. This is America and we look stupid at every turn. Trump, Clinton, Biden, Green, The Squad, Schumer, Pelosi, Schiff, Feinstein, Gosar, Santos, FBI, CIA…The list is endless. Pelosi and Schiff should face consequences, just like Comey and McCabe. The corruption at the top of the FBI, CIA, and DoJ that misused their positions to further a political campaign of one side vs another knowing they had no credible evidence is inexcusable. The 300-page Durham Report can be found here. The “Clinton Plan” is highlighted on Page 84. No, I did not read the entire report. I just ask you to think what would happen if the FBI, CIA, former Secretary of State, and the media worked against Biden, Obama, Clinton or other Democrats. Dershowitz, the famous lawyer, was interviewed on this topic and can be found here and he said, the Durham Report shows “Americans are right to distrust the government.” The WSJ story highlights bias, double standards, and willful ignorance and calls out the press as well. Of note, the report did not recommend any new criminal charges and unfortunately, no one will be held accountable.

Other Headlines

Paul Tudor Jones says the Fed is done raising rates, stocks to finish the year higher from here

JPMorgan Asset Management Says Markets Are Right to Bet on US Rate Cuts

Fed may lower rates by third quarter as US growth slows

Recession is needed to bring inflation back down: Mac Gorain

Fed's Bostic casts doubt on rate cuts this year even if there's a recession

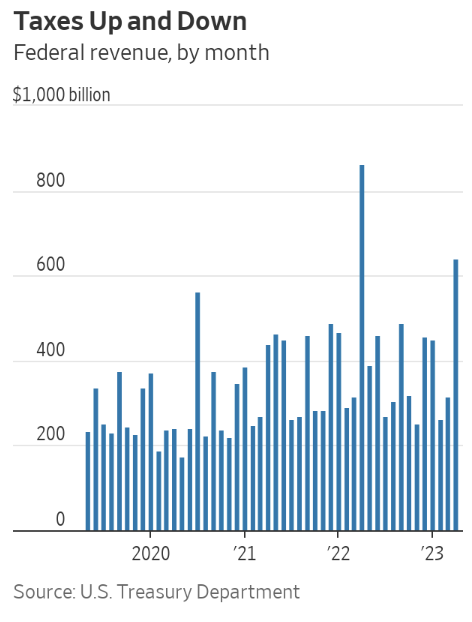

‘Plunging Tax Revenue Accelerates Debt-Ceiling Deadline

WSJ article suggests Federal tax receipts fell $250bn short of expectations which may impact the timing of when the government runs out of money.

New York Manufacturing Index Plunges Most Since April 2020

Huge drop in May, but as you can see, the data is volatile.

Dip Buyers Scorched by Cratering Bank Stocks Rush for the Exits

Investors pull most from financial stocks in a year, BofA says. Little confidence that pressure on regional banks will stop. I do not have faith in regional banks and could not recommend anyone keep material balances there. Of note, regional banks rallied this week.

More than half of Americans don’t have an emergency fund, and 40% of those who do have less than $10,000, according to a recent CNBC/Momentive survey. Does anyone else think this is a problem? No chance that everyone will be getting the entitlements they think they should be receiving. We don’t have the money.

Tiger Seeks to Sell Private-Company Stakes Into Secondary Market

The firm would offload hundreds of millions of dollars in assets. Exit strategy sought with fewer companies going public. I want to see where they get bids on these private positions relative to where they are marked today. I cannot imagine the prices they receive will be pretty. I am working on some projects now, and let’s just say the buyers want to pay a fraction of what the seller is looking to receive.

Amazon is focusing on using A.I. to get stuff delivered to you faster

AI will be a major game changer and sharply improve efficiency and productivity.

Farmers Set to Abandon US Wheat Crops at Highest Rate Since 1917

Weather issues have impacted crops.

Mayor Adams recasts historic Roosevelt Hotel as migrant ‘arrival center’ and shelter

Migrants at NYC hotel busted on assault, disorderly conduct charges

Ten migrants were arrested at 4:30a after two separate drunken incidents. Nothing to see here folks. This immigration policy is working fantastically.

Afghan national on FBI terror list nabbed trying to cross border with migrants

As I wrote in my last note, the border policy is not working.

LA officials monitoring rising use of flesh-rotting 'zombie drug'

The pictures are gross as it eats your flesh.

Crazy story. The attacker had “severe” injuries. This kid must be one hell of a gifted sling-shooter!

Fetterman raises eyebrows with borderline incoherent questioning in Senate hearing: 'Like a riddle'

A Brief, Concerning Conversation With Dianne Feinstein

I want you to listen to the Fetterman commentary and see what Feinstein had to say (claims to have not missed voting despite being absent for 3 months). Sorry, neither of these people should be in office.

Giuliani accused of offering to sell Trump pardons for $2 million each in new lawsuit

The suit includes allegations of sexual assault and harassment, as well as wage theft and discussions of plans to overturn the 2020 election. If the selling of pardons is proven true, it is yet another disgusting example of Guiliani and Trump’s bad judgment.

Biden tells Howard University graduates white supremacy is ‘most dangerous terrorist threat’

I will not dismiss the threat of White supremacists, but is it America’s most dangerous threat when you consider the leading cause of death and violence is not from White supremacists?

Bud Light sales continue to plunge with 24% drop in latest week since Dylan Mulvaney disaster

The article suggested $170mm was made in short order. Maybe I am missing something, but that seems like a lot of money in 18 months.

Aaron Rodgers, David Bakhtiari rip Dianne Feinstein over 'unusual' stock trades

Rosen Report readers know insider trading by politicians is a hot-button issue for me and there are multiple examples of Feinstein’s trading acumen. Yeah right. She is demented. Her staff knows she is demented, yet can trade stocks better than Warren Buffett. Nothing to see here guys. It’s all above board.

Possible miracle at Connecticut church being investigated by the Vatican

The belief is the wafer had multiplied in the ciborium.

Astronomers spot largest cosmic explosion ever witnessed

It is 10 times brighter than any known star.

Toronto anti-capitalist 'pay what you can' café closes after year in business

Let me get this right. A cafe called The Anarchist with a “pay what you can” business model went out of business. Who would have thunk it.

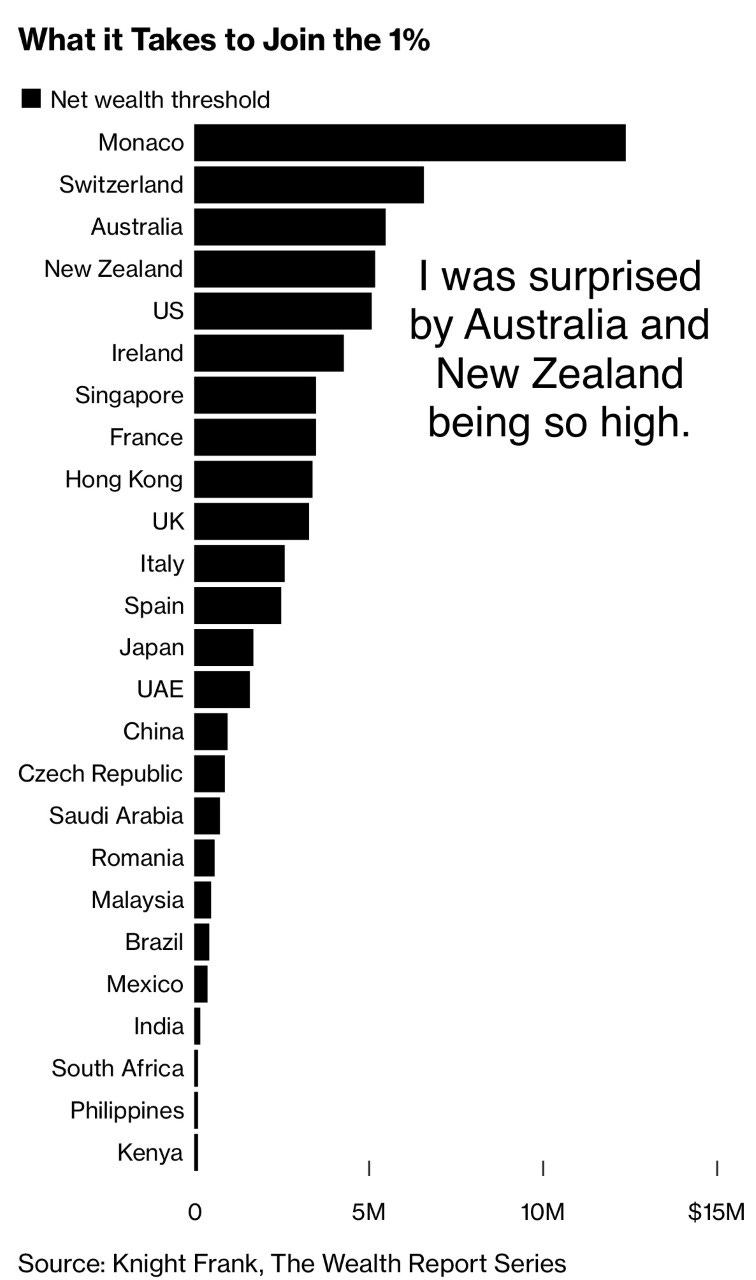

Here’s How Much Wealth You Need to Join the Richest 1% Globally

Real Estate

I found this CNBC article about the best and worst states to retire interesting. They used affordability, quality of life and healthcare to rank the 50 states, and I was a little surprised by some of the findings.

U.S. Apartment Vacancy Hits 2-Year High As Rents Plunge In Sun Belt. The vacancy rate for U.S. apartments hit a two-year high of 6.4% in the first quarter, according to the Redfin report. “The balance of power in the rental market is tipping back in tenants’ favor as supply catches up with demand. That’s easing affordability challenges and giving renters a little wiggle room to negotiate in some areas,” Redfin Deputy Chief Economist Taylor Marr said. Sun Belt markets have continued to weaken from the astronomic rise they saw during the pandemic. Austin and Phoenix were in the top five metro areas with the highest number of multifamily building permits in March. Austin saw the largest decrease in asking rents with a 14.3% drop in April, according to Redfin. Phoenix and Las Vegas came in second and third with rents falling by 9.6% and 7.1%, respectively. This is a positive development as affordability was out of control and there was no inventory. This is a good sign that things are softening and inflation is getting under control.

Venture Capitalist Asks $37.5 Million for Home in One of Miami Beach’s Most Exclusive Enclaves

The Star Island house sits on a roughly 1-acre lot and has 100 feet of water frontage on Biscayne Bay. The house is incredibly ugly and was purchased for $4.65mm in 1999. I assume it would be a teardown and an adjacent 1-acre lot is also for sale. Any big spender want to pay $75mm for 2-acres on Star Island and build a mansion?

In my community, there are now 37 homes for sale and more are “Just Reduced” in price. Remember, in December 2021, there were 4 homes for sale relative to 71 when I bought in May of 2017. Inventory is creeping up and taking longer to move. The home below at 310 E Alexander is under contract, but I do not know the final price yet. It will be interesting to see the clearing price, but heard it is lower than I might have thought. Today, in Royal Palm, a knockdown is $3.2mm on a 12k ft lot. When I moved down, it was $1mm. The highest price home is asking $52mm, and I would guess it is a knockdown on the intracoastal which is worth in the $30mm range. 23 homes are asking $15mm or more. In 2017, one house sold for over $10mm. Prices are up sharply, but clearly cooling down, and those aspirational asking prices just mean the home stays unsold for longer. The price below is the ASKING price, not the final sale price which has not been disclosed.

At Millennium Tower, the San Francisco condo building beset by reports that it is sinking, a penthouse apartment is coming on the market for $14 million. The seller is tech-industry veteran Craig Ramsey, a co-founder of the publicly traded cloud-computing company Veeva Systems and of the software company Vlocity. I would not pay $1.4mm to live in this building in San Fran. The building is sinking and rife with lawsuits. Oh yeah, you need to step over homeless people and home to not get stabbed on your way home as well. The pictures in the link do look nice. The views are AMAZING.