Opening Comments

My last note was about the changing landscape of billionaires since 1982 and the most opened links were UFO story and the Lion King musicians being attacked.

I caught the COVID in NYC. Massive headache, congestion, and severe swelling in my left eye. This could be my most unflattering picture of all time, but of course, I share it with my extra large “friend group.” I had the chills and was sweating but not much of a fever. My body was quite sore, as it felt as though I was in an accident. However, I feel much better now after an uncomfortable 48 hours. I have had zero appetite and have lost 8 pounds since Saturday. No, not Ozempic, the COVID. It seems that COVID is everywhere and many readers are also infected.

While in NYC, I took the subway 5 times and a bus 3 times. I never felt unsafe, but to be fair, my head was on a swivel and my back was always to a wall on the subway platform. I changed subway cars a couple of times as I did not feel comfortable. People smoke weed everywhere and the homeless/immigrant issue seems to get worse. This NBC news article is entitled, “Most people think the U.S. crime rate is rising. They're wrong.” The FBI data, which compares crime rates in the third quarter of 2023 to the same period last year, found that violent crime dropped 8%, while property crime fell 6.3% to what would be its lowest level since 1961. Sadly, it does not feel like it to me when I go to NYC, Chicago or LA. The 2nd chart shows US Census Net Migration by state 4/1/20-7/1/23. Note the biggest winning states and losing states. Given what has gone on in each group, the migration makes perfect sense to me.

On the Rosen Report Jobs front, I have dozens of resumes and a few companies already working with me as well as a good number of summer intern candidates. The website is being built and I am very excited about the progress. I have resumes from CEO, CIO, CFO, analyst, PM and quant candidates. A few job openings are below:

I have a top-notch credit fund looking for junior credit analysts and quants if anyone has an interest. Not only are the positions with an amazing fund, but they are in Florida and it is 80 and sunny now.

A multi-strategy is looking for an investment analyst with experience in oil, gas, industrials, metals, & mining preferred. 2-4 years of experience required. NYC.

I am working on internships with an asset manager in various locations for this summer as well. More to come soon.

If I do a report Sunday it will be a year in review of my favorite pieces from the year. If not, the next report will be in a week or 10 days given the holidays. I will be at Nizuc in Cancun for a few days. If readers are there, you will find me with my Rosen Report hat chasing my kids around. Happy Holidays. Thanks for reading and enjoy the break.

Markets

Israel Market Rally

Boaz Weinstein’s Battle Against Closed-End Funds

Era of Big Taxes is Upon Us

Chapter 11 Bankruptcies Rising/Record # of People Struggling Financially

Wealthy Moving to Florida & Brining Donations With Them

Warehouse Market Slowdown

China R/E Meltdown is Battering Wealth

Picture of the Day-Magnificent 7 vs the Market

Big tech stocks reclaimed their position as the market’s leaders this year. Just how far ahead of the pack have they run? Collectively, the stocks known as the Magnificent Seven— Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta Platforms —have jumped 75% in 2023, leaving the other 493 companies in the S&P 500 in their dust. (Those have risen a more modest 12%, while the index as a whole is up 23%.)

Six Dinners in Three Nights in NYC

Kids, don’t try this at home. I am a professional eater and nearly died consuming too many calories in short order on my trip. There is no sacrifice too great for me to entertain my readers. Although I do not love NYC the way I once did, the food is just too good to deny.

I flew to NYC Thursday morning on the 6 am flight and ate at Roscioli in the Village. It is from Rome and the one in Italy is a showstopper. The restaurant in NYC is worth a go, as the ambiance is amazing and cozy. They have a restaurant and a small store with food for sale as well. The meatballs (beef, veal, pork) over polenta were remarkable with a smoky flavor. I thought the chicken ravioli (waiter recommended) was underwhelming after the meatballs. They have good wine selections by the glass and it would make for a great date night, albeit fully priced. Roscioli also does a tasting menu downstairs but was booked solid. The lower room is equally as impressive as the upstairs in décor and ambiance. From Roscioli, I walked 200 feet to Charlie Bird and again sat at the bar. I would never go back to this restaurant. The Hamachi was very good, but the gnocchi was a 3 out of 10. The service was slow and disappointing. It was overpriced. Note to self, eating meatballs and ravioli followed by gnocchi does not sit well in one’s stomach. The cauliflower with raisins was very good. The volume of food weighed me down. The place I should have gone was King, right next door, which has been getting rave reviews.

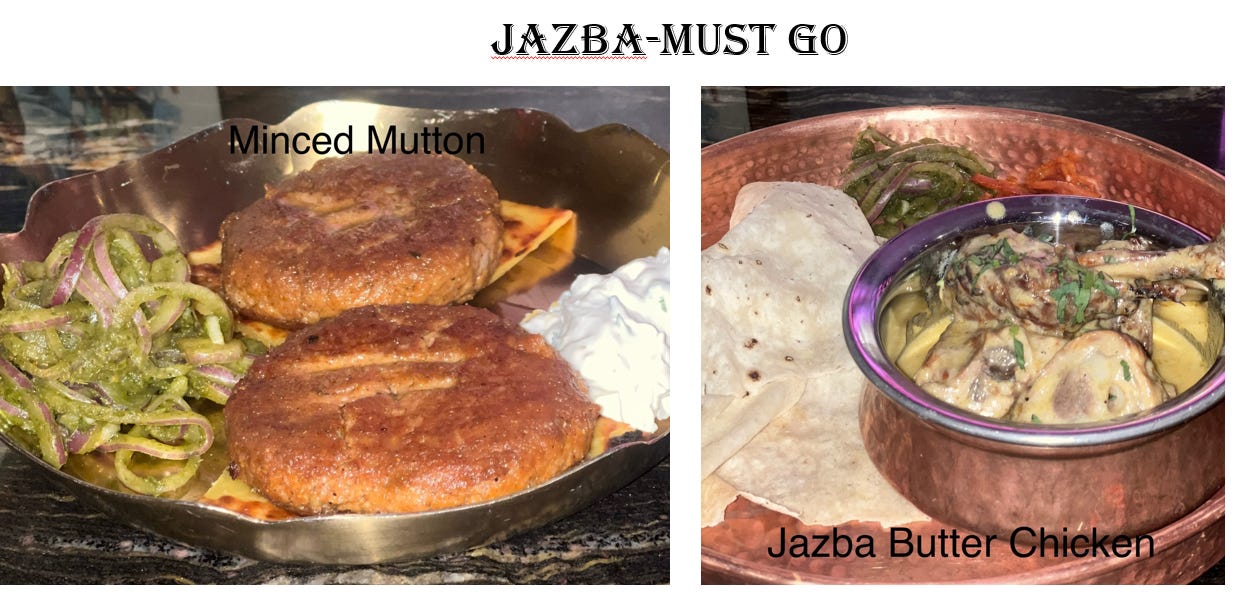

On Friday night, I went to Jazba (Indian) which is owned by Junoon, my favorite Indian in the city. Jazba is in the Lower East Side and the food is OUTSTANDING. The flavors knock your socks off. I had the butter chicken which fell off the bone and was perfect to dip the naan in the sauce. I also tried the minced mutton kabab which impressed me. The prices are reasonable, the service snappy and food is a less expensive version of Junoon. Clearly, my IQ is low. From there, I walked to Milk, directly across the street and bought a small peppermint cookie. I walked another 70 yards to Soothr (Thai for recipe), a popular Thai eatery getting attention from Michelin. The line was out the door. I put my name down and the host told me “45 minute wait.” I was happy to walk around and burn off some of my first dinner. As I was walking away, my phone rang and it was the host telling me there was a seat at the bar. Again, bad idea to go from Indian to a cookie to Thai back to back to back. I started with the Duck Noodles which proved to be an excellent choice. From there, I had the Spare Ribs, which were tender and tasty. But it was another bad idea as they were too heavy after all the food I had eaten. Very young crowd in Soothr. the prices are fair, the service is impressive and they make some fun drinks.

Wait, there is more. On Saturday, I went to Hudson Yards for the 1st time at night and it was pandemonium. The mall was packed. The crowd was a bit Bridge & Tunnel in the mall from my perspective. I sat at the bar at Kamasu and had the 7 piece sushi tasting and a spicy tuna roll. The presentation was beautiful and it was quite good for the price ($68). The wines by the glass were disappointing. I walked a few blocks to Zou Zou (Mediterranean) after the sushi and the place was hopping. Only one seat at the bar. I had the best Fattoush of my life with a beautiful presentation. Then I had the Spiced Beef called, Manti, which also did not disappoint. They have a solid wine selection and every seat in the entire restaurant was taken at 6:45pm on Saturday. Quality Branded owns Quality Italian, Quality Meats and Don Angie as well as Zou Zou.

You must go to Jazba, Soothr, and Zou Zou. I would go back to both Roscioli and Kamasu, but skip Charlie Bird. Please pace yourself and don’t do so much back-to-back eating like I did. Oh, the sacrifices I make for my readers.

Quick Bites

Although Wednesday saw stocks fall by 1.5% (1st decline in 10 days), December and the year have far exceeded expectations. The S&P 500 has risen more than 3% this month and more than 22% year to date, while the Dow has added more than 3% and 12%, respectively. The Nasdaq is up by more than 4% for December and 41% for 2023, putting it on pace for its best year since 2020. However, Fed Ex stock dropped 12% after weaker demand hit the revenue outlook. The VIX is a real-time market index representing the market’s expectations for volatility over the coming 30 days and has been at lows since the pandemic. Today, the VIX is at 13 and was 76 in March of 2020. The December Consumer Confidence survey came in better than expected at 110.7 vs expectations of 104.5. Oil has bounced from low on Read Sea worries, but high production levels in the US are keeping a top on levels now back to $74+/barrel. Bitcoin is back up to $43.5k and is +161% YTD.

The Tel Aviv Stock Exchange is now about the level from Oct 5th. Israeli assets dived when the war erupted. The shekel slumped to its weakest since 2012, bond yields soared and the equity market fell around 15%, with almost $25 billion of value being wiped out. Those assets have recovered since late October, even as the war continues to rage in the Gaza Strip. Israeli markets have also been boosted by a broad rally in global stocks and bonds since the start of November, after the US Federal Reserve gave further indications it was done with raising interest rates. I was with someone from Israel and they were telling me with so many working-age men called for military duty, many businesses are suffering. This article does not give that perspective, nor does this chart.

Interesting WSJ article about Boaz Weinstein’s fight against closed-end funds. To hear Weinstein tell it, his activism in the closed-end fund industry, which spans the better part of a decade, is rooted in its mismanagement. Too often, fund managers are more interested in collecting fees than maximizing returns for shareholders, who mainly consist of retirees and others seeking steady income. “We’re pushing back against grotesque behavior from some in the asset-management industry,” Weinstein, who runs Saba Capital Management, said in an interview. What’s not in dispute is just how much money Weinstein has put on the line in recent months. Nearly 70% of Saba’s $5.6 billion in equity assets were in closed-end fund positions as of December. If activists like Weinstein could erase the discount in every US closed-end fund trading for less than net asset value, investors could earn about $17 billion. “In closed-end fund activism, the medicine of open-ending into a mutual fund or ETF or a tender will collapse the discount every time — and all investors benefit,” Weinstein told Bloomberg.

A different perspective in the WSJ article entitled, “The Era of Big Taxes is Upon Us.” Rich countries are raising more money from taxpayers than they have in decades to finance a burst of state spending as surging interest rates make borrowing less attractive. Tax revenues have risen to record levels as a share of economic output in a number of major economies, including France, Japan and South Korea, according to data published by the Organization for Economic Cooperation and Development, the club of mainly rich countries. In the U.S., tax receipts at all levels of government climbed to nearly 28% of GDP last year, up from 25% in 2019 and the highest level since at least 1965, aside from a brief period of budget consolidation during the Clinton administration. Governments haven’t necessarily raised tax rates. Rather, many are benefiting as high inflation pushes up both prices and wages, propelling taxpayers into higher brackets, a phenomenon known as fiscal drag. Given the fiscal irresponsibility of big government, I will not be surprised to see a tax increase. Clearly, many states are under major pressure with large deficits. (see Other Headlines and NYC)

Chapter 11 bankruptcy filings in the US have skyrocketed since the Fed started raising rates. In November, we saw over 700 Chapter 11 commercial bankruptcy filings, the most since 2018. In recent months, the rate of new bankruptcies has started to accelerate. As we head into 2024, further pressure from high interest rates will spark more bankruptcies. All as consumers continue to take on more debt to "fight" inflation. The third chart shows the percentage of Americans struggling financially and December 2023 saw an all-time high. When all the free money was handed out in 2020, 20% were struggling financially and today it is 44% according to the poll. The last chart shows Biden’s approval ratings at lows and immigration, inflation are atop the list. Also, few Americans say Biden is paying enough attention to their concerns. In another concerning heading, Nearly 9 million student loan borrowers missed their first payment after pandemic pause ended. That equates to 40% of borrowers.

Israel

Correction: In my last piece, I cited a report that suggested that Harvard was limiting Jewish students to be more reflective of the population (1-2%). However, the source has since retracted that statement. At the Rosen Report, we try to correct any errors and this was pointed out by a reader. Thank you.

Fresh Allegations of Plagiarism Unearthed in Official Academic Complaint Against Claudine Gay

Harvard University on Tuesday received a complaint outlining over 40 allegations of plagiarism against its embattled president, Claudine Gay

Roughly half of young Americans say Israel should be “ended and given to Hamas and the Palestinians” amid the ongoing war despite continuing support for the Jewish state among older Americans. While 51% of 18–24-year-olds in the U.S. want Israel to lose to Hamas, that sentiment decreases significantly among the higher age brackets in the monthly Harvard CAPS/Harris poll. 31% of 25–34-year-olds, 24% of 35–44-year-olds, 15% of 45–54-year-olds, 13% of 55–64-year-olds, and only 4% of Americans aged 65 and older say Israel should be wiped out.

Hamas Using Female Suicide Bombers As IDF Closes In On Gaza’s Terrorist Leadership

Doctor who treated freed Hamas hostages describes physical, sexual and psychological abuse

Some of the hostages were branded, but many refuse to call Hamas terrorists.

Nearly half of British Jews considered leaving UK due to antisemitism

John Fetterman rips TikTok over young voters’ ‘warped’ views on Israel-Hamas war

Students rejecting early Harvard acceptance as antisemitism stigma plagues Ivy League institution

I applaud these students as turning down an Ivy is not easy.

The Inconvenient Facts About Antisemitism in the U.S.

Some including the vile person, Susan Sarandon, believe Muslims are disproportionately targeted over Jews in the US. As of 2022, Jews were targeted in hate crimes over 6 times more than Muslims. I can only imagine that the discrepancy is larger in 2023. Susan, Gaza needs you. Will you move there?

Other Headlines

Citigroup to close global distressed-debt business as part of CEO Jane Fraser’s overhaul

I wrote about this frequently. Citi has been a disaster for as long as I can remember. The distressed business was one of my long-time business lines.

Oil major BP becomes latest to pause Red Sea shipments as Houthi attacks continue

Here’s how the Houthi attacks in the Red Sea threaten the global supply chain

Adobe and Figma call off $20 billion merger

Regulatory Hurdles cited.

US Steel, once the world’s largest corporation, agrees to sell itself to a Japanese company

Nikola founder Trevor Milton sentenced to four years in prison for fraud

Wire fraud and securities fraud.

Holiday spending to be up big even as approval of Biden hits new low, CNBC economic survey shows

Donald Trump banned from Colorado ballot in historic ruling by state’s Supreme Court

First time in history Section 3 of the 14th Amendment was used to disqualify a presidential candidate of his role in the events of Jan 6th. The case will be appealed. I have hoped for better candidates than Trump and Biden. However, I am not convinced this is the right way to get it.

CBS News poll: Haley gains on Trump in New Hampshire while he continues to dominate in Iowa

Biden said to be increasingly frustrated by dismal poll numbers

Even Kamala Harris now viewed more favorably than Joe Biden as Dems panic over dismal ‘24 polls

Biden has a 34% approval rating and Harris has a 35% approval. That is a major statement given how poorly Harris is viewed by most voters.

Texas governor signs bill that lets police arrest migrants who enter the US illegally

Ron DeSantis’ super PAC loses its top strategist in latest sign of turmoil

He has crashed hard. I thought he was going to be the Republican candidate.

Adams admits Dems ‘underestimated’ migrant impact, warns of ‘extremely painful’ NYC budget cuts

I called this a year ago. Adams has a 28% approval rating and is scrambling to fill the $12bn hole left due to the migrant crisis. He said, “Everything is on the table.” Austerity measures and Tax increases are the choice.

Biden border crisis shatters record with 14,509 illegal immigrants encountered in one day

We lack the infrastructure and resources to handle the inflows. Major cities’ budgets are imploding due to the immigration crisis.

One-in-Five Mail-In Voters Admit They Cheated in 2020 Election

New York to Consider Reparations for Descendants of Enslaved People

US Military Faces 'Mutiny' Of Enlisted Gen-Zers As TikTok Virus Spreads

I was shocked at how blatant many active military members were on social media. They are aggressively citing the reasons to not join the military (pay, privacy, food, leadership, no sleep…). These people have a lot of followers and it is not helping with recruiting.

Five teens now charged in savage mob beating at Marjory Stoneman Douglas High School

30 minutes from my house and the school that had the mass shooting in 2018. The injured kid in the new attack had a skull fracture. To me, these boys should get long prison sentences.

Tesla drivers had highest accident rate, BMW drivers most DUIs study finds

Interesting that about 90% of the U.S. media is controlled by these six companies

I cannot wait to see this list.

Former CIA agent shares her No. 1 secret to a highly productive and successful week

I never thought about it like Rupal Patel.

Harvard happiness expert: The No. 1 thing to avoid to achieve a ‘real sense of satisfaction’

He is far more successful than I am. I don’t get so upset by the word, “cohort,” but he sure does. He likes to keep it simple. Hard to argue.

‘Tranq tourism’: alarm in Philadelphia as TikTokers travel to film drug users

The article outlines “Tranq” and it is one scary drug.

Saudi Pro League attendance embarrassment continues as just 144 turn up for game

Real Estate

Interesting Fortune/Bloomberg article entitled, “Florida’s Wealth Boom Yields a Windfall for the State’s Charities.” The article outlines people such as Ken Griffin and Orlando Bravo. For Griffin, he gave hundreds of millions to the city of Chicago and now is giving a ton of money to Florida. Bad policies are pushing the wealthiest people out of cities such as NYC, Chicago, San Fran, LA and many others. A good number of them are heading to Florida, Tennessee, Texas, Nevada and Montana. Look at the chart below and the growth in charitable donations of “Give Miami Day.” Griffin gave $130mm to 40 Chicago organizations as he was leaving for Florida. I wonder what his giving will look like in 2023/24.

CRE Daily put out an article, “The US Warehouse Boom is Deflating.” During the last decade, warehouses emerged as highly sought-after assets among investors like Blackstone and Singapore's sovereign-wealth fund GIC. The pandemic further accelerated this trend, as developers rapidly expanded logistics facilities to capitalize on soaring rents and the robust demand from e-commerce giants like Amazon. This led to a widespread transformation of urban and suburban landscapes. However, 2023 has witnessed a dramatic downturn. Industrial property construction starts plummeted by 48% in the first nine months compared to the same period in 2022, the steepest decline since 2009. Similarly, industrial real estate sales fell by 45% in Q3. High debt costs and slowing leasing demand are primarily to blame, with commercial mortgage rates doubling over the past year and land prices not decreasing sufficiently to offset these costs.

Concerning Bloomberg article entitled, “China’s Real Estate Meltdown Is Battering Middle Class Wealth.” At the heart of the decline in family wealth is China’s real estate meltdown, which having a pervasive effect on a society where 70% of family assets are tied up in property. Every 5% decline in home prices will wipe out 19 trillion yuan ($2.7 trillion) in housing wealth, according to Bloomberg Economics. Middle class households are being forced to rethink their money priorities, with some pulling away from investing, or selling assets to free-up liquidity. While China’s official data show just a mild drop in its existing home prices, evidence from property agents and private data providers indicate declines of at least 15% in prime areas in its biggest cities.

© 2023 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #640 ©Copyright 2023 Written By Eric Rosen