Opening Comments

In a recent piece entitled, “Kidney Donation and Perfect Scores May Not Be Enough To Get Into College, I wrote of the challenges of great candidates being rejected from top schools. This does not apply to 16-year-old, Dennis Barnes, who was accepted into Cornell and over 185 other schools. He was awarded over $10mm in scholarships. He graduated with a 4.98 GPA in two years while also attending college and plans to study engineering. Congrats Dennis. VERY impressive.

No internet at my house this afternoon. I am sure I missed something. Only the 10th time we lost internet in two weeks. I love cable companies.

Video of the Day-13-Year-Old Asks Warren Buffett a Good Question

Markets

Senior Loan Officer Survey

Confidence in Powell and Leadership

Irritating Tipping Policies

10 Large Office Loans Coming Due

Eviction Bans

Commercial R/E Broker Performance/NYC Vacancy

Video of the Day-13-Year-Old Asks Warren Buffett a Good Question

Kids today are quite articulate and impressive. This 13-year old kid asked a brilliant question to Buffett and Munger at the annual meeting. The question was basically about massive debt loads in the US and the US Dollar losing reserve currency status. The whole thing is about 5 minutes and worth the watch. I felt the young girl’s question was actually better than the answer which meandered a bit, but he made it clear there is no alternative to the US Dollar today. Good on you Daphne! Also of note, it was her 6th Berkshire Hathaway annual meeting at the ripe old age of 13. On the annual meeting topic, this is a CNBC headline, “The most important thing Warren Buffett said Saturday, and it isn’t good news for the economy.” The “Oracle of Omaha” believes that the “extraordinary period” of excessive spending on the back of Covid pandemic stimulus is over, and now many of his businesses are faced with an inventory build-up.

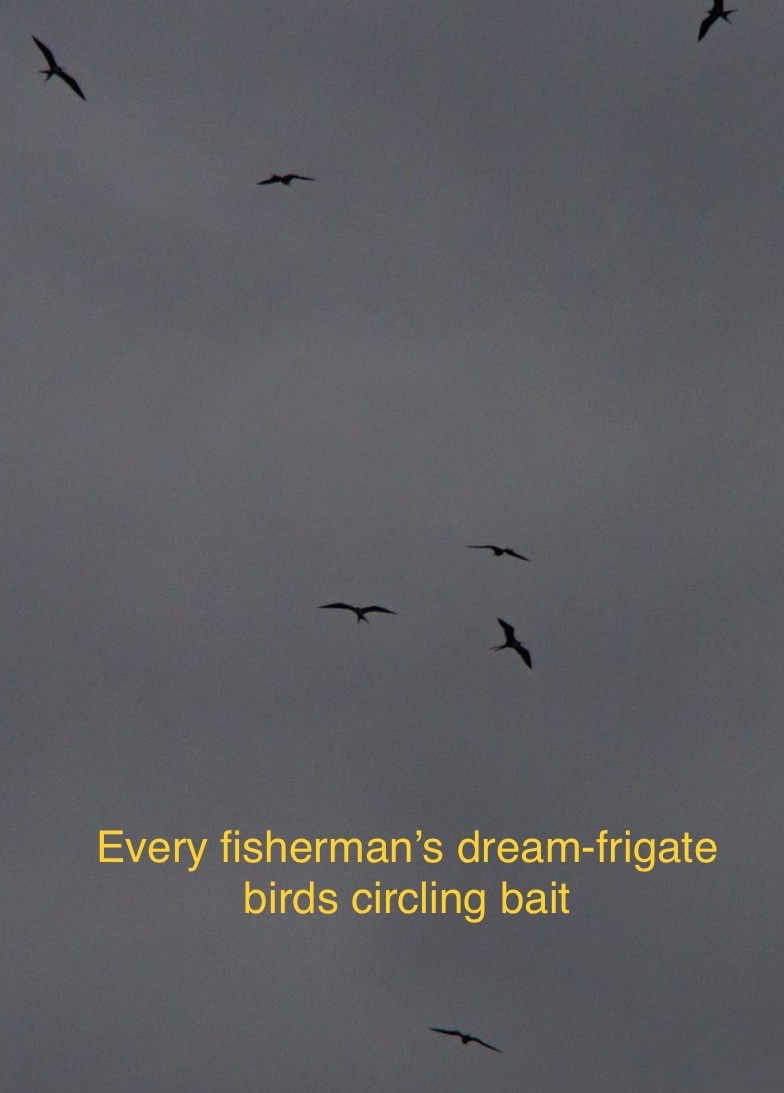

The Sea Explodes in May in South Florida

If you have been a loyal Rosen Report reader, you know that April/May are my favorite months to fish in South Florida. We have distinct fishing seasons with migratory fish that come through our waters. Mid-April-May, we see the end of sailfish and wahoo season and the beginning of mahi, tuna and kingfish season. The beginning of the season brings in the bigger tuna and mahi very close to shore. I have caught them 1/2 mile from the beach this time of the year. The sea is alive with birds, baitfish and large fish all close to shore. Unfortunately, the fish brings out the sharks too.

A few weeks ago, the unseasonably heavy rains CRUSHED the fishing bite. It rained 30” in 24 hours and rained for weeks. The water management teams opened the spillways to let out the freshwater which dumps into the ocean. It turns the beautiful blue water into green or brown, and the best fish will not swim in it. The result was a slow start to my favorite fishing season.

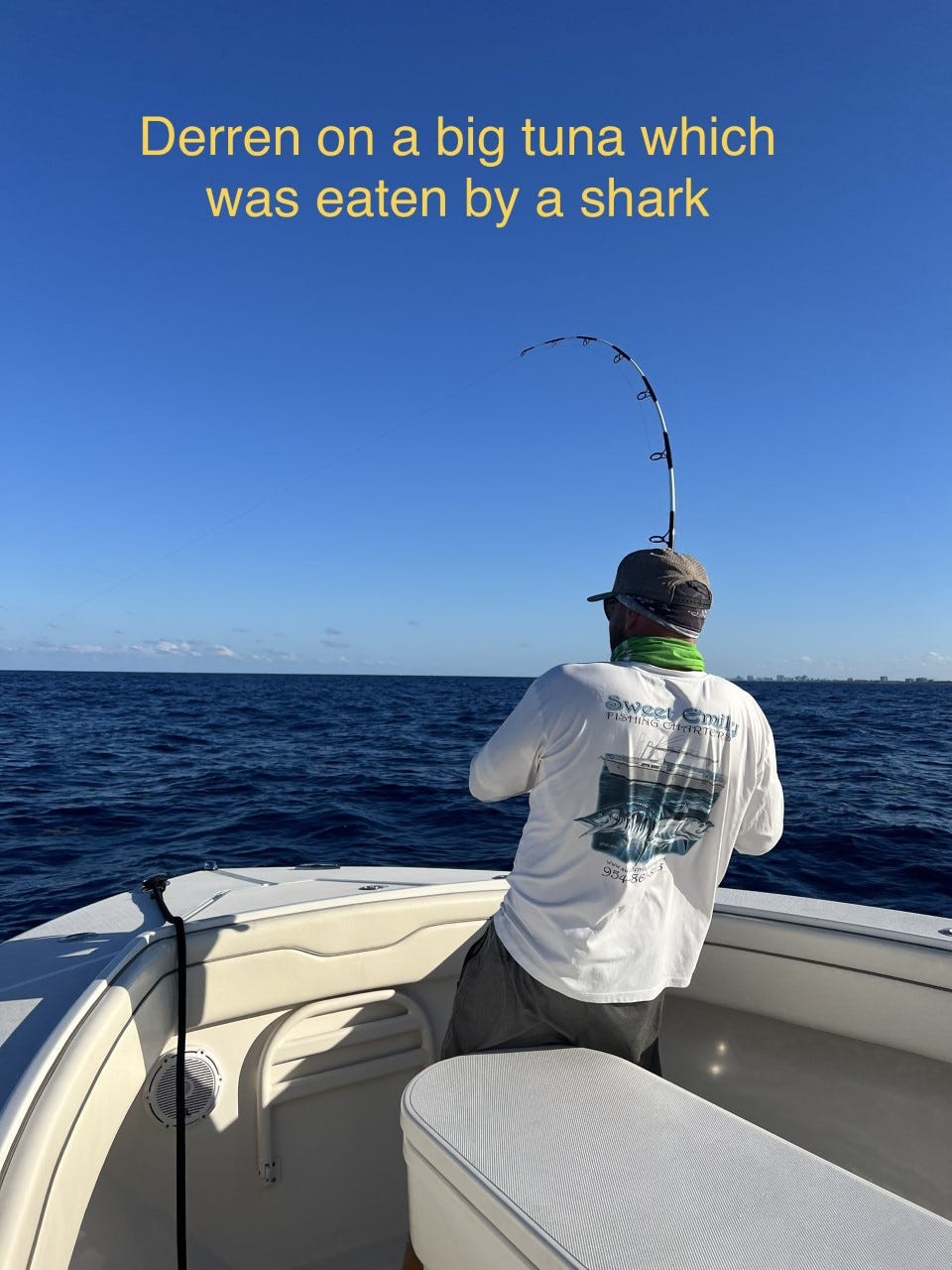

I fished Monday night with my friend, Derren, and the sea was alive. Birds were attacking the bait. Fish were literally jumping out of the water, and there were baitfish everywhere. We fished from 4 pm-7:30 pm, had a ball despite not having any live bait (the best kind), and caught a ton of fish. Unfortunately, May brings out the sharks which were circling the boat. We got hooked up on a solid 35lb tuna and Derren was fighting it given my tendonitis is so bad, I can barely move my left arm. He got it right next to the boat and just as I was going to gaff it, one of the three sharks circling took the tuna! Note how beautiful the blue water looks after the rain stopped for a few days. All the fish shown were caught in the last two years in the month of May right outside the Boca Inlet.

When I went back out Tuesday morning, it was shockingly crowded in the ocean. Despite the number of boats, the fish were still biting, and we caught multiple mutton snapper and kingfish and were cut off about 12 times as well. Again, the birds were diving, fish were jumping and baitfish was everywhere. The ocean is a remarkable place, and I have had countless hours of great memories on it. I have caught some of my best fish in April/May right near my house and have seen beautiful sea life. We saw massive leatherback sea turtles, dolphins, sharks, manatees and amazing sea life in the deep blue waters behind the Boca Resort.

If you call me and I don’t pick up in the next few weeks, chances are I am fishing and enjoying my time on the ocean. Tonight, I will be making fresh Tuna Poke bowls for dinner.

Quick Bites

Inflation rose 4.9% in April from a year ago, less than the 5% expectations. I expect inflation will continue to fall given the pull-back in bank lending (see bullet below) and economic slowdown with the consumer being pinched. The cumulative impact of 10 rate hikes and the end of free money have basically cut inflation in half and believe it will continue to fall. Lower inflation pushed stocks higher Wednesday morning, while Treasury yields fell 8 to 12bps between 2 and 10 years However, stocks reversed gains only to rally into the close. Tech outperformed with the Nasdaq +1%, while the S&P gained .5% and Dow was down slightly. Cyclicals underperformed. Oil dropped to $73 or -1%. Earlier in the day, there was a 100% chance of a 25bp cut prior to year-end, but was unable to check it late in the day. Crypto rallied with BTC and ETH both up less than 1%.

Peter Boockvar put this note out on May 8th, and I agree with it 100% around the Senior Loan Officer Survey from the Fed. This is the link to the CNBC story on the topic. I have been discussing banks tightening lending standards and the impact on the economy for the past couple months. According to the Fed, “Respondent banks received the survey on March 27, 2023, and responses were due by April 7, 2023.” Given the stock carnage in Regional Bank stocks in the past month, do you think standards have tightened more? I do. This will have a big impact on the economy. Check out Ziprecruiter CEO comments last night: "On conversations with our customers, we see employers paring back their hiring in response to the uncertain economic backdrop we now face. Because of these trends which are unlike anything we've seen in our 13 years of doing business, we are not providing full-year revenue guidance."

On top of already much tighter standards, “banks reported expecting to tighten standards across all loan categories. Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and in customers’ collateral values, a reduction in risk tolerance, and concerns about bank funding costs, bank liquidity position, and deposit outflows as reasons for expecting to tighten lending standards over the rest of 2023.” My bottom line, in this debate of recession or no recession, I just don’t see how it’s possible, especially post SVB, that we avoid a recession in response to the interest rate shock therapy we have been treated with. Here are some comments from it and then I’ll include some specifics:

“Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for C&I loans to large and medium market firms as well as small firms over the first quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate loan categories.”

Percent of respondents with tighter standards to medium and large businesses: 46% vs 44.8% in January. For reference and I won’t include Covid, it peaked at 59.6% in early 2000’s recession and at 83.6% in October ’08 right after the Lehman downfall.

Percent of respondents with tighter standards to small businesses: 46.7% vs 43.8% in January. It peaked at 45.5% in early 2000’s recession and at 74.5% in October 2008.

Percent of respondents reporting stronger demand for loans from small co’s: -53.3% vs -42.2%. it bottomed at -50% in October 2001 and -63.5% in April 2009.

"Over the first quarter, major net shares of banks reported tightening standards for all types of CRE loans. Such tightening was more widely reported by mid-sized banks than by either the largest or other banks.

“For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than GSE eligible and government residential mortgages, which remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards.”

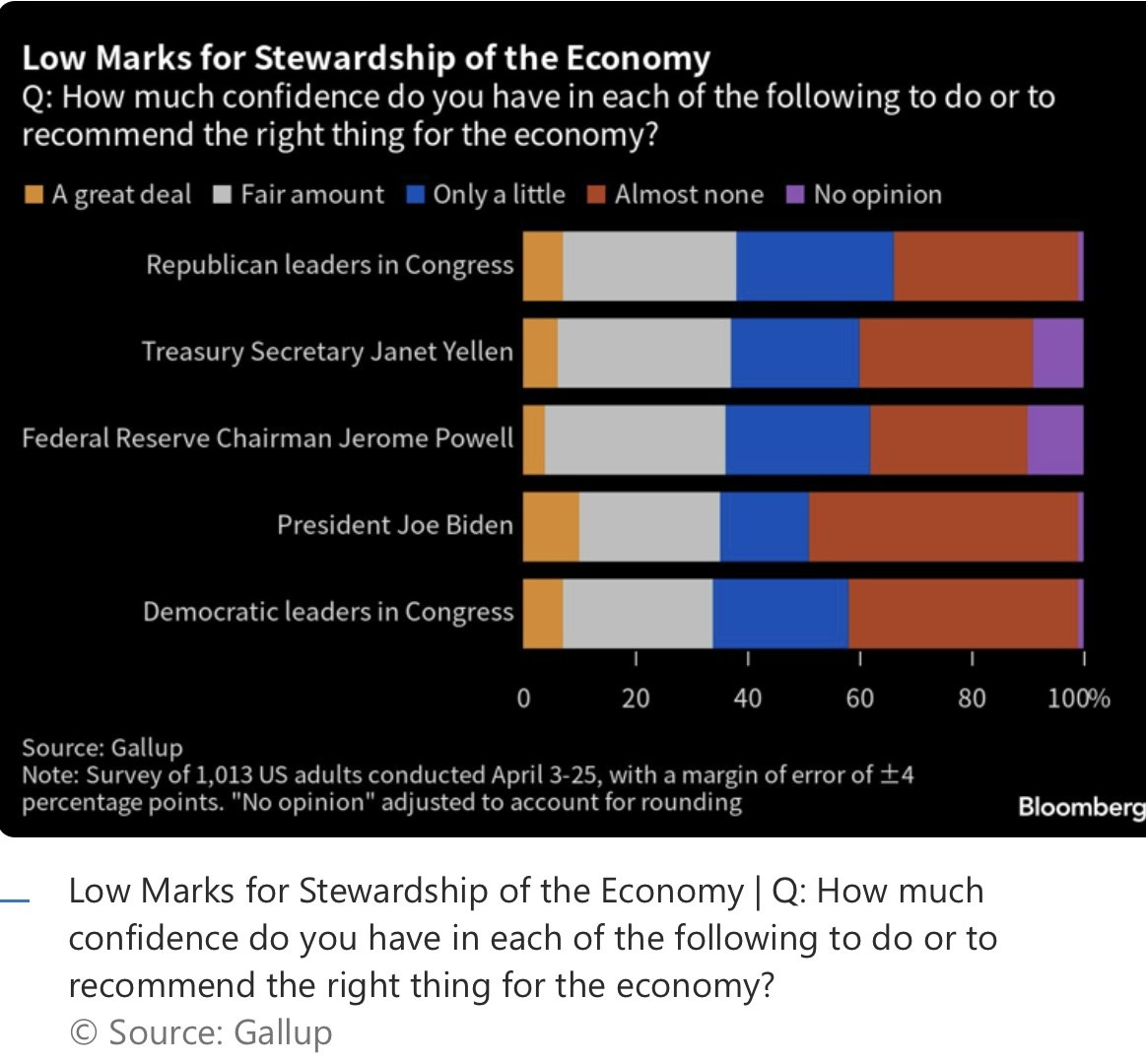

I have been critical of leadership in the US for many years. It seems despite being the greatest country in the world, we attract clown shows into politics, the Fed, the NIH and other leadership rolls. Trump followed by Biden was one hell of a one-two punch in the gut and now they are both front runners again despite their being elderly and their awful ways. This article from Bloomberg is entitled, “Jerome Powell Faces Lowest Public Confidence for Fed Chairman on Record, Gallup Says.” You know I have eviscerated Powell and believe his inflation call and policy decision to keep rates low and QE on for too long were among the WORST POLICY decision in FED HISTORY. That is a big statement given the mistakes of Greenspan, Bernanke, Yellen and many others. Powell is not alone in low marks. Check out Congress, Biden, Yellen… How in the hell do people like AOC, Amar, Tlaib, Greene, Feinstein, Gaetz, Gosar, Boebert, Santos (Charged by Justice Department and pled not guilty to money laundering and wire fraud)…. get elected? As Americans, we deserve better, and it is incumbent on us to vote for the best candidate regardless of party. If I were President, my first order of business would be to fire Powell; it seems most others agree.

I grew up being a busboy, waiter, pizza delivery, and valet parking cars. All of these jobs are reliant on tips from patrons, as the base pay was quite low. I was upset when I felt I went out of my way to provide good service and I was stiffed or given a di minimis tip. I believe in tipping and as my father-in-law liked to say, “You are not going to go broke by being a good tipper.” However, I am growing frustrated with the shaming of tipping at every turn. This WSJ article is entitled, “Tipping at Self-Checkout Has Customers Crying ‘Emotional Blackmail.’ Prompts to leave 20% at self-checkout machines at airports, stadiums, cookie shops, and cafes across the country are rankling consumers already inundated by the proliferation of tip screens. Business owners say the automated cues can significantly increase gratuities and boost staff pay. But the unmanned prompts are leading more customers to question what, exactly, the tips are for. When Julia and I went skiing in Utah in March, I bought a Gatorade on the mountain. I got it myself and checked myself out and there was a woman there who said, “You need to put in the tip.” Tip for what? I got it myself and just paid $7 for a Gatorade. You just marked up this Gatorade 1,000% and want a tip on top of it? Who am I tipping? This is happening far more frequently and the way the cashier turns the screen to you for a tip is offensive to me, and I go out of my way to tip people. What do you think?

Other Headlines

Worst Isn’t Over for US Stock Market, JPMorgan’s Marko Kolanovic Warns

“What equity and more broadly risk markets refuse to acknowledge is that if rate cuts happen this year, it will either be because of the onset of a recession or a significant crisis in financial markets,” Kolanovic wrote in a note to clients Monday. “We never had a sustained rally before the Fed has even stopped hiking, nor before the recession started,” he said.

Yellen warns of ‘economic chaos’ unless Congress raises the debt ceiling

I will only say this with confidence on the matter. IF there were to be a default by the US Government, there would be secondary and tertiary consequences that I am yet to consider and believe they would be bad. On August 8, 2011, the Wilshire Index fell 7% on the day on the heels of the S&P downgrade. Yes, we need to be more fiscally responsible and both sides need to come to a conclusion fast. The spending is unsustainable and read prior Rosen Reports to get the details and charts explaining my concerns. The closer we get to the date, the more damage is done. Debt Ceiling discussions appear to have stalled, but talks continue.

AI could replace 80% of jobs 'in next few years': expert

I will take the under on 80%, but do believe over the next 3-7years, it will prove to be incredibly disruptive and cost many millions of jobs.

Here’s everything Google just announced: A $1,799 folding phone, A.I. in Search and more

Palantir soars on earnings beat and prediction of full-year profitability

Airbnb drops 10% after earnings report offers cautious outlook for second quarter

Carl Icahn’s company stock falls as much as 20% after prosecutors seek financial information

Carl, you own almost all the stock. Just buy it back and take it private if the Hindenburg report is off base.

Senate Judiciary chair says ‘everything is on the table’ in response to Clarence Thomas revelations

The SCOTUS has had blunder after blunder-leaks, death threats, allegations against Justice Thomas, and Justice Sotomayor…

It is time to bow out of the race. You have enough on your plate with lawsuits and cannot be any less Presidential. I hope the party moves on from you.

Videotape of the Trump deposition due to the rape case

Watch this 4-minute excerpt. Trump claims he was not attracted to his accuser and then confuses her with his ex-wife (Marla Maples) in an old picture. His commentary is just awful.

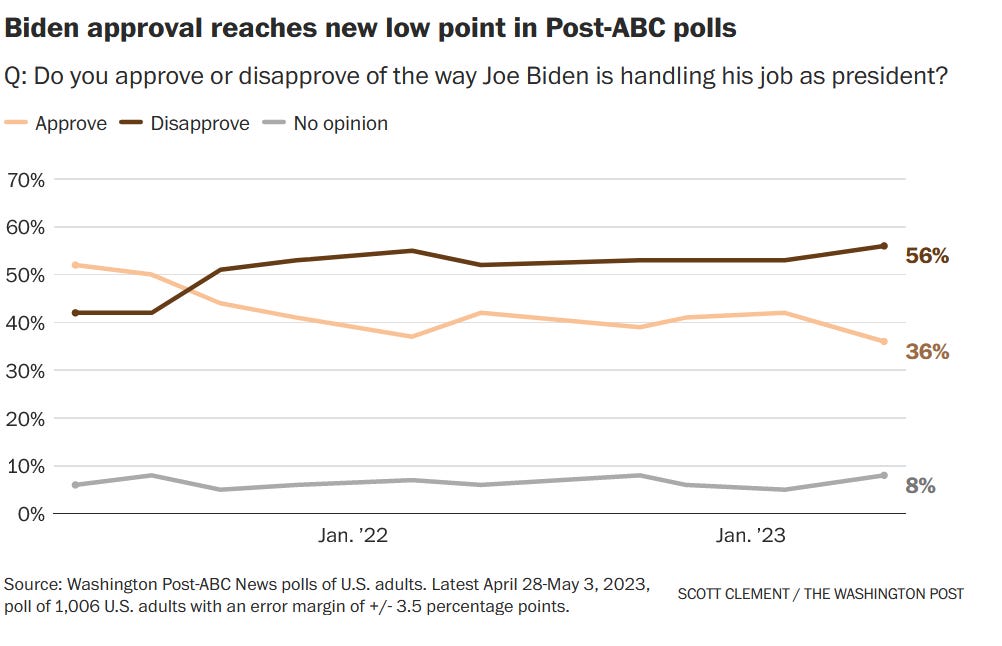

Biden faces broad negative ratings at start of campaign, Post-ABC poll finds

His overall approval ratings have slipped to a new low, more Americans than not doubt his mental acuity, and his support against leading Republican challengers is far shakier than at this point four years ago. This is an ABC/WaPo poll and a WaPo article. As Americans, we MUST demand better than a cognitively impaired Biden or Clown show Trump. Biden would be 86 in office if re-elected and Trump would be 82. The head-to-head polls have Trump and DeSantis each ahead of Biden. These #s are worse for Biden then Trump’s during the same period in their Presidency.

George Stephanopoulos admits new 2024 poll 'just brutal for President

Biden'Former DNC Chairwoman Donna Brazile said the 'sobering' new 2024 poll proves Biden's coalition is 'fragmented.' Need new candidates from both parties.

Biden accuser Tara Reade posts cryptic message about death before potentially testifying to Congress

Remember, Reade accused then-Senator Biden of sexual assault 30 years ago.

Biden family received millions from foreign nationals, tried to conceal source of funds

I would like to see all the proof and believe there should be a serious investigation into these allegations. Bank records are scheduled to be released tomorrow.

‘Really weak option’: Wall Street sours on DeSantis as Trump challenger

DeSantis was flying high post the decisive win last November but since, he has made critical mistakes which is clearly costing him support.

Tucker Carlson to host Twitter show after being fired from Fox News

Elon Musk Pitches Twitter Show To Don Lemon—After Tucker Carlson Launches Own Show On Platform

It would be great to have diversity on a media platform.

Elon Musk: Twitter to launch encrypted direct messages, video chat

Remember, must went from 7,500 employees to 1,000 (-80%), yet is able to innovate. What does that tell you about corporate America and bloated staffing? I think corporate America will continue to do more with less over the next 5 years and AI is only one factor. Bloated payrolls and inefficiency will need to end during an economic slowdown.

Florida bill banning Chinese citizens from buying land passes, moves to Gov. DeSantis

I applaud this decision. Americans can’t buy land or own companies outright in China. Why should we allow them to do it? I wrote about the massive tract of land owned by a PLA general (Sun Guangxin) which is next to a US Airforce base. What could possibly go wrong? Watch this 3-minute video excerpt from a panel I moderated in February on this topic with Kyle Bass. Fascinating and concerning.

Why aren’t people riding BART? Hint: It’s not remote work.

Only 17% of BART riders feel safe. I guess SF woke policies are contributing to the decay of the once great city. Office buildings are empty, retailers are shutting doors, major grocery chains are leaving and the wealth is heading to less woke cities in NV, TX, FL…

California reparations panel OKs state apology, payments

Some estimates from economists have projected that the state could owe upwards of $800 billion, or more than 2.5 times its annual budget, in reparations to Black people. One question? Where is the money going to come from even if the number is 1/4 of the suggested amount in the article? The annual CA budget is $300bn for perspective.

‘Most hippie’ town in Washington outlaws drugs after ODs in streets, fentanyl death of 5-year-old

City officials approved an ordinance on April 10, making it a crime to “inject, ingest or inhale” hard drugs in public— a departure from the state’s law passed two years ago that did the opposite and decriminalized drug possession. . Allowing people to shoot up in the streets turned out to be a bad idea? Who would have thunk it? Under new laws, people will be arrested, but only face misdemeanor charges on hard drugs including meth and fentanyl.

US passes 200 mass shootings this year

We can do better than this. Kids are getting shot at school, in the mall, at the movie theater, walking down the street.

He rapped ‘Murder on My Mind.’ Now, jury will decide if he’s behind a double homicide

Lines Stretch Down the Block at Food Banks as Costs Go Up and Pandemic Aid Expires

Israel readies ‘kosher electricity’ for ultra-Orthodox households

I like the advice, but take the last one a step further and do it handwritten.

The Best Bar in North America Is Double Chicken Please in New York City

This place looks amazing and can’t wait to try it this summer. This is the Double Chicken Please website. Looks like there is some construction being done this month, but hope to check it out in June. The Lower East Side of Manhattan has some hip spots and this sure looks like one of them. Check out the names on the drinks.

An unusual Kansas DUI traffic stop: ‘Sometimes you see things you can’t believe!’

A DUI is no laughing matter, but “Come on, man.” As an aside, the Bud Light sales drop is accelerating. I have been critical of the campaign because the company clearly does not understand the core customer.

Hilton Hotel manager arrested for waking up guest by sucking on his toes

What the hell is wrong with people?

The Most Exciting Young Athlete on Earth Isn’t Playing in America

I had never heard of Erling Haaland, the 6’4” soccer player. Last week, Haaland scored his 35th goal in his 32nd Premier League game, breaking the 31-year-old league’s record with four games still left to play.

Ukraine war: 'Mad panic' as Russia evacuates town near Zaporizhzhia plant

Real Estate

This Business Insider article is entitled, “10 offices’ big loans due soon stoke fears of defaults, banking crisis.” According to the article, $80bn of office loans come due this year and outlines high-profile borrowers who have recently walked away from big loans (Blackstone & Brookfield) were mentioned. The article also outlines $270bn in commercial R/E debt coming due this year and will face higher rates and tighter lending standards, and in many cases, lower valuations. The 10 buildings listed in the article with debt coming due:

Bad policies impact investors’ willingness to play in markets. If you look at the rent stabilization policy changes from 2019 in NYC, they have crushed landlords and tenants alike by not rewarding reinvestment in buildings. The new rules do not allow a landlord to recoup the cost of fixing the apartment in future rent increases. What happens? Apartments are in disrepair and tenants are harmed due to the moronic policy. In CA, eviction bans remain more than three years into the pandemic according to the WSJ article. If you own an apartment building or home and rent units but cannot evict due to lack of monthly rent payments by the tenant, how do you make your mortgage and tax payments? Again, an idiotic policy. I would not consider investing in rental apartments in CA or NY for these reasons. Unpaid back rent across greater Los Angeles could exceed $1 billion, according to estimates from research group National Equity Atlas, which based the figures on Census surveys. My investing is focused on Florida with far more sane rent laws and rules.

I found this on CRE Daily and it shows how commercial R/E brokers are hurting. During Q1 earnings calls of the nation's top commercial real estate brokerages, "challenging" was the buzzword. 5 out of 6 firms reported net losses due to steep declines in transactions and leasing, as well as economic uncertainty.

Slower sales transactions: In 1Q123, firms reported an average YoY revenue decline of 40–50% due to concerns regarding the stability of the banking system and other economic challenges. The volume of transactions across all property types has declined by 56%, and the leasing activity decreases as the first quarter of the year progresses. The market has observed a 56% decline in transaction volumes across all property types. Lower transaction volumes: Lower transaction volumes are expected for the rest of the year due to higher interest rates and difficult debt markets. Colliers, based in Toronto, cut its earnings expectations for the year due to the slow recovery of capital markets transactions and real estate sales. CBRE noted a more than 43% decline in combined capital markets, property sales, and loan origination. CBRE also expects property sales to fall by almost 20% and leasing activity to decrease by "high-single digits." This NYTimes article is entitled, “26 Empire State Buildings Could Fit Into New York’s Empty Office Space. That’s a Sign.” Such vacancy is clearly contributing to the weakness in CRE brokers.