Opening Comments

My salacious picture resulted in a few more sign-ups, but yet again the results were anemic at best. I am looking to grow the Rosen Report, but have been struggling to find parabolic growth. My open rate for Brace Yourself was 62%, the lowest I have had in over a year, despite the fact that readers found it incredibly amusing and sent me many emails complaining about recent experience with braces. Today’s piece is quite embarrassing for me to share with my readers.

I spoke with a restaurateur who told me the cost of ingredients are up 40-60%, which is why he continues to raise prices. His staff costs have risen 40% or more, and he is struggling to find help. He continues to raise prices to offset costs, but it is becoming increasingly difficult. I just get so frustrated when I go out to dinner given how expensive it is, and down here, you generally leave disappointed given the culinary wasteland of Boca Raton. Check out this story about large pay increases at the Hard Rock Casino. Union Boss Deems Hard Rock’s $100m National Salary Scale Raise a “Great Move,” Starting salaries from $18-21/hr or 2.5 times the federal minimum wage. Think of the impact on the competitors in the fight for talent.

This is one hell of a scary 4 minute video about a police officer exposed to fentanyl. To me, anyone caught dealing this should have life in prison without parole. The officer found fentanyl in a car and he inhaled it and almost died. All on video.

Picture of the Day-Stone of Scone

There are Idiots, Morons, Imbeciles and The Author of the Rosen Report

Quick Bites

Markets

CPI Disappoints

Market Views from Major Banks

Cost of College

NYC Homeless Spend vs Students-SHOCKING

Other Headlines

Crime Headlines

Virus/Vaccine

Real Estate

General Comments-Florida with Pictures

Fortune on US R/E Markets

Bloomberg on Global R/E Market Declines

Other Headlines

Picture of the Day-Stone of Scone

I must admit I had never heard of the Stone of Scone which is also known as the Stone of Destiny until reading it in the news this week. The pinkish sandstone weighs 336lbs and is a historic symbol of Scotland’s monarchy that has been used in the inauguration of Scottish kings for centuries. In 1296, the then king of England, Edward I, had it removed from Scotland, and it was built into a new thrown at Westminster Abbey in London only to be returned in 1996. The stone will be used in King Charles III inauguration and was last used in 1953 for the crowing of Queen Elizabeth II. The links included also give a history of the stone. I just find it fascinating with respect to the history of the stone.

There are Idiots, Morons, Imbeciles and The Author of the Rosen Report

I contemplated if I should write about this incident, given how utterly embarrassing it was, but felt my readers needed to hear the truth from me. I hear so many positive comments from my readers who are impressed with my ability to find, digest, interpret so much information on a daily basis and suggest my IQ is high. I appreciate the vote of confidence, but mark my words, I am an IDIOt, moRON, imBECILE. When you read the story and see the pictures you will understand the depths of my stupidity. I have come up with a new word to describe myself and it is an IDIORONBECILE. It combines the words above as using just one of those words is unfair to the word and others who identify as such.

I recently wrote that I bought a 1971 Oldsmobile 442 convertible. I had it shipped from Arkansas and got the new plates last Thursday. I was having trouble starting the car and bought starter fluid. Note to self, I should never try to fix anything. I sprayed the fluid and the car started. I thought I closed the hood as it looked and sounded sealed tight. I was so excited to be driving the car to get high octane gas (1 mile from my home) on US1 and the hood FLEW OFF THE CAR. For those who watch the Matrix, the hood flew over my head in slow motion which seemed to take minutes to fly over the car and crash on the road behind me. I could have been badly hurt and could have killed someone behind me. Thankfully, neither happened. Mind you, I had the car for 24 hours, and it was my FIRST TIME DRIVING IT. The fact that the hood was made from fiberglass, not metal, saved me. It would have flown through the windshield if it weighed more.

How did this happen? I forgot there are locks on the hood. The hood does not just close and lock on its own like most cars. It closes and you MUST MANUALLY LOCK IT with the small silver locks on hood (2nd picture below). You seriously cannot make this up. I cannot be more upset at myself. The only silver lining is no one was injured, as this could have been a catastrophic accident. If you look at the pictures, I broke the metal holders for the hood. The hood is trashed. Yes, I am an IDIORONBECILE. I am so embarrassed by what happened, I almost did not write about the incident. I will need a new hood and am contemplating making the old one art to hang on my wall to go with my John Chamberlain wall sculpture (old car parts).

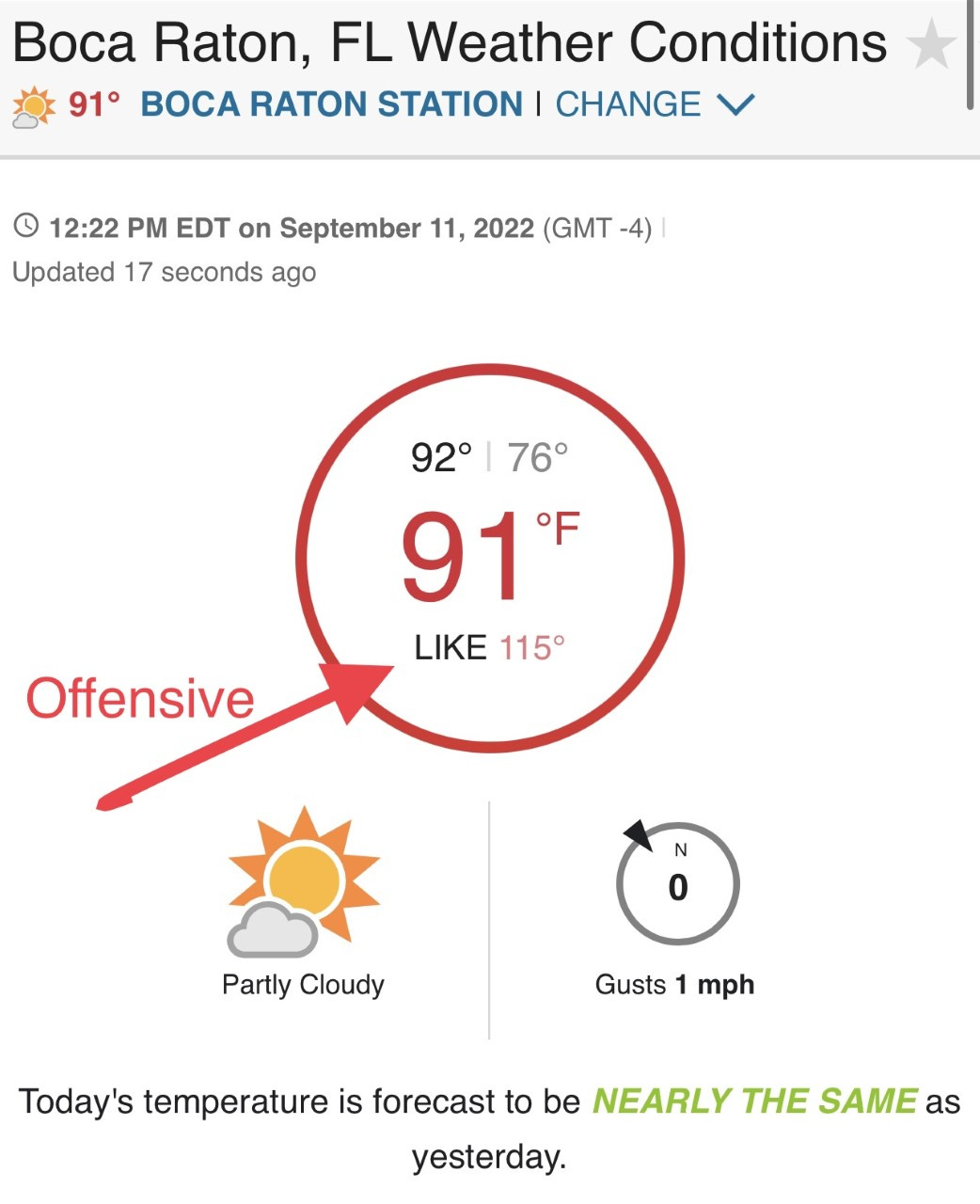

If you need further proof of my IDIORONBECILE ways, check out this picture. I wanted to take a tennis lesson, and they were booked in the morning. The only time which was available was the afternoon. How bad could it possibly be? I took the afternoon time and I lasted 54 minutes with the last 15 minutes barely moving. I looked like death for one hour afterwards. If there is any doubt about the depths of my IDIORONBECILE ways, these two stories should seal it.

Quick Bites

After a multi-day winning streak, stocks crashed on Tuesday post the higher than expected inflation/CPI data (see next bullet which discusses rates as well). The Dow fell -1,276 points or 3.94%, S&P-177 points or 4.32% and Nasdaq dropped 633 points or -5.2%. On Tuesday, tech under performed with NVIDIA -9.5%, META -9.5%, Western Digital -9.1%, Toast-8.9%, Spotify -8.3%, NXP Semi -8.1%, NFLX -7.8%, ADM -7.6%, Docusign -7.2%, AMZN -7.1% and the list goes on. 12-month losers, high short interest names and unprofitable tech were down ~6%. Year to Date, only Energy and Utilities are up for the S&P sector performance with all other sectors down 4 to almost 30%. This is a good link to sector/industry performance compiled by Fidelity. Wednesday stocks were largely flat/up slightly and as of the close YTD index performance as follow: Dow-14.7%, S&P-17.6%, Nasdaq-25.5%. I wrote a few weeks ago I was not constructive on stocks, but I personally feel this move was a bit of an overreaction on Tuesday. I do fear the Fed gets it wrong by raising too much, but I continue to believe inflation has peaked and rate increases take time to get through the system. The HYG High Yield Bond ETF fell 2.3% on Tuesday (-15.4% YTD) which is a big move lower and was hit by both spread and rates, but the JPM HY index fell by 1% on the day. Crypto was hit hard as well with BTC -9.5% and ETH -6.7% on the day. The 1st chart below is sector performance with the two boxes being Tuesday and then Year to Date.

Inflation rose more than expected in August even as gas prices helped give consumers a little bit of a break, the Bureau of Labor Statistics reported Tuesday. The consumer price index, which tracks a broad swath of goods and services, increased 0.1% for the month and 8.3% over the past year. Excluding volatile food and energy costs, CPI rose 0.6% from July and 6.3% from the same month in 2021. Economists had been expecting headline inflation to fall 0.1% and core to increase 0.3%, according to Dow Jones estimates. The respective year-over-year estimates were for 8% and 6% gains. Energy prices fell 5% for the month, led by a 10.6% slide in the gasoline index. However, those declines were offset by increases elsewhere. This upside surprise does not change my view that inflation has peaked. I am not convinced inflation crashes as some market indicators suggest, but that it peaked. Clearly, food, rent, healthcare and wages are an issue, but most everything else is falling in price, and I expect the housing market price declines to increase. This CPI print does put pressure on the Fed to go 75bps, but the Fed and Biden Administration need to take blame for over stimulating the economy. On the heels of CPI print, futures went to 100% chance of a 75bps hike and an 33% chance of a 100bp hike. Additionally as of Tuesday am post CPI, the combined hike over the next two meetings (Sep 21st and Nov 2nd) saw odds of just 12% of a combined 150 bp hike (back to back 75bp hikes OR 100 bp then 50 bps) - those odds are now 72% of a combined 150bps over the next two meetings. The 2-year Treasury sold off 22bps and was at 3.79% on Tuesday before settling at 3.76% (highest level since 2007). For perspective, one year ago, the 2-year Treasury yield was 21 basis points! I am concerned along with Jeff Gundlach that the Fed moves too far in the wrong direction again. Eurodollar futures have a 45 bps CUT priced in right now which is a bit concerning. Wednesday, the PPI came out and fell .1%.

This bullet has three articles with market views from Credit Suisse, JPM and Bank of America. CS writes that inflation “collapse” will spark big market gains. In summary, crashing inflation will lead to a less Hawkish Fed which will drive stocks higher. JPM believes a soft landing is the most likely scenario which will prove to be a tailwind for stocks. Also cited are investor positioning and economic data to drive up stocks. Bank of America wrote about investors fleeing equities with a record 52% underweight stocks with 62% overweight cash. BOA continues that concerns over the economy and earnings deterioration are things to consider as well. The BOA strategist believes in a short term rally followed by another decline. The high cash positions cited by BOA are quite bullish. Of note, these articles were prior to the CPI print on Tuesday am.

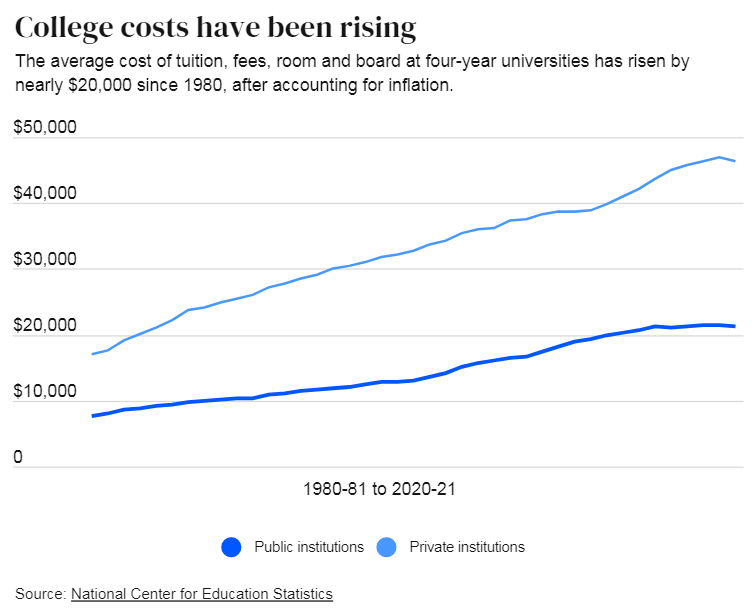

The cost of higher education is climbing upward, and attending one of the top schools in the country comes with a price tag to match: Nineteen of the top 20 national universities cost $55,000 or more for a year’s tuition and fees. The ranking comes from US News & World Report, which published its list of the top colleges for the 2022-2023 school year on Monday. Of the top schools, Yale is the most expensive with a year’s tuition costing $62,250, not counting room and board. I struggle with the costs of traditional four-year programs for a large portion of kids going off to college. I am not convinced it is the right choice economically. More should attend vocational programs and graduate debt-free and earn more quickly. I know a New York University student who pays over $7k/month in rent on top of tuition of $60k and don’t forget Uber and food. Sorry, not convinced an education is worth over $600k. A different article on public vs private college costs is seen below in a chart.

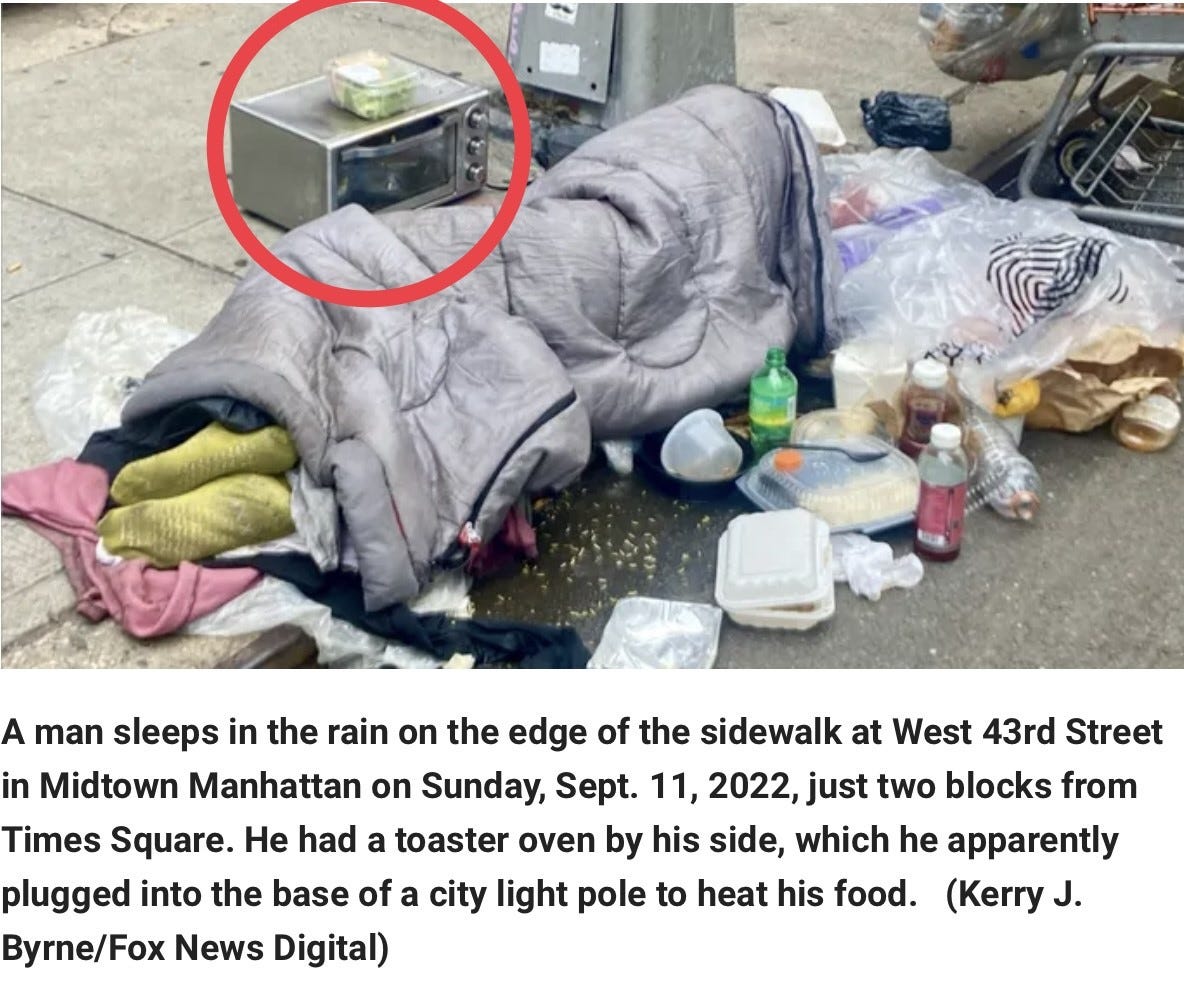

This was a late edition that I could not pass on which discuses NYC and the homeless issue. "It just keeps getting worse," Sal "Sinatra" Salomon, a New York City singer, actor and advocate for the homeless, said. This statement was shocking to me: “NYC spends about $43,750 per year per homeless person — 50% more than it spends on each schoolchild.” New York City’s homeless population has surged to 80,000 people, according to the Bowery Mission, a 150-year-old agency serving the hungry and homeless. Inflation is contributing to more homeless according to the article. I was surprised by the spend vs public school students and researched to find this article which suggest in 2021, $30,000 was spent per student which roughly coincides with the article. In 2020, the article suggests $3.5bn was spent on homeless in NYC.

Other Headlines

China's economy is slowing, its population aging. That could make it dangerous

The stats in this piece are stunning. Here is one: The United Nations projects that China’s population will shrink roughly 40% by the end of the century, from 1.4 billion to a mere 800 million or so.

German Investor Confidence Falls Further as Winter Energy Crisis Nears

I fear this winter will be a disaster in Europe.

From carmakers to refiners, industries brace for rail strike

This could cause a short term supply shock and impact prices.

No end in sight for Wall Street deals slump as JPMorgan says advisory revenue plunges 50%

JPM is not alone. Layoffs coming and lower bonuses. What does that do to housing prices and office rents?

Elon Musk has gone from worrying about inflation to worrying about the opposite awfully fast

Musk is now concerned about deflation.

Goldman's (GS) Apple Card business has a surprising subprime problem

Something to watch in terms of delinquencies. I was surprised to read that GS losses on cards was “well above subprime lenders” at 2.93%.

Nearly 1,300 New York Times workers pledge not to return to office

Goldman Sachs Prepares for Layoffs as Deal-Making Slows and this article suggests hundreds of GS job cuts this month

Given the massive hiring in 2020/21, I expect to see thousands of layoffs from major banks/investment banks. I also expect a challenging bonus year for funds and banks. What does this do to NYC and Hamptons R/E?

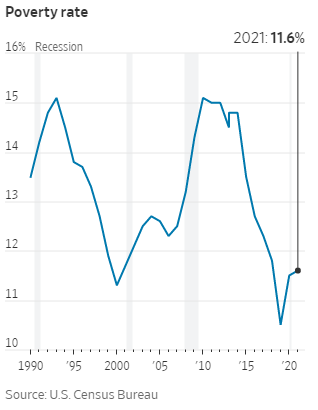

U.S. Incomes Fail to Grow for Second Year in a Row, Census Figures Show

Households facing highest inflation in decades recorded median 2021 income of $70,800. Great interactive chart in the WSJ article on inflation to see price changes over the past 12 months.

97 Members of Congress Reported Trades in Companies Influenced by Their Committees

Kamala Harris insists border ‘secure’ as illegal migrants set to pass 2M

I have been critical of the Biden Administration’s handling of the border, and Kamala is “in charge” of it. Her answers to the questions are embarrassing and liberal personality, Chuck Todd on Meet the Press took issue as well.

Iran says it has developed drone 'designed to hit Israel's Tel Aviv, Haifa'

Iranian leaders are bad actors. Why the US does any reasonable deals with these terrorists is beyond me. Look at the details of the Obama/Iran deal and you must question how we got here.

I talked to 70 parents of highly successful adults—here are 5 phrases they always said to their kids

NBA suspends Suns owner Robert Sarver for a year over workplace harassment, use of racial slurs (Also fined $10mm)

Carlos Alcaraz defeats Casper Ruud to win the US Open final

I mentioned Alcaraz in my last report. He is the youngest #1 in history.

When 209,000 Amazon shoppers rave about $22 wireless earbuds, we listen

I have not tried these, but given the reviews at this price, I wanted to make note.

The education system is broken. It is so left-wing that it is concerning. If it were right-wing, I would be equally concerned. Vocabulary items that appeared on the worksheet included the terms "white privilege," "indigenous peoples," "transgender," "institutional racism," gender pronouns…’ In a related headline, a Texas teacher was fired for asking students to not judge people for wanting to have sex with 5-year-olds and asked them to call pedophiles “minor attracted persons.”

Nursing home hires stripper for seniors in wheelchairs

There is a video. Don’t worry, the strippers wore masks.

FBI seizes Mike Lindell’s phone in probe of Colo. voting machine breach

How Russia could react after its humiliating defeats in Ukraine

California Principal Charged After Being Caught on Camera Shoving Autistic Student

HORRIBLE short video of a principal shoving an autistic 9-year old student.

7 people shot, one fatally, in Chicago park

Less than a mile from University of Chicago.

Texas police union fumes over bond for alleged cop-killing repeat offenders: 'Absolutely foolish'

Can’t make this up. Suspects out on bond for murder and then kill an off duty cop picking up dinner for his family. The suspects bonds were set at $1 and 2mm. Why should they be let go at any price? To kill again? This is in Texas!

Asheville, North Carolina, has seen a 31% surge in violent crime within five years

Texas teen runs over, drags man in wheelchair in shocking video

Violence hits ‘epidemic proportions’ in pandemic-era California, study shows

Maybe soft on crime policies don’t work and weak DAs should be replaced?

Virus/Vaccine

Improvements continue with cases -29% and deaths -8%, while hospitalizations and ICU were down nicely as well.

Real Estate

I met with a contractor in Florida who told me his building costs are up 50% since the pandemic. He is spending $600/ft to build (cost) for high-end Central Boca homes. In my community, Royal Palm, building costs are even higher. There are now 34 homes for sale in Royal Palm, up from 4 in December of 2021, but down from 71 when I bought in 2017. Shockingly, the top 10 listings range from $20-40mm. UNHEARD of for Boca. Pre-pandemic, something in the low teens was high. Clearly, today homes are not moving as quickly, but now that the busy season starts and more traffic will be in town, I expect an uptick in activity. One on the water was listed for $35mm and had a cash offer of $29mm. They turned it down months ago. Now it is listed for $27.9mm, and I expect the new price is under $25mm. Below are the 4 highest listings ($32-40mm). Click on the picture to see all 34 listings and recently contracted homes in the community.

Interesting Fortune article on US residential R/E prices. Home prices are falling in these 98 major housing markets—only 50 markets remain at the peak

Interesting Bloomberg article about global residential real estate cooling. Around the world, soaring borrowing costs are squeezing homebuyers and property owners alike. From Sydney to Stockholm to Seattle, buyers are pulling back as central banks raise interest rates at the fastest pace in decades, sending house prices falling. Meanwhile, millions of people who borrowed cheaply to purchase homes during the pandemic boom face higher payments as loans reset. The rapid cool down in real estate — a leading source of household wealth — threatens to worsen a global economic downturn. While the slump so far isn’t near the levels of the 2008 financial crisis, how the decline plays out is a key variable for central bankers who want to tamp down inflation without hurting consumer confidence and triggering a deep recession.

Other R/E Headlines

Another real estate tech company lays off workers in response to housing slowdown

Housing market to see 'significant amount of weakness ahead,' Goldman says

This move in rates should push mortgage rates over 6% relative to the 2.65% in January 2021.

Seeing Green: Home on Pebble Beach Golf Course Lists for $31 Million

The California property known as Lucky Strike has views of the ocean and the 11th and 12 holes