Opening Comments

Very good feedback on the last piece entitled, “Investing Lessons from Sam Zell-The “Grave Dancer.” There were numerous lessons from Zell that would help anyone become a better investor. Also of note, Blackstone’s Jon Gray said, “the late real estate mogul had a particular genius for timing and managing big negotiations.”

Tina Turner died this afternoon at 83. She was a legend.

Contributions from readers are incredibly important to write my report. I get sent hundreds of emails each week with news stories or requests for me to cover topics. Please email me ideas, feedback, thoughts… at rosenreport@gmail.com.

Markets

JPM Market Call

Private Jet Market Cooling-Vista/Wheels Up

Private School Drama in South Florida

Vornado and SL Green Selling Assets

Pac West Loan Sales-Lending Pullback-Dimon Comments

RXR Walks from 61 Broadway-790k sq ft Building in NYC

Condo Sales at 220 CPS in NYC. One is Over $11k/ft

Aspen House Sold for $65mm after Asking $100mm

Mortgage Rates top 7% and Demand Falls

Video of the Day-Cop on the Hood of a Racing Car

The officer asks the passenger to get out of the car due to an outstanding warrant. The driver got out of the car and the passenger got into the driver’s seat and pulled away. The cop jumped on the hood pointing a gun and telling the driver to stop. The driver is HAULING ASS with a cop on the hood. Talk about scary. The vehicle hit a ditch and the cop broke his back. The driver got 5 years, which seems light to me.

Eye on the Market-Mike Cembalest-Too Long at the Fair

I have recommended since 2009 that equity investors overweight the US and Emerging Markets, and underweight Europe and Japan. The excess returns from such a strategy when applied to regional MSCI equity indexes have been enormous over that time frame. However, the time has come to retire the barbell for a while. I stayed too long at the fair, and should have made this recommendation a few months ago when Europe was trading at a record 35% P/E discount to the US. Interesting market take from Cembalest, and I appreciate he calls out his mistake.

Wall Street Entertainment Perks

Wall Street has gone through boom and bust cycles in terms of compensation, employment levels, and entertainment policies. In the 1990s and 2000s prior to the Global Financial Crisis, there was plenty of leeway to entertain clients. Ski trips, fishing trips, Vegas, Napa Valley, golf excursions, fancy dinners, high-end sporting events, wine tastings and shows; the list was endless. I have been to all kinds of events including major prizefights, the World Series, NBA Finals, countless playoff games across all the sports, amazing Broadway shows and many fun trips. I have golfed at dozens of amazing golf courses across the country. For these events, the firm I worked for took clients or I was taken by a client. As a foodie, the dinners were amazing, and I have been to countless Michelin Star restaurants and fantastic dining experiences.

Some of my most memorable experiences:

1994 Trip to Scottsdale Arizona- I went for a conference for Continental Bank, my employer. I had never stayed at a resort before and was almost 25 years old. I could not believe how nice my room and the grounds were at the fancy hotel. As a kid, I thought Howard Johnsons was 5-star as they had a waterslide at the pool. It was at the TPC Scottsdale (home of Phoenix Open). I had a famous incident where a client and I stayed an extra day to golf and I took him to dinner. He was infamous for going deep on the wine and insisting he orders it, but I did not know. He ordered two insanely expensive wines, and at the time my wine game was almost zero. The bill came and I almost cried. I thought I was going to be fired. I nervously told my boss, and he asked, “Was it Raphael?” Apparently, everyone but me knew that was Raphael’s M.O., and I did not get into trouble, but learned a valuable lesson. I never allowed a client to order wine again.

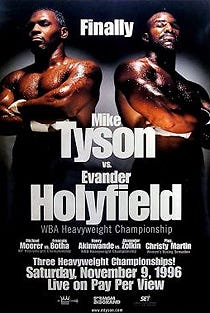

Tyson vs Holyfield in 1996 in Las Vegas-I have been to a dozen major prizefights in the 1990s and early 2000s and none since. This fight was amazing, and Holyfield shocked the world with an 11th Round TKO of heavily favored Tyson. There were multiple headbutts and Tyson was knocked down in the 6th round. The fight was stopped in the 11th round to a stunned crowd. Great restaurants and time with good friends Walt and Mike.

Pebble Beach Golf with Clients in 1998-It was my first Pebble trip, and I was paired with two men, and a woman named Lynn. The other guys kept forgetting Lynn had not hit and would walk in front of her only for me to remind them. On the final hole, Lynn hit her second shot at John who was walking in front of her and the ball smashed him in the head. 100% his fault and Lynn was shaken. It was scary, and I ran like Usain Bolt to help him. He had a baseball-sized lump on his head and was concussed. Ambulances came, and the 18th hole was closed. My first round at Pebble Beach was memorable for the wrong reason, and I did not get to finish the 18th hole. I presume I would have made a birdie, right? I was a lob wedge away from the green.

Wine Tasting-Early 2000’s Chase Dining Room-My team hosted a small wine tasting/dinner with 20 of our top distressed investors. I called in a favor and got Kevin Zraly to be the sommelier for the night. He is a world-famous wine educator and his book, “Windows on the World Complete Wine Course” has sold over 4mm copies. Not only is Zraly one of the top wine minds in the world, but the guy is also just plain funny. I kicked off the event and introduced Kevin and told the crowd that he won’t be holding back despite their successes. The room was filled with top hedge fund managers and he randomly picks a VERY famous market mover (current major sports team owner), and asks what he tastes in a specific wine. Whatever the fund manager said was wrong and Zraly just eviscerated him in a fun way and that really made everyone laugh including the embarrassed wine taster. The room was on edge as to who would be called on next. I learned a lot from Zraly and did a few events with him. Trust me, he is worth the price if he is still doing it. Kevin was the head sommelier at Windows of the World (top of the World Trade Center) and created one of the most amazing wine lists in NYC. I have stories of Windows of the World as well. Great book below for those who want to know more about wine. One caveat, if you are doing a wine tasting with Zraly, invite me!

Jackson Hole Ski Trip around the year 2000. It dumped snow prior to our arrival and the snow was chest high-powder. I had never experienced such a thing prior or since. Because I am an idiot, I went into the trees on my first run and got stuck. Thankfully, we hired a guide and he came back to dig me out or I would have never survived. The trip was first class and we had an amazing three days in pristine conditions with some of my favorite loan investors (Mike, Mark and Dan). I had at least a dozen other ski trips to Aspen, Vail, Park City, Snowbird, Tahoe, which were all fun and part of client entertainment.

2000 Sydney Olympics-Chase was a sponsor and my boss offered me tickets to take clients. I was single and dying to go. I called 10 different clients and they all said the same thing. “You expect me to get a pass to go to Australia with you? No chance.” It was the trip that wasn’t. I could not find one client who could get the hall pass. Watching on TV I was livid I missed it, as I had VIP tickets which I was unable to use.

The Yankees vs Mets 2000 World Series-Game 1-I had been invited to countless World Series games in my life and passed as I am not the biggest baseball fan. I always said, “Use it on someone who loves baseball.” However, when I was invited to the “Subway Series,” I could not pass up the opportunity. It was a chilly evening, and I did not have the right coat. The game went 12 long innings and lasted almost 5 hours. Truth be told, I was ready to go after the 5th inning and stayed the entire game, despite nearly freezing to death. I got home at 2:30am but saw an exciting game won by the Yankees who won the series 4-1. Not sure there will ever be another Yankees/Mets World Series.

The Lakers vs Nets 2002 NBA Finals-The Lakers (Shaq and Kobe) ran over the Nets led by Jason Kidd. I was just off the floor and recall being overwhelmed by how huge Shaq was in person. How that man moved up and down the court is beyond me. If he could have shot 75% from the line rather than 52%, he could have been the best player in the history of the NBA. He missed over 5,000 free throws. I later became friendly with Derek Fisher (starting Lakers point guard), but wish I knew him then.

The Masters-6 times between late 1990s and 2010- If you have never been to the Masters, it is one special experience. On one trip, I was taken by a client on a private plane, and they rented a house. We went to the practice round Wednesday and the event Thursday. It was so amazing and the grounds are STUNNING.

Duke Basketball Game at Cameron Indoor Stadium-I think it was 2011, but don’t recall. We flew privately, had dinner, watched the game, and flew back. I can tell you that a Duke game at Cameron is the BEST sporting experience I have ever had in my life. The stadium seats 9,314, and the seats are for a Lilliputian. The students are right on the court and the place is electric. Despite the fact that Coach K is now gone, I still suggest you go. Nothing like it.

Meeting Bill Clinton-2012

I had a short stint at UBS where I ran Fixed Income in the Americas. It was a miserable year for me in terms of work for a myriad of reasons, and I left after 13 months to start a hedge fund, Reef Road Capital. However, when I worked at UBS, I was invited to a small gathering with Bill Clinton.

The restaurants in NYC are remarkable, and I had a few dinners per week. Prior to the GFC, the spending limits were more lenient and we had some memorable evenings with great food and wine at places like Union Square Cafe, Bouley, Boloud, Gramercy Tavern, 11 Madison, Rao’s, Peter Luger, Le Bernardin, Masa, Le Cote Basque, Jean Gorges, Blue Hill, Shuko, Milo’s, 21 Club, Daniel, Il Mulino, Sparks, Gotham, Marea, Le Cirque, the Four Seasons and countless others.

I have so many remarkable memories of my nearly 30 years working between Chicago and NYC. I met amazing people and had fantastic experiences I could have never dreamed of as a child growing up as a public school kid in Pembroke Pines, FL. Wall Street gave me so many special life-changing encounters. I will be forever thankful and the time gives me plenty of fodder for future Rosen Reports. I also learned a great deal from my brilliant colleagues, clients, and competitors.

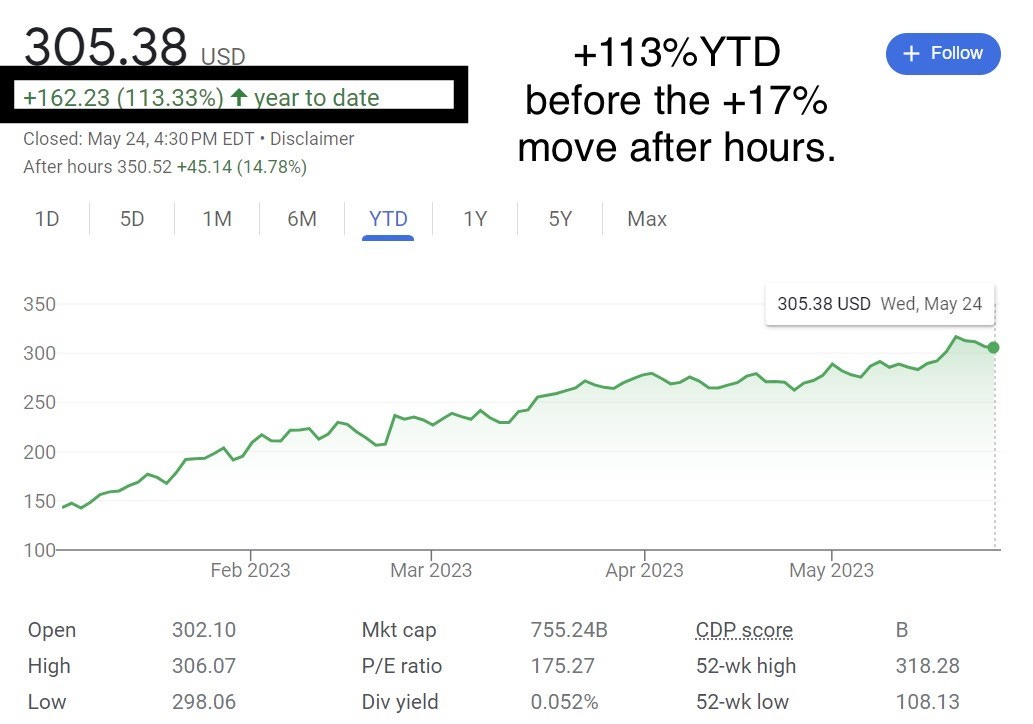

Quick Bites

Stocks sold off approximately 1% on Tuesday after McCarthy stated, “We are nowhere near a debt ceiling deal.” Now, Republicans are questioning the June 1st deadline and Biden is blaming the Republicans. On Wednesday, stocks sold off less than 1% on more Debt Ceiling chatter about being "hung up on spending.” I continue to hammer the issues of fiscal responsibility (both sides are to blame). If the market was truly concerned about a default, it would be down a lot more. Snowflake missed after the bell and fell 12% on missed pipeline estimates, but beats on sales and earnings. NVIDIA stock was up 113% YTD going into earnings tonight. They have been pushed higher by the growth in AI. NVIDIA beat handily on top line and earnings pushing the stock up 17%+ after hours, which is huge on a company with $800bn market cap. Treasury yields have risen in the last few weeks with the 2-Year up to 4.32% from 3.8% on 5/4 as the Fed is talking tough. The market was pricing more than 2 cuts by year-end a few weeks ago and now pricing in only one cut. The VIX is higher on Debt Ceiling fears and has gone from 16 to 20.5 in a week. The chart below shows the large drawdown in bank deposits. This will cause additional pullback from banks’ willingness to lend. The Saudi oil minister warns market speculators to ‘watch out’ ahead of OPEC+ meeting which has pushed oil up 5% from low levels.

It’s time for investors to build out their cash and gold positions, said JPMorgan chief strategist Marko Kolanovic. Stocks have enjoyed a stellar run this year. The S&P 500 is standing near year-to-date highs, after notching its best week since March last week on hopes of a debt ceiling resolution. Meanwhile, the tech-heavy Nasdaq, which has outpaced the other two benchmarks, closed Monday at its highest level since August. However, the rally only highlights the risks for equity investors going forward, Kolanovic told clients in a Tuesday note. Not only are traders pricing in too much optimism around a debt ceiling deal, but they’re also pricing in potential interest-rate cuts from the Federal Reserve later this year without giving enough weight to more hawkish commentary from central bankers.

“This gap is likely to close at the expense of equities, as rate cuts will likely only transpire from a risk-off event, and if rates stay higher they should weigh on equity multiples and economic activity,” Kolanovic said. Marko has had many good calls. He turned bearish a little early, but I am closer to his side than bullish.

The jet business is slowing sharply on many fronts. The Wheels Up founder abruptly stepped down as the business continues to struggle with substantial losses. Wheels Up has been troubled by high costs and operating issues as well. I read recent articles on Vista Jet which have been critical from Forbes, Financial Times and CNBC. Vista Jet auditors, Ernst & Young, question the company’s very ability to continue as a going concern. I spoke with someone at a competitor to Wheels Up and he concurred that things are slowing. My contact gave me examples of slowing demand resulting in reduced pricing. One of his clients runs a fleet of G4s which generally go for $8,000/hr. The fleet is so under-utilized, they are matching super mid-sized jet pricing of $5,200/hr in order to get more usage of the fleet. Aircraft pricing is softening at a fast clip. Planes are not selling as quickly, and owners are lowering prices sharply to move them. Many who bought planes in the past couple of years during the pandemic craze are realizing the high expected utilization rates are not coming to fruition, while pricing is softening. More operators are asking for a "last look" on trips to match or undercut competitors. Remember, these large jet operators (Wheels Up and Vista) took on a great deal of debt to grow and are now struggling. The other factor is those who “subscribed” to a jet service are finding “one-off” open market pricing far cheaper than the supposed discounted rates they thought they were getting with the subscription model. This is further causing issues for the operators. Warren Buffett owns Net Jets and said, “Wheels Up has 12,600 people who have given them over a billion dollars on prepaid cards…I think there’s a good chance some people are going to be disappointed later on.”

Real estate prices are soaring — if you can even find the home you want. And private-school admissions have become cutthroat. Miami really is the new New York City. The Florida city’s top private schools — already bursting at the seams from the throngs of New Yorkers and others who have migrated south since the beginning of the pandemic — are now facing an even bigger shortfall as billionaire hedge-funders and private equity titans compete to enroll their kids. “There’s a new elite in Miami, and, as a result, private schools are inundated. It’s been challenging with this affluent demographic moving in” said, Cyril Bijaoui, a real estate broker. The school situation, which the Financial Times recently compared to a blood sport, is newly exasperated by corporate offices relocating to Miami — most notably billionaire Kenneth Griffin’s Citadel hedge fund. The company recently moved its headquarters from beleaguered Chicago to Miami and Palm Beach, bringing their families with them. And the big whales keep coming: Millennium Management, Goldman Sachs Group, Blackstone Group Inc., D1 Capital Partners, J. Goldman & Co and HRS Management have also made the move to South Florida. Silicon Valley’s VC giant, Andreessen Horowitz, also recently opened an 8,000-square-foot office in Miami Beach. All that wealth means even more type-A families desperate to place their kids in a steadily shrinking pool of Miami’s most elite schools. You MUST get your kid into school PRIOR to buying a house. If anyone wants to start a private school, let me know. The people will pay up BIG for it between Miami and Palm Beach.

Other Headlines

Fed’s Kashkari says a June pause on rates wouldn’t indicate an end to hiking cycle

JPMorgan Chase raises key revenue target to $84 billion after First Republic takeover

In a separate Bloomberg article, Dimon said “he has no plans to quit anytime soon,” despite the fact that Gorman is stepping down from Morgan Stanley, and Dimon is 67 years old.

Apple announces multibillion-dollar deal with Broadcom for U.S.-made chips

Love it. I want to decrease reliance on China at every turn.

Carl Icahn Is $15 Billion Poorer After Hunter Becomes the Hunted

If the Hindenburg report is false, Icahn should take the company private. After all, Icahn owns an overwhelming majority of the stock anyway.

Lowe’s cuts full-year sales forecast, as spending on do-it-yourself projects weakens

Ammonium nitrate is commonly used as fertilizer but can also be used as an ingredient in homemade explosives

The article suggests Epstein threatened to expose Gates affair unless he contributed to the new charitable fund. Someone has a list with video evidence of all the people who Epstein “introduced” to his underaged girls. I believe the list has some of the most powerful people in business, politics, and entertainment….How in the hell has it not been made public yet? Epstein had video cameras in EVERY room in his properties.

Second Hunter Biden IRS whistleblower emerges after dismissal despite five years on case

The accusations of the whistleblowers is concerning regarding coverups and the role played by major US agencies covering for Biden. If this happened to Trump, I would say the same thing. As Americans, we should be concerned. Hunter, 53, allegedly failed to pay taxes on millions of dollars he received from foreign associates. The IRS agent has suggested there has been concern for years about the DOJ conduct into Hunter Biden. Additionally, the FBI refused to provide a subpoenaed document regarding the Biden matter. Do we live in America or Brazil?

DeSantis set to make much-anticipated presidential campaign announcement, formalizing Trump rivalry

The 44-year-old Republican governor plans to announce his decision in an online conversation with Twitter CEO Elon Musk. The audio-only event will be streamed on Twitter Spaces beginning at 6 p.m. EDT. I fear the field is too crowded which helps Trump.

Sen. Tim Scott kicks off 2024 presidential bid, entering GOP primary field led by Trump

Hillary Clinton says Biden's age is a legitimate issue: 'People have every right to consider it'

She talks about him relative to the “alternative” and sides with Biden despite the age concerns. For about the 3rd time, the President claimed his son died differently than his brain tumor. This week he said, “My son was a major in the US Army. We lost him in Iraq,” during an informal visit with troops at Marine Corps Air Station Iwakuni.

Chicago’s new Mayor Brandon Johnson is already bad for business

The Chicago Mercantile Exchange (CME) has been in Chicago since 1898 and is considering leaving. The CEO’s wife was carjacked in the middle of the day. The $66 billion CME may not be around to help with future renewal: The company has rewritten the terms of its lease so it can leave the city if politicians pursue “ill-conceived” public policy. The new Mayor wants new financial transaction taxes which would force CME out of the city.

New York woman suffers severe spinal injury after man randomly shoves her into subway car

63rd and Lex on the Upper East Side in the HIGH RENT district of NYC. This is within blocks of the most expensive co-ops and condos in NYC.

NYC dead last in study ranking best cities to start a career

This one shocked me. I have countless fond memories of my early career in NYC and would recommend recent grads to take a bite out of the Big Apple. NYC ranked last out of 182 cities on 26 metrics across categories considering professional opportunities and quality of life. Metrics included the number of entry-level jobs available per 100,000 working-age residents, average monthly starting salary, housing affordability, average length of the work week and more.

Video shows man brutally attacked by mob of cyclists in downtown LA

Catholic clergy sexually abused Illinois kids far more often than church acknowledged, state finds

Michigan State professor forced students to pay $99 for left-wing causes

Continued indoctrination at universities. Additionally, she raised $60k and bought an RV. Nothing to see here folks.

This professor went ballistic on students expressing anti-abortion views. When the Post went to see the professor, she held a machete to his neck. She then chased them down the street with the machete. You must see the video and pics. She was fired from Hunter College. You cannot make it up. She is suing the NYPD over an injury sustained during the George Floyd protests.

NAACP issues travel advisory in Florida

The travel advisory comes in direct response to Governor Ron DeSantis' aggressive attempts to erase Black history and to restrict diversity, equity, and inclusion programs in Florida schools. It should be noted that the Vice Chair of the NAACP lives in Florida.

Suspect in U-Haul crash into White House grounds ID’d as Sai Kandula

He had a Nazi flag and wanted to take control of the government and kill the President. He had a backpack with duct tape and a notebook.

China’s New Covid Wave Set to See 65 Million Cases a Week

US data has crashed down to under 20k cases/day from a peak of 1.2mm.

Stanford prof Garry Nolan says aliens are ‘100%’ living among us

He is from Stanford, but sounds a little nuts. I am of the belief UFOs exist and we are small-minded to believe Earth is the only planet with life. There are approximately 10,000,000,000,000,000,000,000,000 planets in the universe and 100 billion plants in our galaxy, the Milky Way. Although I am not convinced aliens are living among us, this was me this am. I felt a little off, but I can’t put my finger on it. Also of note, there was a ‘half-football-field-sized” triangular UFO overing over a CA military base with pictures to prove it.

Real Estate

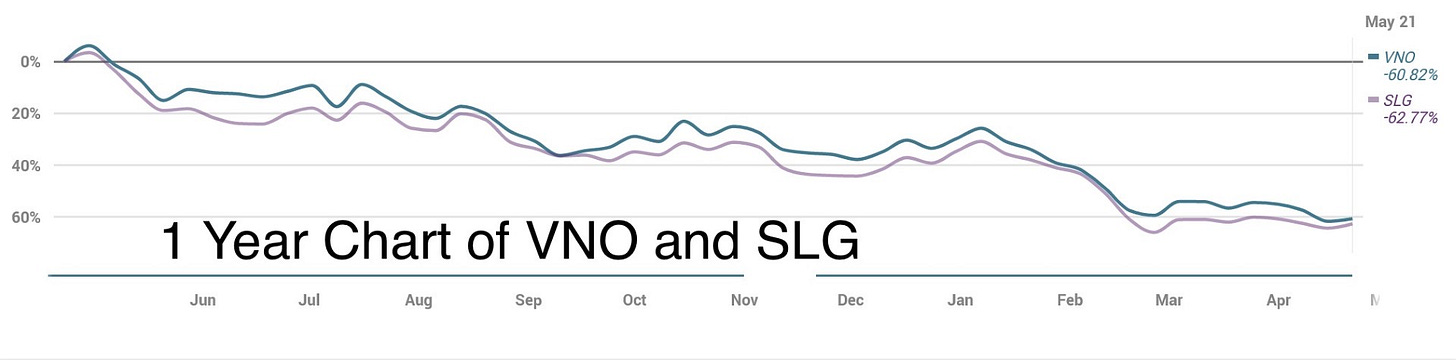

The sales market for office properties is at a virtual standstill. Yet some of New York’s biggest office owners are turning to it to raise cash. SL Green Realty and Vornado Realty Trust are planning large-scale asset sales this year — a move others are resisting. But with their stock prices plummeting and debt costs mounting, both New York-focused REITs are under pressure to buy back shares and shore up their balance sheets. It’s a tough time to be selling offices. NYC office sales totaled just $470 million in the first quarter — down a stunning 85% from $3 billion a year ago, according to Ariel Property Advisors. SL Green is looking to raise cash to achieve the largest single-year debt reduction in the company’s history and to buy back its stock, which is down 78 percent since the pandemic hit. Vornado had suggested that they were not sellers in February, but by May, they changed their tune. Vornado will use some of the proceeds of those sales to fund the share buyback program — another reversal by Roth, who had long opposed buying back the REIT’s stock. It will be interesting to see what assets are listed for sale in a challenging market.

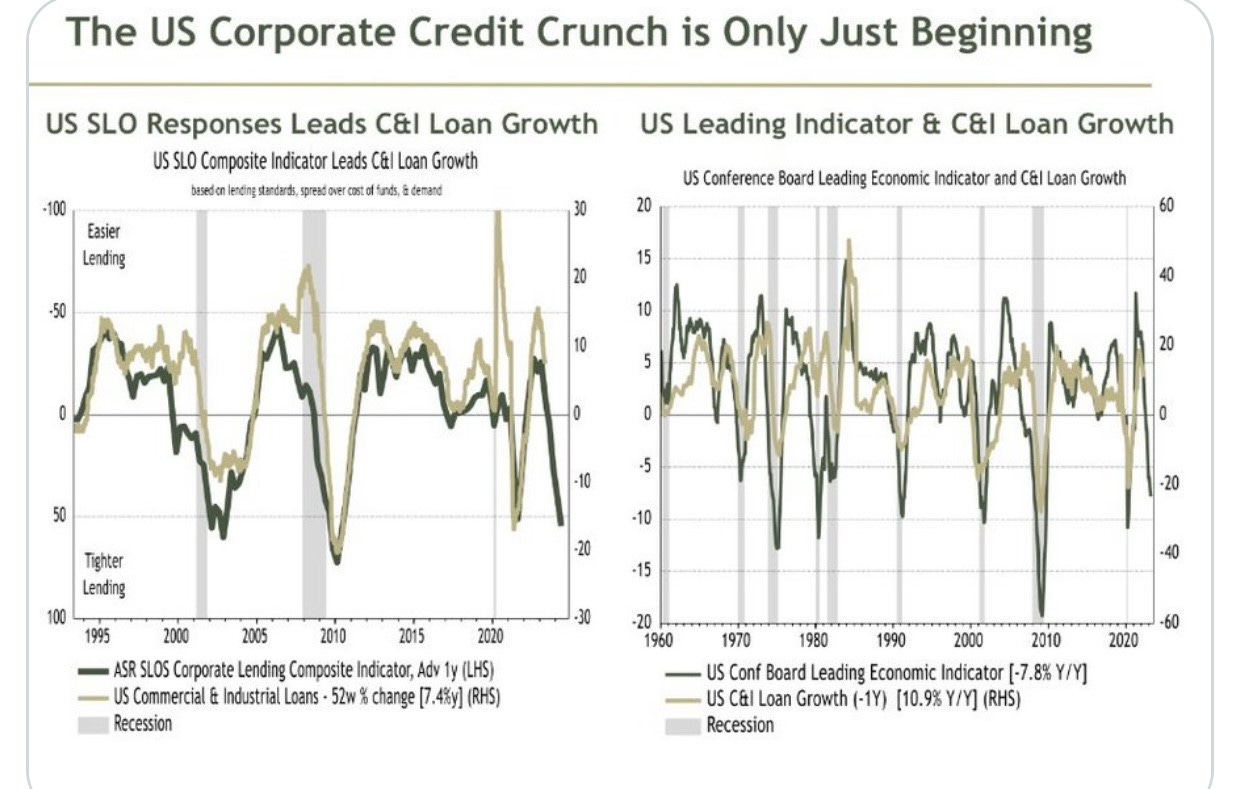

PacWest one of the US lenders engulfed in the regional banking turmoil, agreed to sell a $2.6 billion portfolio of real estate construction loans amid efforts to shore up liquidity. Kennedy-Wilson Holdings Inc. will purchase the group of 74 loans at the discounted price of about $2.4 billion, it said in a statement Monday. This is a small discount of about 7% of the face value or 93% was paid on average. This seems like a high price to me. It said the buyer will also assume all future funding obligations under the loans of about $2.7 billion. The portfolio of loans PacWest is selling accounts for more than half of its real estate construction and land loans. The loans carry floating rates, with an average of 8.4%. I spoke with bankers who explained this portfolio is over $5bn, but roughly 50% of these loans were funded. This is the beginning of regional banks selling R/E loans. However, let’s go one step further and think about the impact of the pullback of so many lenders and the lack of availability of credit over the near term. This chart is telling. Jamie Dimon warns souring commercial real estate loans could threaten some banks.

A reader sent me this note about RXR turning back the keys to a large office building at 61 Broadway. A lot more of this to come. Let’s see where bids shake out next month.

Two units at Vornado’s 220 Central Park South are in contract for $80.5 million in an off-market deal. The deal at the luxury supertall includes Unit 45A, the 6,600-square-foot home that went into contract for $76 million, and a one-bedroom maid’s unit on a separate floor, which went into contract for $4.5 million. Only in NYC would someone spend almost $5mm for maid’s quarters. The larger unit went into contract for roughly $20 million more than property records show was paid in 2019. I have been in virtually all the best buildings in Manhattan. I have never been in a nicer building than 220 CPS. I don’t like the location (too commercial), but the amenities are insane. For $11,500/ft, it better be amazing!

Once Asking $100 Million, Aspen Mansion Sells for $65 Million

Joel Tauber, a manufacturing entrepreneur and philanthropist, bought the ski-in, ski-out home for just over $9 million in 1996. Amazing pictures.

Thank you Eric for sharing