Opening Comments

I am posting more on LinkedIn. For example, I sent something out Sunday night. I do not want to overwhelm inboxes, so I will keep the Rosen Report to Wednesday/Sunday, but if you want more up to the minute thoughts on major topics, I will be posting on LinkedIn from time to time over and above the regular report. Late this afternoon, I moderated a panel for 3i with 5 senior people in finance about the impact of the banking crisis. I will be posting excerpts on LinkedIn once they send them to me and include some in the next Rosen Report.

After 3 years of discussing COVID, I don’t believe it is as relevant. I will only include it when I see something of substance. Truly, the end of an era. It will give more space to other, far more pressing topics we face today.

Video of the day-3-Year-Old Driving a Ferrari around a Race Track

Markets

Inflation

2008 Chart Reminder

Regional Bank Impacts

Treasury Market Madness

High-End Miami Remains Hot, but New Developments are Challenging

Commercial R/E Exposures are Banks are Concerning

Video of the day-3-Year Old Race Car Driver

A recent note was entitled, “Kids Don't Want to Drive Today,” and received a lot of positive feedback. A reader sent me this article about a 3-year-old driving a Ferrari on a race track, and it includes video of the boy in a car seat driving a 1,000 horsepower race car. Seems slightly unsafe to me, but this kid can outdrive my 16 and 17-year-old kids. It is not a close contest. How is this possible?

What Creates Happiness?

Given the craziness in the world today, I thought this study was incredibly poignant. The 12-minute video is a must watch and summarizes the Harvard study via a Ted Talk. There has been a study which began in 1938 and followed the lives of 724 men and then the 2,000 children in the original study. The first group of men were from Harvard and most went off to serve in WWII. JFK was part of the study! The second group of boys were from Boston poorest neighborhoods living in tenements. The 75-year study suggest good relationships keep us happier and healthier more so than other traditional health factors.

I found this fascinating article on CNBC about the Harvard study. The findings may surprise you.

The researchers gathered health records, asking detailed questions about their lives at two-year intervals.

As participants entered mid-and late-life, the Harvard Study often asked about retirement. Based on their responses, the No. 1 challenge people faced in retirement was not being able to replace the social connections that had sustained them for so long at work.

When it comes to retirement, we often stress about things like financial concerns, health problems and caregiving. But people who fare the best in retirement find ways to cultivate connections. And yet, almost no one talks about the importance of developing new sources of meaning and purpose.

We are often shrouded in financial concerns and the pressure of deadlines, so we don’t notice how significant our work relationships are until they’re gone.

Good relationships keep us healthier and happier. Social connections are really good for us. People who are more socially connected to family, friends and community are happier, physically healthier and they live longer than people who are less well connected, according to the long-term study. Loneliness is toxic, and those who are more isolated than they want to be are less happy and their health declines earlier in midlife, their brain functioning declines sooner and life shorter lives.

The quality of your close relationships matters. The study showed that the people who were most satisfied in their relationships at 50, were the healthiest at age 80. If you are in a relationship in your 80s and feel you can count on them in a time of need, your memories stay sharper for longer according to the study.

Given I retired early on two separate occasions (39 and 47), I know first-hand about lost connectivity. I recall my time at JPM fondly, and the bonds that were created. After all, I was working with people 10+ hours a day. You get to know them very well and develop friendships that you cannot get casually spending an hour a week with people. I recall after I left in 2010 feeling a major void in connectivity to people I was once so close with. It was a bit depressing for me. Now that I have been in Florida for almost 6 years and the migration of more people like me continues, my friendships have grown, and I have a growing network of like-minded people with similar interests. I find I am happier as a result of time I spend with friends and family. The connectivity from the Rosen Report has been amazing as well. Maybe there is something to this 75-year Harvard study after-all?

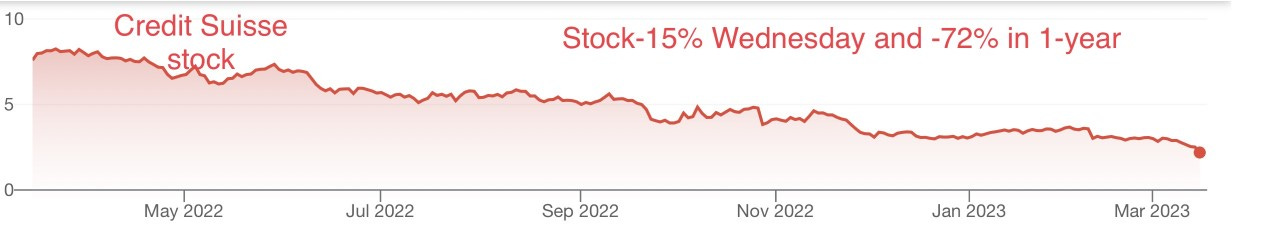

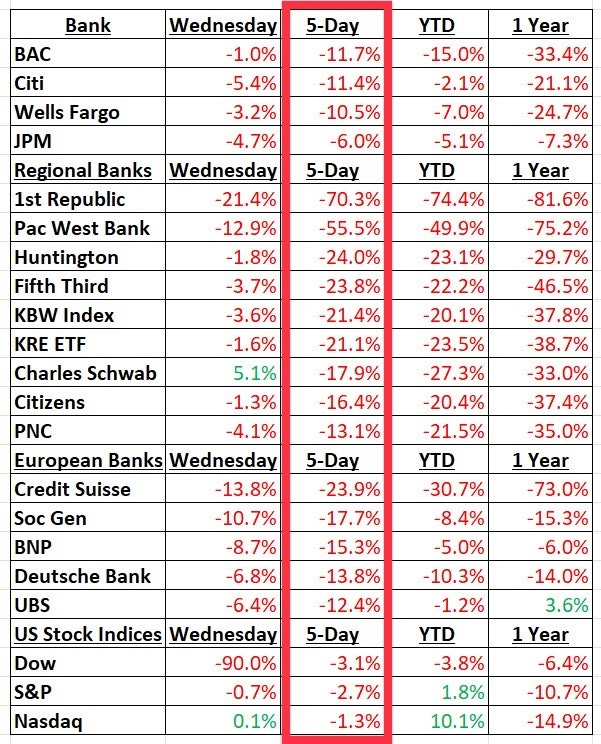

Quick Bites

Markets remained incredibly volatile on the heels of continued pressure on banks. Credit Suisse, the worst run bank of all time, slid 25% Wednesday at one point on the news the Saudi backer ruled out further assistance. Swiss regulators suggested they will step in to provide liquidity to CS if needed and the stock rallied to -15% on the day. CS bank has stepped on every banana peel in the past 30 years, and I have called them out regularly. CS brought down most of the sector sharply on Wednesday after a nice rally Tuesday. BNP announced they are cutting exposure to CS. The Dow ended 281 points, or 0.9%, lower at 31,875. The S&P 500 dropped 0.7% to 3,892. The Nasdaq eked out a small gain, rising 0.05% to 11,434. The major averages ended the day well off their session lows. The Dow at one point was down 725 points, and the S&P 500 briefly gave up all of its 2023 gains. The Treasury market rallied sharply again with the 2-year rallying 30bps to yield 3.90%. Remember, it was 5.06% ONE WEEK AGO. Bank stocks are seen in the chart below. Oil fell 4% on the day and was $68.4 in late day trading on the heels of the bank crisis and economic fears. I still think we can see a decent oil move higher despite the broad market weakness on a supply shock. Although crypto sold off with the broader market on Wednesday, BTC is up nicely to $24.2k from $20k on 3/11. The VIX (volatility for the S&P 500) rallied sharply today and is up to 26. Also of note, the June VIX is more elevated than normal due to fears this volatility will last. The average VIX since 2000, is 20 and even lower if you go back further. The airline stocks were hit hard Wednesday and this week with United -20% and American -16% in the past 5 days.

Inflation gauge increased 0.4% in February, as expected and up 6% from a year ago. Also of note, the producer price index fell 0.1% for February, below the estimate for a 0.3% increase. To me, one positive here is the bank crisis is deflationary in my mind. Less lending, which will force the consumer to retrench. The Fed Funds Futures are pricing in 3 or 4 rate cuts in 2023 as of Wednesday morning. Remember, just a few weeks ago, the market was pricing in zero cuts in 2023. Goldman Sachs lowered its growth forecast by 0.3 percentage points to 1.2% for 2023, as gauged by the fourth quarter of 2022 to the fourth quarter of this year.

The government intervention on the banks staved off calamity. However, I am not convinced it solves the broader problems. Billions of deposits have left regional banks, and the stocks remained under pressure Monday before rebounding nicely Tuesday and selling off sharply again on Wednesday. Evercore ISI’s Julian Emanual warns SVB Fallout Could Force New Market Low. Remember, Bear happened in mid-March 2008 and Lehman filed in September. Market low was 1-year after Bear. My point is other shoes will drop in coming months and not only banks. Icahn was interviewed on CNBC and said, “Our system is breaking down, and that we absolutely have a major problem in our economy today.” Five minute Icahn interview here.

Regional banks offer a great deal of credit to their communities and the massive withdrawals from depositors will put a major dent in the ability and willingness of banks to lend. The consumer was already stretched and believe the likelihood of a recession is high. This Bloomberg article suggested $465bn wiped out of global banking stocks recently (prior to Tuesday rally). Moody’s cuts outlook on U.S. banking system to negative, citing ‘rapidly deteriorating operating environment.’ How do you think that impacts the banks’ willingness to make new loans? This CNBC article is entitled, “SVB’s failure will have a ripple effect across technology ‘for years to come.”

Investors swarmed into U.S government bonds Monday after the collapse of Silicon Valley Bank and subsequent government backstop of the banking system. The rush sent Treasury yields tumbling. The yield on the 2-year Treasury was at 4.02%, down 57 basis points. The yield fell around 100 basis points, since Wednesday, marking the largest three-day decline since Oct. 22, 1987, when the yield fell 117 basis points. The volatility continued Tuesday and Wednesday before the 2-year settled at 3.90 or 114bps from last week’s highs. “In light of the stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22,” Goldman economist Jan Hatzius said. Jeffrey Gundlach says Fed will hike funds rate next week to save credibility — but shouldn’t. Economist Ed Hyman says it might be a good idea for the Fed to pause because of this financial shock. One thing which is indicative of a recession is a 2/10 yield curve which goes from inverted to less inverted as can be seen in the chart below and Gundlach rightly points that out. The markets are calling for a recession now and forcing the Fed’s hand. Thank you to the inept Fed for calling inflation transitory and leaving rates at zero and QE going when there was no business to do so. I have zero faith in the Fed and called this countless times. I was interviewed last week and explain the 2/10 curve inversion and what it means in this short video. The links below are to Rosen Reports written in 2021/2022 about my inflation concerns and there were many more. I think the Fed goes one more hike and is done.

Other Headlines

Apollo Eyes SVB Assets as Suitors Circle $73.6 Billion Loan Book

Based on lessons learned from CFC, BSC, WaMu, you should buy assets and not an entity with liabilities. Of course Apollo has it right.

How Silicon Valley Bank bailout will be a financial burden for US bank customers

SVB collapse: Bank fallout shines spotlight on $620 billion hole in banking sector

SVB bailout shows ‘capitalism is breaking down,’ Ken Griffin says

“There’s been a loss of financial discipline with the government bailing out depositors in full,” Griffin told FT.

Silicon Valley Bank Pledged Nearly $74 Million To Black Lives Matter Causes

Facebook Parent Meta Begins New Round of Job Cuts

Fresh layoffs will trim 10,000 jobs, on top of 11,000 cuts announced last fall. Stock rallied sharply on the news.

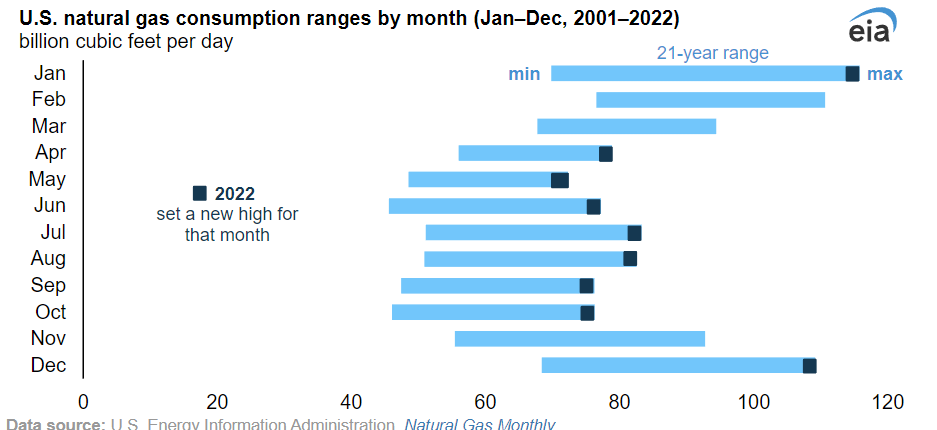

U.S. natural gas consumption set nine monthly records and an annual record in 2022

Much to my chagrin, we will be reliant on fossil fuels for decades. The EIA actually has oil demand higher than today in 2050.

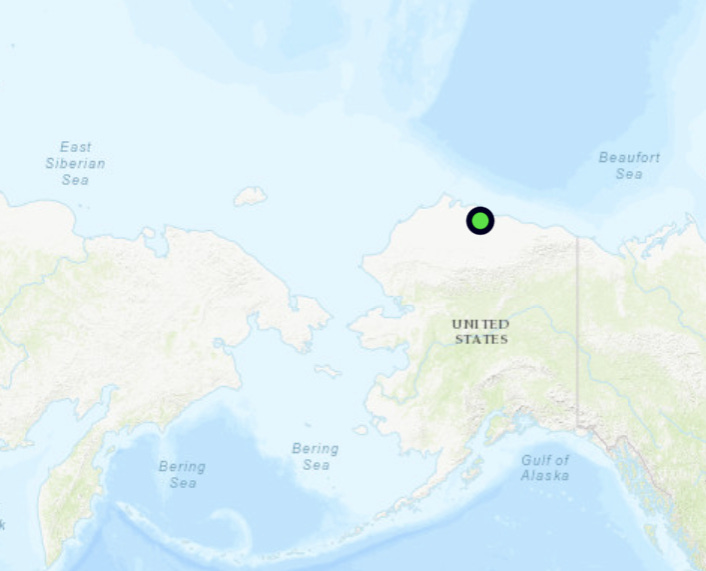

Biden Interior approves controversial Alaska oil drilling project

Meet the typical Tesla owner: A white man with a household income over $130,000

For TSLA to continue to grow, they are going to need to expand their owners outside of white males with income over $130k!

American Airlines CEO tells pilots the carrier is prepared to increase pay to up to $590,000 a year

Delta’s pilots last week ratified a four-year contract with 34% in cumulative raises. We have seen this movie before and it ends with airlines filing bankruptcy in the next downturn.

Bowling for $418? Surge Pricing Creeps Into Restaurants, Movies, Gym Class

Things are so expensive, I don’t understand who can afford them. My daughter and I are going skiing in Park City next week. I will be itemizing the costs, and I am in shock. $250/day for lift tickets per person. Flights, hotels, ski rental, lift tickets, food…will be a small fortune. These prices cannot continue.

Three Years After Covid Hit, Restaurants Are Still Desperate for Workers

The prices being paid for dishwashers, cooks, wait staff, hosts.. is mindboggling and driving costs sharply higher. Going out to eat has gotten out of control between food and labor costs.

If Biden doesn’t run, would Bernie be the best alternative?

Please tell me that we can do better than a person who would be 87-years- old in office if elected.

Morgan Stanley is testing an OpenAI-powered chatbot for its 16,000 financial advisors

Citadel Negotiating Enterprise-Wide ChatGPT License, Griffin Says

One of the most successful hedge fund managers of all time is negotiating to use ChatGPT. Interesting article.

An A.I. chatbot asked Bill Gates what he wishes he could tell his younger self — here’s what he said

OpenAI announces GPT-4, claims it can beat 90% of humans on the SAT

I believe AI is a major game changer and improvements in coming years will make the technology extremally disruptive.

Robber body slams woman onto pavement, leaving her unable to walk, Texas family says

Video shows teen with autism dragged off NYC train, beaten in disturbing attack

Maybe more serious consequences for violence would deter it. We know the current plan is not working.

CME CEO Terry Duffy Says Wife's Carjacking Shows 'Insane' Chicago Crime

3pm in the afternoon. I wonder why Lori Lightfoot lost and the wealth is leaving the city?

'Mexico is safer than the U.S.', Mexican president says

Just like a politician to get creative with the data. At 28 per 100,000 people, Mexico's murder rate was around four times higher than in the United States in 2020, according to data published by the World Bank.

Frustrated migrants storm border between Mexico and El Paso, Texas

Check out this concerning video. Well over 5mm illegal crossings in a couple years.

Stanford finally apologizes to Trump-appointed judge whose talk was ambushed by students, woke dean

The behavior of Stanford students and faculty was abysmal. Listen to what the dean for DEI said. Seriously? So much for free speech and listening to the opinions of others. I would say the same thing if a right-wing school said this about a Progressive. How about a fair debate?

San Francisco reparations idea: $5 million per Black person

Payments of $5 million to every eligible Black adult, the elimination of personal debt and tax burdens, guaranteed annual incomes of at least $97,000 for 250 years and homes in San Francisco for just $1 a family. These are some of the recommendations. SFO is a fiscal mess. Where is this money coming from?

NYC ranked US's most congested city as motorists spend 10 full days in traffic per year

Sunbelt Traffic Jams Are Frustrating Drivers and Threatening Growth

Worsening congestion gums up commutes in cities like Miami, Nashville and Las Vegas. Miami is now awful from a traffic perspective. I could not live there. The lack of infrastructure in terms of roads, schools, hospitals, doctors… is getting worse in South Florida as the migration escalates.

Boca Raton Woman Asks City Board to Create ‘Sugar Daddy and Mommy Appreciation Day'

Yes, I love Florida, but the idiocy of people never ceases to amaze.

California cancels salmon fishing season: "It's devastating"

Aaron Rodgers reveals intention to play for Jets on ‘Pat McAfee Show’

Russian fighter jet collides with US drone causing it to crash into Black Sea

Real Estate

High-end Miami remains hot. Devin Kay of Douglas Elliman put $35mm under contract last week including an off-market condo for $16.4mm in Surfside. From Devin: “The challenge today is trying to get people who want to sell. Unless someone is moving from a house to condo/condo to house, getting divorced or dies, very few people are actually willing to sell, even for a big price. A lot of people are either locked into their properties at low interest rates or low tax basis and therefore they will face a steep increase in carrying costs by selling and going into something else.”

In a related story, there is a Real Deal article about developers delaying projects in South Florida due to higher rates, higher building materials/labor costs and skyrocketing insurance premiums. It’s a common story across South Florida. Developers are focused on zoning and site plan approvals, but they won’t start construction until some aspect of their building costs moderates, experts told The Real Deal. The pause on development projects isn’t across the board, as many developers are well-capitalized or secured preferred equity infusions with ease, while others were not so lucky. Insurance and construction hard costs had been already steadily increasing. This year, commercial carriers will hike premiums by 50 percent, though a doubling of rates won’t be out of the question, according to a Yardi Matrix report. This comes on the heels of last year’s hikes of 15 percent to 30 percent. Tack on higher interest rates, which are hovering at 7.5 percent to 8 percent for construction loans, whereas they were around 4.5 percent, and it makes for an “unprecedented” trifecta of factors, said Marc Suarez, managing director at lender Lument. “You can have one of the three [factors] or maybe two of the three but you can’t have all of the three,” he said.

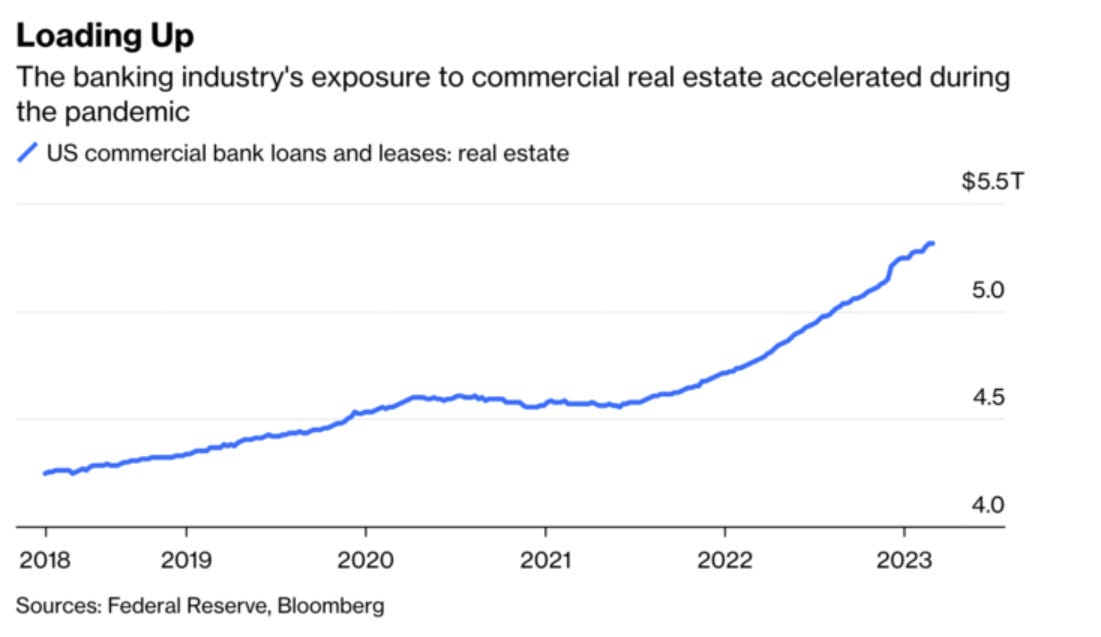

If market participants are wringing their hands over the potential fallout from the collapse of Silicon Valley Bank, just wait until they look at the banking industry’s exposure to the rapidly weakening commercial real estate sector. It seems as if every few days brings news of some big property going into default. Within the past few weeks, an office landlord controlled by Pimco defaulted on about $1.7 billion of mortgage notes on seven buildings in places such as San Francisco, Boston and New York. Before that, a Brookfield busines defaulted on loans tied to two Los Angeles office towers. A $1.2 billion mortgage on a SFO complex co-owned by Trump and Vornado has showed up on a watchlist of loans that may be in jeopardy. This is bad news for lenders because they have ramped up their financing of real estate. Since mid-2021, total real estate loans and leases on their books have soared by more than $725 billion, or 16%, to a record $5.31 trillion, according to the Federal Reserve. Last year’s 11.2% increase was equal to the previous four years combined and the most since 2006. Not only that, but commercial real estate loans make up close to 24% of all bank loans, the most since the financial crisis, according to BNY Mellon strategist John Velis. I have written about this topic extensively and my concerns. Now that the banking sector is weaker and deposits are leaving, regional banks are even more exposed to losses. Refinancing any property will sharply increase costs of the owner and lead to more defaults. Let’s not forget falling prices in many office/retail buildings. Now, lenders are under pressure, especially on the regional banks and won’t be in a position to lend as aggressively with sharply falling deposits.

Other R/E Headlines

Major NYC Lender Signature Bank Shuttered by Regulators

One report suggested Signature had a 12% share of CRE in the NY Metro Area. With lenders pulling back and a major one gone, what does that do to the ability to source a CRE loan?

Three Historic Austin Houses Are for Sale in $20 Million Package Deal

Thanks so much. Appreciate it!

GM Eric,

The Rosen Report always does a excellent job of delving into complex issues, and providing balance and accountability. Your topic, What Creates Happiness?, was excellent. A good life is built on good relationships, which keeps us happier and healthier. What is the key to good relationships? A book I recently read, Wonder Drug, by Stephen Trzeciak, MD and Anthony Mazzarelli, MD has the answer! An extraordinary claim requires extraordinary proof, and they have the data. Altruism: selfless concern for and serving the well-being of others is the key to good relationships and will create happiness. It is very evident to all of your readers that your life is alive with countless good relationships. All good things, Jack