Opening Comments

My last note was entitled, “The State of the US Consumer.” The most opened links were the most dangerous Target store in the US and Dave Chappelle accusing Israel of genocide in Gaza. A close third was the new $700mm nuclear stealth bomber. The chart below was sent to me by a reader after I posted the consumer article. It shows credit card/revolving debt +43% in 3 years, while the savings rate fell from over 32% (free pandemic money) to 3.6% (below pre-pandemic levels).

As a reminder, my readers send me hundreds of articles every week to help me source ideas. An important bullet in Quick Bites today is about ETF concentrated positions in Nvidia. The idea for the topic was given to me by one of my West Coast readers. Send ideas to: rosenreport@gmail.com. This week, Beau, Robert, Peter, Billy, Ed, and Brad were a huge help to me.

Markets

ETF NVIDIA Concentrations-WOW

Trump Convicted

2-Year-Old Artist

High-End Miami Example & Boca Updated

Two Hotel Foreclosures in Miami

Home Sales Fell/Affordability Example

More Seattle Office Woes

Video of the Day-Judge Cannot Believe It

This story is about a man with a suspended license who joins his court date via a Zoom call…while DRIVING HIS CAR. When the judge realizes that the man has a suspended license yet is driving, the judge is livid. The judge tells the driver to report to jail by 6 pm that night. It is a one-minute video. The reaction of the driver is priceless, as he realizes his stupidity.

What I Miss About NYC

If you have read the Rosen Report for any amount of time, you know I have been critical of NYC - the politics, pandemic mandates, cost of living, taxes, crime, immigration, quality of life, homelessness, filth, drugs, shoplifting, bail reform, 2019 rent laws, squatters rights… the list is endless. However, when I return to NYC for a short trip, I am reminded of what I miss about the city and my 40 hours there will outline exactly why.

I landed at LGA at 2 pm on Wednesday. By the way, Ft. Lauderdale airport was a complete zoo. Every seat was taken on the plane. I landed and got an Uber to the 3i offices in Midtown. I reconnected with my friends from 3i (now up to 450 members and growing) and headed to my hotel downtown. A reader got me a deal that was too good to pass up, so I stayed on Wall Street. NOT my ideal location, but the ever-frugal author of the Rosen Report never passes up a deal.

I had heard about a highly-rated Irish Pub called the Dead Rabbit. One of my favorite people from Wall Street asked to meet me for a drink and picked the Dead Rabbit, as I wanted to check it out. The old-school place has sawdust on the floors and is anything but fancy. The mixologists (don’t call them bartenders), make some fun drinks. Although I am a wino, I felt an Irish pub required a drink. I asked for something with tequila, and the mixologist suggested the “Flying Boat.” The drink was smooth with a bit of a kick, and I would describe it as a “Margarita Light.” I had a great conversation with Rob and even though I was going out for dinner from there, ordered the house chips and Guinness-braised rib sliders. For a pub, these were both amazing. The rustic vibe, amazing drinks, young/hip crowd and surprisingly decent food made this a place I would return to. However, the location is awful unless you are down on Wall Street.

From there, I walked a few blocks Northwest over to the Michelin-star restaurant, Cown Shy. Although it is a couple of years old, I have wanted to try it for some time. Crown Shy is the first solo project of Chef James Kent (worked at Bouley, at age 15, Babbo, Jean-Georges, Gordon Ramsey. Eleven Madison…). Interestingly, the crowd was young, and I am 99% sure we saw the founder of Archegos Capital, Bill Hwang, walking out the door as I was eating dinner. His trial was nearby.

Walking into the building at 70 Pine Street is underwhelming, but when you open the doors to Crown Shy you will be impressed with the decor. I made a reservation for myself but let them know if a bar seat was available, I wanted it. Lucky for me there was a seat available. I sat down and struck up a conversation with a man my age who was a former partner at Goldman. We knew a bunch of the same people and enjoyed a great meal. This kind of interaction does not happen with regularity in South Florida. You are far more likely to sit next to an elderly person wearing Velcro shoes than have the bar interaction I had in NYC with a Wall Street professional. However, to be fair, South Florida has gotten much younger and better in this regard in the past five years, especially Miami.

I thought the service was top-notch at Crown Shy, and the food was as good as I would have expected. When you go to a Michelin-star restaurant, the presentation is another level. Nothing was disappointing, but it also was not mind-blowing. It started off with warm olive bread with seasoned butter. Even though I am watching my carbs, I ate the entire loaf. It just means more gym time. I had the Hamachi that was packed with flavor. As you can see, it looked like a work of art. It was not your typical Hamachi, as it was served with strawberry, lemon balm and coconut.

I then ordered the branzino with broccoli rabe and pine nuts, which was presented beautifully. I crushed everything on my plate. Both the appetizer and entree portions were a bit small, a common theme at the Michelin-star restaurants. I finished with chocolate cake which was moist and had the perfect texture. The wines by the glass had something for everyone even if the prices were full.

Was Crown Shy my favorite restaurant of all time? No, it was not. However, the food was wonderful, with great service, and the presentation was off the charts. As good as the food was, the ability to make a great new connection with a stranger made it all the more wonderful. We exchanged contact info, and I will make you a bet there is a 100% chance we golf or do dinner this summer.

Food/Presentation-A- Portions a little small.

Service-A+

Ambiance-A

Wine List-A Vast array of pricing with a huge selection from Europe.

Location-C-So far south, not on everyone’s radar.

Fully priced but worth it. $170 for two glasses of wine, appetizer, entree, dessert and tip.

Thursday, I had a few meetings, again connecting with impressive people. For lunch, I met with my friends, Nick and Jason, for sushi at Kazu Nori, a casual handroll restaurant in Midtown. It is the sister restaurant to Sugarfish that launched in L.A. Both have multiple locations in NYC and L.A. The sushi is a good value at both restaurants. It is not elite-quality sushi, but for the price, it is solid. I had 6 rolls for $48 including tax and tip. Value play, not over the top sushi.

I also had my annual alumni dinner with Jamie Dimon at the beautiful JPM Library. It was great to connect with former colleagues and get some time with Jamie. I will only say he is impressive and his ability to field questions about anything and everything is refreshing. Too bad he won’t run for President.

Do I ever plan on living in NYC again? The answer is, ideally, no, but never say never. Now that the kids are soon leaving for college and I am looking at new opportunities, you never know what can happen. NYC has fallen so much from its former self; it would be hard to move back. However, NYC is a special place, and I enjoy visiting in short stints. The energy, people, culture, and food... make it fun. I am grateful to have lived there for over 20 years and experienced it at its finest.

I took the 6 am flight back on Friday, taking a $70 Uber to LGA, while my Florida Uber was far less money for double the mileage as seen below.

I will be in NYC quite a bit this summer and expect that I will have dozens of restaurant reviews that range from cheap to fancy. I will also try to make more connections as I did at Crown Shy and if history is any indication, I bet I will.

Quick Bites

Salesforce revenue grew 11% but fell short of expectations driving the stock -17% and brought markets lower. In general, software stocks were down sharply on the week with many downwardly revising forecasts and making concerning commentary. SentinelOne-“Buying habits are changing.” UiPath-”Customers were also becoming more hesitant to commit to multi-year deals.” Veeva-“AI represents a competing priority.” Okta-“Macroeconomic headwinds are still out there.” Dell stock was -11% on the week. However, stocks rebounded Friday including Salesforce +7.5% and the Dow had its best day of 2024. Despite the fact that indices were down on the week, the month of May was strong with the Dow +2.3%, S&P +4.8 %, and Nasdaq+6.8%. NVIDIA stock was +32% in May and now has a market cap of $2.7 Trillion. The stock is +3,000% in 5 years. On a positive note, Core PCE posted the smallest gain of the year +.2%, while inflation-adjusted consumer spending fell .1%. The result of the cooler inflation data pushed yields lower with the 2-year -5bps to 4.88% and the 10-year -5bps to 4.51%. Bitcoin was +11% MTD, but Ether was +27% given the approval of ETH ETFs.

A reader pointed out concerning concentrations in ETFs around Nvidia and tech. Let me start with the fact that the S&P 500 is quite concentrated with the magnificent 7 being 30% of the S&P. However, many ETFs are far more concentrated than the S&P. My fear is many consumers are not educated about the makeup of indices, ETF’s and mutual funds and I wanted to highlight a risk. Yes, concentrations work great when the market is ripping higher, but what happens when things turn? Remember, human nature is to be a performance chaser. You see something going to the moon and fear of missing out leads you to invest. How many major funds had a bang-up year, and raised a ton of money, only to get decimated? Quite a few. I show you the example of the once-high-flying ARKK Innovation fund managed by Catherine Wood (see the last chart). As her performance peaked, her assets under management were flying and then her concentrated fund crashed. Given the outperformance of the funds I outline, my concern is people will chase them. Concentrated positions require tight risk management. I hope these ETFs have hard stops on the way down. One more thought, a few data points are dated, as the fund managers do not update holdings daily but clearly outline them in the chart. Although I am sure I missed some funds, you get my point. FBGRX, WUGI, SHOC, SMH, FDG, FFOG.

The big story was the guilty verdict on all 34 charges for President Trump, and he is facing 54 more charges. I was in NYC when it happened and must tell you that I do not believe this is the right case for legally pursuing a former President despite not being a big fan. Trump plans on appealing the verdict. The Trump campaign raised $53mm within 24 hours of the verdict despite the campaign website crashing, but Truth Social fell 5% on Friday. Trump attended a fundraiser after the verdict that had a bunch of Billionaires in attendance. I presumed the ruling would be overturned but Dershowitz feels judges are “terrified” to help Trump. CNN legal analyst, Elie Honig, was critical of the case and said prosecutors “contorted the law in an unprecedented manner in their quest to snare their prey.” Ellie’s full list of issues with the case is outlined in this link, including the fact that the judge donated to a pro-Biden/anti-Trump political operation. Could you imagine if the judge had donated $10 to a pro-Trump operation? I am not positive about anything concerning this election other than I wish there were two other candidates. I think the MAGA base is unwavering, as are the never-Trumpers. I believe this guilty verdict will only solidify the MAGA followers. Some polls suggested that the guilty verdict would not make a huge difference. A Reuters poll suggested 10% of Republicans would be less likely to vote for Trump after guilty verdict. Check out PredictIt and you will see a slight increase for Biden post-verdict. In the end, a handful of swing states are all that matter. Trump gave a 40-minute speech about the “rigged” conviction, saying "If they can do this to me, they can do this to anyone," before going on to criticize his trial and the "highly conflicted judge" who presided over it. Biden called Trump’s response “reckless and dangerous.” Having just been with Jamie Dimon last week, someone of his presence, age, intellect, gravitas, presentation skills, business acumen, and ability to bring people together… would be nice. I do think “Mr. Wonderful” summed up the situation here well in this short video.

I thought this was a fun and interesting story. In a small Bavarian village, a two-year-old boy has become an overnight sensation, captivating the art world with his extraordinary talent. Laurent Schwarz, affectionately dubbed the "pint-sized Picasso," has been making waves by selling his abstract paintings for around $7,000 each. Laurent's journey to artistic fame began unexpectedly during a family vacation in South Tyrol, Italy, in September 2023. His mother, Lisa Schwarz, 32, recalls the pivotal moment. "There was a painting room in the hotel, and we couldn’t get him out of it," she told The Times. Recognizing her son's burgeoning talent, Lisa set up a studio for him just before Christmas, and Laurent's dedication was immediate. "He was in it all the time," she added. His artwork can be found in the link.

Israel/Middle East

Biden says it’s ‘time for this war to end’ as he lays out Israeli ceasefire proposal

“At this point, Hamas no longer is capable of carrying out another October 7, just one of Israel’s main objectives in this war, and quite frankly a righteous one,” Biden said at the White House.

Maniac screams ‘I’m gonna kill all the Jews’ as he tries to run down students outside NYC Jewish school (Pakastani Immigrant was behind the wheel)

Columbia students set up new anti-Israel encampment on campus during alumni weekend

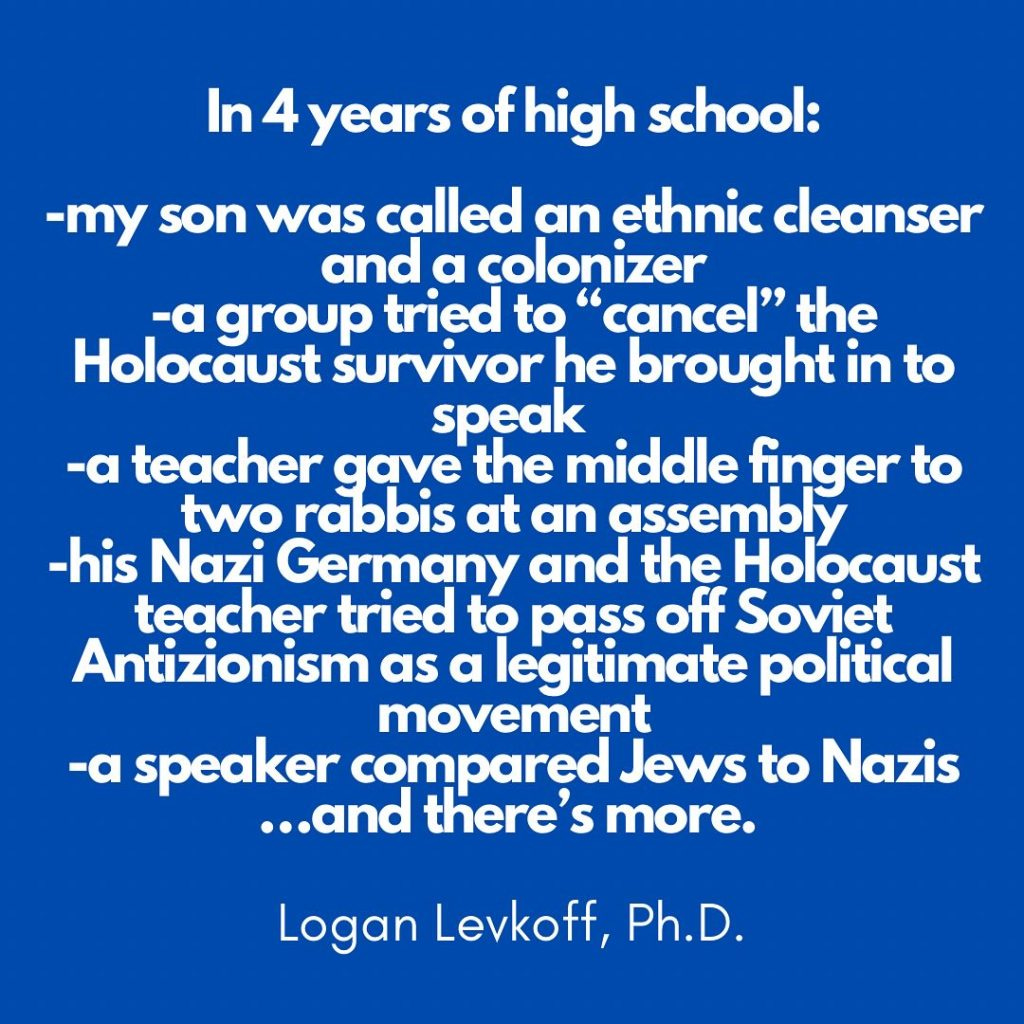

Please read the accusations against Fieldson, a $63k/year NYC school. I toured the school for my son 13 years ago. I recall telling my wife, “There is nothing to get me to send my son to this overly woke and weak school.” I walked out in the middle of the presentation it was so bad. It turns out it is even worse than I thought.

France Foils Planned Attack On Paris Olympics; Israel's Mossad Warns Of Terrorism Ahead Of Games

Other Headlines

Bank of America CEO says U.S. consumers and businesses have turned cautious on spending

My last note was entitled The State of the U.S. Consumer, and I outlined my concerns. Bank of America has as much consumer data as anyone.

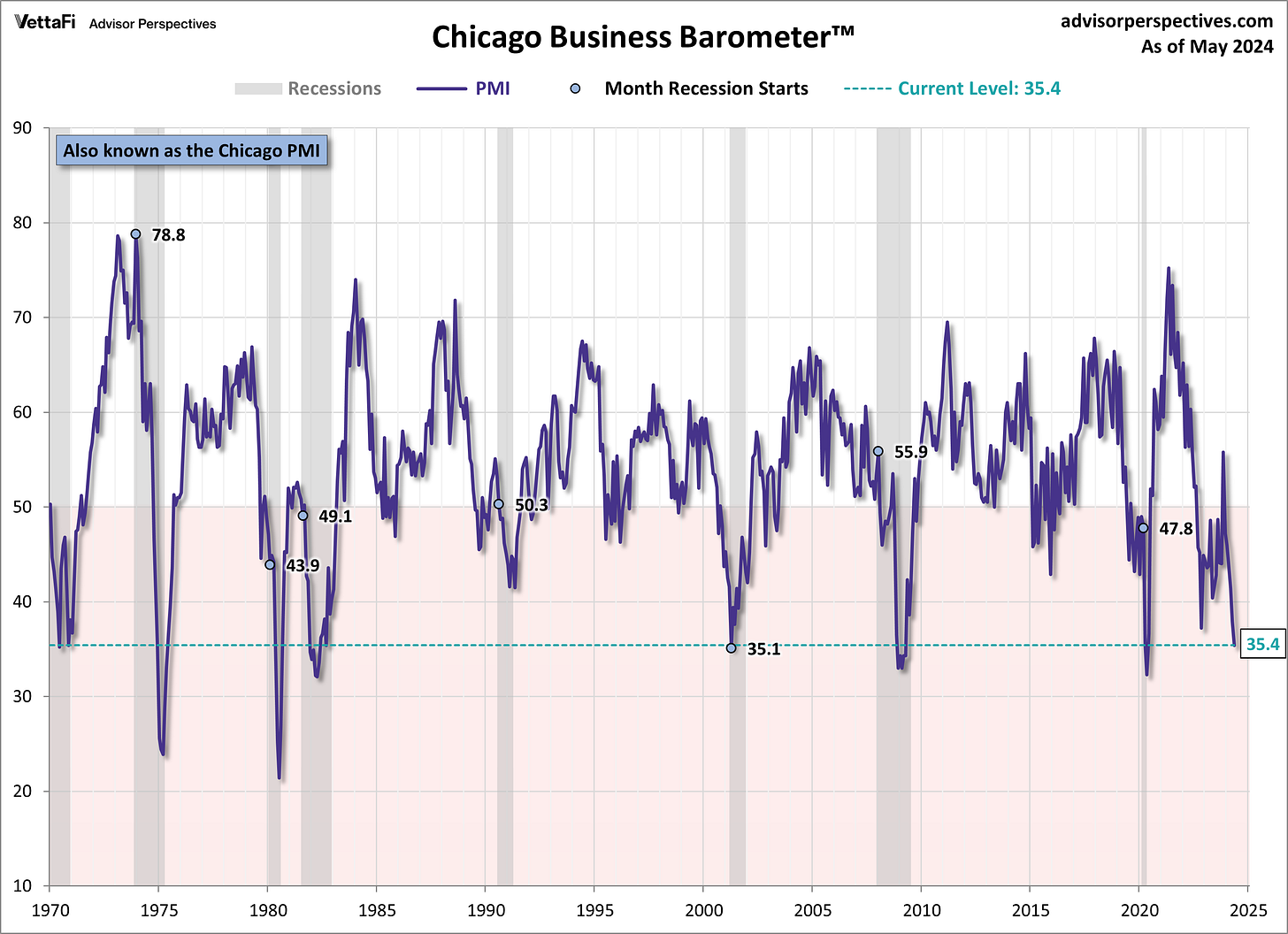

Chicago PMI Drops to 4-Year Low

Value above 50 is expanding manufacturing activity and below 50 is contracting. The reading was 35.4. It is now at levels not seen since Covid or the Global Financial Crisis. There is a lot of conflicting data recently.

At the dinner, he spoke about new products having growing pains that lead to issues. I would not be surprised if Jamie is right on this one. The growth has been incredible.

Bill Ackman selling stake in Pershing Square at $10.5 billion valuation, aiming for IPO one day

He is talking about insurance for cyber security.

Musk Accused of $7.5 Billion of Insider Trades in Investor Suit

Gap shares pop 20% as earnings beat on sales growth at all four brands

They raised guidance as well.

Nordstrom misses Wall Street’s earnings expectations as off-price chain Rack lifts sales

McDonald’s exec says average menu item costs 40% more than in 2019

When you wonder why consumers are upset, you need to consider the inflation that is everywhere. Too much free money for too long. Too many stimulative programs have contributed to inflation squeezing the consumer.

14,000+ Google Search Ranking Features Leaked

This is a bit over my head, but it seems to suggest that prior Google statements are not in concert with what the leaks show concerning search.

In the US, we let in criminals with no questions asked. The former President is banned from going to the countries of our biggest allies. In total, 39 countries have rules that would ban Trump due to the charges.

Joe Manchin leaves the Democratic Party amid speculation he’ll run for West Virginia governor

3 suspects in custody after reported machete attack injures 1 at Times Square McDonald’s

I was 3 blocks away when it happened. NYC is filthy, homeless everywhere, migrants selling crap on street corners. It is not the NYC I loved.

NYPD cops shoot crazed man who tried to stab people in Manhattan after failed taser attempt

Watch the video in the link. Are you serious? No wonder Chicago is such a disaster.

I’ve studied longevity for 35 years: Here’s the one habit I won’t change even for a longer life

Nutritional needs are ‘shifting’ amid rise of weight loss drugs, says Nestle CEO

Runner finishes 36 marathons in 36 days despite doctors warning she’d not live past 16

She has cystic fibrosis. What a crazy story. I could not run one marathon.

Rivers in Alaska are turning orange. The reason surprised even scientists

Furious groom discovers his new bride is a man who scammed him into marriage

Hard not to laugh. The bride wore a face covering while dating for a year. The groom found out two weeks after the wedding.

Real Estate

High end in South Florida remains hot on the East Coast. At the high-end in Miami and Palm Beach, there is limited inventory that is fairly priced, high quality and in a good location or building. Here is an example: A person bought the property for $11.2mm on 10/4/21 and built a house for approximately $10mm on Sunset Island #2. The house is not a desirable location as it is next to a bridge with no view. Despite this, the house sold in one week for $37mm. It is an 8,000-foot house on a 20,000-foot lot. Yes, Miami is hot due to the limited quality inventory to pick from today. Pre-pandemic, the house would have sold for $18mm. The best units in the best buildings in condos now trade for $5,000-6,000/ft. Pre-pandemic, the peak was $3,000/ft at Faena, but other than that it was closer to $2,000/ft. Today, the highest-priced buildings in Miami are the Surf Club, Shore Club, Apogee, Continuum, and a few others. On the flip side, there is inventory if it is not quality or in a good location. The 2nd picture is my community. Note the YTD sales number and averages since I moved down 7 years ago. Everything has almost tripled (median, average, highest, lowest…). Also of note, YTD, we have sold $100mm more than all of last year and it is 5 months into 2024. Check out this story about SW Florida condos for sale. Given rising insurance costs and mounting assessments, there is a rush of condos for sale.

Two luxury hotels in Miami (South Beach) are headed to foreclosure auction. The 132 key Gabriel South Beach on Ocean Drive, and the 129 key Gabriel Downtown Miami at the Marquis luxury condo tower. Despite South Florida seeing a massive migration of wealth and business in the past few years, it is not without issue. Higher rates, tougher lending standards, higher insurance costs are crushing many real estate ventures. Over the next 24 months, I expect to see a ton of defaults across the commercial segment. Obviously, offices will be most affected, but hotels and multifamily won’t be immune.

Signed sales contracts on existing homes dropped 7.7% in April compared to March, the slowest pace since April 2020. Pending sales were 7.4% lower than in April of last year. Sales were expected to be flat compared to March. Since the count is based on signed contracts, it shows how buyers are reacting to mortgage rates in real-time. The average rate on the 30-year fixed mortgage ended March at around 6.9% and then took off, hitting 7.5% by the end of April, according to Mortgage News Daily. This Bloomberg article is entitled, “Homebuyers Are Starting to Revolt over Steep Prices Across the US.” Although the article also outlines skyrocketing insurance rates, I ran the data to compare monthly costs from prior to the pandemic to today. Pre-pandemic, according to the Federal Reserve, the median home price was $329k and today it is $420k. Using 80% financing and a 3.5% mortgage in 2020 vs a 7% mortgage today, the monthly payment doubles from $1,181 to $2,247. Higher housing, home and auto insurance, food costs, healthcare, and everything else have squeezed the consumer.

Martin Selig Real Estate risks imminent default on $239 million in loans tied to seven buildings with 1.1 million square feet of offices in Seattle, each sent to special servicing. The locally based investor faces “imminent monetary default” on the mortgages that matured early this month for the seven buildings in Elliott Park, Lower Queen Anne, Denny Triangle and the Chinatown-International District, the Puget Sound Business Journal reported, citing the special servicer. Looks like multiple buildings of over 800k feet in total as part of the portfolio.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #687 ©Copyright 2024 Written By Eric Rosen.

100%