Opening Comments

Although I feel fine, my chest remains a bit congested and I have a cough. I tried to play tennis on Monday, and I was winded quite easily. I remain light (no weight gained), and don’t have a great appetite. I am eating materially less than pre-COVID. I feel this cough and congestion may take a while to beat. I have a 15-minute podcast today which can be found here. It is meant to augment the reader’s experience.

An oncologist reader reminded me that October is Breast Cancer Awareness month. Screenings are critical in catching the disease early, so be sure to take the time to see your doctors. During peak COVID, Breast Cancer screenings feel 87%. It is critical we get back on track here. Katie Couric revealed she had been diagnosed with Breast Cancer and underwent and lumpectomy and radiation. Couric’s breast cancer story has the potential to inform and remind millions of women about the importance of screening, just as the death of her husband Jay Monahan at age 42 from colon cancer inspired Americans not to forgo their colonoscopies.

I am heading to Austin, TX on Monday, October 24th for two nights. I have not been in 25 years and am excited to check it out. I have a meeting with a manager to help me with my newsletter/podcasts and a 3i networking dinner. Short trip. Not sure where I am staying yet. Any readers have strong views?

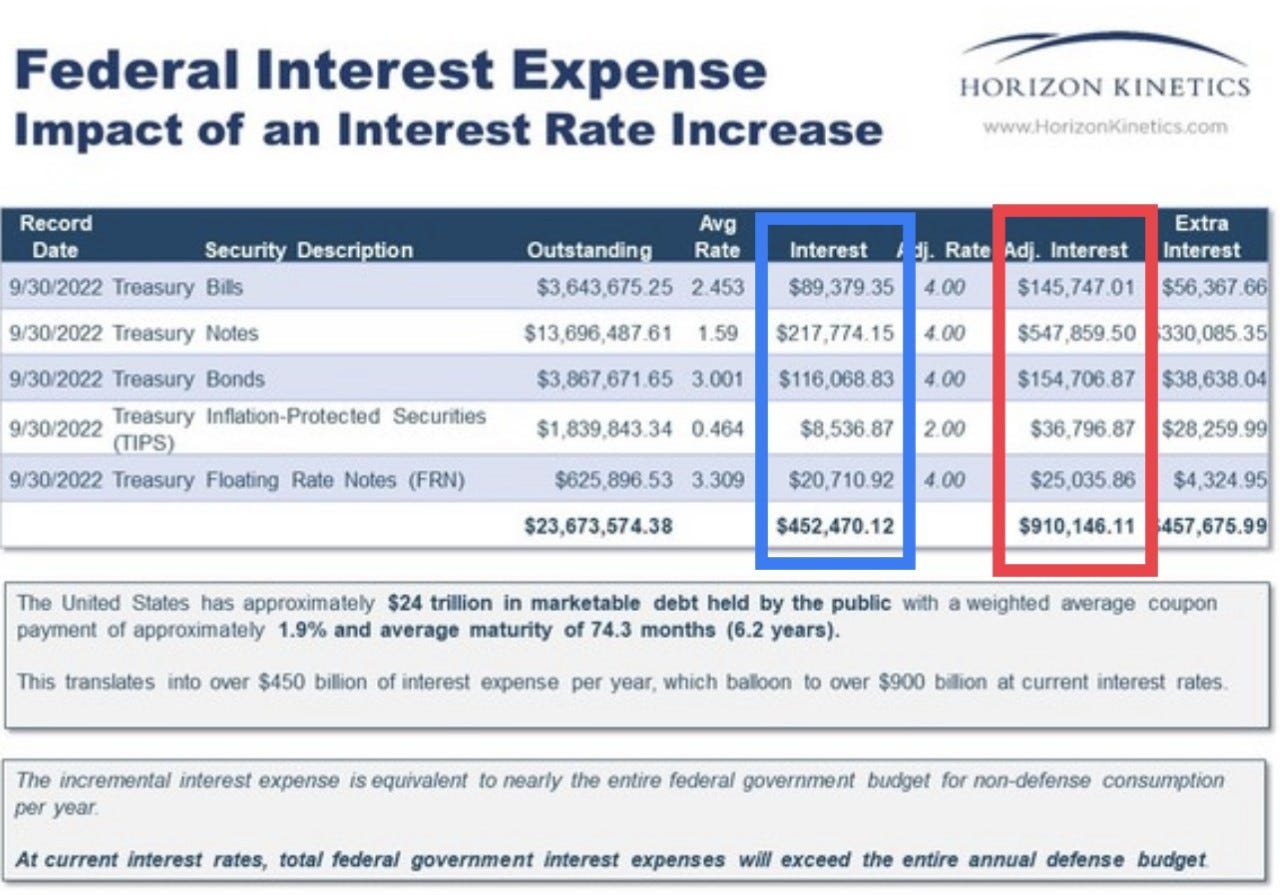

A reader sent me this chart of the potential Federal Interest Expense and I was unsure where to put it. Clearly a big concern. Shows $452bn of interest, but potentially going to $910bn due to the sharply higher rates. Free money for years has consequences which has manifest itself with high inflation and now sharply higher rates. Check out the chart. Troubling. This higher interest expense will crush the Federal budget.

Video of the Day-Chuck Schumer on Illegal Immigration from 2009

Senator Chuck Schumer from 6/2009 on Immigration

Eye on the Market-Michael Cembalest-Reruns

What is a Nickel Worth?

Quick Bites

Markets

UK Corporate Bond Market

Bank America and Goldman Earnings

Inflation Forecast Falling

SPR

US Recession/Stock Performance

Other Headlines

Crime Headlines

Real Estate

Other R/E Headlines

Virus/Vaccine

Video of the Day-Chuck Schumer on Immigration from 2009

How did the Democrats stray from what was a coherent message on illegal immigration? I ask you to listen from the 1 min 30 second mark for 2 minutes and 30 seconds. This video of Senator Chuck Schumer makes a great deal of sense, yet there were 2.5mm illegal immigrants which entered the porous US border in the past year and the Democrats once articulate message on the border is in shambles. Why?

Eye on the Market-Michael Cembalest-Reruns

In Mike’s latest research piece he looks at prior recessions. Great charts. The common theme: The bottom in equities will occur even as news on profits, GDP and payrolls continues to get worse. Mike suggests the ISM manufacturing survey has a good track record of roughly coinciding with equity market bottoms (last chart).

What is a Nickel Worth?

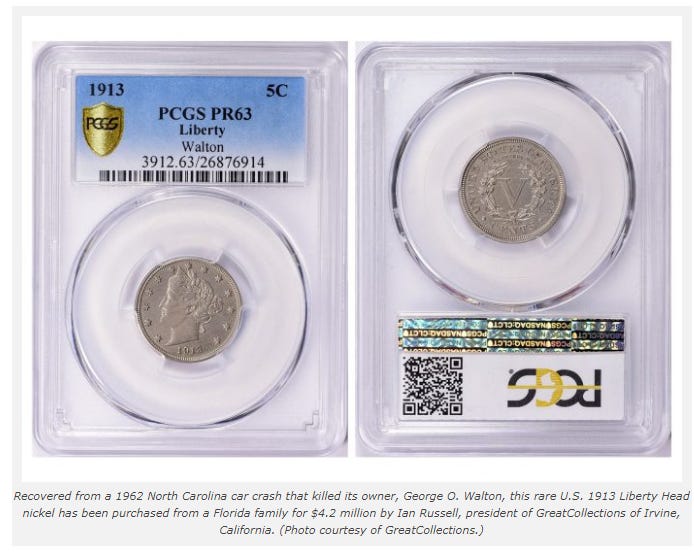

A reader sent me this article about a 1913 nickel which sold for $4.2mm. It is the second of only five known examples of the ultra-rare 1913 Liberty Head Nickel purchased by GreatCollections within 12 months. The Walton 1913 Nickel has one of the greatest stories to ever be told in U.S. numismatics. After being recovered from a deadly automobile accident in 1962, it was stored in an heir’s closet for decades before being uncovered to national fanfare in 2003. It was auctioned ten years later in 2013 for $3,172,500. The sellers, the Firman family, acquired the coin in 2018. The coin was authenticated and graded PCGS Proof-63 by Professional Coin Grading Service (PCGS) in 2013.

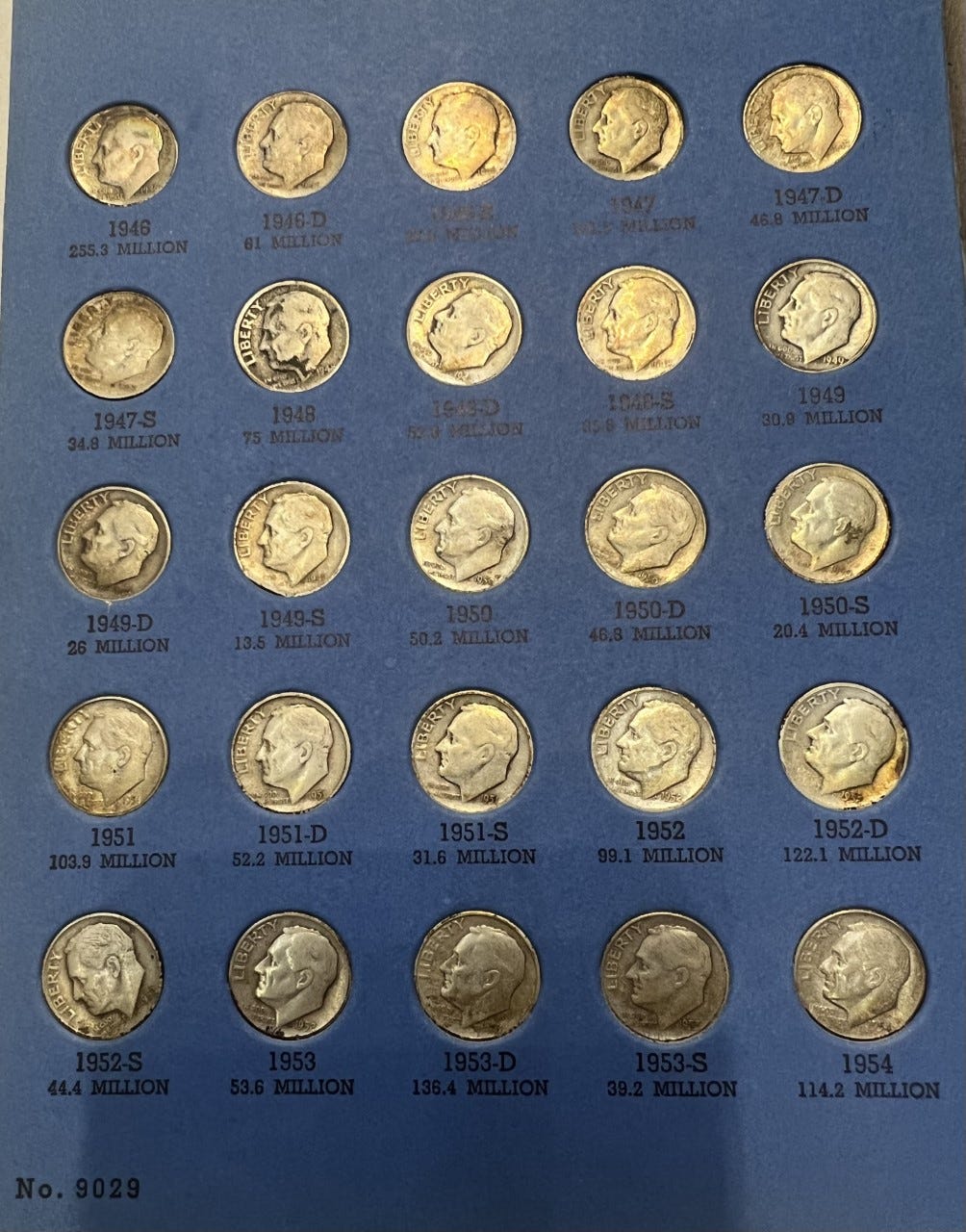

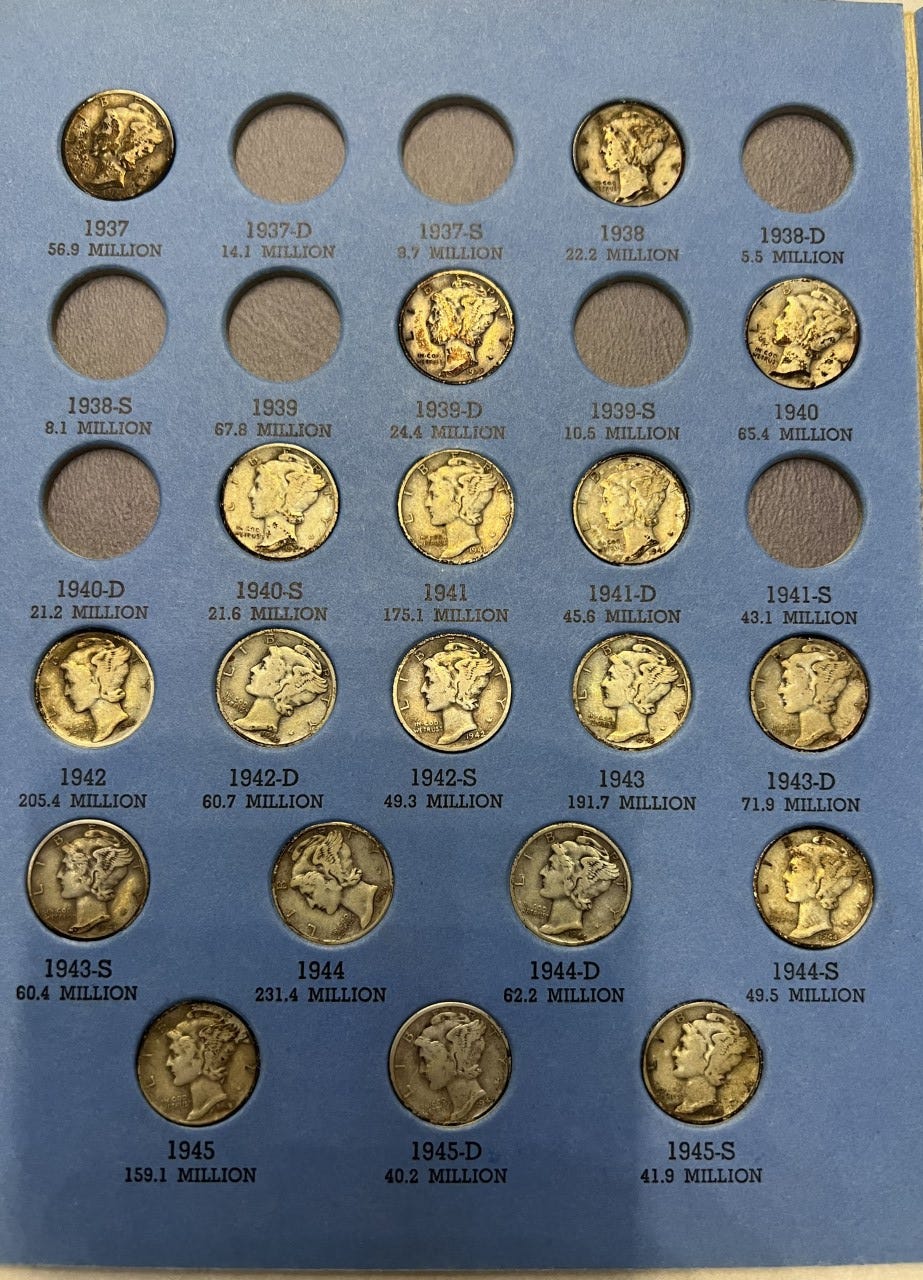

My mother passed away from cancer in July 2008 and had built up a coin collection. I never spent time on it, but the coins sit in a safety deposit box. For those loyal readers, you will remember my disaster story entitled, “Baseball Card Blues.” I had a bunch of cards from the 1960s and 1970s and was sure I was on a goldmine. NOT SO MUCH. A reader/collector came over and said, “I have never seen an older collection be worth less money.” Your rookie cards are awful and your non-rookie cards are great.

This fancy nickel story has me thinking maybe I have coins worth a fortune. What are the odds? Anyone have any coin game? Here are some pictures of a few of the books. Anything here? I have no clue on the value of these coins. Come on. Someone tell me I have a $4mm coin please. I am sure the cumulative value of all the coins is about $20. Just once, I would like a nice surprise that instead of my nickel being worth a nickel, it is worth 10,000,000 of them. If I have a valuable coin, I am sure it will be in horrific condition. That is just how I roll. If you see something amazing, but in bad shape, don’t tell me. I must have another 25 of these sheets.

Quick Bites

Markets remained volatile with a big up day on Monday+2 to 3% and then another rally, albeit smaller on Tuesday. On Wednesday, markets sold off again with rates higher despite decent earnings which have largely been better than expected. According to LPL financial, the S&P has had the fewest up days since 1974 (43.5% of the time). year to date. Stocks moved lower on Wednesday as Wall Street struggled to extend its rally amid a sharp rise in Treasury yields.

The Nasdaq lost 0.85%. The S&P 500 ticked down 0.66%. The Dow slipped 98 points, or 0.3%. The losses ended a two-day winning streak, though all three averages are still up for the week. The Treasury market remains under pressure with the 10-Year at 4.12% after having started the year at 1.51%. The 10 Year is +100bps since early September for perspective and is at the highest level since 2008. Goldman suggests to stay defensive and hold excess cash through year-end. “We see continued headwinds from higher real yields and a weak growth/inflation mix,” wrote analyst Christian Mueller-Glissmann in a Tuesday note. Oil is back up to almost $86/barrel despite the SPR release announcement of another 15mm barrels.The WH Press Secretary did say that a Ban on American petroleum products is ‘On the table.” Hard to make this up. TSLA announced after the close and the stock was -2% despite an earnings beat, but lower than expected revenues.

It has been a bad year for global bonds. But U.K. corporate bonds are being hit particularly hard by a toxic mix of political turmoil, high inflation and soaring interest rates. Highly rated corporate bonds issued in the British pound have posted a negative total return of around 25% this year as measured by the ICE BofA Sterling Corporate Index, by far the largest loss in the index’s almost 26-year history. In comparison, a similar index tracking U.S. dollar bonds is down 18% while one for euro-denominated bonds has lost 15% on a total-return basis, which includes price changes and interest payments. For decades, we have not seen stock markets weaker and bond markets get slaughtered.

Bank America topped estimates with better than expected bond trading and Net Interest Margin and shares rose over 4% on the news. Like its Wall Street rivals, investment banking revenue posted a steep decline, falling about 46% to $1.2 billion, slightly exceeding the $1.13 billion estimate. “Our U.S. consumer clients remained resilient with strong, although slower growing, spending levels and still maintained elevated deposit amounts,” Moynihan said in the release. “Across the bank, we grew loans by 12% over the last year as we delivered the financial resources to support our clients.” Goldman Sachs posted third-quarter results Tuesday that topped analysts’ expectations for profit and revenue on better-than-expected trading results. Here are the numbers: Earnings: $8.25 a share vs. $7.69 per share estimate according to Refinitiv. Revenue: $11.98 billion vs. $11.41 billion estimate. The company said profit fell 43% to $3.07 billion, or $8.25 a share, exceeding the $7.69 estimate of analysts surveyed by Refinitiv. In general, big bank earnings have surprised to the upside driven by solid trading revenue and Net Interest Margin, while banking fees have been hit hard.

I have written extensively about inflation for over 18 months. This Bloomberg article suggests inflation is forecast to fall sharply in coming months. I am not convinced of a fall this fast, but do see inflation falling.

I have been critical of the Biden Administration’s energy policy. It has been awful and the constant depleting of the Strategic Petroleum Reserves (SPR) is concerning. He announced another 15mm barrels of depletion due to the OPEC 2mm/day cut. It will mean 180mm barrels of SPR reduction recently. Remember, Trump wanted to fill the SPR at $23/barrel and the Democrats blocked it. Now, oil is at $80. Biden wants to replenish the oil between $67-72 or triple where Trump tried to buy. More bad policy. The SPR is the lowest level in 40 years. In late October 2021, we had 612mm barrels in the SPR and are now approaching 400mm.

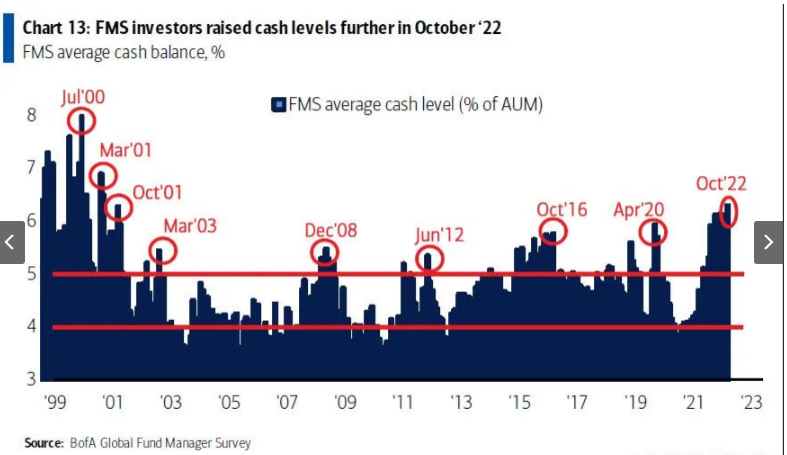

I put together a handful of stories here about US recession and markets. A US recession is effectively certain in the next 12 months in new Bloomberg Economics model projections, a blow to President Joe Biden’s economic messaging ahead of the November midterms. The latest recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by October 2023 hitting 100%, up from 65% for the comparable period in the previous update. Next spring the economy will sink into a 1990-style mild recession, Fitch says. The article suggests it will be mild. However, Jeremy Siegel suggests fear of Fed over-tightening is keeping stocks depressed, but the market could gain 30% in a rally next year. Also, Bank America feels cash positions re high leading to a rally in early 2023. This article (2nd chart) suggests the US Bear Market is in its infancy relative to history. Goldman CEO David Solomon says there’s a good chance of a recession and so it’s time to be cautious. Jeff Bezos is the latest to warn on the economy, saying it’s time to ‘batten down the hatches’. However, Morgan Stanley’s Mike Wilson suggests there could be an 11% bear market rally. He had been fairly negative.

Other Headlines

New England Risks Winter Blackouts as Gas Supplies Tighten

ISO New England Inc. has warned that an extremely cold winter could strain the reliability of the grid and potentially result in the need for rolling blackouts.

Sunflowers, war and drought: Why the price of margarine and butter spiked 32%

Los Angeles is running out of water, and time. Are leaders willing to act?

US's Blinken Says China Wants to Seize Taiwan on ‘Much Faster Timeline’

Saudi prince sends threat to the West after Biden warns of consequences for kingdom

Why? Because Biden could not convince Saudi’s to hold off one month to help the Democrats in an election? Biden hates fossil fuels. Why should OPEC help anyone who hates fossil fuels? Bad energy policy by Biden. We have all the fossil fuels we need in our backyard. Let’s use it and not be reliant on other countries. Just a thought.

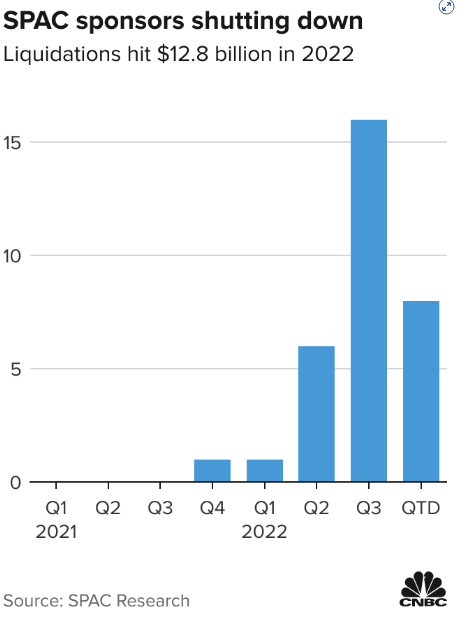

SPAC liquidations top $12 billion this year as sponsors grapple with tough market, new buyback tax

Apple ticks down on report of cut to iPhone 14 Plus production

Tulsi Gabbard compares Joe Biden to Adolf Hitler

Although I believe Biden’s policies around the border, energy policy, foreign policy, crime…have been awful, I feel it is very unfair to compare him to Hitler. Tulsi sounds like an idiot.

Up to $1,160/night. So much for discounted rates as he promised.

Americans' Trust In Media Remains Near Record Low

7% of people have a “great deal” of trust in media. I wonder why.

After two years of shipping snarls, things are starting to turn around

Prices are down considerably, but remain well above pre-pandemic levels.

Apple's VR metaverse headset will 'scan your eyeballs' for information

FBI has ‘voluminous evidence’ against Hunter, James Biden: Sen. Grassley

Biden's family got 'interest-free,' 'forgivable' loan from China, new evidence reveals

We’re Jewish Berkeley Law Students, Excluded in Many Areas on Campus

Nothing to see here folks. Jew hate at Berkeley.

Radioactive material found at Missouri elementary school more than 22 times expected amount

Overwhelmed by 20,000 Migrants, NYC Opens First Tent Shelters

DC tent cities stain the nation's capital

120 Tent cities in DC. Nothing to see here.

Rolls-Royce has over 300 orders for its $413,000 Spectre electric vehicle

Crime Headlines

Justice system hard at work allowing career criminals to hurt law-abiding citizens.

Man dead after being shoved in front of subway in Queens in yet another transit fatality

Dramatic video shows $500K Park Avenue smash-and-grab

Park Avenue. Just not supposed to happen like this.

Wild video captures Grand Central escalator fight and tumble after suspect allegedly punches victim

Real Estate

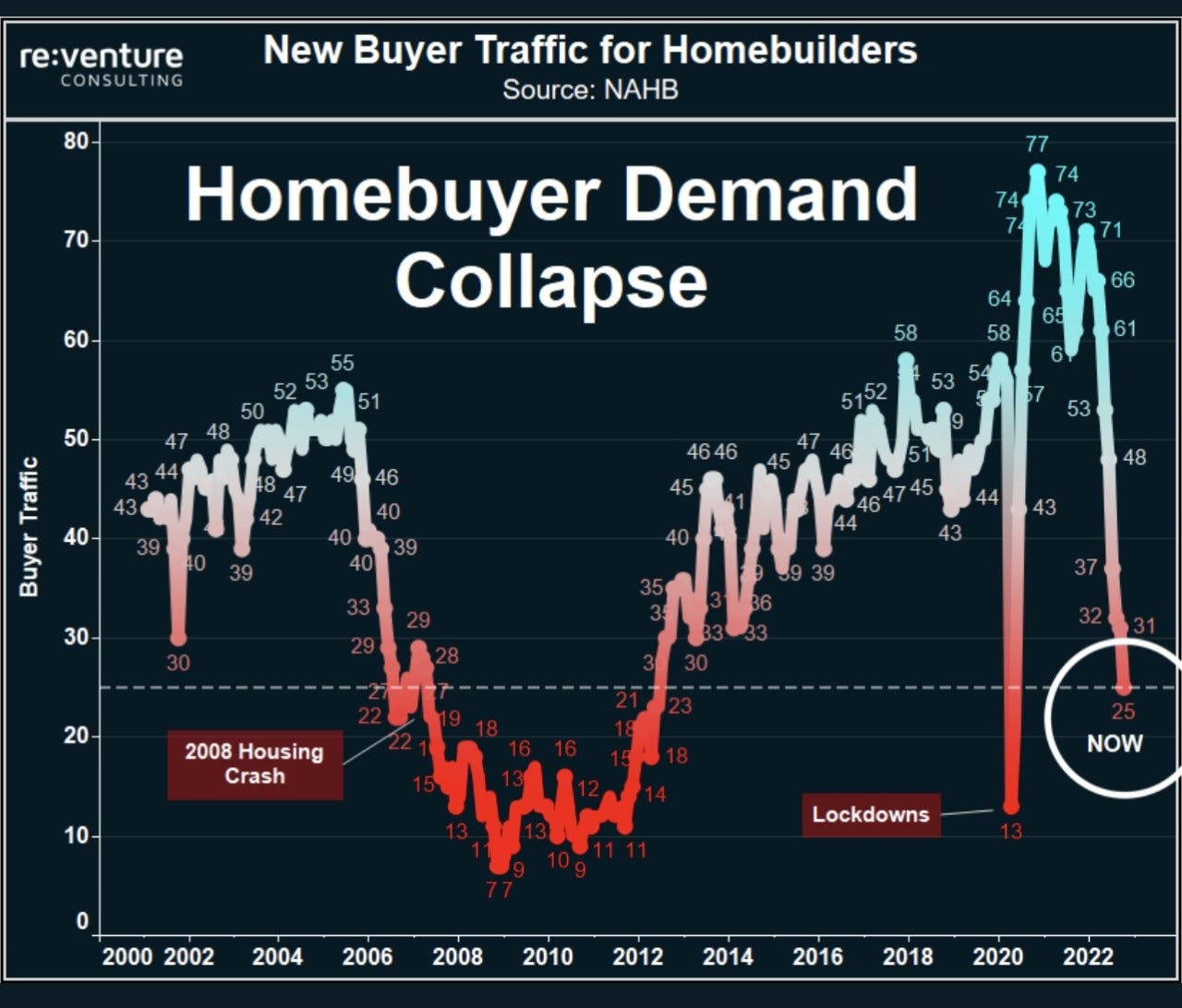

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), which is designed to gauge market conditions, fell 8 points to 38 in October from the previous month. “High mortgage rates ... have significantly weakened demand, particularly for first-time and first-generation prospective home buyers,” said NAHB Chairman Jerry Konter, a homebuilder and developer from Savannah, Georgia. “This situation is unhealthy and unsustainable.” The charts below are pretty telling. Only one way for home prices to go and it ain’t up. The 1st chart is NAHB home builder index.

Jared Halpern from Douglas Elliman in NYC sent me a note. Twenty-four contracts were signed last week at $4mm and above in Manhattan, double the previous week’s total. This snapped 3 straight weeks of decline in sales. Condos outsold co-ops 15-5 and 4 townhouses were in the mix. Six contracts were signed north of $10mm, the highest number sold in a week since May 9th when 7 were sold.

Other R/E Headlines

Home asking prices tumble at record pace as mortgage rates surge

Housing market likely to tip economy into recession in 2023: Fannie Mae

Mortgage demand drops to a 25-year low, as interest rates climb

Manhattan Townhouse Market’s Hot Streak Continues With $57 Million Deal

Virus/Vaccine

Data improving, but I am hearing of more readers who are testing positive at home which won’t show up in the official data. Positivity rate creeping up a touch.

Boston University researchers claim to have developed new, more lethal COVID strain in lab

Researchers at Boston University added a spike protein from the Omicron variant with the original Wuhan strain, which has an 80% kill rate. I am going to ask why we are doing this? Have we not learned anything from Wuhan?