Opening Comments

I am working on some interesting stories in reports over the next week or two. I have a piece which is now entitled, “Kidney Donation and Perfect Scores May Not Be Enough To Get Into College,” and another about the amazing surf adventure which was highlighted in Pictures of the Day in the last report entitled, “Tiger’s Legacy.”

I was interviewed by Jeff Black from Tornado.com last week and recorded a podcast that has been broken into two 20-minute sections. This is meant to be informative and shares my views with some solid data behind it.

If you don’t get my newsletter on Wednesday or Sunday, you can always find it on Substack or LinkedIn. The Substack link has my newsletters going back a couple of years.

Markets

M2 Money Supply Shrinking Fast

Presidential Polling-New Candidates Please

Tucker/Lemon Shake Up/Firing

Ramifications of SpaceX Launch

Boca High-End Housing Slowing-Not on the Ocean in Palm Beach-$170mm

CMBS Yields Today-Single Asset-Office NYC/SFO

Office Market

Bronx Apartment Buildings Sold at a Loss

Investment Banks on Commercial R/E

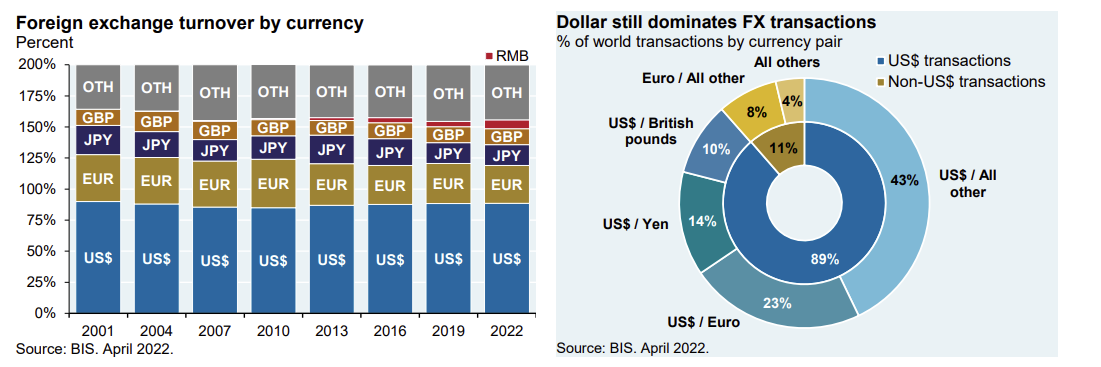

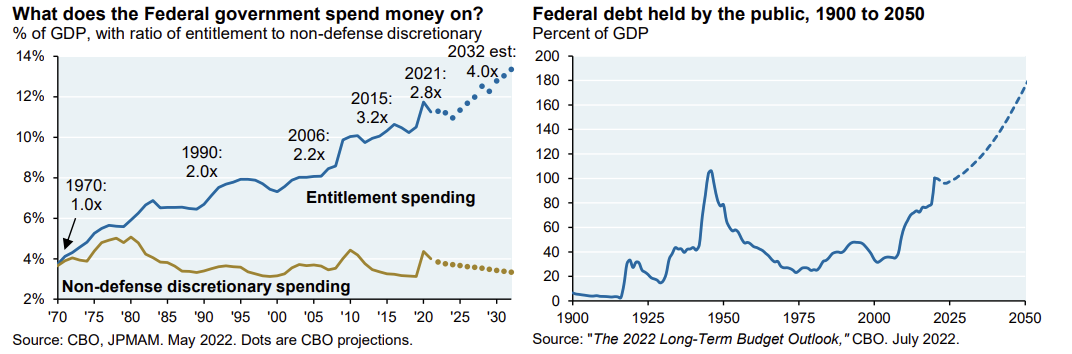

Eye On The Market-Mike Cembalest on the US Dollar

This is a MUST read given all the questions my subscribers ask about the US Dollar and its reserve currency status. The dollar is still the dominant currency of choice for investment of foreign exchange reserves at ~60%. The dollar’s share has declined by ~6% since 2015 as some Central Banks diversify holdings away from the dollar and the euro. I’m of the view that the US has around 20 years to figure things out before a more sustained reserve currency threat from the RMB materializes, particularly since China has debt issues of its own. China’s debt has accumulated in the corporate sector, some of which is increasingly indistinguishable from the government. If by that time the US debt ratios have veered off into Greece/Japan/Venezuela territory, then the long-predicted decline of the dollar as reserve currency may finally occur. The chart on the lower left is scary and something I have written about extensively. The government has a spending problem.

Yo Cuz, Cafe Martorano-Go for the Meatballs & Gravy

Owner, Steve Martorano has a solid staple at his Italian eatery in Fort Lauderdale which has been around for 30 years. Martorano is a South Philly guy who knows how to cook. I have been to the restaurant maybe dozen times over the past 8 years. The food is consistently solid and the service is snappy, as they turn the tables 3-4 times a night. Yo Cuz is one of Steve’s phrases and is used as a term of endearment and is also part of the title of a book. He is a large, muscle-bound guy who is hard to miss behind the counter in the open kitchen.

For me, the show stopper is the meatball salad. The tender meatballs and gravy are some of the best I have had. Gourmet Magazine called them, “Maybe the best meatball in the world.” You must order a handful for the table, as it is my favorite dish on the menu. They are tender and full of flavor. I am scared to ask what is in it, but know they are delicious.

Martorano calls himself a cook, not a chef, and focuses on foods he likes to eat himself. I like the service, but you must order all at once given the lines to get into the place. The ambiance is quite loud and mobster movies play on TVs all over the restaurant. I believe they have a DJ later on some nights as well. Many movie stars, mobsters, athletes and other chefs go frequently. Celebrity chef Geoffrey Zakarian featured Martorano’s baseball-sized meatballs with salad appetizer on the Cooking Channel’s The Best Thing I Ever Ate.

I ordered a fantastic grouper dish over mashed potatoes which I crushed in no time. The table loved the parmesan fries too. However, my daughter had the Trecce Spicy Vodka Pasta and was not blown away. He does serve the pasta “Al Dente” which is a little undercooked relative to many others. Jack had a Chicken Parm with Gnocchi and he devoured it.

I am generally not a lover of Italian desserts, but these are pretty solid, as Martorano’s wife, Marsha, apparently makes them and they have more of an American flair for some and they are quite good. Booking a table at a choice time is not easy, so call in advance. Bring your earplugs and spandex pants, as you are gonna eat.

Food-A-, but meatballs are an A+

Ambiance-B-Gets loud

Service-A

Wine-Good by the glass selection

Price-Expensive, but note offensive

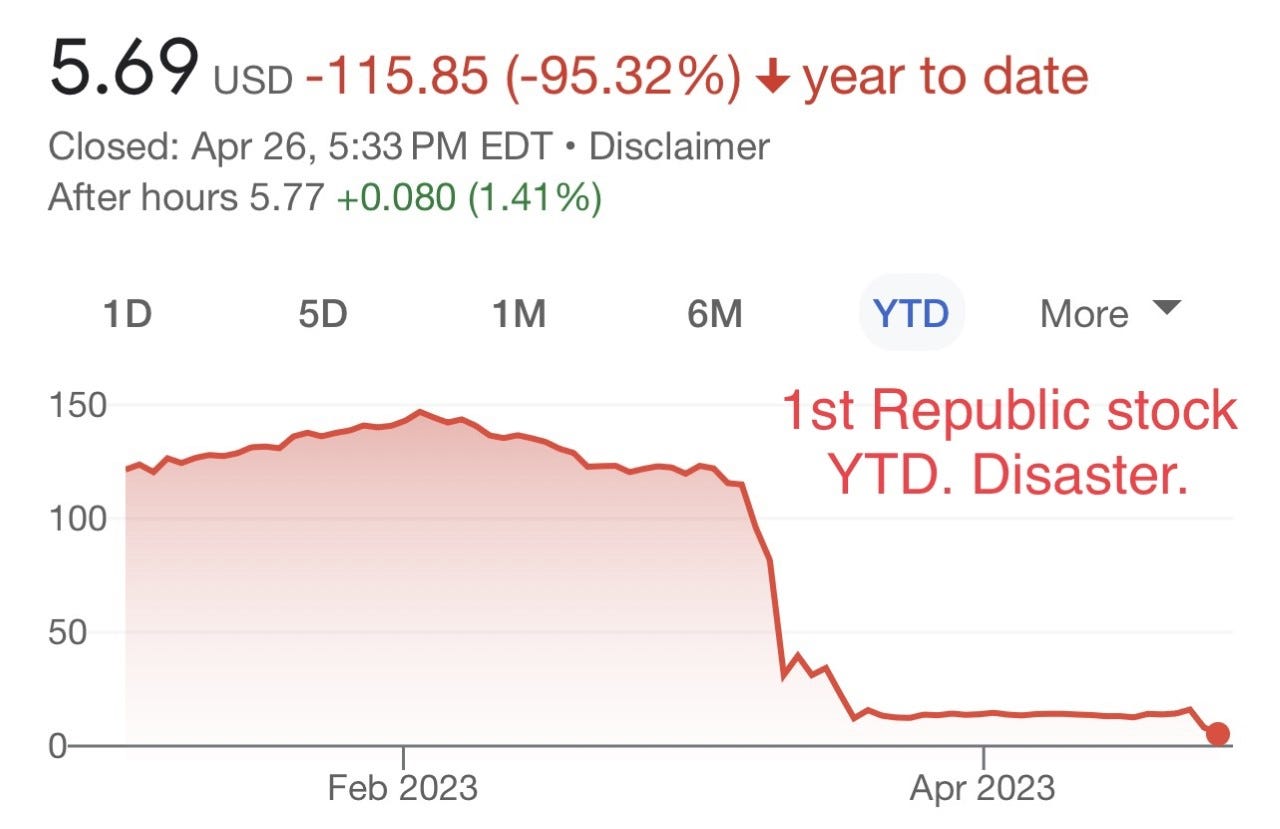

Quick Bites

The market sold off sharply on Tuesday on the heels of First Republic which fell 49% on the day. The stock is down as much as another 41% Wednesday and - 97% YTD to $4.8/share, before settling at $5.7 (-30%). The bank’s deposits shrank by 40.8% during the quarter as customers pulled out money following the collapse of SVB. The result was the S&P was -1.6% on the day. I made it clear to my readers that despite the recent calm in markets I felt the banking issues were not yet behind us. There is a story the bank is trying to sell up to $100bn of assets. Today’s sell-off was also around a story of additional equity capital raise assuming banks buy assets (at a premium) to help First Republic. I have no idea why any bank would do this and if I were a board member, I would vote against overpaying for assets to help the bank. Additionally, I recently wrote that First Republic stock remained low despite the $30bn in deposits from the major banks and felt that was a sign of trouble. If you run a Regional Bank today, you better be sure to have AMPLE liquidity which will negatively impact your earnings and willingness to lend. On Wednesday, the S&P was weaker (-.4%) brought down by the banking concerns, but tech was strong with solid earnings pushing the Nasdaq up .5%. Goldman suggested quants are “Out of Ammo” for buying stocks. Again, I am 70% of my net worth in short-dated Treasuries or like securities within 3 years and question the stock market levels due to earnings, consumer, and the pull-back in lending coming. Since hitting a yield of 4.26% one week ago, the 2-year Treasury yield has fallen back to 3.94% on the broader market concerns.

RDI 5-This explains the RDI.

Money supply (M2) has now been shrinking year-on-year since December, an unprecedented development in modern times that should make investors sit up and take notice - growth, asset prices, and inflation could all weaken. It is largely a consequence of the reversal of the liquidity generated by massive post-pandemic fiscal and monetary stimulus, the Federal Reserve shrinking its balance sheet via quantitative tightening, falling bank deposits, and weak demand for and provision of credit. M2 measures the nation's overall stash of cash, coins, bills, bank deposits, and money market funds, and is basically the broadest measure of cash and cash-like liquid assets. This link explains M2, but is a month old. Note the chart which shows the sharp recent decline in M2 and suggests we have not seen M2 contract in almost 90 years. The March M2 growth rate was -4.05%, the biggest year-over-year decline on record. This is yet another factor to watch. The 2nd chart is from DBs Jim Reid, and his comments make it clear that the large fall is after the massive explosion in M2 given the accommodative policy due to the pandemic. This fact makes it hard to compare with prior markets or events, but again, something to watch.

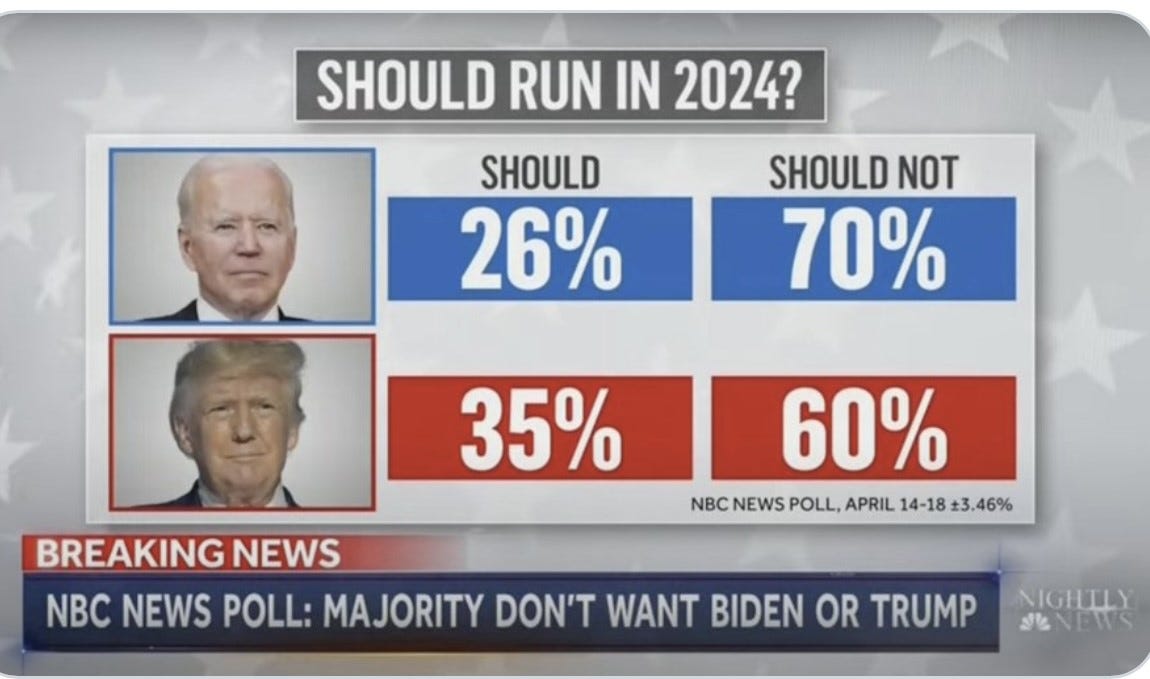

Biden announced he was running for re-election despite the fact that he would be 86-years old in office and his cognitive ability has been severely compromised. Ex-White House doctor, Rep. Ronny Jackson (R-Tx.), is demanding that President Joe Biden take a cognitive test or drop out of his newly announced 2024 race altogether. I believe all of Congress, SCOTUS, and Presidential candidates should have to take a cognitive test every couple of years. The chart below is concerning. Are you telling me that the greatest country in the world cannot do better than either of these two candidates? 70% of Americans suggest Biden should not run and 60% feel Trump should not run. These two clowns are the likely candidates we get to pick from? Why is it always the lesser of two evils rather than someone we can get behind? I want new and younger candidates who move toward the Center. Trump suggested he may skip the two Primary debates given his commanding lead in the polls. I don’t think that is a good idea and feel all candidates should participate. Biden is attracting big-money donors after his announcement according to CNBC.

There has been some big news on the anchor front at Fox and CNN with both Tucker Carlson and Don Lemon out of jobs. Both hired a famed layer, Bryan Freedman, but I am not aware of any lawsuits yet. Tucker was supposedly fired due to a lawsuit filed by Abby Grossberg, and I am sure the discovery during the Dominion lawsuit did not help matters. Grossberg claims Tucker contributed to a “sexist” work environment. Also, this WSJ story suggests vulgar messages about his colleagues helped seal his fate. Lemon had been accused of misogyny and bad behavior and is supposedly owed approximately $25mm under his contract. Based on ratings, the loss of Tucker is a bigger impact on Fox than CNN losing Lemon. Tucker had 3.25mm viewers on average in the first quarter of 2023, which is well ahead of Chris Hayes’ 1.33 million and Anderson Cooper’s 703k. Lemon’s ratings have been falling and he had become less relevant in recent months. Also of note, Jeff Shell, NBC Universal CEO left following an investigation of “inappropriate conduct.” The speculation was an affair with Hadley Gamble, a CNBC anchor, and international correspondent.

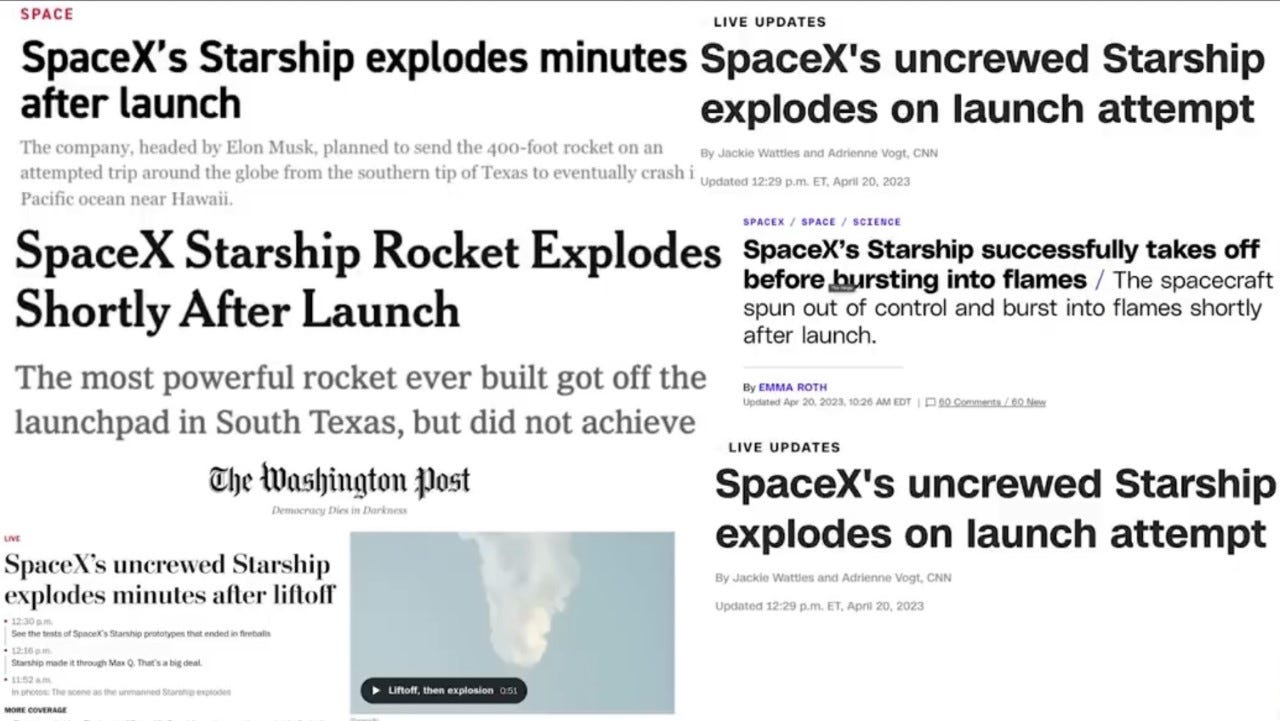

I found the coverage of the SpaceX launch interesting. The general media was very critical of the explosion (1st picture) which occurred roughly 4 minutes into the flight of the rocket, Starship. Not following the story closely, I too felt it was a disappointment until I heard the perspective of a Board Member of SpaceX. For any inquisitive minds, listen to the first 20 minutes of this All-In Podcast. The view of the Board Member was the fact that Starship got off the pad and flew for four minutes (39 kilometers) and the rocket got past Max q, the point when an aerospace vehicle’s atmospheric flight takes the maximum stress. The implication is this vehicle can get to orbit and eventually Mars. Insane statistics in the video. Eventually, the cost of sending over 100 metric tons into orbit of a variable cost of under $2mm according to the podcast. This is a step-function change. The Falcon 9 mass to useful orbit is 17 metric tons, and the variable costs are approximately $15mm. Eventually, with the Starship, they will be able to lift over 5 times the mass to orbit at 15% of the cost of the Falcon. This is roughly 50 times improvement in the unit economics, which is a massive move in the right direction. At 8:21 into the podcast, they discuss the ramifications of travel and shipping which BLEW MY MIND. You will be able to fly across the globe or bring cargo to the other side of the world in a couple of hours. The iterations and changes in these rockets and what the engineers can do in short order are remarkable (16-minute mark). I will say it again. Elon Musk is the single most important person in the world and the most impressive despite his immaturity and stupid Tweets.

Other Headlines

‘Easy money is behind us, the hard money is now,’ Stifel’s chief strategist warns

He questions the market’s ability to generate any real returns for the next decade.

Cooperman has warned markets of an coming recession, and said stocks could plunge 20% this year.

Every reader knows Druckenmiller is my hero. The guy’s returns were roughly 32%/year for 30 years. When he speaks, I listen. He believes the US will be forced to cut rates soon.

Boaz Weinstein Preps for Credit Crunch After Wins on Banking Turmoil

Saba founder sees ‘huge problem’ brewing in private credit. Banks already deleveraging to prepare for corporate distress. I am in agreement with Boaz. I have known him for over 20 years. He has done well on asymmetric tail-hedge trades historically.

US default on debt would trigger 'economic catastrophe,' Yellen says

I agree that there would be ramifications of a default that would severely impact the economy. However, I do not believe it will happen despite my lack of faith of the idiot politicians in DC. Cooler heads should prevail. If not, things get ugly quickly.

Microsoft reports earnings beat, says A.I. will drive revenue growth

Britain blocks Microsoft’s $69 billion acquisition of Activision Blizzard

MSFT stock is +8% (earnings) and Blizzard -11% on the news.

Electric car sales surged by 55% last year to surpass 10 million, and China led the way

According to the article, 26mm cars on the road globally out of 1.5bn (1.7%). Great progress, but a long way to go, and lots of infrastructure is needed, as well as sharp price reductions to compete with ICE vehicles.

Musk Bets the House of Tesla on Low Prices and Razor-Thin Margins

TSLA stock is +50% YTD, but is down 22% in the past three weeks.

Peter Thiel, Republican megadonor, won’t fund candidates in 2024

Thiel is unhappy with the Republican Party's focus on hot-button U.S. cultural issues, said one of the sources, a business associate, citing abortion and restrictions on which bathrooms transgender students can use in schools as two examples.

Disney sues Florida Gov. Ron DeSantis, alleges political effort to hurt its business

Autistic Jewish teen has swastika carved on his back in Las Vegas

There are disgusting pictures in the link. What a sad state of the world.

San Francisco Target puts entire inventory on lockdown amid shoplifting crisis

Please open the link to watch the short video. Insanity has arrived in America. SFO is beyond screwed due in many cases to moronic policies. The city had a vacancy rate of 4% pre-pandemic and now it is approaching 33% with an availability rate approaching 40%. SFO cellphone activity is 31% of pre-pandemic levels. NY is a 74%, Chicago is at 50% and Boston at 54% of pre-pandemic levels. Salt Lake City was at 135%!

Suspect falls as armed duo robs worker at NYC store

An elderly worker was pistol-whipped in a Soho electronics store.

Vagrant who allegedly beat NYC straphanger charged with strangling girlfriend to death

Awful story.

A 13-year-old boy was groomed publicly on Twitter and kidnapped, despite numerous chances to stop it

The abduction came after a series of missed opportunities in which Twitter and law enforcement failed to effectively intervene. Read this story. Talk about scary. Parents go into the bedroom and find the boy missing with the window open. The 13-year-old was repeatedly sexually assaulted. The internet is a scary place.

Kim Foxx won't seek reelection as Cook County State's Attorney

Chicago voters, you threw out Lightfoot and elected another soft-on-crime mayor. Now is your chance to elect a DA who actually believes in putting criminals behind bars.

Trans Marathoner Defeats 14,000 Women in Race after Competing as Man Months Earlier

I am 100% supportive of any adult who wants to go through the transitioning process. However, I am not supportive of biological males competing against females.

Steven Spielberg: ‘No film should be revised’ based on modern sensitivity

Potentially dangerous doses of melatonin and CBD found in gummies sold for sleep

“One product contained 347% more melatonin than what was actual listed on the label of the gummies,” said Dr. Pieter Cohen.

An Allergy Season So Bad You Don’t Need Allergies to Feel Miserable

I have environmental allergies and I have taken more allergy meds in the past month than I have taken in the last 5 years.

Russian official says ‘Ukrainian’ drone found outside Moscow

A district official says Victory Day parade cancelled after drone discovered approximately 30km (19 miles) east of the capital.

Real Estate

I have spoken about high-end Miami and Palm Beach remaining in high demand, and there is limited inventory. In Boca, although the market is strong on the high-end, homes are sitting unsold for many months now. I wrote about a beautiful house on a canal in my community, Royal Palm. It was initially listed for $35mm a year ago, a price that I felt was aspirational. I am told they received an offer of $29mm cash but turned it down looking for $32mm (not confirmed). The price was cut $29.250mm many months ago and was just slashed again to $26.5mm. The house at 298 Key Palm can be seen here. When I moved here in 2017, there were 71 listings with an average ask of $4.9mm. In December of 2021, there were only 4 listings. Now, we are back to 33 listings but the average ask is now $17.6mm. In 2017, one home sold for over $10mm. Today, 21 homes are asking over $10mm, 12 are asking over $20mm and 5 are asking over $30mm! I do believe some softening is due to given rates, economic slowdown, and the challenge of getting into schools. However, I do see the migration continue from Blue to Red states for all the obvious reasons and believe South Florida will continue to be a net winner. This Bloomberg article is entitled, “Miami’s Luxury Rent Surge Means Your Money Goes Half as Far.” Just today, a house in Palm Beach on the ocean sold for $170mm, an all-time high. The 1.6 acre property is on 589 North County Road. Interestingly, a few doors down is Nelson Peltz and he has 8.5-9 acres. What is that one worth???

I spoke with friend who is involved with CMBS-Commercial Mortgage-Backed Securities. He told me you can now buy AAA-rated bonds at a low double-digit yield for single-asset office space in NYC and SFO. These mature in a few years (extension risk is real) and are now trading in the low 90s. A year ago, they were the high 90s to 100 and yielding 3%. With respect to the mezzanine debt, nothing trades, and the bonds of these deals are quoted in the 60s. He has not seen a trade in a couple of months. For perspective, CMBS backed by the housing market traded sub 50 for AAA bonds in the Global Financial Crisis.

Landlords in Houston and Dallas are having a tougher time filling their empty office buildings with new tenants than any other market in the country, according to office market statistics compiled by CoStar and JPMorgan. Why? One reason: They overbuilt when interest rates were low. Houston and Dallas put up more new office space between 2010 and 2021 than all regions except New York. Despite the disruptions of the pandemic, they still have millions more square feet under construction. Vacancies now are higher than any other metro area, despite attempts to fill the gaps with heavy discounts. Houston and Dallas had 18.8% and 17.2% of office space sitting empty at the end of 2022, according to the figures from CoStar and JPMorgan, well above the national average of 12.5%. New York, San Jose, San Francisco, and Chicago had vacancy rates of 12.3%, 12%, 16.4%, and 15.1%, respectively.

Taconic Investment Partners is taking a substantial loss on a portfolio of Bronx multifamily properties. The firm sold a 14-building portfolio — largely centered in the Fordham Heights neighborhood — to InterVest Capital Partners for $60 million. InterVest, funded by the sovereign wealth fund of Kuwait, was the buyer of the portfolio of 5- and 6-story walk-up and elevator rental buildings that were a part of a roughly $100 million play by Taconic. Taconic, run by Paul Pariser and Charles Bendit, assembled the portfolio through two purchases in 2018. At the beginning of the year, Taconic entered into a contract to buy a dozen properties from Related Companies and New York City pension funds for $70 million. That portfolio consisted of 368 rent-stabilized apartments. Later in the year, an affordable housing joint venture from Taconic and Clarion Partners picked up a pair of buildings in Concourse for $27.8 million. City Skyline Realty was the seller of those buildings, which housed 131 rent-stabilized apartments. Billions of losses will be taken in the next 36 months in the Commercial Real Estate space, especially office and urban retail.

Morgan Stanley’s wealth management chief investment officer, Lisa Shalett, wrote in a recent report, “More than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points.” Even before the bank failures, office properties were already facing “secular headwinds,” and are expected to face more challenging times ahead, Shalett wrote, with vacancy rates close to 20-year highs. Therefore, Morgan Stanley’s “analysts forecast a peak-to-trough CRE price decline of as much as 40%, worse than in the Great Financial Crisis.” The distress, following the number of loans set to mature, and the likelihood of defaults and delinquencies as a result, will trickle down and affect more than banks and landlords—and no sector would be “immune” to the effect of that, Shalett wrote. UBS is far less bearish as outlined in the article. GS is bearish on the space, but it seems not quite as negative as MS.