Opening Comments

My last post, “Charging My Daughter Service Fees,” was well received. I feel the Rosen Report is improving due to help from consultants and survey feedback. Readers continue to send me story ideas and constructive criticism, which is always appreciated. Approximately 25% of my story ideas come from readers in any given newsletter.

Markets

Consumer Debt Concerns, but remain Resilient

CA Nat Gas Prices Defying Broader Market

Social Security Needs to Be Addressed

Blackstone Commercial Mortgage Loans to Special Servicer

Vornado Retail Default

Dropbox Hit on SFO Lease Losses

Pictures of the Day-The Boca Raton (Resort)

South Florida is hopping, and President’s Day Weekend brings in the crowds. The Boca Raton (resort) is 100% full. My friend and I went over Friday night for a quick bite, and the place was PACKED. A lot of younger families are clearly from NYC. This is not your grandmother’s Boca anymore. Dell bought the resort just prior to the pandemic and spent $300mm on upgrades, and it shows (other than the golf course). The bars and restaurants are all Major Food Groups (Carbone Fame), and the crowds are thick. The new pool and water slides are great for kids, and the beach club is fantastic. However, you will have sticker shock when you go. Prices are up sharply since the renovations, and Forbes just gave it 5 stars this week.

GFC-The Short and Long of It

In July 2007, I became concerned about the market and alerted the heads of the Investment Bank and CEO of my views through a short daily note. It was the precursor to the Rosen Report you know and love today. I have most of the emails I wrote from the summer of 2007 though early 2010. Some were a few sentences and others were longer. It started going to the handful of most senior management at the firm and ended up going to virtually the entire investment bank at JPM. People from other firms (buyside and dealers) were calling me as my notes were forwarded around Wall Street. Below is an example from July 2007.

I started building a short position in the summer of 2007 to hedge our long-biased trading books. I felt hedges offered asymmetric payouts through the credit and equity markets. The world was priced to perfection, and volatility was cheap. Credit spreads were tight and very easy to take a short risk position by buying Credit Default Swaps (CDS) which is effectively credit insurance and put options. I could buy CDS and I expected to make 20-50+points for spending 50-500 basis points per year in hedging costs on many names.

Cutting our long positions and adding short positions created some complexity for the massive trading books with over 1mm live CDS trades. Liquidity was drying up, and getting out of long positions was not easy as the negative headlines mounted. The balance sheet across all my businesses was approximately $50bn with thousands of line items across Commercial Paper, High Grade and High Yield Bonds, CDS, Preferred Stock, Loans, indices, Structured Credit positions, Distressed Assets…

Most were not convinced of my market views, and many were not calling for a recession. Remember, our rocket scientist Fed Chairman, Bernanke, was not calling for a recession in November of 2007 or as late as February of 2008. I was early, but never had more conviction in my life.

Actually, in the history of my Wall Street career, my business grew every year except 2007. Why? My desks had large short risk/long volatility positions and was right, but early. This created pain at points during the sharp rallies in 2007 and 08.

Right after the start of the short was set, I was a genius as markets sold off in July to mid-August. Unfortunately, the shorts were not massive yet. Then I was an idiot for a couple months in the fall and was shorting into it. My desks gave back massive PnL during the rally and was asked to cut the short by management. I did not believe I could be wrong, but the rally was killing me. I cut some of the short, and then the market puked again. I added the short all back and then some on the way down. At the end of 2007, my trading desks were better positioned, but I got cut up during the year as can be seen in the chart below. We did not lose money in 2007 but were down from the prior year for the only time in my career. Funds like Paulson were massively short and did great. I remember meeting with John Paulson in his offices with a few of his team and we compared notes. It was the only meeting I can recall during 2007/8 where I found someone more negative than me. I just wish I had been even bigger on the short position like Paulson, but hindsight is 20/20 and the rallies would have put in me in the hospital.

I was miserable given how things were playing out, but the desk started making real money in 2008 as markets exploded and vol trades were printing money. The desk was long volatility which was bought inexpensively, and the carnage made the desk a fortune. The short positions in anything that moved (autos, banks, mortgage related, insurance, consumer….) were down big and the daily PnL was growing. However, I was feeling as though the world was ending by the end of 2008 and was concerned about the financial system collapsing. I was in various meetings with the Fed and things were getting ugly.

I vividly recall my birthday in November of 2008. I did not feel like celebrating. I had two friends (Dan Loeb-Third Point Founder and Ashok Varadhan-Co-Head of Securities at Goldman now) at dinner with my wife in a small Italian restaurant in the Village. Everyone was miserable, and it was the worst birthday dinner given the mood. Funny, for some reason I kept the bottle of wine Dan brought as the gift. He sure is generous and has killed it since 2008, as has Ashok. I knew them before they were rulers of the universe. Note the inscription on the wine, “No re-Gifting, from Dan.” Bud, you really think I am going to give a bottle like this to anyone? You know me better than that.

By the end of 2008, my trading desks were up almost 300% from 2006 levels despite inheriting awful positions from Bear Stearns which we had to use or shorts in some situations to offset. Many other trading desks lost billions.

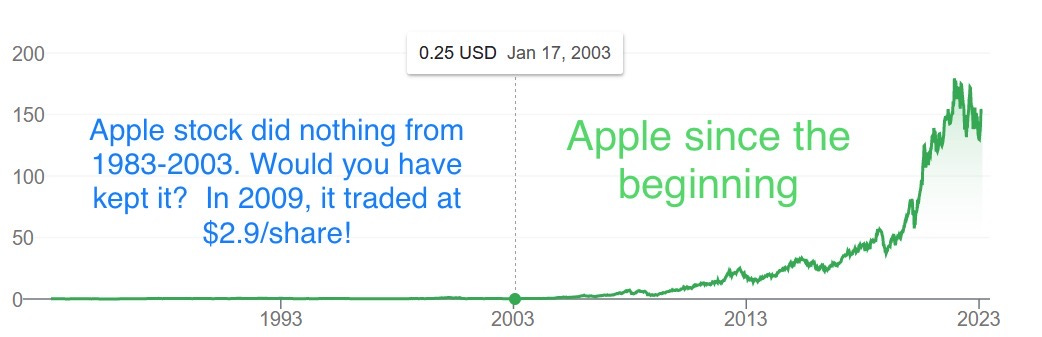

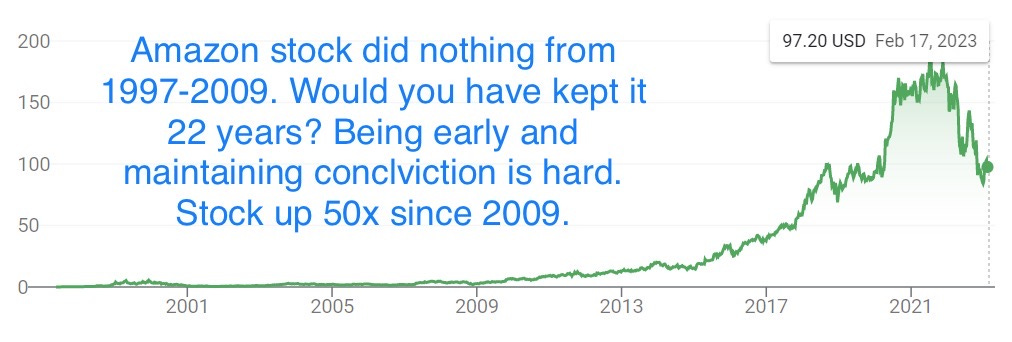

Keeping your position when it is going against you is not easy, and you question it 1,000 times when losses mount. If you look at charts, two of the greatest companies of all times, Amazon or Apple, you would be shocked. You could have been a buyer in the IPO and done very little for 20 years. Check out Apple and Amazon below. Apple was .2 in 1983 and .25 in 2003 with a few ups and downs along the way. Apple almost went out of business in 1996/7, but was saved by a $150mm MSFT investment. Having enough conviction to keep positions when they are going against you is easier said than done. The market cap of Apple is now $2.4 TRILLION.

I am not convinced I will live through another Global Financial Crisis. If I do, I think it will be debt related as the fiscal irresponsibility coupled with higher rates, an aging population and massive social programs will be painful at some point. Its either that or WWIII.

Quick Bites

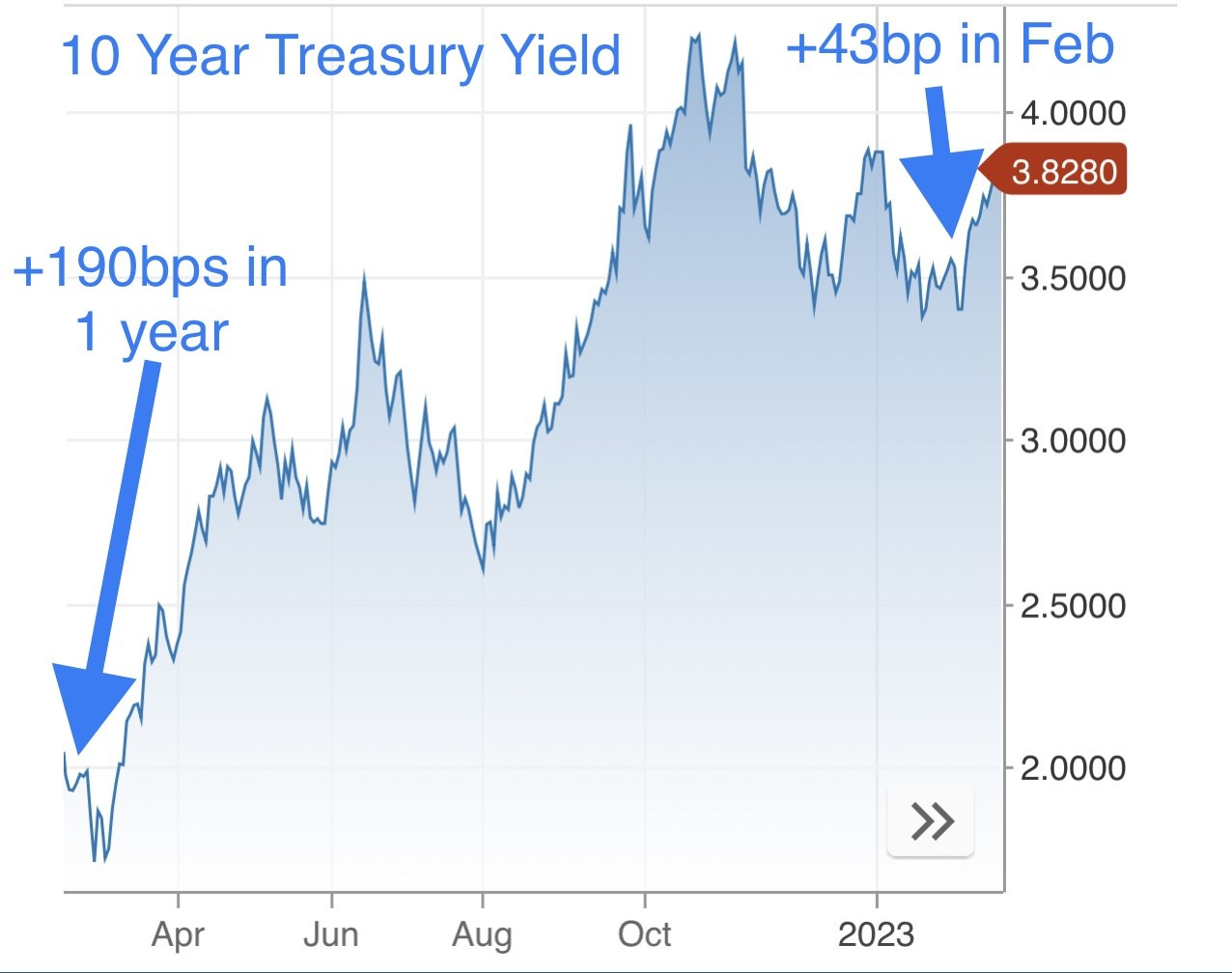

U.S. stocks were mixed on Friday as stubbornly high inflation and a rebound in rates continued to weigh on investor sentiment. The Dow rose 130 points, or 0.39% to end at 33,827. The S&P shed 0.28% to end the day at 4,079, and the Nasdaq fell 0.58% to close at 11,787. Yields on the 10-year and 2-year U.S. Treasury bonds hit levels not seen since November, weighing on equities early in the session. I believe the rates story since the jobs data is the big market news. Markets believe the Fed Funds rate will peak at 5.29% in August of 2023 and that a 50bps hike could be on the table and St Louis Fed President Bullard wanted a 50bps hike last month. Both GS and Bank America now forecast three more rate hikes. As long as I can get 4-5% in short dated Treasuries and my concern around the consumer exits, I prefer bonds to equities and my equities holdings are lighter as a result. Bitcoin has rallied almost 50% YTD and is now at $24k.3k despite fears of more regulation. Oil was down on the week over fears that higher interest rates will weigh on demand. I was surprised to read this article about the French stock market outperforming due to massive rallies in luxury brands.

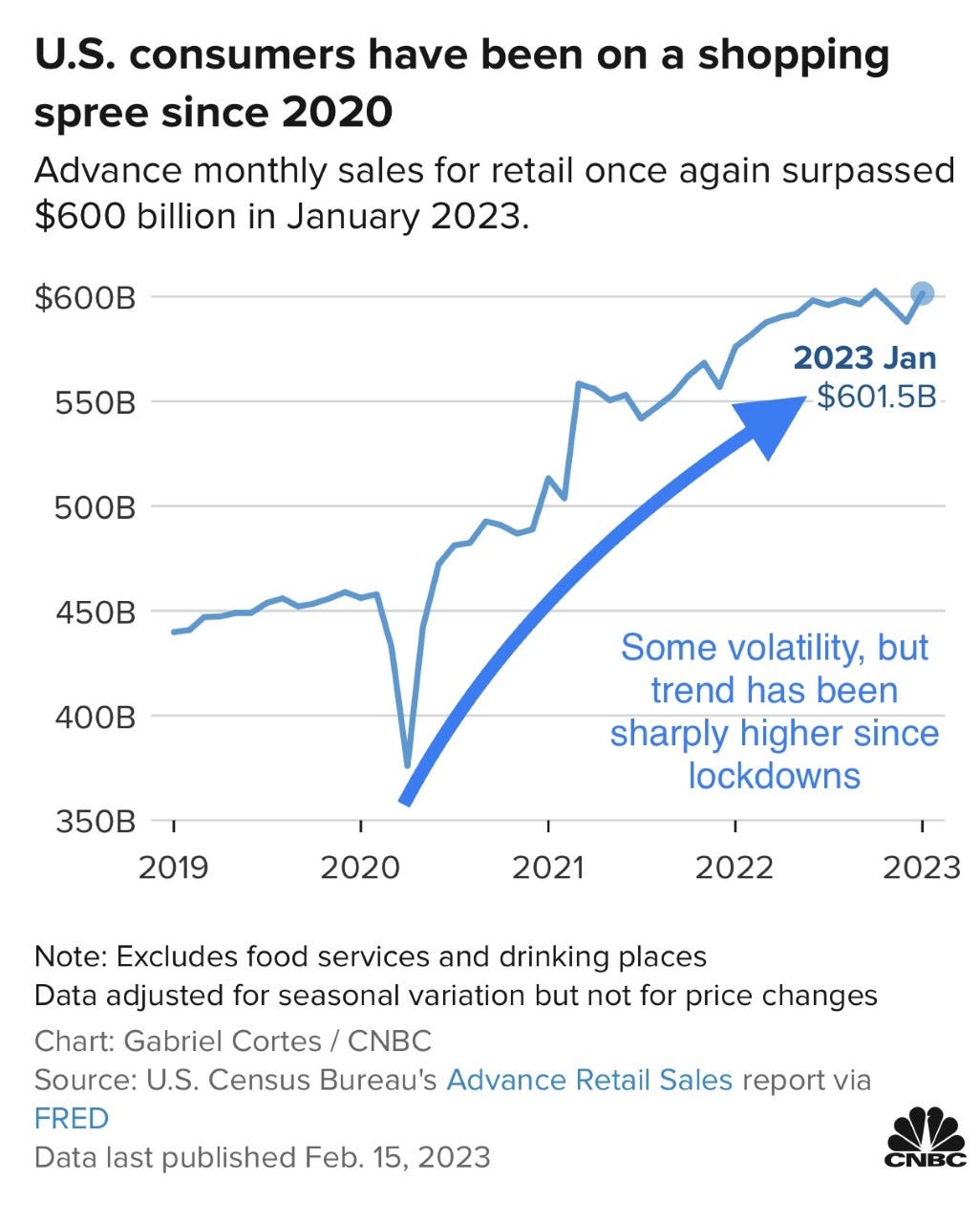

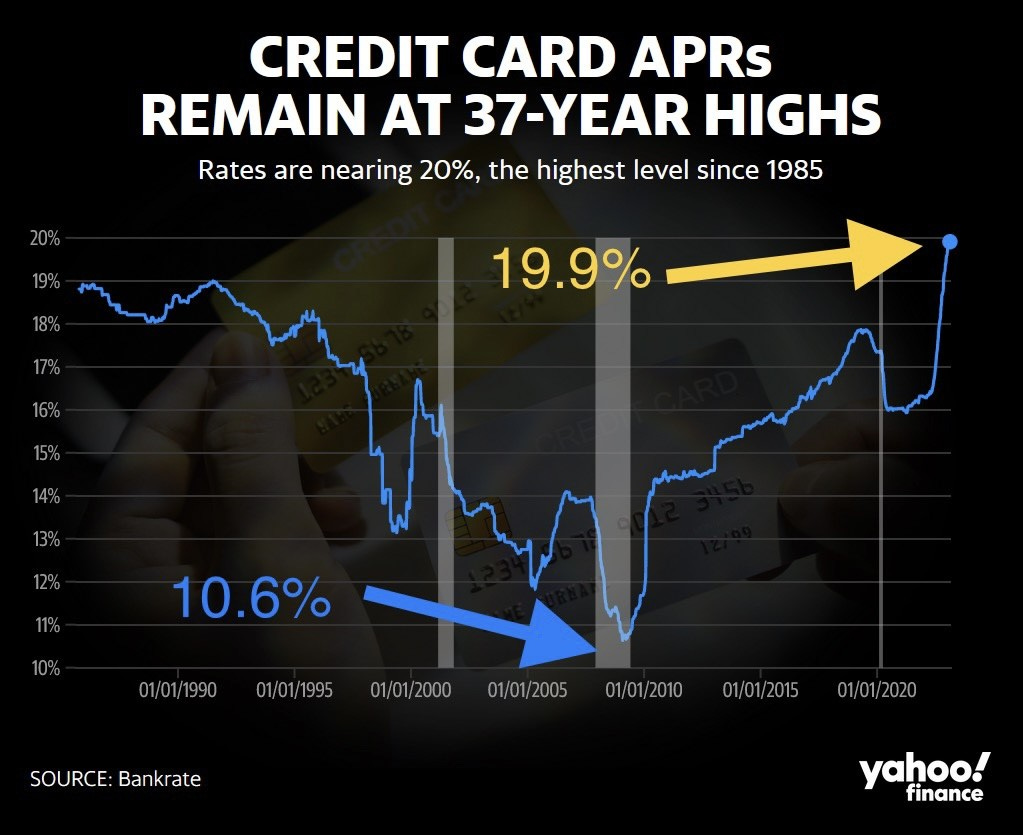

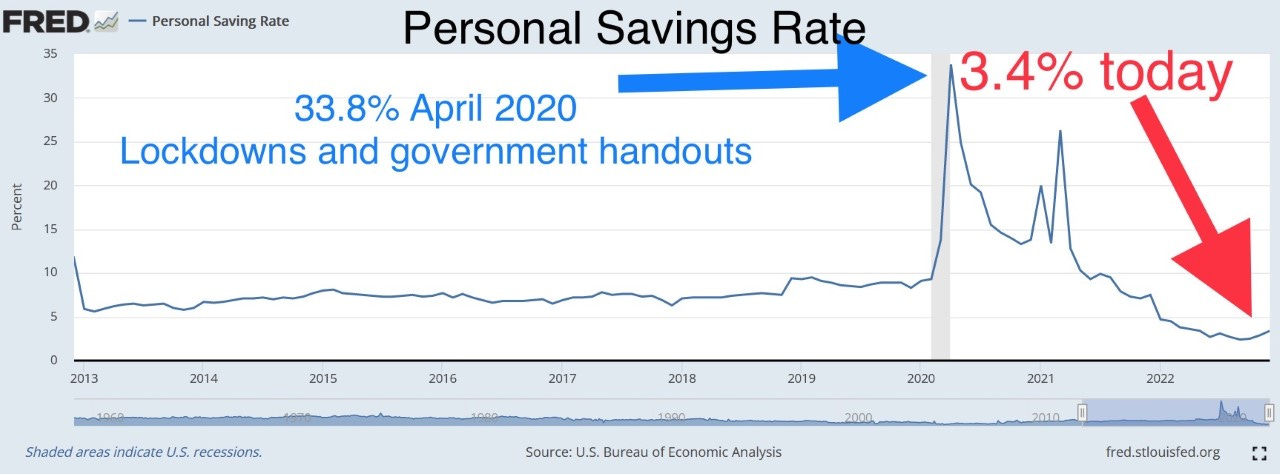

We have seen mixed data in recent months on the consumer. But most recently we saw VERY impressive retail sales numbers suggesting the consumer is doing well. Record debt and credit card balances, crashing savings rates, rising auto deliquesces, stubborn inflation, higher interest rates…are squeezing the consumer, yet they continue to spend. AirBnB earnings were strong and cruise lines are booked solid. Subprime Auto delinquencies of 30 days ore more are approaching levels of 2010. Credit card delinquencies remain low, but are rising. Consumers are borrowing and dipping into savings to live, and that is not sustainable. Consumer debt hit a fresh record at the end of 2022 while delinquency rates rose for several types of loans, the New York Federal Reserve reported Thursday. Debt across all categories totaled $16.9 trillion, up about $1.3 trillion from a year ago, as balances rose across all major categories. Auto loan debt delinquencies rose 0.6 percentage point to 2.2%, while credit card debt jumped 0.8 percentage point to 4%. The strong consumer data is confusing me. I am just not convinced it is sustainable. This CNBC article questions the strength of retail going forward.

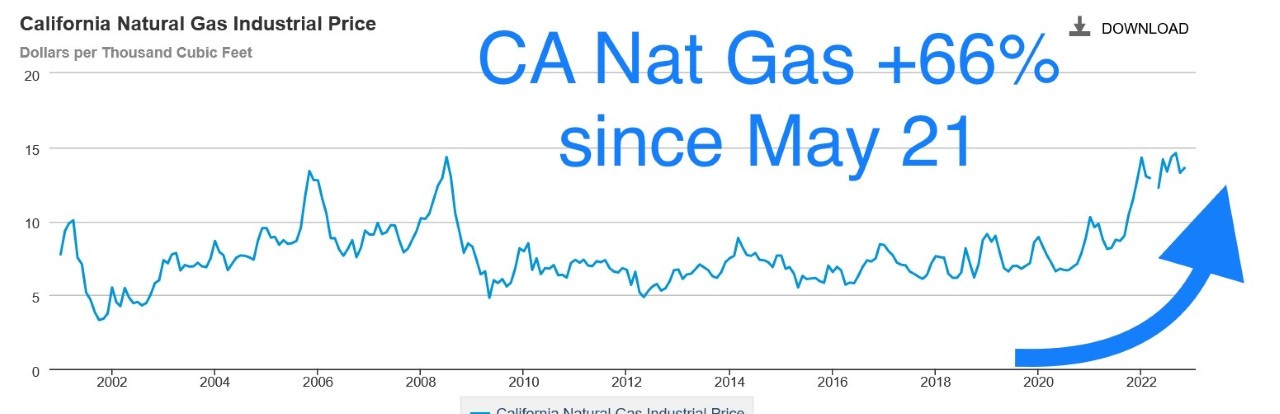

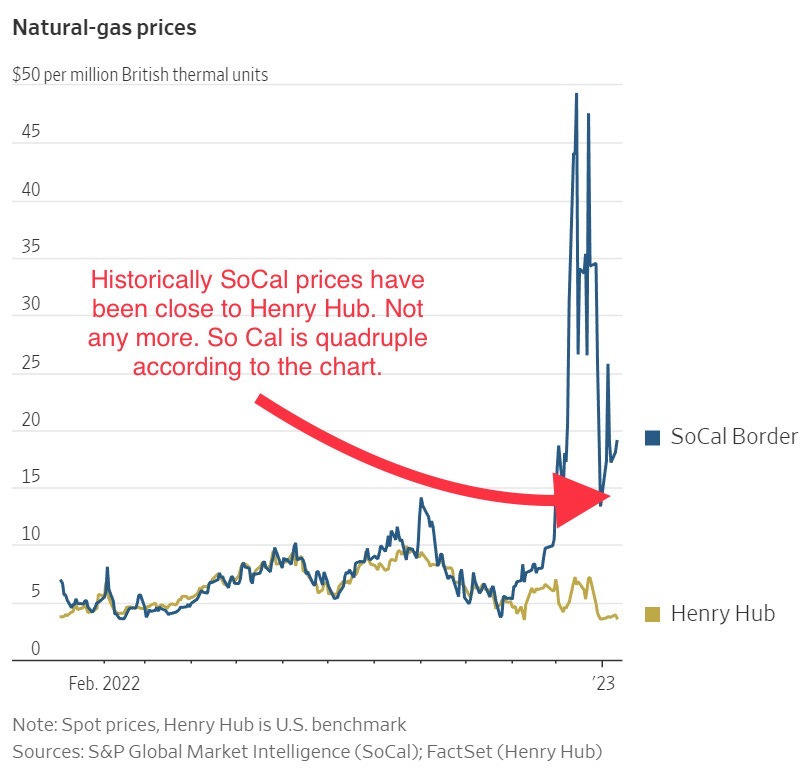

I have been critical of the policies in California around many topics: crime, homelessness, taxes, regulation, traffic, COVID mandates (while politicians don’t follow the rules they mandate), highest gas prices in USA, weak power grid and what seems like endless natural disasters (fires, floods, droughts, earthquakes…). Although natural gas prices have crashed globally due to a warmer than expected winter, California is seeing 2-3 times higher gas prices than last year. Natural gas prices in Southern California have jumped this winter on the back of maintenance issues, a decline in hydropower output and a general lack of investment in infrastructure. Read this link from the LA Times on gas bills for consumers and businesses. Wealth is leaving in droves; companies are relocating out of the state and for good reason. The projected budget deficit in the state is now $23bn for fiscal 2023. How will they balance it? More taxes on business, and the wealthy? The new R/E tax on any property over $5 and $10mm in LA County will be taxed at 4% and 5.5% respectively and begins April 1, 2023. Great WSJ article which explains the CA nat gas issue. This San Diego Union-Tribune story is entitled, “Feds using ‘enhanced surveillance’ to see what’s behind the natural gas spike in California.”

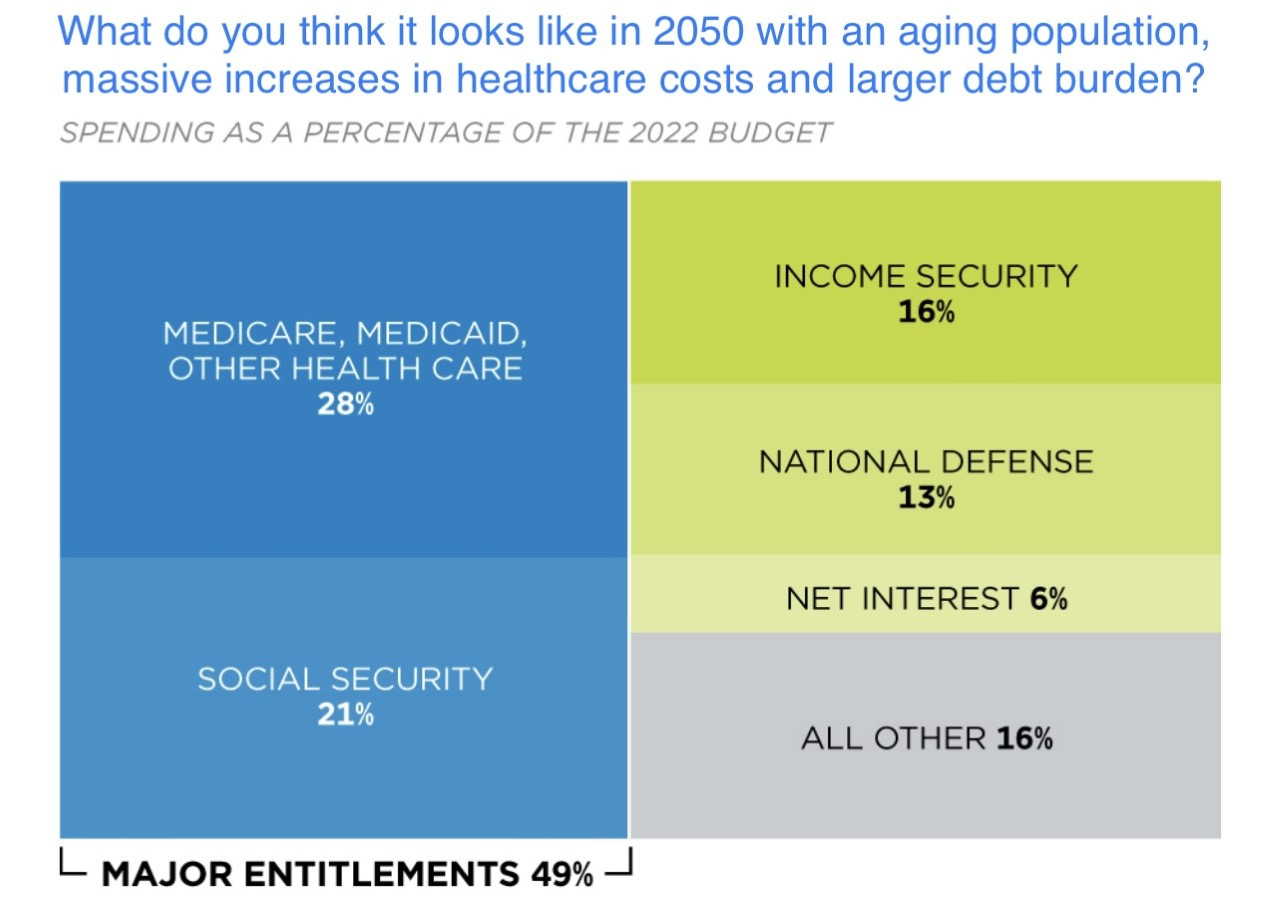

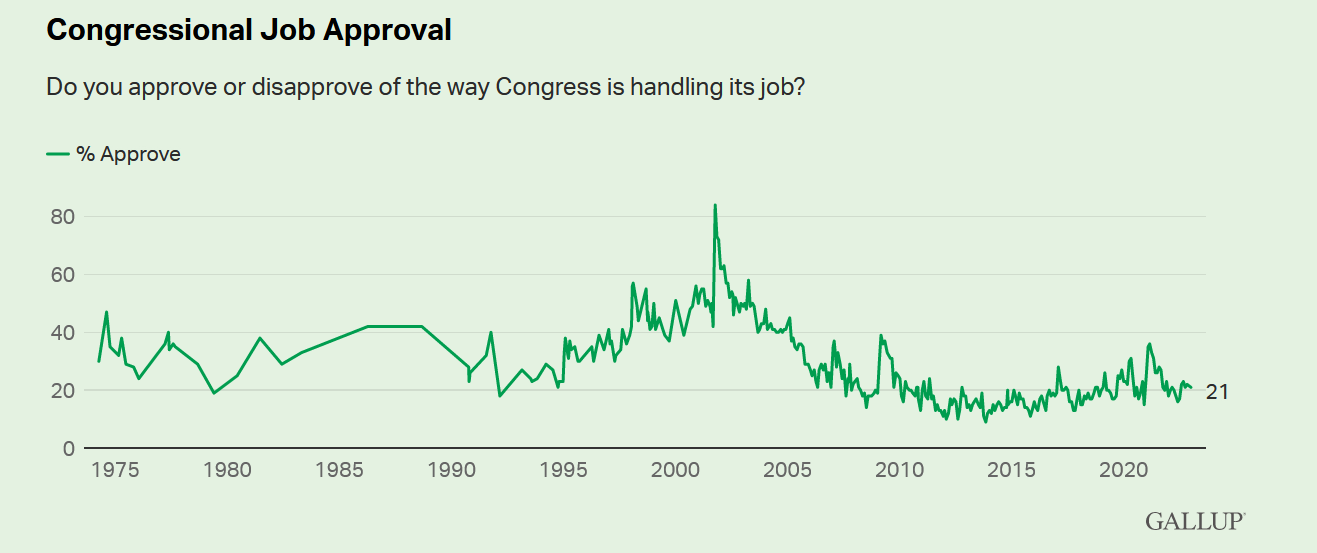

There are protests in France over a proposal to increase the retirement age from 62 to 64 years old. It got the hamster turning in my head about the US and the entitlement programs. I am no expert here, but read a dozen articles on the history of Social Security which was established in 1935, while life expectancy was 60.7 years. We have taken the age up to 67 from 65 years old for those born in 1960 or later, which is a step in the right direction, but not nearly enough. The average life expectancy in 2020 was 78.8 years, or a jump 18.1 years since 1935, and we have only started to increase the age to receive benefits. The number of Americans over 65 has gone from 9mm in 1940 to 54.1mm n 2018 and will be almost 100mm in 2060. At some point soon, the “brilliant” politicians need to actually make hard choices before America goes bankrupt. Means testing and raising the age of eligibility to get benefits are two key measures which need to be addressed. With medical advancements, AI developments and other cutting edge technology, life expectancy should continue to rise, and the entire system will tip over. The approval rating for Congress 21% for a reason. They do not tend to make the right long-term decisions and are more worried about making promises they can’t keep in order to get re-elected. I am not suggesting ending programs, but do believe tough decisions need to be made due to longer lifespans and a massive increase in the number elderly Americans. What about health care inflation costs which have historically been higher than broader inflation? 10,000 people are turning 65 each day which will add to the massive burden. The math just does not work. I would argue, if an 80 year old can be the leader of the Free World, maybe 65-67 is too young for some of these entitlement programs to kick in?

I am not going to spend a ton of time on the Ohio train derailment topic, but found this recent All-In Podcast (starts at 8 min 34 seconds) interesting and concerning. Based on the discussion, I would feel uncomfortable living near the accident until I could confirm all was safe and zero chance I would drink the water. The ecological disaster with the release of toxic chemicals is not getting the press it should and there is much misinformation. This piece by Media Matters, “National television coverage of East Palestine train derailment ignored industry culpability,” shows how little coverage the media has done on what is a pretty major disaster. The Biden administration turned down a request for federal disaster assistance from Ohio Gov. Mike DeWine in the aftermath of the train derailment in the state earlier this month that led to a large release of toxic chemicals. I don’t know the bar to get federal disaster assistance, but this spill sounds pretty serious with major carcinogens. The chemicals—including vinyl chloride, butyl acrylate, ethylhexyl acrylate and ethylene glycol monobutyl, according to the Environmental Protection Agency (EPA)— were being carried aboard the train when it derailed. East Palestine residents worry rashes and headaches are from the spilled chemicals. This post article has an amazing video of the creek near the accident and I can tell you that something is wrong with it.

Other Headlines

Fed Can’t Reach 2% CPI Without Crushing Economy, Mohamed El-Erian Says

“You need a higher stable inflation rate. Call it 3 to 4%,” El-Erian, the chairman of Gramercy Funds and a Bloomberg Opinion columnist, told Bloomberg Television. “I don’t think they can get CPI to 2% without crushing the economy, but that’s because 2% is not the right target.”

Why America’s outdated energy grid is a climate problem

Most of the U.S. electric grid was built in the 1960s and 1970s. Today, over 70% of the U.S. electricity grid is more than 25 years old. In 2021, approximately 61% of the US electricity generation was from fossil fuels, primarily natural gas and coal.

Ken Griffin Scored $4 Billion in Wild Hedge Fund Year

I am not convinced this included Griffin’s Securities Business profits. I believe had Ken stayed in Chicago, he would have owed $200mm on the stated income or approximately 4% of the total budget for Illinois. He lives in Florida, so he paid ZERO state taxes.

Facebook Parent Meta Gives Thousands of Workers Subpar Reviews

The performance ratings may signal that more job cuts are on the way

Georgia grand jury recommends perjury indictments in Trump probe

Fox News hosts didn't believe Trump vote fraud claims

Some damaging texts/emails uncovered from Rupert Murdoch, Hannity, Carlson and Ingraham. “Sydney Powell is lying,” Tucker said to his producer via text.

Trump seeks to bar evidence of 2 other alleged sexual assaults at rape defamation trial

Biden snaps at reporter over question about family's business relationships: 'Give me a break, man'

Sen. John Fetterman in hospital for depression

How people elected this guy into office is the problem with politics today. He was clearly of diminished capacity and could barely talk after just recovering from a serious stroke. This is really the best Senate candidate from the state? He could be in the hospital for more than a month, but anyone who watched him interviewed or the debate knew this was a huge risk.

To Increase Equity, School Districts Eliminate Honors Classes

Supporters say uniform classes create rigor for all students but critics say cuts hurt faster learners. Rather than pushing down the top of the class, the educators should lift up the bottom. If you want to kill the future of America, let’s make all classes teach to the lowest common denominator in the name of equity. What could possibly go wrong? The argument for such awful policies makes me puke. In short, the brilliant educators feel AP and honors classes make those who cannot take them feel bad about themselves. Participation trophies for all is not the way to create people like Musk, Jobs, Bezos, Buffett, Griffin, Ellison, Gates, Zuckerberg, Page, Brin, Bloomberg, Dell, Barra, A. Johnson, J. Fraser…Challenge people to be better and push for greatness or we fail.

Roald Dahl books rewritten to remove language deemed offensive

UFO shot down by $400K US missile may have been a $12 hobby balloon

You cannot make this stuff up. We spent $400k to shoot down a $12 balloon belonging to an Illinois enthusiast club according to the article.

Alvin Bragg slammed for going soft in violent attack on NYC nurse

A nurse was viciously attacked by a patient, yet Bragg’s office only charged the assailant with a misdemeanor despite a law that prescribes felony raps on the healthcare worker. Maybe, just maybe being tougher on crime is a better call, Bragg. Bloody pictures in the link.

Poop bacteria rampant on Upper East Side streets, study finds

Take off your shoes in the house according to the article. Pretty gross.

Reputed NYC gangster arrested again after mugging teen

A reputed gang member who was let off the hook for multiple felonies by the Manhattan DA’s Office used his second chance to allegedly mug a 14-year-old boy and pack a pistol on a playground. The amazing policies from the awful NYC DA continue.

Oldest complete Hebrew Bible expected to break auction records

Talk of getting $30-50mm at the Sotheby’s auction. I did not realize who owned it, but it is someone I know who attended my wedding and is an amazingly generous and nice person.

Teen girls who exercise every day exhibit better attention spans - even without drugs like Adderall

English teacher in Japan highlights school rules that would 'send Americans into a coma'

Piercing and make-up are prohibited, kids clean the school, indoor/outdoor shoes….

Real Estate

I wrote a piece in September 2022 entitled, “Concern Growing & the R/E Double Whammy is Not Helping,” which outlined my concerns over sharp declines in valuation while interest rates have risen sharply and lenders have pulled back. We are seeing more examples every week of what will continue to happen over the next 24 months in terms of defaults on commercial real estate in office, retail and apartments.

The $271 million commercial mortgage-backed securities (CMBS) loan on Blackstone’s Manhattan multifamily portfolio has been sent to special servicing. The loan backs the BX 2019-MMP CMBS deal and is collateralized by 11 multifamily properties totaling 637 units in Chelsea, the Upper East Side and Midtown South. One source said that while Blackstone continues to lean into multifamily overall as a high conviction theme, it doesn’t believe the best use of its capital is to continue to fund cash-flow shortfalls within this specific multifamily portfolio. We are seeing more commercial buildings in trouble. Most I have seen thus far are office or retail, but these are all NYC MARKET RATE apartments. I do not know the details, but presume it is due to a mortgage refinancing at sharply higher rates than prior financings. Rents in NYC have exploded higher and Blackstone still is not making money on these?

Vornado has disclosed that its joint venture with Crown Acquisitions has defaulted on a $450M non-recourse loan on the venture’s highest-profile retail asset—the ground-floor space at the St. Regis hotel, 100 feet of prime frontage on Fifth Avenue that Vornado brands on its website as the “epicenter of the Fifth Avenue retail district.” If prime retail space is being defaulted on, what about all the fringe stuff all over the rest of NYC and other major cities? Higher rates, less foot traffic with WFH, high shoplifting… retail is in trouble.

Dropbox made splashy headlines in 2017 when the software company signed the biggest office lease ever in San Francisco, securing 736,000 square feet over 15 years in the city’s Mission Bay neighborhood. The combination of a global pandemic in 2020, which led to a boom in remote work, followed by a downturn in the tech market last year has turned that massive space into a financial albatross with an original minimum commitment of $836 million. Dropbox said in its fourth-quarter earnings statement on Thursday that it recorded an impairment in the period of $162.5 million “as a result of adverse changes in the corporate real estate market in the San Francisco Bay area.” Its total real estate impairment for the year was $175.2 million. Although high, it is still well below the $400 million hit the company took in late 2020. Think of how bad SFO commercial R/E has become. High crime, high homelessness, filth, Work From Home… has led to massive vacancies and crashing rents. Many more stories like this coming.

Other R/E Headlines

A Quarter of London Companies Downsize Offices for Flexible Work

Vacancy rates rising as sustainable spaces command top rents

Landlords are adjusting with long and short-term contracts

Meet the developers giving old-school Boca Raton a luxury facelift

Boca has changed a great deal in my 5.5 years here. It is far younger, far wealthier and more well-educated professionals have moved down given WFH. The article talks about some of the developments and improvements. As an aside, the Mayor of Boca, Scott Singer, is quite impressive (Harvard undergrad and Georgetown Law).

A $32 Million Home Sets Price Record for Miami Beach’s Palm Island

The newly built waterfront property, which spans roughly 14,000 square feet, had asked as much as $51.9 million at one time

San Francisco Bay Area Housing Market Crashes, Prices Plunge 35% From Crazy Peak

Mortgage rates are creeping back up as can be seen in in the chart below.

Virus/Vaccine

Improvements slowing, but largely going in the right direction.