Opening Comments

If the number of calls and emails from private jet companies is any indication, prices are going down. During the pandemic, private planes were at capacity, and my inbox was not full looking for my business. Last week, I received emails from 4 different companies trying to “get my business” and received two additional calls. One plane broker told me that Europe charters are “abysmal,” and expects pricing in general to trend down on charters and plane prices for purchase. However, demand is still up sharply from pre-pandemic.

I wrote a newsletter entitled, “Holy GRAIL of Cancer Detection” in July of 2022. According to a new article entitled, “Holy grail of cancer detection predicts tumors a year before they form,” a new technology is being tested which can detect cancer before a tumor forms. In a trial of 1,000 participants — 500 non-cancer and 500 cancer patients — researchers were able to accurately anticipate the formation of tumors across at least 25 types of cancer, including all of the most prevalent and deadly varieties, such as breast, pancreatic, lung and colorectal. The founder added, “We did not get even one false negative, not even one false positive.” Advances is medical detection and treatment will help us live longer and healthier lives, but will also crush our entitlement programs.

Eye on the Market-Mike Cembalest-Growing Pains: The Renewable Transition in Adolescence

Markets

First Citizens Buying SVB Assets at a Discount

Shadow Banking

Americans Changing Priorities and Political Divide

Bon Appetite-Miami Might Just Be the Most Exciting Culinary Destination in the Country

Office Distress

$500mm for 4 Acres in Miami?

Rental Market Slowing

Virus/Vaccine-Dramatic Improvements in Data

Picture of the Day-Wollman Rink Will Be for Pickleball

A reader sent me this story about the spring transformation of Wollman Rink into a pickleball center. Personally, I am not the biggest pickleball fan, but down in South Florida, it is insanity. There are never available pickleball courts, and people wait hours to play at the public ones near my home. I cannot imagine the wait list at the NYC courts, assuming the plan below goes through.

Eye on the Market-Mike Cembalest-Growing Pains: The Renewable Transition in Adolescence

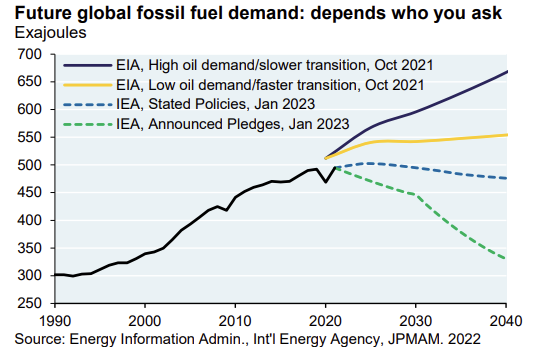

Mike is a unique individual who has the rare ability to distill complex information and make it digestible for everyone. He dives DEEP into the energy space, and the charts are solid. Cembalest points out that a lot has been accomplished on renewables, but we have a lot more to go. After $6.3 trillion spent on renewable energy and another $3.3 trillion spent on electricity networks since 2005, global energy use is still ~80% reliant on fossil fuels, from a low of 70% in Europe to 86% in EM ex-China. Wind and solar generation globally exceeded nuclear for the 1st time last year, EV sales are growing, and it appears peak fossil fuel demand is close. I have written no fewer than 20 times that the world will be reliant on fossil fuels for my lifetime. This piece is incredibly detailed and has a lot of information for anyone interested in the topic.

Party Crasher

One of my favorite comedies is “Wedding Crashers” starring Owen Wilson, Vince Vaughn and Rachel McAdams. It was a fun and crazy story about two friends who crash weddings and the insanity which ensues as a result. I had my kids watch it with me last weekend and I lost count at the number of times I laughed out loud. Check out the picture below and note the soon to be mega start to rival Tom Cruise.

Unfortunately, my party crashing is far less provocative. I live across from a big hotel and resort which hosts a ton of Wall Street conferences….Bank America, Jeffries, KBW, Futures & Derivatives... It seems that in season, every few weeks there is another conference at the Resort and have connected with a bunch of people as a result. Whenever I hear there is a conference, I drive my golf cart across the street and head over to the main bar around 8pm. Inevitably, I see someone I know and then numerous others. Consistently, what is meant to be a 15 minute check-in turns into something far more.

There was a conference at the resort in mid-March and an old friend and former JPM colleague told me he was there on a Wednesday night. I went over and walked around. I met up with Alex and hung by the bar. In no time, a bunch of ex-JPM people were holding court by the main bar. Turns out one of the crew, Tom, is a big Rosen Report fan. Clearly, he has great taste in newsletter authors and has opened EVERY report since signing up. Given the Rosen Report takes so long each week for research, writing, editing, responding to emails from readers… it is the worst paying job of all time at precisely ZERO dollars per hour. However, Tom bought me a glass of wine and I am officially monetizing the newsletter now!

We ended up hanging with a dozen or more ex-JPM folks who were able to swap stories about the glory days and commiserate on the latest banking crisis.

Another successful conference crashing event for Eric Rosen. The 15-minute crash turned into almost 3 hours, and I picked up some new readers along the way. If you are coming to Boca for a conference, chances are the author of the Rosen Report will be crashing it at some point and fully expects you to pay for the bar tab.

Quick Bites

Stocks rose broadly Wednesday, as strong gains in tech helped the Nasdaq rebound after a losing session. Sentiment was also lifted by easing concerns around the state of the banking sector. The Dow traded 323points higher, or 1%. The S&P 500 gained 1.4%, and the Nasdaq added 1.8%. Big Tech shares also rose, with Meta, Amazon, Netflix and Apple all gaining more than 2%. Micron shares climbed more than 7% after the chipmaker posted its fiscal second-quarter figures, despite the company posting a $1.4 billion inventory write-down. Info tech was up 1.9% today and real estate +1.7% (see REIT comments in R/E Section). Regional banks rose broadly, with the SPDR S&P Regional Banking ETF (KRE) advancing 1%. The benchmark 10-yearTreasury yield closed 3.57%, and the short-term 2-year rate climbed to 4.11% (+4bps). Bitcoin hit $28.4k despite regulatory concerns, as the markets are starting to presume rate cuts ahead. Oil was down slightly and now down almost 10% YTD largely on economic fears of a slowdown.

First Citizens is buying large pieces of Silicon Valley Bank more than two weeks after the lender’s collapse sent tremors through the banking system. The FDIC said First Citizens is acquiring all of SVB’s deposits, loans, and branches, which will open Monday morning under the new ownership. The purchase includes $119 billion in deposits and about $72 billion of SVB’s loans at a discount of $16.5 billion. Some $90 billion of SVB’s securities will remain in receivership. The FDIC agreed to share any of First Citizens’ losses or potential gains on SVB’s commercial loans. Overall, the FDIC estimated the failure of SVB will cost a federal insurance fund it oversees about $20 billion, or roughly 10% of the bank’s assets before its failure. The news sent regional bank stocks sharply higher with the KBW Index +4% Monday morning, and First Citizens stock was +53% on the day. As I mentioned, SVB was not purchased in its entirety, but assets were bought at a healthy discount. Clearly, lessons learned from the GFC when JPM and BAC were pushed to buy banks only to be sued for billions due to litigation. I did think this chart sent around by CNBC’s Carl Quintanilla was interesting about deposit outflows. Also, SVB customers tried to pull nearly all deposits in two days, Barr says.

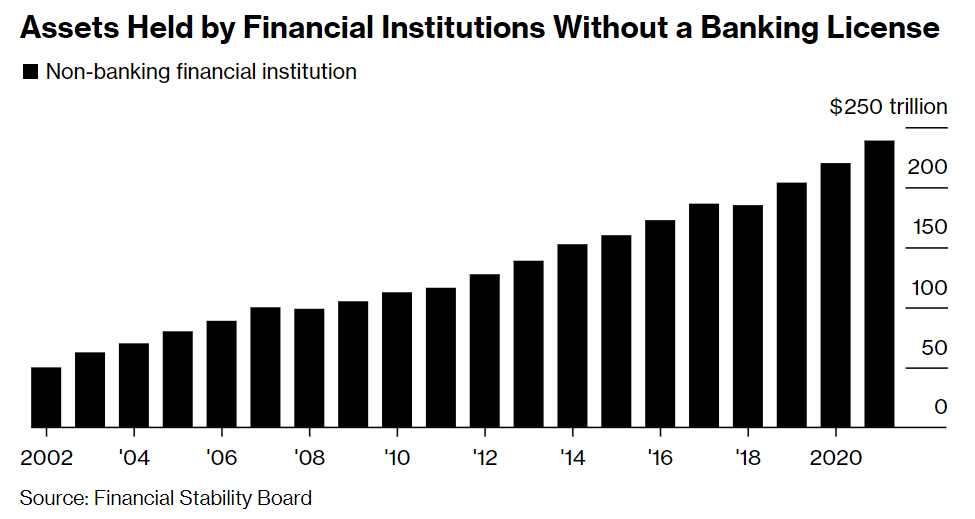

Interesting Bloomberg article entitled, “Banking Crisis Raises Concerns About Hidden Leverage in the System.” The article outlines concerns about the growing “shadow debt” in the system. “Warning signs are developing in what is a completely unregulated segment of the financial markets with substantial amounts of hidden leverage and opaqueness,” asset manager VGI Partners Global Investments Ltd. said in a letter to investors at the end of January. “Private equity funds may prove to be a hidden risk in the system.”

A few readers sent me this interesting WSJ article entitled, “America Pulls Back From Values That Once Defined It, WSJ-NORC Poll Finds.” Patriotism, religious faith, having children, and other priorities that helped define the national character for generations are receding in importance to Americans, a new WSJ-NORC poll finds. The survey, conducted with NORC at the University of Chicago, a nonpartisan research organization, also finds the country sharply divided by political party over social trends such as the push for racial diversity in businesses and the use of gender-neutral pronouns. I feel we need to move a bit more to the center and am concerned about the division. This survey sure highlights the disparity of views and changing priorities. More charts in the link, but you get the idea.

I have helped over 100 families relocate to Florida in the past few years. The great migration has been impressive. With the wealth that has relocated to Florida, we have seen countless new fancy homes and condos built. We are seeing $5,000/ft for condo buildings in Miami (unheard of), numerous $50mm+ homes from Palm Beach to Miami, $1mm initiation fees into golf courses, and long wait lists to get your kid into school. Think Horace Mann, Dalton, Brearley… challenges to get into schools in South Florida today. This Bon Appetit article is entitled, “Miami Might Just Be the Most Exciting Culinary Destination in the Country.” The article includes La Mar, Red Rooster, Cafe La Trova, Ariete, Michael’s Genuine, and StripSteak. I am a food snob of epic proportions. For my son’s 11th birthday, we went to Le Bernardin which got him his 34th Michelin Star, as he too appreciates great food. Although I am not in agreement with the article in full, I can tell you that in my nearly 6 years in South Florida, the food game has risen exponentially. There are now 11 Michelin Star restaurants in Miami (up from zero) and 29 “Bib Gourmand” designations from Michelin. Hate on South Florida all you want but the quality of life, cost of living, weather, taxes, pro-business regulatory environment, crime, homelessness, and lack of mandates sure look a hell of a lot better than virtually any alternative.

Other Headlines

Schwab’s $7 Trillion Empire Built on Low Rates Is Showing Cracks

Great Bloomberg article with solid stats. Less than 20% of Schwab’s depositors exceed the FDIC $250k limit, compared with 90% at SVB. Talks about substantial unrealized losses.

Stock Chart

Phillips-Van Heusen Corp Up 19.53% To $88.00 After Earnings Beat

Lyft CEO and president to step down, former Amazon exec David Risher named as replacement

Cofounders stepped down, and the stock rallied. Lyft and Uber have raised tens of billions of dollars and still lose billions each year. Lyft has lost a fair amount of market share and is now at 29%, and Uber has picked up a fair amount and is at 71% in the US.

Electronic Arts is cutting about 800 jobs, or 6% of workforce, and reducing office space

Jamie Dimon is being deposed over JPMorgan Chase role in Epstein lawsuits

Alibaba to split into 6 units and explore IPOs; shares pop 7%

Once the darling of many is nothing more than a criminal, who duped the brightest in the world.

Banks in France Face More Than $1.1 Billion Fines After Raids

The investigation includes: Soc Gen, BNP, Paribas, HSBC, Natixis.

Wait, CS in the news for stepping on a banana peel? I don’t believe it.

Sergio Ermotti returns as UBS CEO to steer Credit Suisse takeover

Manhattan Trump grand jury set to break for a month

Article suggests any indictment would be delayed.

MTA wasting millions in Second Ave. subway extension

The #s are startling relative to the big European projects. The waste is disgusting. I have written on this topic before and as New Yorkers, you should be mortified. Please look at the #s in the article.

Why there may be no return to ‘normal’ for the U.S. used vehicle market

The IRS Makes a Strange House Call on Matt Taibbi

An IRS agent shows up at the home of the Twitter files journalist who testified before Congress.

Reparations for Black Californians could top $800 billion

The amount is more than 2.5 times CA’s $300bn budget. Where will the money come from? Reading the article, the estimate is on the high end, but even if you cut it in half, I question where the money comes from.

How the rat population in New York City grew by 800% and infested the city in less than 65 years

At least 3 children and 3 adults killed in Nashville elementary school shooting

The 28-year-old female shooter was a former student. Used assault rifles and a handgun. This link shows footage of the shooter stalking the halls.

Defunded Austin PD takes so long to respond to DUI crash, driver sobers up and walks free: family

How Much Is Ivy League School Education? Costs Are Nearing $90,000 a Year

Psychologist shares the No. 1 exercise highly successful people use to be happier

I have zero problem with leaving Afghanistan given the US lives lost and trillions wasted. I do have a problem with the US leaving BILLIONS dollars of military equipment for the Taliban. The US could not have taken the equipment? Blown it up?

Great story. I’m sick of people wasting stimulus money and this woman did something good with it.

Pope Francis in Balenciaga deepfake fools millions: ‘Definitely scary’

The technology is so advanced, you cannot believe your eyes. Pictures of the Pope wearing Balenciaga look real to me, but they are not. There is a real story that the Pope has been hospitalized with a respiratory infection.

Real Estate

I have written extensively on the office market and the pressures which have largely fallen on older buildings with fewer amenities. This WSJ article is entitled, “Distress in Office Market Spreads to High-End Buildings.” Defaults and vacancies are on the rise at high-end office buildings, in the latest sign that remote work and rising interest rates are spreading pain to more corners of the commercial real-estate market. For much of the pandemic, buildings in central locations that feature modern amenities fared better than their less-pricey peers. Some even were able to increase rents while older, cheaper buildings saw surging vacancy rates and plummeting values. Now, these so-called class-A properties, whose rents generally fall into a city’s top quartile, are increasingly coming under pressure. The amount of U.S. class-A office space in central business districts that is leased fell in the fourth quarter of last year for the first time since 2021, according to Moody’s Analytics. The owners of a number of high-end properties recently defaulted on their mortgages, highlighting the financial strain from rising interest rates and vacancies. Close to 19% of all high-end office space in Manhattan was available for lease in the fourth quarter of 2022, according to brokerage Savills, up from 11.5% in early 2019.

Another example of a NYC building value destruction is 850 Third Avenue which just sold to the lender for $266mm ($431/ft). Chetrit bought the property in 2019 for $422mm and refinanced it in October of 2021 (half empty) and received a $320mm loan. So the building lost almost 40% of its value in a few years. What are the ramifications for other buildings in major cities? WFH coupled with higher rates and lenders pulling back are all contributing to the sharp valuation declines.

DTLA (LA Office) stock -65% YTD and -88% for 1 year.

Vornado (NYC Office/Retail) stock -29% YTD and -68% for 1 year. Dividend yield is 10%+. Stock +5% today.

SL Green(NYC Office/Shopping)-33% YTD and -73% for 1 year. Dividend yield is 14%+. Stock was +10% Wednesday.

R/E Stocks rallied sharply today? Tide turning? The stocks have been beaten up, but thought it was still a little early.

Terra has offered half a billion dollars to buy out an oceanfront condo building in Miami Beach, six months after a Related Group-led venture backed out, according to a letter obtained by Commercial Observer. Located at 5445 Collins Avenue, the property, Castle Beach Club, sits on 4 acres along the famed Miami Beach strip, offering 576 linear feet along the ocean. If finalized, the deal would effectively become the most expensive land purchase in the Miami area. Terra, led by David Martin, will most likely tear down the 18-story building and construct an ultra-luxury condo complex. The site can accommodate a structure up to 200 feet tall. The suggestion is $500mm for 4 acres of land. Crazy numbers.

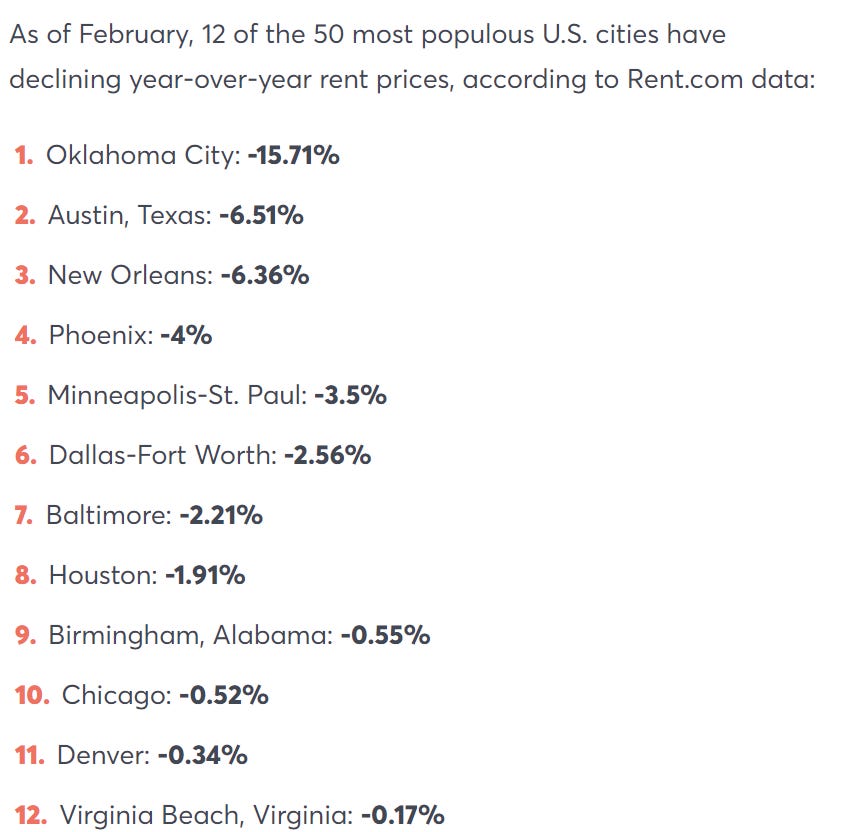

The rental market has seemingly flipped: After prices surged throughout 2021 and most of 2022, they’ve declined almost as quickly for five of the last six months, a new rent report reveals. U.S. rent prices decreased by 0.25% from January to February 2023, according to the latest data from rental listings site Rent.com. While it’s a smaller decrease than in previous months, it brings the U.S. monthly average rent price down to $1,937 — lower than its August 2022 peak of $2,053. As I speak with owners of tens of thousands of units, rent is just one part of the equation. Vacancies are up. Time to rent after the tenant leaves is longer. Concessions are up and cap rates are higher while lenders are pulling back. If you need to refinance a building (office, apartment, retail…), it is far harder today than a year ago and cost a lot more IF you can get financing.

Virus/Vaccine

I am only posting this to show the dramatic decreases in recent weeks across the board.

Good thoughts. I have been adamant against the hate for fossil fuels and have said repeatedly we are no where close to ending our reliance on them. Technology is improving on alternatives and will continue to gain efficiency over time. Yes, they are currently reliant on subsidies, but I am hopeful that over the next 20 years technological advancements will lessen the need for massive subsidies.

"A lot more to do" on renewables implies that we should steer even more subsidies into an inferior technology. Renewables are inefficient, unreliable and a giant, bipartisan vote buying scheme. As someone who spends a lot of time in a middle-income country, the biggest problem the world's poor has is not enough access to fossil fuels. Bizarre displays of corporate virtue signaling leads to carbon offsets, aka paying other countries to not develop their natural resources so that they remain undeveloped and poor.

This is a good review of an impressive book. The book notes how, when you never mention the benefits of fossil fuels, indeed they look bad. When you factor in their benefits, you quickly realize all of our wealth, improved longevity and quality life are a direct result of them. Switching to renewables is not a one-for-one swap but rather a huge step backwards.

https://betonit.substack.com/p/read-fossil-future

Thanks for the excellent newsletter. Keep up the great work.