Opening Comments

Within two hours of sending on Sunday, I had a 45% open rate, I think that may be a record for opens in such a short time. Thanks for reading the Rosen Report. Again, my readers spend a lot of time and energy sending me stories, giving me ideas, and collaborating with me on various topics and articles. Thank you.

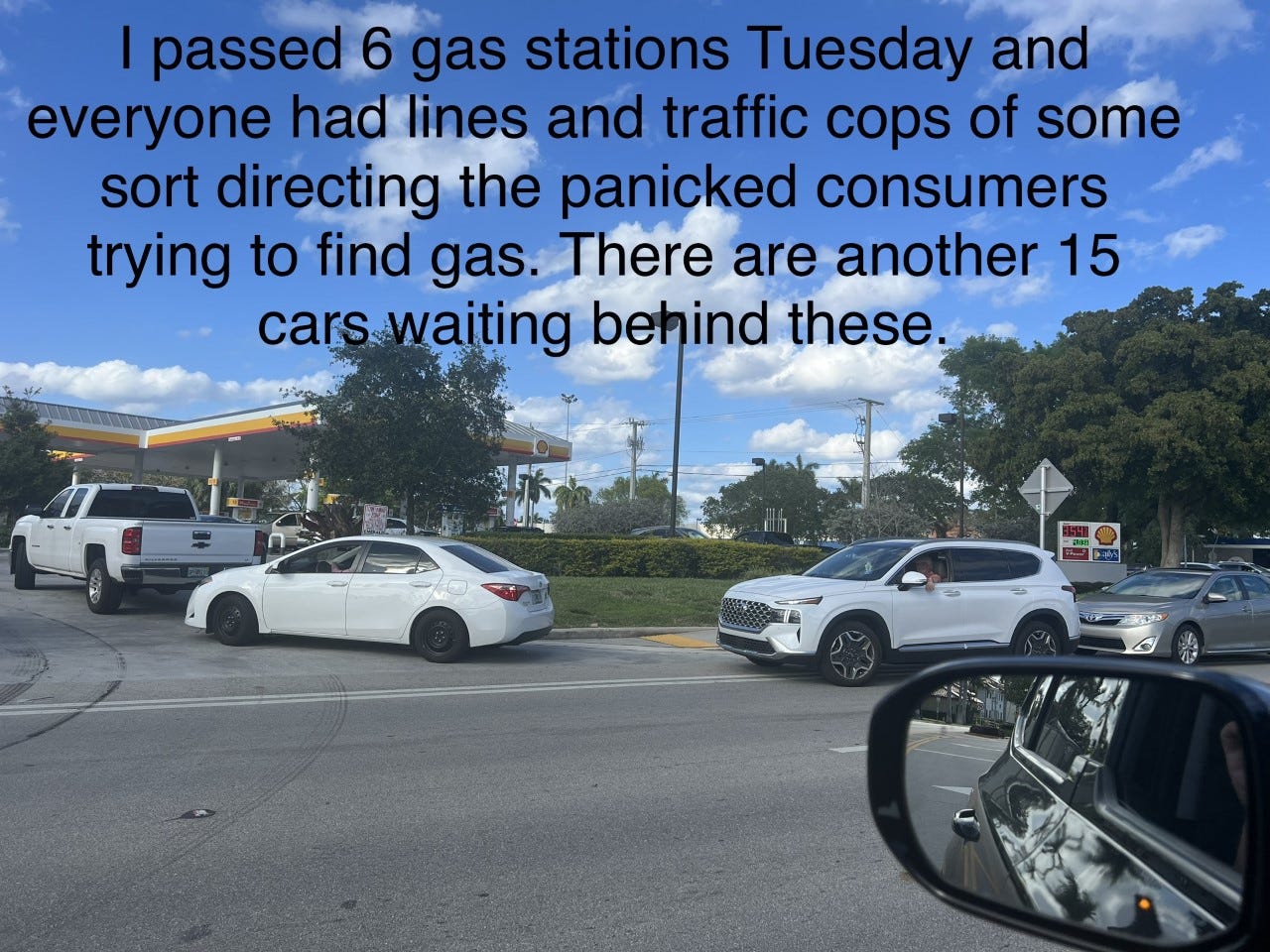

I wrote about gas shortages in South Florida due to the rain impacting the ability to deliver gas. Well, the gas lines were getting worse on Tuesday. I passed 6 stations, and the shortest line was 20 deep, and pumps were running slow. This is what it is like in front of a big hurricane. A reader told me at one station there were over 70 cars waiting. Tuesday night, one reader paid $4.49/gallon, up $1.2 in a week. I went to 7 stations on Wednesday morning before finding gas. 59% of stations in Miami and Ft Lauderdale were out of gas at one point on Tuesday.

I am heading back to Miami for an event tonight and again taking the Brightline, so we have an early send.

Markets

JPM Strategist on Markets

Most Investors Underweight Stocks

US $ Discussion-TINA

South Florida Office Rents-What?

Brookfield Defaulted on $161mm in Debt

German Housing Market Woes/Global Housing

AutoGPT-Gamechanger Over&Above ChatGPT

I had written a "Tiger's Legacy" piece for today's newsletter. However, I learned of a new development on the AI front which was so compelling, I had to quickly put this piece together. No “Video of the Day” today so you will focus on this topic and watch the video included below. Also, I want to keep this section shorter than usual so you will spend time watching the video.

I wrote a section in my January 4, 2023 newsletter, "The Best Money I Ever Lost," on ChatGPT and included a very informative video explaining the AI model. Weeks later, ChatGPT was on every news outlet. I feel I was early on ChatGPT being a game changer and feel the same about the piece today on AutoGPT.

On Tuesday morning, I listened to the "All In Podcast" (listen to first 30 min), and the opening section was on AutoGPT, a new cutting-edge development that I feel could be incredibly disruptive. I want to be clear, I am not much of a tech guy and for that matter, believe the Tech Gods despise me. My phone, computer, printer, AppleWatch, EarBuds...all hate me and I might have more technical-related issues than any other 100 people in the world combined.

As I understand it, AutoGPT allows different GPTs to talk to each other and can complete tasks with limited intervention. AutoGPT can string together prompts, unlike ChatGPT. AutoGPT has 94,000 stars in less than 3 weeks on GitHub (code repository for open-source projects). This link does a nice job of summarizing AutoGPT from a more informed perspective than mine. AutoGPT utilizes advanced technology, utilizing stacking to recursively call itself, building it's knowledge base with other AI models and tools.

One example given in the podcast was by the moderator, Jason. He spoke of two programmers, one was a "10X" (the mythical programmer who can do the work of 10 programmers) and one programmer was far less experienced. They worked on a project using AutoGPT to help code, and the less experienced coder was equally as good and fast as the seasoned pro. So much so that the 10X basically said, "My competitive advantage is gone and the other coder is now effectively an expert." The ramifications of development costs and times are incredible. What took the equivalent of years to develop can happen in days.

Another example was a person who told AutoGPT, "You are an event planner, and I would like you to plan a trip for me for a wine tasting in Heidelberg this weekend. I want the best places for food and wine which are kid-friendly on this budget.... AutoGPT designed a weekend of events and as one task was completed, another was created. AutoGPT came up with a schedule, budget, and checklist... Think about replacing the assistant with a system that can do something based on a command. No days off, no sick days, no couch time... Many jobs will be disrupted.

This technology will give companies the ability to become increasingly productive. I had put this chart into a prior note and feel due to this technology, we will be going sharply lower (improving productivity) in the coming years if I am properly comprehending the ramifications.

Again, my goal is to educate when I learn things early, but remember, I am no expert, and a lot of this is over my head. Soon, I may not be writing the Rosen Report, and I will merely ask AutoGPT to write in the manner of the world-famous writer, Eric Rosen. I only fear it will be more informative and funnier than I am, so I am scared to ask it to do so. Please spend time educating yourself on it. If any reader is an expert, let me know if you are willing to help educate us.

This 2-minute video shows you how to tap the resource I discussed. I imagine it will become better and more powerful over time. I am concerned about what these models can do over time and what happens in the hands of bad actors.

Quick Bites

Treasury yields rose again on Monday and are now well above recent lows. Positive economic data from NY area manufacturing and some earnings beats are pushing the market to the 25bps hike. The 2-Year Treasury yield is up to 4.26% and there is now an 80% chance of a 25bp hike at the next meeting. Futures are pricing in a little over 25bps of cuts prior to year-end. As of 3pm on Wednesday, equity markets are largely unchanged. For the past week, the S&P is up slightly and the Nasdaq is up about 2%. The VIX (measures the volatility of the S&P) is down to just above 16. Based on the crazy rates market vol, this is surprising to me. Gold has given back some gains and hoovering around $2k as a rate hike looks more likely. The same is true on crypto with BTC and ETH down 3% and 5% respectively today on rate fears.

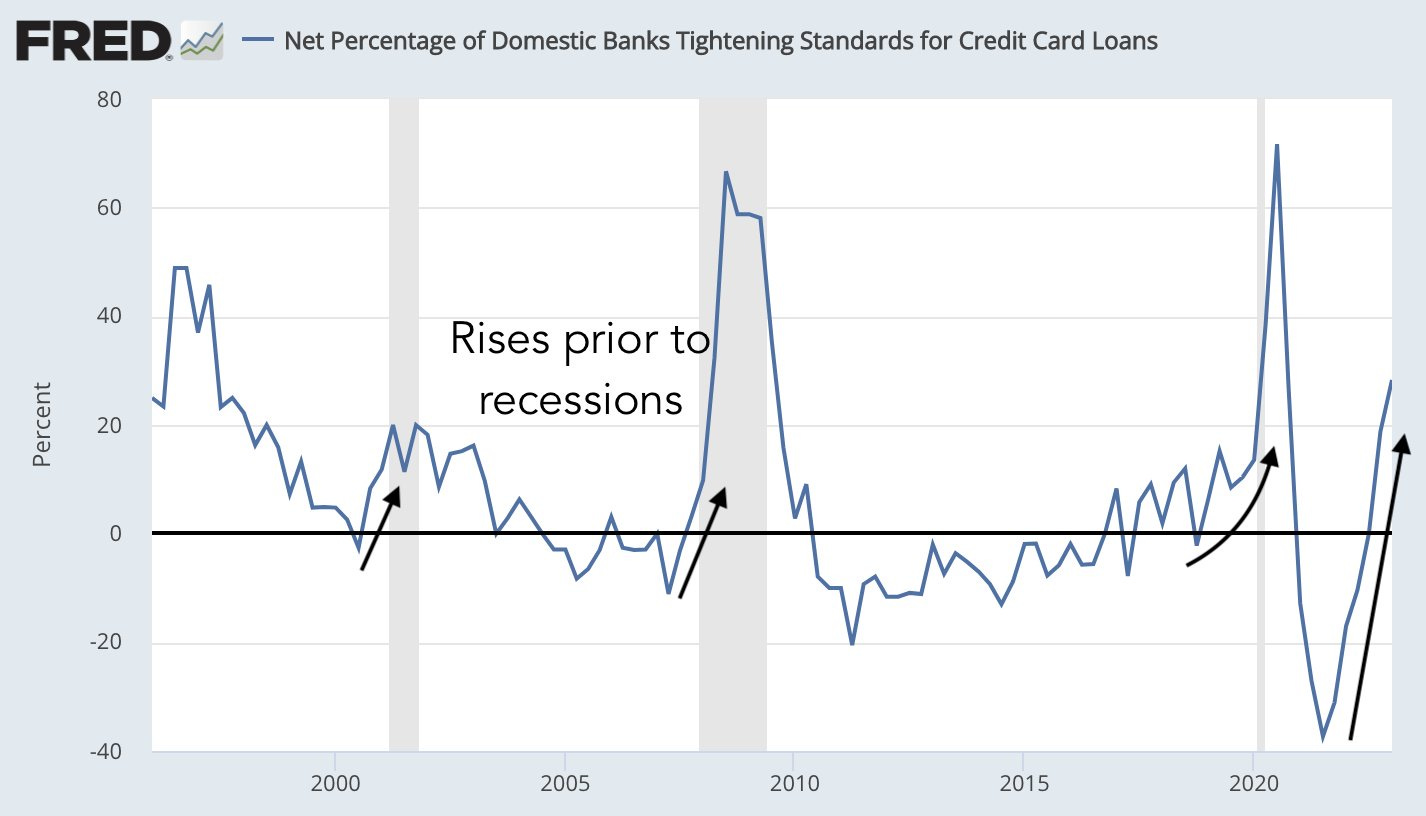

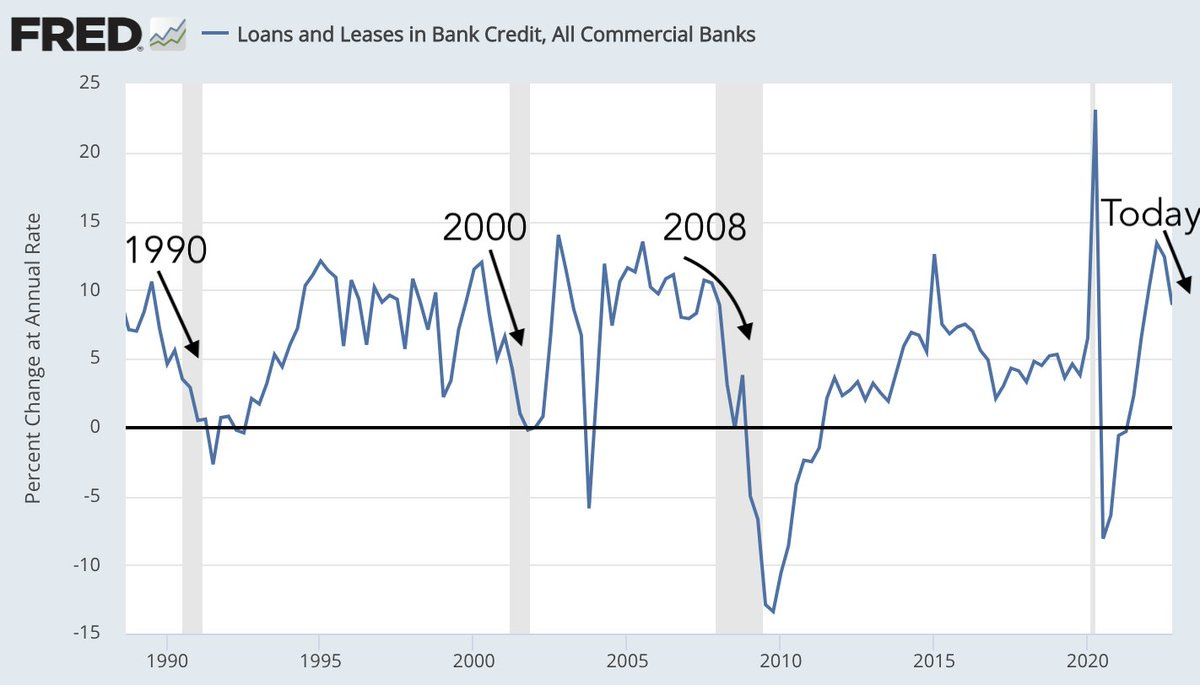

Marko Kolanovic is a very good market strategist from JPM who has been on top of the rankings. His note on Monday was pretty clear. With short term US yields near 5% and equity multiple near 20x, risk-reward heavily favors cash. Even in an optimistic scenario of soft landing (which even the Fed deems unlikely based on the March Board staff forecasts), equity upside is likely less than 5% and that is the return that is delivered by short-term fixed income. On the downside, even a mild recession would warrant retesting the previous lows and result in 15%+ downside. Short-term fixed income provides not only full protection on the downside but also optionality to buy risky asset classes should this pullback happen. While one can come up with complex risk premia models that show equities expensive vs bonds and cash, this upside vs downside scenario illustrates why we favor risk-less assets. We view the recent rally as irrational and believe it was mainly driven by systematic inflows and short covering, but these drivers are likely running out of steam. We continue to believe a recession is likely this year, as ongoing pressures from high rates/QT, credit contraction (following the banking crisis), pressure on carry trades, and geopolitical headwinds permeate through the economy. Markets often bottom before the end of a recession, but not before the beginning of one. We therefore maintain a defensive tilt in our model portfolio this month, unchanged vs. last month, with an UW in equities and OW in cash. We remain OW commodities, primarily energy, given resilient demand (particularly in Asia on COVID reopening), tightening balances, and oil’s typically strong performance after the last Fed hike. I am largely in agreement with Marko. The chart below from the Federal Reserve shows banks tightening standards. The 2nd chart, again from the Federal Reserve, shows loans and leases shrinking at banks. To me, these are not super bullish charts despite the good technicals outlined by some (next bullet).

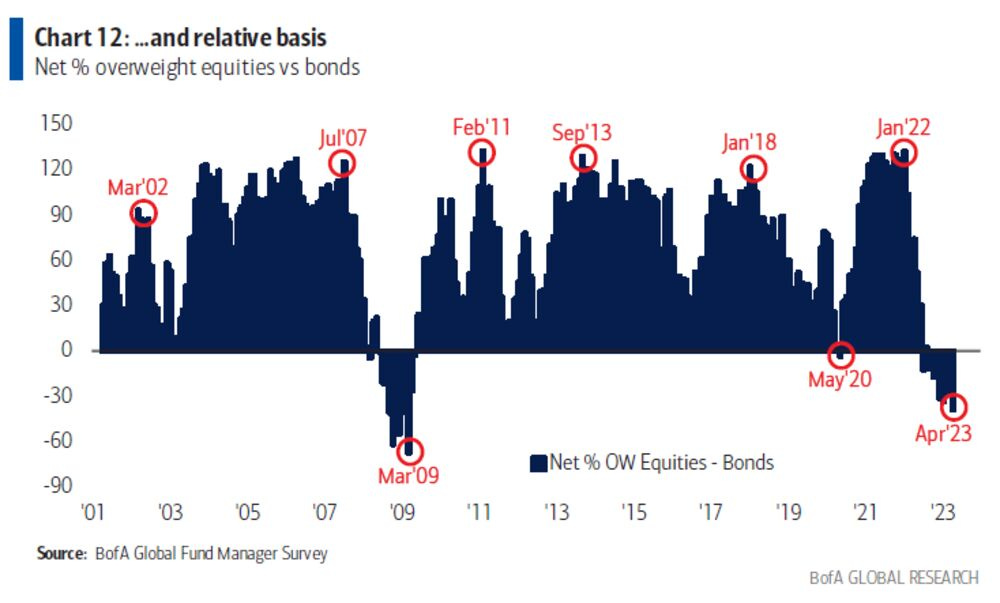

Good Bloomberg article entitled, “Investors Most Underweight Stocks Versus Bonds Since 2009, BofA Says.” Investor allocation to equities relative to bonds has dropped to its lowest level since the global financial crisis as worries about a recession take hold, according to Bank of America Corp.’s global fund manager survey. Still, the bearish turn in sentiment is a contrarian signal for risk assets, strategist Michael Hartnett wrote in the note. If “consensus lust for recession” isn’t satisfied in the second quarter, the “pain trade” would be a rally in bond yields and bank stocks, he said. Hartnett was correctly bearish through last year, warning that growth fears would fuel a stock exodus. Good stats in the article including cash positions above 5% for 17 consecutive months, and the most crowded trades…. The large cash positions and low equity allocations create bullish technicals for the equity market.

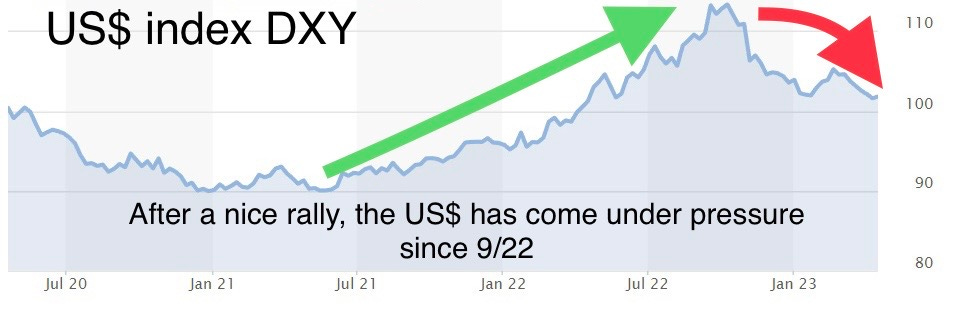

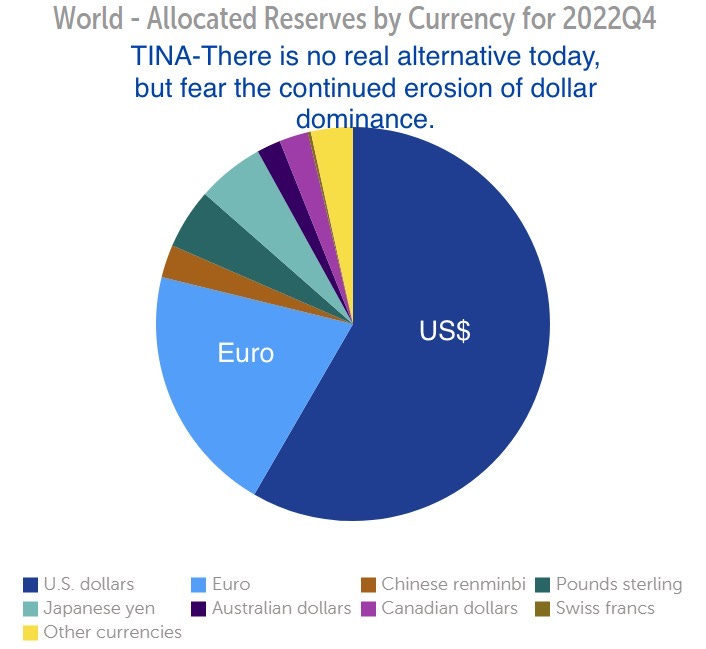

I have written about the US Dollar volatility at great length and have been asked by countless readers about the ramifications of what has played out recently. This is a fantastic article by Market Watch entitled, “Big question with the dollar under fire from rival countries and currencies: What happens to markets if the greenback loses its dominance? The rapid unwinding of last year’s torrid rally in the U.S. dollar, combined with efforts in Beijing and beyond to ease dependence on the buck, have helped to reinvigorate speculation that the greenback’s dominance over international trade and finance may be moving toward its twilight. Talk about “de-dollarization” has intensified, and Wall Street analysts have joined in, publishing research reports forecasting more competition for the dollar in trade and global reserves alongside assessments about where the dollar is heading in the coming months, and how the adoption of so-called central-bank digital currencies might shake things up. A fresh challenge to the dollar’s stability may loom on the horizon as Congress prepares for another ugly showdown over the debt ceiling. Putting aside the dollar’s ups and downs, it remains the most popular currency for both international payments and global central-bank reserves, which reinforce its status as the undisputed international reserve currency. But its hold on the global economy has, in fact, weakened somewhat over the past few decades. The greenback accounted for 58.4% of central-bank foreign-exchange reserves during the fourth quarter of last year, down from roughly 70% in the late 1990s when the euro was first launched. For perspective, the Euro is 20.5% of foreign exchange reserves at the end of 2022. The article ends with a comment TINA (There is No Alternative) today, and I agree. I am concerned about the degradation of the dollar and the ramifications, but I believe the Euro is not the solution and not sure the alternative to the US $ today. Clearly, we have seen gold bounce, and part of it is US $ related.

Other Headlines

I agree 100% on Dimon’s comments, but I am not as adamant on Buffett’s.

Morgan Stanley stock strategist who called the bear market says we are ‘far from out of the woods’

“We think the recent collapse in breadth is the market’s way of warning us we are far from out of the woods with this bear market,. Wilson wrote.

China’s economy grew 4.5% in the first quarter, the fastest pace in a year

UK inflation rate surprises again with March figure holding above 10%

Apple launches savings account with 4.15% interest rate

No minimum balance required and can be set up from Wallet app on phone.

Bank of America shares gain after first-quarter results top expectations on higher rates

Goldman Sachs misses first-quarter revenue estimates after taking $470 million hit on Marcus loans-Stock was -1.7% on Tuesday.

Schwab Deposits Tumble 30% as Brokerage Pauses Share Repurchases

However, Schwab beat on earnings and stock was up 2.3% on the news.

Shares of Roblox fall 12% after company releases March update

Fox to pay Dominion Voting Systems $787.5 million to settle election defamation lawsuit

I have no problem with the outcome here. Fox was incredibly sloppy and hopefully sends a message to all news outlets. Remember, there is the Smartmatic $2.7bn claim outstanding.

McKinsey, Bain Delay Some M.B.A. Start Dates to 2024

Given the slowdown, some of the biggest consulting companies are offering cash to defer the start date and encouraging young professionals towards philanthropy, travel, and learning a language and paying them to do it.

Investment taxed at 86% — Biden's tax plan would kill Wall Street

The article outlines the new tax proposal which would crush the wealthy and hurt investment plans. The article walks through the math with examples of corporate and individual taxes on capital gains and then adds the state tax angle where it applies. The answer is to reign in spending. Again, you cannot tax your way to prosperity.

Only 10 Electric Vehicles Qualify for Full $7,500 US Tax Credit

The industry remains reliant on tax-credits to drive sales. Check out the MSRP and note that TSLA has lowered prices 6 times in 2023 with yet another round of cuts today.

John Fetterman, Mitch McConnell return to Senate; Dianne Feinstein does not

Fetterman shockingly was elected despite being significantly cognitively challenged due to a stroke. He then took off for two months due to depression. Cognitive testing and age limits should be required.

Andrew Gillum was almost elected Florida governor. Now he’s on trial in federal court

Gillum lost to DeSantis by .41% or 34,000 votes. Gillum was found by police in a South Beach hotel in the company of a man who OD on drugs. Now he is facing multiple counts of wire fraud and lying to the FBI.

Hundreds of teenagers flood into downtown Chicago, smashing car windows, prompting police response

Shots were fired and two teens were wounded. 300-400 kids were reported to be running in the area. Chicago Mayor-elect Brandon Johnson condemned a chaotic "Teen Takeover" of downtown over the weekend but said it's "not constructive to demonize youth." Call me crazy. Violating the law, by smashing windows, beating up bystanders and shooting people should result in being demonized. Only 15 were arrested as police were overwhelmed. Sorry Mayor-Elect, these kids are breaking the law and hurting people and property. No sugar-coating it. I want you to watch this 20-second video of ‘misunderstood” kids and what they did to a woman (dragged by her hair and brutally beaten). Now and IL state Senator called these horrific acts, “A Mass Protest,” defending the behavior. Not sure why Chicago is such an unmitigated disaster with such solid leadership.

Forty-three druggings, seven deaths: New York clubgoers face wave of violent robberies

Black teen shot after ringing the wrong doorbell while picking up his siblings, police say

Compton residents say street takeovers have become common; LASD to partner with CHP to stop looting-Hundreds involved and no arrests. Crazy videos.

Half of migrants piling into NYC not vaxxed for polio, top doc warns

Mask mandates, vaccine mandates, school closures, lockdowns, but let’s allow illegal immigrants who are not vaccinated for polio. Makes perfect sense.

At Formula 1 Miami, Tickets for $5,000, Bottle Service for $200,000

At the Miami Grand Prix, $35,000 for a table at a club is just the beginning. The prices are insanity. $6,000 dinners. I know a lot of this is on an expense account, but wow.

What Do Americans Want in a European Vacation? Fewer Americans

WSJ article suggests more are looking for off-the-beaten-path places to avoid a bunch of rowdy American tourists. Eastern Europe and the Balkans were mentioned.

Some travel is ‘off the charts’ expensive, experts say. Here are 3 ways to cut some costs

NFL-Hurts becomes NFL's highest paid player ever (5-year $255mm)

Scientists confirm long-held theory about what inspired Monet

In a letter to his wife, Monet wrote, “Everything is as good as dead, no train, no smoke, no boat, nothing to excite the inspiration a little." It appears that pollution and smoke helped Monet’s creative juices flow. Interesting read.

Bear stuns man ‘chillaxing’ on patio in video: ‘My eyeballs got a stretch’

Funny short video of a bear scaring the crap out of a man sitting on his porch.

Now, as many as 6 more of these Chinese spying operations in the US. China is not an ally of the US. They cheat, lie, steal, pollute, awful human rights abuses, caused the pandemic and lied about it, bought up all the PPE in front of the virus hitting the US and have been a horrible partner. The US needs to significantly reduce our reliance on this bad actor and move production back to the US, Southeast Asian, Central America…

Real Estate

It is clear to me that shiny new office buildings are massively outperforming the older buildings in markets across the country. Even in NYC where the market has pockets of stress, the office space in One Vanderbilt and Hudson Yards is doing quite well with high rents. The same is true of redeveloped buildings with amenities in Midtown (550 Madison Avenue the former Sony building). In Palm Beach, new office building rents are going crazy. Rents could be $120-140/ft on a TRIPLE NET basis for new construction like One Flagler. After all costs, it is anticipated taking rents could reach $150-170/ft for the project. To be clear, this is a unique property under development and priced higher than others but thought the price point was telling. While demand remains strong developers will still need to land an anchor to go into the ground/vertical. These will be unheard-of economics for Palm Beach, but for the handful of anticipated new/high-end buildings, it will be the going rate. Even the existing/dated office space is up to $100/ft from $65 pre-pandemic. For perspective, my hedge fund was at 747 Third Ave. Two blocks from Grand Central. Nice, but an older building. I was paying $65/ft (6 years ago) and today, they are asking $65/ft, but giving some free rent and a bunch of build-out concessions, so effective rent is around $50 today. Yes, markets like Palm Beach are small, but the demand is off-the-charts today, especially the new buildings. One important point, firms take far less space in Florida than in NYC, so many of the office requirements are under 8,000-15,00k feet. In NYC, some of these tenants take much more space. According to a Cushman and Wakefield report on Miami, Class the average Class A is $85/ft on Brickell now. Expectations for new buildings in Miami are for over $150/ft in and around Brickell. I know new buildings like Sternlicht’s office property at 2340 Collins are full and getting over $100. Again, unheard of for South Florida pre-pandemic. High-end NYC (One Vanderbilt and Hudson Yards) is getting between $120-300ft. One Vanderbilt is going for more on the high-end than Hudson Yards. As a side note, the availability rate in Manhattan is approaching 20% or 90mm square feet and estimates suggest up to 24% availability. The issue is “B” product, while “A” product, new construction only has 6% availability rate.

With recent stress in the regional banking sector, sentiment in US commercial real estate (CRE) - and especially the office sector - has turned negative as investors prepare for potential spillover effects (with JPM, Morgan Stanley, and Goldman Sachs all joining the gloom parade), especially as high-profile defaults continue to make headlines as borrowers face higher debt service costs and refinancing becomes much harder ahead of a $400 billion CRE debt maturities this year alone. The latest headline fueling concerns about a potential CRE crisis involves a fund belonging to CRE giant Brookfield defaulting on a $161.4 million mortgage for twelve office buildings in DC. According to Bloomberg, the loan was transferred to a special servicer working with "the borrower to execute a pre-negotiation agreement and to determine the path forward." This RealDeal article shows 9 loans with balances in excess of $100mm which were recently sent to special servicing (precursor to default). The loans were mostly office and retail and in Chicago, LA, Las Vegas, Paramus, NJ, Queens, Deptford, NJ, Minneapolis, Fairfax, VA, Santa Ana, CA.

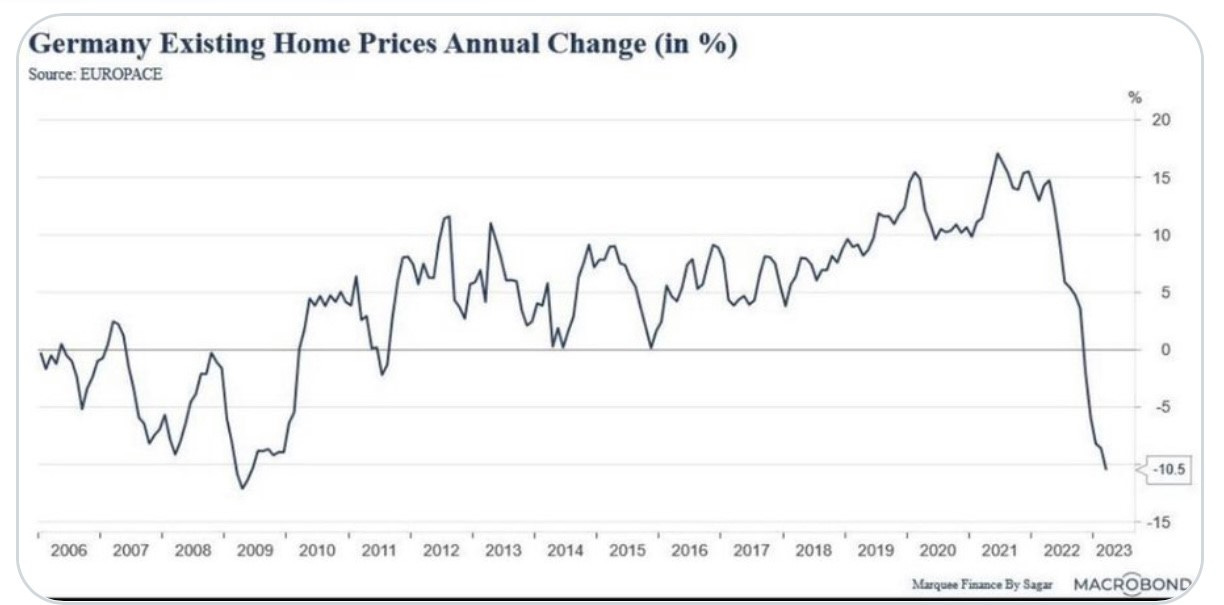

I was sent a Tweet about the German housing market which has taken a turn for the worse. An article from late February outlines some housing price declines and nothing I have read suggests the trend has changed. Stockholm was 20% below peak and Sydney -14% from the highs. Auckland -22% and Tornoto-16%. The article showed Seoul -24% since October 2021. The article outlines a dozen or so markets across the globe.