Opening Comments

Podcast-Today’s is 25 minutes.

Some fantastic feedback from my last piece, “A Deal you CAN Refuse,” so if you missed it, take a glance. I was invited to a lovely couple’s house for a drink Monday night. They are both senior people in the world of finance and have led very interesting careers. They are avid readers, and we had a great conversation after meeting through the newsletter. Interactions like this one makes me so excited about the power of the Rosen Report.

Fishing in am tomorrow. My freezer is light and need some Wahoo. I tried to fix my boat and I will remind readers that my least favorite words are “some assembly required.” It took me 6 hours to do something a mechanic could have done in 20 minutes. There is no mechanic on earth who is worried about losing their job to me.

Eye on the Market-Mike Cembalest-VERY Informative

Pictures of the Day-Raw Emotion at the Bill/Bengals Game

The Best Money I Ever Lost

Quick Bites

Markets

Big Bank Economic Views

Tech Layoffs

Speaker of the House?

Chat GPT Explained-Fantastic Video

Other Headlines

Crime Headlines

Must Read Last Bullet in Crime Section

Real Estate

South Florida School Limitations Hurting High-End Sales

NYC Office-Flight to Quality

Other R/E Headlines

Virus/Vaccine

Eye On The Market-The End of the Affair-Mike Cembalest-JPM

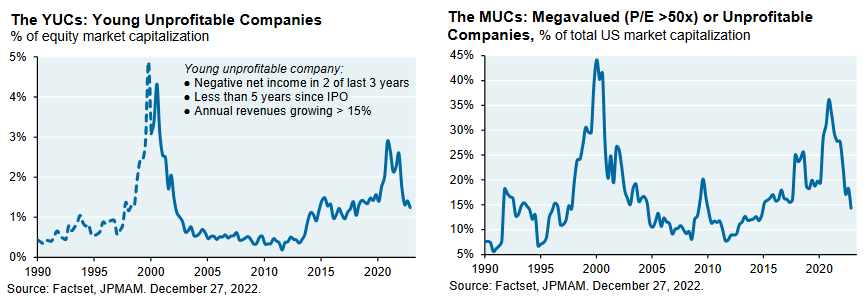

My readers know I have a lot of respect for Cembalest from JPM and we worked together for many years. His latest piece is insightful and always has amazing charts. It is entitled, “The End of the Affair.” Cembalest looks at the ISM data as a guide for equity market bottoms and believes equities will bottom in the 1st half of 2023, while the 2022 lows will hold. I enjoyed his thoughts on YUC’s (Young Unprofitable Companies MUC’s (Megavalued Unprofitable Companies) and the 2nd chart below. A lot more discussed in the informative piece, and I sent a note to Michael telling him I felt this was among his best work.

Pictures of the Day-Raw Emotion at the Bill/Bengals Game

On Monday night, the Bill/sBengals played in Cincinnati for a key game in determining playoff positions. However, tragedy struck when 24-year old Bills corner-back, Damar Hamlin (#3) tackled wide-receiver, Tee Higgins. Hamlin collapsed and went into cardiac arrest in a scary scene. Players and coaches from both sides were in tears and fearful for the teammate and friend. Players from both teams locked arms, hugged and prayed together. It was tough to watch, but it was nice to see players from both teams come together in such a challenging situation. The NFL eventually decided to end the game to replay at another time given the gravity of the event. It is a reminder how brutal the game of football can be today. Also, the final photo is of the average length of an NFL career by position which shows just over 3 years. Below are some pictures which captured the weight of the event. The medics did get Hamlin’s heart to start beating, and he is in the hospital in critical condition, but appears to be showing some signs of improvement by late in the day Wednesday. This link has a bunch more pictures of the event. Fans donated almost $4mm to Hamlin’s charity after the incident.

The Best Money I Ever Lost

In 1992, I worked for Continental Bank in Chicago and hated my job, something I wrote about in the note, “Lessons Learned from Good Bosses and Bad.” One of my 1st business trips was to Las Vegas. I was excited to go to a place I had never been on the company’s dime. We had a preferred rate at the Caesars Palace Hotel and to me, it was amazing. I had never stayed at a fancy hotel before and I thought this was like being on the Lifestyles of the Rich and Famous. I guess because of our rate relationship, they gave me a suite and the room had a Jacuzzi tub. I wish I had a camera to take a selfie of how excited I was to be in such a high-end suite.

My boss, Dan, and I met with our client who was a Caterpillar dealer. The meeting went fine, and we took them out to a nice dinner, but don’t recall where. I had a big steak and drank fancy wine, so I was pretty happy, as it might have been my first client dinner. It was long before I had the food and wine game of today, so I was far more easily impressed 30 years ago.

After dinner, maybe 8:30pm, we were back at the hotel and I decided to get $100 worth of chips and play Blackjack at the $5 table. Mind you, I had never been to a casino, and I was 22 years old. I recall a lot of smoking, and I hated smoke, so I was struggling to breathe and kept moving tables to get away from the cigarettes. The waitresses kept bringing me free drinks, another thing I had never experienced. I am 53-years-old and have never smoked a cigarette or had a cup of coffee. Yes, I am a bit strange.

In relatively short order, I turned my $100 into $500-600 and was convinced I was basically a card counting genius. I decided to quit while I was ahead and jump in my very own Jacuzzi. I had my chips and was laying in my fancy King Sized bed thinking about how I could turn my chips into far more money. At 2:30am, I decided in my infinite wisdom to go back to the casino to again use my genius to make many thousands of dollars. It was very quiet with not much activity, and I was going against the dealer one-on-one. If I recall correctly, I lost 12 straight hands (not easy to do) and even lost on a couple 19s and 20s. Within 15 minutes, I lost all my chips and was devastated. I went back up to the room very disappointed in myself. I realized I lacked the discipline necessary at the time. The result is that I have never been much of a casino gambler. As an aside, I believe my salary was $28k at the time.

Could you imagine if I had turned that $100 into $5,000? I would probably still be chasing it 30 years later. I think it was the best money I ever lost, and I also don’t think I ever stayed in a room with a Jacuzzi tub since. Thank you Caesars for taking my money and teaching me a valuable lesson. The $100 saved me hundreds of thousands, I am sure.

The Eric Rosen today would have taken half and cashed in the chips and bet with house money, but that is experience and age talking.

Quick Bites

Stocks closed higher Wednesday after a choppy session as investors looked past Federal Reserve meeting minutes that showed the central bank will remain aggressive in its policy to tame high inflation. The Dow rose 133 points, or 0.40%, to close at 33,270. The S&P 500 climbed 0.75% to 3,826 and the Nasdaq gained 0.69% to close at 10,459.76. Bond yields were lower, even as the Fed reiterated that rates would move higher this year. I was surprised the market rallied despite this statement, “Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time,” the meeting summary stated. “In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy.” I do not believe the Fed has any credibility in my mind. They have been so wrong. I will be shocked if they do not pause and pivot in 2023, but the statements are suggesting otherwise. Most of the Treasury market rallied despite the hawkish Fed commentary. Oil prices fell 5% on China demand concerns, recession fears and warmer weather.

Big banks are predicting that an economic downturn is fast approaching. More than two-thirds of the economists at 23 large financial institutions that do business directly with the Federal Reserve are betting the U.S. will have a recession in 2023. Two others are predicting a recession in 2024. The main culprit is the Federal Reserve, economists said, which has been raising rates for months to try to slow the economy and curb inflation. Though inflation has eased recently, it is still much higher than the Fed’s desired target. Most of the economists surveyed by The Wall Street Journal expect the higher rates will push the unemployment level from November’s 3.7% to above 5%—still low by historical standards, but that increase would mean that millions of Americans would lose their jobs. Most also expect the U.S. economy to contract in 2023. This article outlines my base case and have written about it quite a bit. Yes, there are paths to avoid a recession, but to me, unlikely. The consumer is stretched too thin with crashing savings while debt is ballooning and the higher rates have not fully gone through the system.

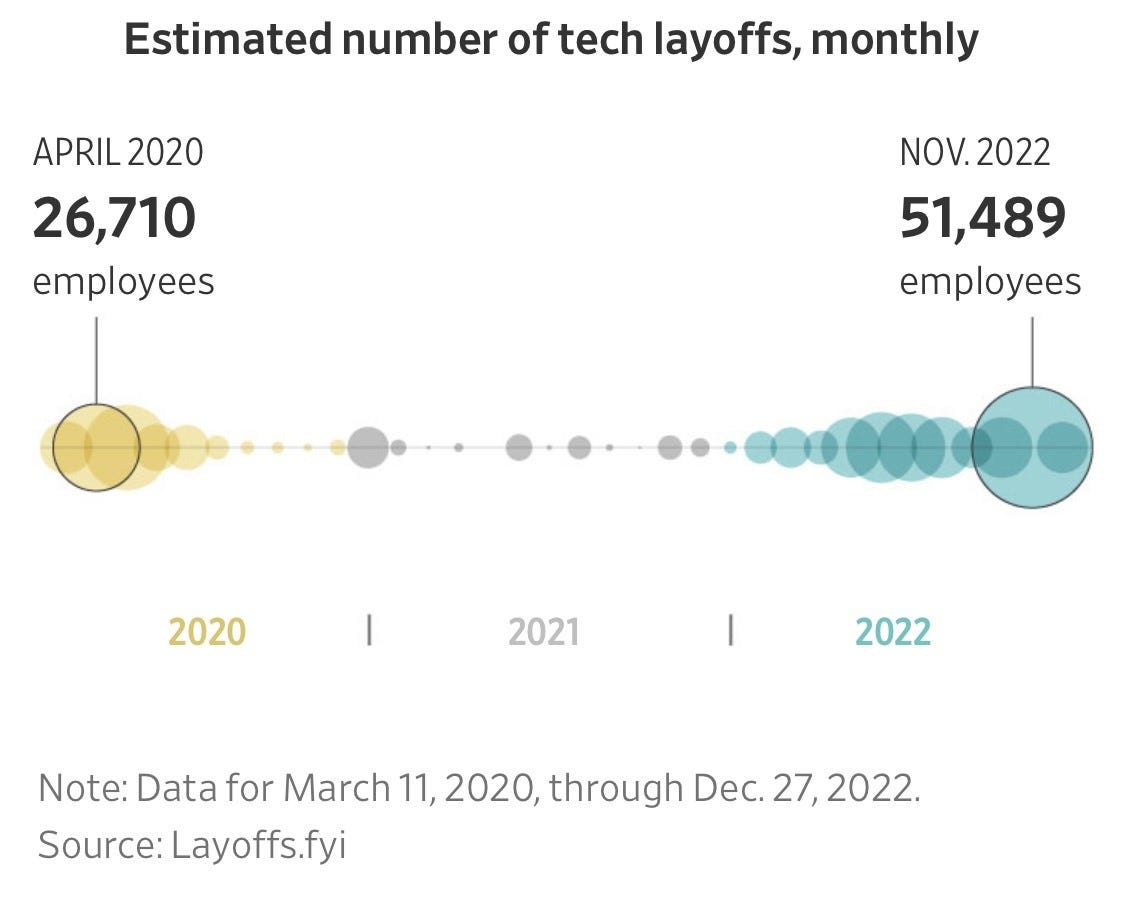

Interesting WSJ article on tech layoffs rising in 2022 with some very good interactive charts. More than 150k tech jobs were lost in 2022 compared with 80k in 2020 and 15k in 2021. These are higher paying jobs, and I would think they going forward, many laid-off employees will find difficulty in getting new jobs in the space. However, the article suggests that 79% of workers who were recently let go found a job within 3 months. I do believe Musk’s aggressive layoffs at TWTR will lead other tech companies to become more aggressive in controlling costs as business and funding slows. In a different article, I found average salaries of various tech positions according to Dice Tech. According to the Bureau of Labor, the average annual income was approximately $54k/year in the US in 2022, so the tech space is approximately twice the average. Just today, 1/4/22, Salesforce announced a 10% job cut and trimming office space. The company has 80,000 employees, after hiring 30,000 during the pandemic. Growth is forecast to fall to 9% from 14% in 2021 and years of 20%+ growth previously.

For the 1st time in 100 years, the majority party in the House did not elect a Speaker on the 1st vote. There has been staunch opposition from a small group of Republicans which now totals 19 to 20. In the 3rd vote, McCarthy won 202 of the 2018 votes needed to win as Speaker, while the Democrat, Jeffries, won 212 votes and Jordan (Republican) won 20 votes. More voting on Wednesday with what appears to be similar results, but they are just coming in late in the day. The “Never Kevins” are hurting the Republican Party and the country. Biden called it “embarrassing,” but I think we can all agree he too has had his fair share of moments himself. I do agree this is not ideal for the country. Given all the issues we face today, I sure hope this does not drag on for a long time. The “Never Kevin’s” include Conservative Reps. Andy Biggs of Arizona, Matt Gaetz of Florida, Bob Good of Virginia, Matt Rosendale of Montana, and Ralph Norman of South Carolina, but now others have joined the fray and the opposition to McCarthy is more meaningful. The “Never Kevins” said McCarthy’s resistance to rules changes, involvement in primaries and leadership history — among other issues — meant they could not support him for Speaker. Until a Speaker is elected, no committees can be formed and nothing can get done. It seems as though there will be an uphill battle and lots of concessions in order for McCarthy to become the next Speaker; politics as usual in America. Even Trump, the king of embarrassing moments is asking the far right to support McCarthy to avoid embarrassment.

A reader sent me a 17-minute video about ChatGPT (Generative Pre-Trained Transformer) where the narrator is clearly knowledgeable in the space. ChatGPT is a chatbot launched by OpenAI in November 2022. The video explains how it works, implications, uses, future and to me, it was quite informative and scary at the same time. I believe ChatGPT is the biggest innovation recently and the implications are serious. If you want to learn more about it in simple terms, watch this video with Alex Hormozi which ends with ways to profit from the innovation. Yes, some of the discussion is a little crazy (romance and aliens), but much of it is informative. I have been playing on ChatGPT and think it is incredible. Eventually, it may be writing the Rosen Report! The platform went from zero to 1mm users in 5 days, the fastest of any company ever. It took Facebook and Instagram 2 years to get to 1mm users for perspective.

Other Headlines

European Bonds Start 2023 With Rally on Bets Inflation Will Slow

Gold surges to 6-month high, and analysts expect records in 2023

Hedge Fund Losses Hasten Tiger Global’s VC Transformation

Venture bets have swelled to nearly 75% of assets since 2020

Through November, the hedge fund was -54% and long only -60%+. I would like to see the marks on the private portfolios of all the major funds. Let’s just say, I expect a big disparity and feel regulators need to get involved in the marking process of illiquid assets in the asset management business.

Tesla reported 1.31 million deliveries in 2022, growth of 40% over last year

4th Q deliveries fell short of expectations with 405k delivered relative to 427k expected and is cutting production due to weak demand. TSLA fell another 12%+ on the news or -71% over the past year when the stock was almost $400. TSLA was +5% on Wednesday.

Apple’s market cap falls under $2 trillion as sell-off continues

The value was $3trillion+ one year ago.

Twitter sued for not paying rent on San Francisco HQ since Elon Musk takeover

Qatar and the US tied for the World’s Top LNG Exporter

Here’s how much money it takes to be considered middle class in 20 major U.S. cities

Since peaking at 61% of the population in 1971, the middle class is hovering around 50%. The middle class earns between 2/3rds and twice the median American household income which in 2021 was $71k.

A new weight loss drug could become the best-selling drug of all time. Who can afford it?

There are a few of these drugs and I have spoken with multiple readers who have taken them and seen amazing results. One reader had a very bad reaction and had to stop after a few doses. The article suggests that annual sales of the drug, Tirzepatide, could hit $48bn, more than Pfizer’s COVID vaccine in 2021 which sold $37bn. There is a question around cost and insurance reimbursement. Some estimate $1,500/month for the medicine.

At Harvard, pretty much everyone gets an A now

In my last piece I wrote about “equity” in education today and bringing down the best and brightest to the lowest common denominator. I thought this chart was a good follow up. 100 years ago, the average Harvard GPA was 2.4% and now it is 3.8%. Note the move in the past 20 years.

Crime Headlines

Unprecedented NY flood of fentanyl causing ‘heartbreaking’ loss

The data is scary, and the deaths are mounting. Mexico and China are the largest producers, and clearly the wide open southern border is not helping matters. This drug is incredibly dangerous and is taking too many lives. A majority of over-dose deaths are fentanyl related.

Dollar Tree Employee murdered with machete on New Year’s Day

Man in Chicago divorce case jailed like criminal while dangerous suspects run free

In Chicago, murders, rapists, robbers, carjackers get out of jail with little or no bail, but a man going through a divorce is held on $10mm bail over a civil dispute on stock ownership? Does anyone else see a problem with this story? The 14-year divorce case sounds awful, but 6 months solitary confinement and $10mm bond for a man never convicted of any crime, while hardened criminals roam the streets seems like a problem to me. I was born in Chicago and lived there after college again. Nothing could ever get me to move back to that once great city.

Elderly man has part of his face, ear chewed off in attack (Portland, OR)

Real Estate

I have written extensively about the limited school options in South Florida and the fact that the schools are at capacity. Many people who want to move down are unable to do so given the lack of quality seats at schools. I have written about infrastructure issues down here. Limited public transportation, schools, crowded roads, limited decent doctors, limited private golf openings, clubs, mounting traffic…. As attractive as South Florida has become for all the obvious reasons, the infrastructure issues are becoming more prominent. There is an article on the Real Deal entitled, “Mansions on hold: Deals delayed because Palm Beach private schools at capacity.” Hard to pull your children from a great school in NYC or a suburb if the choice in Florida is a bad public school. I know that many Citadel employees have struggled relocating due to the school choice limitations. Again, PRIOR to buying down here, get your kids accepted into a school. It is not like NYC where there are dozens of choices. There are really only a handful of good choices from Miami to Palm Beach. When I moved down almost 6 years ago, schools were looking for families and today, basically any decent school is at capacity with waiting lists.

A lot of data on office leases in this article, “Flight to quality’: Landlords celebrate premium-lease boom in 2022.” Please note that when citing rent per foot, it does not include free rents or build-out expenses borne by the developer/owner. The stated rent and effective rent can be quite different, but here are a couple headlines. The year 2022 saw 77 leases in the C-note club ($100 ft or more), up from 56 in 2021, according to a new survey from JLL. According to JLL’s Year-End Recap, leases signed at $100-and-up per square foot totaled 6.1 million square feet, more than double the amount of premium-priced floor space signed in 2021. I spoke with one major building owner in NYC who told me, “headline rent is irrelevant given the amount of concessions we are giving on free rent and build-outs. The effective rent is what matters.”

Other R/E Headlines

Home price increases weakened sharply in November, posting the smallest annual gain in 2 years

Manhattan Home Prices Slip 5.5% in First Decline Since Mid-2020

People U-Hauling out of NY, California — heading to Texas, Florida: study

Worst states for departures are CA, IL, MI, MA, NY, NJ. The in demand states are TX, FL, SC, NC, VA and TN.

Mortgage demand plunges, as interest rates rise

Mortgage application volume was down 13.2% at the end of last week from two weeks earlier. The average contract interest rate for 30-year fixed-rate mortgages increased to 6.58% from 6.34% two weeks prior. At the end of 2021, the rate was 3.33%

Virus/Vaccine

Test positivity has exploded and is now back up to 16% after being 8% in November. Now that the holidays are over and the new variant, XBB 1.5, is becoming more prevalent, I expect the data to deteriorate in coming weeks.

China’s COVID lies could prove deadly for America

I have been critical of China since day one of the pandemic. The government has lied about everything from origin, transmission, deaths, hospitalizations and bought up all the PPP early negatively impacting other countries. Now, the country is at it again. The LIARS said only 1 person died December 29th, 1 person the 30th and 1 person the 31st in ALL OF CHINA, but the funeral home business tells a different story. Body bags are strewn everywhere. I continue to believe the lab leak theory, which I stated early in the process. I want China to pay the US trillions for the damage they caused.

At least 70% of Shanghai’s 25M residents infected with COVID, doctor fears

This would be 20 to 30 times the April/May levels. So much for the “Zero Covid Policy” implemented by the moronic government officials.