Opening Comments

The last piece was well received, and many readers are scrambling to get into some of the restaurants I mentioned. The two most opened links were the sucker punch of the subway rider and the keys to happiness. Early send today, as I am hoping in the car for another drive to Philly.

I neglected to put in this picture of an olive oil rosemary cake from Rezdora. It sounds awful, but the combination of sweet and savory is shockingly good. Just another reason to eat at the Michelin Star restaurant… if you are fortunate enough to get in.

My fill of Spring Hill Suites and living out of a duffle bag has been maxed out. My wife is taking Jack to his golf tournaments for a week so I can go home to Florida, sleep in my own bed, cook my own meals and do some fishing. I don’t know what the thread count of my sheets are at home, but I am going to suggest they are significantly higher than Spring Hill Suites. My towels are softer, and my food is far better. Don’t even get me started on wine. Given heavy rains, we were stuck in the hotel room for two days. Hopefully, I can get to the Bahamas on my boat and get the tail end of the yellowfin tuna season. Below are what I would be going for on the trip if weather cooperates.

Video of the Day-Shark Bit a Man on a Boat & Pulled Him Into Water

My Foray Into Private Aviation-If It is Too Good to Be True…

Markets

Crazy United Airlines Lifetime Pass

Taylor Swift Tour

Misery Index Improving/Biden Approval Rating

245 Park Sold for Effectively $2bn. Unbelievable.

Urban Doom Loop

Crazy Landlord Stories

National Rents Starting to Fall

Video of the Day-Shark Pulls Fisherman in Water

This is one hell of a scary video of a fisherman putting his hand in the water off a boat at Everglades Park in Florida. A shark grabs him and pulls him in. The video is only a few seconds and crazy. I have put my hands in the water about 500 times just like this guy when I fish. The man was taken to the hospital with hand injuries. Lots of bull sharks in those waters, but the species was not confirmed. The guy said, “two seconds won’t do anything.” Famous words before the incident.

My Foray Into Private Aviation-If It is Too Good to Be True…

In late 2016, I was introduced to “Jetsmarter,” a private aviation company which was membership based. You paid a one-time fee and joined for the year. This gave you UNLIMITED access to flights. If you wanted to initiate a flight, you had to pay more but if you just wanted a seat on an already scheduled flight, and one was available, you went at no additional cost. They had quite a few flights every day from NYC area to South Florida. Planes ranged in size from small to heavy jets. This link goes into additional details on Jetsmarter.

I bought 15 months of all I can fly for a total of $12.5k and I was guaranteed that the price could never increase but would have to pay that amount each year. Given I was moving to Florida, I was constantly flying down as the house was being finished. I flew down once a week and rarely stayed overnight, just to check on the construction progress. The planes were clean, on time and made life so easy, as you could get to the airport 20 minutes before the flight. They would have a rental car waiting for you on the tarmac. It sure made flying less of a hassle. I felt like a rockstar jumping off the plane and into a waiting rental car with the AC blasting. Jetsmarter had a deal with Sixth Rental Car and they gave us upgrades to fancy cars for very reasonable prices.

The people on the plane ranged from normal business folks to rappers, mobsters, criminals and strange people. On one flight, Whoopi Goldberg bought multiple seats to be sure no one would sit next to her. It was clear she was not to be bothered. On another flight, I sat next to a man who was carrying an obscene amount of cash in a money vest and I did not want to ask why. It was warm on the plane before take off and he was wearing a jacket and unzipped it and when he did, I could see the vest of cash. There were definitely some wise guys on the planes, but overall, I had a great experience. I actually made a few friends on these flights, and we would always laugh about how little we were paying. If it is too good to be true….

I sure felt like a star on planes which ranged from Phenom 300s to Gulfstream 450s. On one flight, I thought we were going to die. We hit a storm and the plane dropped a shocking amount in 5 seconds. Every glass on the plane broke and food was flying everywhere. It was like a scene out of Matrix, as water flew out of my bottle in slow motion. People were screaming and the flight attendant was visibly shaken.

I flew over 50 legs in the year and never initiated a plane at the additional cost, because it was unnecessary. I calculated that I spent about $240/leg to fly privately! I felt the deal was so good, shortly after my purchase, I got a deal for the family and for approximately $50k, we all had access.

I told a few friends about it and they all signed up, but I warned them I was uncertain as to how long this opportunity would last.

Early adopters paid as little as $4k/year for access which could not increase in price. They were also given free helicopter service to and from NYC to the airports. Jetsmarter offered great food and drink on the flights too. It seemed like there were others that took advantage of the situation as I did and flew a great deal, which caused Jetsmarter to lose money. I was given free helicopter transfers on multiple occasions to whisk me to the city from the airport. I believe my experience and other savvy consumers like me were responsible for the ultimate demise of the company.

Jetsmarter hosted lavish parties and dinners. I recall being invited to Milos in Miami with about 20 other customers and the food and wine flowed. I vividly recall sitting next to some clown who somehow got my cell number and was hounding me to invest in his EV battery start up in West Africa. No joke. I had to call Jetsmarter to tell them that the guy would not leave me alone.

I am not sure the exact date, but the company started cutting back on extras and in 2018, Jetsmarter did away with the “all you can fly” plan for one fee and started charging per seat. It remained reasonable but far more than we had been paying. It was clearly the beginning of the end and not what we had signed up for initially.

In January 2019, CNBC aired an investigative report on JetSmarter, titled "Tailspin" stating that "JetSmarter tried to be the Uber of private jets, now it faces lawsuits, losses and security questions.” It was valued at $1.6bn at one point with the Saudi Royal Family and Jay-Z as investors. Jetsmarter had celebrity spokespeople and amazing marketing. The short video link in “Tailspin” is worth a look. Yes, crazy things happened on some flights including a passenger having a breakdown caught on camera and eventually being found not fit for trial.

In the end, Jetsmarter was bought by Vista Global. I can tell you firsthand that the transition from flying commercial to private is a lot easier than the transition back to commercial. As mom always said, “It was too good to be true.”

I get calls and emails from aviation companies today and much to my chagrin they are charging slightly more than $240/leg. Although prices have come down from the pandemic craze, they are still too rich for my blood. Jet Blue Mosiac it is. It was fun while it lasted.

Quick Bites

The S&P 500 was little changed Wednesday as traders digested the latest commentary on the pace of future monetary policy from Federal Reserve Chair Jerome Powell. Powell on Wednesday said there is more restriction coming, including the likelihood of more interest rate hikes at consecutive meetings. Chip stocks fell after The Wall Street Journal reported that the U.S. was considering new export restrictions to China. Artificial intelligence beneficiary Nvidia was lower by more than 1%, and the iShares Semiconductor ETF also declined. YTD, the S&P is +13.9%, the Nasdaq+29.8% and the Russell 2000 +5.4%. The 10-year Treasury yield was down about 5 basis points at 3.71%. The 2-year Treasury yield was last trading at 4.71% after falling by 4 basis points. Oil prices climbed about 3% on Wednesday as the second straight weekly draw from U.S. crude stockpiles was bigger than expected, offsetting worries that further interest rate hikes could slow economic growth and reduce global oil demand.

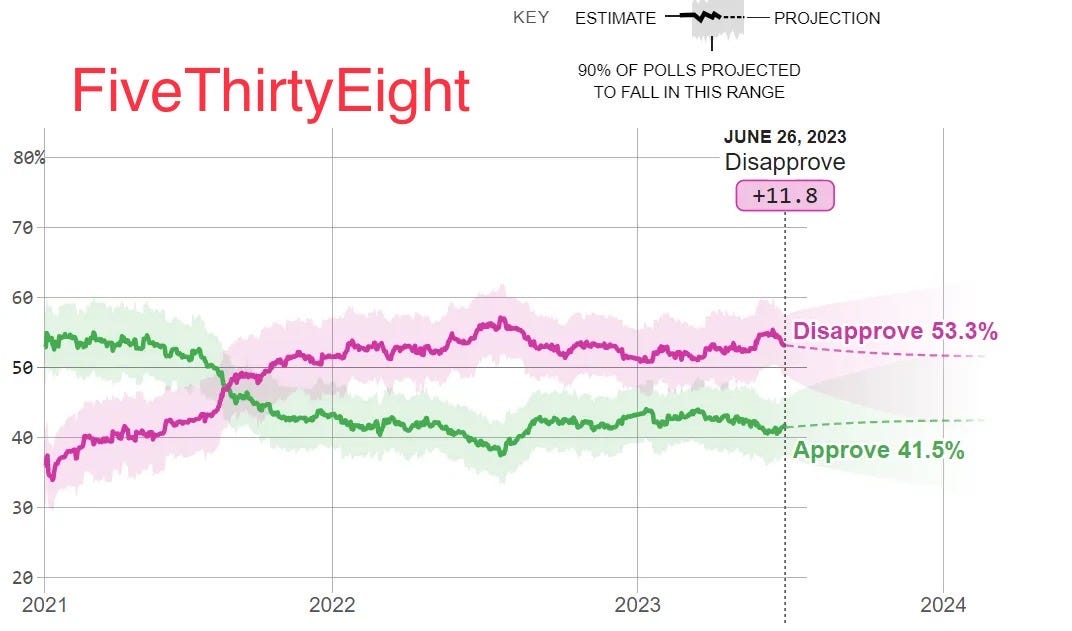

The Misery Index is improving in recent months, which is positive news for Biden. I contend the latest information on Hunter and the then VP’s connection will be far more damaging than the help from the index, but I need to be sure to call out positives when they happen. Recent polling data remains concerning for Biden (54% Disapprove) and would think the recent revelations about Hunter and payments from foreigners will not help his ratings. Biden’s attorney confirmed the damaging WhatsApp text was written by Hunter. President Biden still claims he has never had knowledge of Hunter’s business dealings. At this point, that comment lacks all credibility in my mind, but I give him credit for sticking to his guns. Here is another headline: IRS whistleblower says he was barred from taking ‘certain investigative steps’ that could’ve led to President Biden. As Americans, we should know the truth about what happened. Hunter Biden prosecutor told six witnesses he couldn’t charge outside Delaware: IRS whistleblower. This statement contradicts AG Merrick Garland. On President Biden’s health, Biden disclosed he has begun using CPAP machine for sleep apnea after indentions from the straps were on his face Wednesday.

I wrote a recent piece entitled, “Why I Love Taylor Swift,” which received a lot of attention and this WSJ article outlines that the Eras tour could be the first $1bn tour in history. Besides her original 52 U.S. dates, which end in August, she’ll be playing 54 shows overseas, bringing her to 106 gigs by the last show in London next summer. More dates could be added. Now that Swift is performing 106 shows worldwide, she could cross the record-breaking $1 billion line. But it’s not a done deal. Top tickets in the U.S. tend to cost 20% to 30% more than in the rest of the world, which makes the U.S. a more lucrative market than Europe or Asia. Swift’s 54 international shows aren’t worth as much as her American ones, though in some cases the venues overseas are larger in size, allowing for more concertgoers and revenue. Regardless of the final tally, Swift has proven she is at the top of her game. The article goes into details on ticket revenues ($6-13mm/show), merchandise ($2mm/show) and sponsorships.

Amazing article about a man who bought a lifetime United Airlines pass and his world travels which ensued. In 1990, Tom Stuker bought a United Airlines lifetime pass for $290k. He has since flown 23 million miles. Stuker told The Washington Post that the pass was the "best investment of my life." 2019 was the best year, according to Stucker, during which he took 373 flights that covered 1.46 million miles. If he had bought all these flights in cash, it would have cost him $2.44 million. Stuker told The Post that he has been to 100 countries and had over 120 honeymoons with his wife. And according to The Post, the airline has a Mercedes ready on the airport tarmac if Stuker needs to make a quick connection. Flying commercial would not be so painful if we were treated like Stuker. What an amazing purchase for $290k which changed his life and has allowed him to travel the world many times over.

Other Headlines

Japan stocks are roaring back. This rally may be different from the 1990′s ‘bubble high’

First Human Trials Begin for AI-Designed Drug

Very exciting. Article talks about slashed times for drugs given the power of AI. New technology will have people living longer and better treatments will be available. Yet another reason we need to tackle entitlements. Rising the age of eligibility and means testing is a start. DO IT NOW.

Fla. struggles with superyacht influx, dock space fetching $1M

According to a study, Sunshine State boat sales soared to $19 billion in 2022 — a jump of 197% from 2018. I can tell you demand for dockage is at an all-time high down here. The price of the slips in my marina are up 70%+ in 5 years. Marinas have multi-year waitlists.

Robinhood Lays Off About 7% of Its Full-Time Employees

About 150 employees are being laid off, according to an internal company message. Last year, they laid off over 1,000 employees.

UBS to cut more than half of Credit Suisse workforce, report says

Trump Steers Campaign Donations Into PAC That Covers His Legal Fees

CNN Airs Recording of Trump Allegedly Showing Off ‘Highly Confidential’ Iran Documents

Listen for yourself. Just plain reckless and careless.

McCarthy floats impeachment inquiry into Garland over DOJ ‘weaponization’

Alito’s Wife Leased Land to an Oil and Gas Firm While Justice Fought EPA

I would say this classifies as a conflict of interest.

Rolex and Patek Prices Fall as Subdial Index Nears Two-Year Low

Here's what's left for the Supreme Court's final week of the term

Affirmative action in college admissions. Can businesses deny service to LBTGQ customers. Giving state lawmakers unchecked power over federal elections. Biden’s student loan program. Religious accommodation for postal worker.

Man dies after knockout punch during NYC road-rage fight, cops say

Woman was mugged and dragged behind a car a died. Her family does not want arrested men to serve time. You can’t make this up.

4-time burglar is arrested for burglary 5 days after getting out of prison (Chicago)

'Disgusted' New Zealand Surgeons Now Required To Consider Ethnicity Of Patients

Doctors want medical conditions to determine urgency of treatment.

What the hell is wrong with people? The parents are awful.

NYC rules crack down on coal, wood-fired pizzerias -- must cut carbon emissions up to 75%

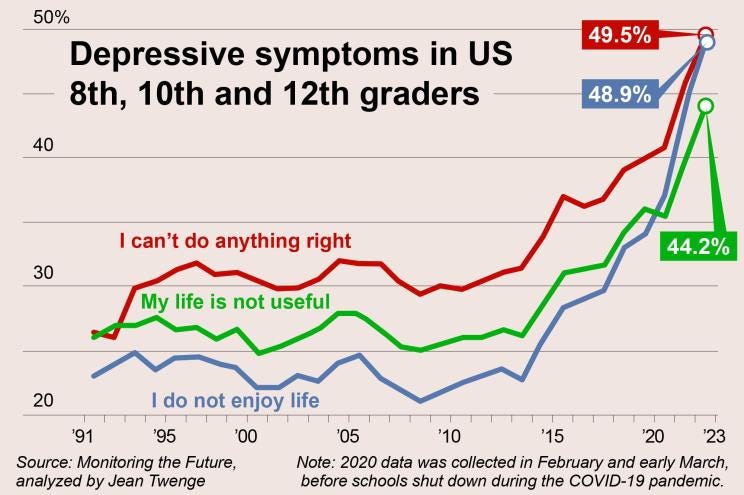

Number of teens who 'don't enjoy life' has doubled with social media

Over time, we will realize that social media is among the most damaging things ever introduced to children.

Congestion pricing gets final okay from feds to move forward (NYC)

The MTA has yet to set the exact amount for the toll but has signaled it will range between $9 and $23 per day to drive a car into the Central Business District. I am not convinced congestion taxes are the way to coerce people to come into the city. Higher taxes don’t attract people anywhere. From the # of “For Lease” signs in NYC, you need to use a carrot, not a stick.

9-year-old signs six-figure NIL deal with sports agency

Ghalee Wadood Jr.’s father, Ghalee Wadood Sr., shared the news with KTLA describing his son as a “standout 9-year-old athlete who excels in football, baseball, track and karate.” Kid is a little young. What are the chances he makes it?

Pill for Obesity Has Wall Street Salivating

Obesity treatments are currently limited to injections, but pills could expand the market and lower costs. This will be a massive improvement in availability and cost. I have seen many friends lose a significant amount of weight on these wonder drugs. Given the impact on obesity in this country, these drugs could have a large impact on longevity and health over the next 20 years (diabetes, heart disease, cancer, stroke…).

5 people contract malaria within U.S. borders — first such cases in two decades

Of course, 4 of them were in Florida.

16.5MILLION Americans at risk of stroke from EXERCISING too hard, study suggests

Harvard’s Francesca Gino, Dishonesty Expert, Is Accused of Fraud

Funny, no? The Dishonest expert is accused of fraud!

Senator Marco Rubio says officials with 'high clearances' have 'knowledge' of UFO craft retrievals

China created COVID-19 as a 'bioweapon,' Wuhan researcher claims

Chao Shao asserts that the virus was deliberately engineered by China as a "bioweapon," and that his colleagues were tasked with identifying the most effective strain for spreading. I have been very early on this and questioned the “Wet Market” theory. Major wars have been started for far less than the lives lost and TRILLIONS in damages. I don’t think zero consequences for China is a fair outcome. How can anyone question the Wuhan Lab leak today?

Yes, Putin being replaced sounds good, but the suggestion is the replacement could be worse. I suggested at the beginning of the year that I thought Putin may not last all of 2023 either due to his illness, assassination or being over thrown. It is clear that Putin is losing power. I had some amazing links explaining the leader of the Wagner Group, Prigozhin, and his crazy background as a flea market hot dog vendor who turned into Putin’s Butcher and then turned on Putin. This story suggests the Kremlin threatened the families of the leaders of Wagner which is why they stopped the march to Moscow.

Real Estate

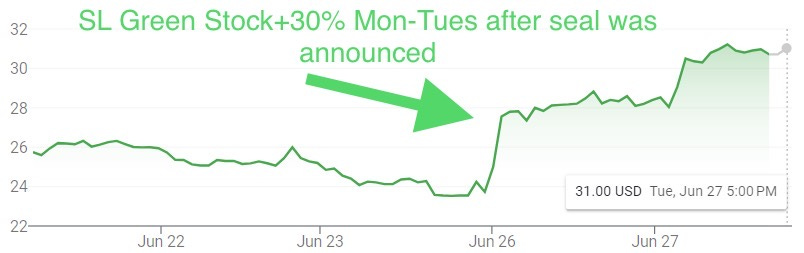

In the largest office sale since the Federal Reserve’s rate hikes froze commercial real estate markets, SL Green sold a stake in 245 Park Avenue in a deal that values the tower at $2 billion. Japanese developer Mori Trust last week closed a deal to buy 50 percent of the equity in the 1.7 million-square-foot tower north of Grand Central Terminal, sources close to the sale told The Real Deal. The implied price of $2 billion. The previous owner, China’s HNA Group, bought the tower for $2.2 billion in 2017. The building is undertaking a $100mm renovation (seems light to me). SL Green stock popped 30% on the news which tells you it was a good sale, but I believe an overreaction. Stock fell 7% Wednesday, but should be down more. One angle is the fact that there is $1.7bn of financing on the building at 4.2% until 2027, so the buyer only needed to put up $125mm for a 50% stake. Given we are talking about such a small equity check, the headline # is less relevant. Mori Trust also bought $500mm of the mezzanine debt on the building. On a positive note, EQT recently signed at $135/ft in the building, but Major League Baseball left the building. Remember, Japanese investors have a legendary reputation for being awful buyers of US Real Estate and this article outlines some major mistakes. They bought up tens of billions in the 1980s and dumped it at massive losses in the 1990s. So many times, Japanese institutions bought at the high and sold in a crisis. My gut tells me 245 Park Avenue is worth materially less than $2bn today despite it being an A+ location next to Grand Central. Two of the most expensive buildings in the city (One Vanderbilt and the New JPM Headquarters) are steps away from 245 Park. I don’t buy this $2bn valuation and the market moves based on this deal.

Last year, NYU economist Arpit Gupta used the phrase "urban doom loop" to describe a decline of foot traffic in central business districts, which "adversely affects the urban core in a variety of ways," including lowering municipal revenues, and making it more challenging to provide public goods and services without increasing taxes. Now, as Insider's Eliza Relman writes, the 'Urban Doom Loop' has hit the heartland, as Midwestern states are facing a crisis of their own; struggling to attract workers, residents, and visitors to their downtowns - a problem which predates the Covid-19 pandemic. According to economists and urban planners, Midwestern cities need to make major changes in order to boost quality of life in their downtowns, instead of just being a place where people are forced to go to work. In terms of migration, the Midwest has also struggled to attract new residents and hold onto its existing residents - marking a net decline of over 400,000 people between April 2020 and July 2022. If these cities fall into the "urban doom loop,' things could get even worse, as commercial property taxes make up a significant portion of many city budgets. It therefore makes sense that as office vacancies rise, the decreased tax revenue could force lawmakers to curtail city services or make cuts to key programs. This decline in quality of life and services in turn causes people to leave in a 'self-reinforcing exodus.' Bad policies are exacerbating matters. Soft on crime policies are making it even more challenging in attracting residents and workers.

I thought this story about crazy landlords was indeed nuts. They demand you MUST be a smoker, you CANNOT be vaccinated, and another refuses to rent to lawyers. These stories are worth a read. Almost unbelievable. One landlord believes the vaccine spreads disease and will only rent to those unvaccinated. Another landlord wanted to have sex with a woman in order to give her a lease. What the hell is wrong with people?

Some welcome news for renters: The US median rent in May fell from May 2022, the first annual rent decline in at least three years, according to a Realtor.com report released Monday. In May, the national median asking rent was $1,739, which was up a skosh ($3) from April but down 0.5% from May 2022. It’s the first decline since Realtor.com started tracking the year-over-year data in March 2020. The West and the South recorded year-over-year rent declines in May of 3% and 0.7%, respectively, whereas the Midwest and Northeast are still seeing rents climb higher, according to the report. The metro areas with the largest year-over-year rent jumps include Columbus, Ohio (9.3%); St. Louis, Missouri (7.7%); and Cincinnati, Ohio (7.7%). The largest year-over-year declines are in Las Vegas (-6%); the Riverside and San Bernardino area in California (-5.9%); and Phoenix (-5.7%). Rents are expected to continue to soften through the remainder of this year and into next year, Hale (Chief Economist Realtor.com) said. Helping those declines will be an expected surge in supply, Hale said, noting the historic levels of multifamily construction activity currently underway.