Opening Comments

My last piece was entitled, “The Oppenheimer Disaster & My Link to Paul Giamatti.” The most opened link was DeSantis speaking to an empty crowd and the TV thief who returned the first one to steal a larger TV only to be caught at Target.

I was in Nashville visiting my friend for the day and had to send it early given my flight back to Florida and travel to the airport. I will write up Nashville soon, but really it. I have never seen more cranes in a town of this size.

I played tennis a few weeks ago at the beautiful Bridgehampton Tennis & Surf Club which was where our wedding rehearsal dinner was 19 years ago next week. I played with my 60-year-old friend, Richard, who beat me handily. He has a mean forehand. I made the mistake of eating a big lunch at East Hampton Golf Club just 30 minutes before playing and was a bit lethargic. My strength is my athleticism and willingness to run, not my stroke. I had not played over the summer and the rust showed. Make no mistake, I lost, and my normal hustle plays were just not there that day.

However, I played a King of the Court the other day in Boca with two players who are far better than I, yet I was controlling the court. This means when you win, you stay on the court and a new player emerges. The more you win, the longer you are on the court, and it gets tiring at 53 years old. My winning was not because of my stellar skills, but I outhustled and went for every drop shot just trying to keep the ball in play. I redeemed myself after my horrific Hamptons showing. I think I went 8 for 12. Josh and Maarten left dejected, and I stayed after to sign autographs for my adoring fans of which ZERO showed up. The heat index was 100 at 8am and I looked like a drowned rat after one-hour.

Covid cases continue to rise and I know more people testing positive. The Eris variant is spreading all over the world. US hospital admissions are +19% over the past two weeks after a long period of decline. The US positivity rate has more than doubled to 10.6% in the past two months.

Markets

Inept Treasury Department

Are You Rich?

Trump Indictment #4

Public Colleges/Universities Overspending

CA Affordability Is a Big Issue

Affordable Housing in Palm Beach?

San Fran Doom Loop

The 10 Best States for Flipping Houses

Tom Ford Buys $52mm East Hampton Estate

China Mansions Causing “Ghost” Towns

Video of the Day-Video of My Boat and a Sinking Boat

I went fishing the other day and had my boat put on a rack to clean it and flush the engines. I looked in the water just past my boat and there was a boat sinking with a large pump trying to get the water out. My guess is the electronics went and with the rain, the boat took on water and the bilge did not drain properly. The video is 40 seconds and shows my boat and the sinking boat.

I Lost the Club Championship

For those who know me, chances are you would not believe I won a club championship at any respectable golf club today, and you would be right. My good golf is in the rearview mirror with mounting injuries, a slowing swing speed (107 down to 102), and a high volatility game. I can still hit very good shots, but my bad shots are downright awful. However, if you know me well, you understand that my clearance sale shopping skills are top-notch and of Olympic Gold Medal caliber. When my golf courses have a clearance sale, they know they can count on me to “Go Deep,” and buy out everything of high quality in my size and Jack’s size.

At a club down in Florida, I held the title of the “Best Sale Shopper of ALL-TIME,” and there was no #2. I just got back into town and went to the pro shop only to find out that not only did I lose my title, but I was also smoked. The guy who took my crown made me look like an amateur sale shopper which is nearly impossible. In golf terms, I had the course record with a 65 and he just shot 59.

At the last sale, I spent about $950 and bought out all the high-quality items in my and Jack’s size. Then, a newer member comes in and embarrassed me by spending $1,200 at the summer sale rack and basically clearing the entire Clearance Sale out on his own. Turns out his brother and father were there, and they all grabbed gear according to the new Clearance Sale King.

I called up the new “Clearance King” to let him know I was displeased with his flagrant violation of the shopping code. I cannot have my good name as the best clearance sale shopper of all time eviscerated by a young hotshot. Did he try on anything? Did he just willy-nilly load up without consideration of the fit? Seems he has a lot to learn to hone his skills to be the biggest spender AND get the best quality. I went to a mall the other day and saw the sign below. I could not resist taking a picture.

He may have beaten me on the spending, but I cannot imagine he can touch me on quality. I buy only the best brands (Chervo, Ralph Lauren, G/FORE, Greyson, KJUS…). I want to see his stash to see what crap he had to buy to take my title.

He must have bought a bunch of Nike, Puma, Adidas, Under Armor, and Callaway to get those numbers. I am protesting his title. He is a paper champion. He is a champion in quantity, while I remain the quality title holder.

Eighteen months ago, I wrote a piece, “You Had Me At Clearance Sale,” as a play on Jerry Maguire when Rene Zellweger said, “You had me at hello.” In the piece, I discussed my sale shopping prowess and bragged about my creative shopping genius. I feel like a 2nd rate sale shopper after hearing about Mr. Big Spender taking down $1,200 worth of sale items. There is always the next sale. The day after Thanksgiving is always special, and I show up at 7 am to be first in line. Colton, I am coming for you, kid. At the next sale, come and watch the master in action. It is hard to stay disciplined on a major sale, but I never falter only buying the best quality at low prices. You buy crap and you never wear it.

Quick Bites

Stocks fell Tuesday as concern over the state of the global economy and a decline in banks pressured Wall Street. Sentiment across the globe was downbeat after disappointing data out of China and a surprise rate cut from the country’s central bank. Wednesday saw stocks mixed as of 2:30pm with the Dow largely flat and S&P and Nasdaq down slightly after the Fed released the July minutes. “With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy,” the meeting summary stated. Retail sales increased .7% in July, better than expected. Core retail sales in July rose 1% m/o/m, twice the estimate and vs a .5% gain in June (revised down by one tenth) and a .6% rise in May (revised up by 3 tenths). Spending on line and restaurants was strong while autos, furniture and electronics fell. Industrial production in China increased by 3.7% in July from the year-earlier period, missing expectations. Retail sales also grew less than expected from the year-earlier period. Meanwhile, the People’s Bank of China lowered rates by 15 basis points to 2.5%. The 2-Year Treasury yield is now 4.98% and the 10- year is 4.25%. The 2-Year is +16bps and the 10-Year is +25bps over the past week.

Eye-opening WSJ article, “The Scary Math Behind the World’s Safest Assets.” I have been sounding the alarm on fiscal irresponsibility and mismanagement by the Fed and Treasury Department. The view that inflation was “Transitory” clouded their judgment of locking in low funding for longer. I wrote countless reports on the Fed/Treasury being wrong and here are some examples: Druckenmiller vs the Basket Regarding Inflation-I Take Druck (May 2021)

There Ain't No Such Thing as a Free Lunch (July 2021) There Is No Such Thing As A Free Lunch-Part II (June 2022). The low-IQ PhDs massively contributed to inflation (rates too low for too long and QE) and have mismanaged the debt term structure by not refinancing and extending the duration of the liabilities. Check out the chart with over 44% of Treasuries maturing within one year and a total 74% maturing within 5 years. The higher interest costs will be devastating to the budget. In 1970, we spent $34bn on interest, in 2000, $300bn and now we are annualizing at $1trillion (2nd chart). The 3rd chart shows various CBO forecasts, and they are awful at predicting the future. We could be paying almost $2 trillion in interest by the end of the decade. Couple this issue with the aging population and entitlement costs which are exploding, and things get out of control in a hurry. We cannot balance a budget and continue to give money to anyone who asks. What could possibly go wrong? If you look at the last chart, the Treasury could have refinanced the short, dated bonds with 20–30-year maturities at 1.1-1.5%, but they thought inflation was transitory. The result will be TRILLIONS more of interest expense over any reasonable period of time. Maybe they all need another PhD and one is not enough. Had they read the Rosen Report, they would have known better.

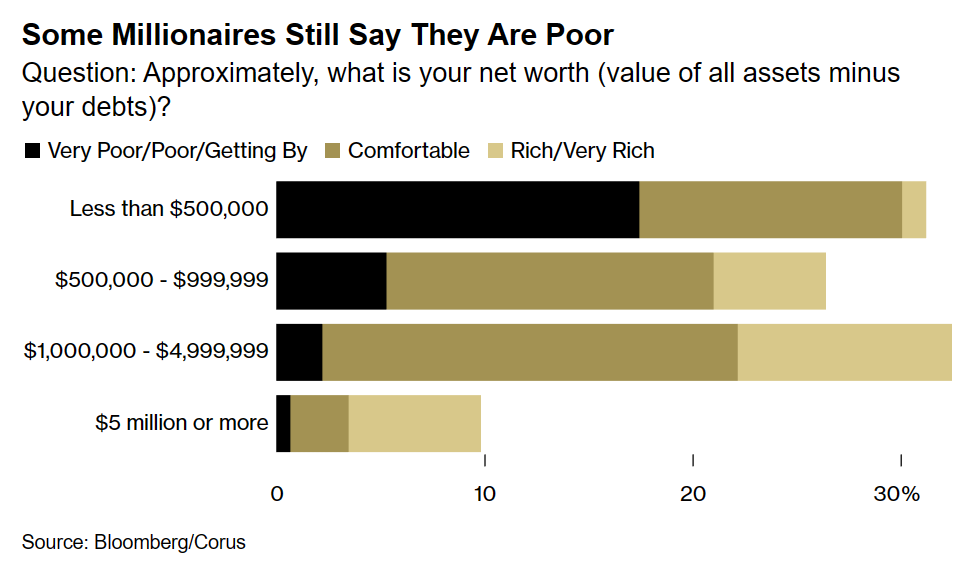

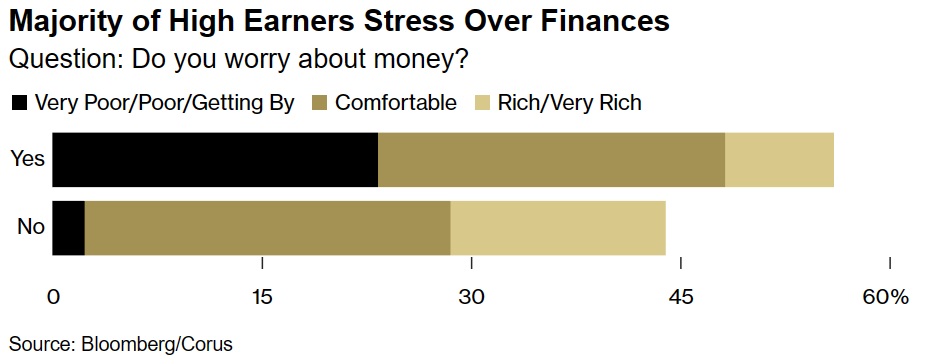

I enjoyed this Bloomberg article entitled, “Are You Rich?” Billionaires know they are. Low-wage workers are very well aware that they aren’t. But vast swaths of America’s “regular rich” don’t feel that way, and it’s keeping everybody down. The story is about the fact that despite hard work and saving, many families are struggling. It even suggests some millionaires feel “poor.” The people we polled have good jobs, own their homes and have savings for retirement. By some combination of hard work and good fortune, they’ve achieved the old-fashioned American Dream. Still, for many it’s not enough. At a time when pretty much everything is more expensive, including cars, tuition, travel and groceries, over half of respondents in our survey said they worry about money. Some 25% don’t think they’ll be better off financially than their parents. And many have considered moving to a different part of the country, joining the pandemic exodus away from high-cost cities to areas of the US with lower taxes and a cheaper cost of living. Work From Home, inflation, and quality of life issues have allowed many to relocate. This article helps you to find places you might consider. A ton of good charts in the link.

Trump and 18 of his advisers were indicted this week and this time it was around Georgia election interference and an anti-racketeering law. It is the 4th indictment for Trump. Prosecutors say Trump and others "joined a conspiracy to unlawfully change the outcome" of the election. This article suggests the GA indictment could be the most problematic, as it is a state charge which CANNOT be pardoned according to the article. The piece suggests the document charge is easier to prove. The 98-page indictment includes 41 counts that chart in stunning detail an alleged conspiracy to pressure local officials, make false statements about electoral fraud to state legislatures, harrass election workers, and solicit Justice Department officials and then-Vice President Mike Pence. The 4 indictments are: NY Hush Money Probe, Mar-a-Lago Documents Case, Jan 6th, and GA Election. This article outlines Trump’s packed court schedule for his upcoming trial going into the 2024 election. Please, can we not have Trump or Biden on ballot.

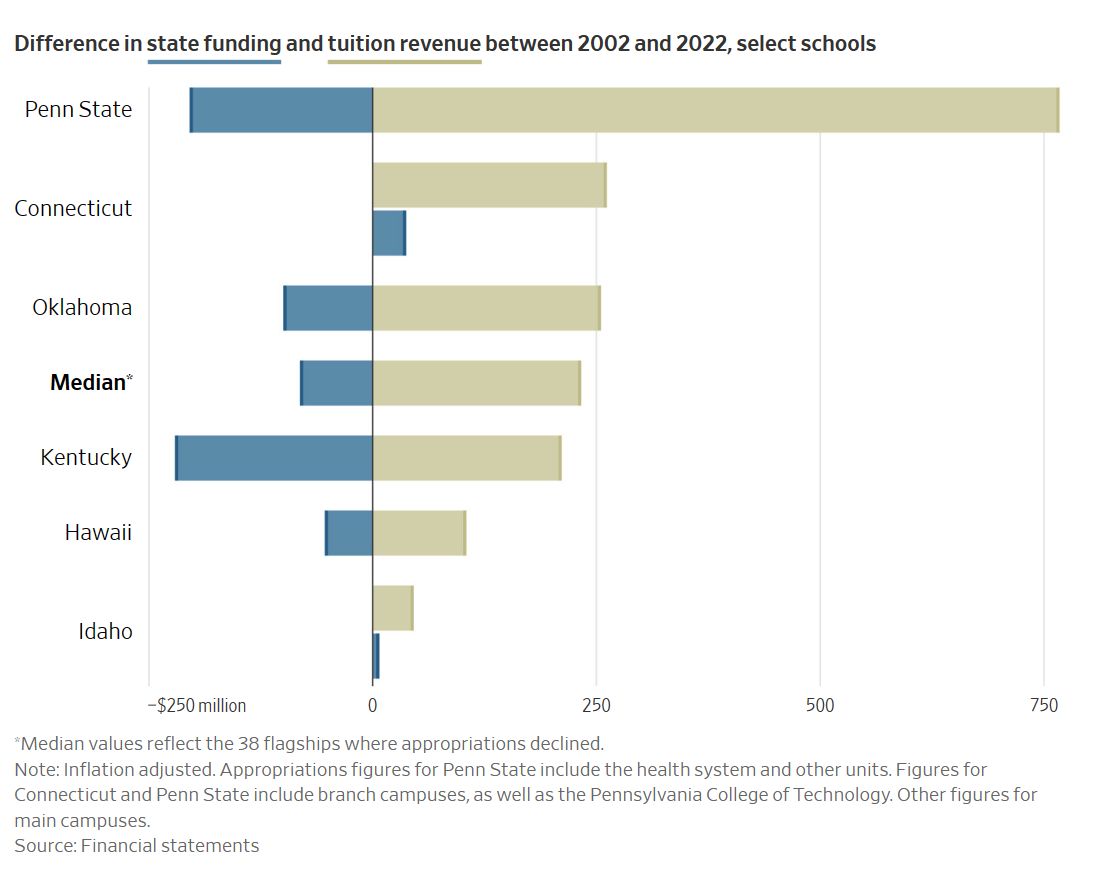

Another WSJ article entitled, “Colleges Spend Like There’s No Tomorrow. These Places Are Just Devouring Money.” It seems as though they went to the US government school on fiscal irresponsibility. The nation’s best-known public universities have been on an unfettered spending spree. Over the past two decades, they erected new skylines comprising snazzy academic buildings and dorms. They poured money into big-time sports programs and hired layers of administrators. Then they passed the bill along to students. The University of Kentucky upgraded its campus to the tune of $805,000 a day for more than a decade. Pennsylvania State University spent so much money that it now has a budget crisis—even though it’s among the most expensive public universities in the U.S. Colleges have paid for their sprees in part by raising tuition prices, leaving many students with few options but to take on more debt. The University of Florida in 2022 had more than 50 employees with titles of director, associate director or assistant director of communications, roughly double the number it had in 2017.

Other Headlines

David Einhorn is worried about the market, sees stickier inflation than expected

His fund is doing well this year after a long challenging period. He is adding to hedges. “If we were ‘bearish’ until March and ‘neutral’ through June, we would now characterize ourselves as ‘worried,’” Einhorn said in the letter. “The inflation bullishness has not yet materialized. Recent inflation readings have shown a noted deceleration and the tailwind from higher rents is likely to dissipate, causing core inflation to fall further,” Einhorn said. “Even so, we believe inflation is stickier and more entrenched than the market is currently appraising.”

Home Depot beats earnings estimates, but sales slide as consumers pull back on big-ticket buys

Target slashes full-year earnings forecast as retailer struggles to win over thrifty shoppers

Stock +4% on earnings. Inventories fell 17%.

Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase

Homebuilder sentiment drops sharply, as mortgage rates surge over 7%

Sentiment fell 6 points to 50 in August. Over 50 is positive. Average 30-year fixed-rate loan hit 7.2% Monday.

Airlines can’t add high-end seats fast enough as travelers treat themselves to first class

Four reasons why the consumer is so confusing — and what that may mean for retail earnings

US inflation means families are spending $709 more per month than two years ago

No wonder credit card debt has exploded.

More consumer stress. I am not supportive of canceling student loans. I worked my way through college and went to a state school to make it cheaper. According to research from the Federal Reserve Bank of New York, the average student loan monthly payment is $393. They also found that 50% of student loan borrowers owe more than $19,281 on their student loans.

Trump’s legal bills are mounting and he is burning cash while fundraising is slowing. I just don’t see him digging into his own pockets to run.

Biden’s issues are mounting as more evidence is brought forward. I called Michelle Obama as the surprise candidate on a podcast in February of 2023. I am hearing that more Dems are pleading with her to run.

An unlikely solution to the problems with Harris and Feinstein

Brilliant idea from the Left Leaning LA Times which suggests Kamala Harris should replace Feinstein as CA Senator leaving Biden the ability to bring in someone more electable. Harris has the lowest rating of any VP in the history of the poll with 49% having a negative view and a net-negative rating of -17.

4 Takeaways From Former FBI Agent’s Testimony on Tipoff in Hunter Biden Case

Continued testimony of how the FBI tipped off the Secret Service about the IRS plan to interview Hunter.

Hundreds of NYC shelter beds sat vacant while migrants slept outside Roosevelt Hotel

The ineptitude of city, state and Federal governments never ceases to amaze.

Randall’s Island migrant shelter to cost NY taxpayers $20M a month — or $10K for every migrant

I keep saying how inefficient the government is and how much they waste. I recently dedicated an entire theme piece to government waste. We continue to embarrass this country with bad decisions, runaway spending. Stan Druckenmiller is the single best investor ever with 32% returns for 30 years with NO down years. His biggest concern is spending, deficits, entitlements and waste. Let’s listen.

Erie County Won’t Take More Migrants After Second Alleged Assault Involving Asylum Seeker

Maybe we need a better plan?

Post police bureau chief sucker-punched by stranger during NYC commute

Read the story. Sorry, this is one of the many things wrong with NYC today. Too many crazy people on the streets putting law-abiding citizens in danger. No wonder my phone won’t stop ringing with wealthy people trying to leave NYC.

Grandma, 84, slammed to ground after allegedly being attacked on Los Angeles bus, video shows

Scary video. He pushed her off the bus and she was unconscious and spit on her. Then, a man acted as though he was helping her and stole her purse. How about serious jail time for these criminals?

Do you think it is the top 3% of income/net worth or the bottom 3%? What are the implications for the NYC income tax collections? Sales tax collection as wealthy people spend disproportionately. Bad policies matter and the wealthy are leaving. The constant $50mm+ homes sold between Palm Beach & Miami tell you all you need to know. It never happened prior to the pandemic.

I lived 4 blocks from here. It was once considered the nicest part of town. Locals now call it the Murderous Mile.

Small-town Kansas paper was probing ‘Gestapo’ police chief over sex claims before he raided it

This is UNBELELIEVABLE. The cops raided the paper and the home of the editor. The editor’s 98-year-old mother died the following day. The articles suggest the police chief was trying to stop a report of alleged sexual misconduct.

How many millionaires have left Mass for other states due to the tax?

'Very disturbing': 20 Lake Tahoe bears hit by cars in the past month

Lots of amazing bear pictures in the link. When we were there last, there was a large black bear on the golf course while we were playing. Also, we heard of a story that a bear broke into the unlocked home of someone and got into the fridge tearing apart the house. They are everywhere in Tahoe.

It is getting harder to obtain insurance for fire, earthquake, flood.. in CA and FL. The prices have gone up exponentially.

Most millionaires surveyed didn’t have high-salary jobs. Instead, 93% said they’d created wealth simply by working hard.

To be clear, Mars is an incredible musician and entertainer, yet he believes trusting his gut and self-discipline has helped him succeed. I am a big believer in hard work and trusting your gut.

Meet the 16-Year-Old Pickle Ball phenomenon

Fun video and great story. Her mom is her doubles partner. As an aside, I went to a sporting goods store for tennis shoes and the section said, “Pickleball and Tennis.” They had a dozen shoes and 10 of them were Pickleball. Crazy. No tennis selection.

Fans accuse Lionel Messi of cheating on free kick

Short video shows Messi moving the ball closer to the goal a bunch of times. Pretty funny.

Real Estate

Buying a home in California slipped further out of reach as interest rates climbed and scarce inventory bolstered prices. Only 16% of households could qualify to purchase a median-priced single-family home in the second quarter, the California Association of Realtors reported Friday. That’s down from 19% in the first quarter and 17% a year earlier. The state faces an affordability crisis that threatens to hamper growth in the economy and population. People and companies have left California, or chosen not to move there, because housing is so much more expensive than in most of the US. For an existing single-family home at California’s median price of $830,620, buyers in the second quarter needed a minimum annual income of $208,000 to qualify for a 30-year mortgage after a 20% down payment. Loans on condos and townhouses, with a median $640,000 price, required a minimum $160,400 income. How many more reasons do you need to run from the state of CA?

For the first time in 30 years, a new affordable apartment building has been built in downtown West Palm Beach. Located on Tamarind Avenue and Banyan Boulevard, the Flagler Station Apartment is just blocks from downtown and major transportation. Rent at the Flagler Station Apartments ranges from $437 to $1,869, depending on a resident’s annual income. The units are reserved for residents earning no more than 30, 60, 70, or 80 percent of the area median income. All 94 units are filled.

The WSJ article is entitled, “Can San Francisco Save Itself from the Doom Loop? The city is racing to come up with solutions for its downtown, hollowed out by a tech exodus and struggling with homelessness and street crime.” A combination of bad policies, homeless and Work From Home have all contributed to the disaster of the once great city of San Fran. Urban doom loops start with a triggering event tied to a core industry, like when manufacturing jobs started to leave Detroit in the 1970s. Tax revenue falls, services suffer, businesses close and disorder moves in. Residents leave, commuters and shoppers stay away and the cycle is self-reinforcing. Homelessness and drug use remain prevalent in and near downtown. On a related note, a San Fran office tower Sixty Spear sold 66% less than the recent assessed property value of $121mm. What do you think that does to the R/E tax base? Hundreds of government employees were told to work from home due to high crime levels. Something must change.

Besides Sixty Spear, SFGATE provided data on other recent tower transactions:

The 13-story 180 Howard St. building, known for being the headquarters of the State Bar of California, sold for about $62 million after being expected to sell for about $85 million.

The offices at 350 California St. reportedly sold for roughly 75% less than its previously estimated value in May, and the 22-story Financial District edifice mostly sits empty. Just a few weeks later, nearby 550 California changed hands for less than half of what owner Wells Fargo paid for the building in 2005.

The ten best states for flipping houses. The factors used were determined using data from Zillow, Redfin, the U.S. Bureau of Labor Statistics and more. They include:

median home price

the average price of fixer-upper homes

number of fixer-upper homes

median days on the market

home flipping gross ROI

property tax rate

average kitchen remodeling cost

average bathroom remodeling cost

number of real estate agents

number of construction managers

number of construction laborers

Tom Ford spent $52mm on a 7-acre East Hampton estate where Jackie O summered. The home last sold in 2918 for $24mm. Great pictures in the link.

Great Architectural Digest article entitled, “See Inside a Ghost Town of Abandoned Mansions in China.” The pictures in the link are crazy. The State Guest Mansions were envisioned as the palatial homes for the upper crust of society. Now, their only residents are hurdles of cattle and the occasional adventure explorers meandering like ghosts around the arched verandas and stone façades of hundreds of abandoned villas. Located around the hills of Shenyang (about 400 miles northeast of Beijing), the development was originally planned by Greenland Group, a Shanghai-based real estate developer, and broke ground in 2010. But as AFP reports, within two years the project had come to grinding halt, leaving the half-formed skeletons of imitative royalty in its wake. Today the crumbling estates are still abandoned, left in an eerie series of rows appearing like an architectural cornfield.