Opening Comments

My last note, “If you Build it, They Will Come-The Reef Road Story,” saw two links most opened. The 1st was the empty stadium for DeSantis. The other was the story of the woman who was attacked by a snake and a hawk seconds apart. Opens were down 10%. I may go to once a week until the end of summer if the open rate does not go back up.

I need to correct an error from a recent piece. I included a COVID case chart which I did not realize was dated. Cases are rising with Global cases +80% in a month and a new variant known as EG.5. which is related to Omicron XBB1.9.2 and apparently South Korea is seeing a substantial increase in cases.

I am off to Nashville Tuesday and returning Wednesday to visit a close friend who has been battling cancer. I am only flying up for 24 hours and won’t be seeing much of Nashville, but it is a town I could absolutely live in 6 months of the year. Young, hip, cool, restaurants, music, jobs, sports, great hospital, Vanderbilt University, and centrally located.

One of my readers reached out to me and I connected him with Ali who took him from LGA to the Hamptons on Wednesday night. The Gambian Giant is getting work from the Rosen Report. Love that.

My readers continue to contribute to the Rosen Report and I am thankful. I am getting countless emails and texts from readers with story ideas, links, and topics to include. Keep them coming, please.

As a reminder, I have two “Subscribe Now” buttons on EVERY email. I get a lot of emails asking for me to sign someone up. If they have a report, there is a subscribe button at the top and bottom of each note and another one here:

Markets

Inflation Data

Private Credit

Bezos Buys $68mm Miami Knockdown

Wework Impact on NYC/SF

New R/E LLC Laws for More Transparency

Big Banks Dumping Office Loans

Manhattan Average Rent Rising

“Reasonable” Luxury Alternatives to the Hot Spots

Picture of the Day

I have found Michael Ramirez’ illustrations impressive. I have been incredibly critical of government spending, fiscal irresponsibility, entitlements, the growing debt levels, and the long-term ramifications. I thought this picture summarizes my concerns well. You can link to his article here and sign up if you are interested. According to the Debt Clock, we are at $32.7 trillion in debt and we were at $9 trillion in 2008 and $23 trillion in 2019. Today, the debt per citizen is $97.5k and growing fast. The high debt levels and nearly $1 trillion of annual interest expense coupled with massive entitlement spending are crowding out discretionary spending, and is concerning. I do not believe the downgrade is a big deal on the surface.

The Oppenheimer Disaster and My Link to Paul Giamatti

My family decided to go to the much-discussed Christopher Nolan-directed film, Oppenheimer, the other day. We went to an iPic in Boca which gives you a better audio, visual and comfort experience. You can order food and drinks from the wait staff while the movie is playing. The ticket prices are 25% less than NYC and free parking. As an aside, I was an avid movie theater fan years ago, but since 2020, I had only been to one movie, Top Gun, and this was my second foray in years.

The incredibly irritating previews of horror movies were shown prior to the film. Who in the hell wants to see the movie The Exorcist? The other awful preview was of the Haunted Mansion. One preview which I could see was for a movie called, “The Holdovers,” with Paul Giamatti, the amazing actor from Billions, Sideways, John Adams, and many others. I will go back to my Giamatti story after I discuss my Oppenheimer disaster.

The feature film began, and I found it interesting. I am hardly a history buff, but feel fairly knowledgeable, yet I was learning as I was watching the movie. I will say I felt Oppenheimer bounced around a bit and could have used a subtitle for dates to help follow the action. We were one hour into the film and the sound continued, but no picture played. I got up to tell the manager and apparently, this was happening in EVERY theater. The sound kept playing with no visuals, and after 20-25 minutes, I decided to get a refund. The movie was hard enough to follow with the picture and impossible without it. Yes, I will go back to see it in its entirety, but was frustrated by the experience. I am not convinced it needed to be 3 hours, but I will reserve judgment until I see the entire show. For a man with ADHD, 3 hours seems like an eternity.

Back to Giamatti. I recently wrote a piece about “My Legendary NYC Apartment Rental” in Greenwich Village. The apartment was at 20 5th Avenue (9th Street). The closest grocery store was Citarella on 6th Avenue and 9th Street just one block west of my building. I would walk down the south side of the street and I would guess 30% of the time, I would see the actor, Paul Giamatti, sitting on the stoop of a townhouse just east of 6th Avenue. He would be reading. He would be there for hours. I am a big fan of his and did not say anything until about the 20th time I saw him.

I stopped and said, “I am a big fan of yours. How do you like living in the neighborhood?” I also did an imitation of him from the movie Private Parts which was probably not my finest acting moment. He laughed, but it was probably out of sympathy rather than finding my impersonation interesting. Sometimes, I just can’t help myself.

Giamatti said, “Thank you for the kind words. I do not live here. I live in Brooklyn. I just like this stoop.”

I presumed he was joking as the dude sits all day long on these stairs. I said, “You are kidding, right?”

He told me he spoke with the owners and they were fine with him crashing on their stairs and reading. He told me he loves the block and enjoys his time there. He would be there with a book or practicing lines. He was very friendly and going forward always said hello. I just thought it was crazy that he took a subway to sit on someone else’s stoop and the preview of his new movie reminded me of this interaction.

When I was in NYC a couple of weeks ago, I walked down my old block and took a picture. I had not seen him there since I moved uptown in 2011, but think this was the stoop. As an aside, John Leguizamo and Uma Thurman lived on this block and I would see them all the time. My wife, Jill, dressed Uma for years as her stylist and traveled the world for Kill Bill Volume II with her to dress her for all the premier showings. Other stars within a few blocks include Julia Roberts, Sarah Jessica Parker/Matthew Broderick, Tom Cruise, Mario Batali, and many others.

Quick Bites

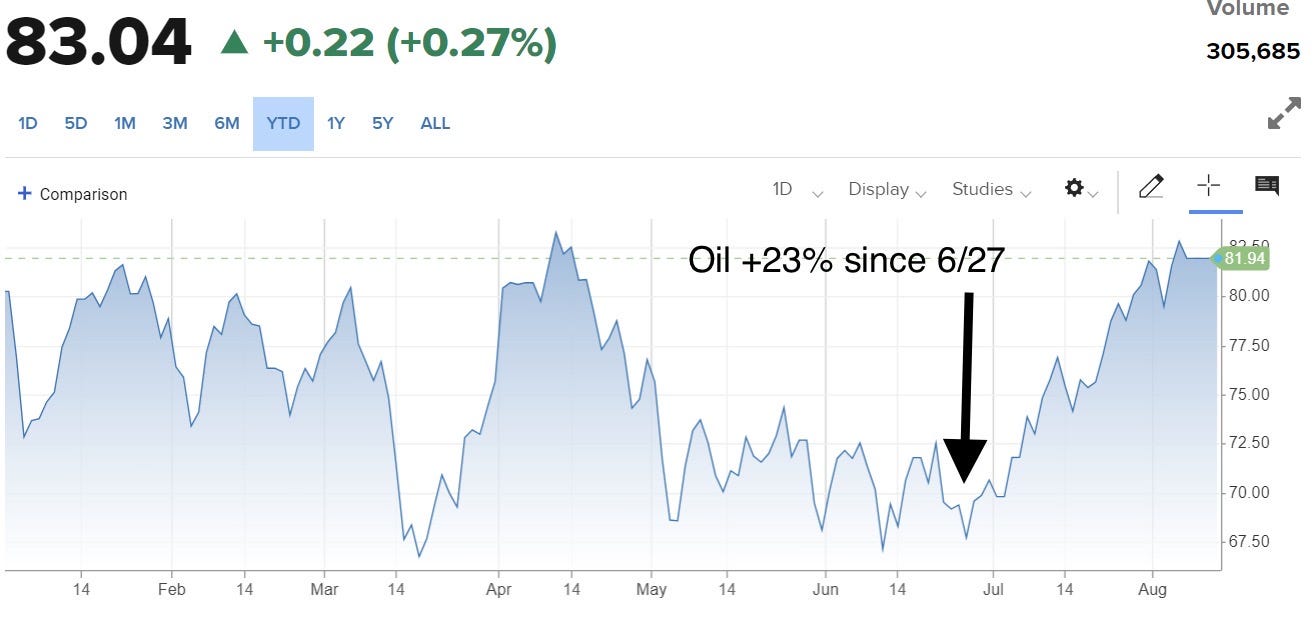

Stocks were mixed, but small moves on Friday. However, Both the S&P and Nasdaq were down on the week (.3% and 1.9% respectively), while the Dow was +.6%. This is the first time in 2023 that the Nasdaq fell two weeks in a row. Despite this fact, YTD the Dow is +6.4, S&P+16.2 and Nasdaq+30.4%. Global oil demand reached a new record of 103mm barrels/day, while the Saudi supply cut is still in place. Early in the year, my contrarian call was a potential oil shock higher. Oil got killed earlier in the year and now is actually +27% from the March lows. Also of note, Natural Gas is +7% on the 7th straight week and back up to almost $2.78. Gasoline is now up to $3.85 on average or +30 cents in a month.

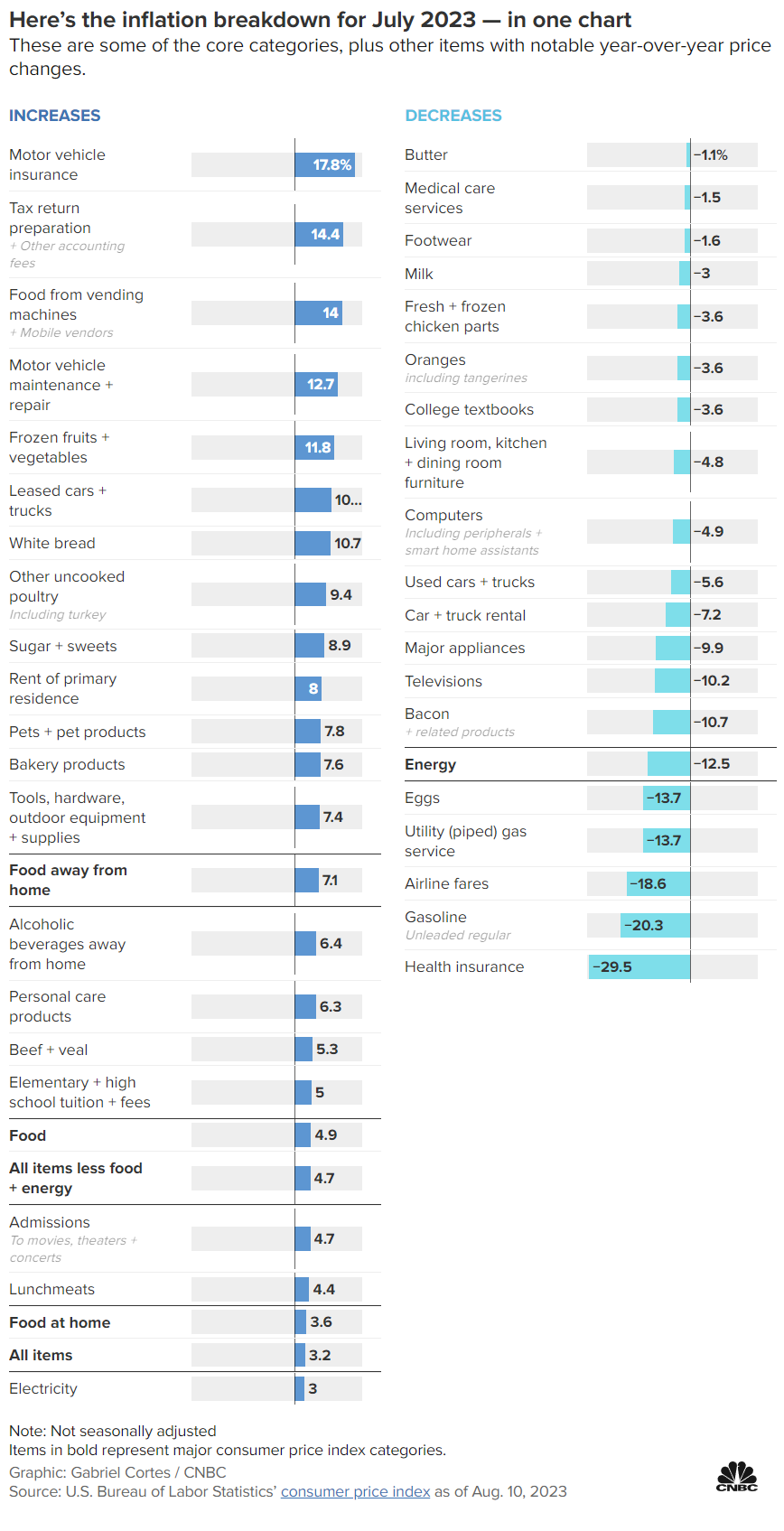

The consumer price index rose 3.2% from a year ago in July, slightly below expectations. The core CPI ran at a 12-month rate of 4.7%, also below the estimate. Both measures were up 0.2% on the month. Almost all of the monthly inflation increase came from shelter costs, which rose 0.4% and were up 7.7% from a year ago. Real wages adjusted for inflation increased 0.3% on the month and were up 1.1% from a year ago. While inflation has come well off its 40-year highs of mid-2022, it is still considerably above the 2% level where the Federal Reserve would like it. July’s producer price index rose 0.3% from the previous month. Economists polled by Dow Jones expected the report, which is closely followed by the Federal Reserve and market participants, to increase 0.2% month over month. Consumer inflation expectations as measured by the University of Michigan unexpectedly fell in early August, despite higher gasoline and grocery costs. Meantime, producer prices grew last month by more than expected, primarily due to increases in certain service categories. Treasuries sold off post both the CPI and PPI release apart from the very front end. The 2-Year is now trading at 4.89% (+10bps on week) and the 10-Year is 4.15% (+8bps on week). December 2024 Fed Funds Futures are pricing in 110bps of cuts today.

Private credit firms are raising billions of dollars to grab a share of the $5.2 trillion market that includes US consumer debt, seizing on a growth opportunity while the industry’s traditional lenders are in disarray. Direct lenders such as Ares Management, BC Partners, KKR & Co., and Medalist Partners in recent months raised the money for funds designed to lend to consumer financing companies. Providers of auto and consumer loans have been unable or unwilling to tap their usual funding sources, namely regional banks and securities sales backed by assets like loan portfolios. The private credit firms see a chance to increase returns for their investors and to diversify their offerings, lessening the focus on increasingly competitive corporate loans without adding an unmanageable amount of risk. While the more-opaque consumer debt market is vulnerable to a downturn in the economy and a given sector can be hit by defaults, loans backed by assets like real estate or autos can be attractive.

Other Headlines

Dave Portnoy buys Barstool Sports back for $1, years after selling it

He sold it for $551mm. GENIUS. When Portnoy sells it, he must give half the proceeds back to Penn (seller).

UPS CEO says drivers will average $170,000 in pay and benefits at end of 5-year deal

The tentative deal would raise part-time workers’ wages to at least $21 an hour. Full-time workers will average $49 an hour.

U.S. judge sends Sam Bankman-Fried to jail over witness tampering

After Absence Induced by Anxiety, PGA Tour Chief Admits Mistakes With Saudi Deal

Harvard, do a business school case on HOW NOT TO BE A LEADER starring Jay Monahan. He should not have a job. He was paid $14mm/year? PGA Tour, my email is rosenreport@gmail.com and I will be the commish for less and do a far better job while having the respect of the players, fans and sponsors.

China slams Biden’s order limiting U.S. overseas tech investment

Biden rarely impresses me, but I like this. Oh no, China is upset at America? What are they going to do? Unleash another virus, then lie about it. Buy up all the PPE and lie about the transmission killing millions and causing trillions in damage? America needs to reduce its reliance on China for anything critical. The government is not to be trusted for anything. They are the worst “partners” in the history of America. My only hope is the rising youth unemployment and deflation will lead to an overthrow of the government.

Over the past two decades, $147 billion in US funding has been appropriated to the war-torn Middle Eastern nation. Last I checked, the US has enough problems of its own. Homelessness, education problems, families hungry, vets needing care, healthcare woes, porous border…yet we continue to give money away. Time to focus on our own and stop spending my hard-earned dollars wastefully. Let’s not forget about the BILLIONs of equipment we left the Taliban with our awful withdrawal.

With the crap that goes on from our politicians, every day I feel as though we are closer to Ecuador than ever before.

Biden finally sending top aide to meet with Mayor Adams in NYC as migrant crisis price tag hits $12B

Who is going to pay the $12bn? Open borders have consequences and 6mm+ illegal immigrants crossed under Biden. We need a better plan, and having just been in NYC, I can tell you that around the Roosevelt Hotel is chaos. We lack the systems, infrastructure, capital… to allow such numbers without a real plan. These cities cannot handle the volume.

U.S. Reaches Deal With Iran to Free Americans for Jailed Iranians and Funds

$6bn in Iranian oil revenue assets will be “unfrozen” from South Korea in exchange. Just great, we are allowing terrorists who hate America and Jews to get $6bn which I am sure will be used to fund terrorists.

Florida Republican rep. files articles of impeachment against Biden

Although I am highly confident that Biden was involved and took money, I am yet to see the smoking gun needed to impeach him. The mounting evidence and testimony are quite damaging. I need more for impeachment and maybe if the FBI, DOJ and IRS contributed, we would see it. The idiot, Hunter, and his laptop was full of emails damaging to the then VP about paying his father. Hunter was being paid millions from foreign countries and giving money to his relatives and paying Joe’s bills. Come on, man.

'I wish I hadn't called it that,' said Biden. I wrote on this topic and the absurdity of the claim that spending $ 1 trillion would reduce inflation.

Trump Is Disqualified From Holding Office, Conservative Law Professors Argue

Professors are clear in their interpretation of the Constitution and claim the ban can only be lifted by a 2/3rds vote of each House of Congress. Remember, these professors are both active in the conservative Federalist Society.

Attorney General Garland appoints a special counsel in Hunter Biden probe

Lots of questions about David Weiss as special counsel given his role as federal prosecutor and the inherent conflict of interest. Weiss gave Hunter the sweetheart deal with no jail time. The appointment seems questionable to me.

Jared Kushner ‘crossed line of ethics’ by accepting $2B Saudi investment

I agree. Does not have a proper appearance to me.

Say it ain’t so, Bernie. Is there no politician who is honest?

30 thieves steal $300K in merch from California Yves Saint Laurent store in brazen smash and grab

He stole a TV, went back to return it for a bigger one, then got caught. There are idiots and there are idiots. These TVs were HUGE.

The 15-page letter is in the link with some disturbing claims after serving for over 20 years.

LAPD dwindles to smallest force since 1990s due to 'anti-police rhetoric,' police union says

Less than 9k officers for the LAPD today and they cannot respond to 911 calls due to lack of staffing. Since 1990, the population has grown 15%. The new recruiting class is 29 people, less than half full.

Hot tub-like Persian Gulf fuels 158-degree heat index in Iran

I complained about 118° in Vegas a couple of weeks ago. There are a lot of reasons I will never step foot in Iran. The government hates Americans and Jews.However, check out the heat index in Boca on Thursday.

As death toll from Maui fire reaches 93, authorities say effort to count the losses is just starting

Another article shows over 1,000 still missing. Link to scary pictures.

Eco-Warrior Leo DiCaprio Is Back for Another Vacation on the $150M Superyacht Vava II

He is the ultimate hypocrite. He flies privately and takes massive gas-guzzling yachts on vacation, but drives a Prius and a Karma and yells at you for not being eco-friendly. Yes, you are a good actor, but you are the worst kind of environmentalist. Let’s not forget his 2016 trip of 8,000 miles on a private jet to accept an award for his environmental activism.

Go to work, stay social and read.

Could walking extend your lifespan? - study

The risk of dying from any cause or from cardiovascular disease decreases significantly with every 500 to 1000 extra steps you walk. I did enjoy walking in NYC and must have walked 10 miles or more in my 38-hour visit.

I have been on these for 20 years. Without them, I am in trouble and it sounds as though my years of taking them could be doing a lot of damage too.

50% of Americans tried weed, 17% regular smokers

If you walk the streets of Manhattan, you would think 80% smoke weed. It is everywhere. I don’t do drugs. I do fear the increasing prevalence of pot usage and the medium-term ramifications of it.

From "machine learning" and "hallucinations" to "generative AI" and "neural networks," here are the AI terms everyone should know. A reader sent me this link and would like people to take a look to help educate folks on what will continue to grow in importance in my mind. Easy to read and not too technical.

Real Estate

The wealth keeps moving to South Florida. Bezos paid $68mm for a teardown in Indian Creek. The property is 2.8 acres and is next to another property for sale asking $85mm. I won’t be surprised if he buys that one too. For perspective, in 2017, a new construction home was sold for the unheard-of price of $50mm in Indian Creek and now, $68mm teardowns are being sold. For perspective, I looked at what was a teardown in 2016 on the island for under $20mm and could have been all in at the time for $27mm which would be worth closer to $90mm today. If Bezos relocates from CA to FL, how many billion does he save in taxes? Last week, DJ David Guetta, bought one of the worst lots (with a new construction house) for somewhere in the $60mm range in Indian Creek. The club is notoriously challenging to gain acceptance with multiple billionaires being turned down. Julio Iglesias was rumored to get $150mm offer on his 4-acre lot on Indian Creek, but the structure of the sale prevented it from closing. Julio owns the property in an entity of some kind and needs to sell the entire entity rather than just the property which has become a sticking point. Rumors were that Bezos bid on it. As you can see in the map below, there are only a few dozen properties on the island and a country club. The place is fortified with armed guards and boats which patrol the waters. Owners include: Bezos, Tom Brady, Carl Icahn, Julia Iglesias, Eddie Lampert, Norman Braman, Jeff Soffer, Ivanka and Jared Kushner…

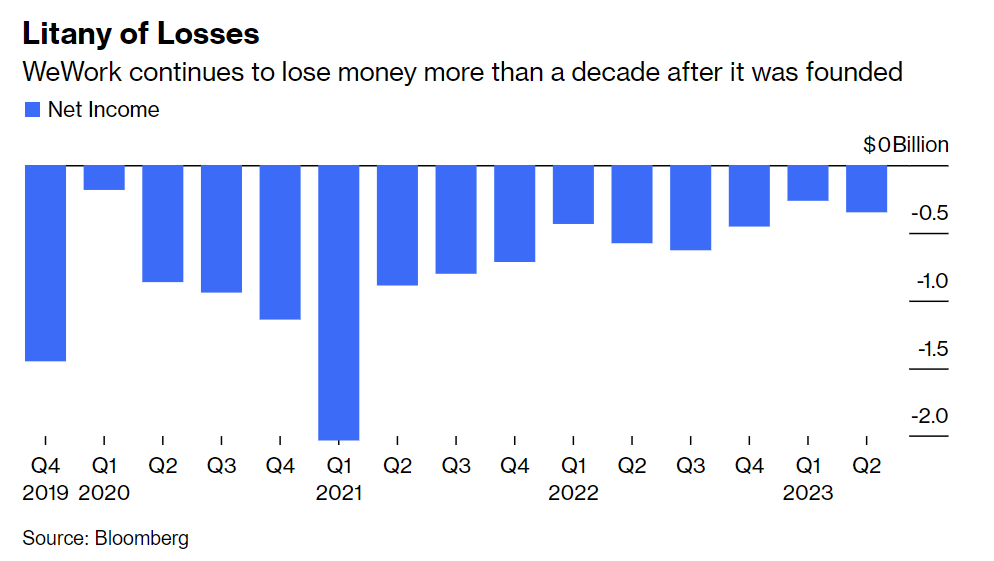

Last note I touched on WeWork’s likely bankruptcy. They occupy 6.8mm feet in Manhattan. Just what NYC needs, more space coming to market. That is the equivalent of 4 GM buildings! Wework has lost almost $17bn since it was founded over 10 years ago. Lender exposure to WeWork is extensive. Analysts at Barclays Plc estimate that there’s about $7.5 billion of commercial-mortgage-backed securities that are potentially exposed to WeWork, according to a note Wednesday. Roughly 38% of that is concentrated in New York. The Manhattan vacancy rate was 17% at the end of June. The company’s website lists 21 office spaces in the Bay Area, including three floors in Salesforce Tower and co-working locations in several other downtown buildings. WeWork had over $13 billion in long-term lease obligations at the end of June, the firm said in a filing with the Securities and Exchange Commission on Tuesday. At the end of June, the San Fran vacancy rate was 32% and the availability rate was over 36%. Wework was valued at $47bn at its peak and is now a couple hundred million.

Regulators in the United States are closing in on a rule targeting anonymous purchases of luxury real estate. The Treasury Department is expected to propose a rule that effectively bars such a hidden activity, Reuters reported. The department’s Financial Crimes Enforcement Network is scheduled to propose the rule this month, though exact timing is unclear. The rule is anticipated to require real estate professionals like title insurers to report the identities of the beneficial owners of companies purchasing real estate. While some wealthy buyers use companies to keep their dealings private, others have taken advantage of anonymity to hide and launder money. I am fully supportive of this new rule and feel too many bad actors have been able to launder money and accumulate choice R/E in the USA undetected, especially near military bases.

Big US banks are reportedly trying to dump commercial real estate loans - but buyers are scarce as pressures mount for property markets Big banks want to some of their commercial real estate loans, but buyers are proving scarce as troubles pile up in the sector, according to report out from Bloomberg this week.

JPMorgan, Goldman Sachs, Capital One, and M&T Bank are among firms trying to whittle down their commercial real debt holdings, sources familiar told Bloomberg this week, but have been struggling to find many interested buyers.

Banks could be willing to sell property loans at a discount as troubles mount in the sector, but some are hesitant to sell off commercial real estate debt at too-low of a price, as that could reignite fears of banking troubles, sources added. As a result, many banks are choosing to hold onto the debt while they seek better offers. JPMorgan, for instance, has been looking to sell a $350 million loan backed by the HSBC Tower in Manhattan, Bloomberg reported, with the bank offering potential buyers ultra-low interest financing, sources said. I know for a fact that banks are aggressively attempting to sell loans with massive incentives of low-cost leverage to get headline exposure off the books. I am seeing mid-teens returns on what I deem to be lower-risk attachment points on quality buildings, as banks want to show lower exposures to the space.

The average Manhattan rent just hit a new record of $5,588 a month. The average monthly rent in July was $5,588, up 9% over last year and marking a new record. Median rent, at $4,400 per month, also hit a new record, along with a price per square foot of $84.74, according to a report from Miller Samuel and Douglas Elliman. It was the fourth time in five months that Manhattan rents hit a record.

My recent piece on luxury R/E got traction and a lot of emails and texts from readers. One from Detroit sent me stunning estates on the water for cheap relative to many of the most highly sought-after locations (South Florida, Hamptons, Beverly Hills, Malibu…) and I thought I would share what you can get in less highly regarded markets. These homes are impressive 100-year-old estates that would cost a FORTUNE to build today. I appreciate them architecturally and the finishes, but I would not want one for myself despite depressed prices. I have no desire to live in these places, and the carrying costs of a huge estate make me ill. However, they are incredibly cheap relative to what you get in the hotter markets. With .5 acre lots going for as much as $25mm+ in hot areas of south Florida, check out what you can get in Grosse Pointe, Michigan. Both homes are unsold after years on the market. The listings were both recently pulled, but you get the idea that amazing homes can be had in off-the-run places for very reasonable. Just think of the parties you can throw.

15420 Windmill Pointe Drive, Grosse Pointe Park, Michigan, United States, 48230

An impressive 2.3 acre estate on Lake St. Clair with a history dating back to c.1928 has been reduced to $6,499,000. Designed by architect Robert O. Derrick for J. Bell Moran, the Tudor mansion, known as Bellmoor, extends more than 17,000 square feet with wonderful original character, including leaded glass windows, wide plank wood flooring, tracery ceilings and intricate fireplace mantels. There are six bedrooms and fourteen bathrooms throughout, as well as large formal entertaining rooms, an updated kitchen, and irreplaceable detail from nearly a century ago. The grand great room features magnificent hand-carved oak paneling, a decorative plaster ceiling, intricately carved fireplace and leaded windows, while the formal dining room is an entertainer’s delight with seating for more than ten guests. The last asking price is $6,499,000. It last sold in 2013 for $2.8mm.

Lavish mansions cluster on the shore of Grosse Pointe Park’s Windmill Pointe, mostly built during Detroit’s glittering 1920s. They drip with adornments like gold leaf, carved wood, crystal chandeliers. But among this flashy group, the interior of this mansion — larger than 14,000 square feet — may be most lavish of all. It was built by a prominent patron of the arts, attorney Hal H. Smith. What’s more, its current owner, who’s lived here 42 years, has added to the embellishments. You could charge admission to the huge library alone, 1,000 square feet with two stories of books and a barrel-shaped 21-foot ceiling. Down the length of the room, the curving ceiling is painted with life-size images of angels, clouds, classic architecture and the Seven Deadly Sins. The house was last asking $4.75mm. A waterfront home of this size and magnitude in the Hamptons would be $40mm+.

Check out this 1940 home on the Country Club of Detroit Golf Club asking $2,250,000. Almost 10k feet with 6 beds and 9 baths with a 2.3 acre lot. It is hard for me to look past the awful furniture, wallpaper and rugs, but this is a lot of house for the money.

Yes, he is an amazing actor. I just thought it was crazy that he would sit on that stoop all the time and did not live there. I loved the movie, Sideways.

Eric, Paul Giamatti - a fantastic actor I agree - lives in Brooklyn Heights for years.