Opening Comments

My last note on the best rock bands from 1960-2000s generated some feedback but given the Labor Day weekend, opens were the lowest in years at 62%. I knew I had forgotten some bands and was hit hard by my readers: Santana, The Grateful Dead, Phish, Elvis, Chicago, INXS the Clash, Def Leopard, Cream, Allman Brothers, and many others. Interestingly, the Stones are coming out with their first new album in 18 years, “Hackney Diamonds.” All the bands below were in my piece and were released within weeks of each other.

The most opened links were the town that banned cell phones for kids, and the link on M2 money supply shrinking and the implications. One astute reader pointed out the M2 growth was massive and a pullback was in the cards, but historically, it has suggested trouble ahead.

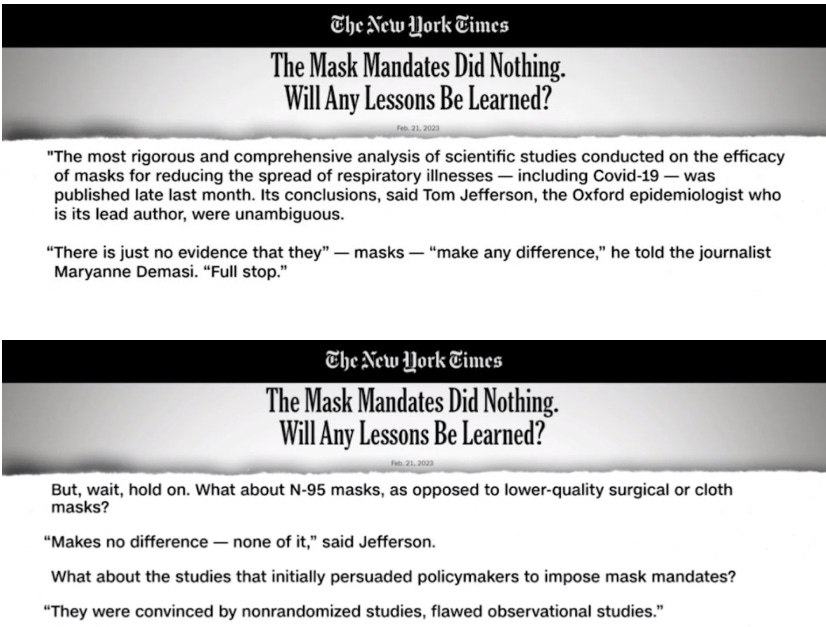

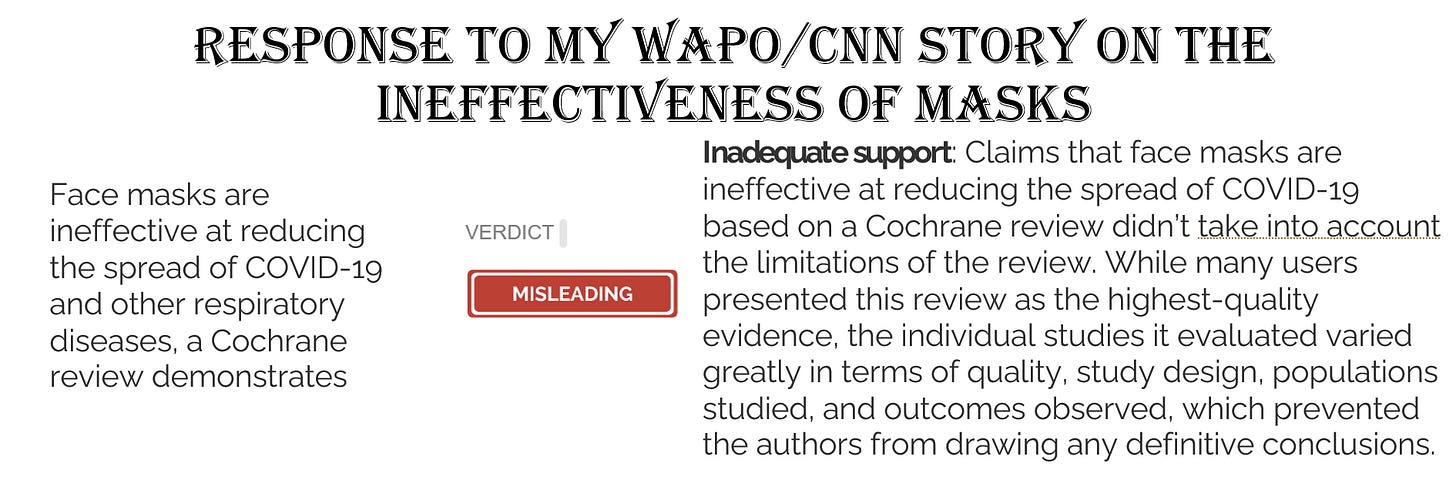

In my last note, I included a short CNN video of Smerconish interviewing Fauci about the ineffectiveness of facemasks and cited the NYTimes article covering an Oxford study on the topic. A reader told me he felt the study I cited (CNN/WaPo-not exactly Right leaning) was misleading and included his findings on the bottom. At the Rosen Report, we give all sides the ability and try to call out the Left and Right and are more about Right and Wrong. I side with the Oxford study. A prominent Johns Hopkins surgeon told me the Cochrane reviews which are cited below have an impeccable reputation for doing strong research. He further suggested that Tom Jefferson’s reputation is fantastic and he is not political. Cheap Costco masks that don’t fit properly provide little protection in my mind. High-quality masks must be tightly and properly fitted to have any effectiveness and you cannot sustain that for any reasonable period of time. Masking children is a waste of time. Have you ever seen a 5-year-old wear a mask properly for 8 hours straight in school?

To all my food lovers out there, I want to impart a little wisdom. If you enjoy cooking and want to step up your game, invest in quality olive oil. Every year, my favorite food store, Eataly, has a sale in September on olive oil. I always buy 8-10 bottles to last much of the year. Don’t buy too many as they expire. When I cook, these high-quality oils are used as a finishing oil or for dressings, and marinades. If I sauté or roast veggies, one of these oils will be drizzled on top after cooking. On top of fish or meat for others depending on the oil. Trust me, it is a game-changer. Yes, they are more expensive than the crap you buy at Costco, but well worth it. I am pointing out the sale, so take advantage. When you click the link on the specific oil, it will give you the flavors and the best pairings. This year, they changed some of the inventory, but there are a couple I really like and I am trying new ones. I try to pay $1/oz or less, but not always the case. Free shipping over a minimum spend. You will enjoy these high-quality oils, and I may write a piece about how I became hooked on this topic with Eataly depending on the comments about this section. Reach out with questions.

Markets

JPM Marko Kolanovic, PhD On Markets

2023 Deficit of $2 Trillion-Nothing to See Here

Warren Buffett Advice

South Florida Hurricane Season Peaking

My Diatribe on South FL R/E

Apartment Market Cooling

Renting vs Buying

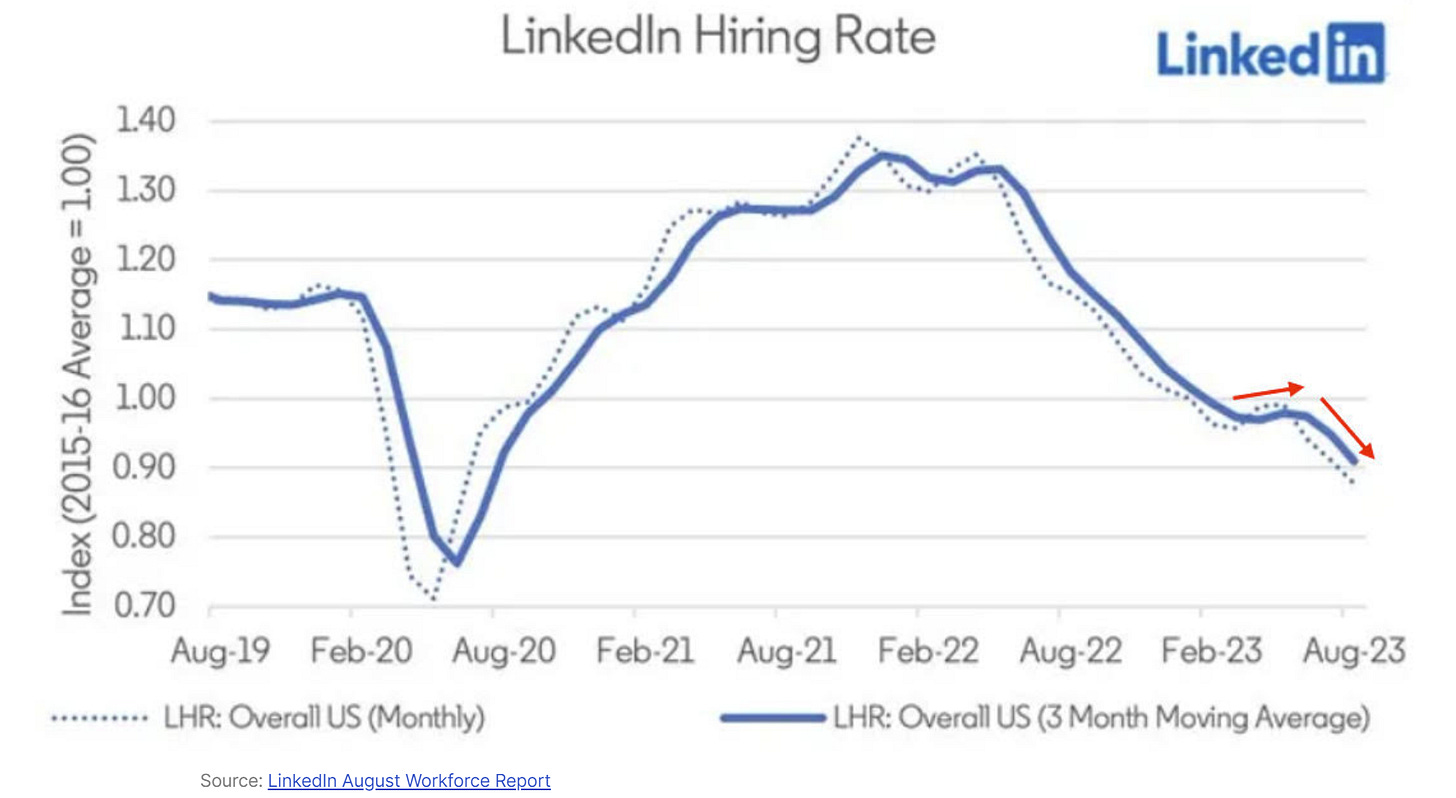

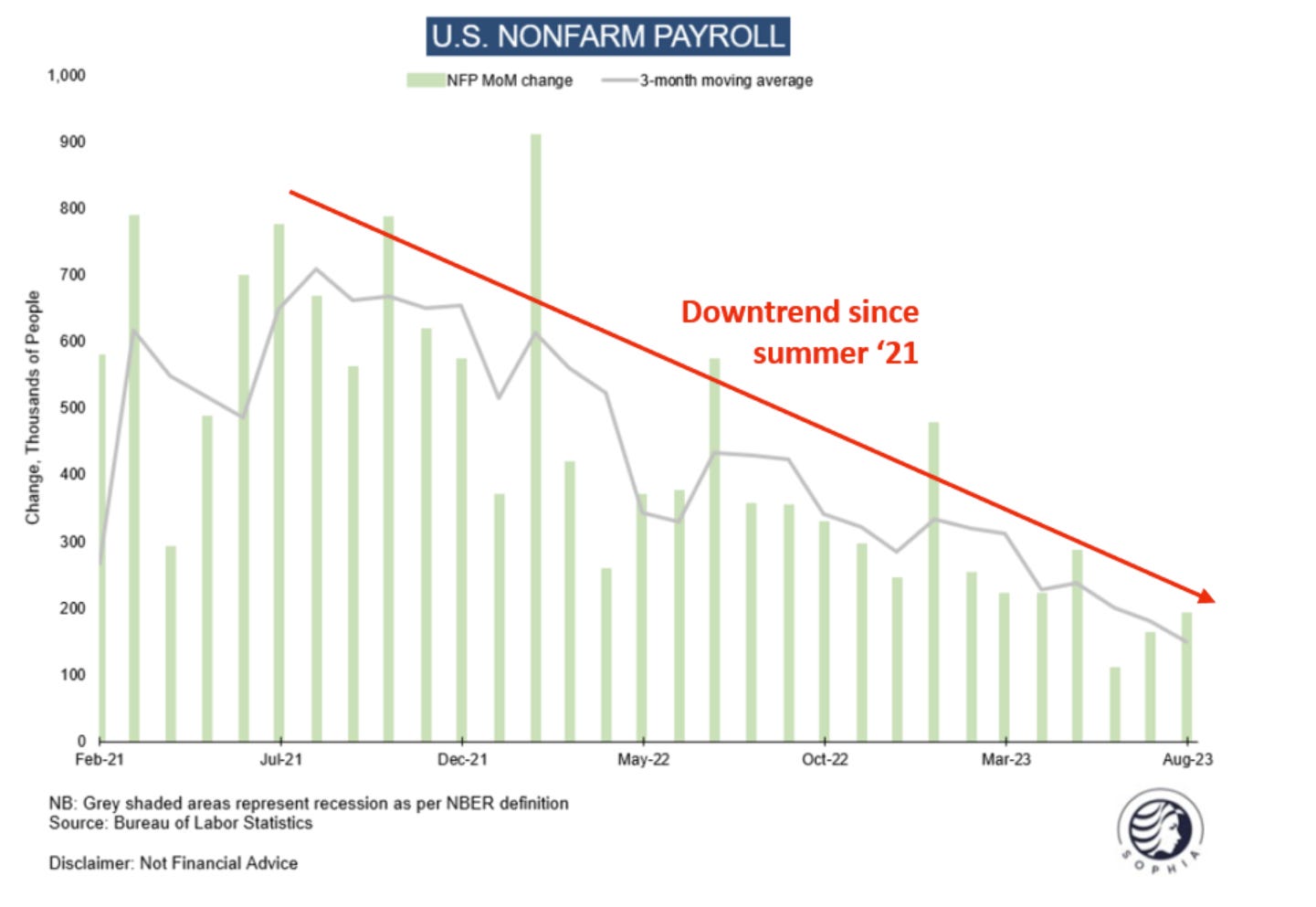

Pictures of the Day-Jobs Data

We have seen some weakening on jobs data and a reader sent me some charts that show concerning trends. This comment was taken from Peter Boockvar’s recent note on the subject. Bottom line, the 3-month payroll average is now 150k vs the 6 months average of 194k, the 12-month average of 257k and the 2022 average of 399k. That's a clear moderation but also coincident with a low unemployment rate. Expect to see hiring continue to slow as the 'challenging macro environment' that I heard countless times over the past month in earnings calls continues. The bottom line on labor from the Beige Book was this, “Job growth was subdued across the nation.

Tuna Fishing Off Venice, Louisiana

I was fortunate enough to be invited on a fishing trip by a reader, Tom, who lives in Tennessee and takes his private banking clients on a trip with his impressive colleagues. I flew into New Orleans and drove a couple of hours to Venice. You stay on a houseboat and share rooms. There were approximately 18 people on the trip. There is a comfortable kitchen/dining/living room where everyone gathers to talk, eat, drink, and have fun while you are not fighting big Tuna or Redfish.

I got there Wednesday afternoon at about 4 pm and the chef prepared a great shrimp boil. They like to do crawfish boils, but they are not good in the summer given the water temperature. I must say the shrimp were great, but prefer crawfish boils. I am not good at peeling crawfish, and at my last boil, I was so bad, the locals took pity and started peeling for me. One of the many low points in my life, but I shut my mouth and said, “Thank you.” As an aside, Venice is where many shrimp boats launch and catch the shrimp you eat. At the local fish market, you can buy a pound of shrimp for $2 fresh off the boat, slightly less than your local fish store. One night, we had crawfish etouffee and I had three helpings. I need to learn how to make it myself.

Thursday, two boats from the guide company, Super Strike left the dock around 6 a.m. My boat was a 37’ Freeman with quad 300 Yamaha engines. The boat is a beast and given the double-hull nature of the design, it rides beautifully. We started catching baitfish for well over an hour before heading another 60 miles to an offshore oil rig.

The captain and mate throw live baitfish in the water after seeing fish on the screen (pic below) and then let out fish on the hook. I am not lying that we were hooked up on our first yellowfin tuna within 15 seconds. We are always close to the rig which is a huge structure and helps to attract fish. The water is 5,000 feet deep and it makes for a big fight. Generally, we passed the rod around and split the fight between 3 or 4 fishermen as you got tired fast. Having a torn calf muscle did not help matters.

Here is a small sample of the catch. We caught 9 tuna and would guess the total weight was about 750 pounds. You lose approximately 40% when you fillet them. I bought home a small bag, but the guys brought massive coolers and drove them back to Tennessee to split up the tasty catch. The 125 lb fish was hard for me to hold. The fish are incredibly strong and put up a great fight, especially in such deep water. All the pictures below were a few hours apart and I wore 3 different hats during that period. I’m a superstitious fisherman who changes hats when things go cold. Yes, it works.

The couple of days in Venice were a ton of fun and I have never seen larger yellowfin so concentrated. We were hooked up constantly and it was well worth the journey. The hosts and the guests were great people and made the trip even more enjoyable. Up at 5:30 am, quick bite, catching baitfish by 6:30 am, catching tuna before 11 am, and back at the dock at 5:30 pm made for a full day. I was sound asleep by 10:30 pm.

If you want to do a fun fishing trip with a small or big group, I strongly suggest Venice, Louisiana. Fly into New Orleans and have a good lunch, then drive to Venice. Fish one-day deep sea for Tuna, Wahoo, and Snapper depending on the time of year, and then do one or two days of inshore fishing for Redfish, Sea Trout, and Tripletail. You can stay at Venice Sportsman Lodge. The food is delicious, and the AC is cold. The rooms and showers are a bit sparse but well worth it. Below is the living room/dining room where people hang out when not fishing or sleeping. Everything is super casual. Tight Lines! Upcoming report on Red fishing as well with incredible pictures.

Quick Bites

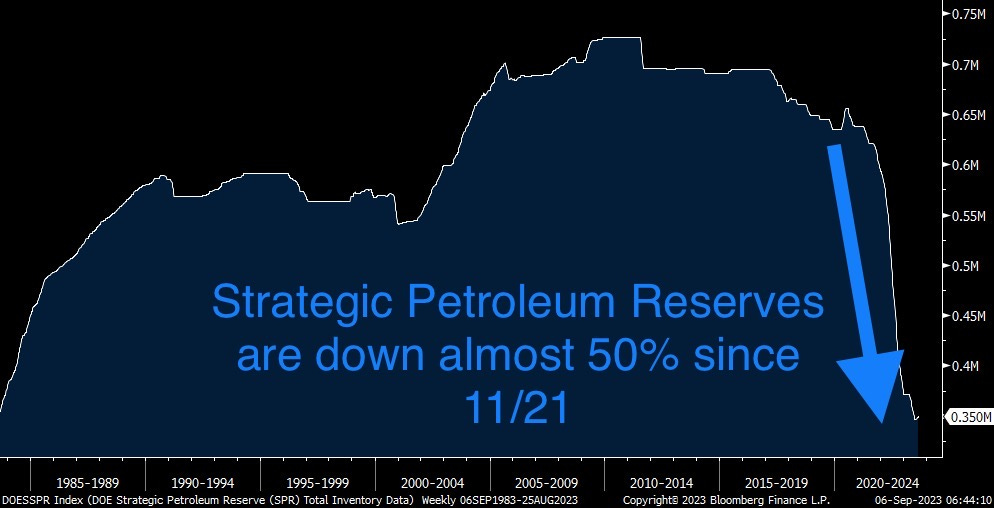

Stocks sold off Wednesday, continuing the sluggish start to September, as concerns mounted that the Federal Reserve may not be done hiking interest rates. New data released Wednesday also raised concern over the potential for higher Fed rates. The ISM Services index for August came in at 54.5, above a Dow Jones consensus forecast of 52.5. That marks the eighth straight month of expansion for the services sector. The S&P 500 dropped 0.7%, while the Nasdaq shed 1.1%. The Dow slipped 198 points, or 0.6%. Information technology and consumer discretionary stocks underperformed. Treasury yields also jumped, weighing on risk assets again. The yield on the 2-year Treasury note was last up more than 6 basis points to trade at the 5.02% (hit 5.04% on day), the highest level since March. The 10-year was +3bps to 4.3%. Saudi Arabia is set to extend the cut of 1 million barrels/day until the end of 2023 and oil is now up to $88/barrel or +11.5% YTD and +31% since mid-June. Remember, the Biden Administration has significantly used the Strategic Petroleum Reserves and is yet to replenish them.

From JPM’s Marko Kolanovic on markets. Most of the year, we have held a negative outlook for risk markets (our year-end price target for the S&P 500 is 4200), and over the course of the year, we have increased our model portfolio’s allocation to cash. There were two main reasons why we took a negative stance: 1) the unprecedented rise in interest rates (relative to the current levels of debt outstanding), which are slowly eroding economies and setting the stage for a market de-risking, and 2) geopolitical deterioration that has significantly increased tail risks for economies and global markets. Following the regional banking crisis earlier this year, markets took an optimistic view: soft landing became a consensus, European stocks rallied at the back of China reopening (e.g. luxury goods, travel, etc.), and Japan stocks rallied as many institutions reduced exposure to China and moved money into Japan as a proxy. The US equity market rallied as investors extrapolated that AI will transform and boost the economy and corporate profitability in a short period of time; however, we see this as unrealistic. US tech stocks, particularly the largest ones, drove the market higher, as the NDX rallied ~50%. This rally was mostly a multiple expansion on the AI narrative, while in some cases revenue of key tech stocks declined, and overall corporate profits declined 6.5% YoY (as of June 30th). The question now is where we do stand and should we analyze things differently seeing that the market was more ‘resilient’ than macro fundamentals warranted. As both premises for our cautious outlook (rates and geopolitics) turned more negative over the past few months, while positioning and valuations increased, we think there is now a higher likelihood of a crisis over the next 6 to 12 months, the severity of which could be higher than market participants anticipate. Interesting market commentary from a smart market strategist. The full report can be found here.

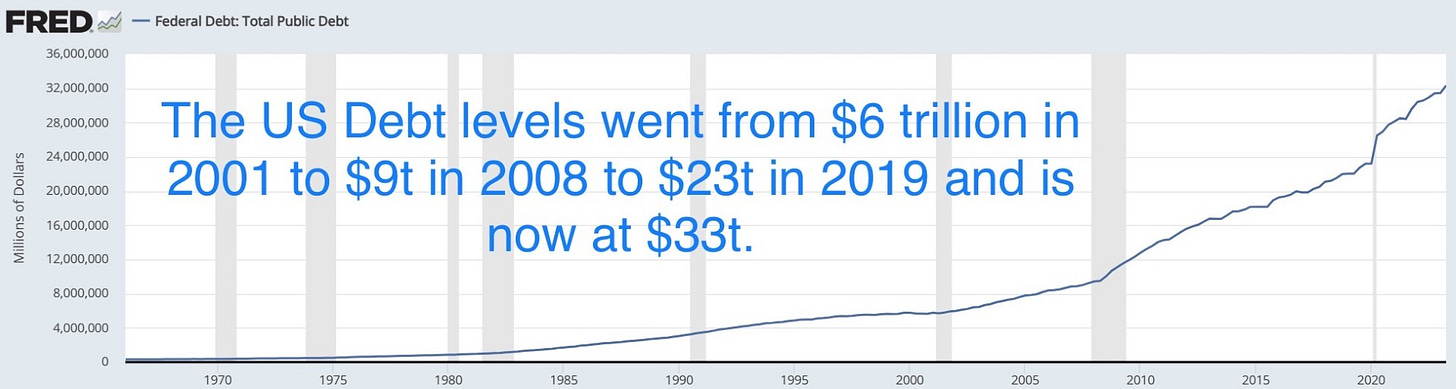

For two years, I have harped on the ineptitude of the Fed and Treasury and written countless pieces about inflation, government spending, Quantitative Easing and keeping interest rates too low for too long….May 2021-Druckenmiller on Inflation, July 2021-Tere Ain't No Such Thing As a Free Lunch, June 2022-There is No Such Thing As A Free Lunch-Part II). This WaPo article is on the mounting US deficits projected to be $2 TRILLION this fiscal year due to higher interest payments and lower tax receipts while the politicians never seem to curtail spending. After the government’s recording spending in 2020 and 2021 to combat the impact of COVID-19, the deficit dropped by the greatest amount ever in 2022, falling from close to $3 trillion to roughly $1 trillion. I believe the 2022 deficit was closer to $1.4 trillion. I am not impressed by the suggestion that the drop from 2021 shows restraint. But rather than continue to fall to its pre-pandemic levels, the deficit then shot upward. Budget experts now project that it will probably rise to about $2 trillion for the fiscal year which ends September 30, according to the Committee for a Responsible Federal Budget. These numbers ignore President Biden’s $400bn student debt cancellation policy struck down by the Supreme Court. The unexpected deficit surge, which comes amid signs of strong growth in the economy overall, is likely to shape a fierce debate on Capitol Hill about the nation’s fiscal policies as lawmakers face a potential government shutdown this fall and choices over trillions of dollars in expiring tax cuts. We need to curb spending, have major entitlement reform, and move to balance our budgets for a change. Remember, foreign ownership of US Treasuries is down from 44% in 2014 to 30%. which makes funding these deficits more challenging. Oh yeah, the Fed stopped buying too and is now selling.

I am a big fan of Warren Buffett and his investing acumen, patience, words of wisdom and low-key life. He has lived in the same home since 1958 he bought for $31,500. One of my frustrations with people is the need for instant gratification and spending all their money on frivolous purchases. I accumulated wealth because I lived like I made a fraction of whatever I made, as I feared returning to my childhood's financial condition. If I made $30k, $50k, $100k, or millions, I put as much away as I possibly could. Remember, I drive a $50k Kia Telluride. In this link, Buffett discusses some advice for building wealth. Don’t have a “Zero-Balance Mentality” meaning don’t spend all that you make. Be mindful of leverage and do not use the “Buy Now, Pay Later.” Buffett said, “If you don’t have leverage, you don’t get in trouble.” He also suggests that you do not try to “Keep up With Your Neighbors.” Envy shouldn’t drive financial decisions. Avoid this mistake if you’re trying to build long-term prosperity. Today, people see the smoke and mirrors on social media and believe the nonsense. They see something they want and buy it without considering the ramifications of the purchase. Fiscal restraint goes a long way, something almost every politician can learn a little bit more about to get our deficits under control. Warren, thanks for imparting more wisdom.

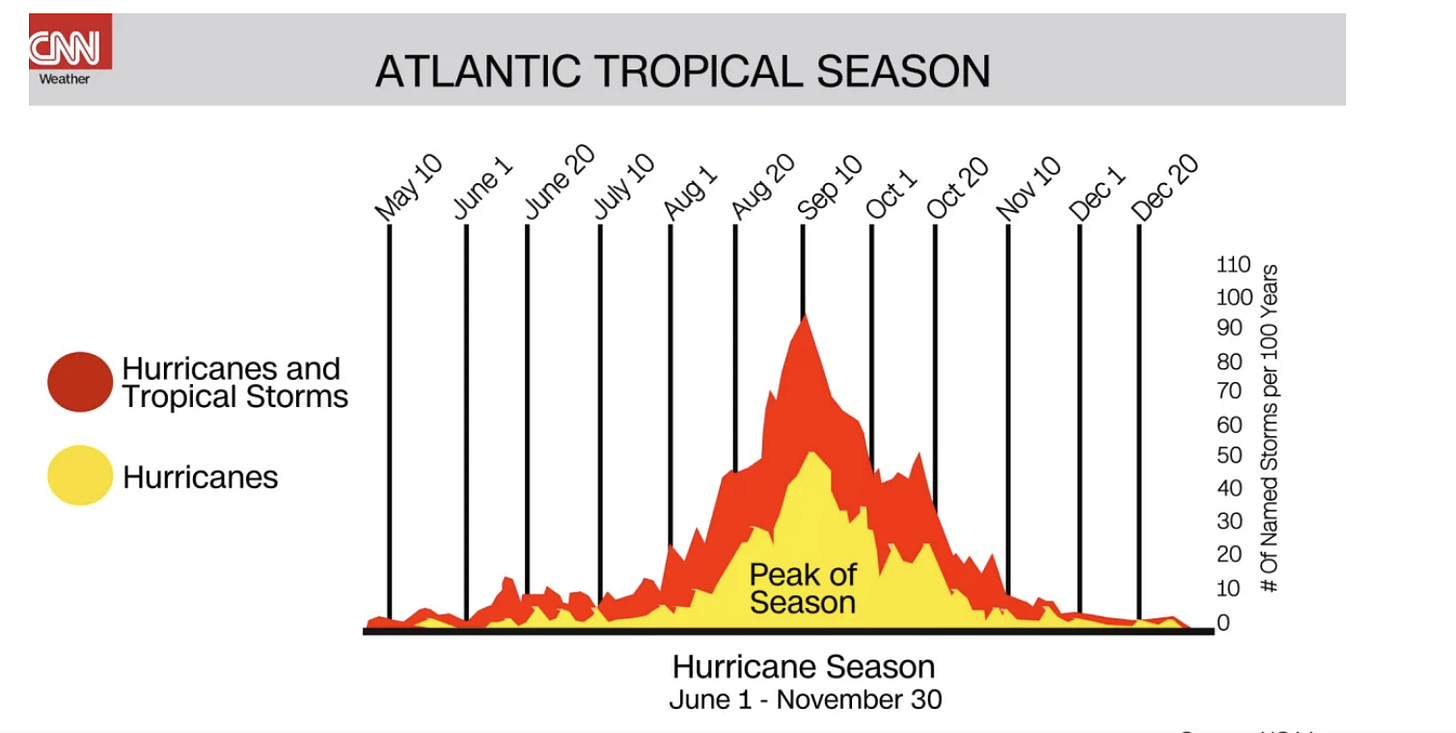

One thing about this time of the year in South Florida is all eyes are on the tropics and potential storms turning into hurricanes. This storm is getting my attention as it is forecast to be a Cat 4 in coming days. The current forecast has it moving north well before Florida, but I will be following closely just in case.

Other Headlines

Chip design firm Arm seeks up to $52 billion valuation in blockbuster U.S. IPO

Diamond Prices Are in Free Fall in One Key Corner of the Market

Diamond demand across the board has weakened after the pandemic, as consumers splash out again on travel and experiences, while economic headwinds eat into luxury spending. However, the kinds of stones that go into the cheaper one- or two-carat solitaire bridal rings popular in the US have experienced far sharper price drops than the rest of the market. The article mentions the rising demand for lab-grown stones.

Huawei Teardown Shows Chip Breakthrough in Blow to US Sanctions

Huawei Technologies Co. and China’s top chipmaker have built an advanced 7-nanometer processor to power its latest smartphone, a sign Beijing is making early progress in a nationwide push to circumvent US efforts to contain its ascent. Huawei’s Mate 60 Pro is powered by a new Kirin 9000s chip that was fabricated in China by Semiconductor Manufacturing International Corp., according to a teardown of the handset that TechInsights conducted for Bloomberg News.

Meta employees are back in the office three days a week as part of new mandate

Credit card and car loan defaults hit 10-year high as inflation squeezes families

This year, credit card delinquencies have hit 3.8%, while 3.6% have defaulted on their car loans, according to credit agency Equifax. You heard it first in the Rosen Report, as I have been speaking about the consumer for over 6 months.

Voice Deepfakes Are Coming for Your Bank Balance

This is concerning. I was hacked and the scum hackers sent an email from MY account to my JPM banker asking for money for construction costs. I was doing construction on my apartment at the time. My banker called me to confirm and I told him I never sent anything. If these people are copying your voice, it makes it that much easier to steal from you.

The power of AI is concerning on many levels and we all need to be more vigilant to protect ourselves.

The $53,000 Connection: The High Cost of High-Speed Internet for Everyone

Officials doling out billions of dollars for broadband in rural America are struggling to decide when a new hookup costs too much

State election officials prepare for efforts to disqualify Trump under 14th Amendment

Prosecutors will seek Hunter Biden indictment before Sept. 29, court filing says

Those major concerns (economy/age) could be what’s dragging Biden’s overall job approval underwater at 42%, versus some 57% who disapprove, according to the Wall Street Journal poll of 1,500 registered voters contacted Aug. 24-30. A 60% majority of registered voters indicated in the poll that they do not consider Biden “mentally up for the job” of being president. Nearly three-fourths of respondents, 73%, said they think Biden is too old to run for president — a much higher response than they gave Trump, who is 77 years old.

McConnell vows to finish Senate term despite health scares, GOP concerns

Why? 81 years old with cognitive issues. You have served 38 years in the Senate. Retire with grace. That goes to Feinstein and Fetterman as well.

Despite the clear video, cops let the suspect, Blake, walk. Blake has 9 prior arrests for drug possession, assault, trespassing, and resisting arrest and he gave the police a fake name when they came for this incident. Watch the video and tell me this deranged and dangerous individual should be walking the streets. Sorry, crime needs consequences or there is bedlam.

41 people have been arrested at NYC’s migrant Roosevelt Hotel since May — most for domestic violence

If you come to the US illegally and get arrested, it should be an automatic deportation. The businesses around the Roosevelt are getting crushed. I walked by in July and won’t do it again.

Woman charged with slashing stranger on NYC street threatens to do the same to judge in court

Read what this woman has done to INNOCENT people in unprovoked attacks in NYC and how many times she has been let out bail-free. Sorry, I am not supportive of violent, repeat offenders free to commit crimes over and over again.

Homeless destroy motel in Wyoming city, leave about 500 pounds in feces on streets

A D.C. grocery store is removing Tide, Colgate and Advil to deter theft

Neo-Nazis parade swastika flags in Florida, chanting 'We are everywhere'

Proud Boys leader Enrique Tarrio sentenced to 22 years in prison, longest for a January 6 defendant

American Library Association President Caught Saying Public Libraries Should be Leftist

Drabinski, who describes herself as a “Marxist lesbian,” was elected president of the ALA in April of 2022. She expressed her desire to make libraries and schools fronts for “socialist organizing.” I would be equally infuriated if she said we want libraries and schools to be fronts for the Right.

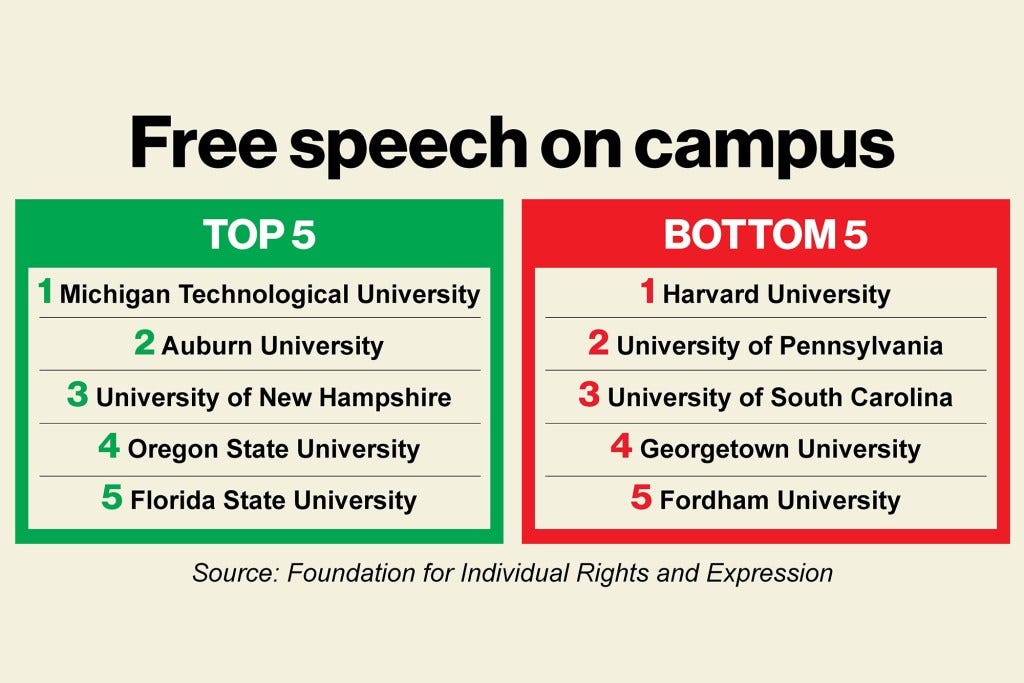

Harvard is named worst school for free speech — scoring zero out of possible 100

Goldman Sachs exec reveals No. 1 productivity hack that saves her ‘hours’ in her day

The short answer is Timeboxing. I like the thought.

Harvard-trained pediatrician shares 5 things she never does when her ‘own kids’ are sick

1) If they have a fever but are sleeping, I never wake them up for medication. 2) I never hesitate to give fever-controlling medication if they look uncomfortable. 3) I never focus on temperature over their appearance. 4) I never use anything but honey to help a cough. 5) I never measure medicine in teaspoons.

Super gonorrhea cases are rising and could be fatal, WHO warns

Opposites don’t attract: couples more likely to be similar than different, study shows

According to the research, between 82% and 89% of traits examined were similar among partners, with only 3% ranking as substantially different.

The 25 most exciting new restaurants to hit NYC this fall

I recently put in the top 15 new restaurants as suggested by Bloomberg and here are the top 25 by NY Post. I don’t miss a great deal about NYC, but the food is something I dream about now that I live in the culinary wasteland of Boca Raton. Yes, it has gotten a bit better over 6 years and Miami actually has some great choices, but neither can smell NYC from a food perspective.

Why bearded lads are 'more attractive' to women, according to science

'Most disturbing website on Internet' can find every single picture that exists of you

I did it and it found many recent pictures of me, but by no means not all of them. I post so many on the newsletter, there should be hundreds from that alone.

Kim Jong-un and Putin Plan to Meet in Russia to Discuss Weapons

The article suggests Kim is traveling to Russia to discuss supplying the country with more weaponry for the war.

Real Estate

I am in the process of helping approximately 10 families move to South Florida from NYC area. The theme is consistent: Quality of life, crime, homelessness, mandates, taxes, the likelihood of continued deterioration… As you know, I was early in moving from NYC in 2017 after selling the Park Ave Penthouse in 2016, as I did not like the direction of NYC. I am constantly asked for my view on R/E down here as people are trying to get a better deal. I will start by saying I think too many sellers are holding onto hope on asking prices which are unrealistic, and I would say aspirational. I am seeing high-end homes sit on the market for longer, but too many times, the sellers are delusional. As long as these cities continue to charge a fortune with bad issues, the wealth will continue to flow out of NY, IL, CA, DC, PA… to TN, FL, TX, NV, MT, NH… I feel the lack of inventory will be the key driver. The decade from 2010-2020 saw such few housing starts relative to history due to the Global Financial Crisis. I was fortunate enough to listen to one of my investing heroes, Barry Sternlicht, as he shared the data in the chart at the bottom citing the 2010 decade of limited homes built. Couple this with a massive rise in rates which is preventing people from selling a home. If you were locked in at 2.5% and sell and buy a new house at 7.5%, you generally cannot afford the new home, so people are not moving. I feel the best value is if you can buy something that needs work or build on your own. People don’t have vision or patience. In the end, I recommend those with the means to make a lifestyle decision. If you are unhappy where you are, leg into the trade. Buy something smaller to get down here and then get smarter. Also, there are homes that sell off-market that you won’t know unless you are down here and pounding the pavement. The best communities are limited on inventory and what is listed is not generally appealing from a price perspective. I don’t see a crash coming in South Florida absent a major shock, but do agree asking prices in many cases are not rational. I think South Florida outperforms, but could see some pullback given the stratospheric pricing and higher rates, but the lack of inventory will prevent a major sell-off. To me, there is not enough inventory, too many unhappy living where they are (NYC, LA, SF, Chicago, DC…), and many coming to the realization that waiting it out could be too long. Happy to speak with anyone about any market in particular, but that is my view on South Florida.

I found this article on CRE Daily. The apartment market, once a hotbed of growth, is seeing a downward trend in rent prices, marking a shift from its previous trajectory, as noted in the September 2023 Apartment List National Rent Report. Recent Trends: Specifically, the rent index decreased by 0.1% in August 2023. Interestingly, this decline started a month earlier than it did the previous year, bucking the typical trend of prices rising in the spring and summer and dropping in the fall and winter. Just last year, all 100 surveyed cities reported positive year-over-year rent increases. The current annual rent growth is at -1.2%, meaning apartments are now 1.2% cheaper than they were a year ago. This is a significant change from past years when annual rent growth was as high as 18% nationally, with some cities even witnessing growth surpassing 40%.

A reader and good friend, John, sent me this picture from an article on the cost of buying vs. renting in America today. With home prices and mortgage rates both rising, the U.S. is now witnessing the biggest numerical gap in the monthly cost between owning a home and renting in over 50 years. In August 2023, mortgage rates rose to the highest level in 23 years, with the national average 30-year fixed mortgage hitting 7.48%. As a result, the median rent in America is approximately $1,850 per month, about 30% cheaper than the median cost to buy, standing at $2,700 per month. This gap represents the largest difference between renting and buying in U.S. history. While the difference was less than $200 in 2022, in 2023 the gap surpassed $800. Interestingly, the chart is from Visual Capitalist, and I have been finding more charts they create lately.

Thanks. I appreciate it.

JPMorgan Chase's Marko Kolanovic's views on the market This link requires permission to access 🙂