Opening Comments

My last note was entitled, “Spirit Airlines has no Spirit,” was about my awful flying experience. The most opened links were: 10 nutrition mistakes and the JFK assassination story uncovering new perspective. Call me crazy, I feel the American public deserves the truth on this topic some 60 years later.

I am heading to NYC in a few days on Sunday and will be there for a bunch of meetings. I will be doing a handful of podcasts and interviews as well. I will also be going to some great restaurants including the new Major Food Group eatery called Torrisi.

On Monday, I had some friends over for dinner. I cooked up a storm and as always, thought I made too much food. 4 lbs of wagyu skirt steak (no bone) and 3.5 lbs of salmon), veggies, mashed potatoes, seared tuna appetizer and desserts. All the meat and fish were gone. Only some veggies and a few cookies left. Another satisfied crowd. Opened up a Component 100% Petite Verdot wine (hard to find and a personal favorite by Component) and a Cain Five.

I spoke with 10x developers (a very adept developer/engineer) about the state of development today with the assistance of AI. I was blown away. One gave an example of managing a team of 40 developers for 4 years on a project. He said, “Today, I can do it in two months with 3 or 4 engineers.” Think about that for a minute. It took 400,000 programming hours 5 years ago and less than 2,000 hours today. Additionally, they are using generative AI to market their new services. No human salesperson. Yes, AI is disruptive and I am not convinced people fully comprehend it yet.

Markets

Instacart IPO

Joker #24

The Beatles Pictures by Paul McCartney

New Miami Beach Waterfront Lot Listing

Limited High-End Inventory in South FL

Luxury Apartment Glut Coming-Great Article

Video of the Day-Jamie Dimon Bathroom Incident

Given the title of today’s note, I thought I would include the video from a recent speech where I explained the famous Jamie Dimon Bathroom Incident. The video is under 2 minutes in length and is a funny story about an interaction in the men’s bathroom on my trading floor and what ensued. I actually wrote a Rosen Report last summer about the incident here entitled, “Dimon to the Rescue.” It resulted in the Eric Rosen “Memorial Washroom.” No, I am not dead.

My First Interaction with Jamie

JPM bought Bank One on July 1, 2004 for $58bn. Bill Harrison was the CEO of JPM and the combined entity, but it became apparent very quickly that this was the Jamie show. I happen to like Bill, but he was outmatched by Jamie on basically every front. Bill did a great job of buying banks but was not nearly as adept at finding synergies and cost savings when combining the various entities. I believe the original deal had Harrison as CEO for a couple of years but recall Jamie being effectively in charge well before that official date.

One of my favorite Jamie stories was when Jamie held a senior management meeting shortly after the merger. He talked about squeezing out synergies, something I believed our firm did not do a great job of back then. I felt we were a big, inefficient bank with a low cost of funding. Jamie specifically spoke about 3 or 4 credit card systems due to the various mergers over the years. He said, “In 9 months, we will be converted to one main system and turn off the others saving countless millions.” Everyone looked around the room and was questioning such a bold statement. I am not lying, 9 months later to the day, he made the announcement that the other systems were gone and one was in place for all the credit cards and there were no glitches. I was sold that this was the guy to take us to great heights.

My boss in 2004 was a guy by the name of John Steinhardt. He ran all of the credit trading and origination businesses. He was a former Bear Stearns trader and the single most responsive boss of all time.

It was August and John was going on holiday. I was running the Par and Distressed Loan Trading business at that time (was not promoted to run credit trading until November of 2004). John was going on vacation and asked me to handle the risk meeting with Jamie in late August. Given the merger with Bank One just happened, it was an early risk meeting and all the senior people were trying to find their way around with the new sheriff in town. I thought nothing of it, as I felt confident in my understanding of global credit markets. There was no way Jamie could compete with me on this front given I was in the weeds day to day.

I walked into the room of maybe 10 people and Jamie sat right next to me. I spoke last as people spoke from his left and I was to his right. I was cool as a cucumber. The mortgage person spoke and Jamie grilled him on intricate details. I was impressed that the soon-to-be CEO would know to ask such detailed questions about mortgage-related risks. He grilled Ina Drew in Treasury, then on to equities and so on. I actually started getting nervous, something which does not really happen to me when I am speaking about topics where I feel I am an expert. I was thinking, could Jamie ask me a question I don’t know the answer to and embarrass me? I gave my market summary and key risks, he asked me a few questions which thankfully I knew the answers to and I was relieved. Soon after, he invited me to our first lunch together and I was so impressed with him, I will never forget it.

I feel confident that Jamie is the best CEO in banking in the world and I believe the most important person in finance, globally. Yes more important than Powell or Yellen. I want him to run for President, but don’t think that happens, much to my chagrin. I made it clear I would do any role in his administration and would quit the world-renowned Rosen Report to do so. Unfortunately, it appears instead we will have two geriatric nincompoops to pick from unless Jamie reads this note and throws his hat in the ring. To steal from Biden, Come on, man. Just think of the Trillions wasted in DC and what Jamie could do with his leadership and business acumen.

Quick Bites

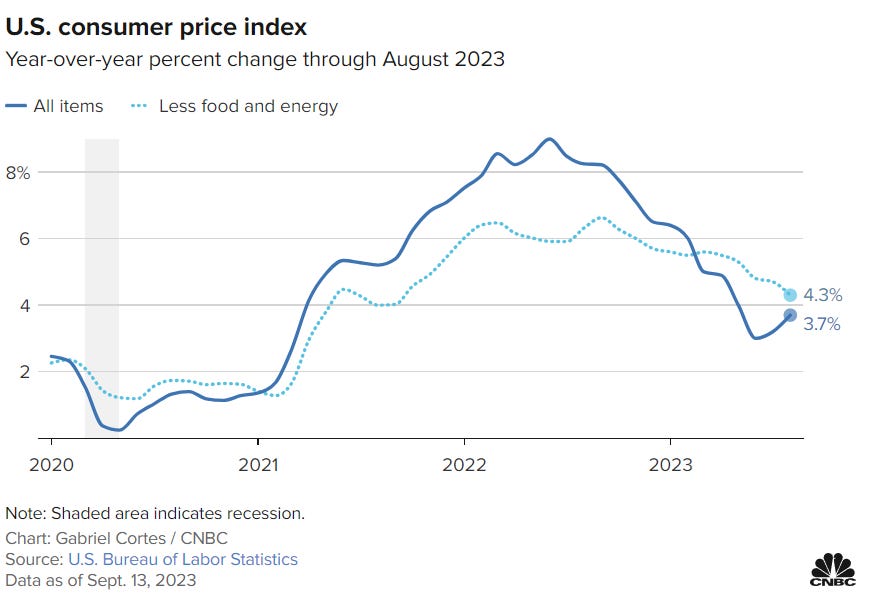

Tuesday, markets were down with the Nasdaq being the hardest hit given Oracle fell 13% post-earnings and Apple was down after unveiling the new iPhone. There is a new charging cord for the phone which is incredibly frustrating, as I must have a dozen of the current cords. On Tuesday, oil continued its climb and hit $89/barrel given tight supply issues, but settled at a slightly lower on Wednesday. Higher oil has pressured airline stocks. On Wednesday, stocks were mixed, but generally unchanged post the inflation data. The core CPI increased 0.3% and 4.3% respectively, against estimates for 0.2% and 4.3%. Fed officials focus more on core as it provides a better indication of where inflation is heading over the long term. This data pushed treasury yields slightly higher on Wednesday with the 2-year at 5% and the 10-year at 4.28%.

Obviously, many tech-related company valuations are down sharply. I thought the news on Instacart’s IPO was interesting. Instacart is targeting a valuation of roughly $8.6 billion to $9.3 billion in its imminent IPO, a fraction of what the grocery-delivery company was previously worth, in the latest sign of diminished investor enthusiasm for private growth companies. The expected valuation, on a fully diluted basis, is a far cry from the roughly $39 billion Instacart garnered in a fundraising round in 2021, the year it started laying the groundwork for a public listing. Since then, valuations of high-growth startups have fallen as interest rates rose, making riskier investments less attractive. How many venture and other funds are carrying valuations of investments in private companies at higher levels than the true value today? If Instacart is any indication, it is -76% from 2021 levels and generated $242mm in profits. Many are unprofitable.

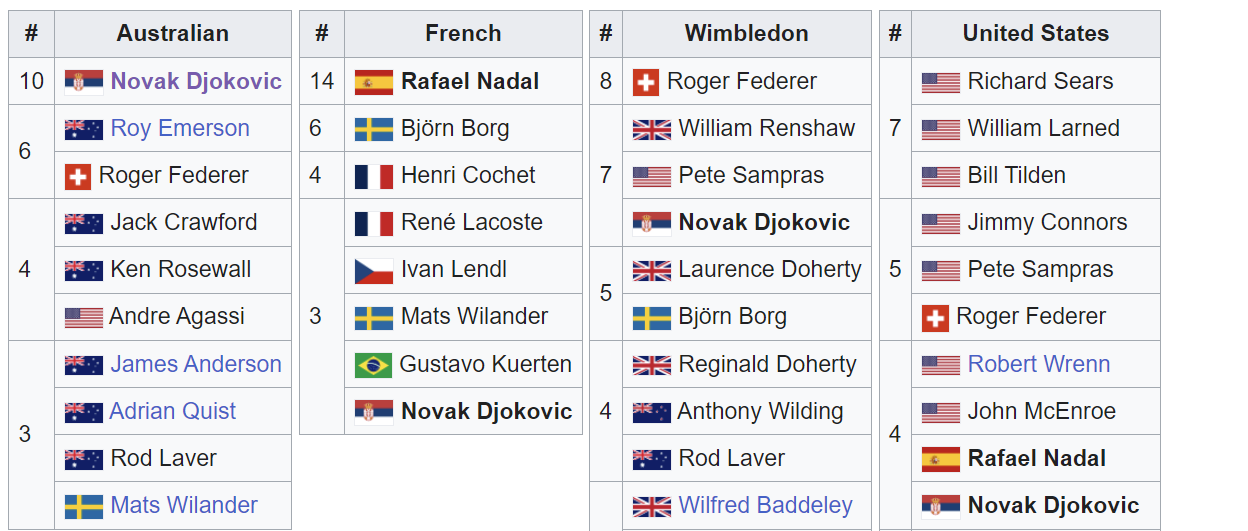

In the last note, I congratulated Coco Gauff on her big win at the US Open. The Joker won his 24th Grand Slam title at the US Open on Sunday. His greatness is legendary. Novak Djokovic is 36 years old (the oldest male to win a tennis major) and is now officially the greatest male tennis player of all time. The Serbian beat Medvedev in straight sets to claim the title. Remember, Djokovic was not allowed to play in 3 majors due to absurd vaccination requirements. He missed two US Opens for refusing a vaccination, but the US did not force illegal immigrants to be vaccinated. I want that to settle in for a second. The #1 tennis player of all time who pays millions of taxes was not allowed to play in a tennis event, OUTSIDE due to his vaccine beliefs and countless illegals came into the US with no consequence on the vaccine. The way Joker is playing, he could have another 10 Majors in him and win 4 or more absent injuries. I make a market right now 27-29 on the # of Joker’s Grand Slams when all is said and done. Remember, Nadal’s last Wimbledon final was 12 years ago. Federer’s last Roland Garros final was 12 years ago. Neither won. Meanwhile, the Joker has won all four of the grand slams in the past 14 months. This is the mic dropping.

My recent piece about the best rock bands of the last 60 years was well received. No one argued with my comment that the Beatles were the band of the decade of the 1960s. This CNN article shows a bunch of amazing photos taken by Paul McCartney with his 35mm Pentax camera. Most pictures have never been public until now and were taken between 1963-1964. If you are a Beatles fan, you must take a look.

Other Headlines

I do not see a replacement to the US Dollar as a reserve currency, but believe the downward trend will continue. Again, the US Dollar was 85% of reserve currencies in 1971 and is 58% today.

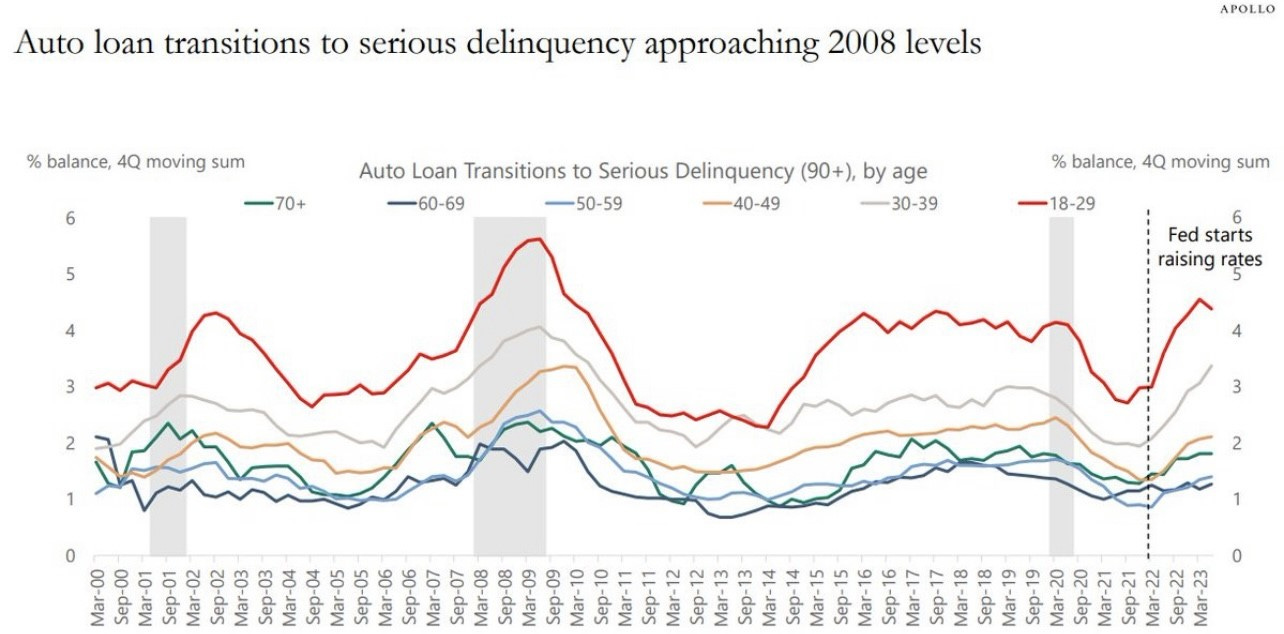

The Mighty American Consumer Is About to Hit a Wall, Investors Say

I have discussed this topic for almost 8 months, well before Bloomberg was writing articles. Nice charts.

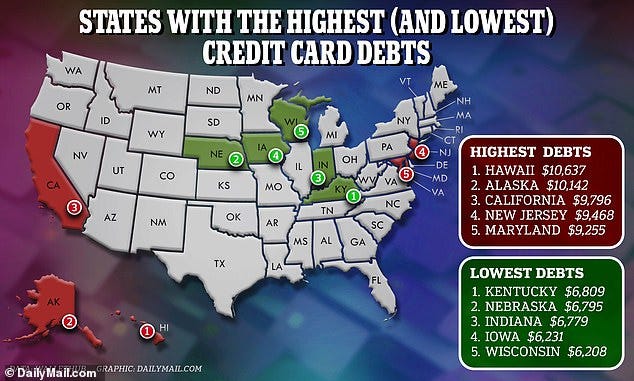

Data from the New York Federal Reserve shows nationwide credit card debt swelled by $43 billion in the second quarter of the year - the second largest increase on record. The positive is home equity is up massively, but debt levels, rates and delinquencies are all going the wrong way.

Jamie Dimon says it’s a ‘huge mistake’ to think economy will boom with so many risks out there

Advance Auto Parts Stock Tumbles After Credit Rating Lowered

Stock is -62% YTD and was -8% on Tuesday.

Google Pays $10 Billion a Year to Maintain Monopoly, US Says

No doubt in my mind there is a monopoly and Google pays billions to maintain it. They have 89% of the search market, the definition of a monopoly.

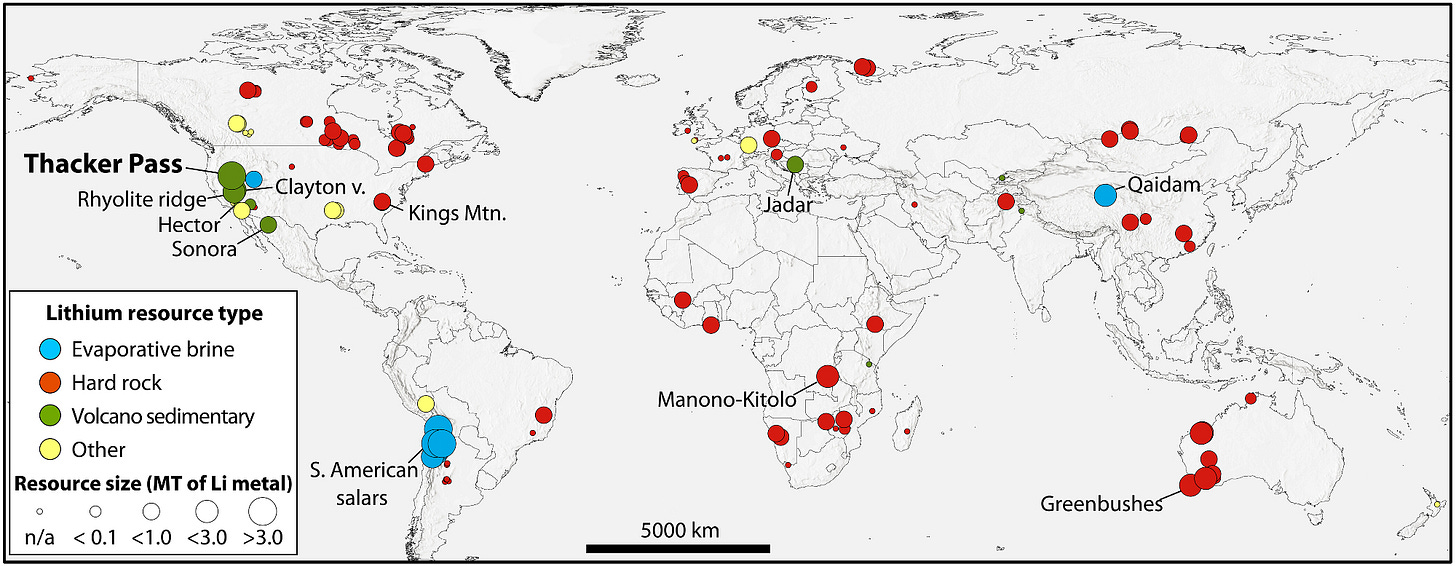

Lithium Deposit In Extinct Nevada Volcano Could Be Largest In The World

One article suggested it was worth $1.5 TRILLION. Why could they not discover this under neath my home?

What Electricity Sources Power the World?

I often speak about the world’s reliance on fossil fuels and this chart is pretty telling. Remember, we are at all-time highs of global oil demand at 103mm barrels/day. This chart outlines global power usage and coal, natural gas and oil accounts for 60.6% of the world’s power. Renewables are 14.4% of total.

I went to the University of Chicago for B-School and must tell you, I feel an MBA is a waste of time. It looks good on the resume, but would not do it again and struggle to recommend them. Expensive, time-consuming and you don’t learn much. However, here is Bloomberg/Businessweek’s rankings of the top schools. I rarely hired students out of business school. I would rather take them out of undergrad and train them. They are far more productive and better in my opinion.

‘We would’ve done everything differently’: Newsom reflects on Covid approach

Wait, you mean shutting down the economy, closing schools, shuttering business for years and crushing industries was a bad idea? Who would have thought it?

This is the link to the latest betting odds for President

Note how well Newsom is doing despite not being in the race. Michelle Obama too. I still think she may throw her hat in the ring.

McCarthy to green light Biden impeachment inquiry this week

Below are two articles from the Left and Right explaining why, in their view, the impeachment inquiry is right or wrong.

Poverty rate jumps in 2022 after end of enhanced child tax credit

Some 12.4% of children were in poverty last year, up from 5.2% the year before and roughly comparable to where it was prior to the pandemic in 2019.

The US moves to advance a prisoner swap deal with Iran and release $6 billion in frozen funds

Iran hates America and Jews and funds terrorism. The leadership wants to end Israel. What could possibly go wrong with giving them $6bn. What happened to not negotiating with terrorists? This will only encourage more hostage-taking. I feel bad for the hostages, but nothing could ever get me to step foot in Iran.

NYC kids being used to rob businesses like modern day ‘Oliver Twist’

We are talking 8-10 year olds. Nothing to see here folks.

Nike permanently closes iconic Portland store amid 'theft and safety issues'

This is a major statement as Nike is headquartered 9 miles from the store.

Shocking video shows zombie-like addicts at ‘ground zero’ of Philadelphia’s ‘tranq’ epidemic

Like a horror movie. Scary pictures and video.

El Salvador Is Imprisoning People at Triple the Rate of the US

El Salvador has jailed 1.6% of its population under President Nayib Bukele's unprecedented gang crackdown. This is triple the rate in the US.

Scientists grow human embryo in a lab without sperm, egg or womb

THE MAESTRO-The man who built the biggest match-fixing ring in tennis

Crazy story of a man who paid tennis players to fix matches and was caught. He had an international business and was making huge money.

Dozens of rich Norwegians worth billions have relocated to Switzerland to escape higher taxes

Norway increased the wealth tax and $4.4bn left the country for Switzerland. Fancy that, wealthy people have choices and it follows what is happening in NY, CA, IL, DC, MA and other high-tax states with the wealthy leaving for greener and warmer pastures amid crime, homelessness, mandates and policy issues.

If you really want to be rich, use these 3 Warren Buffett techniques that no one ever talks about

Pick Managers, not stocks, avoid commodity-like companies, sell put options. The last one threw me for a loop and do not believe most investors should be doing it.

Billionaire reveals what he seeks in a job applicant, and the ‘lifetime habits’ needed to succeed

His first note is being frugal. I love this guy. He clips coupons. On hiring, he likes showing your drive, integrity, writing ability, being inquisitive, and a few others. Check it out.

AI bot is better than doctors at diagnosing patients in A&E, study finds

Great observations and agree. Not all are practical, but should be noted. Definitely a European mentality here, but does not mean it is wrong.

The most common oral decongestant in the US does not work, FDA finds

This determination will impact drug makers that use PE as an active ingredient, which can be found in Sudafed, Vicks Sinex, and Benadryl Allergy Plus Congestion, for example. WOW!

Rich teens are invading ritzy NYC restaurants — and they’re spending big

Crazy article with amazing examples of youngsters spending. This turns me off and find it inappropriate. I don’t care how rich the parents are; it is wrong.

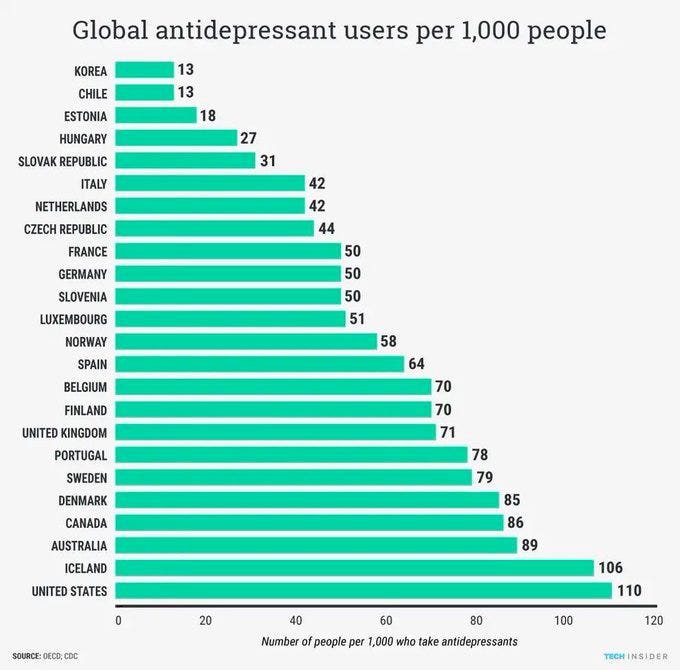

11% of Americans over the age of 12 are taking antidepressants

For such a great country, what is driving the outsized use of anti-depressants relative to other 1st world European Countries

Ozempic, Wegovy may curb drinking, smoking: What we know

Everyone I know on these drugs has seen a reduction in appetite and desire to drink.

I know many don’t buy in, but I do not believe we are alone. No, I have not been abducted…yet, but I am ready just in case. Crazy pics.

Real Estate

I believe that buying land and building a home or working on an existing home is the best way to add value today. My friend, Devin Kay, from Douglas Elliman just got another listing in Miami which is going official this week. The lot is on North Bay Road with an asking price of $18.9M and an approximately 14,000-foot lot. It comes with approved plans and permits ready to build tomorrow. Buyer saves 12-18 months of planning and architecture. 52nd and N Bay 4 blocks from La Gorce with amazing skyline views. The home is next door to 2 houses worth over $60M. The house sits 13 feet above sea level and has amazing views of the downtown skyline sunsets. Post building costs, you are in for $25mm range. It should be worth mid-$30mms finished. If I bought a home in Miami Beach, I would be in the 50s on North Bay Road if I could. This is the in-demand aesthetic today. Renderings below:

A reader is looking for a home in South Florida in a community in the $5mm+ range and came down to find a house. He struggled mightily to find something given inventory is so low in the best spots. This is a common story with the best neighborhoods having very limited inventory at the high end in many cases or a house with an unrealistic seller. Finding a home, and getting into a school and a golf club are the hard parts. Once you are down here, it is amazing. As an aside, I was just told of a $12mm house in Miami (not on water), and the owner was quoted $200k/year for insurance. Couple this with the tax burden, and it is close to $400k carrying cost without a mortgage. In a recent piece, I discussed the limited number of new home builds from 2010-2019 post-GFC (2nd chart) and I found the chart below from John Burns Research and Consulting to add to that point showing months of supply of inventory at levels well below prior to the GFC.

A reader sent me this WSJ article, “Luxury Apartment Glut in South Florida Offers Some Price Relief.” Developers are racing to build more luxury rental apartments in South Florida, threatening to create a glut at the higher end of the market despite the stream of affluent new residents still pouring in.

Multifamily construction has been soaring across the U.S., particularly in the Sunbelt. It has been especially robust in South Florida. The Miami metropolitan area, which consists of Miami-Dade, Broward and Palm Beach counties, has more units under construction as a share of inventory than any other major market in the country, according to real-estate data firm CoStar Group. Rents are still edging higher in the Miami metro area, but rent prices for the more expensive apartments were down about 1% in the second quarter of 2023, CoStar said.

As more luxury units become available, they are taking longer to rent. Vacancies have risen to 5.6% from a low in 2021 of 3.6%, but still below the U.S. average of 6.9%. At the high end in South Florida, vacancies are around 8.5%, CoStar said. The luxury sector’s vacancy rate will rise to 11% over the next two years, according to a forecast from Juan Arias, CoStar’s director of market analytics in South Florida. About 90% of all the new apartment units coming to the market are considered higher-end, or rent for $2,261 a month or more, CoStar said. The bulk of that product is expected to be delivered in 2024. R/E goes in cycles and many developers get wiped out in each one. Too much product gets built in some segments (apartments, condos, homes…) and then prices correct. To me, this is good and healthy and will make South Florida more affordable and attractive, but due to the price moving down, developers, investors, and banks can get hurt along the way. The article mentioned that rising input costs and high labor pushed developers into the luxury segment. Inflation strikes again.

Rosen Report™ #613 ©Copyright 2023 Written By Eric Rosen