Opening Comments

My last note was about the insanity around the pricing on luxury vacations and the most opened links were Bryon Wien’s 20 Life Lessons and No. 1 life regret of dying patients. I received countless emails of people agreeing with me about the ridiculous prices of vacations today.

I got a great note from a new reader who is a Wall Street trader. He was recently turned onto the the Rosen Report and went back and read all the theme pieces for the past couple years. I love hearing that kind of commitment. He is friendly with one of my former colleagues and it looks like we will be getting together at Art Basel.

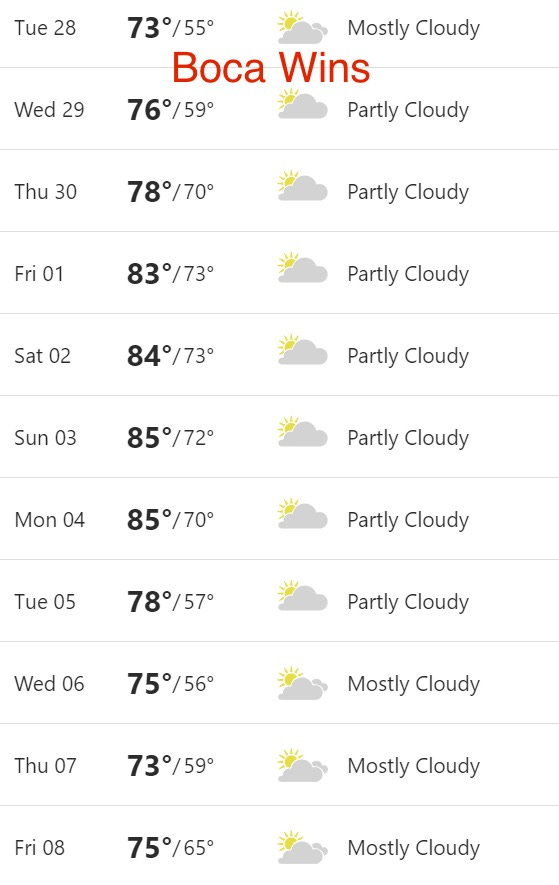

I was at the Boca Resort yesterday in the Member’s Room after my work out and a woman looked at me and said, “You are Eric Rosen from the Rosen Report. I love reading your newsletter.” She was with her friends and I ended up speaking with them for over 30 minutes. I did not even have my famous Rosen Report hat on at the time. I am so appreciative of my diverse group of readers from S&P 500 CEOs to Hedge Fund Managers, Venture, Private Equity, Real Estate CIOs, college students, retirees and everyone in between. Thank you for reading.

Warren Buffett’s partner, Charlie Munger died at 99 years old this week. He had 3 life lessons and I agree with them 100%. This article did a nice job of summarizing Munger’s life and work.

1. Don’t sell anything you wouldn’t buy yourself.

2. Don’t work for anyone you don’t respect and admire.

3. Work only with people you enjoy.

As a reminder to my new readers, send me story ideas, and feedback to rosenreport@gmail.com. Some readers literally send me dozens of story ideas a day. I do this solo and cannot possibly cover everything without help. Also, some servers require you to hit, “View Entire Message,” as the long email gets truncated. Remember, you can always view my notes on LinkedIn or go to Substack and search the Rosen Report to look up prior emails. People love the Substack App as well.

Markets

Inflation Inflicting Pain

Amazon Surpassed FedEx & UPS

Estate and Inheritance Taxes by State

EV Sales Rates and Oil Reliance

$32mm Sunset Island & Four Season Surf Club

NYC High End Under Pressure in Spots (Examples)

The Luxury Market in the US

High-End CA Homes

Video of the Day-Sommelier Breaking a Wine Bottle

I love wine and have had many issues with older wines where the cork has softened. This video BLOWS ME AWAY. If you want to see an amazing way to open a bottle of old wine in short order, check this out. The guy breaks the bottle after heating it. The concept is brilliant. The video is short and must watch for any wine drinkers.

The Tide is Turning on Off-Market Lending Opportunities

Since retiring, I have kept quite active with my kids, newsletter, running my family office, board/advisory work, charitable endeavors, fishing, cooking and countless other things. Mentoring students and young professionals can take hours a week of my time as well.

My family office work has me investing across asset classes through public and private markets from private equity, venture, R/E, stocks, bonds, and commodities…. One of the things I have been doing over the past four years is hard money lending. I have done about 8 deals, so it is hardly a massive sample size, but I have looked at dozens. Remember, I ran the Credit Trading business at JPM, and my fund, Reef Road Capital focused on credit and special situations, so I understand how to get to the right answer quickly. More people are calling me to bring me into deals given I can turn things around in a hurry. I have historically done the deals alone and funded them myself. I have a lawyer I trust to help me structure and document the deal in short order as well.

Until recently, I would be shown one or two deals per month for hard money lending. The leads were from my network and nothing formal. Most of the time, those looking for financing had other alternatives (rates were low, lenders were aggressive) and capital was easy to find. As a result, my rates and terms were generally uncompetitive and I was not doing a ton of transactions.

I can tell you that the flows I have seen in the past couple of months are VERY different from the prior 4 years. I am seeing multiples of the number of opportunities I saw a year ago. The number of entities looking for money quickly and willing to pay for it has surprised me. The significantly higher rates and lower lending levels must be crushing these entities that need money in a hurry.

With the move in rates and the pullback by traditional lenders, Private Credit has exploded as we have discussed. The deals I do are too small for many of the institutional players in the game. I am doing $3-10mm+ deal sizes which tend to be transactions of 3 months to 2 years.

Given I have been working with a few clients on finding them luxury homes from Miami to Jupiter, I have not had the time to focus on some of the opportunities, but am working on one right now. I have told them the terms for me to consider lending and if it comes to fruition, the person who brought it to me wants to participate.

To be clear, for me to consider funding, I need to see loan to values in the 30-50% range with real collateral and clean titles. The loans are shorter-term in nature and the borrower must check out from a business perspective.

If the past few months is any indication of the next year with massive maturity walls, there will be amazing opportunities for the bigger players. The 2nd chart has some well-known fund managers if you are interested in the space. On an interesting side note, I have readers in senior management from at least half of the 20 firms listed in the chart below. The Rosen Report reach is getting impressive thanks to your help which has grown it 100% by word of mouth.

Quick Bites

U.S. GDP grew at a 5.2% rate in the third quarter, even stronger than first indicated. GDP is on track to expand at a meeker 1% to 2% annual clip in the fourth quarter, the most recent forecasts show. On another positive note, I put gas in my boat this am for $4/gallon, and 18 months ago, I paid almost $7, while the gas for my car is well under $3/gallon today in South Florida. Since 10/27/23, the S&P is now +10.2% and +18.5% for the year. During that time, the 2 & and 10-year Treasury bond yields fell by 38 and 62bps respectively. There is a growing belief that the Fed is done raising rates. After the bell Wednesday, Salesforce beat earnings as sales increased 11% which pushed the stock +7.5% after hours.

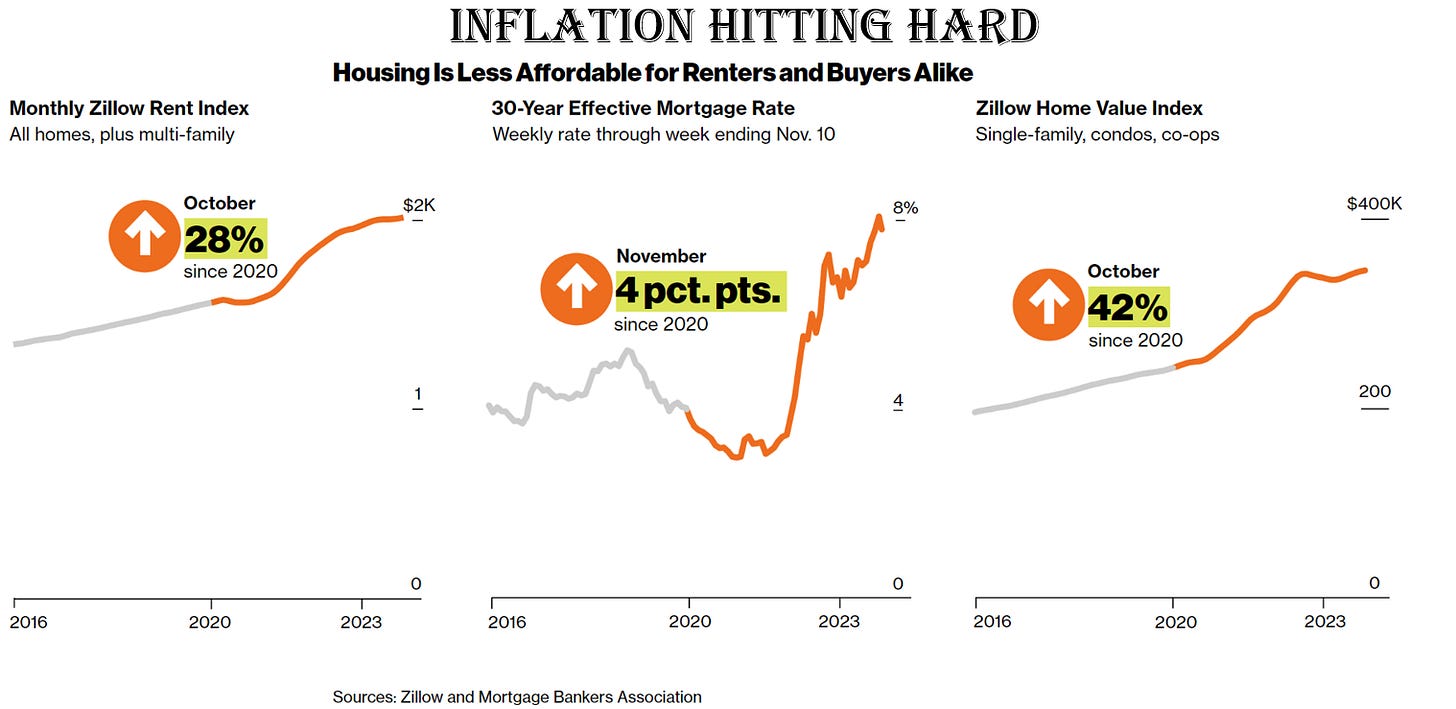

Good Bloomberg article entitled, “Just How Bad Is the US Cost-of-Living Squeeze? We Did the Math.” In the four years before the pandemic, grocery prices increased less than 1%, offering shoppers a certain predictability. In October 2020, a Census Bureau survey showed a four-person household spent an average of $238.32 in a week on food at home. Three years later, a similar survey showed that figure had jumped to $315.22 — roughly 32% more. Mortgage rates are around a 23-year high, and home values have jumped nearly 42% since the start of 2020. Car insurance is up 33%, and the combination of higher car prices and a surge in borrowing costs has pushed the average monthly payment for a new car to a record high of $736. Health care, already expensive in the US, has become even more so. Along with paying higher prices to visit the dentist or the hospital, data from an annual KFF survey showed the average employer-sponsored health insurance premium jumped to almost $24,000 this year. Meanwhile, restaurant prices are up 24% since January 2020. In terms of wages, according to the Bureau of Labor Statistics, since 1st Q 2020, wages are +17.5%, not keeping up with the price moves outlined in the article during the same period. The article has far too many data points to include all of them, but you get the idea. Who is to blame? An inept Fed/Powell and the Biden Administration’s policies of free money and massive deficits.

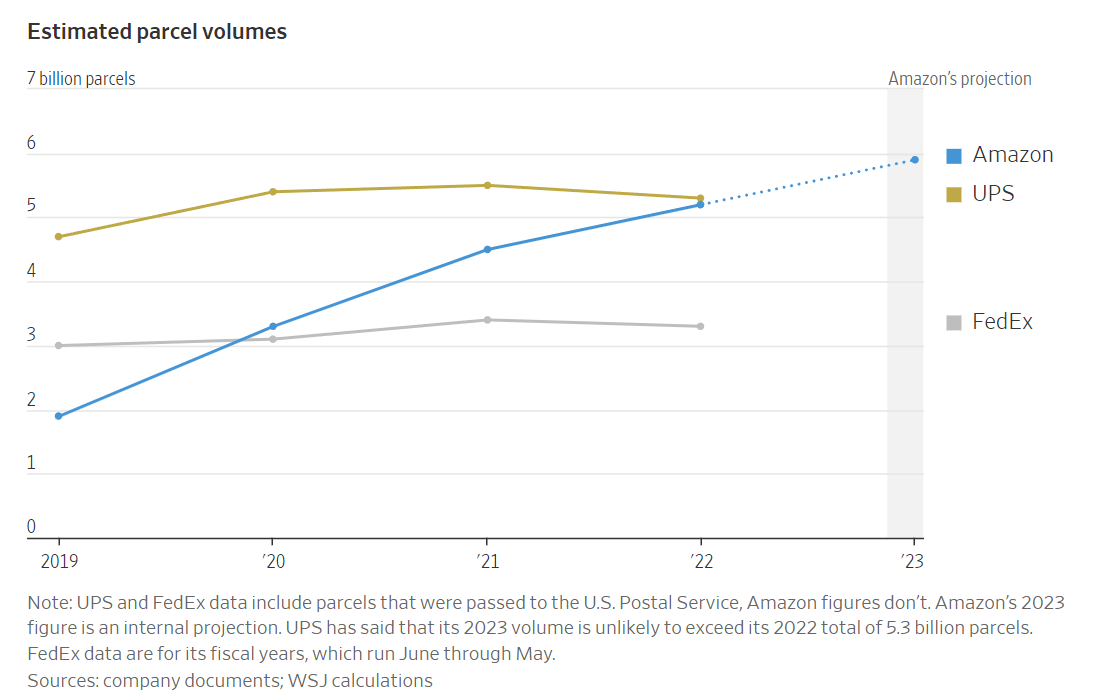

I often write about Amazon and Bezos given the greatness which has been created. It is among the most disruptive companies of all time. I wonder what will disrupt it someday. An enlightening WSJ article outlines Amazon’s delivery dominance. The Seattle e-commerce giant delivered more packages to U.S. homes in 2022 than UPS, after eclipsing FedEx in 2020, and it is on track to widen the gap this year, according to internal Amazon data and people familiar with the matter. A decade ago Amazon was a major customer for UPS and FedEx, and some executives from the incumbents and analysts mocked the notion that it could someday supplant them. Amazon’s outsize growth combined with strategy shifts at FedEx and UPS have changed the balance. Before Thanksgiving this year, Amazon had already delivered more than 4.8 billion packages in the U.S., and its internal projections predict that it will deliver around 5.9 billion by the end of the year. Last year. Of the 5.9 billion packages that Amazon delivered in 2023, approximately 1 billion was to the Rosen home due to the fact that my wife only shops at Amazon today. Now, Amazon wants businesses to use its palm-scanning device to allow employees into the office. Also of note, AMZN is looking for 50,000 ft of office space in Florida on the heels of Bezos’ big home purchase in Miami.

Good WSJ article entitled, “The Estate Taxes Catching Americans by Surprise,” which is enlightening and important. I did not move to Florida because of the income and estate/inheritance tax laws, but it was clearly a nice benefit. If you have substantial means, dying in a high-tax state makes little sense absent a robust estate plan. In New York, when the estate’s value is slightly higher than the exemption amount, the effective tax rate on the excess value is extraordinary, said Toni Ann Kruse, a private-client lawyer with McDermott Will & Emery in New York City. For an estate that is valued at $6.9 million, 5% above the $6.58 million New York exemption amount, the estate tax would be $626,000, a 9% effective tax rate but a 190% marginal rate on the excess. This link outlines states that will not tax you upon death and the list is quite long. I was surprised to see California on the list. The bottom chart outlines the NY State Estate Tax which can be up to 16%. How many more reasons do the NY politicians need to give you to move? What I find most amusing is all the DIE HARD NYers who told me they would “NEVER LEAVE,” NYC and now they no longer have it as their primary residence. I was called an idiot for moving to Florida, and now a bunch of haters have bought in South Florida and claimed it as their primary residence.

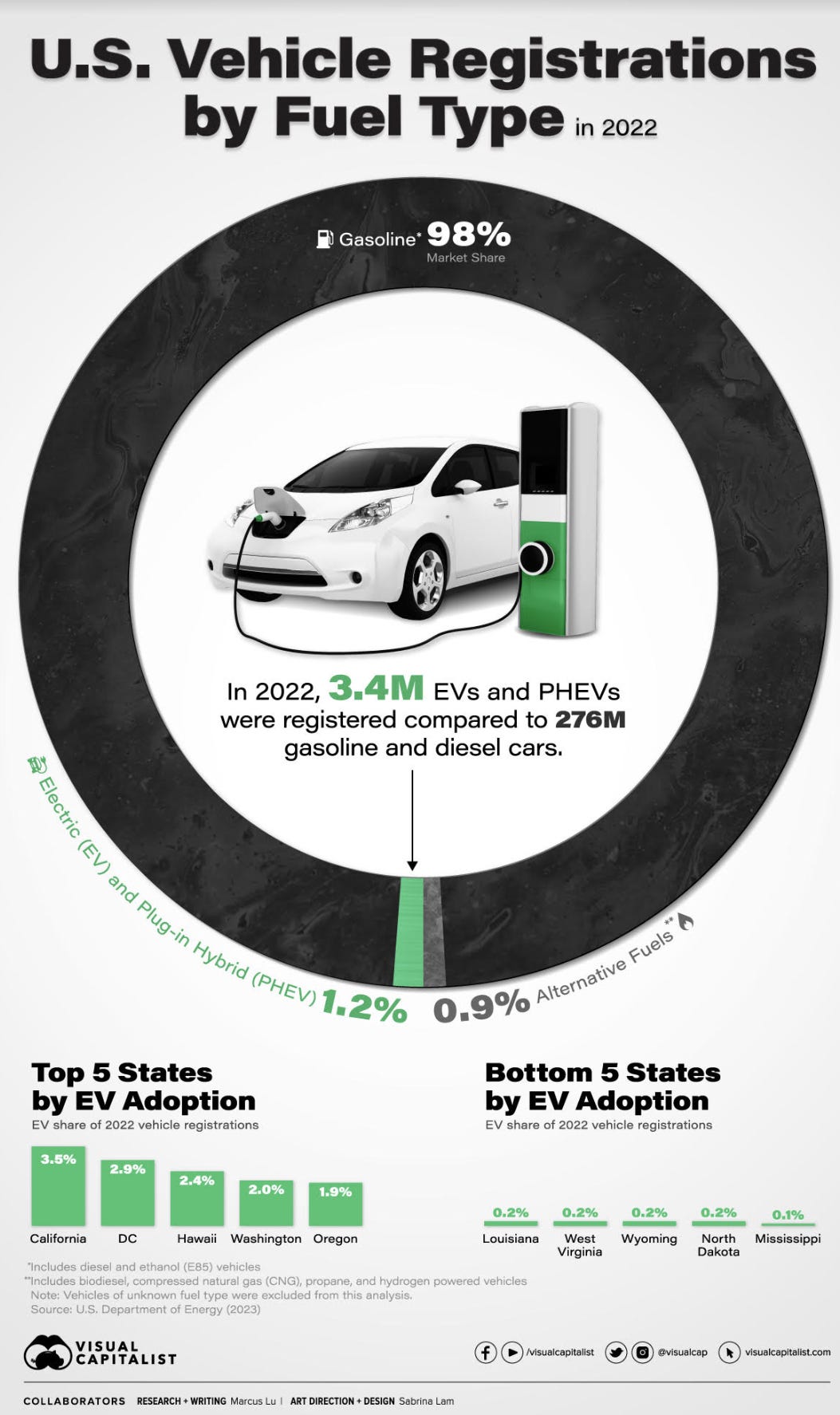

I have a TSLA, but have written extensively about the limitations and reasons there is only one of them in the Rosen household. Unfortunately, the world will be reliant on oil for decades as I have written. Globally, we consume approximately 102 MILLION barrels a day and in the US alone, approximately 20 MILLION+/day. Global demand is set to reach almost 106mm barrels/day by 2028. OPEC believes that number will be 116mm/day by 2045. Vilifying an industry the world needs to survive is bad politics. I have been using more charts from the Visual Capitalist and they do a great job. This headline hit yesterday, “Dem governor withdraws electric vehicle mandate in stunning blow to environmentalists.”

Israel

Fifth group of hostages released after Israel and Hamas agree to extend cease-fire

Biden reportedly apologizes for doubting Hamas's Palestinian death count: 'I will do better'

President Joe Biden walked back his criticisms of Hamas terrorists' death count in a private meeting with several Muslim Americans, according to The Washington Post. I don’t know who I trust less, the Chinese Government or Hamas when it comes to the death count on COVID and Israel Bombings respectively.

Wealthy Jewish families are rejecting the Ivy League for ‘Plan B’ schools

Good. This is the right call. I would not send my kids to an Ivy in light of what is going on today. The one-minute video in the link shows professors from various schools (Ivy and non-Ivy) spewing hate. See one professor’s post below. Let me get this right. These “professors” are teaching the future leaders of America?

Harvard, Penn, MIT Presidents Called Before Congress on Antisemitism

USC professor's 'Hamas are murderers' comments draw calls for both his firing, reinstatement

An antisemitic riot in an NYC high school needs more than just ‘I’m outraged’

Other Headlines

JPMorgan sees the S&P 500 dropping nearly 8% in 2024 as macro risks build up

These regional banks are at greatest risk of being taken over by rivals, according to KBW

Apple is trying to unwind its Goldman Sachs credit card partnership

The Goldman foray into the consumer business has been an unmitigated disaster.

Nvidia CEO Jensen Huang says AI will be ‘fairly competitive’ with humans in 5 years

NY retailers lost $4.4 billion due to organized shoplifting rings in 2022

Instagram’s Algorithm Delivers Toxic Video Mix to Adults Who Follow Children

Content served to WSJ test accounts included risqué footage of kids, overtly sexual adult videos and ads from major brands

Billionaire-backed Koch network endorses Nikki Haley for president

The article suggests that the network will deploy “Massive Resources” to support Haley. On the other hand, Home Depot co-founder, Bernie Marcus will fund Trump even if convicted.

Did Deutsche Bank Just Destroy New York AG's Case Against Trump?

George Santos Says He’ll Wear Impending Expulsion ‘Like a Badge of Honor’

He is among the worst, but sadly, so many in office should not be there.

21 Migrant Sex Offenders Busted in One Texas Border Sector in 7 Weeks

Open borders have consequences. Massive policy failure by the Biden Administration will have dire ramifications for years. Look at what is happening in Europe and the move to the Right with the leading issues being immigration and cost of living.

Mark Cuban is selling his majority stake in the Dallas Mavericks to the Adelson family

Cuban still owns a stake in the team and run basketball operations. He claims he is not running for President.

I Have Regrets About Retiring Early: 4 Expenses I Should Have Prepared For

10 healthy habits to practice every day that take less than 10 minutes each

Expats are flocking to this European country for happier lives abroad—here’s why

The top three cities for expats to thrive in their new lives abroad are all in Spain, according to the latest report from the online community Internations.

Good thoughts here from Mike Massimino.

Lake-effect snows could dump up to 30 inches in Upstate New York

Major League Pickleball asks players to take 40% pay cut on the back of rapid growth

I am not playing Pickleball but getting a court in South Florida is akin to winning the lottery. They are turning tennis courts into Pickleball everywhere.

Saudi Pro League embarrassment continues as just 447 people turn up to latest match

Talk about no crowds? The stadium holds 38,000 and 447 showed up despite the $1bn+ spent on soccer in Saudi.

China Confronts U.S. Warship as Tension Grows Over Flashpoint: "Drove it Away"

China's military said it had driven a U.S. warship from waters it claims in the South China Sea at the weekend and accused the United States of being the "biggest destroyer" of peace and stability in the region.

China has acquired a global network of vital ports

40-second video. I am sure we can trust the Chinese government to do the right thing. They are so honest with the world.

Just remember, any “official” story out of China is a lie. Let me guess, this time a mandolin and a panda mated and created a new deadly virus? The pictures are concerning.

Real Estate

A 6,100 ft home on Sunset Island sold for $32mm in an all-cash transaction. The lot was 13,000 ft (quite small). The house had sold for $5.8mm in 2014 and was rebuilt in 2017. It was renting for over $1mm/year previously and heard the house was beaten up a bit. This is the Zillow link with maps and pictures. On a related note, Four Seasons Surf Club is one hot property. Some one-bedrooms go for $5mm. A West-facing 2-bedroom rented for 15 days in February at an average of $8,000/night. Six years ago, Surf Club sold for $2k/foot or less, today it can be $6k/foot for some units. Check out the Surf Club listing prices for sale and rent below. The high prices face the ocean. Tell me whatever you want about South Florida, but luxury R/E in Miami and Palm Beach Island remains hot.

Juxtapose Miami and Palm Beach with many (not all) of the high-end NYC market. Discounts are dominating at Extell Development’s One57, where recent resales have taken sizable cuts off their past prices. PH88 closed this week for $31.5 million, according to Zillow. Serhant agent Talia McKinney initially priced the 88th-floor unit at $45 million. The home at 157 West 57th Street spans 6,200 square feet and has five bedrooms and five bathrooms, as well as a private elevator entrance and Central Park views. It traded above its $28 million sale price in 2020, but way down from the $47.8 million got for it in a 2015 sponsor sale. A 58th-floor condo sold in March for $19.3 million, down from the sponsor sale price of $24.6 million. The building’s other 58th-floor unit sold in December 2020 for $16.8 million, less than half its original sale price. Investor Robert Herjavec, known for his appearances on Shark Tank, took a $13 million haircut on his unit in the building. If you bought in Miami in 2015 at a nice condo or home, you would likely have doubled and could have tripled in price. In NYC, you are seeing things sell for massive discounts to prior sales in many instances. The wealth is leaving given the quality of life has deteriorated and austerity measures will begin. Also, a lot of high-end new product has been built in NYC.

Robb Report article entitled, “The Luxury Market Is Booming Despite U.S. Homes Sales Hitting 13-Year Low.” Last month, existing U.S. home sales dipped 4.1 %to an annual rate of 3.79 million, a pace so slow it hasn’t been seen since 2010. Compared to last October, sales across the country dropped 14.6%, despite an increase in existing home prices. This year, the median home price clocked in at $391,800, a noticeable 3.4% uptick from 2022. Even though October marked a 13-year low in activity within the overall market, it’s a different story for high-net-worth buyers shopping for homes in the luxury category, which a recent Redfin report defined as properties that are estimated to be in the top 5% of their respective metro area. In fact, in the third quarter of 2023, the luxury market grew at three times the rate of the mainstream market. Indeed, the median price of a luxury residence reached a record high of $1.1 million, up 9% compared to last year.

I found this in CRE Daily which is a solid commercial real estate newsletter. A growing trend is emerging in the office real estate market: landlords are increasingly choosing to surrender properties to lenders voluntarily, opting to cut losses and redirect investments elsewhere. The latest CoStar data reveals a surge in voluntary property surrenders, especially in the office sector. Office buildings constituted 43% of all deeds in lieu of foreclosure in Q2, compared to the 20% average for 2022. This increase is set against the backdrop of rising interest rates and stricter lending criteria, making it tougher for owners to refinance maturing loans. During the early stages of the pandemic in the first half of 2020, office property deed-in-lieu constituted 21% of all foreclosures. This number dipped to 6% in the first half of 2022 but rebounded to 30% by the second half and increased to 33% in the first half of 2023. This shift indicates a strategic decision by property owners to cut losses on underperforming properties and redirect their investments to more profitable ventures.

Tech Investor Wants $150 Million for California ‘Beach Bungalow’

The Manhattan Beach home helped prompt an ordinance that limits the size of homes in the community. The place is nice, but not $150mm nice.

Another Megamansion Hits the Market in Los Angeles—This Time for $185 Million

The roughly 35,000-square-foot home would be among the priciest to sell in the area if it fetched that price. Now this place looks incredible but just outside of my price range.

Rosen Report™ #634 ©Copyright 2023 Written By Eric Rosen