Opening Comments

My last note was entitled, “Unwelcome Guests.” about a family that I barely knew crashed in my Greenwich Village apartment and did not want to leave. The most opened links were the video of IDF soldiers taking out a Hamas terrorist and my newsletter from July 2023, “My Legendary Apartment Rental.”

Call me crazy, but I don’t love Vegas. My biggest pet peeve is smoking and I have never smoked. I have zero tolerance and all the casinos I walked by allowed it. However, these hotels are massive and impressive. My speaking engagement at the SF Net Conference was a success and I received positive feedback. Given it was Super Bowl week, hot restaurant reservations were tough to come by. We ended up at Lago in the Bellagio and I felt the food was just ok and overpriced. Nothing was remarkable other than a good presentation. I would not go back.

I am making more posts on LinkedIn and YouTube and not all will make the Rosen Report. If you want to see more, check out those links and sign up.

Here is my latest interview with Alicia Levine and Peter Boockvar on 2024 Macro Market Trends as part of my partnership with 3i Members. These experts are always impressive.

I am trying something new today. I am highlighting an accomplishment of one of my readers (check the R/E section). I will start to give shout-outs from time to time where appropriate. If you get a big deal done, accomplish something special or do a philanthropic event, send it over. It does not have to be business-related. You can send a picture as well. I cannot post them all, but I feel the Rosen Report community is so impressive, I want to share your successes. Rosenreport@gmail.com.

Rosenreportjobs.com had a couple of glitches and won’t push it hard until they are resolved. However, there are some internships posted and resumes, but over the coming weeks, I am hopeful we will see more. Please check it out. I also have a handful of full-time searches going for banks, hedge funds, private credit, and the credit arm of a large PE firm. They are not posted, as they want me to do it directly. Looking for a lot of credit research analysts at various levels. Reach out if interested. I have a growing list of impressive credit candidates with fantastic quants as well.

Scary Accident-I Helped Get the Driver Out of a Flipped Vehicle

Markets

Investors Get the Fed Wrong

Auto Affordability and Negative Equity

DOJ Report on Biden is SLIGHTLY Concerning

Chicago Wait Staff Minimum Wage Law

Rent Taking a Bite out of Pay/Consumer/Card Data

Rent Stabilized Apartments-GREAT CHART on Bank Exposure

House On My Block Sells for $16.9mm

Guide to Ground Leases

Scary Accident-I Helped Get the Driver Out of a Flipped Vehicle

I was driving to my golf course in the 1971 Olds 442. I turned left onto Military Trail and there was a motorized bicycle in front of me. I thought how dangerous. One minute later, I looked down and looked up and there was a helmet on the street and a car flipped over. I thought the kid was dead. I pulled over and ran to the other side of the car and there was no bike or kid. There was a woman stuck in the car. I asked if she was ok and there was another man to help me. She said, "I am a firefighter. I am ok." We helped her get out of the car from the passenger window. She was shaken. I said, "Where is the motorbike you hit." I had assumed the car was on top of the bike and the boy. She said, "There was no motorbike. A jeep cut me off." I asked about the helmet in the street and she said it was hers that had fallen out of the truck. My fears of a dead kid were gone and a woman came over and said, "I am so sorry. My daughter is 16 and a brand new driver.' I went over to the jeep and there was a sobbing teenager. It was a scary few minutes, as I thought the motorbike guy was dead and did not know how bad the driver was. Thankfully, no one appeared to be seriously injured. I took a short video so you can see the truck.

Eye on the Market

Mike Cembalest came out with his latest note, Five Easy Pieces. Below is an outline of the note which I enjoyed. I liked his section on the Magnificent 7 and take on the potential impact of No Labels on the election.

Magnificent 7 stocks keep rolling, driving market concentration to its highest level since 1972

The improving performance of free open source large language models and implications for closed model revenue moats

The No Labels movement risks triggering a 12th Amendment Contingent Election if it wins electors in a few states

The Armageddonists: an update on one of my guilty pleasures

Bottom-fishing in Chinese equities and parallels to the 2008 TARP bill in the US

Cocaine Hippos

For some reason, I have been fascinated by Pablo Escobar and there are many crazy stories about him, his lifestyle, money, drug trade domination, and now, “cocaine” hippos. I am not suggesting he is a hero, given the death and destruction he caused, but the stories around his wealth, lifestyle, and corruption are fascinating.

Four hippos were originally brought to Colombia in the 1980s to be part of Escobar’s private zoo. Today, 170 hippos are roaming northwest Columbia and there are fears the number can hit 1,000 by 2035. The population of hippopotami descending from Pablo Escbobar’s so-called “cocaine hippos” is reportedly on the rise — and some locals are growing increasingly concerned about their presence. Hippos can get to almost 10,000 pounds and are extremely dangerous. Their teeth can get 20” in length and these animals get very aggressive. They have started to attack people in Columbia. Despite their size, they can run 19 mph and even attack boats. Colombia is sterilizing hippos and transporting them to India and Mexico to cull the population. This is an amazing quality video of hippos from the BBC Earth series. It is incredible how one rich person’s actions have such a large impact on the ecosystem of a country.

Now, why would the author of the Rosen Report be so interested by Escobar, a man responsible for countless deaths and the biggest drug dealer of all time? I am not here to glorify a person like Escobar, but when you learn about the extent of his corruption, it is unfathomable. Here are some famous stories from his life as with the italicized stories outlined in articles from the Independent and an article from the ATI.

Before getting into the drug trade, Escobar sold stolen tombstones to smugglers and was also into the business of stealing cars.

In the mid-1980s, Escobar's cartel brought in an estimated $420 million a week, which totals almost $22 billion a year. (This is in 1985 dollars meaning it is 3 times more today).

The "King of Cocaine" factored in a $2.1 billion loss in profits each month, but that didn't really matter. Money was lost, eaten by rats or destroyed by the elements.

And he expensed $2,500 on rubber bands each month.

Escobar made the Forbes' list of international billionaires for seven years straight, from 1987 until 1993. In 1989, he was listed as the seventh-richest man in the world.

Once he started a fire with $2 million in cash because his daughter was cold.

In the late 80s, authorities seized some of Escobar’s assets including 142 planes, 20 helicopters, 32 yachts and 141 homes and offices.

By the end of the 1980s, he supplied 80% of the world's cocaine.

He smuggled about 15 tons of cocaine into the US every day.

Escobar’s biggest shipment to the US weighed 51,000 pounds.

Escobar was said to have smuggled cocaine into airplane tires. Depending on how much product pilots flew, they could earn as much as $500k/day.

He hid money in thousands of houses in walls. His nephew found $18mm in cash in a wall. I am sure many billions were never found.

I read that the authorities in Colombia only found 400 of Escobar’s “safe houses” where tens of millions were stashed in each. There are countless other homes in Columbia with tens of millions sitting in walls.

He once offered the country of Colombia $10bn to change the extradition laws.

He cut a deal with Colombia to be imprisoned, but in a luxurious prison he built and named "La Catedral" -- the cathedral.

Escobar was responsible for killing 4,000 people including 200 judges and 1,000 police, journalists and government officials.

Escobar used his extraordinary wealth and popularity to get himself elected to Colombia's Congress.

Despite his horrific business dealings, Escobar did fund a number of programs to help Colombia's poor residents. He gave money to churches and hospitals, established food programs, built parks and football stadiums, and created a barrio.

He was killed 30 years ago at the age of 44 by the Columbian National Police. Just think of the carnage and wealth he would have had if he kept doing it until today. He would not need to stash his cash. All Bitcoin!

I do not condone Escobar’s actions and am not suggesting he was a good person. I just thought his dominance of the drug trade and wealth creation was worth outlining the story. Now, I just want to find one of those houses with $35mm in the walls that have not been eaten by rats.

Quick Bites

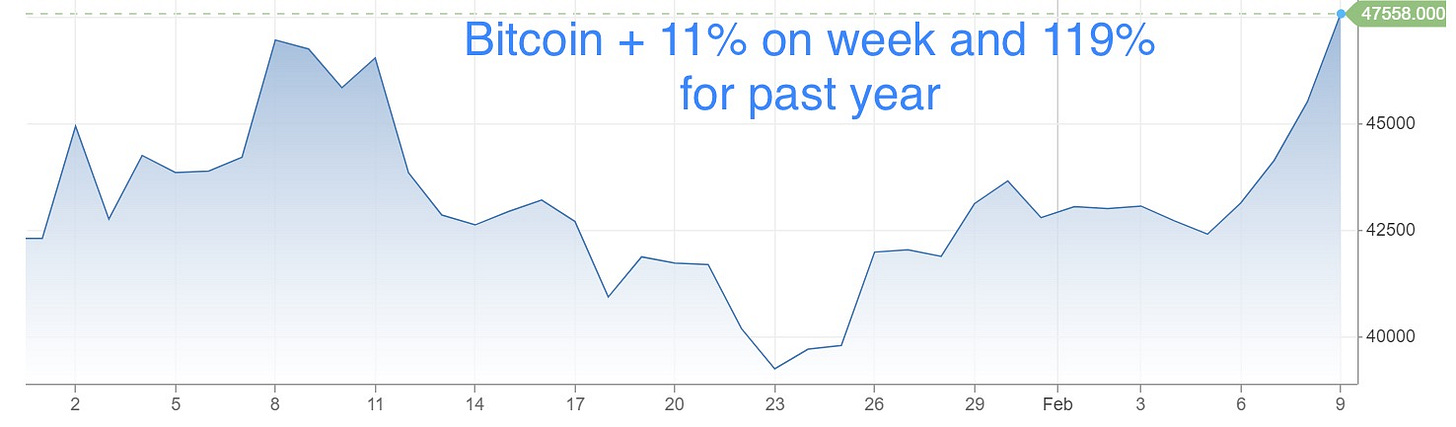

The S&P 500 closed on Friday at 5,022 (+.6%) after the government announced December’s inflation was lower than first reported. For the week, the S&P added 1.4%, while the Nasdaq gained 2.3%. The Dow finished flat. All three major averages notched their fifth straight winning week and 14th positive week in 15. After a long period of underperformance, the Russell 2000 (small caps) is starting to catch up and was +1.5% Friday. The S&P is +5.8% YTD and S&P -2.4%. I want to put something into perspective. If you bought the S&P in Jan 2009, it is worth over 640% more today. On the week, the 10-Year Treasury yield was +15bps to 4.19%. Oil has been up a bit and now +5% YTD on Middle East concerns after the US killed a militant commander in Iraq. Bitcoin is back up to $47.5k (+11% on week) as inflows into ETFs and the prospect of halving soon has created optimism.

I thought this was an interesting WSJ article entitled, “Investors Are Almost Always Wrong About the Fed.” Investors are more convinced than ever that interest rates are coming down later this year. Their record on these things, however, isn’t great. Wall Street has been caught offside in both directions while betting on the path of interest rates over the past few years. Few thought the Federal Reserve would get anywhere near 5% in the first place. Now traders keep ramping up bets that rate cuts are just months away, only to see that day recede with each batch of strong economic data. The Fed has been pretty clear and has suggested the rate cuts will be slower than the market expects. A month ago, 5-6 rate cuts were priced in and today, it is 4-5 cuts for 2023. I am thinking 3. To be clear, I was wrong last year, as I thought they would have been forced to cut late in 2023.

This is a good article about auto affordability or lack thereof sent to me by Manuel. The average new car goes for about $49,000 these days, and used models sell for $26,000 on average. Those are increases of a whopping 31% for new cars and 40% for used since just 2020, per Cox. And shrinking affordability means growing loan responsibilities. For reference: About 17% of consumers who financed a new car in Q2 of last year have monthly payments north of $1,000 per month—that’s an all-time high, and it’s almost triple the number of drivers who were paying that much just three years ago. The average household income in the US is about $70K a year…that means a considerable chunk of US drivers could be putting more than 17% of their monthly household income toward their car payment alone. To be clear, negative equity is the amount of the loan over the value of the car. If you owe $52k and your car is worth $45k, you have -$7k of equity. Given people paid up during the pandemic and prices have come down, they owe more than the car is worth. However, with earnings, we have seen multiple companies comment on the strength of the consumer (MSG, Wynn Resorts, Hilton Hotels, Hertz, Chipotle…). Shocking.

There is a concerning story about Biden’s diminished mental acuity. I am sorry, this is the President of the United States. We can no longer act as though he is fine and we need to hold the President to a higher standard. At no time in recent history have we had this much geopolitical risk and our President is so diminished that the Department of Justice is calling him out. Biden's own DOJ said he has 'diminished faculties and a faulty memory': Classified docs probe reveals he left Afghan files next to dog bed in garage, forgot when his son Beau died AND couldn't remember when he was vice president. Special counsel Robert Hur’s report, issued Thursday, found evidence that President Biden “willfully retained” and shared highly classified information after his vice presidency when he was a private citizen, but determined that evidence didn’t support charging the president. The report called Biden “a well-meaning, elderly man with a poor memory.” Don’t worry, Biden said, “my memory is fine” and that he is the most qualified person in this country to be President. During Biden’s Thursday night press conference trying to show his mental acuity, he referred to the president of Egypt, Abdel Fattah el-Sisi, as the president of Mexico. This week, Biden also claimed he spoke with German Chancellor Helmut Kohl at an event in 2021, but Kohl died in 2017. He also claimed to have spoken to French President Mitterrand at the same 2021 event, but he died in 1996. Despite the facts, Biden’s attorneys claim the DOJ statements are false and inflammatory. A CNN poll from November showed only 25% of Americans believed Biden had the stamina and sharpness to serve effectively. After this week, the DOJ report, and the countless miscues, the percentage of Americans who believe in Biden must be lower now. Age limits and cognitive testing should be required for such important positions as Congress, Senate, and President. Democrats, find a new candidate not named Biden or Harris. Do I hear Michelle Obama? If you recall, I called out Biden on these issues PRIOR to the election in 2020 and was canceled for it. If Biden somehow wins, it means Harris will be the President with a 28% approval rating. I also would rather see a different Republican candidate. Trump is also slipping and recently confused Haley and Pelosi, not to mention 91 indictments. Check out this article from Clinton adviser, Bagala who claims the Hur report is “Terrible for Democrats,” and Biden made it worse with the press conference.

I want to be clear on something. As an American, I pull for the pilot. You can put in a Progressive or an Oath Keeper and I hope the person does well. Too much at stake to hope for bad outcomes. When I get on a plane, I don’t say to the pilot, “I hope you have a bad flight because I don’t agree with your political views.”

I missed this story from a couple of months ago. A reader who is a restauranteur in Chicago took me to dinner and explained a new law passed going into effect in 2025 but increases in stages. It will force restaurants to pay $15.8/hour to the wait staff in addition to tips and is called “One Fair Wage.” The full wage will be effective in 2028. This level is up from the current pay of approximately $9/hr +tips. My Chicago restaurant friend told me this would push more restaurants out of business. His busboys, dishwashers, and hosts want raises now too. He needs to raise prices sharply to accommodate the price increases. How many reasons does Chicago give you to leave? High crime, high taxes, high cost of living, bad weather, awful policies, and woke teachings… The Illinois Restaurant Association surveyed restaurant owners about how they would handle the implementation of the One Fair Wage bill:

Israel

US warns: Without proper planning, major IDF offensive in Gaza’s Rafah would be disaster

Top Hezbollah commander hit in apparent Israeli strike as air force head threatens more

Israel cannot use Oct. 7 as ‘license to dehumanize others,’ Blinken warns in Tel Aviv

In Private Remarks to Arab Americans, Biden Aide Expresses Regrets on Gaza

In a closed-door meeting, the aide offered some of the administration’s clearest notes of contrition for its response to the Gaza war, a sign of rising Democratic pressure on President Biden.

Patriots Owner Robert Kraft Buys $7 Million Super Bowl Ad Combatting Antisemitism

Of note, Israel beat Ireland 87-57.

Other Headlines

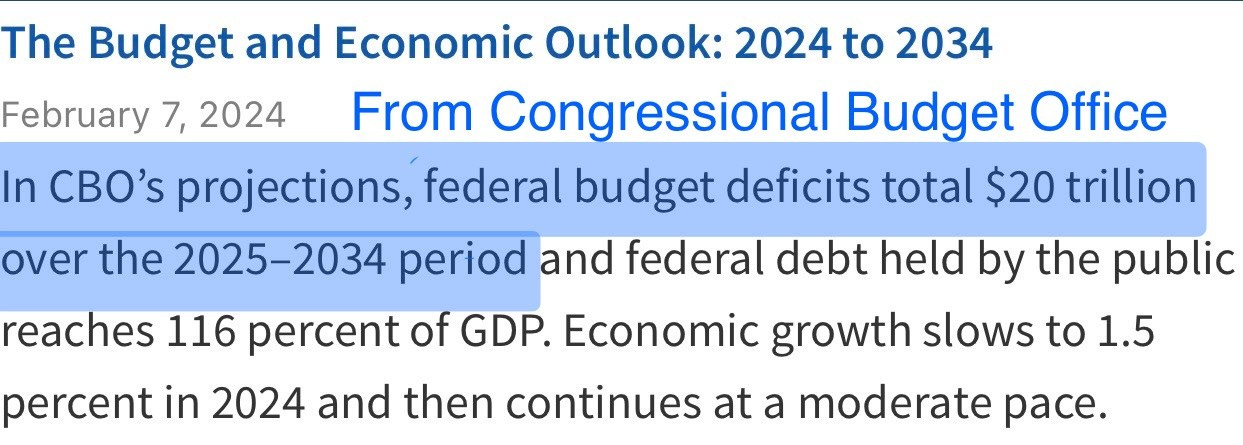

U.S. deficit will soar in the next decade, new CBO projections show

Reckless spending, higher rates, entitlements…what could go wrong? This will be the main issue in the 2028 election. $20 trillion over 10 years.

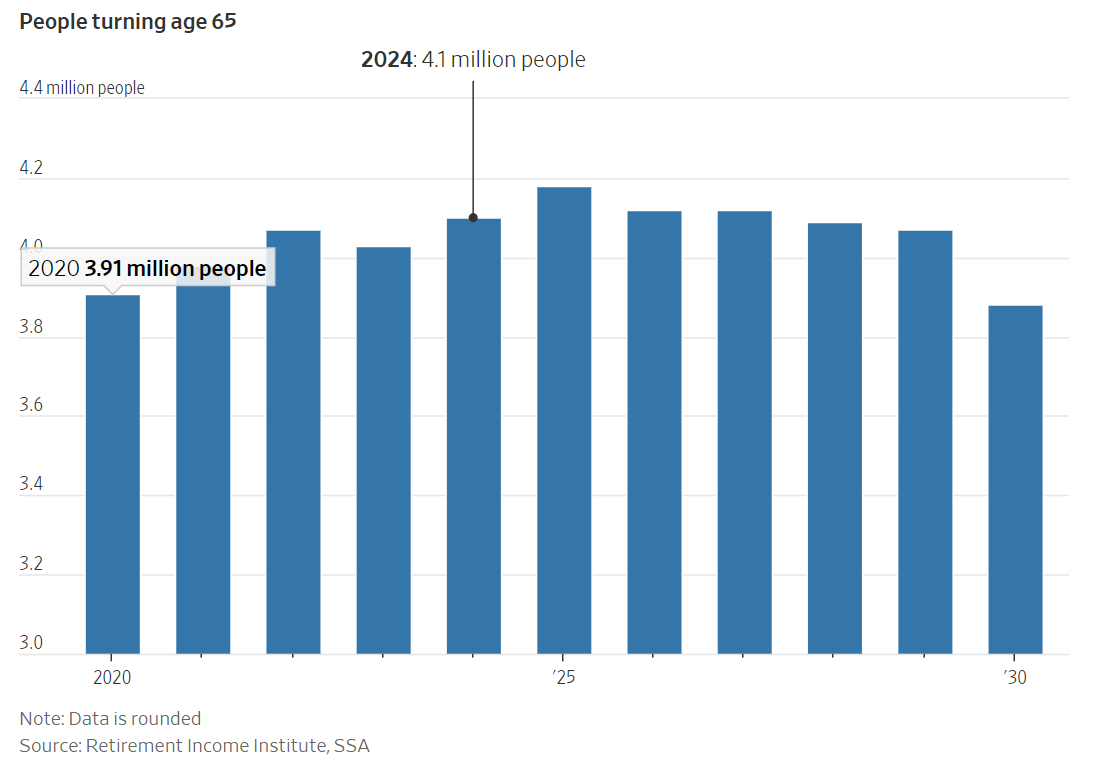

America Has Never Had So Many 65-Year-Olds. They’re Redefining the Milestone.

The ramifications of an aging population, healthcare inflation, entitlements, lower birth rates… result in trouble for the US budget, debt and discretionary spending.

Arm’s post-earnings pop leaves stock trading at over 100% premium to Nvidia

Cloudflare stock jumps 21% on earnings beat as the company wins larger deals

Softbank shares rose 19% in a couple of days. I have been critical of Softbank and the management team for good reason. However, they had some positive news, so I had to put it in. Since July 2010, Softbank ADR is +205% and the S&P is + 345%.

Hedge fund billionaire Bill Ackman to launch a NYSE-listed fund for regular investors

I do not believe Trump’s net worth is anywhere near where he suggests. The article quotes a lawyer who suggests she has seen Trump’s financial documents and she said Trump does not have the money he claims.

Scores of N.Y. Public Housing Workers Charged in Record Corruption Case

Manhattan’s federal prosecutor said the number of bribery charges, 70 in all, amounted to a single-day record for the Justice Department.

Muggings are so common in the upscale neighborhood, that women stopped wearing jewelry while shopping and walking their dogs. This is a block from my old apartment on 74th & Park in the high-rent district in NYC.

It is about time.

Under siege: Retailers flee cities as unarmed security, public authorities fail to curb thefts

Concerning stories and statistics in the article.

Cops: Dealer Handed Out Coke Samples

A Canadian drug dealer handed out cocaine samples attached to his business card. Brilliant, right? Not so fast, he was caught.

Border Agents Encountered Over 1,000,000 Migrants Since Oct. 1

Chinese migrant encounters continue to climb, too. Agents have encountered over 19,600 since October 1. They encountered 37,000 total in fiscal year 2023.

Prominent NYC developer Nir Meir arrested in vast years-long $86M fraud scheme

How did these people think they would not get caught? He transferred his luxury cars to his wife so he would not have to pay the lender $20mm.

I am not supportive of trans players competing against biological women. It is unfair and dangerous. There are too many stories of runners and swimmers who were not competitive as men and then dominated as women.

Harvard-trained nutrition expert: If I could only prioritize one food in my diet, it’d be this

I did not see this one coming.

Super Bowl bets will shatter records: 1 in 4 Americans to gamble on big game

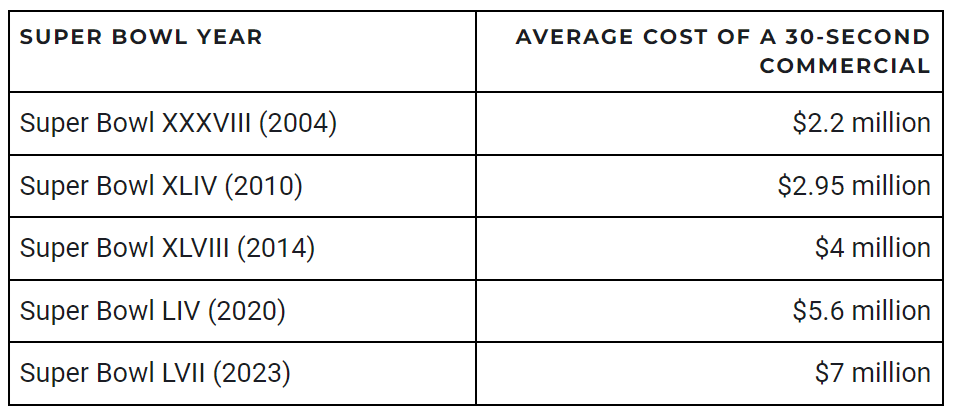

I heard there will be cosmetic ads on the Super Bowl given Taylor Swift. If this is true, is there a more powerful person in the world? Generally, it is beer, Doritos, Chips, Cars, Soda, Crypto… Look at the cost of ads over time for the big game:

Mutant wolves roaming Chernobyl Exclusion Zone have developed cancer-resilient abilities

Real Estate

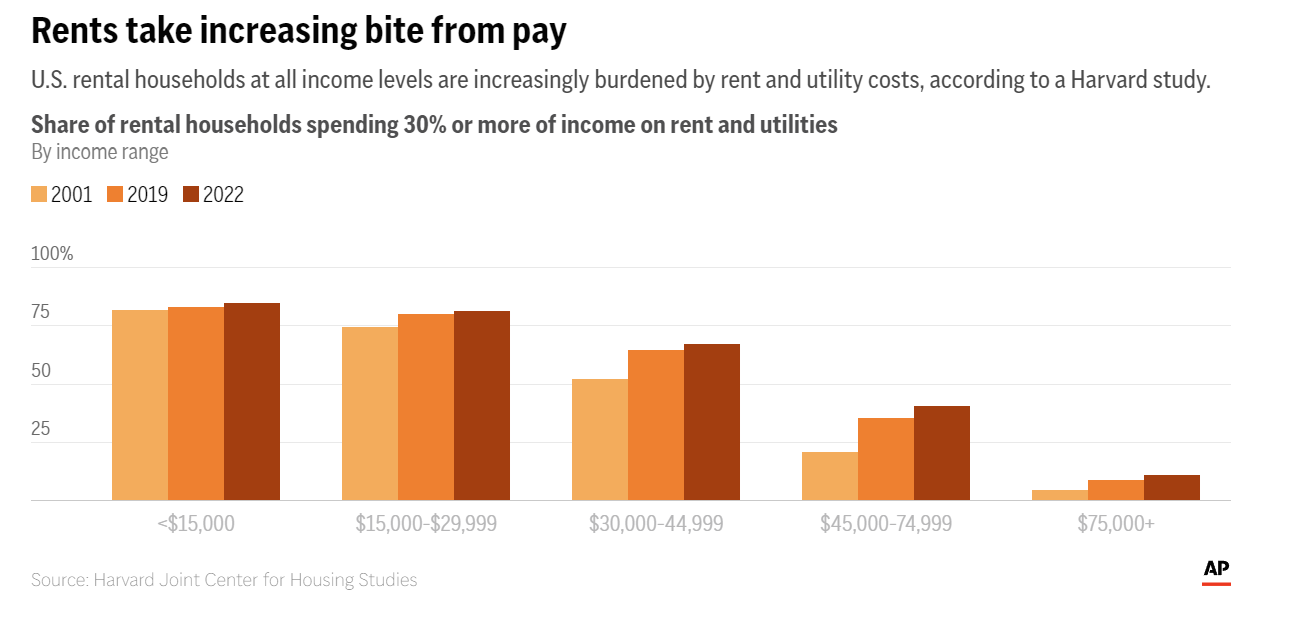

A record number of Americans cannot afford their rent. The latest data from the Harvard Joint Center for Housing Studies, released in January, found that a record high 22.4 million renter households — or half of renters nationwide — were spending more than 30% of their income on rent in 2022. The number of affordable units — with rents under $600 — also dropped to 7.2 million that year, 2.1 million fewer than a decade earlier. On a related matter, this article caught my attention: “Average credit card balances jump 10% to a record $6,360, and more consumers fall behind on payments.”

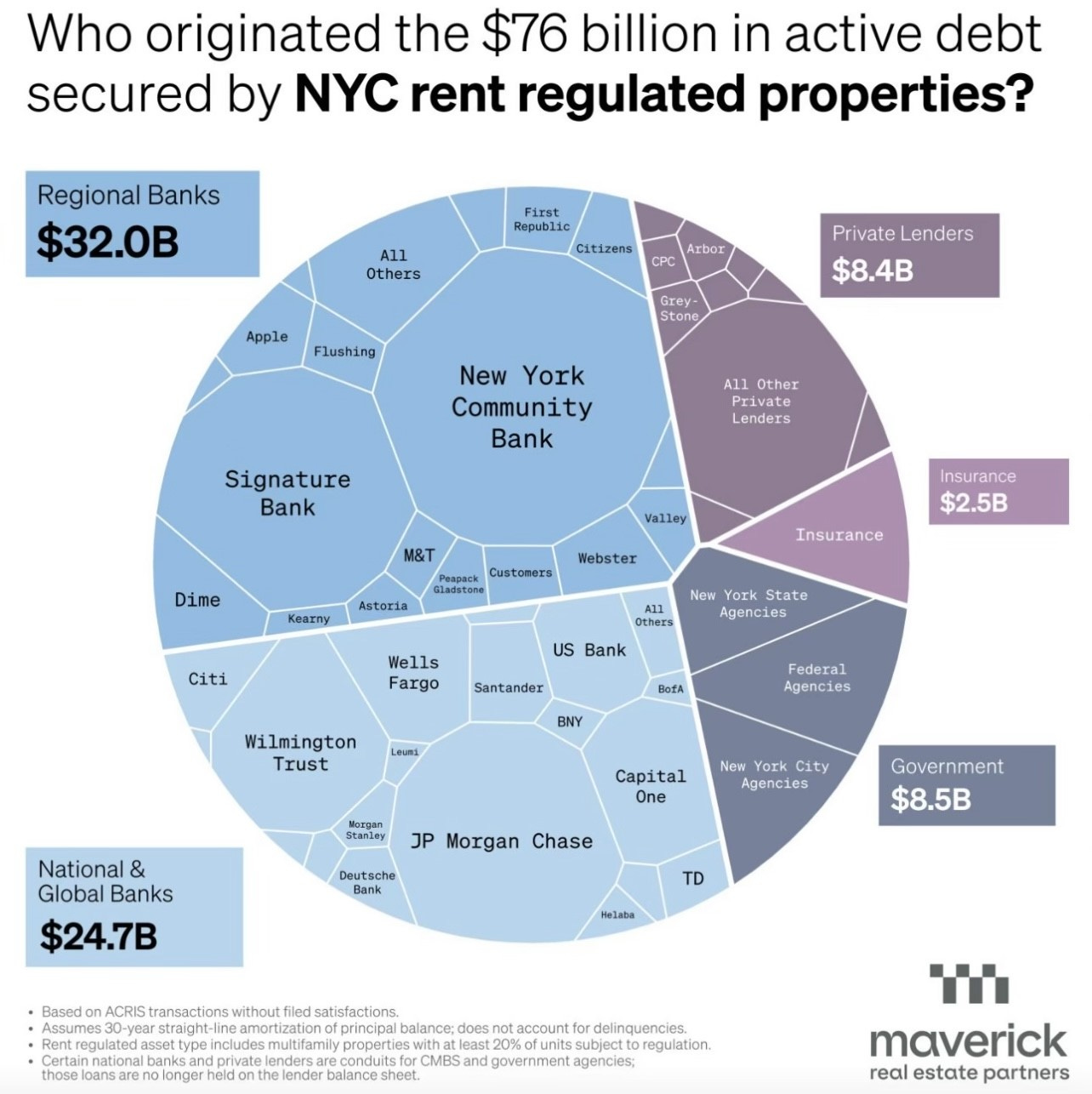

I wrote about NY rent-stabilized apartments and the carnage in my last newsletter. This Real Deal article gives yet more examples. The New York market has put another number to rent-stabilized deterioration: 64%. That’s the haircut investment firm BentallGreenOak took on 120 and 125 Riverside Drive when it sold the buildings to New York-based Aya Acquisitions last week. BGO unloaded the properties for $31 million; it had purchased them for $85 million in 2013, PincusCo reported. Rent-stabilized building values have plummeted since the 2019 rent law severely limited rent increases. Below is a fantastic chart by Maverick R/E Partners. Look at which banks have the most exposure to NYC rent-regulated properties. Note how large NYCB share of regional banks is below. That is clearly part of the reason for the stock - 60% YTD. A reader who is a large player in the R/E business sent me the chart.

I am a big fan of Jeff Gundlach, founder of Double Line. His team just put out their views on Commercial Real Estate. The 7-page note has a lot of charts and information on multifamily, hotel, industrial, office, and retail.

This house sold on my block (6 doors down). Similar lot, but this is a new house and mine is now 7 years old. When I bought, it was the highest-priced golf course home in history at $6.3mm in 2017, and now this one sold for $16.9mm. Below is a chart of my community, Royal Palm, in Boca Raton and the price history since I moved. Note, the average price went from $3.6mm to $8.5mm, while the highest price of the year went from $12.4mm to $28.0mm since 2017. The market is pretty hot again as this is peak season. I expect it will start cooling again come April.

NEW GUIDE TO GROUND LEASES: Congratulations to Rosen Report reader and advisor/contributor Joshua Stein, a CRE lawyer in NYC. He’s just published a 3-volume treatise about ground leases – very long-term leases often signed between developers and long-term owners of development sites. For information, visit www.groundleasebook.com.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #655©Copyright 2024 Written By Eric Rosen