Opening Comments

My last note was entitled, “Relevantly Irrelevant,” about the ebbs and flows in my career and retirement. The most opened links were vacation secrets of the mega rich and the incredible video of Yuja Wang on the piano.

I am looking for an editor to help me with the Rosen Report. Ideally, strong grammar skills to catch my mistakes would be helpful. Also, if you are proficient in social media, you can help this old dog make better posts. Reach out at rosenreport@gmail.com if you are interested. It is 2-3 hours a week.

Sushi Yasu Tanaka-Miami Design District

I went with my two pals, both named John, to the Design District for lunch. We ate at the food court and had Omakase at Yasu Tanaka. As you can see, the food was quite good and fresh. I felt the price was reasonable at $59, but the three Omakase orders were not enough and also shared the 6-piece tuna special with a half roll. I would say the ambiance is not not impressive and that makes a difference in the dining experience. However, for sushi in a food court, it gets a high mark and I would go back again. I do prefer Sunset (reviewed in my last note) over Tanaka.

Overcoming Obstacles

Rosen Report reader, Max Greyserman came in tied for 4th this week in the PGA Tour event in New Orleans with his playing partner, Nico Echavarria. It is the best finish for Max in his rookie year on the PGA Tour. I feel there is an important message in Max’ impressive play in his rookie season. If you take the time to watch the video of the day about Jensen Huang (CEO of NVIDIA), he talks about resilience and overcoming setbacks. A couple years ago, Max was injured and not sure if his wrist would allow him to continue to chase his golf dreams. How did he respond? He earned his PGA Tour card and has a 4th and 7th place finish in his first year. In two years, Max went from 700 in the world to 138. Max, well done. The setbacks don’t define you. How you respond does. Max, I think it is time for a rematch of our putting contest after that compete lucky win you had. Max drilled an 85 foot putt to win.

Markets

Impact of Higher Minimum Wage on Fast Food Prices in CA

Why Men Have Stopped Working

Big Tech & Billionaires Can’t Resist South Florida

Is Crime Going Up or Down?

Florida Residential Wealthiest Markets

More Fire Sales

New Brooklyn and Miami Buildings in Default

Small Business Rent Delinquency Rising

China Developer Stocks Rallying

Video of the Day-Jensen Huang

Obviously NVIDIA has been on a tear (+500%) in the past two years. The chips are changing the world and the ability to compute faster allowing AI developments that were not possible a short time ago. I do not have a strong background in tech, yet found this interview/talk by Huang to be informative and easy to understand. I did not realize the new chip is over 30lbs and has 35,000 parts. Jensen went into detail about what “human intelligence” means and I found his take fascinating. If you want to be more knowledgeable on the new world of AI and super computing chips, you should spend time on this informative video. He said, “Unfortunately resilience matters in success. I don’t know how to teach it to you, except for I hope suffering happens to you.” I could not agree more. I was shocked at his management style, review process and compensation plans. Huang also talked about coding and the changing way someone will code in English rather than in Python or another language. Fascinating. “English is the best programming language of the future.” Huang also addressed the question about his leather jacket that I found funny.

Fishing Season Has Officially Started

I have written that April and May are my favorite months to fish in Florida. It is the end of Sailfish and Wahoo season and the beginning of Tuna, Mahi and Kingfish season. You don’t know what you might catch during these exciting months. The seas are calmer than the winter months. In the winter, wind blows from the Northeast causing rougher seas and there are weeks that I cannot fish. In the spring, the wind shifts to more East South East and the seas are generally better with fewer rough days.

Last Thursday, I was planning on fishing alone, but a young man, Spencer, joined me. He is a solid fisherman. I had planned on buying live bait and when I called the dock, they were out. I was very upset as live bait gives you the best chance of catching this time of year. We went fishing anyway and clearly, we did just fine. One important side note, the water color was SPECTULAR. A deep blue color means the water is clean and when it is green or brown, it is far harder to catch good fish. We caught 15 Tuna and let most of them go, just keeping a handful of the big ones. We caught plenty of fish despite leaving the dock at 2:30 pm and returning at 6:15 pm. The joys of South Florida fishing in the Spring.

We were trolling various lures and everything was working. Another nice thing about spring fishing is the fish are relatively close to shore. We were never in more than 450 feet of water (within a few miles from shore). At one time, we had four fish on and it was a bit crazy (15-second video here). We had a great time despite not having the ideal bait and it is a reminder that April & May in South Florida offer amazing fishing. We saw a massive leatherback turtle and some Mahi, but did not catch any. The flying fish were everywhere as well and despite seeing them constantly, I always get excited about it. Yes, nature is stunning. Tuna, Mahi, Wahoo, Sailfish and other species travel in schools and it is not uncommon to get a double, triple or even a quadruple as we did. It is pandemonium when all the rods are bending at the same time, especially when only two people are on the boat.

We split up our catch and I came up and put my tuna in vacuum seal bags to keep fresh. On Friday, I made poke bowls. Not sure what is better than seared tuna caught 24 hours before and properly prepared. There are few places in the country where you can fish so close to shore and get so many species (Wahoo, Mahi, Snapper, Kingfish, Tuna…) within a few miles from the beach.

My boat is being serviced next week and I will be fishing a lot the last three weeks of May and will be sure to share the pictures. Below is from prior April/May fishing.

Quick Bites

Volatile earnings and inflation concerns sent stocks higher at some points and lower at others during the week. Labor costs rose 1.2% (1% expected) and yields increased with the 2-year Treasury crossing 5.03% and is now +79bps on the year. On Thursday, stocks sold off 1.5-2% post the news and increased Treasury yields. As the chart below shows, the markets expected 6.7 cuts in 2024 in January and now are expecting 1.25 cuts for the remainder of the year. Despite this massive move in rate expectations, stocks have performed better than I would have thought based on the Treasury move. The Fed left rates unchanged, citing a “lack of further progress” on inflation. However, the amount of Quantitative Tightening each month will drop on Treasuries from an annual $720bn to $300bn. Stocks reacted positively to the news (Powell also said a hike is unlikely pushing yields down 3-6bps for Treasuries. However, they sold off into the close to finish closer to flat on the day. For the month of April, the S&P lost 4.2% and Nasdaq-4.4%. Amazon cost cuts drove operating margins past 10% for the first time in an earnings beat. Crypto has been hit again and trading around $58k largely driven by higher rates. Bitcoin is -20% from recent highs. Oil is back down to $79 as U.S Crude inventories have grown and there is more truce talk in the Middle East.

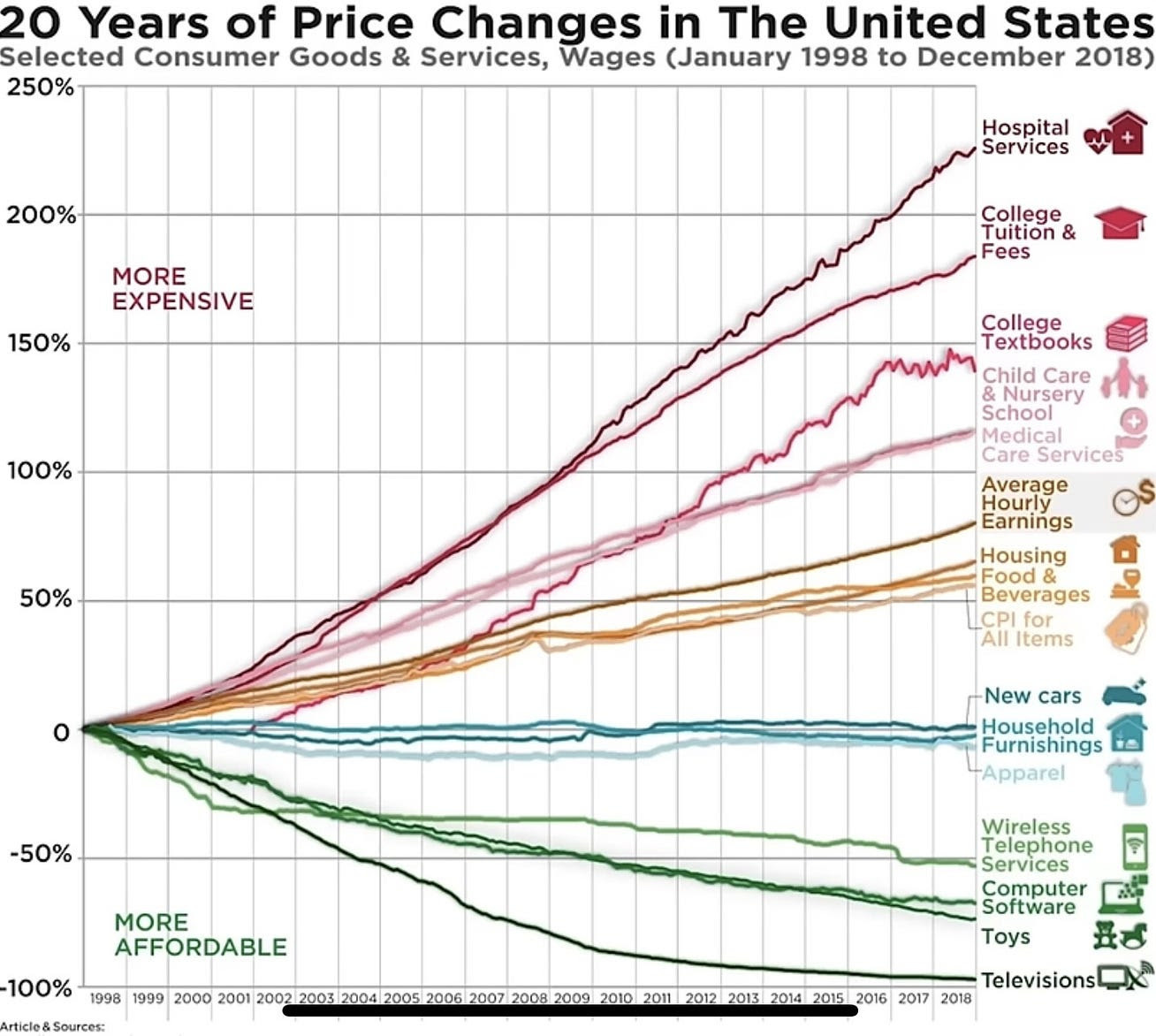

Government intervention tends to lead to higher prices. In April, California passed a $20 minimum wage for fast food workers up from $16 previously. The result is the consumer is paying for it at the restaurants through higher prices. Chipotle (CMG) said in an investor call Wednesday that prices at its nearly 500 California restaurants climbed 6% to 7% during the first week of April compared with last year, playing out across its menu. In Los Angeles on a recent April afternoon, a usual $16 meal at the Chick-fil-A in Hollywood, Calif., now costs $20. The price for a spicy chicken sandwich at that location had gone up to $7.09 from $6.29, or 13%, since mid-February. Mike Alfred posted “When I was in California for the Nuggets game on Thursday, we stopped at Chipotle. The same double steak bowl I get for $17 in Nevada is now $39 in California.” This was from a note I wrote on 1/25/24. I love the All-In podcast and thought David Friedberg (15-minute mark) showed an impactful chart of how the government “assistance” backfires. Note the things in the chart that are up the most in price tend to be industries with more government intervention. When free markets can work, innovation, technology, and efficiencies are gained, and prices have come down in most cases. Friedberg spoke about government intervention and wealth redistribution. Friedberg said, “The market role the government plays causes inflation, causes degradation in economic opportunity, economic mobility, and prosperity for most people.

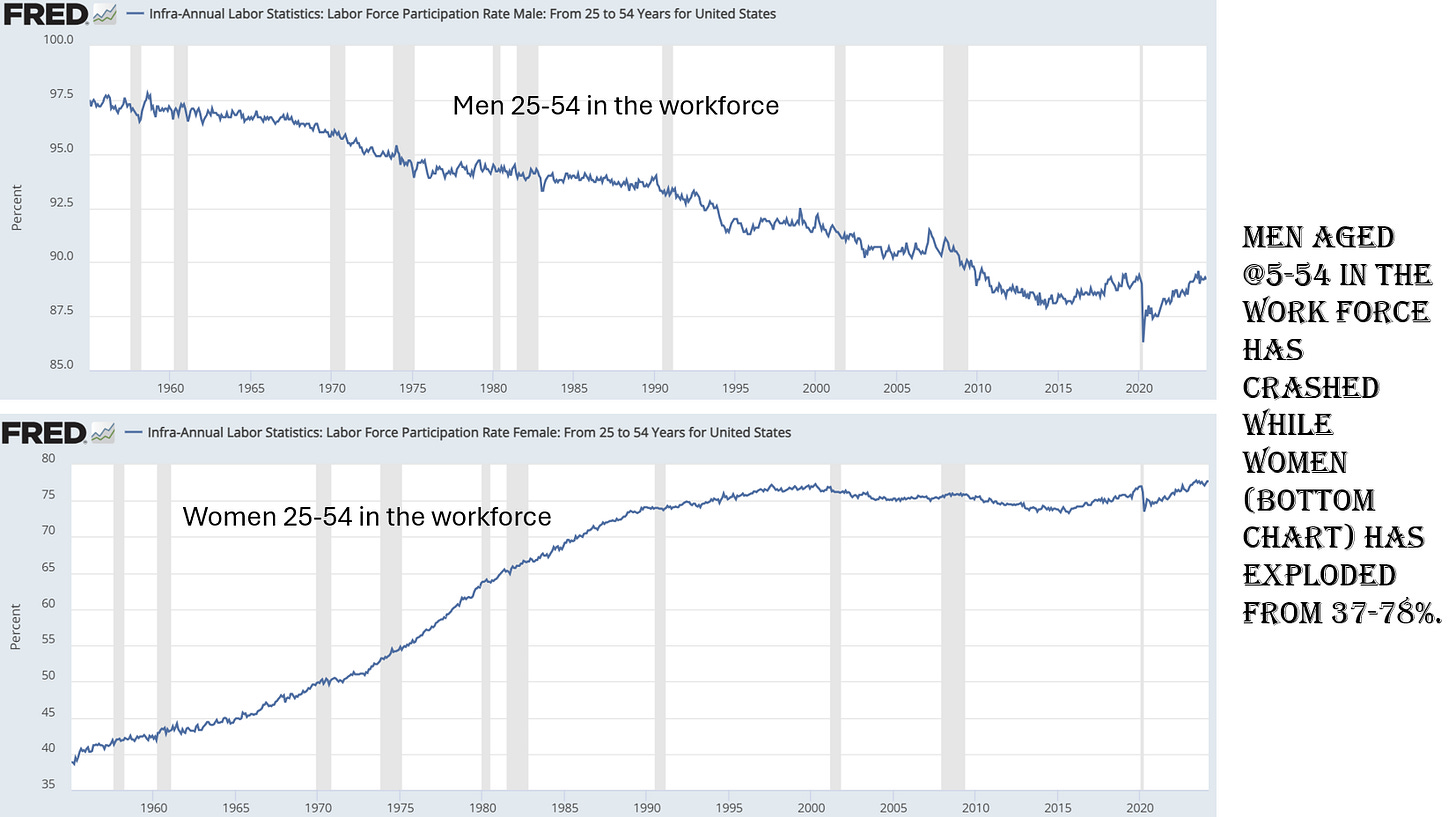

I found this article entitled, “Why so many men in the US have stopped working,” to be interesting and concerning. In the early 1950s, as many as 96% of prime working-age American men, who were between the ages of 25 and 54, had jobs. Due to a mix of factors, from the effects of recessions to those of globalization, only about 86% do today, below the OECD average of other developed countries as of 2022. Since the 1950s, whenever the US economy fell into a recession, the rate of working men tended to suffer a lasting blow.

When the economy entered a recession in 1953, the share of prime-age men with jobs dropped from 96% to 92.8% and never fully recovered to the pre-recession level. This pattern repeated in many of the recessions that followed. During the Great Recession, the prime-age male employment rate fell from 88% to 80.6% — and has never since reached above 86.7%. The pandemic recession may prove to be an exception: After falling as low as 78% in 2020, the rate has nearly recovered to its pre-pandemic level.

Great Fortune article entitled, “Big Tech and billionaires suddenly can’t resist the lure of South Florida, and while New York can ‘afford to lose some Citadels, it has to learn the lesson.’” The article goes into detail on the moves and cites Citadel, JPM, Microsoft, Amazon, Apple, Ken Griffin, Bezos and others. The EIG tracks states' economic dynamism', which means firm growth rates, startup rates, the number of entrepreneurs per capita, worker churn, and labor force participation rates. By this measure, New York has been sinking—down from a score of 35.9 in 2000 to 23.4 in 2024—while Florida's nationwide ranking has conversely jumped from seventh place to fifth. "Population growth and economic growth feed on each other so as New York has deepened its decline, its relative attractiveness has diminished. Florida has continued to grow, bringing more workers and capital investment," Fikri added.

This WSJ Opinion Piece is entitled, “The Media Say Crime Is Going Down. Don’t Believe It,” and showcased some statistics that surprised me. As you know, I have been critical of soft on crime policies, woke DAs who refuse to prosecute career criminals and policies that result in no consequences for bad acts. However, I did report that some crimes are coming down recently. Americans think crime is on the rise, but the media keep telling them they’re wrong. A Gallup survey last year found that 92% of Republicans and 58% of Democrats thought crime was increasing. A February Rasmussen Reports survey found that 61% of likely voters say violent crime in the U.S. is getting worse, while only 13% think it’s getting better. Journalists purport to refute this by citing official crime statistics showing a downward trend. Americans aren’t mistaken. News reports fail to take into account that many victims aren’t reporting crimes to the police, especially since the pandemic. The U.S. has two measures of crime. The Federal Bureau of Investigation’s Uniform Crime Reporting program counts the number of crimes reported to police every year. The Bureau of Justice Statistics, in its National Crime Victimization Survey, asks some 240,000 people a year whether they have been victims of a crime. The two measures have diverged since 2020: The FBI has been reporting less crime, while more people say they have been victims. The divergence is due to several reasons. In 2022, 31% of police departments nationwide, including Los Angeles and New York, didn’t report crime data to the FBI. In addition, in cities from Baltimore to Nashville, Tenn., the FBI is undercounting crimes those jurisdictions reported. A concerning article, but at least sheds light on the topic of crime.

Israel

New York City’s Jewish Population Under ‘Dark Cloud’ as Tensions Rise

New York City is home to an estimated 944,000 Jewish residents—more than any place outside of Israel. In interviews, many Jewish people who once felt comfortable in the city said they now wrestle with feelings of insecurity, and in some cases play down their religious identity.

Welcome to the new America where an American flag results in violence.

Wait until you get a load of this one. Northwestern has agreed to offer five full-ride scholarships for Palestinian students and two guaranteed faculty jobs for Palestinian professors. Rewarding bad behavior does not deter it.

Outrage as drag queen leads young kids in ‘Free Palestine’ chant: ‘Wrong on every level’

We wonder why young Americans have so much hate. They are indoctrinated at a young age in schools. Why should little kids be at a “Queer Storytime for Palestine” and be asked to chant, “Free Palestine?”

“I am a UCLA student…my class is over there. I want to use THAT entrance. Let me go in.” This is absolutely DISGUSTING. Another school off the list. You must watch this video. Also, protestors should not be allowed to cover their faces. There should be a list of all the protestors and any real firm should have them on a DO NOT HIRE list. UCLA protests turn violent as fights break out and firecrackers explode in ‘tent city’

Dozens arrested as NYPD cops dramatically storm Columbia campus to clear out anti-Israel mob

300 arrested at Columbia. Are they expelled? Deported if not Americans?

The University of Florida continues to get it right. Check out the statement.

“[UF] is not a daycare, and we do not treat protesters like children—they knew the rules, they broke the rules, and they’ll face the consequences.”

Other Headlines

Morgan Stanley banker sees 10 to 15 more tech IPOs in 2024, and a ‘better year’ in 2025

Very BIG news for the industry. The big cannabis ETF, MSOS went up 25% post news. Of note, after the big rally, MSOS was -15% on Wednesday.

Billionaire Investor Bill Ackman Has 100% of $11 Billion Portfolio in Just 8 Stocks

Shares of two big online education stocks -10%+ as students use ChatGPT

Starbucks shares sink 12% as coffee chain slashes 2024 forecast

Samsung Electronics’ operating profit jumps 933% in first quarter

Tesla jumps 11% after passing key hurdle to roll out full self-driving in China

McDonald’s earnings miss estimates as diners pull back, Middle East boycotts

Philips shares rocket 46% as firm settles U.S. respiratory device case

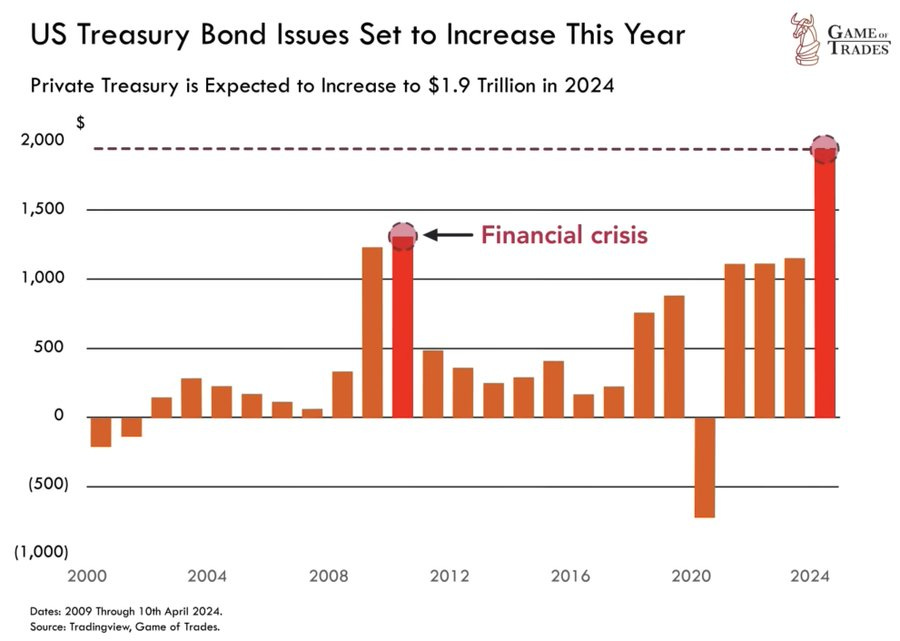

Treasury bond issuance in 2024 is expected to hit $1.9 TRILLION

Folks, we don’t have a revenue problem, we have a spending problem. Note the US is running massive deficits and many of the highest tax states are as well. Florida has no state tax and the economy is BOOMING.

CNN Poll: Trump maintains lead over Biden in 2024 matchup as views on their presidencies diverge

Assessing Biden’s time in office so far, 61% say his presidency thus far has been a failure, while 39% say it’s been a success.

Trump Meets DeSantis Seeking to Tap Ex-Rival’s Donor Connections

As of April 21, Trump had just $6.8 million in the accounts he’s been using to fund his lawyers.

Lawyers for Hunter Biden plan to sue Fox News 'imminently'

Action is pending because of Fox’s alleged "conspiracy and subsequent actions to defame Mr. Biden and paint him in a false light, the unlicensed commercial exploitation of his image, name, and likeness, and the unlawful publication of hacked intimate images of him.” We are talking about a former crack addict who posed nude with prostitutes while holding a gun he obtained illegally. Had an affair with his dead brother’s wife. He had a baby during an affair with an exotic dancer and tried not to acknowledge it was his child, as he had “no recollection” of the encounter until DNA tests proved otherwise. Hunter was kicked out of the military for cocaine use. He lied about the laptop not being his when indeed everything on the laptop showed otherwise. Evaded approximately $1.5mm in taxes and the list continues. He took millions from China, Russia and Ukraine….He feels Fox painted him in a bad light? Maybe be a better person and hold yourself to a higher standard. The NY Times outlined Hunter’s issues is this article.

Kristi Noem ‘had a shot’ at Trump VP slot before dog-killing boast

I thought Noem would be the VP candidate. That is no longer on the table after her horrible admission about killing a 14 month old dog that she deemed “useless” for hunter and was a danger to chickens.

Photo shows disturbing moment bully knocks NYC grandma unconscious in vicious sneak attack

NY to require internet providers to charge low-income residents $15 for broadband

If you can say these 6 phrases with confidence, you live a happier, more hopeful life than most

Young Americans’ wealth grew by nearly 50% over the last 4 years—it’s not just from buying homes

Helicopter operator’s flights to East End cost up to $1,050. I have taken various Hampton Jitney trips over the years maybe 150 times. I would not pay an extra $200+ to take a luxury service. I would take an Uber.

AstraZeneca admits its Covid vaccine can cause rare side effect in court documents for first time

Pharmaceutical giant being sued in class action over claims its vaccine caused death and serious injury in dozens of cases.

I am shocked we are over two years into this war and the devastation on both sides. I thought Russia would run over Ukraine in a few weeks.

Real Estate

Great article outlining the wealthiest neighborhoods in the US and the overwhelming majority are in Florida. The ritzy Miami-area neighborhood of Coral Gables has replaced regions in California and New York for the most expensive homes in the United States. Since the pandemic, much has been made of the exodus from those Democrat-controlled states to Florida and Texas but the Sunshine State appears to have lapped the field, according to Zillow data. Seven of the ten most expensive neighborhoods in America are now in Florida, with one Coral Gables' Gables Estates topping the list. The average property in the Gables Estates' neighborhood runs around $19.14million. In February 2020, the last month before America's pandemic shutdown, California (six) and New York City (two) took up eight of the top ten spots. California is now down to three - all of which are in Beverly Hills and Malibu - and New York City no longer appears. Joining Gables Estates in the Florida stable of neighborhoods needing serious cash to move in are: Naples' Port Royal ($16.49 million), Coral Gables' Old Cutler Bay ($10.22M), Miami Beach's Rivo Alto Island ($9.1M), Jupiter's Bear's Club ($8.99M), Naples' Aqualane Shore ($8.88M) and Miami Beach's San Marino Island ($8.84M). What is the lesson here? Policies matter? Safety, crime, taxes, COVID mandates/lockdowns, woke teachings, taxes, cost of living… all play a role and the wealthiest individuals have options.

Blackstone sells NYC office building at a shocking $420M 'haircut.' 1740 Broadway sold for $185M. Blackstone paid $605M in 2014 and millions on renovations during their ownership. In another sale at a big discount, the Holiday Inn Express in DC sold at an 80% discount to the debt owed on the building. The lender was the only bidder and was owed $83mm. The 247 room hotel opened in December 2022 and sold for $18.5mm. Some of the most prominent R/E investors in the world are losing properties each month given the carnage. In San Francisco, the availability (vacancy+sub let) rate in the office market is now approaching 37%. This article outlines the Flatiron District in Manhattan and all the empty storefronts. I lived in this part of the city and LOVED it.

Foreclosures are taking place everyday in hard hit cities such as LA, San Fran, Chicago, NYC as well as cities seeing growth like Miami. Even newer buildings finished in the last few years are coming under pressure. Higher for longer on rates will continue to create havoc for developers and owners of real estate. Also, lenders are not as aggressive as they were previously. The tallest tower in Brooklyn is facing foreclosure. The asset includes 398 rentals and 143 condos as well as 130k square feet of retail. In 2019, the sponsor took out a $664mm debt package to construct the building. Larry Silverstein's debt platform provided a $240mm mezz loan. Since then, Silverstein also bought the asset's senior $424mm mortgage. All of the loans are in default. The foreclosure auction is scheduled for June 10th. This Miami office building is in a foreclosure lawsuit. The Gateway at Wynwood. 200K SF office space; 25K SF retail; and 490 parking spaces. Unpaid balance of ~$99mm. Loan basis is ~$440 PSF on the office and retail SF. Asset was constructed in 2021. ~80K SF appears to be available for lease at an asking price of $70 triple net. This WSJ article is entitled, “Office-Loan Defaults Near Historic Levels With Billions on the Line,” and outlines $38bn+ of office buildings threatened by default. In the next 12 months, $18 billion of office loans converted into securities will mature—more than double the volume in 2023. Moody’s projects that 73% of loans will be difficult to refinance because of the properties’ income, debt levels, vacancy and approaching lease expirations.

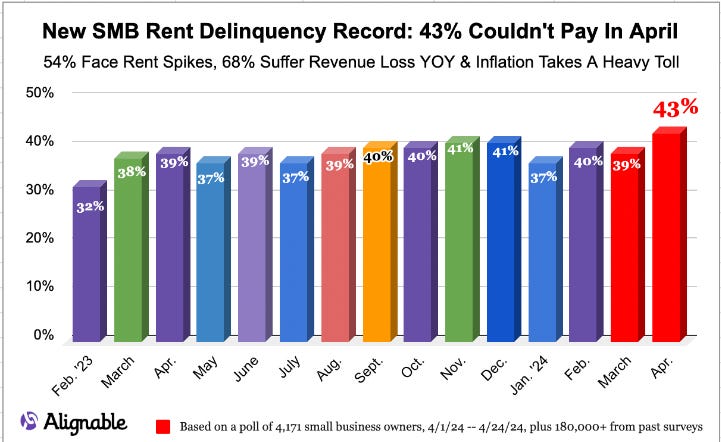

Concerning chart showing small business owner rent delinquency at 43%. That's up four percentage points since March, also creating the largest month-to-month surge in rent delinquency in over a year. April marks the worst month For SMB rent delinquency In 3 years. Several economic challenges have culminated in April, leaving small business owners with the highest national rent delinquency rate in over three years.

I have written extensively about the sell off in Chinese R/E developer stocks. However, the developers staged strong rally after more major cities removed home purchase restrictions. In HK, China Aoyuan surged nearly 30%, CIFI up more than 18%, Sunac China up 15%. In A-shares market, real estate is best-performing sector, with index tracking the sector surging over 4%. Despite the rally, these stocks are down sharply. Aoyuan is -99% in the last 5 years and -38% YTD despite the recent move higher. CIFI is -93% over 5 years.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #678 ©Copyright 2024 Written By Eric Rosen.