Opening Comments

My last note was about appreciating the moment and recognizing the mistakes I made by not enjoying wins and good times. My note resulted in some amazing comments. One stood out from a writer that I respect, Ted Merz: “This was a wonderful essay about your childhood.” If you missed the piece due to the holidays, it is worth reading the title section. The most opened links were CNN’s year-in-review quiz (I got 18 out of 20) and the UFO story. Happy New Year to all my RR readers and your families.

Friday, I am having a group of 3i members to Replay, the pickle/padel sports club that I invested in. We will have a King of the Court Tournament and it will be a blast. There will be coaching for beginners as well. We expect about 20 members and then 40 for lunch.

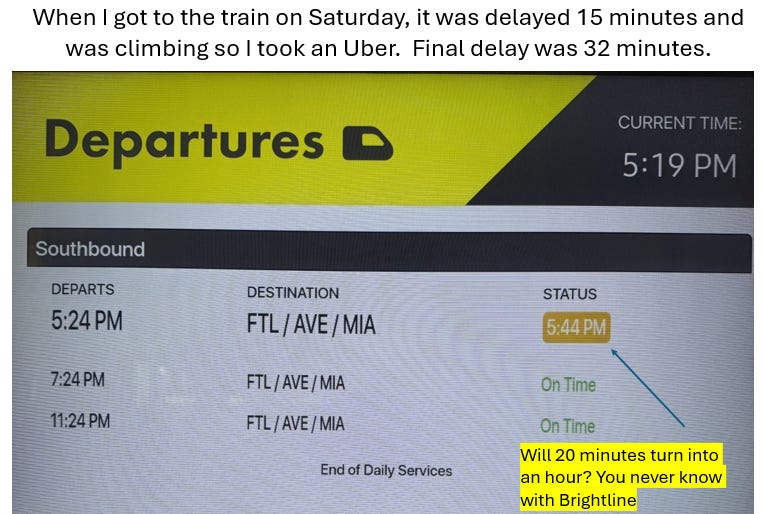

Brightline-Not so Bright

I want to make an emphatic statement about Brightline; the new train that connects Miami to Orlando. The idea is genius. Sadly, it is run by people who do not love their customers. On a positive note, the trains and stations are clean and new and when it works, it is great. That is where the positives end. What started as a great experience for me to get to Miami has turned into a nightmare. Many of the trains are delayed for hours or canceled. The train hits cars and people at a shocking rate (not Brightline’s fault). According to reports, from September 2023-June of 2024, 34 people were killed by Brightline trains between Miami and Orlando. Brightline generally credits 50% of your fare when the train is late. Wait. I was not at fault and I was harmed, yet they don’t give me my money back? The number of times I’ve gone to the station only to encounter multi-hour delays is concerning. Then I need to figure out alternate transportation and only get 50% of my money in the form of a credit that expires in 90 days. This has happened to me countless times including last Sunday night. The train was delayed (shocker) and the delay kept growing so I took an Uber. Thankfully, I had not bought a ticket yet, so I left the station without too much hassle. Brightline management: You need to reconsider your idiotic policies that are not consumer-friendly. You spent billions on this rail system and I do not see how it works out well for you. Give yourself a chance with better customer service. This week, I sent my daughter via Uber instead of on your crappy and overpriced service, as I cannot count on it delivering her on time. Also of note, the cost of your train was just $10 less than an Uber. The Brightline reports an industry-leading 94% on-time record. I can assure you that has not been my experience.

One clarification point. I sent a nasty note to Brightline and they issued me additional credit on New Year’s Eve. This does not make up for the countless errors they made but at least they showed some willingness to attempt to satisfy the customer. A small step in the right direction.

My bet with Chris Burch is in the books. I WON! The Russell was +10% on the year and Chris needed it to be +17% or higher to win. Dinner on him. Readers: Give me ideas for the best of the best in Miami. He is paying, so I will bring my appetite and leave my wallet at home. Michelin Star, here we come.

Markets

Treasury Bond Market Concerns

My 2025 Predictions-Markets and Beyond

Rising Credit Card Charge Offs

Upper East Side Restaurants are Hot?

High-End Boca Chart Paints the Picture

Largest Ressie Deals in LA in 2024

CMBS Delinquency Rates Rising

$520mm Lot sold in Miami on Brickell Bay Drive

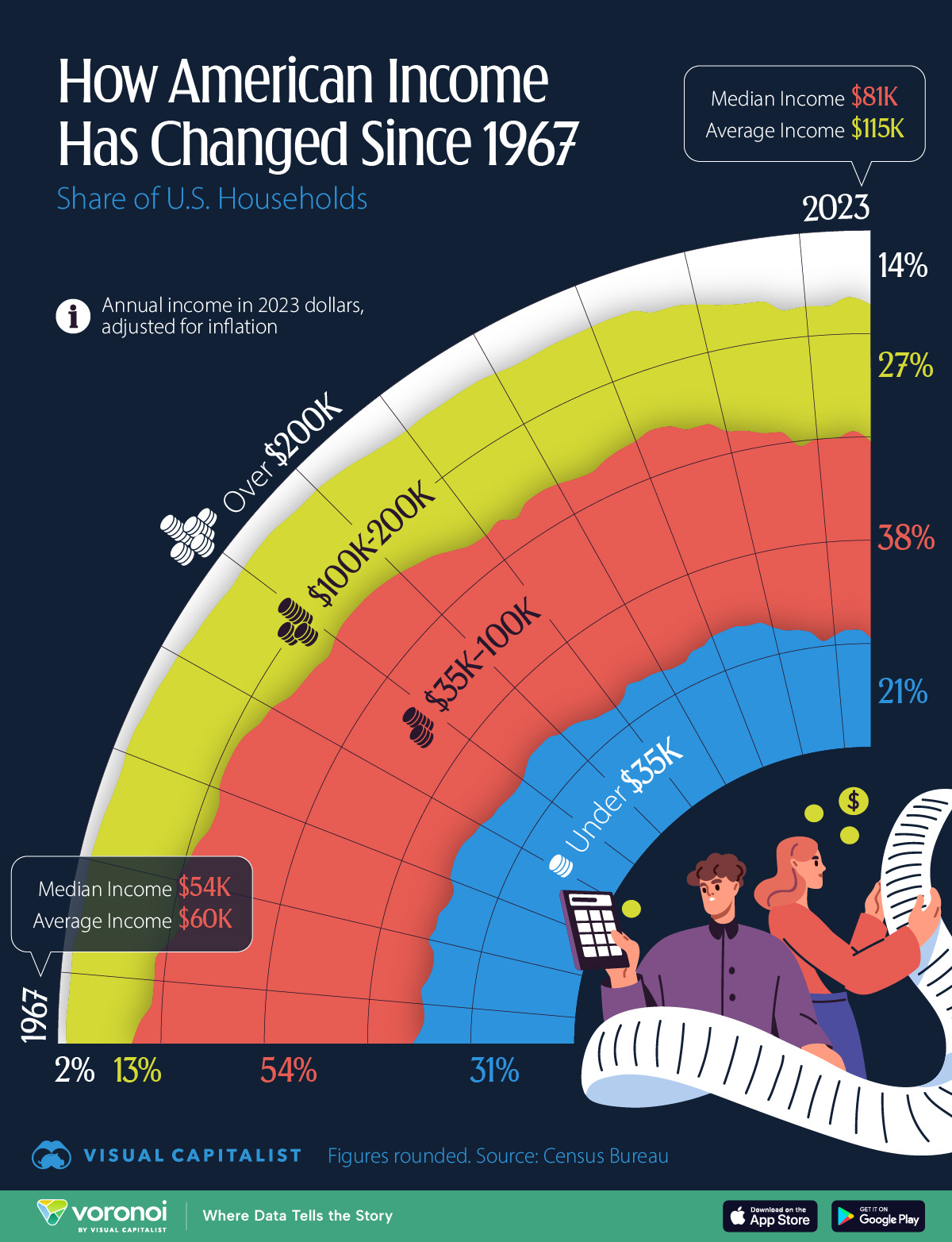

Picture of the Day-Income Changes Since 1967

This chart tracks the share of U.S. households by annual income bracket from 1967 to 2023. All annual income is in 2023 dollars, adjusted for inflation but not for cost-of-living differences. Data is sourced from the Census Bureau, published 2024. Note that median income is $81k. Another chart from Visual Capitalist.

Mayan Marvels and Decapitated Winners

The Rosen family had an amazing day going to the Chichen Itza Mayan Ruins 2 hours from Mayakoba. Chichen Itza is one of the New Seven Wonders of the World. The Mayan Tribe was incredibly advanced on many fronts and what they accomplished almost 2,000 years ago is impressive. Chichen Itza was one of the largest Mayan cities and was built between AD 600-900.

Our tour guide, Marco, was the single most impressive guide I have had for any excursion in my life. He was an encyclopedia of knowledge on any topic related to Mayan history. He has done 5,000 tours of Chichen Itza, so he knows it like the back of his hand.

“The main ruin, the Pyramid of Kukulkan, meaning Feathered Serpent, stands 30 meters tall. This limestone building houses two smaller versions. The Mayans built these temples every 52 years. Sadly, they do not allow tourists to touch the ruins or go inside. What is remarkable is the limestone quarry was 3 miles from the ultimate location. They used complex systems to move tons of rocks. After rain, workers at the quarry would insert ears of corn into drilled holes; as the corn expanded, it caused the rock to crack. This particular ruin showcases an extraordinary feat of engineering.

The Mayans were experts in creating sound systems and echo chambers. Clapping near the pyramid produces an echo that, in certain spots, resembles the sound of a chirping bird. If you stand equidistant from the top opening of the structure and clap, you hear a perfect echo up to 1.5 miles away. To think they did this nearly 2000 years ago is remarkable.

Even more impressive, the Mayans build this structure to create a serpent from shadows during the Equinox that shows a new section of the snake every 13 minutes. Sadly, it was not happening when we were there, but tens of thousands come to witness it. An Equinox is when the day has the same duration as the night, a phenomenon that occurs two days a year, on March 21st and September 21st. Many ancient civilizations including other Mayan cities like Dzibilchaltun have events related to these dates. The effect lasts a few minutes, as the sun casts a shadow onto the stairway formed by the nine platforms, creating the appearance of a serpent’s body that seems to move as the sun travels across the sky. The video of the equinox can be seen here. AMAZING. If you gave me all the modern technology in the world, I could not build this today.

The largest Mayan sports field is housed here. It is 120 meters long and the game is called Pok Ta Pok – onomatopoeia for the sound the rubber ball made when the game was played. The ball was made from tree resin. The game was a combination of ping pong, tennis, soccer, rugby, baseball, and basketball. Once your team got the ball (6 to 9.5 lbs) down the field to the serpent head (88 meters from serpent head to serpent head), the captain was given a shot to hit the heavy ball through a ring. The game was over when the captain got the ball through the ring.

However, winning came at a cost. The winning captain was beheaded by the losing captain, but the winning captain’s children received a higher place in society. Also, the winning captain had a totem of his liking made to commemorate the win. I love my kids, but I am not willing to be beheaded for them. Sorry Jack and Julia, Daddy only loves you so much.

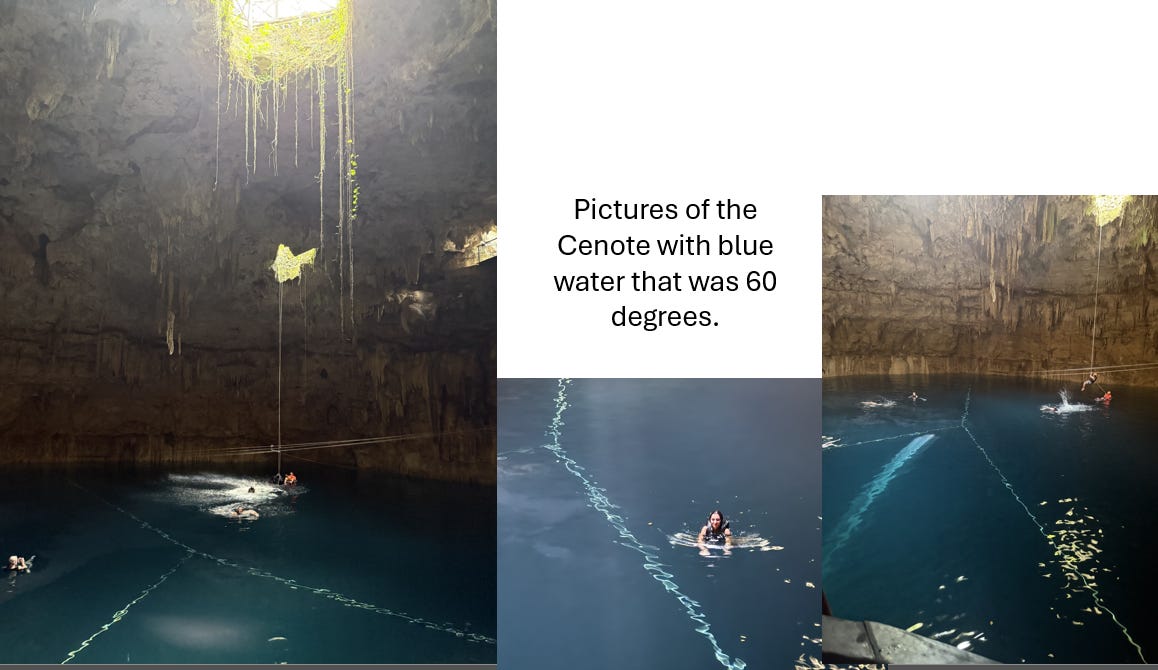

I learned a great deal from Marco and the Rosen family left beaming. From Chichen Itza, we went to an underground spring (cenote) to swim, zip line, and dive off platforms in the chilly blue water for yet another adventure. It was truly a memorable day.

Quick Bites

Stocks have performed well over the past two years, as shown in the first chart. The two year gain saw the S&P +53%, the best since the 66% in 1997/1998. 2024 saw AI-related enthusiasm and the potential for productivity gains push major averages despite higher than anticipated interest rates. The last time just 10 stocks accounted for 38% of total market cap was just before the Great Depression (2md chart Goldman). Many of the big tech companies hit new highs. Fed rate cuts helped in the 4th quarter, and Trump’s win drove equities and crypto higher. Bank stocks rallied sharply post the election with JPM (+41% YTD) and GS (+48%). However, December has brought some market weakness, and long-term rates remain high despite the Fed’s actions. The Dow ended the month down 5.3%. The S&P fell by 2.5%, while the Nasdaq grinded out a gain of 0.5%.

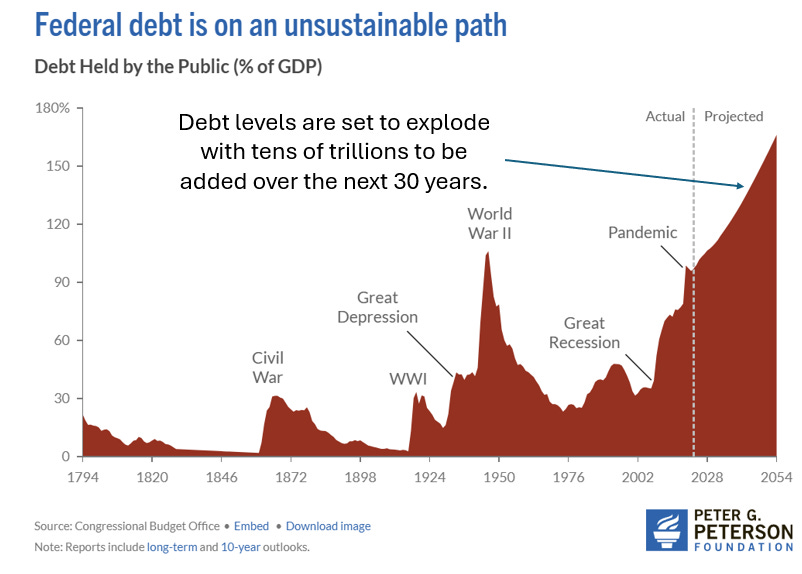

This is a concerning article from Bloomberg. “Treasury’s Elite Bond Dealers Will Struggle to Handle $50 Trillion Debt.” The piece suggests more experts are worried about the market as the size of the treasury market has exploded, the number of primary dealers has halved, and the regulatory environment has become more challenging. “Issuance has gone up almost threefold in the last 10 years and the anticipation is for it to close to double to $50 trillion outstanding in the next 10 years, whereas dealer balance sheets haven’t grown at that magnitude,” said Casey Spezzano, head of US customer sales and trading at primary markets dealer NatWest Markets. “I worry about the Treasury market,” said John Madziyire, senior portfolio manager at Vanguard during a recent interview. “We’re now relying on principal trading firms to do a lot of the intermediation, but they’re more short term,” and in bouts of market stress, they step back as “they’re not obliged to make prices in those periods.” With the US running $2 trillion deficits indefinitely, increased issuance is likely to put continued pressure on Treasury bond markets. “There is no silver bullet,” according to Darrell Duffie, a professor of finance at Stanford University, who spoke at a Treasury market conference held at the New York Fed in September. “No single reform — in progress or anticipated — is going to solve this problem.”

US consumers have been incredibly resilient. This Zero Hedge article outlines the jump in credit card defaults. Card lenders wrote off $46bn in delinquent loans through 9/24, which is a 50% increase from the prior year. The head of Moody's Analytics, Mark Zandi, noted, "High-income households are fine, but the bottom third of US consumers are tapped out," adding, "Their savings rate right now is zero." Is this sharp increase in default a sign of more challenges in 2025?

I thought it might be fun to have some thoughts on different topics for 2025. I wouldn’t call them predictions, but rather outcomes that seem more likely than the market currently anticipates. This is Mike Cembalest (JPM) 2025 outlook. Just came out at 9 am on 1/1. Yet to read it.

Musk will outlive his welcome in Trump’s orbit-Yes, Musk is brilliant, but I am not convinced the antics will be well received for long by the man with the biggest ego in town.

Bitcoin can hit $150k+ in 2025-I think there will be euphoria with Trump and his pro-crypto team. I do fear the impact of the Willow chip in the medium term. I will likely cut my BTC position in half during 2025.

10-Year Treasury could hit 5%-The yield was up almost 100bps since the Fed started cutting and finished +98bps from the September 17th low with a current yield of 4.57%. Deficits will not shrink, and I am not convinced Trump’s policies will lead to sharply lower deficits. If you see a 5% 10-year, I feel the highly valued stocks are susceptible to underperform.

There will be no more than two rate cuts in 2025, and I won’t be surprised if there is only one cut.

We will hear more talk of commercial R/E troubles due to higher rates.

The S&P and Nasdaq will not come close to the returns generated in 2023/24

2024 S&P return was +24% and Nasdaq was +30%.

DOGE will come up with some big ideas and Congress will not adopt as many as I would like. DOGE will be successful in exposing waste and calling out inefficiency but will not get anywhere near $2 trillion in savings. I hope for $500mm.

The conflict in the Middle East will die down with Trump’s involvement. Couple that with slowing China and Trump’s “Drill baby Drill” slogan and you can see oil trade sub $50 in 2025.

The Russia/Ukraine war will end or be at a much different scale within months.

A combination of Israel and the US will take out Iran’s nuclear capabilities in 2025. This may be just wishful thinking on my part.

Trump should demand an investigation into the Biden family and the media and social media powerhouses will yet again have egg on their faces.

The Trump administration will not be able to deport nearly as many illegal immigrants as promised.

My base case is the DEI and Green Wave that pushed crazy outcomes for hiring, college acceptances, crime policies, border, vilification of oil/energy/nuclear and more will continue to die, especially with Trump in office.

I cannot believe I am writing this about the Upper East Side (UES) restaurant scene. I have always considered the UES a culinary wasteland of epic proportions. I lived in that area for seven miserable years and rarely had a good meal in the area. The Bloomberg article, “Is the Upper East Side New York’s Hottest Restaurant Neighborhood,” is an eye opener. NO, I do not believe the UES is the hottest restaurant neighborhood, but I do believe it has seen a sharp improvement in recent years. The West Village is my favorite neighborhood for dining. The past 12 months have been especially gratifying for diner-outers. Late last year, a revamped new Michelin one star, Café Boulud moved to 63rd Street, on the corner of Park. In July, Le Veau D’Or, one of those tired old French bistros we’d been warned about, reopened under new stewardship to great fanfare on 60th Street, off Lexington. And then there’s the recently launched Lungi, with its superbly executed Sri Lankan and South Indian curries, over on First Avenue; the buzzy tavern Nightly’s on Second Avenue; and next door, the Keys & Heels speakeasy. Up next: chef Harold Moore’s reincarnation of Commerce Restaurant, his late and much lamented West Village eatery, on Lexington and 70th Street. It will be joined by another name familiar to West Villagers, American Bar, which will open two blocks away. Now comes one of area’s most anticipated openings, Chez Fifi. The excitement is not least because of its owners: David and Josh Foulquier, the brothers behind the two-Michelin-star Sushi Noz, one of the country’s preeminent spots for high-end raw fish. I actually want to try some restaurants on the Upper East Side. That is something I have never uttered in my life.

Election/Politics

President Jimmy Carter died at 100 years old. I attached two articles to share both sides of his legacy. He served his country and should be remembered for his service. However, he is not remembered as a strong president and his 1980 loss to Reagan (489 to 49 electoral votes) is a major statement.

Trump tests influence over GOP with Johnson Speakership vote

GOP lawmakers demand release of $17M ‘congressional sexual slush fund list’

Taxpayers funded $17mm for cases of workplace disputes including sexual harassment. The names of those who used the money should be disclosed.

'Farms will come to a stop': Farmer warns of soaring food prices and shortages under Trump

This is a farmer’s take if there are mass deportations.

The true damage done to America due to the idiotic open border policy won’t be known for years. Counties without strong borders lead to chaos. Western Europe and the US are two examples.

Xi Jinping says no one can stop China’s ‘reunification’ with Taiwan

Germany accuses Elon Musk of trying to influence its election

Israel/Middle East

Israel kills Hamas commander who led heinous Oct. 7 attack on kibbutz that left dozens dead

Mossad chief believes Israel should target Iran to get at Houthis; PM disagrees

I believe there are many reasons to target Iran (the leadership hates Jews, Israel, the West, they fund terrorists, they have or will have nukes, they treat their people horribly and if given the chance, they would eviscerate Israel and America).

9/11 terrorists to be spared death penalty after judge shoots down Pentagon’s bid to nix plea deals

Other Headlines

‘Major incident’: China-backed hackers breached US Treasury workstations

Natural gas surges as much as 20% on expectations for colder-than-usual January on the East Coast

S&P 500’s 2024 Rally Shocked Forecasters Expecting It to Fizzle

After running people over, he started shooting. Ten dead and 30 injured.

Lunatic accused of shoving random commuter into path of NYC subway is charged with attempted murder

Another unprovoked subway attack in NYC. The victim is lucky to be alive as he fell under a train. The attacker had previously assaulted a police officer. Let me be crystal clear, if you attack a cop, you should not be out on the streets.

Human Smuggler Arrested in Texas for Kidnapping, Forced Labor

They told her no one goes to a bar to watch women’s sports. Jenny Nguyen proved them wrong

Class dismissed: Colleges expected to close as enrollment numbers tank

Rising prices, falling birthrates, woke teachings, difficulty finding jobs, pay for vocational work, and other factors are contributing. The cost of tuition plus room and board at the average four-year private college was $58.6k in 2024-25.

AI spots heart conditions before sufferers have symptoms

The medical breakthroughs over the next 10 years thanks to AI will be remarkable and should lead to extended life expectancy. Between finding diseases early and designer drugs, many people will be saved.

Rapid brain aging occurs at three distinct ages, scientists discover: Here’s how to slow it down

The article suggests it occurs at 57, 70, and 78. Diet can help.

Scientists Destroy 99% of Cancer Cells in Lab Using Vibrating Molecules

Good pictures in the link.

The human brain processes thoughts 5,000,000 times slower than the average internet connection

NYC congestion pricing set to start as planned Sunday after ruling in final lawsuit

Harrowing footage shows Gonzaga team plane, Delta jet near-miss on LAX runway

Real Estate

I have often written about South Florida real estate and how hot it has become. I left NYC in 2017 and moved to Boca Raton. My neighborhood is called Royal Palm. Check out the chart below. Since I moved down, the median and average is up 3 times – but remember, many of those are knockdowns (a $3-10mm lot would be turned into an $8-30mm+ house). In 2017, the highest price was $12.4mm for waterfront but today, a new interior home (no water or golf) can be that much. The most expensive in 2024 was $40mm for a knockdown on the intracoastal that turned into multiple homes. The low print in 2024 was $3mm for a 1960 tear down on an interior lot. Another slightly larger tear-down lot recently sold for $4 million. While total volume will be slightly lower than in 2021 during the pandemic frenzy, including properties under contract in 2024 brings us just below that level. The higher end properties in South Florida remain hot, from Miami to Jupiter. Condos at the Surf Club have sold for $6k/ foot recently, and Boca has seen condo sales approaching $2.5k/foot. Trump’s win is bringing wealth to Palm Beach, where many billionaires are searching for homes with limited new inventory. New builds in a good location are hard to find and the wealthy are willing to pay a premium for “move-in” condition.

CMBS Delinquency Rate Surges in December 2024, Office Hits All-Time High, Retail Sees Largest Respective Rate Increase. The Trepp CMBS Delinquency Rate rose once more in December 2024, with the overall rate increasing 17 basis points to 6.57%. The office delinquency rate rose 63 basis points in December to 11.01%, surpassing the 11% mark for the first time since Trepp began tracking delinquency rates in 2000. Prior to this, the highest the office delinquency rate had climbed was to 10.70%, reached in December 2012. There was north of $2 billion in office loans that became newly delinquent in December.

A waterfront site in Miami’s financial district is set to be sold for more than $500 million, marking the largest land transaction ever in the Florida city. Apartment Investment & Management Co. agreed to sell 1001 Brickell Bay Drive and 1111 Brickell Bay Drive to an entity managed by Erik Rutter and David Weitz, the founders of Oak Row Equities. The combined 4.25-acre (1.7 hectare) properties are in the heart of a neighborhood that has boomed in recent years, after an influx of financial companies and new residents. The buyers will pay $520 million, Aimco said in a filing, with the potential for the purchase price to increase to $540 million depending on certain financing arrangements. That would top the record $363 million sale of a development site to billionaire Ken Griffin in 2022.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #749 ©Copyright 2024 Written By Eric Rosen.