My last note was the review of the Jean Georges Midtown stunner, Four Twenty Five on Park Avenue. The most opened links were the article on the elite moving on from the Hamptons and where they are going instead and the 10 least healthy fast food chains.

I moved to Florida eight years ago this coming August and many of my NYC friends laughed and told me it was a bad idea. I haven’t regretted leaving Manhattan for a second, and with Mamdani in the picture, it feels like an even better decision. Governor DeSantis put out a Tweet this week and it is clear Florida is doing a lot of things well:

Heavy rains hit the NY area on Tuesday, and this video of the flooded subway shows the impact of the storm. The 2.07” of rain in an hour made it the 2nd wettest hour ever recorded in NYC. The video of the NJ Honda dealer is insane.

Markets

Global Prices

BNPL Will Be Part of Your Credit Score

M&A Deal Flow Improving?

Second Home Market Weakness-Baby Boomers Aging Out

One Third of Major US Housing Markets Have Falling Prices

Manhattan & Miami HOT Rental Markets

Video of the Day-Silent Disco

I had never heard of a “Silent Disco.” Each participant wears wireless headphones and dances to the music but there is no audible music outside of the headphones. It is used at rooftop events, parks, and libraries with noise restrictions. It is brilliant. All I could hear on the video was the squeaking of shoes on the floor. The video is 30 seconds and worth a look.

Rise of the Robo Chef

I have written regularly about productivity gains over time and the impact of AI and robotics which will only speed up productivity in coming years. I am a big fan of the All-In Podcast, and last week, Travis Kalanick (Uber founder) was on discussing his new project (Lab 37) to better automate the restaurant industry. It will streamline kitchen operations and significantly improve both efficiency and cost.

The video is amazing and gives us a “taste” of the future of restaurants. You order online and the machine will custom make your food to your specifications and measure each input exactly. The machine takes out a lot of the cost of assembly. The cost of labor in a restaurant is 30-35% of revenue, but this machine brings it down to, s 7-10% of revenue. However, I did not find the price of this equipment anywhere.

Travis outlined the importance of end-to-end automation, and this machine seems to be an incredible breakthrough in taking out a great deal of labor and costs. The staff preps the food, puts the food in the machine, and then leaves. The machine assembles and packages the food with utensils and seals the bag to the tune of 300 bowls an hour. Then another machine takes the bag to the front of house to a locker and the courier will waive their app in front of the locker to open the door to get their delivery. This technology reduces mistakes and improves consistency. The technology is being deployed starting this quarter.

How does this impact real estate? Will there be more of these automated kitchens that require a much smaller footprint and reduce the need for space? Somewhere between 75% of restaurant orders are for delivery. I have many readers who own restaurants, and many are reducing footprints already given the proliferation of delivery relative to dine-in in fast and cast casual restaurants.

This example of automation is one of many that will be impacting the economy in coming years. The good news is it will make restaurants more efficient and arguably give a better experience to the customers. However, there will be significantly fewer employees required. There are approximately 12.3mm workers in restaurants across the US. Some estimates are as high as 15mm+ workers which would be approximately 10% of the US workforce.

This technology has major implications. If paired with automated delivery using self-driving cars or drones, it could benefit nearly everyone, though it will likely displace jobs. There are millions of drivers in the US in trucking, delivery services, UPS, FedEx, USPS, Amazon, Uber, Lyft, taxi… As self-driving and drone delivery technology improves, how many of those will be displaced, while efficiency for the companies who perform the tasks improves?

I am 55 years old and glad I am not coming out of college now. So many jobs will be replaced by AI or robotics. So much for flipping burgers as companies such as Lab 37 take off. Those jobs won’t be available soon!

Quick Bites

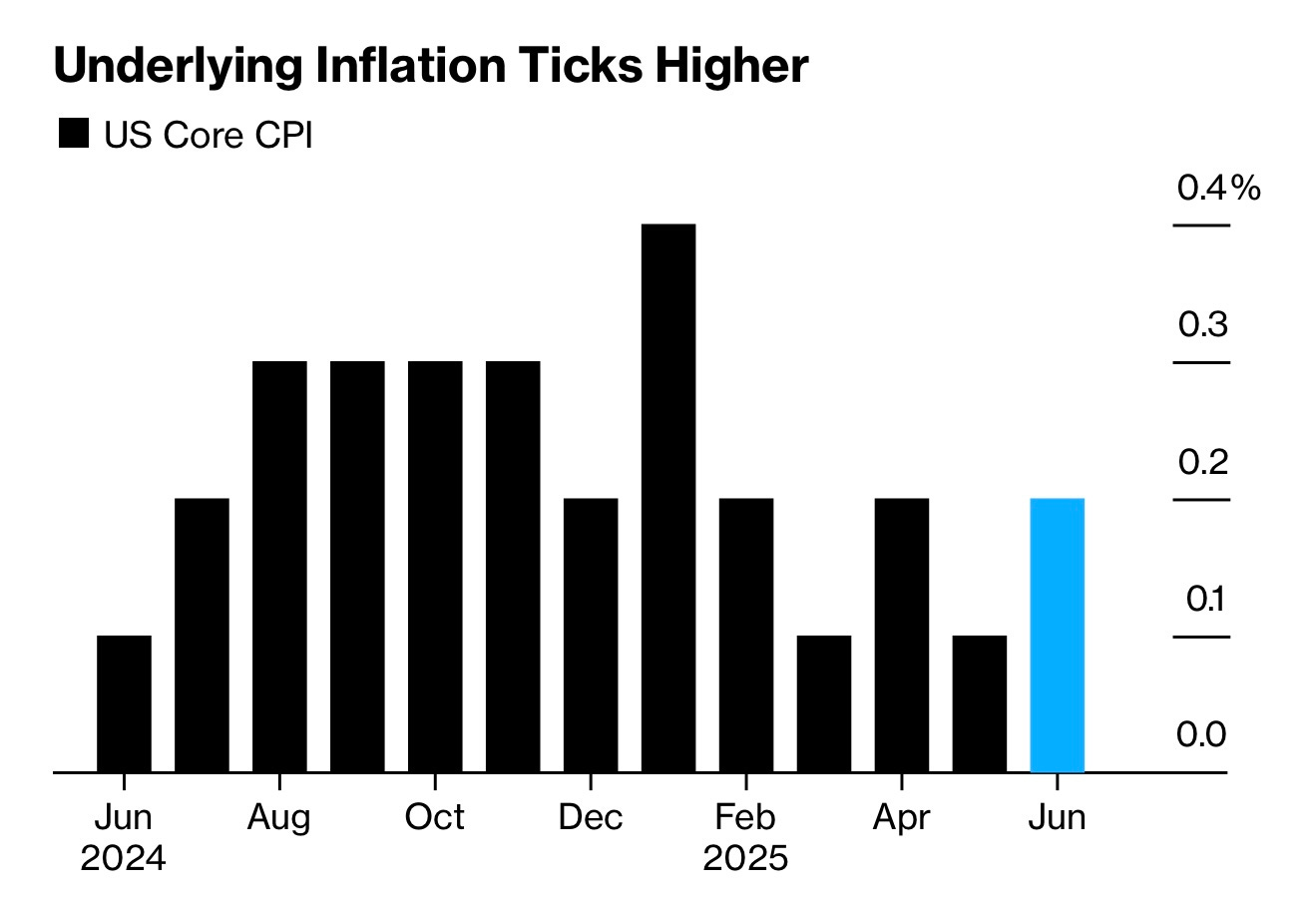

Despite negative tariff headlines over the weekend, stocks were higher Monday as investors believe Trump’s tariffs will not stick. They have seen this movie before and know that the starting point and ending point are very different when it comes to the Trump tariffs. On Tuesday, CPI came out at 2.7% *2.4% prior month), moving the annual rate to 2.9%, with some suggesting tariffs are starting to show in the data. Stocks sold off slightly to the CPI data and the uptick in rates. Due to CPI data, Treasuries sold off with the 10-year +5bps to 4.49% and the 30 year +6bps to 5.02%. The wholesale inflation number was unchanged (+.2% expected) in June which conflicted with the CPI data. The result of the new inflation data and rumors that Trump may fire Powell pushed the yields on 10- and 30-year Treasuries down 2-3bps. Wednesday, stocks were up slightly despite the Powell rumors after Trump denied the report. The 2nd chart is from Torsten Slok at Apollo and suggest the AI bubble today is bigger than the IT bubble in the 1990s.

Treasury Secretary Scott Bessent, in an interview on Bloomberg Surveillance on Tuesday, said that a "formal process" is already starting to identify a potential successor to Federal Reserve Chairman Jerome Powell. Trump has said he won’t appoint anyone as Fed Chairman who does not support rate cuts. Kevin Warsh is said to be a leading contender for the position, and he supports rate cuts. I feel Powell and Yellen got the “transitory” inflation call horribly wrong, causing trillions in damage. I am not a fan of either of them. However, I do feel Powell did a good job over the past 18 months or so. No, he would never be my pick as Fed Chairman. However, I want an independent Federal Reserve and do not want the President of the United States influencing the Fed. EVERY president wants lower rates.. Jamie Dimon also believes the Fed should maintain independence Given all the tariff uncertainty and new announcements on copper, EU, Canada… over the past week coupled with higher CPI on Tuesday, I am not of the belief that rates should be cut now. If inflation stays relatively in check, then in the fall, I will consider cuts. Remember, I was screaming that rates should be increased in 2021, and quantitative tightening should end. I wrote numerous reports on the topic to no avail and was proven correct. Also of note, just because the Fed cuts rates, do not expect to see 10–30-year Treasury yields fall. Since the Fed cut rates 100bps beginning in September of 2024, the 10-year Treasury yield is +83bps to 4.47% and 30-year Treasury yield is +105bps to 5.0%. We should be cutting deficits, not running them at 5-7% of GDP.

Great Deutsche Bank Research Institute piece “Mapping the World’s Prices.” Lots of great info in the link. Way too much in the research paper to summarize but there are great charts. I would take a few minutes a flip through it. The prices of most things you would have interest in knowing are outlined in the 58-page link.

In recent years, M&A and IPO volumes are down sharply. Obviously, the “Liberation Day” fiasco did not help related volumes due to the market volatility and uncertainty. However, JPM announced 2nd quarter earnings and there were some promising results on the banking side. Investment-banking fees climbed 7%, the bank said in a statement Tuesday, while analysts were expecting a 14% decline. Within investment banking, debt underwriting rose 12% and fees from advising on mergers and acquisitions climbed 8%, both bucking analyst expectations for a decline from a year ago. Equity-underwriting revenue fell 6%, while analysts expected a 29% drop. Even Citibank saw an 18% increase in banking revenue in the 2nd quarter. These are great signs that M&A is ticking up. Of note, Citi stock is +24% YTD after a long period of underperformance. Goldman and Morgan Stanley cited higher than expected trading revenues for the outperformance in the quarter.

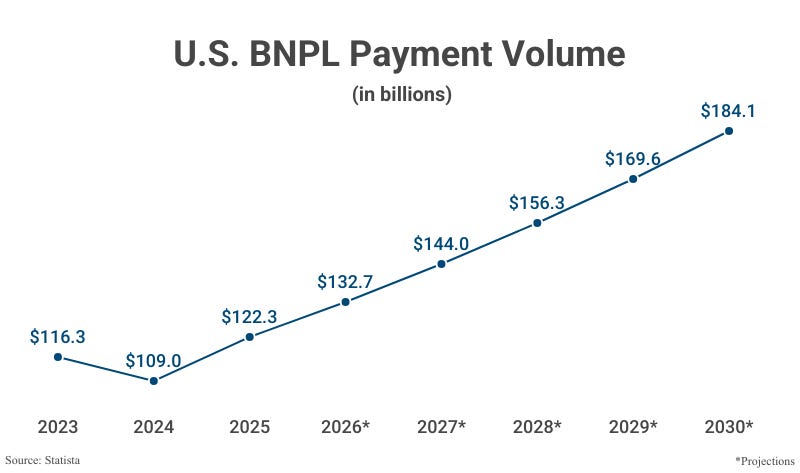

Anyone who reads the Rosen Report knows that I have been critical of Buy Now Pay Later (BNPL) programs. I am of the opinion that you only buy what you can afford, and buying a pair of UGG boots or a concert ticket to pay for it over months makes no sense. This article outlines concerns about BNPL. The buy now, pay later revolution that has taken America’s economy by storm could soon catalyze a credit "catastrophe," according to one expert. "My concern is that the carelessness, the lack of education is really going to cause a lot of harm to people unnecessarily," credit restoration expert and influencer Micah Smith told Fox News Digital. In June, major credit reporting firm FICO announced that it will begin incorporating "buy now, pay later" (BNPL) loan data into its credit scoring models, specifically with the introduction of FICO Score 10 BNPL and FICO Score 10 T BNPL. For consumers, this means credit scores will now be impacted by their BNPL habits. Payments did not always show up on credit scores, so missing one did not impact credit worthiness. However, it didn't help build credit either. The article suggests more than 40% of BNPL users have late payments, up from 34% the prior year.

Tariffs

The EU is delaying retaliatory tariffs on US goods in hopes of reaching a deal by Aug. 1

The Race Is On to Build U.S. Copper Mines After Trump Pledges Higher Tariffs

Trump says Indonesia trade deal features 19% tariff; Jakarta yet to confirm

Politics

'One more': Senate Republicans eye tackling another reconciliation bill

Trump ‘certainly’ can fire Fed chair Powell ‘if there’s cause’: Hassett

This is an embarrassing list of failures that needs investigation.

“Adam Schiff said that his primary residence was in MARYLAND to get a cheaper mortgage and rip off America, when he must LIVE in CALIFORNIA because he was a Congressman from CALIFORNIA. I always knew Adam Schiff was a Crook,” the president wrote.

Supreme Court allows Trump administration to implement widespread Education Department layoffs

Andrew Cuomo set to run as an independent in NYC mayoral race — but there’s a catch

He wants all candidates other than Mamdani to agree to drop out of the race in mid-September if they are not in the lead, and he will agree to exit the race as well. I personally believe the best chance to beat Mamdani is for all to step out other than Adams. I am of the view he has the best chance to beat Mamdani. Adams does not seem very excited about Cuomo’s decision to stay in the race.

Mamdani-loving Brad Lander aids boycott movement against Israel with ‘withdrawal’ of bonds

Musk slams Trump’s defense of Bondi on Epstein controversy: ‘Just release the files as promised’

I agree with Musk. Despite all of Trump’s recent wins, the Epstein files are overshadowing accomplishments of this administration. More information needs to be released, and Trump is getting upset that the MAGA crowd will not drop this issue.

Inside the Jeffrey Epstein death report and the TEN troubling questions the DOJ refuses to explain

Some good points brought up in this article.

The FBI's Jeffrey Epstein Prison Video Had Nearly 3 Minutes Cut Out

This only makes matters worse. Just share the files. To suggest there is nothing to see after one of the world’s most prolific pedophiles dies under questionable circumstances and had a “client” list of epic business leaders, is a joke.

Border czar Tom Homan defends ICE agents masking up in clash with podcast host: 'Let me answer'

Pam Bondi’s Allies Believe Dan Bongino ‘Burned His Bridges’ and Needs to Quit

Former Israeli PM Naftali Bennett denies conspiracy theories linking Jeffrey Epstein to Mossad

Trump-backed crypto regulation bills fail to clear key hurdle in Congress

Navy's next-generation submarine program faces alarming delay to 2040

Production constraints and rising costs force nine-year delay as shipbuilding programs operate in 'perpetual state of triage.' I often talk about government inefficiency and waste. This is yet another example. This submarine will cost almost $8bn per vessel and replaces one that cost $4bn. It has seen massive delays and cost over runs. No shock there. It is the Federal government at work.

Cameras Capture Marking on President Trump's Right Hand During Press Avail With Reporters

Donald Trump's 'swollen ankles' spark fresh health fears as president crammed into shoes

Pictures are pretty clear. His ankles are massive.

University of Virginia President Resigns Under Pressure From Trump Administration

Middle East

Other Headlines

These are America’s most expensive states in 2025, where inflation still hits hardest

Jamie Dimon Warns Of 'Significant Risks' Even As JPMorgan's Q2 Results Smash Wall Street Estimates

“Significant risks persist – including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices,” Dimon said.

Jamie Dimon says JPMorgan Chase will get involved in stablecoins as fintech threat looms

One of the world’s priciest parking spots is located in Brooklyn

Blue city officers flocking to cop-friendly red states, police leader says: ‘Why would anyone stay?’

With an exodus of millionaires, businesses and workers, has London lost its spark?

These are America’s 10 weakest state economies most at risk in a recession

These are America’s 10 strongest state economies best prepared for a recession

Washington State's New Luxury Taxes on Aircraft, Boats, and Vehicles

Another state that does not get it right. Big consumption tax increases in 2026. The number of states I will never live in keeps growing.

Netherlands rations electricity to ease power grid stresses

Country provides early warning for rest of EU if investments in new cables do not keep pace with shift to greener economy.

Billionaire Trump ally Marc Andreessen warns elite universities will ‘pay the price’ for DEI

Strong words from Andreessen.

Interesting article about people sharing private planes through chat groups.

Military jet's mysterious collision raises questions about advanced UFOs in US airspace

16 abandoned places around the world that have become must-see tourist attractions

Health

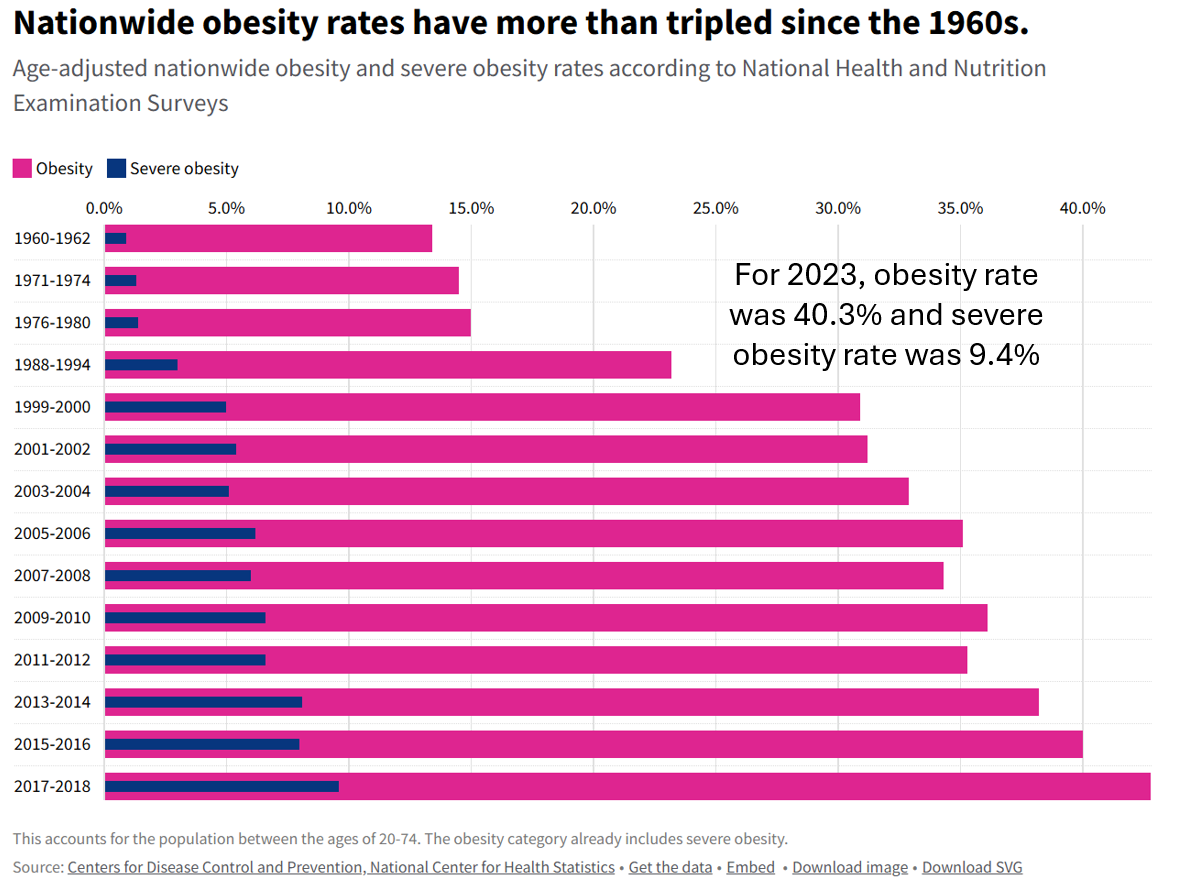

Cancer deaths from obesity have tripled in 20 years — which states have the highest and lowest rates

The US suffers from a major obesity issue with poor food choices and lack of exercise. My children have never had soda or fast food apart from Chick-Fil-A a few times and they have not had that in years.

Study reveals you can stuff your face and keep the pounds off — if you follow this one rule

I’m 78 and my brain is sharp as a whip—my No. 1 rule for a strong, healthy brain is so simple

I’m 68 with 15% body fat and my own gym empire — my 6 secrets to being in incredible shape

NJ woman hospitalized ‘one step before liver failure’ after taking popular supplement

I’m a neurologist — 3 foods I won’t eat because they could give you neurotoxins or brain parasites

These 4 common food types could make you smell bad, experts caution

Dr. Peter McCullough on Covid and myocarditis

Nothing to see here folks. You were not lied to about the vaccine. Fauci would never do that to you.

Real Estate

Interesting LinkedIn post entitled, “The Death of the Luxury Second Home: A Generational Unraveling,” outlining how Baby Boomers are aging out of fancy homes. Interesting read and the suggestion is that pressure is building on many second home locations with growing inventory and fewer interested buyers. 12,500 Americans turn 65 every day. The wealthiest among them are no longer skiing black diamonds or hosting 20-person family Thanksgivings.

The dream of “this will be the family’s forever home” has collided with reality:Health declines

Home maintenance becomes a burden

Travel slows

And kids? They’re not showing up for a year long heavy carry to gather for 2 weeks annually.

The heirloom house is a liability, not a legacy.

The kids — now grown — want flexibility, cash, and mobile freedom.

They don’t ski. They don’t want upkeep. They want liquidity

And as the parents age or pass, the second homes are dumped on the market like snow off a roof in spring.

Overinflated home prices, high mortgage rates, rising supply and falling demand are all joining forces to cool the nation’s housing market. Annual home price growth in June was just 1.3%, down from 1.6% growth in May and the slowest rate in two years, according to ICE, a mortgage technology firm. Nearly one-third of the largest 100 markets are now showing annual price declines of at least a full percentage point from recent highs, and the trend suggests more markets will do the same. Single-family home prices were up 1.6%, while condominium prices were down 1.4% nationally. Inventory has been rising steadily over the past year, up 29% in June compared with the same month last year. The gains, however, began slowing this past spring. The average rate on the 30-year fixed mortgage has hovered in the high 6% range for most of this year, double what it was during the early days of the pandemic, when home prices initially took off.

Manhattan’s median rent reached another record high in June, according to a report by appraiser Miller Samuel and Douglas Elliman, marking the fourth broken record in five months. Not only was the median rent on a new Manhattan lease a whopping $4,625 last month, but the competition for these units is fiercer than ever. In Manhattan, 25% of rentals incurred bidding wars in June — a fraught process typically reserved for homeowners. More than half of Manhattan renters understandably chose to stay put in the first quarter of 2025, according to RentCafe’s analysis of Yardi data. Lease renewals reached 70% in that period. Fewer vacant apartments meant crowded open houses — 11 renters were competing for each open apartment, the report found. That’s an increase from just seven renters pet unit during the same period last year. Manhattan certainly isn’t the only city where renters are feeling the heat. Miami renters are facing far greater competition for housing. The Sunshine State’s largest city boasts an occupancy rate of 96.6% in the first quarter of 2025, with 21 prospective renters per unit and average vacancies of just over a month.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #802 ©Copyright 2025 Written By Eric Rosen.