Opening Comments

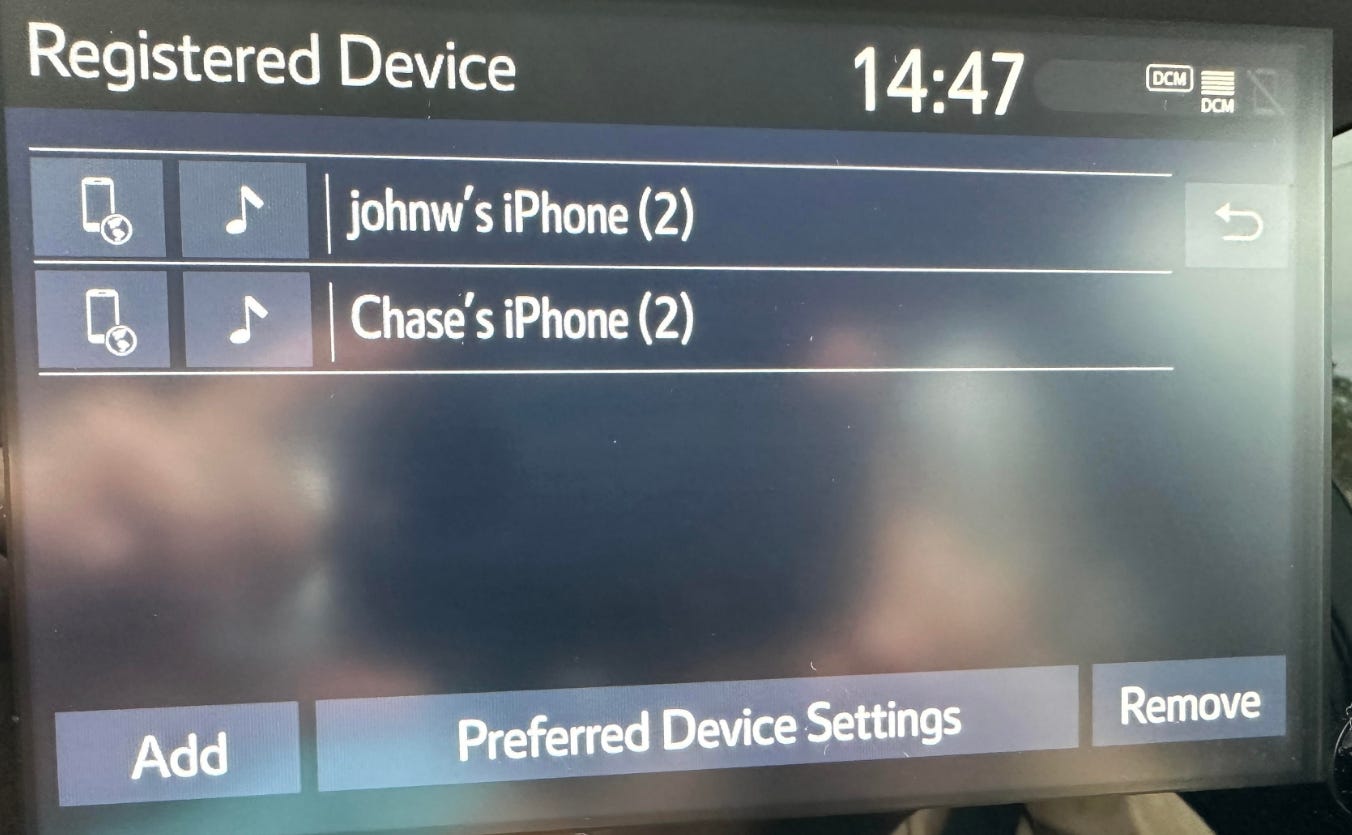

In a recent report, Prevent Hacking, I wrote about the dangers of USB and rental cars. The reader, Ray, who helped to write the report just sent me this picture of his rental car. The previous renters plugged their car in and all the data was left behind from John and Chase.

There is an expanded R/E section today with a lot of good information and charts.

There are anchor links in the major titles in the table of contents below. If you click on the main headline, it will bring you to that section.

Markets

US Consumer-Cards and Autos

FBI Uncovered More Documents

Debt Ceiling/Default Ramifications-My View

Distressed R/E Growing

SFO Housing Crash-Meta Reduces SFO Footprint-NYC Tax Hole

Boca/Delray Luxury Housing Data/Trends

$60mm Vero Beach Compound

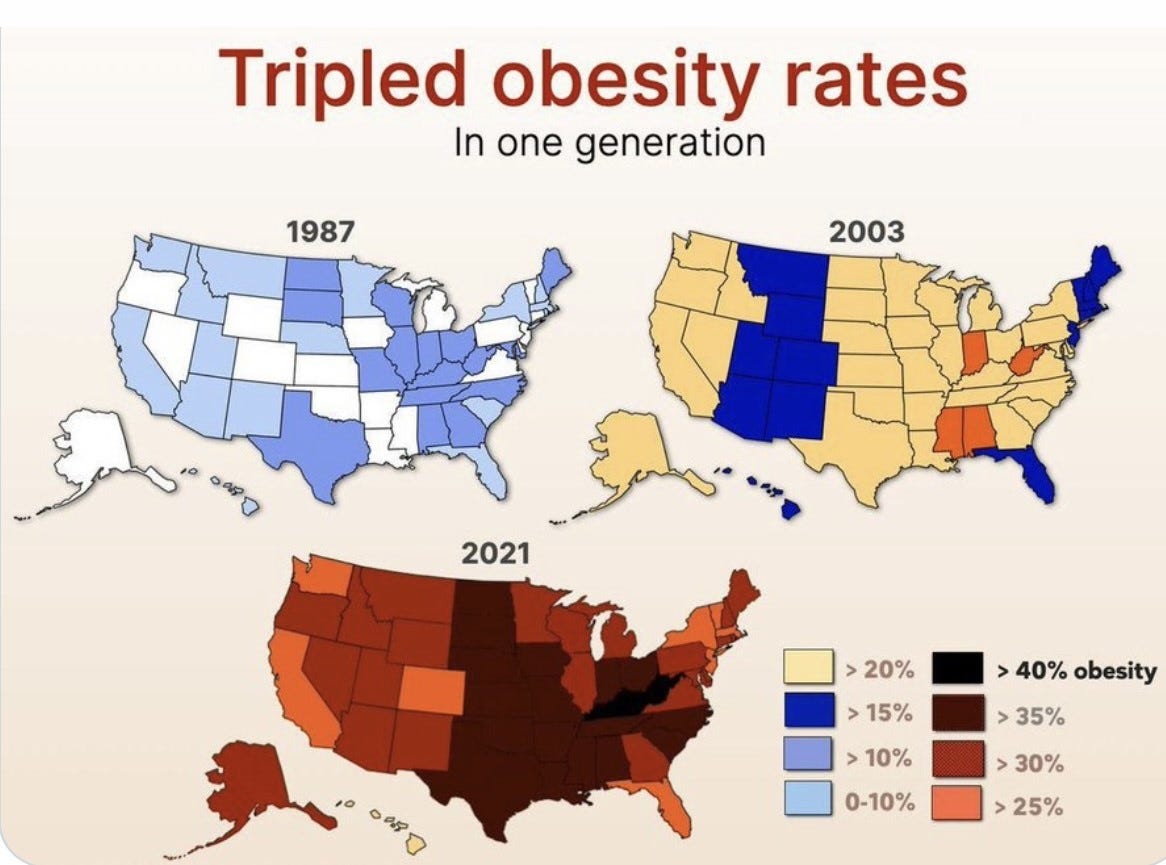

Picture of the Day-The Growth of Obesity in the USA

I thought this obesity chart was interesting and concerning. We need to tackle this issue, as obesity is straining the healthcare system and leading to many issues including: diabetes, cancer, stroke, heart disease... In the early 60s, less than 14% of Americans were obese, and now it is 43%. The middle-aged and the poor are disproportionately impacted. The CDC data suggests that 71.6% of Americans are overweight or obese.

My First Ever Trip to NYC

I lived in NYC for over 20 years, but had not been there until I was 22 years old. It is almost impossible to fathom that fact today. I was working at Continental Bank in Chicago, and went on one of my 1st business trips in the fall of 1992. The air was crisp and I was excited to see NYC despite the fact that it was only a one-night trip.

My boss, Dan, and I stayed at the world-famous Plaza Hotel on 59th and 5th. My initial thought was that I could surely get accustomed to travelling like that. As a kid, it was the Howard Johnson’s or Holiday Inn for me. I was taken aback by the service and the number of people to assist you in your stay.

After we checked in, we went to meetings and they wrapped up around 4pm, so we headed back to the hotel prior to getting ready for the client dinner. I changed into my running attire and pushed myself through the revolving door and the doorman stopped me. “Sir, where are you going?”

I replied, “I am running in Central Park.”

He shook his head and said, “Sir, I do not advise you to run in the park, as it is dangerous.”

I was a bit stunned and in a rare occasion was at a loss for words. He advised me to go to the gym in the hotel. I had wanted to see Central Park in person, but took the gentleman’s advice and went back inside. I came to find out there were 2,605 murders in 1990 and 2,397 in 1992 relative to 558 in 2019 (pre-pandemic). Despite turning out to be a bit of a nutcase later in life, Mayor Giuliani did a magnificent job cleaning up NYC during his tenure from 1994-2001 which saw the crime rate fall sharply. In 1992, there were 108k robberies and 88k aggravated assaults, which was down to 18k and 45k respectively in 2019.

After my indoor workout, I changed, and we went to Sparks Steakhouse in Midtown. It turns out my hedge fund was in the building next door 20 years later. The meal was memorable for me, as I had not been to a ton of client dinners and had not been to many fancy restaurants. Now that I am a culinary king, I would not give Sparks much of a look. In 1985, the famous crime boss, Paul Castellano, was murdered outside of Sparks.

The next morning, we met for an early breakfast at the restaurant in the Plaza. I recall ordering a 3-egg omelette, wheat toast, granola parfait and freshly squeezed two glasses of OJ. Dan had coffee, eggs, bacon and a side of fruit with a croissant and of OJ. When the bill came, he asked, “Eric, how much do you think breakfast was today.” Remember, I had zero high-end game at this point in my life, and I was oblivious. Also, this is 30 years ago.

I said, “$42,” and he started laughing. I believe the bill with tip was $73. I just checked and for your pleasure, you can see prices today. Do the $28 pancakes (add $4 for bananas or chocolate chips), the $17 OJ, or $18 espresso or $19 smoothie scare you? I estimated the same breakfast today with tip would have been $150+ tip today.

I recall feeling so intimidated by NYC. Despite living in Chicago, it seemed like NYC was larger than life and everything moved so fast. I did not realize in a few short years (1997) I would make it my home and felt I needed to spend more time there to better understand it. Within a couple years of my first foray to NYC, I was going constantly and found my footing quickly.

Quick Bites

The Dow added 331 points, or 1%, to close at 33,375, while the S&P 500 advanced 1.89% to 3,973. Both indexes snapped a three-day losing streak. Meanwhile, the Nasdaq rose 2.66%, with help from Netflix and Alphabet, to end the day at 11,140.43. The Nasdaq was also the outperformer for the week, posting a 0.55% gain and its third positive week in a row. The Dow finished the week lower by 2.70%, and the S&P posted a 0.66% loss, both breaking two-week win streaks. YTD the Dow is +.7%, S&P 3.46%, 6.44%. Tech is outperforming and has announced a great number of layoffs in recent months and has ramped up in 2023 as outlined in this link. NFLX beat expectation on subscribers and the stock rallied 8.5%, while Alphabet was+5.3% on Friday after announcing layoffs. Bitcoin is up 40% YTD and traded well over $23k.

I have written extensively about my concerns around the US consumer with record credit card debt, plunging savings rates, inflation, higher interest rates, stock market losses…. Interesting charts below. The Discover Financial Services (credit card issuer focusing on low to middle income households) reported earnings this week and the forecast for credit losses were sharply higher (3rd chart). Yes, losses have been incredibly low with all the free money handed out in the past few years, but the higher card balances coupled with higher rates are starting to hit the consumer. In a related topic, auto delinquencies are rising as well. Cox Automotive shed light on the rapidly deteriorating auto loan market. The report said loans delinquent by more than two months increased by 5.3% and jumped 26.7% from a year ago. In December, 7.11% of subprime loans were severely delinquent, increasing from 6.75% the prior month. The subprime severe delinquency rate was 163 basis points higher than a year ago, and the December rate was the highest in the data series back to 2006. In 2021/22, used car prices soared and many took out loans to buy over-priced autos which are now worth sharply less. I expect a continued increase in auto defaults in 2023.

The FBI found additional classified information in President Biden’s home in Wilmington, DE during a consensual 13-hour search on Saturday. This is the fourth time since November that classified material has been found under Biden’s care. Some items found were from his Senate days and others from his time as VP. The White House spokesperson, Karine Jean-Pierre had said the search was complete before additional documents had been found on more than one occasion. Biden has “no regrets” on how he has handled the discovery and disclosure of the documents according to this NPR article. Mind you, the 1st batch of documents were found prior to the mid-term elections, but no mention of it for months. Could this have impacted any close mid-term elections? The picture below of a beat-up box of “Important Doc’s” was out in the open at Biden’s house according to the laptop. The positive news is that Biden’s team turned over the documents, and the volume is far less than Trump’s who also fought turning them over. However, Biden has more to lose and his image of being “clean” is now sullied. Also, depending on how far the special prosecutor goes with this, the rumored $50k/month rent paid by Hunter on the Wilmington, DE house should bring up questions. The house was valued between $1-1.5mm at the time in 2018. The rent should have been $5k. Also, the Penn Biden Center received tens of millions of anonymous donations from China. Just not a good look for someone trying to be the upstanding President after the disaster of Trump. The benefit of the doubt is gone for Biden, something Trump lost a long time ago. In the end, I have a funny feeling if Bush, Obama, Clinton all had their homes and offices raided just after leaving office, I think they all would have documents which should have been left behind.

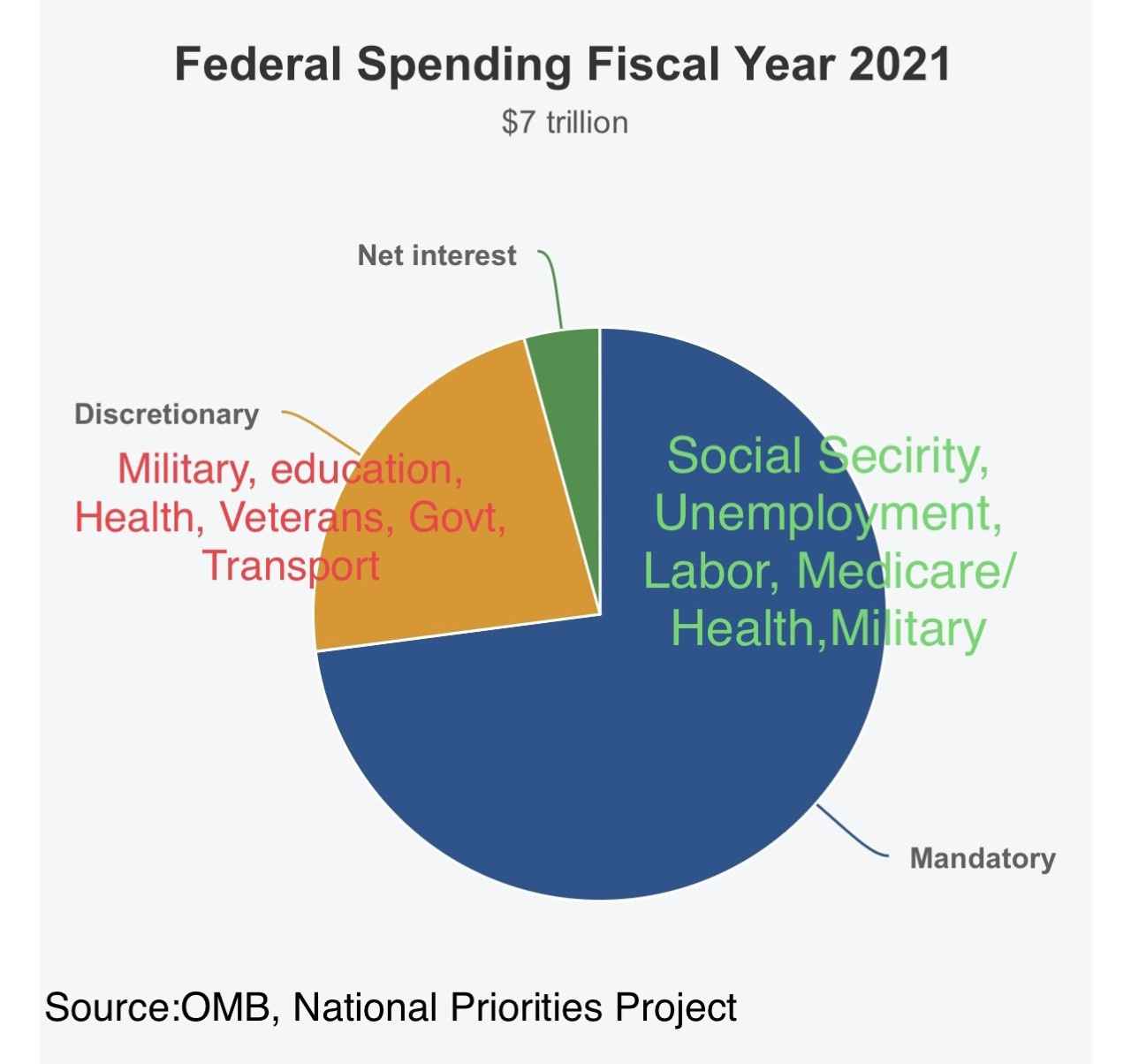

The US reached the debt ceiling, and the Treasury has begun extraordinary measures including prioritizing payments (see here for explanation). With respect to the standoff around debt limits, I am concerned that we could see a short-lived default. I am not an expert on this topic, but have spoken with a few people I respect a great deal. There is far too much for me to tackle here in a short note, but I think there is a less than a 5% chance of a bad outcome despite what will be a lot of heavy handed discussions and scary headlines. I think that if there was a missed payment, it would be short-lived and nothing like a default in Argentina, Greece, Venezuela… On the low likelihood something happens here, there could be significant unintended consequences which am not fully equipped to discuss. Yellen suggested that the US would be downgraded, and could result in something as broad as the Global Financial Crisis. Money market funds own Treasuries, and people view these investments as cash alternatives. Corporate own short-dated Treasuries in lieu of cash could lead to big problems. Banks own large positions in Treasuries… Personally, I own a great deal of Treasuries as well. In the event of a default, I can see stocks down sharply and Treasuries fall, but should present a buying opportunity, as it will be quick. I just cannot fathom a long-lasting default, but that does not mean a short-term default will be without consequence. In the end, the divide between Left and Right has not been greater in recent history, and if both sides dig in their heels, we could have the 1st default in US history. The growth in debt over the past 50 years (2nd picture) is alarming, especially since 2008. I do feel that politicians need to tackle spending, as Mandatory spending (Social Security/Unemployment/Labor, Medicare/Health, Veterans, Education, Transportation… is overwhelming the budget (3rd picture), and it is only getting worse as social programs grow and interest expense increases due to rates and the larger debt load. This link goes into detail on Discretionary vs Mandatory spending. Discretionary spending is only approximately 30% of the budget now. I am not doing a ton with my money due to the potential default, as the correlations of asset classes will largely be highly positive but will buy some out of the money put options on the S&P now that vol has collapsed (VIX under 20). This issue is timing. When would a default take place if at all given the extraordinary measures of the Treasury? Yellen suggested it could be as early as June. Of note, gold has rallied 18% since early November and silver has rallied 23% in that time.

Other Headlines

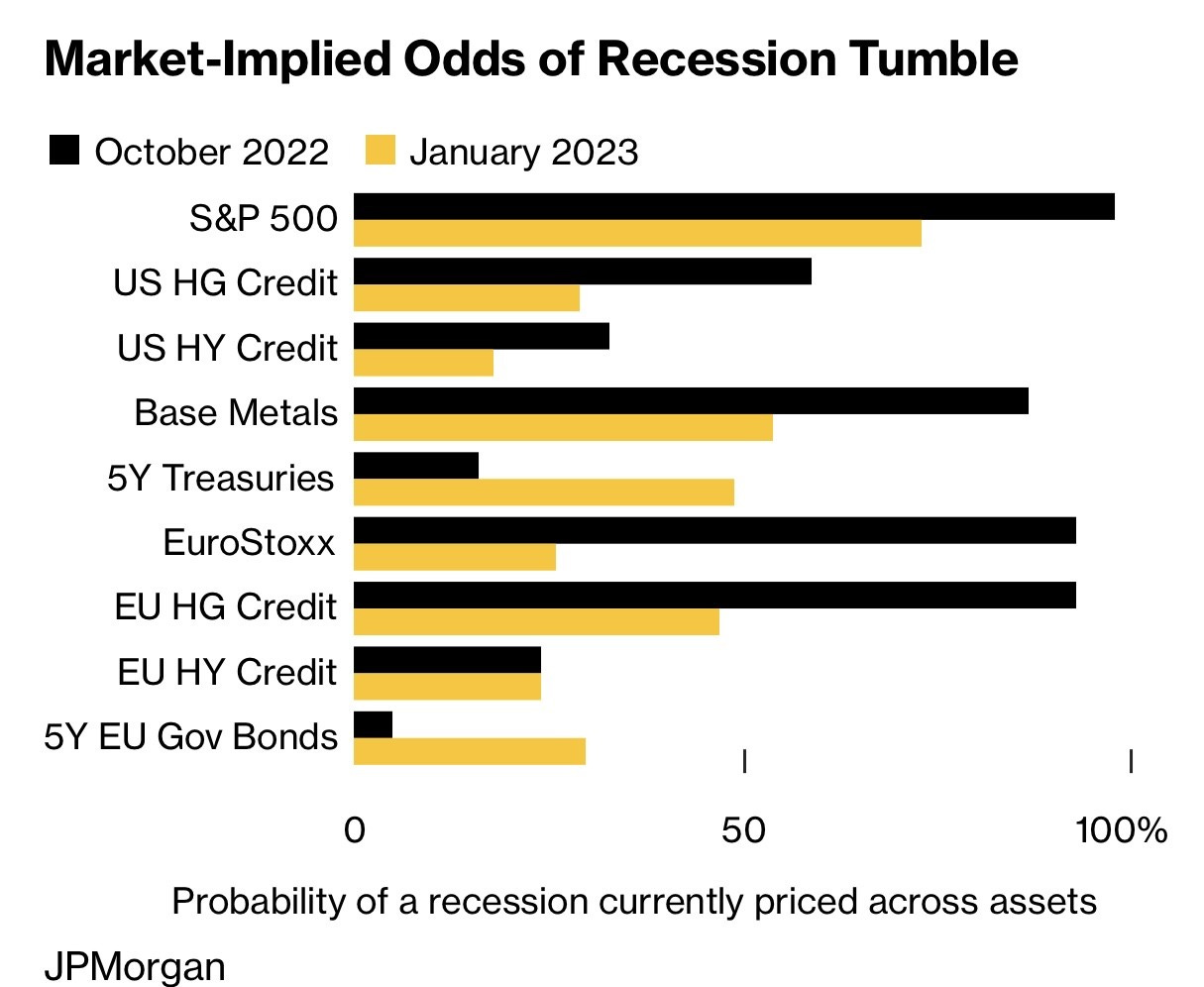

JPMorgan Model Shows Recession Odds Fall Sharply Across Markets

S&P 500 still assigns 73% recession bet, from 98% in October

Jamie Dimon says rates will rise above 5% because there is still 'a lot of underlying inflation'

Fed Governor Lael Brainard sees high rates ahead even with progress on inflation

Bank of America's Brian Moynihan warns against 'wealth effect' that could feel like 2007-08

Goldman Sachs slashes bonuses for junior bankers by as much as 90%: insiders

All the major banks will have challenging bonuses this year. What is the impact on real estate for NYC and the surrounding area when you couple it with higher rates? I do feel badly for the junior bankers who work a lot of hours and are getting pay slashed sharply. NYC is expensive, and let me tell you, not a lot of fun without discretionary money to spend. Rents are out of control and a dinner ain’t cheap.

Oaktree’s Marks Sees End to Junk-Bond Rally With Defaults Rising

The corporate default rate for the last decade or so averages about 2%, compared with 4% in decades past. “I think 4% is more normal,” Marks said.

The 8 'rarest' types of employees—they 'simply outperform everyone else,' says career expert

This Humanoid Robot Can Run, Jump And Throw Things Like Humans, Internet Fascinated

I am not sure if this is exciting or scary, but the short video of the robot is insanity. The future is now. The agility is human like. Please watch.

How does an 8-year-old know they want to be a nun? I find it incredible.

1,400 illegal pot shops now open in NYC, already wreaking havoc

I wrote about this last month after a trip to NYC. I do not do drugs, but found all the pot shops and street vendors out of control. They don’t have a license. What happens if a restaurant or bar serves alcohol without the proper license? However, sell weed without one and nothing happens in NYC.

Trump and lawyer ordered to pay $1m for bringing ‘frivolous’ lawsuit against Hillary Clinton

New Yorkers abandoning their state in record numbers for sunny climates, low taxes of Florida

I don’t think taxes are the key driver. After 20+ years in NYC and 6 years in South Florida, the quality of life, cost of living, weather, crime/safety and taxes are all factors. Not to mention the lack of mandates and woke policies.

Elizabeth Holmes made an ‘attempt to flee the country’ after her conviction, prosecutors say

Tax Season Is Coming, and These Firms Can’t Find Enough Accountants in the U.S.

Harvard Medical School offers course about healthcare for LGBTQIA+ 'infants'

How do you know an infant is LGBTQIA?

Jewish community reacts to antisemitic display at FAU as the university denounces group's presence

I loved Lawrence in his Clemson days, and despite a rocky start as a rookie under Urban Meyer, Lawrence finished strong by winning the last 5 games of the regular season and one playoff win. Lawrence is a strong leader and the video in the link shows what leadership looks like. Good on you, Trevor.

Is Milf Manor the queasiest new dating show on TV?

As I understand it, there are 8 single mom’s and their sons on the show and the sons and moms “mingle.” The pure idiocy of programming is quite frightening. The reviews on this show are awful. The video of the reveal is quite frankly hysterical, as the moms and sons had no idea the other would be there. Someone at the network should get fired for airing this crap.

U.S. investigating first cases of "concerning" new drug-resistant gonorrhea strain

Knife-wielding roosters kill 2 men in cockfighting events in India

I love the irony here.

Putin ally warns NATO of nuclear war if Russia is defeated in Ukraine

Crime Headlines

New study shows how NY law puts bad guys back on streets

The rate at which cases were dismissed citywide rose from 44% in 2019 — the year new “discovery” rules were adopted by state lawmakers — to 69% by mid-October 2021, the Manhattan Institute finds.

Two teens shot outside NYC high school, 12-year-old in custody

Man dies after being pushed onto tracks by ex-con Andre Boyce at NYC subway stop

When I lived on UWS in NYC, this was my express stop.

Suspect arrested in slaying of NYC woman found bound-and-gagged

15-year-old shot outside of NYC rec center dies from injuries

NYC Chase ATMs close early over 'rising crime,' vagrancy

Again, law abiding citizens are hurt due to soft-on-crime policies.

10 dead, at least 10 injured in mass shooting in Monterey Park outside of Los Angeles

Asian community celebrating Lunar New Year, and the gunman has not been found.

Real Estate

The slump in the world’s biggest asset class has spread from the housing market to commercial real estate, threatening to unleash waves of credit turmoil across the economy. Almost $175 billion of real estate credit is already distressed, according to data compiled by Bloomberg — about four times more than the next biggest industry. As the toll from higher interest rates and the end of easy money mounts, many real estate markets are almost frozen with some lenders telling borrowers to sell assets or risk foreclosure amid demands for additional capital from landlords. The article discusses global R/E markets and gives numerous examples of stressed/distressed properties. Last September, I wrote an article on this topic Concern Growing & the R/E Double Whammy is Not Helping. I believe there will be a great deal of distressed product in the R/E space in the next 18 months. In a related article, “Evergrande chairman: This billionaire from China has lost over 90% of his wealth,” there is a discussion of the substantial issues in China.

Housing Bust 2.0: San Francisco Bay Area House Prices Plunge 30% From Crazy Peak

There is volatility in the data of median prices and seasonality in these charts, but the trend is not good. Tech crash, layoffs, IPOs-94% in 2022, higher rates, crime, homelessness, high taxes… don’t lead to a strong R/E market.

Meta dumping nearly half a million square feet at San Francisco high-rise. The building is next to the Salesforce Center in SFO. Remember, Salesforce is shrinking its payrolls and reducing office footprint as well.

This article is entitled, $9B plunge in NYC commercial real estate sets up brutal political fight over shrinking tax pie. The estimated 43% drop in revenue from taxes on commercial transfers are projected to be $465mm. When you factor in the residential transfer taxes, it is hundreds of millions more. This is in addition to lower R/E taxes on properties. In a related note, Vornado, the large Steve Roth REIT which owns a ton of NYC R/E was dropped from the S&P as it is now “more representative of the midcap market space.” Vornado stock is -67% since Feb 2020.

A good report on the Boca and Delray luxury housing market. It shows inventory, sales though almost a dozen charts. Quick read.

An Under-Construction Vero Beach Compound Lists for $60 Million. If the 2.5-acre oceanfront property sells for close to that price, it would become the Florida town’s most expensive home. Developer Nathan Saks bought the lot in 2018 for just under $3.5 million, according to public records. Mr. Saks is codeveloping the home with Victor Hernandez, founder of the Florida-based construction design and management company Haute & Boss. The property has just over 150 feet of beach frontage, Mr. Hernandez said. Once complete, the gated estate will include a roughly 15,000-square-foot main house with seven bedrooms, plus a 2-bedroom guesthouse. A separate structure will house a fitness center with a spa, sauna, steam room, juice bar and plunge pool. Adjacent to the fitness center will be a 75-foot lap pool in addition to a main pool facing the beach. There will also be a security office at the property’s entrance, which can be staffed with guards, Mr. Hernandez said. I cannot fathom spending $60mm in Vero Beach, as it is 81 miles north of downtown Palm Beach.

Other R/E Headlines

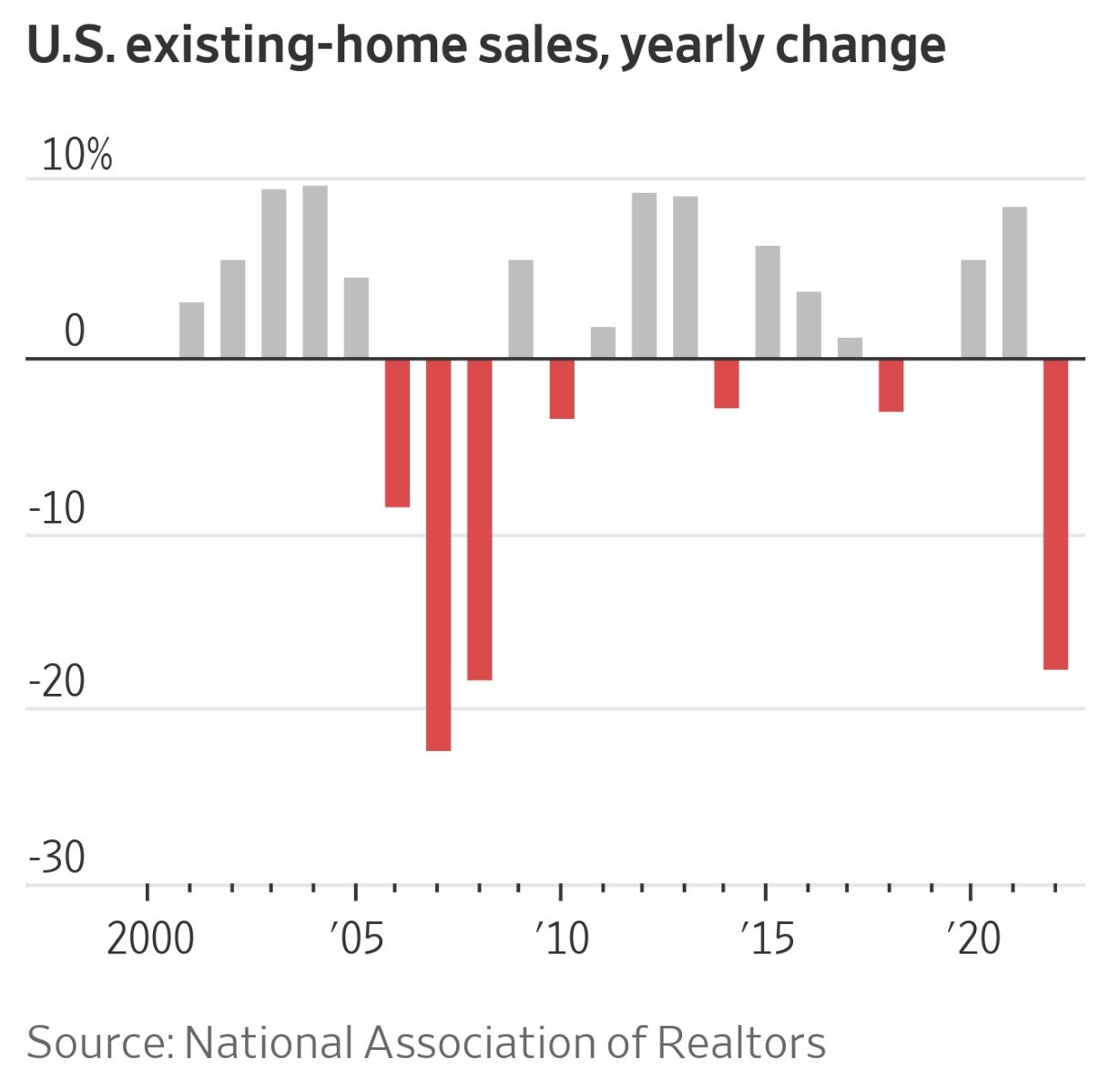

Existing home sales drop in December to slowest pace since 2010

Why US home prices will fall another 10%, according to economist Ken Rogoff

South Florida's era of giant rent hikes has come to an end

Good detailed data on South Florida rent growth slowing.

Virus/Vaccine

Data has turned for the better in the past few days with large decreases in cases, positivity, hospitalizations and ICUs, while deaths fell slightly.

China says Covid outbreak has infected 80% of population

Clearly, onerous lockdowns proved ineffective as herd immunity was never reached.