Opening Comments

Today’s Podcast-21 minutes.

My last report was entitled, “The Best Money I Ever Lost.” Check out yet another humiliating story about my life.

In light of the scary situation on the football field last week, I thought this link would be of interest. If you don't know how to perform CPR, watch this. It is a 3-minute video which helps teach the updated CPR (hands-only) CPR. When I was certified it was both chest compressions and mouth-to-mouth. This short video is informative and goes over the key things in case you need to perform it. On a positive note, Hamlin is awake and holding hands with his family as of Thursday afternoon and began speaking. When he was on a ventilator, his first question was written on the chalkboard, “Who won the game?”

Be sure to read my Cash Alternatives bullet in Quick Bites. It pertains to all readers.

I continue to send readers to Contessa, the Northern Italian restaurant in the Design District in Miami. The food reviews remain top notch, but friends went last night and complained about the service being sloppy. My experience was fantastic from all perspectives.

Pictures of the Day-Markets Charts-ZERO Negative Yield Globally

I Owned a Minivan-Not My Finest Hour

Quick Bites

Markets

Economic Data

Cash Alternatives in the New Environment-MUST READ

Hedge Fund Marking Illiquid Assets

McCarthy Won, but at What Cost?

Other Headlines

Crime Headlines

Real Estate

Shell Bay Development-Miami

Royal Palm Boca Raton Over Time

Florida Employment Changes in Charts

Virus/Vaccine-Deterioration in Data as Expected

Pictures of the Day-Markets Charts

The 1st picture is of negative yielding debt globally over time. It went from $18 trillion with a negative yield in 2021, to ZERO today after the dumb central bank policies ended. Think about that for a second. There was $18 trillion in debt, which if you bought and held to maturity, LOST you money. I was opposed to zero rate policies and QE for so long, but clearly central banks did not listen to me. The 2nd chart is the performance of the S&P and the US 10-Year Treasury since 1872. Note that 2022 is quite the outlier. with both the S&P and 10-Year Treasuries down sharply. Both charts were from DB, Jim Reid who puts out thoughtful pieces. Please spend time on my cash alternative bullet in Quick Bites today.

I Owned A Minivan-Not My Finest Hour

In my life, I have had numerous moments in which I have been humiliated and clearly were not my finest. At the top of the list is the period when I owned a Toyota Sienna Minivan from 2011-2014, while living in NYC. In the history of my life, I never thought I would be that clown minivan driver, but indeed I was. How does a person go from driving a beautiful convertible Porsche and a 1963 Mercedes 220 SEB convertible to a Toyota Minivan? The answer is simple; become a dad. I wore dark glasses and a baseball cap to disguise my look when driving the minivan. At one point in my life, I was the cool kid and have totally lost my mojo ever since I owned that dorkish automobile.

To be crystal clear, it is IMPOSSIBLE to look good in a minivan. Pick the coolest cat in town. Paul Newman, Steve McQueen, Marlon Brando, George Clooney, James Bond, James Dean, Lenny Kravitz…. in a minivan they become complete geeks. Once hip and cool people own a minivan, they become complete morons with zero game. I thought I could buck the trend with my coolness, but to be clear, I looked like a complete idiot and nothing you can do can make you look good behind the wheel.

My kids were 3 and 5 years old and the sliding door made life so much easier that I broke down and bought one after renting a minivan on a trip to Miami. The high safety rating also played a part along with the storage for those irritating kids things like strollers, toys, and plastic crap made in China. What the hell was I thinking? All my street cred was shot in the name of convenience. It is akin to a supermodel wearing a pair of flats to the Met Gala in front of Anna Wintour. Just not the look you want.

We were in the Hamptons in 2011, and a Hurricane Irene was brewing. In my infinite wisdom, I took my kids to the beach while driving said minivan. Check out the kids hair blowing in the 50mph winds while hanging outside the ugliest car in town. What other ride could you take such a picture? The kids were screaming that sand was blowing in their eyes, but I wanted the picture, and made them endure like a good dad. My kids were cute at this age, and now they are giants with Jack at 6’ and Julia approaching 5’8.”

Apart from taking fun pictures of kids during a hurricane, I cannot think of any other hip part of owning this ugly, but efficient car. I think that once I owned a minivan I lost my special factor and have been a bit of a downward spiral since. Do we have any lawyers in the house who want to help me sue Toyota for taking my mojo? No, there are no pictures of me behind the wheel, as it is a few years of my life which I will not publicly admit, and looked more like the Unibomber driving incognito. Not enough time has passed, and the wounds are still fresh 10 years later. Just don’t tell anyone I ever owned a minivan. This is a secret for Rosen Report readers only.

Quick Bites

The Dow increased 700 points, or 2.13%, to close at 33,631. The S&P 500 ended up 87 points, or 2.28%, to 3,895. The Nasdaq added 2.6%, which equates to 264, to end at 10,569. The Treasury market largely rallied with the 10 year -16bps and two year -20bps, as economic data (outlined below) is showing signs of additional slowing; bad news is good news, suggesting the Fed is closer to the end of rate hikes. Oil sold off on the week on global recession fears and the weaker US Dollar, but I remain concerned about the supply picture in 2023.

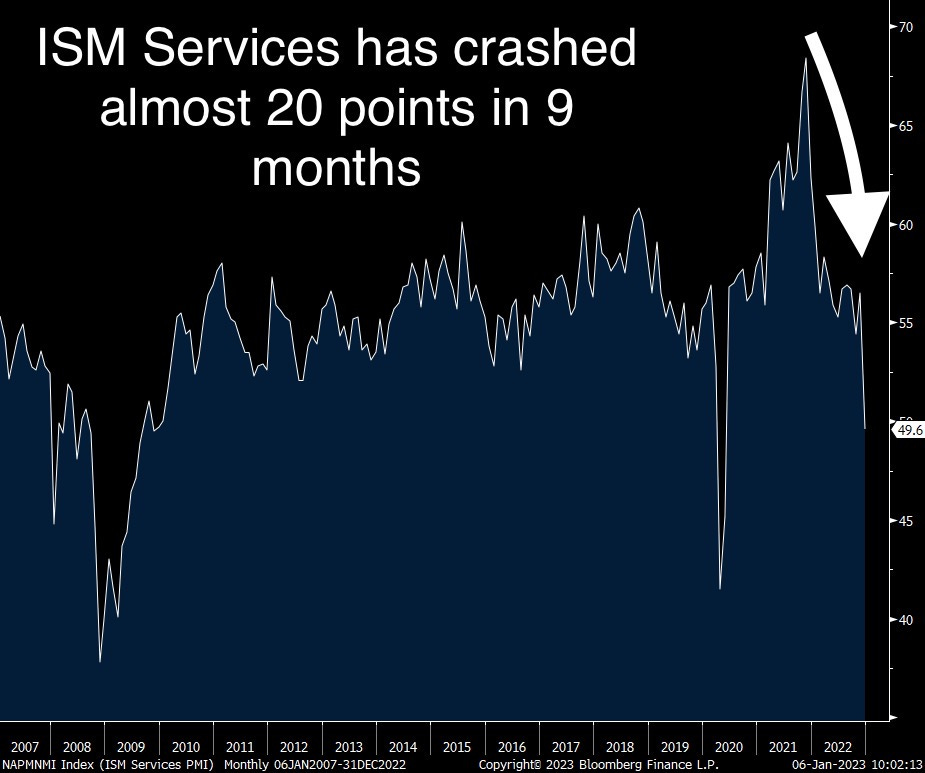

Nonfarm payrolls increased by 223,000 for the month, above the Dow Jones estimate for 200,000, while the unemployment rate fell to 3.5%, 0.2 percentage point below the expectation. The prior two months were revised down 28k in total. The workweek fell to 34.3 from 34.4. Average hourly earnings grew by .3% m/o/m, one tenth less than expected and November was revised down by 2 tenths. To me, the report was mixed, and stocks rallied post the news, as wage growth is slowing. In another economic release, the December ISM fell to 49.6 from 56.5 in November. The services report measures business activity for the overall economy; above 50 indicating growth, while below 50 indicating contraction. Not including Covid, this is the first time we’ve seen a below 50 figure since December 2009. New orders plunged by 10.8 pts to 45.2 while backlogs fell a modest .3 pts to 51.5. (Part of this commentary is from Peter Boockvar). I continue to reiterate my view that the Fed will need to pause and pivot faster than they are suggesting because inflation, the economy, wage growth are all slowing. Despite the data, Raphael Bostic suggests the Fed needs to “Stay the course.”

I have written extensively about cash alternatives and have STRONGLY recommended my readers take time to explore options for cash to enhance yield. I wrote about the billions of dollars Americans are leaving on the table by sitting in checking accounts. On Friday, I connected with my JPM bankers and cleaned up ALL lower yielding positions. Check out what the options are as of 1/6/23 mid-day. YOU MUST SPEND TIME ON THIS TOPIC IMMEDIATELY. Billions are being left on the table by not investing your cash properly. Finally, after over a decade of ZIRP (Zero Interest Rate Policy), you can earn money on short dated positions. Remember, each bank is different on what they offer, but the Treasury yield is the same where ever you go. Look at the crap yield on checking account balances. I moved any cash into a myriad of positions below after having moved a bunch into 2 and 3 year Treasuries months ago. The shorter dated Treasuries gives you less duration risk, but also you take on re-investment risk if the Fed pivot scenario plays out.

VHPXX 100% US Treasury MMF 7-day SEC Yield: 3.72%

PJLXX Liquid Assets MMF 7-day SEC Yield: 4.23%

1-month treasury 4.11%

3-month treasury 4.61%

6-month treasury 4.79%

12-month treasury 4.72%

Checking .01%

Savings 1.93%

Brokerage 1.19%

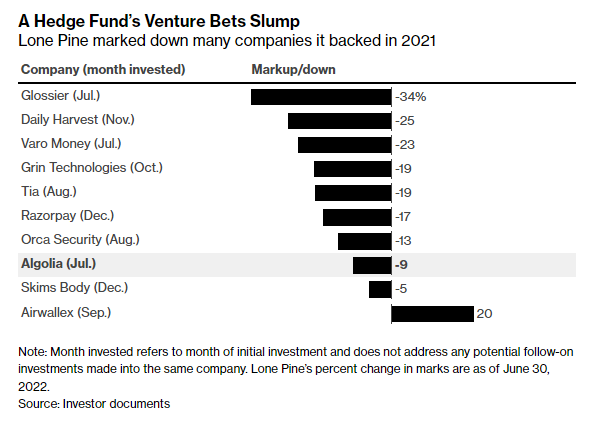

I have been extremely critical of hedge fund valuations of private holdings. Given the absurdity of the Fed leaving rates at zero for too long, hedge funds ventured far more aggressively into the private arena in search of returns. This Bloomberg article, Hedge Funds Gave Startups Billions. What Are They Worth? has some amazing interactive charts. The 1st chart is interactive in the link. By the end of 2022, high-flying ventures known as unicorns lost more than 40% of their value from the year’s peak, according to an estimate from private-market data provider Caplight Technologies, a sharper drop than the rout in publicly traded tech stocks and worse than the returns most hedge funds in the space reported. I have invested in illiquid assets for 30 years. I feel I know more about this topic than 99.99% of the world. Trust me, there are issues here on valuations from what I have seen and read. If you invest in funds with illiquid assets, question the valuations based on what the world is telling us. The article suggests that hedge funds are not marking down private investments at a fast enough rate. Great interactive charts.

After 15 votes, McCarthy was finally elected Speaker of the House with 216 votes as some members of Congress voted “Present,” rather than for a candidate which lowered the required votes to win. McCarthy had to give numerous concessions to secure needed votes. Now, a single member can make a “motion to vacate” which can trigger a vote to remove the speaker (I don’t like this). A new mandate will require a 72-hour period between posting a bill and voting (I like this). Also, trying to have a constitutional amendment that would impose term limits (I like this, but don’t believe it will pass). The Never Kevin group also negotiated for seats on various committees that they likely would not have received otherwise. There are spending restraints to cut spending to 2022 levels. McCarthy also pledged to tackle immigration, “woke” education polices and IRS funding. I am confident there were many closed door concessions we will uncover in coming months. Politics as usual in America. I do fear all the concessions which empower the rank-and-file members may backfire with unintended consequences.

Other Headlines

Citadel Posts Record Revenues for Hedge-Fund, Securities Operations

Hedge-fund business is said to have taken in $28 billion in revenue for 2022. No doubt, Kenny G is OUTPERFORMING.

Stitch Fix plans 20% job cuts as CEO steps down, founder Katrina Lake to re-assume post

As I have written, tech layoffs mounting, but won’t make a dent on the unemployment data in my opinion. However, those being let go in tech make far more than the average worker in the US.

Bed Bath & Beyond shares plummet after company warns of potential bankruptcy

Stock was -25% at one point on the news.

Samsung Expects 69% Drop in Profit on Slumping Tech Demand

Operating profit for the quarter is -69% blamed on falling sales of smartphones home appliances.

Walgreens executive says ‘maybe we cried too much last year’ about theft

Shrinkage was about 3.5% of sales last year but that number is now closer to the mid twos. This is a positive development on shoplifting, but stock was -6% on earnings and shoplifting remains a major issue for retailers costing almost $100bn in 2021.

Constellation Brands’ shares tumble as higher costs hit beer supply chain

Stock 10% post earnings.

Around 7 million “prime age” men between the ages of 25 and 54 are reportedly sitting it out.

Amazon to Slash More Than 18,000 Jobs in Escalation of Cuts

AMZN hired huge during pandemic (800k in 2020/21). For AMZN, the layoffs are small, but going from massive hiring to layoffs is a statement.

Car Owners Strain as More Loan Payments Soar to $1,000

Almost 16% of consumers who financed a new car in the fourth quarter have monthly payments reaching that level, up from 10.5% a year earlier. It was 6.7% for 4th Q 2020. Given the repricing sharply lower in recent months in used cars, what does this mean for the lenders?

Evacuations ordered as California storm knocks out power

100% of CA cars sold need to be EV soon. Maybe, let’s get the power grid right first? Remember, electricity sources are 38% natural gas, 22% coal, 20% renewables and 19% nuclear meaning we will be relying on fossil fuels for electricity.

I'm a psychologist in Finland, the No. 1 happiest country in the world—here are 3 things we never do

Pickleball popularity exploded last year, with more than 36 million playing the sport

I played for 3 minutes and was MISERABLE. Eventually, I will play when I am unable to play every other sport.

China Reopens to the World as International Travel Restrictions End

A single Iranian attack drone found to contain parts from more than a dozen US companies

Crime Headlines

327 crooks made up 30% of shoplifting arrests in 2022

Why are repeat offenders given so many changes? Think about how many crimes they committed and were not caught. Why do people think allowing these career criminals to be on the streets is a good thing?

Five wounded in Midtown Manhattan slashing frenzy in Midtown in 3 Hours

Miami restaurant shooting leaves 10 injured during French Montana music video filming

12 terrorism suspects nabbed sneaking across southern border, according to DHS data

With 5mm illegals coming into the US in the past two years, how many terrorists got through?

6-year-old in custody after shooting teacher in Virginia, police chief says

‘Bleeding blue’: Cops flee NYPD in biggest exodus since 9/11

Real Estate

I spoke with Devin Kay from Douglas Elliman in Miami. He has been incredibly busy the past few weeks and sold roughly 20% of the residences in the past month at Shell Bay. I have written about the project in Hallandale, FL which is a 108 unit condo (before combinations), Auberge Hotel, country club, marina & yacht club, fine dining including Le Bilboquet….Places have gone for over $2,000/ft despite not being in the heart of Miami, although this product would be $5,000k/foot if on the ocean in Miami Beach, and you wouldn’t have 135 acres which gives you a world class resort/club. The solid pricing is due to the robust amenity package as outlined in the Robb Report article. Shell Bay has taken some members for as much as $1mm, and I am told the price is going up to $1.25mm in coming months given the strength of sales of the condo units. I spoke with people involved in the project and it sounds to be incredibly high-end. The level of product being built surpasses buildings selling for $4-5k+ per foot on the ocean. Wine tasting rooms, rooftop pools, world class racket club including 7 tennis courts (4 har-tru, 1 red clay, 1 grass & 1 hard court) with pickle ball + racquetball, over 15,000 sf of fitness & wellness, spas, sport simulator lounge, teens’ club, bowling alley and many other amenities are included. Given the lack of golf access in Miami and the nature of the development, it seems like a reasonable price point & is located within 15-20 minutes of Miami Beach, Bal Harbor & Fort Lauderdale.

I live in Boca in a community called Royal Palm and the sales data for recent years is below. Remember, one year ago, there were only 4 listings given the height of the market and today, there are 29. The sharp drop in volumes in 2022 was largely due to a lack of inventory relative to prior years. Clearly, higher rates and the broader market sell-off did not help. Today, there are homes for sale at $14.0, $16.5, $17.0 $18.0, $22.5, $22.8, $25.0, $25.0, $28.0, $29.0, $32.0, $35.0, $39.5, $40.0, $41.5 at the high-end. Over half the homes for sale are OVER $10mm today. When I moved down in 2017, only one home sold for over $10mm and in the past two years over 20 sold for more than $10mm. The wealth migration has been insane, and the demand for waterfront, new/move-in/furnished/modern has been very high. Since I moved 5.5 years ago, the average price is up 215%, but at the high end, more. A place I could have bought for $9mm on the water was worth $27mm at peak and now maybe $23mm. Construction costs have effectively doubled since I moved down for high-end homes. This link is to sold homes and current listings. I am seeing high-end homes in my community stay on the market longer and price cuts are becoming more common. In 2017, you could buy the cheapest lot for $1.2mm and now the lowest price lots are over $3mm.

$25mm new construction on a canal (not intracoastal).

$40mm on intracoastal

A reader sent me this great chart which proves the great migration is real. It shows Florida vs US employment and how the trend has changed given the migration of younger, working age people moving. The migration from Blue to Red will continue. NY, NJ, CT, IL, CA, MN… have many issues and the trends will become more prominent. Think of the CA/NY budget issues now that tech has crashed or wealth has left the states. How will budgets look in 2023/4 in places like NY, CA, IL?

Virus/Vaccine

The brief holiday improvements are waning and data is largely going in the wrong direction as I suggested now that people are back from vacation.

Why there are so many COVID-19 cases, hospitalizations in the Northeast