Opening Comments

My last note was about the power of the mind and I gave a couple examples of it. The most opened links were the article about prostate cancer and the Katzenberg video about the new tool to help parents monitor kids on social media without being intrusive. As my loyal readers know, I started writing the Rosen Report five years ago as a joke, and it has turned into something I never imagined. The network of readers includes leaders in business, finance, entertainment, real estate, doctors, lawyers and the networking has been amazing. Within 17 minutes of sending the note, a reader got it to Katzenberg and he responded. I am amazed by the reach of the Rosen Report and the impressive readership.

Concerning the Signal chat disaster, I need to clarify that Signal uses end-to-end encryption, but still should not be used for such classified war info that was shared with the Atlantic editor. However, members of Congress use Signal to communicate. In a recent poll, even Republicans say Signalgate is serious.

I am off to California on Wednesday. Flying to LA for my surf trip at the Kelly Slater Wave (KSW) Pool in Fresno. It will be my last trip there. Despite being a perfect wave, the trip is too far, it’s too hard to get there, and it’s too expensive to justify going forward. I hope to have some updated photos and videos as I had from prior visits. I’ll be in LA on Wednesday and then I’ll drive three hours to Fresno on Thursday. I hope to be able to surf despite my torn labrum in my shoulder.

Markets

Consumer Confidence/Wealthy Spending

Wealth in America

Wages by Major Country

Pockets of Strength and Weakness

North Bay Road, Miami Beach

PH in the Steinway Building

Top Neighborhoods for Buying a Home

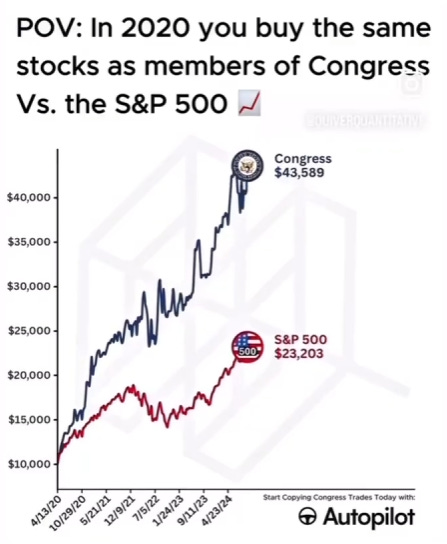

Picture of the Day-Congress Outperforms the S&P

I have been critical of the fact that politicians can trade stocks on inside information. This goes for BOTH parties. It is criminal. This interactive 40-second link shows how Congress has outperformed the S&P 5000 since 2020. In the words of President Biden, “Come on, man!” Very few actively managed stock funds stock outperform the S&P over any extended period, yet Congress has doubled the performance of the S&P over 4 years.

Possessions Tie You Down

My mother had quite a few sayings that she repeated often. She had an amazing work ethic and was very wise despite never attending college. I wrote about her life lessons in a prior piece. When I was a kid and without substantial means, I longed for the finer things in life. Fancy cars, homes, boats, trips, clothes, restaurants. “Champagne Wishes and Caviar Dreams,” as Robin Leach preached on Lifestyles of the Rich and Famous, seemed too good to be true to me. I could not fathom a Michelin Star restaurant or five-star hotel. I am not lying, as a kid, Bennigan’s, TGIF, or Red Lobster were fancy restaurants in my mind.

One of my mother’s many sayings was that “possessions tie you down.” When you are young and hungry, all you want is to acquire assets and possessions. I was always impressed when I saw a fancy car or drove through a nice neighborhood. As you age, you realize all this crap is nothing but headaches. You start to appreciate experiences, time with family and friends, trips, and memories more than material possessions. Some of the best times in my life were when I had limited means and appreciated things in a different manner.

I did not believe this would be my view at this stage of my life (55 years old), but I am getting rid of things. I sold my 1971 442 convertible. I could not justify a car I barely used. My large house and boat will be sold over the next 18 months as I no longer need them. My kids are off to college, and I no longer require such a big home. I will only live in Florida 7 months a year and will be somewhere cooler for the summer and early fall. Sadly, my children will be in college and then hopefully working somewhere, and I will not need a home with 10 bathrooms. I am not convinced I ever needed a home with that many commodes.

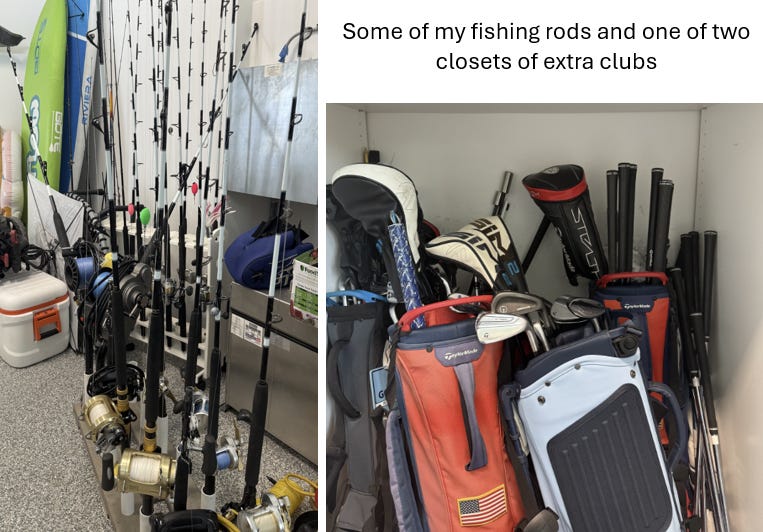

I have 8 surfboards that I don’t use, and my garage must have 75 golf clubs. Despite having a large home and four car garage, we spend $150/month on a storage bin for more crap that I am convinced we will never use. The local charities that accept this stuff are going to love me. I already gave away 15 suits, 12 blazers, countless pants, sweaters, jackets, coats, ties, and shoes. I wear shorts and a T-shirt every day. I have 18 coats despite living in Florida and rarely travelling to cold climates. I do think it is time I started reducing the number of golf shirts in my closet as well as I believe I have 75. Those damn clearance sales kill me. My once expansive watch collection is down to a few and I barely wear them; hello Apple Watch.

There is a saying, “youth is wasted on the young.” I can’t believe I am saying this, but my mother was right: “Possessions tie you down.”

Quick Bites

Core inflation in February hit 2.8%, hotter than expected. The higher inflation and weaker consumer sentiment pushed markets down 2-3% on Friday with the Nasdaq underperforming. Adding to economic data, the new tariffs that will be effective next week and markets reacted negatively. YTD, Fidelity sector performance shows energy (+8.6%) and healthcare (+5.4%) as the biggest outperformers and tech (-10.6%) and consumer discretionary (10.9%) as the largest underperformers. European stocks continue to outpace the US by a record pace. The 10-Year Treasury yield fell 11 bps despite the hot inflation data, as recession fears continue to escalate. Gold continues to soar, closing at $3,114 and was +1.7% on the week due to stock volatility and inflation fears. The US$ is coming under pressure as outlined in the 2nd chart.

I have written extensively about the stretched consumer, and now, more articles discuss declining consumer confidence. Numerous companies have cited a consumer pullback and declining confidence, which has pushed a growing number of CFOs to reduce guidance. Just this week, Lululemon shares dropped 15% after the CEO cited inflation and economic concerns were weighing on spending. At the start of 2024, 18-to-34-year-olds had the highest consumer sentiment reading of any age group tracked by the University of Michigan. The index of this group’s attitude toward the economy has since declined more than 6%, despite the other age cohorts’ ticking higher. Though the recession humor has had a years-long history online, it’s gained momentum in recent weeks as the state of the economy has become a more common talking point, according to Cohen, the Queens College professor. To add to the story, this is a concerning Bloomberg article, “The Richest Americans Kept the Economy Booming. What Happens When They Stop Spending?” The stock market volatility set off by concerns over President Donald Trump’s rapidly shifting trade war threatens one of the primary growth engines of the US economy: spending by high-income earners. When investor pessimism really takes hold, it can cause a swift hit to spending and growth. “It’s not like we continue dribbling out some low rate of our wealth. We clam up,” says Ferguson, adding that we’re not at that point yet. Interestingly, this CNBC article suggests tariff fears are pulling spending forward due to concerns of upcoming price hikes.

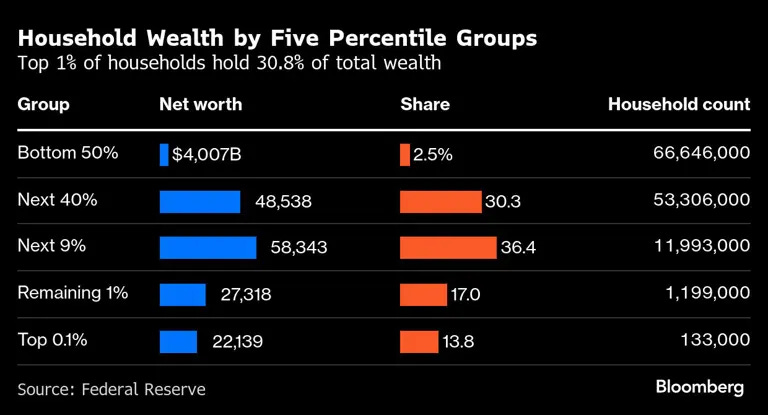

The wealth gap in the US has grown incredibly large and is concerning. This article outlines just how large the gap has become with some interesting charts. The richest half of American families owned about 97.5% of national wealth as of the end of 2024, while the bottom half held 2.5%. The lower 50% of the distribution saw their wealth share improve marginally during President Joe Biden’s term in office, climbing from 2.2%. The 66.6 million households in that group collectively owned about $4 trillion in net wealth at the end of last year, an increase of $1.25 trillion from four years earlier. Over the same period, America’s richest households — the 133,000 that make up the top 0.1% — gained more than $6 trillion in net wealth, mainly thanks to a surge in the value of corporate equities and mutual fund shares.

This is an interesting chart that shows how wages of major countries have changed over time. I know Trump wants to bring back manufacturing to the USA, and I am all for it. However, wages, unions and healthcare/benefit costs make the US very uncompetitive in making things relative to other countries. It is hard to compete when your wages are literally 50-100%+ higher than other countries.

Politics

Trump announces 25% tariffs on all cars ‘not made in the United States’

Trump’s new auto tariffs will likely drive up car prices by thousands of dollars

He expects to raise $100bn in tax revenues. Again, I support reciprocal tariffs, but do not support his poor strategy of implementing these tariffs. I cannot imagine these 25% tariffs will last for years. He is trying to raise revenues to pay for the continuation of the Trump tax cuts that expire this year. I am just not convinced all these tariffs will work out as he expects.

Wall Street analysts say Elon Musk is the clear auto tariff winner: ‘Tesla wins, Detroit bleeds’

Asian auto stocks extend declines as Trump tariffs on car imports dent sentiment

Trump threatens ‘far larger’ tariffs if EU and Canada unite to do ‘economic harm’ to the U.S.

Musk says he will finish most of $1 trillion federal cost cuts within weeks

Through March 24th, DOGE claims $115bn in savings. IF DOGE were to save $1 trillion and it is VERIFIED, this would be incredibly significant and a massive win for the administration. The federal budget is roughly $7 trillion – out of that, we’re short about $2 trillion each year.

Taxpayers Spent Billions Covering the Same Medicaid Patients Twice

When recipients signed up in two states at once, insurers often got paid by both; ‘it definitely is wasteful.’ A billion here and a billion there. Pretty soon we have $500bn in annual savings.

State Department formally shutters USAID after Trump court victory

Feds investigating Stacey Abrams-linked group’s ‘insane’ $2B EPA grant

White House weighing tax hikes for rich to pay for Trump’s no tax on tips promise

Trump anti-sanctuary city executive order could target federal funding, says expert

Trump pulls Rep. Elise Stefanik's nomination to be U.N. ambassador

Trump said Stefanik will remain in the House, where Republicans have a razor-thin majority.

"White men are going to be treated a lot tougher by judges from Tuesday, compared to other groups.”

Ex-Gov. Andrew Cuomo and top aide Melissa DeRosa had ‘emotional romantic relationship’

More than 200 'Tesla Takedown' protests planned this weekend

She fell on her face trying to chase down a young man wearing a MAGA hat. Who in the hell thinks it is ok to touch another person because you don’t like their politics?

Middle East

Israel Supplied Intelligence in Airstrike Discussed in Signal Chat, Officials Say

Houthi missile expert was tracked with help of Israel-linked human source in Yemen

Israel hits building in Beirut's southern suburbs, first since truce

Houthis say 17 air strikes hit Yemen as rebels attack US, Israeli targets

Israel’s antisemitism conference draws Europe’s far-right leaders to Jerusalem

Columbia’s new prez called Congress hearings on antisemitism ‘Capitol Hill nonsense’

Another clown as President of an Ivy League School.

NYC doctor fired over disturbing anti-Israel posts denying Oct. 7 attacks: ‘Long live Hamas’

I am thinking twice about who I would consider for a doctor.

Other Headlines

The New Billionaires of the AI Boom

The rush into artificial intelligence has minted fortunes worth a collective $71 billion for 29 founders.

The deal values xAi at $80bn and X at $45bn. Musk paid $44 billion for X in 2022, which I thought was wildly overpriced at the time. I am not convinced Twitter is worth $45bn today. The bigger point: Twitter was founded in 2006, became a successful social media company, and is now worth about half as much as xAI, a company that didn’t exist two years ago.

CoreWeave prices IPO at $40 a share, below expected range

The company, which provides access to Nvidia graphics processing units for AI training and workloads, had planned to sell shares for between $47 and $55. The 1st trade was $39 and closed at $40/share.

ChatGPT’s viral image-generation AI is ‘melting’ OpenAI’s GPUs

GameStop shares drop 22% after the retailer issues debt to buy bitcoin

AppLovin plunges 20% after third short-selling firm slams company’s technology

That $20 burrito you order from DoorDash could now cost you $70

Startup founder Charlie Javice found guilty of defrauding JPMorgan Chase in $175 million deal

Stranger shoves 86-year-old woman — breaking her teeth — in random attack at NYC supermarket

This happened on the Upper East Side at 1:25 pm. Bragg, what happens when he is caught? Any consequences for the crime, or let’s give him another chance? This is blocks away from some of the most expensive apartments in NYC.

Tragic moment boy, 16, shot dead at NYC bodega captured in distressing video

Texas menace accused of ramming mini 4-wheeler into parked Teslas

Kansas babysitter checks for monsters under child’s bed and discovers grown man hiding

If my daughter were babysitting and this happened, I think she would never recover.

Texas private school’s use of new ‘AI tutor’ rockets student test scores to top 2% in the country

Think of the implications of AI/robotics over the next 10 years. What jobs will be eliminated? How much more efficient will companies become?

Given that acceptances are going out now, I thought this was interesting.

Tens of thousands feared dead as Myanmar earthquake could see worst quake death toll ever

Old-school metal braces are making a comeback

Remember my note on the subject? Brace Yourself.

Meet Desmond Watson — the 464-pound lineman who could become heaviest player in NFL draft history

Health

Puberty is starting earlier. Should parents worry? 5 things to know from a pediatrician

Massive Study of 40 Countries Shows America Is an Outlier in the Worst Way

Study shows how America is underperforming on health-related results despite outspending other countries.

Real Estate

There are pockets of strength and weakness in the housing market in the USA. Two houses went on the market for similar prices at about the same time earlier this year. One got 25 offers. The other got none. There are many variables that determine demand, from the condition of the house to the price set by the seller. But one factor is having a major impact right now: geography. The Northeast and Midwest markets have far more prospective buyers than available homes. But parts of the Sunbelt are seeing a flood of houses for sale. The divergence is playing out in places like Wyckoff, N.J., where a four-bedroom ranch was on the market for just over a week in early February. With dozens of offers, the winning buyers contracted to buy for about $200,000 above the roughly $1.1 million asking price. But in Miami, a six-bedroom with a grand staircase and pool has sat on the market for nearly two months without a firm offer. The sellers cut the price by $9,000 to $990,000. In South Florida, there are more pockets of weakness showing. High prices, rising interest rates, and soaring insurance and maintenance costs have made it harder for people to buy homes. I am starting to see some homes sit on the market a bit longer in Boca, and inventory is even growing at the higher end. However, the best product tends to sell if priced appropriately.

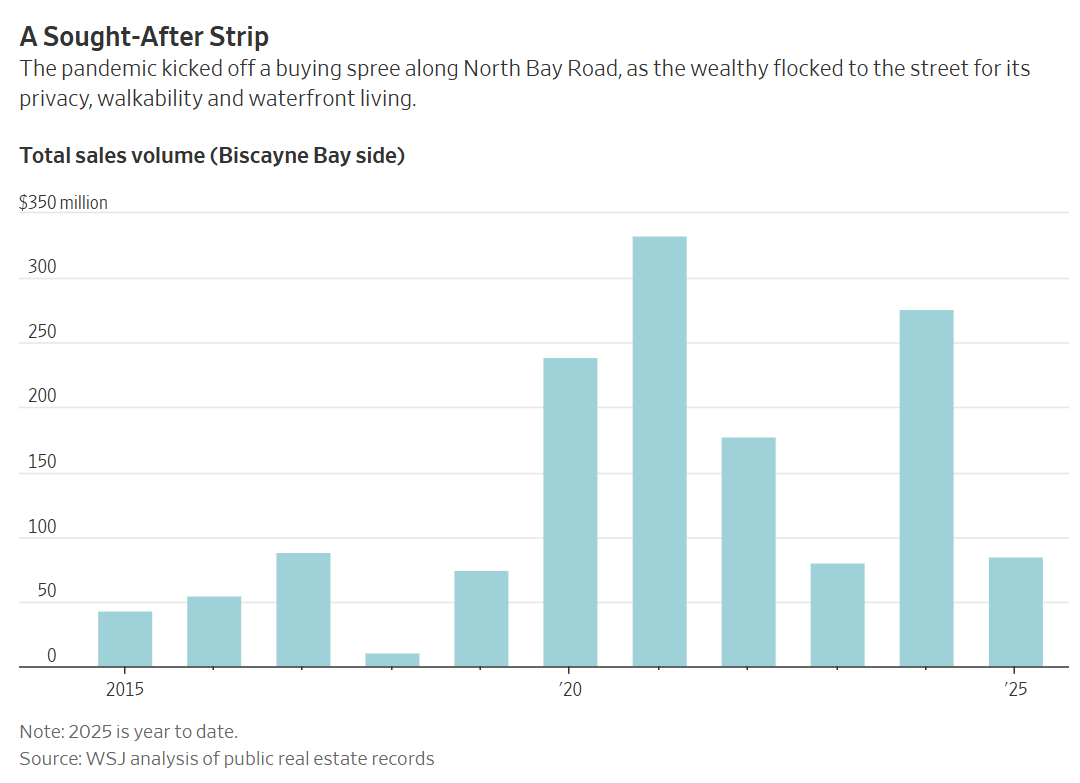

I have often written about North Bay Road in Miami Beach, and this WSJ article outlines what has transpired on one of the most sought after streets in Miami. In one example, over 20 years ago, a lawyer paid $3mm for 1 acre with 200 feet on Biscayne Bay and built a house for $15mm. Since COIVD, he has seen offers of over $100mm. Great interactive maps and pictures in the link. North Bay has some famous owners (Anand Khubani, Barry Diller, Barry Gibb, Beckham, Rande Gerber/Cindy Crawford, Jon Oringer, Shakira, Karlie Kloss/Josh Kushner, Josh Harris, Barry Sternlicht, Orlando Bravo, Chris Burch, and more). Some of the homes are spectacular and have amazing views. I have at least half a dozen readers who live there. A new spec house being built will be asking $250mm and a 1.5 acre lot will be asking $80mm on North Bay Road. On a related note, a house just sold in the low $80mms on La Gorce Island in Miami after a few weeks on the market. The same house was on the market in the $40mm range pre-COVID and is almost 20 years old. Welcome to the world of crazy prices for high-demand areas in South Florida.

Check out this PH from the Steinway Building that went into contract this week after asking $56mm. It has 7,256 interior feet over three floors and 1,241 ft of exterior space. The condo has 14’ ceilings, floor-to-ceiling windows, and a private elevator entrance. I would never want to live in this location, but the asking price was almost $8k/foot and has $20,841/month in common charges. Amazing photos in the link. Great amenities in the building.

NY Post article about the top 10 neighborhoods in NYC for buying a home. Brooklyn is for the buyers. Six neighborhoods there ranked among StreetEasy’s new top 10 list of New York City neighborhoods with the best conditions to buy, despite intense competition. From suburban Dyker Heights to pricey Park Slope, all of these neighborhoods shared increases in inventory and declines in median asking prices. That translates to more options at lower costs for buyers, offering much-needed relief amid volatile mortgage rates and eye-popping asking prices.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #773 ©Copyright 2025 Written By Eric Rosen.