Opening Comments

My last piece entitled, “Mentoring NBA Players,” had the link with the chimp reuniting with caretakers as the most opens.

I have a dear friend and major contributor to the Rosen Report who has a gifted son at Wake Forest who is majoring in physics. His summer internship was abruptly pulled as his lab at Berkley did not receive funding just prior to his start date. He is looking for a summer opportunity and is more interested in learning than the ultimate compensation. If you know someone who has a need, reach out and I will connect you.

I was sent this link for learning guides on generative AI from Google by a savvy friend who is a venture capitalist and founder of a multibillion-dollar company. I started listening to various courses to improve my knowledge of all these cutting-edge technologies and I found them informative. Some of the courses are below. If you are an AI idiot like the author of the Rosen Report, you might want to check some of these out while sitting at the beach this summer.

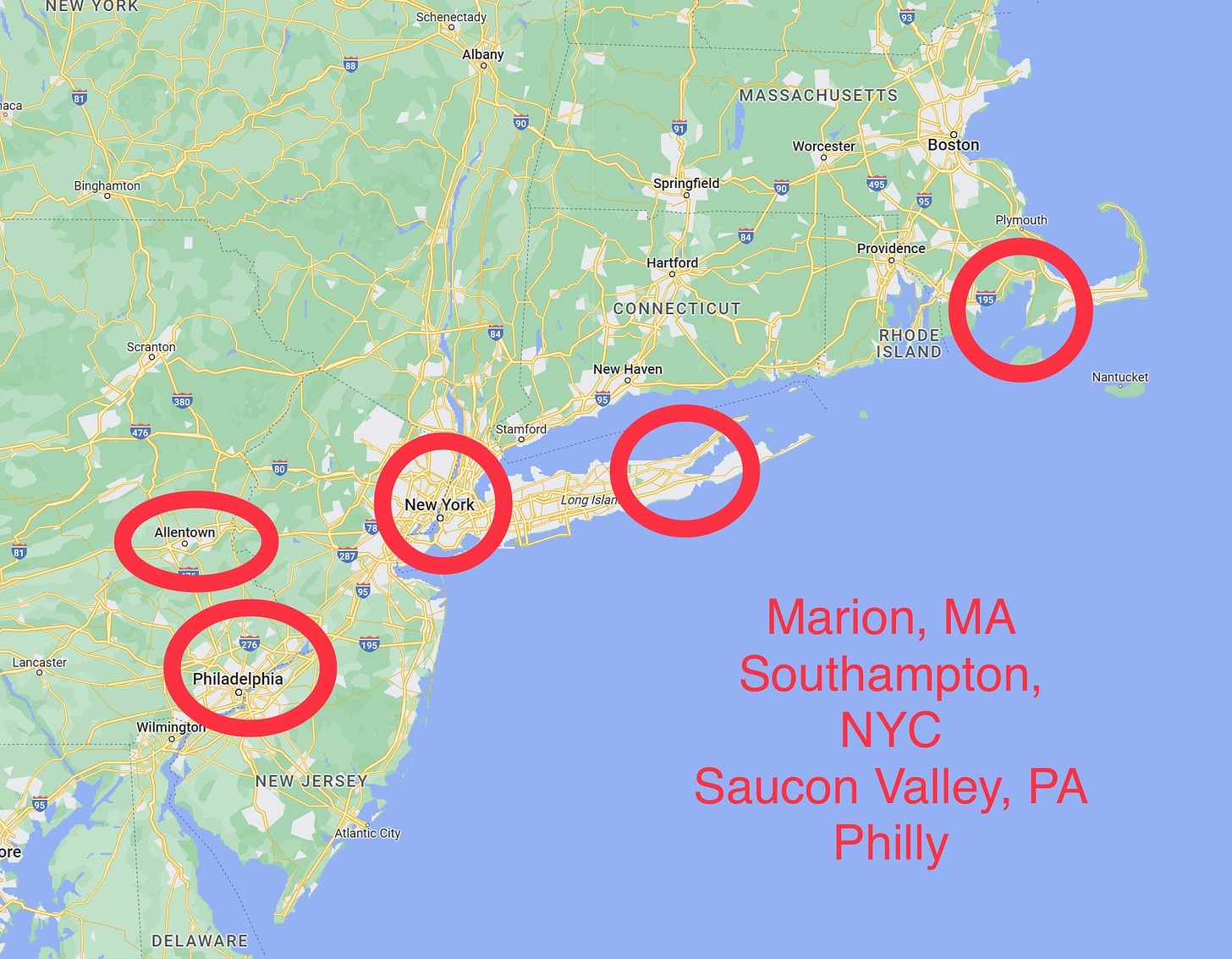

Jack and I leave tomorrow for NYC to start his golf tour. I vetoed Jack’s southern swing this year after the debacle of driving 9,000 miles across Louisiana, Kentucky, Mississippi, Alabama, Tennessee, and West Virginia in the heat wave last summer. This summer will be bouncing around the Northeast and be between NYC, Marion Mass, Saucon Valley PA, Hamptons, Philly and a few other locations for tournaments. I need some restaurants near Philly, as I will be there a couple times. No chance we eat Philly Cheesesteaks. If you want a good laugh, read my piece on that topic from two summers ago. The pieces this summer will likely be a little shorter given that doing them on a laptop is far more challenging. I hope we can breathe in NYC Thursday, as the fires in Canada appear to be causing haze issues down in the city. This CNBC article called NYC air the worst in the world on Wednesday and caused flight delays. The air quality index rose to 353 out of 500, which is 80% worse than the 2nd ranked city of Delhi, India. A normal day in NYC is about 100. More than 55 million Americans are under smoke alerts due to the Canadian fires.

Markets

Private Credit Growth and Issues-Charts

Russia Selling Oil to India, Saudi, China

Recent High-End Miami Home Sales with Link

San Fran Housing Declines

Two Major San Fran Hotels In Trouble

Banks Dealing with Office Exposure

Jeff Blau on Flight to Quality for Office

Pictures of the Day-Cafe Maxx-Pompano Beach, Florida

I am going to make an emphatic statement. I have lived in South Florida for the past 6 years and there is one restaurant between Broward and Palm Beach counties that stands out as better than the rest. It is Cafe Maxx which opened 40 years ago. It is the single most consistently solid restaurant by me. The food, service, wine, and dessert are top-notch. The room is nice, but the crowd can be hit or miss. I just never have a disappointing meal there. Prices are up sharply, but so many good dishes make it worth the money. My snapper with caramelized onions was amazing and they change the menu daily. I like the tuna sashimi pizza and the Brussels sprouts. Once you get down to Miami, there are more impressive restaurant choices with Michelin Stars and Bib Gourmand designations.

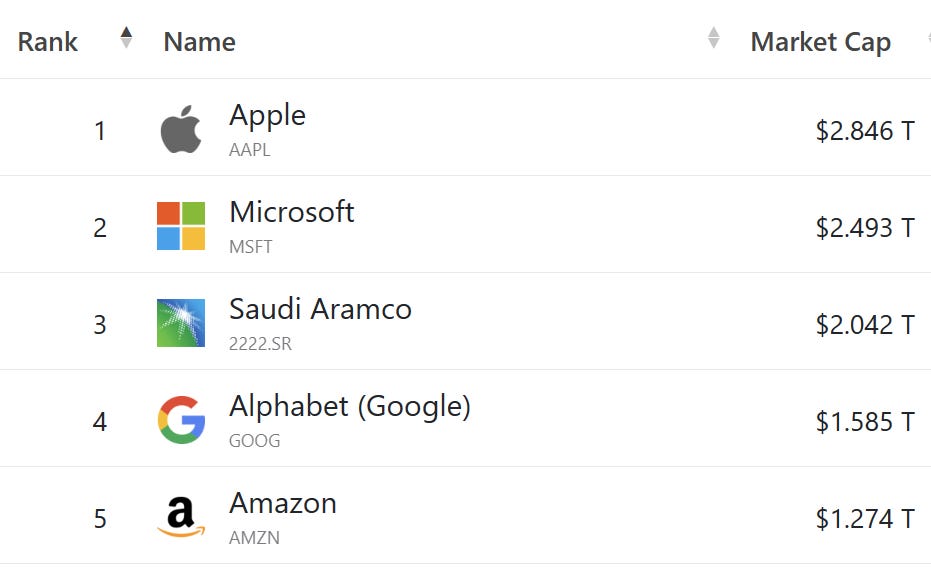

The Economics of Absurdity-Everyone Has a Price

Unless you live under a rock, you are somewhat aware of the absurd economic decisions the Saudis have done recently in an effort to “diversify” away from oil. Saudi Aramco (Saudi oil/natural gas company) went public and is the 3rd most valuable company in the world behind Apple and Microsoft. MBS, the Crown Prince of Saudi Arabia, has ventured into sports to improve the profile and move away from oil as the only revenue source for the country. The investment in sports is an essential part of a broader economic plan, Prince Abdulaziz said. Crown Prince Muhammad Bin Salman's "Vision 2030," a $7 trillion plan to diversify the economy beyond oil, while also softening some of the country's most restrictive social conventions and laws. It is clear to me that the Saudis are trying to improve their image with “Sportswashing” after some high-profile blunders from the government.

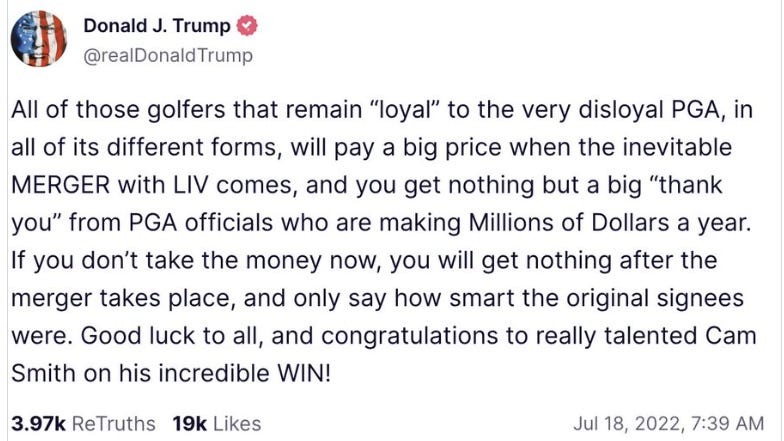

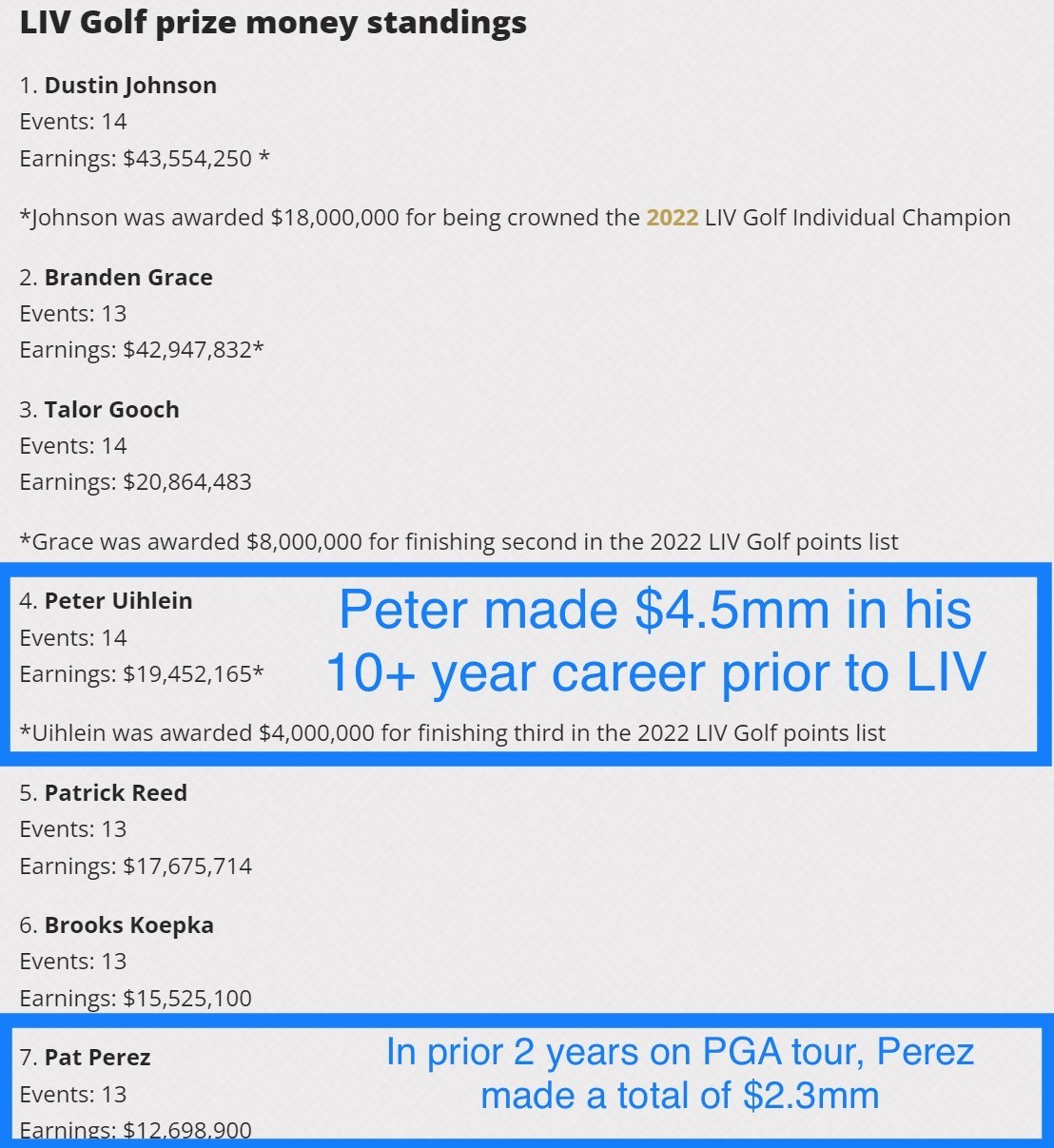

The Saudis have created a bit of a stir of controversy over the LIV Golf Tour. The Saudi Public Investment Fund spent almost $800 million in 2022 not including the massive signing bonuses to top players according to ESPN. Top players received $100-200mm signing bonuses (Phil Mickelson, Dustin Johnson, Brooks Koepka, Bryson DeChambeau). It was just announced on Tuesday that LIV and the PGA Tour, bitter rivals are “merging.” Shockingly, Trump called the merger in July 2022. Trump appears to be right that those who left “cashed out,” while those who stayed behind lost out.

One person close to the tour told me, “This transaction was covert and only a few people had knowledge of it.” This merger was so unexpected because the Commissioner of the PGA Tour, Jay Monahan, dug in his heels and fought LIV and the Saudis. He crushed the Saudis for the 9/11 attacks and said, “And I would, ask any player that has left or any player that would ever consider leaving—have you ever had to apologize for being a member of the PGA Tour?” He banned players who left the PGA Tour from playing in PGA events and was sued over it. There were many lawsuits that vanish due to the merger. I personally believe that the PGA Tour was on the wrong side of some of these suits and would have lost, which contributed to the merger. Also, mounting legal fees were weighing heavily on the PGA Tour. Another driving factor was sponsorships. The PGA Tour tried to keep up with the massive prize money from LIV only to find out the PGA sponsors pockets are not as deep as Saudi Oil money. I despise Monahan as do many PGA Tour players who are calling him a hypocrite. Many players are calling for Monahan’s resignation, and I concur. The Tour is supposed to be run by the players, but clearly is not the case.

Greg Norman, the hated former PGA star, who ran LIV said LIV has secured an additional $2bn of funding with plans for additional events in 2023 and 2024. It appears Norman will not have a role going forward post-merger, but needs to get a great deal of credit for putting LIV and Saudi Arabia on the map for golf. Players who struggled on the PGA Tour are making MILLIONS on LIV and taking the massive private plane LIV provides to tournaments. TV ratings for LIV events have been awful. Six events and three months into its sophomore season, LIV has quietly stopped publicly reporting its TV ratings, reversing course on an early-season strategy, and a sign that the league could be struggling to generate sufficient viewer interest.

For perspective, the 2023 prize money for LIV is $405mm across 14 events for the 48 player fields. To compare this to the PGA Tour in 2022, the total prize money was $428.6mm across 47 events and approximately 150 players per event.

The best example is Peter Uihlein who made $124k in his last PGA Tour year 2022 playing 14 events and made a total of $4mm in his 10 year pro career. In the past 14 LIV events, Uihlein has made $19.4mm. LIV also takes care of a majority of your travel expenses unlike the PGA Tour.

I feel the PGA Tour made critical mistakes and should have partnered with LIV earlier. This would be a good Harvard Business School Case study on what not to do by Monahan who helped to create this disaster and should not be rewarded. However, I just don’t understand the economics of LIV and have no clue about the path to break even, let alone profit. I am happy that Brooks Koepka won the PGA Major last month and do felt LIV players should receive World Ranking Points, but now they will with the merger.

I do not have the details of the “merger,” but one article has the Saudis putting in $3bn to start and I am not convinced it is a good investment even though the PGA Tour announcement is a big win for Saudi. Clearly, everyone has a price and we found Monahan does too. I cannot fathom he can last long with virtually no support from the tour. I am told this is basically a “handshake” deal and the details have not been finalized. The structure of this deal is critical to get around anti-trust issues and it may mean the end of LIV as we know it. One player told me the PGA players are talking about unionizing. Also, numerous politicians have weighed in with concerns over Saudi involvement. “Hypocrisy doesn’t begin to describe this brazen, shameless cash grab. I’m going to dive into every piece of Saudi Arabia’s deal with the PGA”, Oregon Senator Ron Wyden wrote on Twitter. “U.S. officials need to consider whether a deal will give the Saudi regime inappropriate control or access to U.S. real estate.” I do feel there will be roadblocks from an anti-trust perspective and it will be interesting to see how they are addressed.

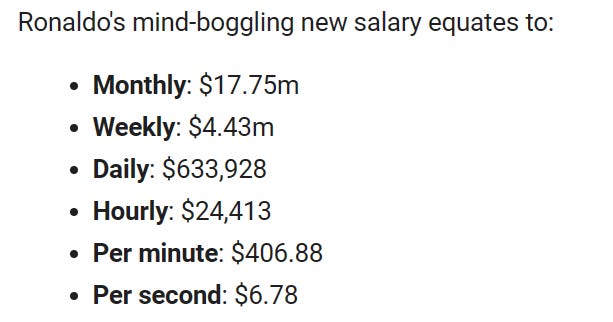

Golf is not the only sport the Saudis are dumping money into. Superstar, Christiano Ronaldo, signed with the Saudis for team, Al Nassr, which paid him $213mm/year. Remember, Ronaldo is 38 years old and well past his prime. For perspective, the highest-paid player in the Premier League is Kevin de Bruyne (31 years old) at 20.8mm pounds. An aging star is getting 10x what the top-paid player in the Premier League is getting? How does that make sense?

Karim Benzema, the Real Madrid forward and reigning Ballon d’Or winner is following in Ronaldo’s footsteps and signed a two-year deal worth a reported $600mm to play with Jeddah based, Al-Ittihad. Lionel Messi was rumored to be signing with the Saudis as well. One report has the contract at $658mm to play for the Saudis next season, while a Bloomberg article suggested the Messi deal could be $400mm/year. However, today it was announced that Messi will land at Inter Miami. I just again cannot fathom the economic feasibility of such decisions on these players.

In the end, I am reminded of the great scene from the movie, Wall Street with Michael Douglas (Gordon Gekko) and Charlie Sheen where they go up against Sir Larry Wildman on Anacott Steel. Wildman says, “I can break you mate…I can buy you 6 times over,” and won the deal from Gekko by buying him out. Seems eerily similar to the way Saudis ran over the PGA Tour given they have all the money and I believe the stronger legal hand due to Monahan’s ineptitude. Watch the fantastic 2-minute clip here.

Now Saudis, if you are reading this note, I know a brilliant man with good hair who writes an amazing newsletter called, The Rosen Report. If you are looking to expand your empire into the media world and want to own a widely respected newsletter filled with fascinating stories and news, I might be able to help you negotiate with the author. I hear he has a price for everything and will consider a partnership or sale. The list of readers is truly a Who’s Who of powerful business leaders, so strike while the iron is hot. I hear there may be multiple suitors who want to own a piece of history, so act now or you may miss out. I hear that Blue Horseshoe loves Anacott Steel and the Rosen Report.

Quick Bites

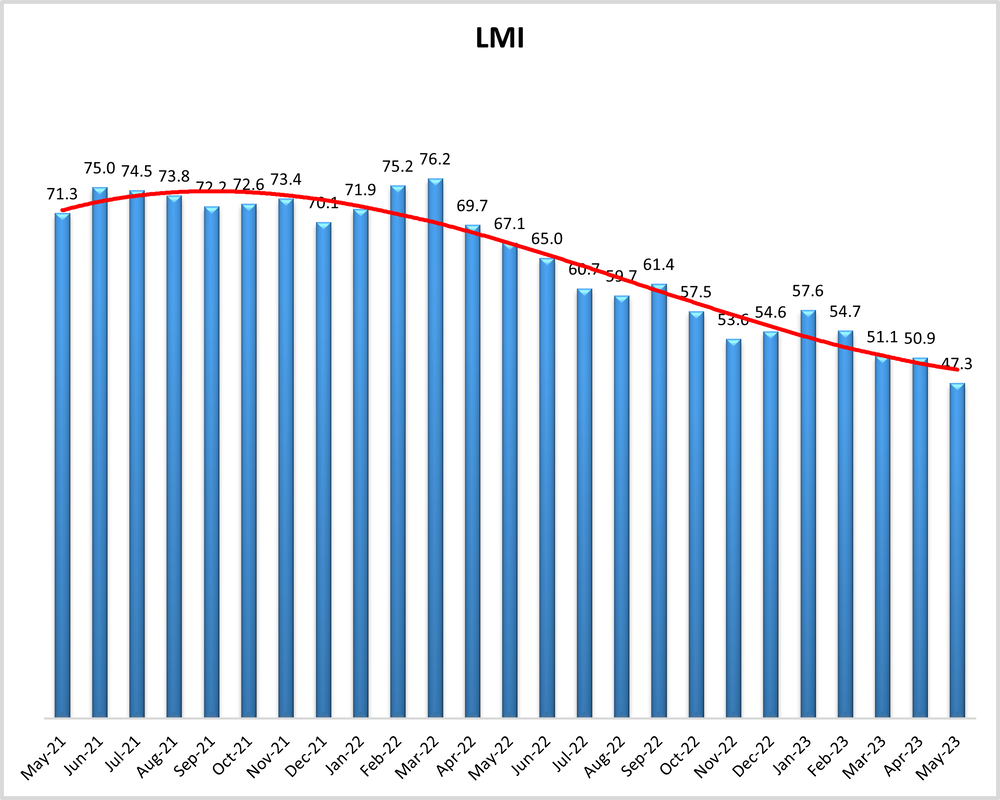

This week, the markets have not been very volatile, and equities and Treasuries are little changed. The Dow was up slightly and S&P down .4%, but Nasdaq was -1.3%. Energy was the best-performing sector at +2.5%. The Russell 2000 was up 1.8%, the biggest outperformance over the Nasdaq in over two years. Something to watch. The Fed meets next week and there is a 24% chance of a hike and 84% in July. Now, NO cuts are priced by year-end. Oil was +1.2% to $72.5 as the Saudi cut seemed to outweigh weak demand signals today. The May Logistics Managers Index (LMI) fell to 47.3 from 50.9 in April. This is the first time in the 6 1/2 yr history of this survey to slip below 50, "contraction territory." LMI said "The biggest factor behind this drop is the continued softening of the freight market."

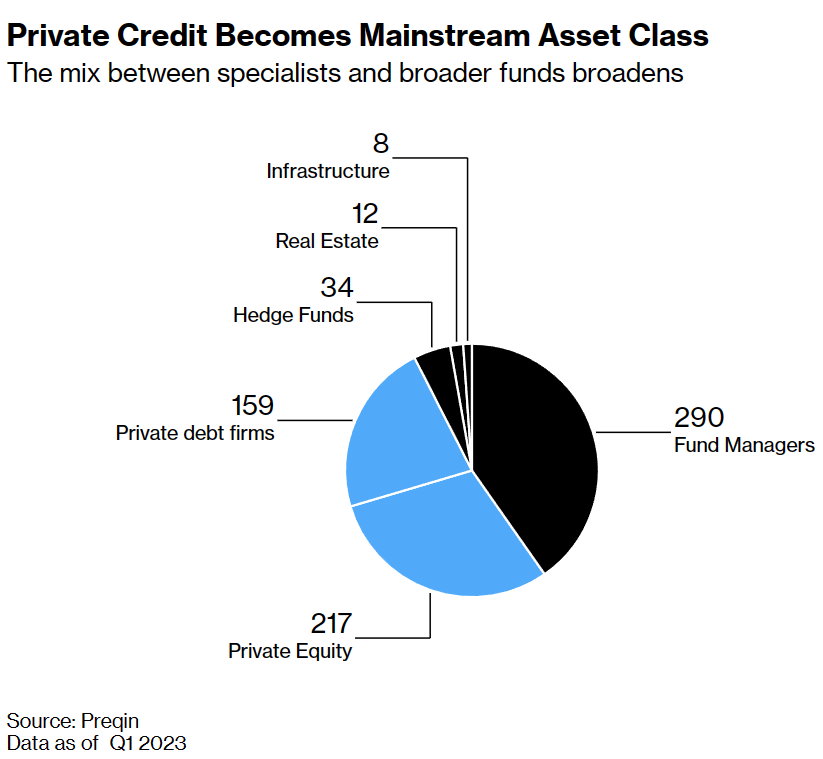

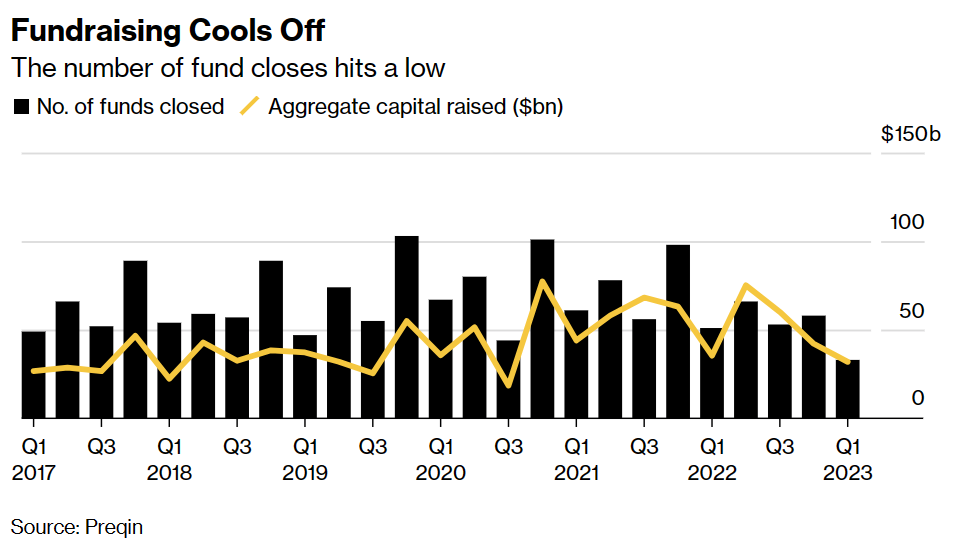

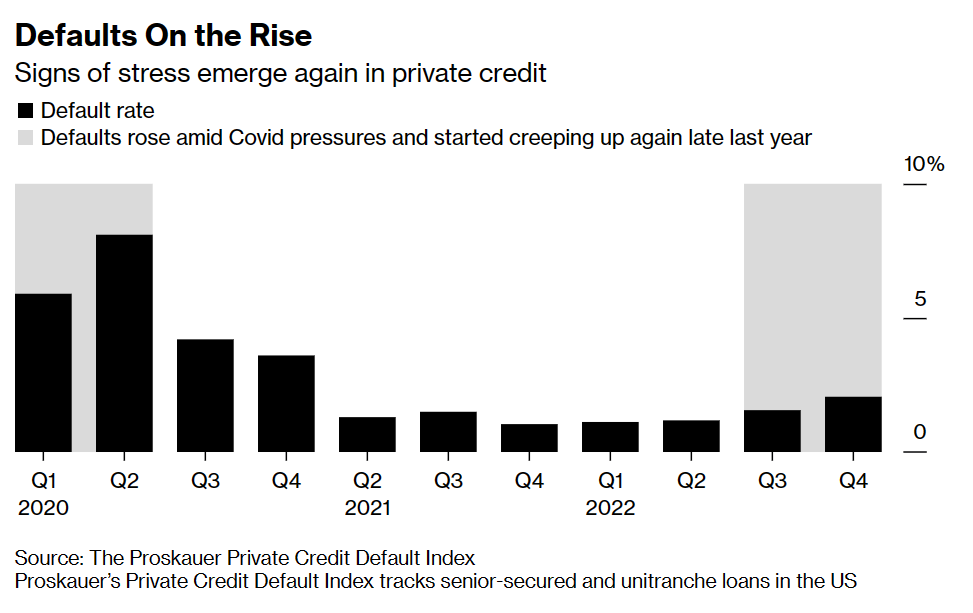

Interesting Bloomberg article entitled, “Private Credit is Poised for a Multi-Trillion-Dollar Boom, But It Could Get Ugly Soon.” The private credit market — which began by catering to private equity businesses and grew rapidly as banks pulled back after the global financial crisis — has roughly tripled in size since 2015 to $1.5 trillion. Apollo Global Management, the biggest alternative credit manager, says the industry could grow to replace as much as $40 trillion of the debt markets. A lot of great charts in the piece. The conclusion is that a huge amount of loans have been funded at lower rates, and given the floating rate nature of the loans, many borrowers cannot handle the additional interest burden today. The implication is rising default rates. Having been in the credit markets for my entire career and founded a credit hedge fund that did this type of business, I do feel these funds will replace banks that have pulled-back lending. The deposits leaving the system and the stress in banking have opened up the opportunity set for these funds and believe they will continue to grow. The issue becomes an over-saturation of the funds competing for deals which will reduce the attractiveness of the loans from both a yield and structure perspective. No, I don’t think direct lending is going away anytime soon but won’t be surprised if the over-saturation of new entrants coupled with an economic slowdown and higher rates leads to some bumps.

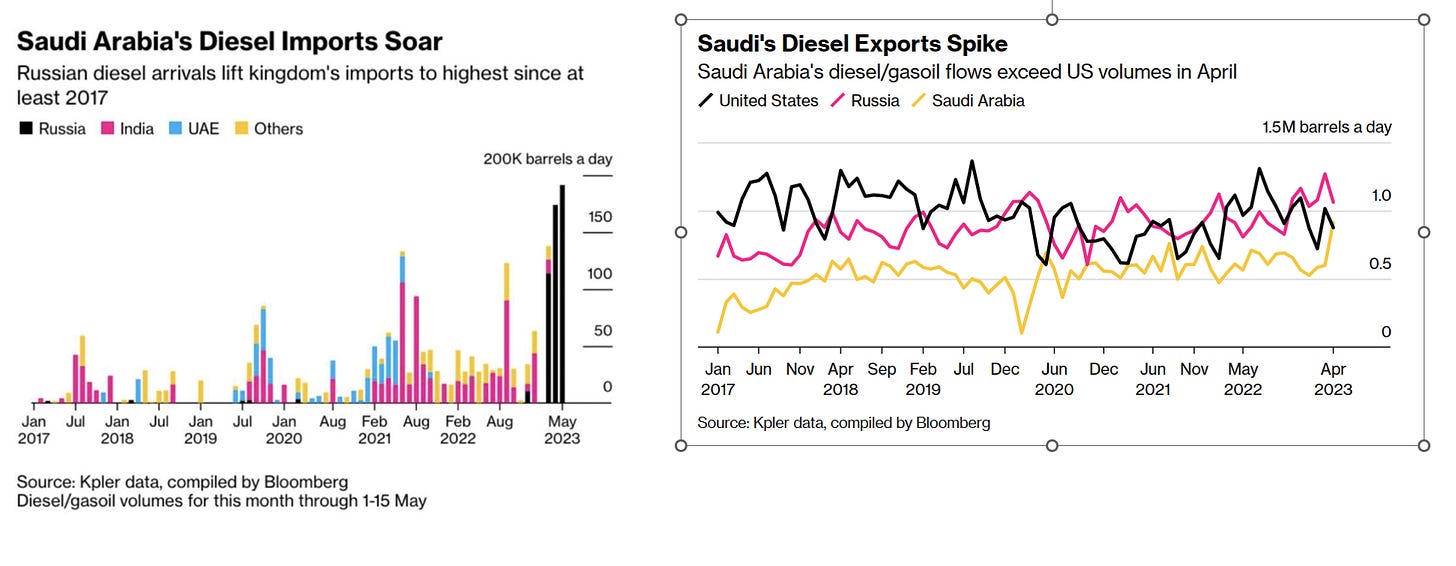

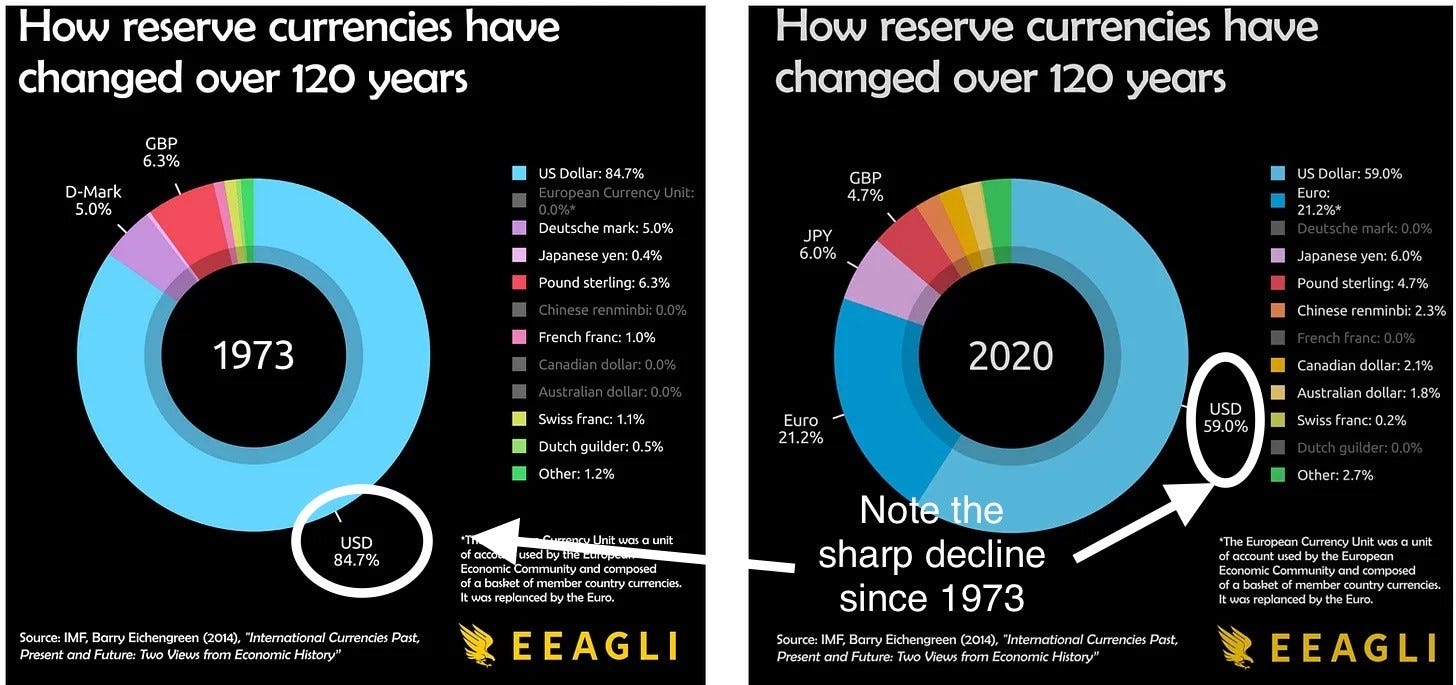

The US and EU put restrictions on purchasing oil and gas from Russia, but that has not stopped the Saudis, India and China from buying from Putin. Saudi Arabia is snapping up millions of barrels of Russian diesel that Europe no longer allows, while simultaneously sending its own supplies back to buyers in the EU. The kingdom imported 174,000 barrels a day of diesel and gasoline from Russia in April and even more so in May, data compiled by Bloomberg from analytics firm Kpler show. Simultaneously, it became Europe’s top supplier, leapfrogging Russia since February. India's imports of Russian oil rose tenfold last year, according to Indian state-controlled lender Bank of Baroda. The figures show Asia's third largest economy saved around $5bn (£4bn) as it ramped up crude purchases from Moscow. Russia has been selling energy at a discount to countries like China and India, which is the world's third-largest importer of oil. In 2021 Russian oil accounted for just 2% of India's annual crude imports. That figure now stands at almost 20%, Bank of Baroda said. China’s imports from Russia are hitting records as well. It just does not seem as though other countries take the US very seriously anymore and there are no ramifications. The US is losing its leadership position due to clown Presidents, bad fiscal policy, runaway money printing, bad foreign policy… the list is endless. Although the US $ remains the reserve currency, it is losing its luster. The US $ remains 58% of reserve currencies but it has fallen in recent decades, and expect that trend to continue. For perspective, the dollar was 84% of reserve currencies in the early 1970s. This is an amazing interactive chart that shows changes over time for reserve currencies, but only goes through 2020. Check out this Bloomberg headline, “US Treasuries Blacklisted by German State as ESG Law Takes Hold.”

Other Headlines

Goldman Sachs lowers the chance the U.S. could slide into a recession

Took it from 35% to 25%. They cited Debt Ceiling and less banking stress.

Jeffrey Gundlach sees higher chance of downturn as economic indicators look ‘full on recessionary’

Morgan Stanley Expects a Shock 16% US Profit Drop to Kill Rally

How many buyers are there for $3,500 mixed reality glasses. I certainly am not one of those who cares.

OPEC+ sticks to 2023 oil production targets as Saudi Arabia announces further voluntary cuts

Oil rallied 2.5% on the news. Saudis will cut 1mm barrels/day in July.

Twitter’s U.S. Ad Sales Plunge 59% as Woes Continue

Twitter’s U.S. advertising revenue for the five weeks from April 1 to the first week of May was $88 million, down 59 percent from a year earlier, according to an internal presentation obtained by The New York Times. The company has regularly fallen short of its U.S. weekly sales projections, sometimes by as much as 30 percent, the document said.

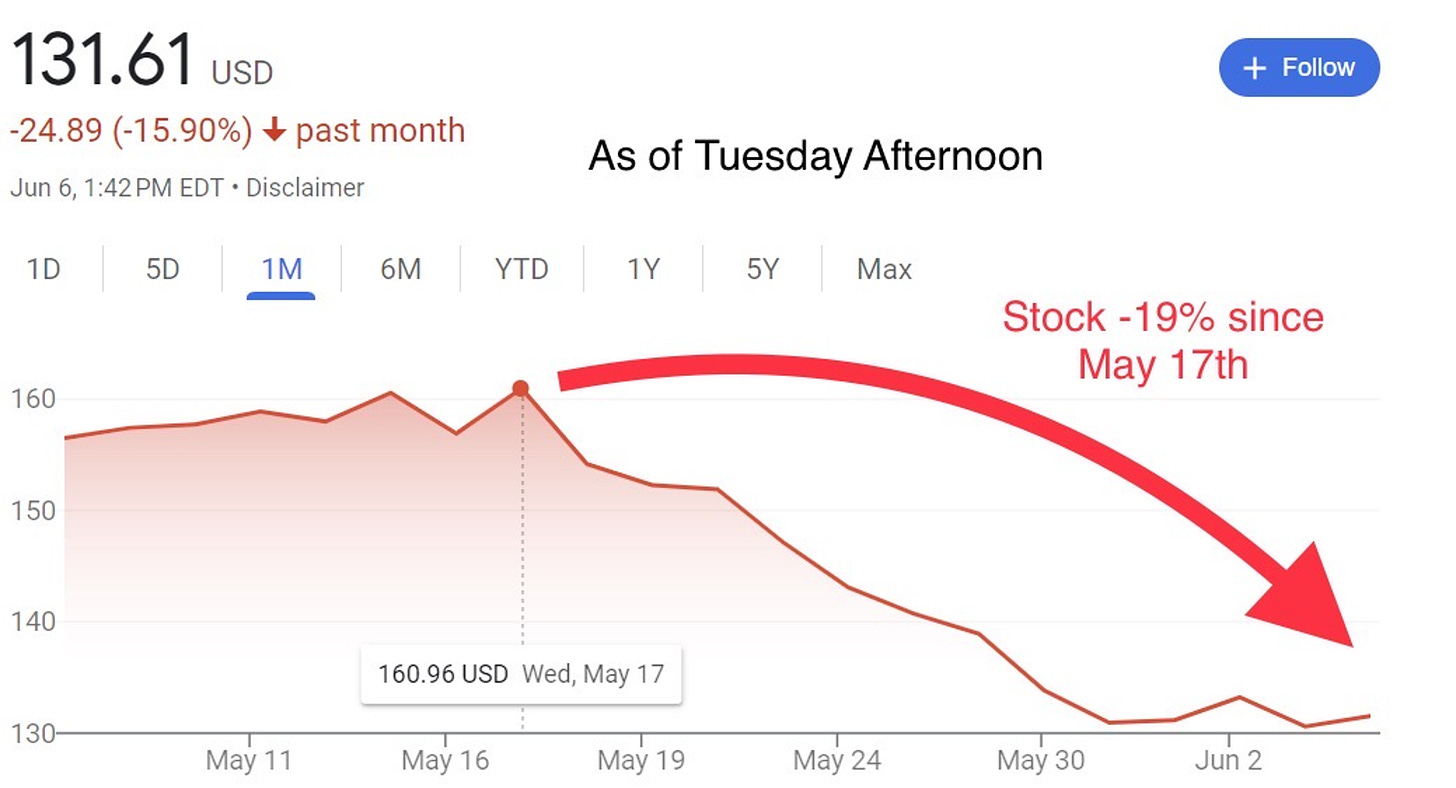

During this time, the S&P 500 is up 3%. There is also a story that Target is funding an effort to tear down Mount Rushmore. In the link, Kevin O’Leary outlines his criticisms of the woke ad campaigns and the cost to the companies. Now, over 200 LGBTQ groups upset about Target’s decision to pull Pride merchandise are demanding the company “Denounce extremists” and restock the shelves. Target literally CANNOT WIN.

GitLab shares rocket 31% as software vendor boosts forecast, announces generative A.I. plans

US SEC sues crypto exchange Coinbase, one day after suing Binance

After a brief sell-off, Bitcoin rallied 6.5% to $27k+ and ETH was +4.5% to almost $1.9k on the news, but both were off 2% on Wednesday.

CNN CEO Chris Licht out after Trump town hall fallout, brutal Atlantic article

The network has become a dumpster fire.

Jamie Dimon Has ‘No Plans’ to Run for Office, JPMorgan Spokesman Says

This is disappointing given the lack of leadership in this country. I would 100% support Dimon if he were to run. We need a leader with good policies and having both of those factors has proven elusive for too long.

Trump’s Truth Social Faces More Trouble As SPAC Partner Admits Financial Statements Are Unreliable

'I Think He's Toast': Watergate Prosecutor Says Trump Case Is Now 'So Strong'

Videos of boxes of confidential documents being moved and now an audio tape of Trump admitting the documents were not declassified. Just does not show well for Trump. The Republican candidate list is growing and now stands at least 8 candidates, and I may have missed some. An article today says, “Feds inform Trump he is target likely to be indicted as DOJ rebuffs prosecutorial misconduct claim.”

Adams floats idea of New Yorkers housing migrants in ‘private residences’

He is putting some migrants up in churches and paying $125/night per person which is cheaper than the hotel rates. However, Adams is discussing paying private residences money to house illegal immigrants. We all know that NYC residents have so much extra space in their apartments to house more people. What could possibly go wrong with this plan? How many more reasons do these politicians give you to leave NYC? If the private residence plan went ahead, it could mean New Yorkers are being paid more to host a migrant than a foster parent is given to raise a child in the Empire State. The state currently pays a daily allowance of $40 for children aged over 12 years, according to the Office of Children and Family Services. Roughly 2,200 migrants arrived at city shelters in the last week alone, according to City Hall.

California judge robbed of Rolex, car keys by 3 men at gunpoint in broad daylight

Footage shows Chicago group with 'machine guns' blast away, killing 14-year-old

Box-wearing thief drops disguise long enough to reveal face, helping lead to arrest

Of course, this was in Florida. The idiot wore a box which he had to take off as he could not see. He was found at a nearby liquor store with his friends. He stole 18 iPhones and $8,000 in cash.

Woman attacks strangers, lunges at mother and baby in wild rampage inside NYC park

This downtown park was one my kids played at countless times. Watch the disturbing video. How long you think she stays in jail?

E-bike battery fires this year have killed more in NYC than in 2022

America Signs Global Climate Agreement to Crack Down on Farming

Elon Musk Sends a Powerful Message to Anxious Farmers Worldwide

You need to read this article.

About 9% of adults in 30 countries identify as LGBTQ, survey says

Respondents included more than 22,514 adults under the age of 75 in 30 countries who answered the survey online between February 17 and March 3. I spoke with a high school student who had a teacher who told the class that 50% of Americans identify as LGBTQ and when a student questioned the accuracy of the statement, the teacher lost it and talked about her advanced degrees and never to question her.

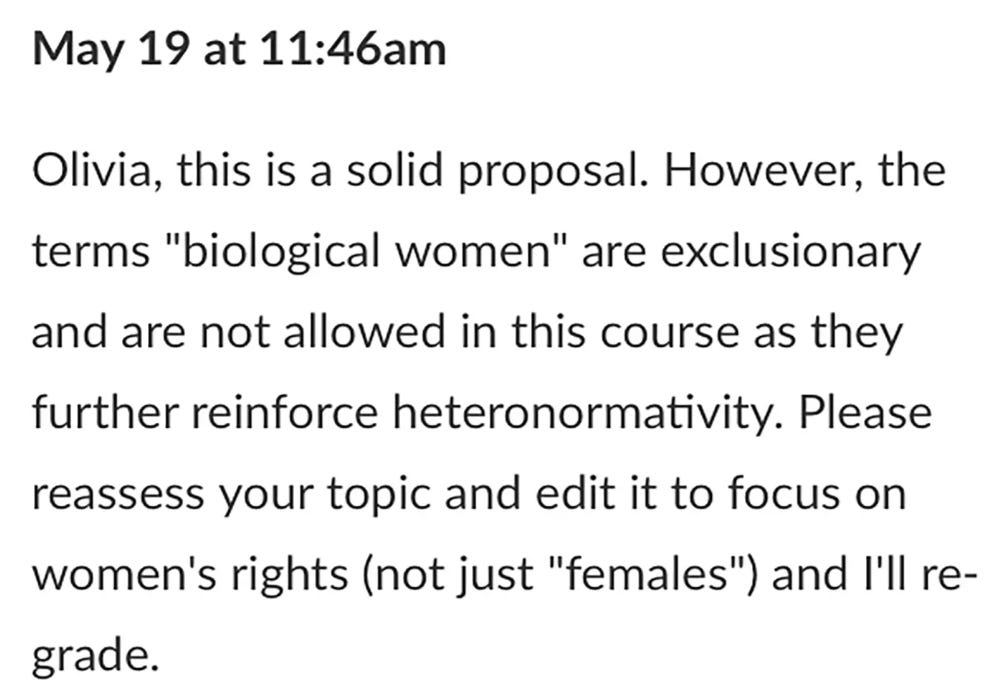

Why send your children to college if this is what they will learn? Read the article. How sad that you cannot use the term “biological woman” in college. “Focus on women’s rights, (not just females.”) Welcome to academia in 2023. Remember, Harvard just hired Lori Lightfoot.

Americans are ‘more afraid of running out of money than death’

With interest rates at zero for a dozen years, big stock market drawdowns in GFC and COVID as well as people living longer, inflation and offensive healthcare costs more folks are concerned about outliving their savings.

GREAT parenting. I loved reading this article. The kid is incredible.

Treatment Breakthrough for an Intractable Brain Cancer

The drug helps glioma patients stave off cancer growth. The median time without spread for patients on the drug stretched beyond two years, and the drug reduced the risk of cancer progression or death by 61% in the 331-person study.

This Summer Will Be a Tick Fest. Know What to Do if You Get Bitten.

Good tips in this WSJ article. Remove the tick without twisting. Clean the area with rubbing alcohol. Flush the tick down the toilet, don’t crush it. The CDC tick bite bot has more information. Check yourself carefully, as these little ticks are no joke.

Mysterious, Morse code-like ‘structures’ at center of Milky Way ‘stun’ astronomers

A mere 25,000 light years away, these dots seem to be pointing to a black hole. Check out the pictures which are amazing.

Whistleblowers 'worked on secret US government program to rebuild crashed UFOs'

Incredible story. I am a firm believer that UFO’s are real and that we are not alone. I am begging to be abducted to write about it in a future report.

Ukraine dam supplying water to nuclear plant and Crimea is breached, unleashing floods

Real Estate

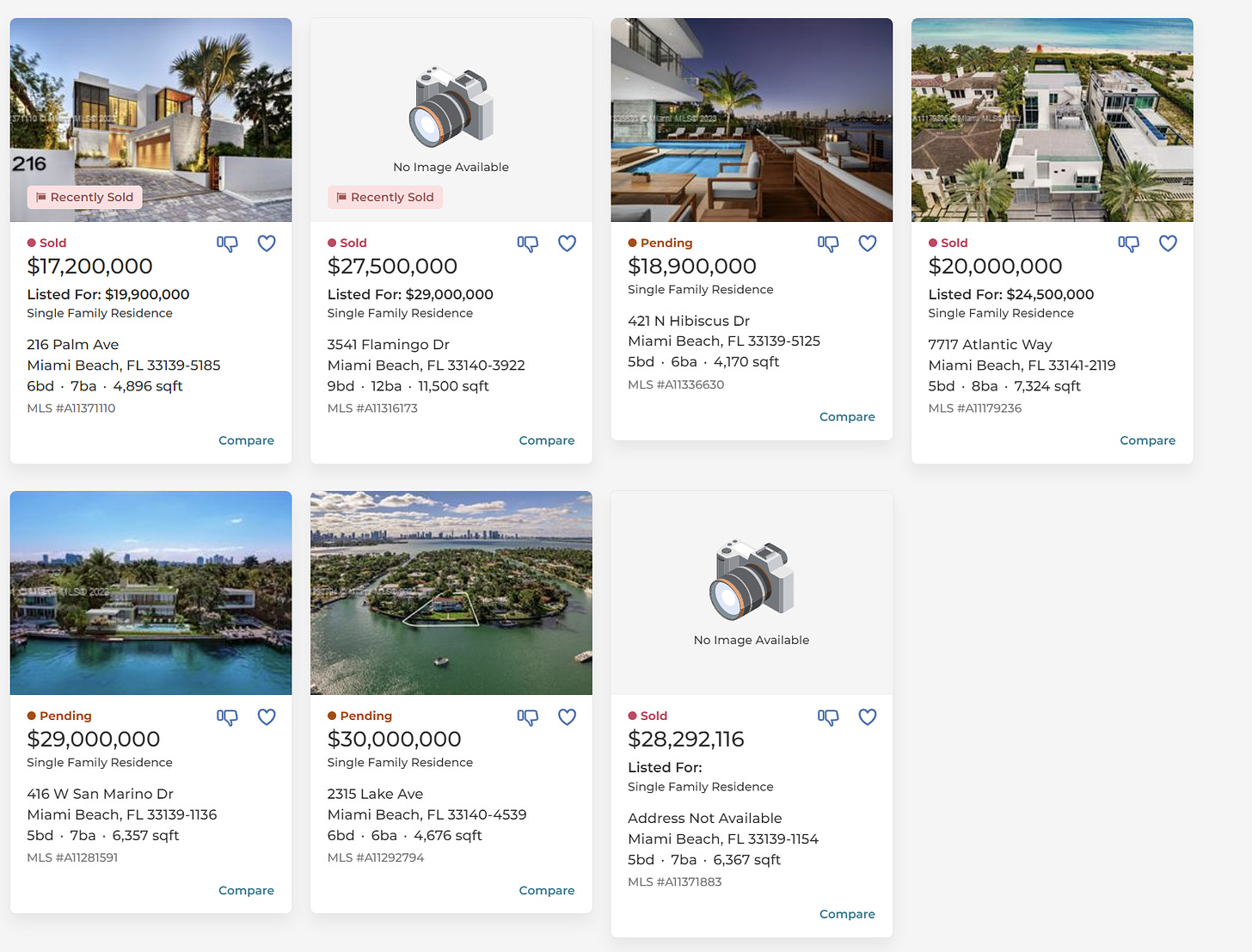

In Miami, some higher-end homes have slowed down on sales up until the past week. Ten waterfront homes over $17mm have gone “pending” recently. Devin Kay from Douglas Elliman made these comments: All of these houses have recently sold, many of which have been lingering on the market for quite some time. Additionally, below the ones pictured are a few others that have gone into contract but the MLS has not been updated yet. I believe what is happening in the $15-30mm price point is a lot of these buyers who were hoping pricing would adjust lower or inventory would come online realized that is not happening so if they want to secure a prime property in Miami Beach whether it be for relocation, prior to school starting etc they needed to act now. It is very uncommon to see this many high-end homes go into contract in such a short timeframe at this point in the year when most of the UHNW buyers have already left for the for summer.

2700 N Bay Road - Teardown. Sold for $24.5M

6445 Allison Road - weird layout & specific decor. Turned down an offer during peak Covid market for $21mm, heard it sold around $18mm

1370 S Venetian way just sold for 21M

US residential home values have declined modestly since their 2022 peak, reflecting higher mortgage interest rates. But residential values have plunged in San Francisco, falling by about 16.7%, compared to a decline of just 3.3% in the rest of the country, a difference of about 13.4 percentage points. San Francisco’s housing stock was valued at nearly $2 trillion by real estate valuation firm Zillow before the price plunge. This additional 13.4 percentage-point drop means that San Franciscans have lost an extra $260 billion more in residential real estate value than it would have had it kept pace with the rest of the country. San Francisco’s housing price decline reflects the fact that the city has lost more than 65,000 residents, roughly 7.5% of its population. San Francisco’s population loss has been the largest among all major cities in recent years. Quality of life and crime have worsened in San Francisco, even in these expensive neighborhoods. Nearly 90 percent of Nob Hill sidewalks and streets were recently found to be soiled with feces. Unacceptable street and sidewalk sanitation, including human feces and used hypodermic needles, have been an issue for San Francisco for years. Clearly, work-from-home has had a huge impact given tech, but the crime policies, drugs, homelessness, filth, and woke DAs…have played a big part in the decline of the once-great city. More folks from San Fran are moving to Florida. The chart below is a few months old.

On a related note, the owners of two large San Fran hotels have stopped paying on the loans citing, “Concerns over Street Conditions.” This is despite the fact that San Fran’s tourism board just spent $6mm on an ad campaign to try to improve the reputation of the city. The hotels in focus are the 1,921-room Hilton San Francisco Union Square and the 1,024-room Parc 55 San Francisco. After much thought and consideration, we believe it is in the best interest for Park's stockholders to materially reduce our current exposure to the San Francisco market. Now more than ever, we believe San Francisco's path to recovery remains clouded and elongated by major challenges – both old and new: record high office vacancy; concerns over street conditions; lower return to office than peer cities; and a weaker than expected citywide convention calendar through 2027 that will negatively impact business and leisure demand and will likely significantly reduce compression in the city for the foreseeable future." Maybe, just maybe the policies of San Fran are not good for businesses or residents. Wealthy people are leaving in droves, large companies including Tesla and Oracle have left and the homelessness, crime, and filth are incredible. The vacancy rate is around 33% and the availability rate is approaching 40% in San Fran for office space. Nordstrom, Target, Walmart and other major retailers have closed stores. Who would move to San Fran today?

Interesting article from the Real Deal entitled, '“Banks tearing off Band-Aid on bad office loans” on banks office exposure and more borrowers turning over the keys as there is no path to a turnaround. The banks don’t want the Class “B & C” office buildings and there are not a lot of buyers in the wings. Banks are typically reluctant to realize defaults, as they force the lender to mark loans to market value. The difference appears as a loss on their balance sheets. An extension staves off that bottom-line hit. But banks now have dwindling hope that office will recover and that owners can make good on their debt. “The office industry is in secular decline,” said Ben Miller, CEO of investment platform Fundrise. “Values are going down and they’re going to keep going down.”

A study revised this month by Columbia University and New York University projected office values would shed 44 percent of their pre-pandemic value by 2029 – up from an estimated 22 percent a year ago. “It’s an unenviable scenario, to end up with a Class B or C office building,” Sam Chandan, director of NYU’s Institute of Global Real Estate Finance told The Real Deal’s podcast. “That’s not necessarily the outcome any lender is looking for.” Note sales offer a third option. A bank can sell distressed loans for cents on the dollar to wash its hands of the loans. The buyer, having paid far less than what is owed on the loan, can initiate a workout with the borrower or foreclose on the asset securing the loan. But the secondary market for these loans has been devoid of bidders, as most see office as more trouble than it’s worth, workout experts say.

Thanks so much. Amen to better hotels! Where did she play?

Good luck on the Summer tour with Jack! May your lodging options be better than last year’s horror stories. Have daughter in Boston who played Mbr/Guest today...no smoke there. Hope the NY area improves quickly for all.