Opening Comments

Today’s summary Rosen Report is available via a 22-minute audiocast here. Feedback appreciated.

Wednesday’s piece was entitled, “Stem Cells-The Future of Medicine?” I heard from numerous readers who wanted to learn more, so I connected them with the doctor. I believe it is worth the time to have a discussion to see if the treatments may help you. One wellness doctor with a remarkable pedigree called me to tell me he read my piece and said, “You are right. Stem cells are the future of medicine, and most doctors do not realize it yet.” Please take the time to read Wednesday’s piece and watch the video.

I also wrote in the last piece about major insurance issues in Florida due to Hurricane Ian. Another concerning headline, “Tampa insurance CEO says Hurricane Ian losses will push industry 'to the brink? I am worried about how the storm will impact the rest of the state and the resident’s ability to get coverage. “In Hurricane Ian’s Wake, Insurers and Homeowners Gear Up for Coverage Fights.” Premiums will skyrocket.

I moved the Virus section below Real Estate for now given the substantial improvements in the data and the interest in R/E. However, watch Europe, cases are rising with the colder weather and there are concerns it will happen in the US.

Picture of the Day-Record KDW

Guinness Book of Records for Swear Words in 1 Hour

Quick Bites

Markets

Energy Independence or Reliance?

Stress Fractures Due to Rate Policy

Consumer Credit Growth

Biden Pardons Pot

Other Headlines

Crime Headlines

Real Estate

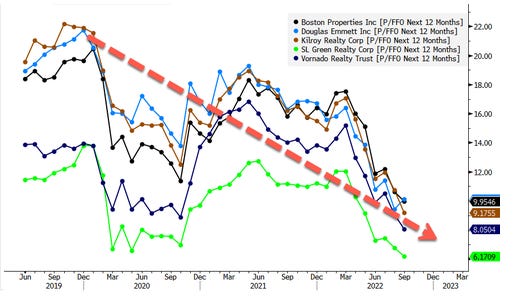

Negative Articles on Office Space and Upcoming Losses

Other R/E Headlines

Virus/Vaccine

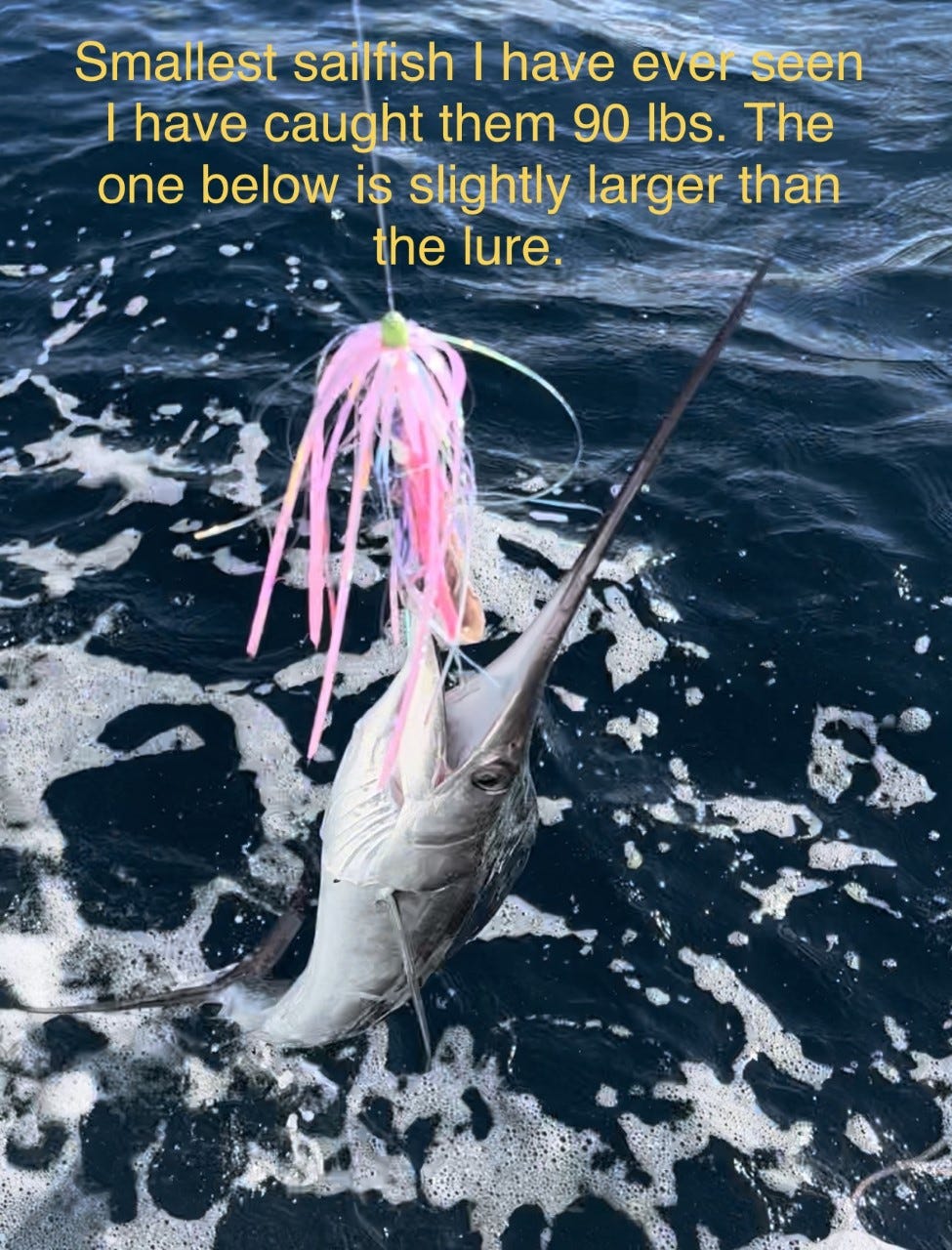

Picture of the Day-KDW

KDW stands for Kingfish, Dolphin, Wahoo. It is an acronym for fisherman and it is a nice feat to accomplish. In a tournament if you catch a nice KDW, it could be 75-100lbs in total. Meaning the total weight of the 3 fish would be 75-100lbs. On Thursday, I went fishing for the 1st time in weeks given the Hurricane Ian and my boat getting fixed. I got a KDDWS. Meaning Kingfish, Dolphin/Dolphin, Wahoo and Sailfish. Sounds super impressive. The variety indeed was, but the size of the fish was awful. My KDDWS totaled less than 15 lbs. It was seriously embarrassing. My largest King ever was 50lbs, Dolphin 45lbs, Wahoo 51lbs and Sail 90lbs. I always let 100% of the sails go and this one did not weigh 3 pounds. The embarrassing KDDWS can be seen below. I did make Wahoo nachos for dinner. It was a beautiful day on the ocean and we saw a massive Hammerhead Shark. Lots of fun despite the embarrassing size of the catch.

Guinness Book of Records for Swear Words in 1 Hour

I have beaten myself up about the car accident from a couple weeks ago as outlined in my piece, “There are Idiots, Morons, Imbeciles and The Author of the Rosen Report.” For those who missed it, I bought a 1971 Olds 442 Convertible and wrecked it in my first day of ownership as the hood flew off my car after I did not secure it with the locks. I ordered a new hood and had been awaiting word to bring the car into the shop.

The shop called and asked me to have it towed in on Tuesday am. I started the car Tuesday early, no problem and thought all was fine. The tow truck driver, Kyle, came and I could not get the car started. Literally 30 minutes with no joy. I was cursing like a drunken sailor, and he was getting a nice chuckle out of it. He suggested we get more gas as the tank appeared low. I lost count at 742.

I ran to the hardware store for a gas can and went to a gas station. I put in my card and the pump and my card was locked. I could not get the card back or gas. I went into the cashier 4 times with no joy, and while he was trying to get my card back, I tried at another pump with another card, which he said worked only for the same thing to happen. Kyle was waiting for me and I had not gotten any gas and was down two credit cards. After 15 minutes, my cards were released, but not before I cursed a minimum of 753 times. I then paid cash at a different pump and filled the tank. However, the gas stopped flowing every 3 seconds, so it took an uncomfortable amount of time to fill it and gas was all over me. More swearing. Let’s assume 423 times.

I got home and filled the gas tank, but not before spilling gas all over myself in the transfer to the car. You guessed it. More cursing. Approximately 325 times. Then the car still would NOT start. I don’t know the word I can use to describe my frustration as irate is not nearly strong enough to paint the right picture. I called my son, Jack, to help us push the car onto the enclosed truck. Given he is 5’11.5” and 128 lbs, he is not much help pushing the 4,000 lb car, so he steered as Kyle and I pushed. We could not get the car up the ramp and I had to call in for back up. My good friend, Jaron, rushed over and excitedly helped up push the car into the truck, but not before another few hundred zingers were uttered.

I am humiliated enough from what I did and the mistake I made in damaging the car, and it has been compounded by me looking at the car in my garage without a hood AND then the inability to get it started. I feel like such an idiot and sounded like an even bigger one with my tirades in my garage, at the gas station, on my driveway and on the street trying to get the car into the truck. I lost count at 2,543 swear words and wonder if anyone knows someone at Guinness to see if I win anything. I need some good to come out of this debacle. In a related story, the Post came out with the city most likely to have residents to curse and the winner was Columbus, Ohio!

Quick Bites

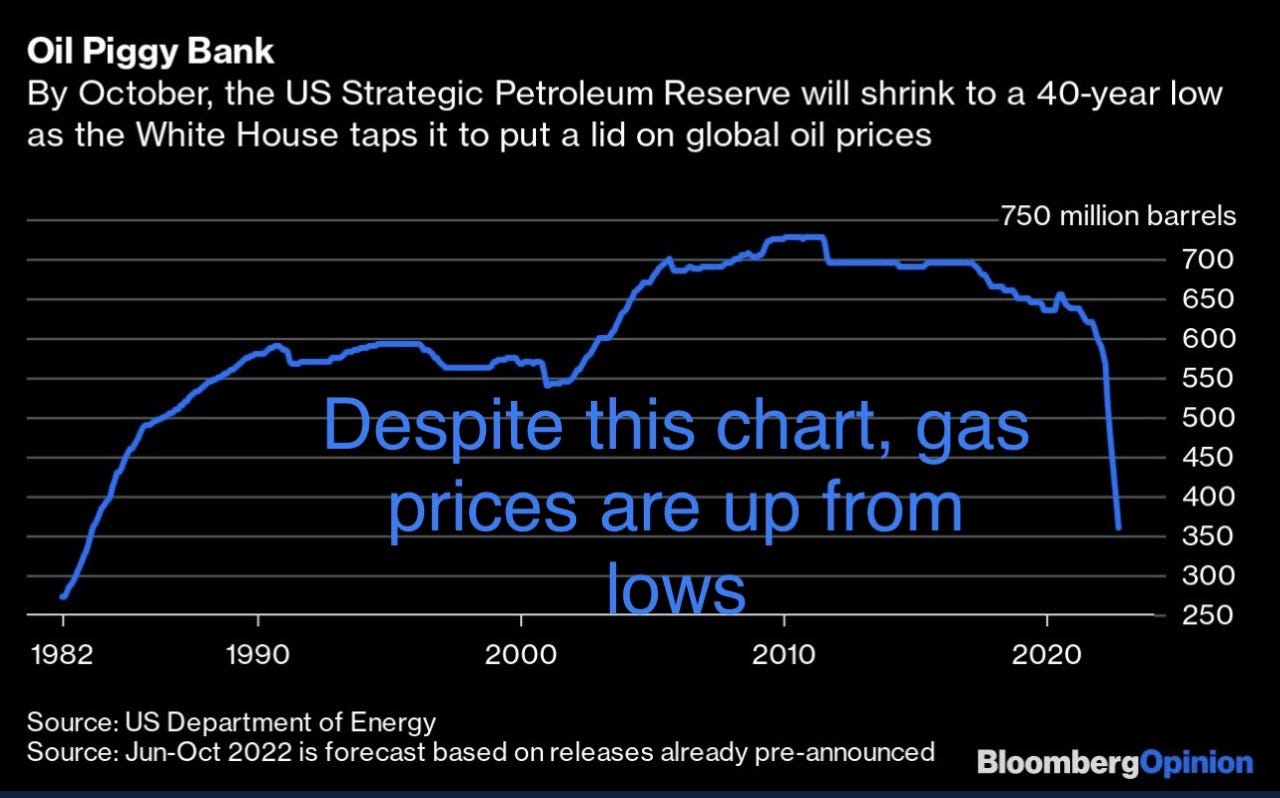

The market had a wild ride this week starting off hot (+5%+) before selling off sharply. The September jobs report showed payrolls rose by 263k and Unemployment fell to 3.5%, while hourly wages rose 5% from a year ago. The report helped to push stocks lower on Friday. The Dow fell 630 points, or 2.1%, to 29,297. The S&P 500 lost 2.8% to 3,640. The Nasdaq slid 3.8% to 10,652, which is less than 1% above its low of the year. The Dow rose 2% for the week, while the S&P added 1.5%. The Nasdaq eked out a 0.7% gain. As noted, I was surprised by the severity of the rally earlier in the week and remain uncomfortable about the market in general. The best performing stock sector was Energy+13.9% and worst performing was R/E -4.2% and Utilities -2.6% according to Fidelity. Rates sold off sharply on a combination of economic data and hawkish Fed commentary. The terminal rate expectation had been creeping higher all week, Monday it was 4.45% and it ended Friday at 4.66%, not far from the ~4.7% peak. A 75 bp hike in November was already consensus, but odds went to 95% Friday. The 2 & 3 Year Treasuries are now yielding approximately 4.3%, and I like those levels to buy. Federal Reserve Bank of Cleveland President Loretta Mester said the US central bank has more work to do to tame inflation and she has not seen the evidence needed to convince her that the officials should slow the pace of interest-rate increases. Oil ripped higher on the OPEC cut speculation and rallied further upon the news of 2mm/barrel a day cut. Oil was up 17% from the prior week and closed above $93/barrel after being at $76 late last week. GS Expects oil to hit $110 by year-end. This is bad for Biden as gas prices are on the way up just as mid-terms are approaching. Gas is +20 cents/gallon over the past few weeks and averages $3.9, but remains well below the June high of $5.01. I expect gas to be well-above $4/gallon soon. Big week for earnings releases. Let’s see how many cite weaker guidance and downward revisions.

US Energy Independence-I have written tirelessly on this subject and the importance of US energy policy as a national security issue. I have been disappointed with the Biden Administration’s energy policy. This Forbes article is good and, here is an excerpt: “The Biden administration claims to be doing all it can to increase oil and natural gas production but it’s not. It has issued fewer leases for oil and gas production on federal lands than any other administration since World War II. It blocked the expansion of oil refining. It is using environmental regulations to reduce liquified natural gas production and exports. It has encouraged greater production by Venezuela, Saudi Arabia, and other OPEC nations, rather than in the U.S. And its representatives continue to emphasize that their goal is to end the use of fossil fuels, including the cleanest one, natural gas, thereby undermining private sector investment.” No mention of the cancelled Keystone pipeline, which was another bad idea. The US has ample in ground reserves and needs to take advantage of the remarkable fracking technology to become 100% energy independent. Even Senator Manchin is on my side. Globally, 100mm barrels/day of oil is produced. OPEC just announced a substantial, 2mm/barrel cut and the Democrats are furious. Given idiotic energy policy out of this administration, we are reliant on other countries for our oil. The US is considering action against OPEC and the Saudis for the 2mm production cut. Here is an idea. Screw them and produce it ourselves! Let’s be fully energy independent. We surely have the resources. We peaked at 13mm barrels of production/day in the US and are now at 11.6mm/day according to the EIA. The 3rd chart shows that due to a lack of investment in wells, our production will fall significantly in coming years. Please stop vilifying the industry or we won’t recover.

Good WSJ article on the stress fractures in the market due to the rapid rate increases by the global central banks. I continue to contend the Fed made a catastrophic mistake in 2021 leaving rates at zero and continuing QE for too long. Central banks are raising interest rates at the fastest pace in more than 40 years—and signs of stress are showing. Recent turmoil in British bond and currency markets is one. That disturbance has exposed potential risks lurking in pensions and government bond markets, which were relative oases of calm in past financial flare-ups. The Federal Reserve and other central banks are raising interest rates to beat back inflation by slowing economic growth. The risk, in addition to losses in wealth and household savings, is that increases can cause disruptions in lending, which swelled when rates were low. Major U.S. stock markets recorded their worst first nine months of a calendar year since 2002, before rallying this week. Treasury bonds, one of the world’s most widely held securities, have become harder to trade. The data this week will pressure the Fed to continue to be hawkish and raise rates even though I believe the markets are cracking.

I enjoyed this Forbes article entitled, “U.S. Consumer Borrowing Has Reached Record Highs,‘ and it gives yet another reason to be concerned. There is a good chart in the link, but shows small when I downloaded it. American consumers are more indebted than ever. The just recently released Federal Reserve Consumer Credit-G.19 report shows that U.S. consumer credit outstanding has reached historic levels; outstanding consumer credit is now at $4.7 trillion. These current levels of consumer debt show that the Federal Reserve raising rates has not slowed down consumer borrowing. While consumer credit declined in the years immediately after the 2007 – 2009 financial crisis, since the second quarter of 2011 until the second quarter of this year, consumer credit has increased by 90%.

President Joe Biden on Thursday pardoned thousands of individuals convicted of possessing marijuana, saying the current system “makes no sense” and sending pot stocks soaring on the news. The pardons apply only to federal offenders convicted of “simple marijuana possession” as well as those charged in the District of Columbia, but Biden called on governors across the country to follow suit. More than 6,500 individuals with prior convictions for simple marijuana possession were impacted by the pardons. The MSOS Cannabis ETF was +34% on the day on the news, but gave back a few percent Friday. Note, -55% YTD despite the one day move. I do not smoke pot or take gummies. It is just not my thing. I am concerned about pot being a “gateway” drug, but at this point, the train has left the station. Just legalize it on the Federal level already.

Other Headlines

Musk must complete Twitter deal by Oct. 28 to avoid trial, judge rules

Great for the word to have a less biased social media company. Check out this week’s story about Facebook blocking “Florida Strong” T-Shirts despite 100% profits to help Hurricane victims. I feel the TWTR deal is bad news for Musk. He is massively overpaying and takes his eye off the ball from all his other companies. Now, Musk is suggesting the deal is contingent on $13bn in bank financing. TSLA stock -16% in the past 7 days.

Banks financing Musk’s Twitter deal face hefty losses

Morgan Stanley, Bank of America and Barclays. Mitsubishi UFJ Financial Group, BNP Paribas, Mizuho Financial Group and Societe Generale are also part of the syndicate.

FedEx Ground to lower holiday volume forecasts (Stock -24% in last month)

Wharton’s Jeremy Siegel says today’s biggest threat isn’t inflation — it’s recession

The Stock Market Made Nancy Pelosi Rich. Now, She Wants To Ban Her Colleagues From Trading

Of course, she has already made her money doing it for decades.

Citadel’s billionaire CEO Ken Griffin becomes GOP $100 million midterm megadonor

Only Soros Fund Management founder George Soros and shipping magnate Richard Uihlein have given more to candidates running for the U.S. House or Senate.

Proud Boys member is first to plead guilty to seditious conspiracy

Colleges struggle with enrollment declines, underfunding post-Covid

Here is a thought: Make college more affordable with less political bias.

Biden's chilling 'Armageddon' warning sharpens the stakes with Putin

US splashes $290m on anti-radiation drugs after Putin ups nuclear threats

I was very wrong on Russia/Ukraine. I thought Russia would win in a week. I learned how depleted the Russian military actually is today and how unhinged Putin is as the leader of Russia. There is a non-zero chance he uses a tactical nuclear weapon on Ukraine which opens another can of worms, and the US stockpiling anti-radiation drugs is telling.

Mayor Adams finally calls out Biden for border fiasco — and he has to help fix it

Yes, allowing well-over 2mm illegal immigrants into the US in a year has a cost, and no one wants to pay it. Great policies by this inept administration. This link on illegal immigration has scary data on #s of illegals and the amount of money smugglers are making bringing them to the US.

American tourist denied visit with pope, smashed Roman busts in Vatican museums: report

Kanye West said he will go 'death con 3' on Jewish people in a now-removed Tweet

Here is an idea. All Jews should never buy anything from this loser again. Not his music, ugly clothes, brands… Nothing. Why should any Jew support someone who hates them.

'Beginning of the end': Ayatollah Khamenei to see Iran regime collapse as protests surge

I will throw a party if the regime collapses, I just fear the leadership starts getting more aggressive to prevent it from happening. Horrible people lead this country. They hate the West and Israel and wish death upon us.

New PayPal Policy Lets Company Pull $2,500 From Users’ Accounts If They Promote ‘Misinformation’ (in the sole discretion of PayPal). As I was hitting send on this report, PayPal pulled back after backlash. In my audiocast, it was recorded before the new PayPal announcement.

Number Of Trans Youth in 2021 Up 70% From 2020, 9 Reasons Why Media Is At Fault

I disagree, and believe schools should take some blame for the things being taught and discussed today.

California’s ‘Inflation Relief’ Payments Start Going Out Friday

NYC Michelin Guide Strips Stars from Carbone, Marea, Peter Luger

I can see Carbone and Luger not having a star, but Marea? I love that place and have eaten there dozens of times. I just recommended a reader eat at the bar with a date, and he has been raving for two weeks.

Crime Headlines-Can we admit that the Progressive crime policies are not working out well in NYC, Chicago, Philly, LA, SFO….

Homeless man in fatal stabbing of NYC dad was free without bail in subway slashing case

Governor Hochul, you must recall DA Bragg for the good of the city.

14-year-old with 18 priors suspected in scooter shootings

At what point with the idiot DAs come to the realization bad people need to be held accountable for their bad acts?

4 Members of the Green Goblin Subway attack have 15 arrests between them.

NYC gas station worker pummeled by three brutes during robbery

Scary video. What is wrong with people?

10 injured after NYPD car driving on wrong side of road during emergency call crashes in Bronx

This was my home stop from 2002-2011 and used it almost every day.

Suspect in custody after 2 dead, 6 injured in stabbing attack on Las Vegas showgirls

I want the death penalty for this man.

Thailand Mass Shooting at Child-Care Center Leaves at Least 36 Dead

FBI crime report shows murders rose over 2020's historic number as midterms approach

Real Estate

The National Bureau of Economic Research (NBER) outlines NYC office buildings may experience a massive wipeout in valuation, upwards of $453 billion. NBER said the value of office buildings plunged 45% in 2020 and is forecast to remain around 39% below pre-Covid levels due to remote working, companies shrinking corporate work spaces, and some firms gravitating to newer buildings. Even though Goldman Sachs, Morgan Stanley, and other Wall Street firms have pushed for a return to the office after the Labor Day holiday, NYC's office-occupancy trends are still below half, according to card-swipe data provided by Kastle Systems. I wrote a piece last week entitled, “Concern Growing & the R/E Double Whammy is Not Helping,” which outlined my anxiety about the office and retail market. In a related Bloomberg article entitled, “San Francisco’s Office-Vacancy Rate Tops 25% as Tenants Depart,” shows another challenging office market. Estimates are approaching 40% vacancy in coming months for office in SFO. Another article from NY Sun is entitled, “Office Real Estate ‘Apocalypse’ Could Cause Fiscal ‘Doom Loop’ for NYC,” and cites more of the same as the NBER article above.

Other R/E Headlines

Miami tops FT-Nikkei ranking of best US cities for foreign businesses

186-Unit Luxury Apartment Building Planned At Wynwood Salvation Army Property

Wynwood was a transition/super gritty place not long ago. Projects like this are a great sign that the area has arrived.

Builders prepare to slash new home prices

Article talks about lower prices in San Antiono, TX and builders increasing commissions to brokers to attract buyers.

How Far Will Home Prices Fall? UK Market Under Pressure With Rates Soaring

Given the US $ strength against the Euro and Pound, there will be a big buying opportunity in Europe soon.

Virus/Vaccine

Covid vaccines prevented at least 330,000 deaths among U.S. seniors in 2021

Dr. Fauci: A new, more dangerous Covid variant could emerge this winter

The article questions the analysis which was behind the decision.