Opening Comments

My last note was about my jobs site, RosenReportJobs.com and the most opened links were things happy people have in common and the CNN anchor were shocked when the learned why shoplifters don’t stay in Florida. Those who watched or listened to my Ted Seides interview really enjoyed it. I also reviewed Pasta e Basta in Miami and had quite a bit of traffic on that one too. Amazing homemade pasta.

I just thought this was an interesting graph that one of my loyal readers sent me. The pink lines are recessions. Note how frequent and long they were from 1870-1940.

I am in Vegas and just spoke at the SF Net Conference this afternoon. Things here are a bit crazy with the Super Bowl this weekend and the weather is not great. I spoke at an insurance conference here in July and it was 118 degrees. Now it is cold and rainy. I need to come in the spring or fall and no more visits in summer or winter. I feel like Goldilocks and cannot seem to find the right temperature in Vegas. I did eat at the breakfast buffet at the Wynn and will write it up. In short, don’t confuse quantity with quality. Lots of food. Not much of it any good for $65! I worked out this morning and was next to John Rahm, #3 golfer in the world. He could not have been nicer and is a big dude. He was hitting the weights hard. He just went to LIV (playing in Vegas this week) for a reported $566mm.

Given my travels and speaking engagements, I am sure I missed some news. Apologies. Flying back on the redeye tonight after dinner. As a reminder, my readers send me news stories, ideas, comments to rosenreport@gmail.com. I receive hundreds of emails each week and over 30% of my stories come from readers.

Markets

Consumer

India Stocks Outperforming China-Chart

News Website Traffic Falling

College Consultants Ain’t Cheap

Rent Stabilized Buildings Under Pressure

Mortgage Rates Over 7% Again

Americans Giving up on the West Coast

$295mm Home For Sale in Naples, FL

Adam Neumann Buying WeWork?

Video of the Day-Amazing Video of a 1930s Story

This is a short video that outlines the story of Gillian Lynne, a dancer and choreographer who was a “problem child” who could not sit still. Schools were complaining that there was something wrong with her. The doctor suggested dancing and the rest is history. Listen to the brief video from a man who interviewed Gillian and is trying to inform us that not every kid on the planet has ADHD. Gillian had an amazing career and was the choreographer for Cats and Phantom of the Opera. I enjoyed this one and it was another late-night find given my new Instagram Reels addiction.

Unwelcome Guests

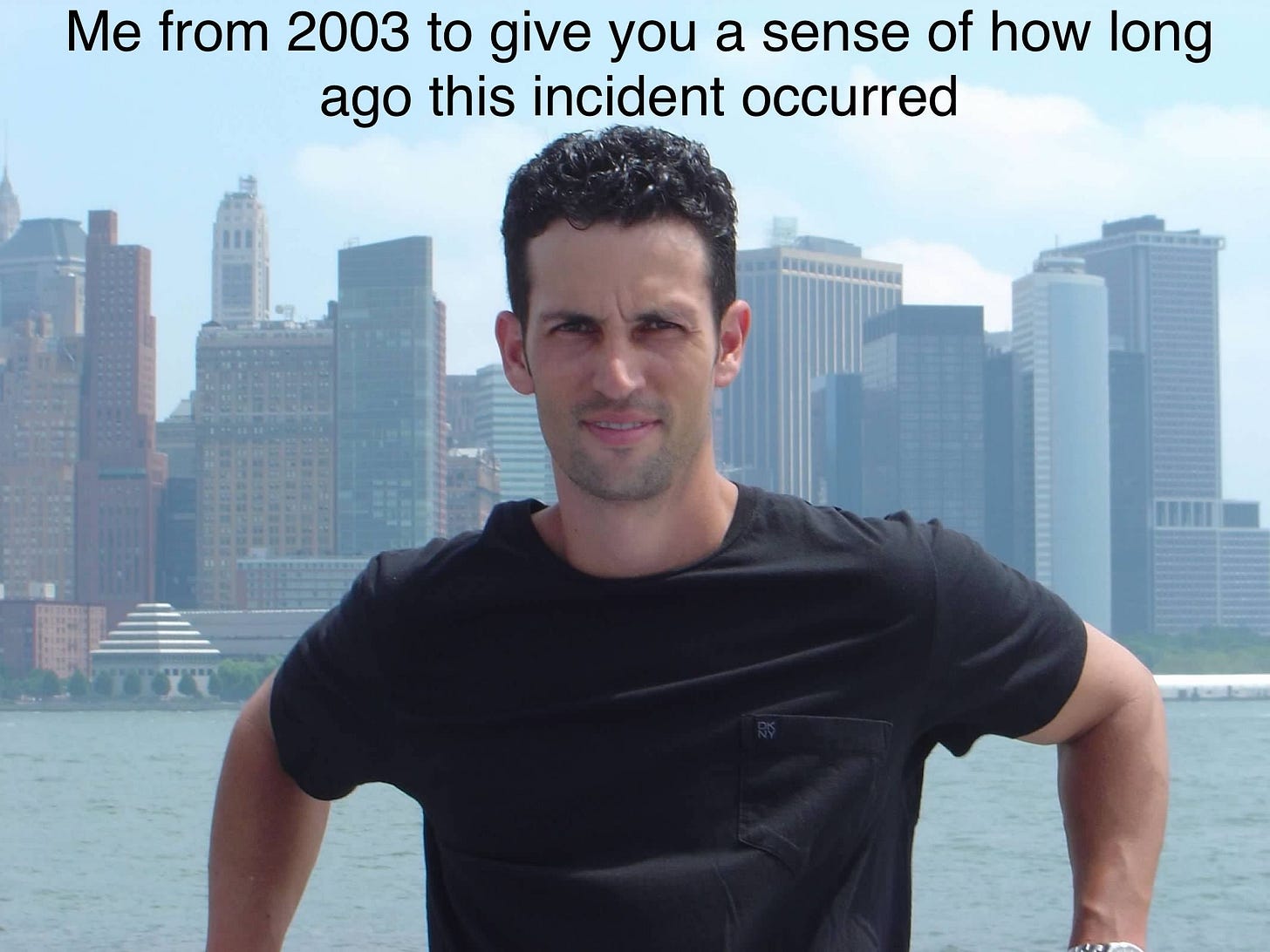

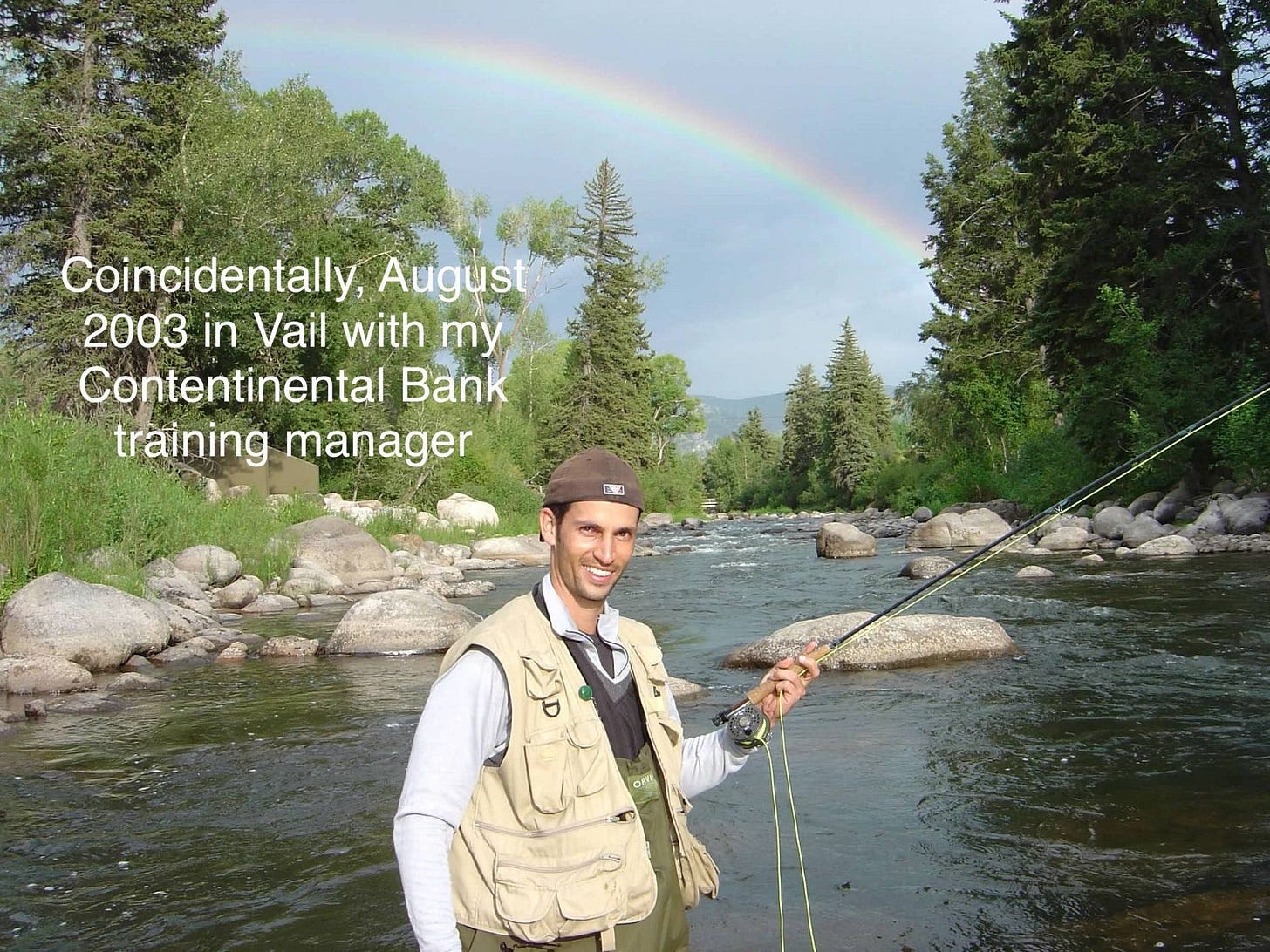

It was about 2002 and I was in Scottsdale, Arizona on business seeing one of our best loan manager clients when I was at JPM. I stayed the weekend with my old boss, Walt, from Continental Bank in a great golf community called Desert Mountain. During my stay, he introduced me to a couple and a group of us had dinner.

I think we all have been guilty of offering something we regret. I don’t recall my exact words, but after the dinner and drinks, they told me they were planning a family trip to NYC. I said, “If you come to NYC for a weekend, let me know and you can stay with me.” I thought that was a nice gesture, but never thought they would call. Well, some months later, I received a voicemail. When I played it, I could not recall having ever met this person. They said they were coming to town and wanted to stay with me. When I returned the call, he reminded me we met in Scottsdale and was a friend of Walt.

He asked if my offer was still good and could his ENTIRE family could stay with me for a weekend. I thought this was an odd request as I met him once, but I had a 4 bedroom apartment as a single guy (explained here) and thought one or two nights would not be a big deal.

Remember, I was working from 6:30 am until late with dinners virtually every night during the week during this period. So, the family showed up at my apartment and I told the doorman to give them the key. When I got home that night, there were 4 guests in my house (husband, wife, and two kids) and my immaculate apartment looked like a tornado hit it. They had bags like they were moving in, and they were disgustingly messy.

I was thrown off guard, but it would only be a few nights. YEAH right. I asked him where he planned on staying for the rest of his 10-day trip and he said, “We are working on accommodations” Big red flag, but I was unsure how to handle it. When I got home the next day, the messy apartment was officially a train wreck. I was livid and they were encroaching on my life and they were strangers.

I was tired and went to bed without being much of a host. I was so upset, I did not know what to do. These leeches ended up staying for 5 or 6 nights until I made up a story that my mother was coming into town, and I needed them to leave. They bought it and left, and I never heard from them again. Note to self, NEVER agree to have someone you met through a friend for a nanosecond stay with you. The entire story just pisses me off when I tell it. I am a complete idiot for opening my big mouth in the first place. No good deed…

Quick Bites

Monday saw a bit of a sell-off in stocks due to higher treasury yields on concerns rate cuts have been pushed out. Also, McDonalds fell 4% after mixed earnings results. However, Wednesday saw a sharp rebound with better than expected earnings and upbeat guidance, especially in mega cap tech and AI names. The S&P closed in on 5,000 for the first time. Of note, the Russell 200 continues to underperform as it is -3.8% YTD, while the S&P is +5.6%. Snap shares fell 35% on a revenue miss and weak guidance. This stock is just too volatile on earnings. Treasuries were little changed on Wednesday with the 2-year at 4.4% and the 10-year at 4.11%.

I have written quite a bit about my consumer concerns. I admit they have been far more resilient than I imagined in the case of crashing savings, rising credit card balances, higher rates, increasing delinquencies and inflation. Clearly rising home prices, locked in low mortgage rates, increasing wages and higher interest rates on savings have helped the consumer. This CNBC article is entitled, “Credit card delinquencies surged in 2023, indicating ‘financial stress,’ New York Fed says.” Credit card delinquencies surged more than 50% in 2023 as total consumer debt swelled to $17.5 trillion, the New York Fed reported Tuesday. Total debt rose by $212 billion in the quarter, a 1.2% increase quarterly and about 3.6% from a year ago. With a total of $1.13 trillion in debt, credit card debt that moved into serious delinquency amounted to 6.4% in the fourth quarter, a 59% jump from just over 4% at the end of 2022, the New York Fed reported. The quarterly increase at an annualized pace was around 8.5%, New York Fed researchers said. “Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed. “This signals increased financial stress, especially among younger and lower-income households.” Yes, the consumer has been more resilient than I expected. I just don’t see how it lasts.

India’s stock market is substantially outperforming China’s market as can be seen in this chart.

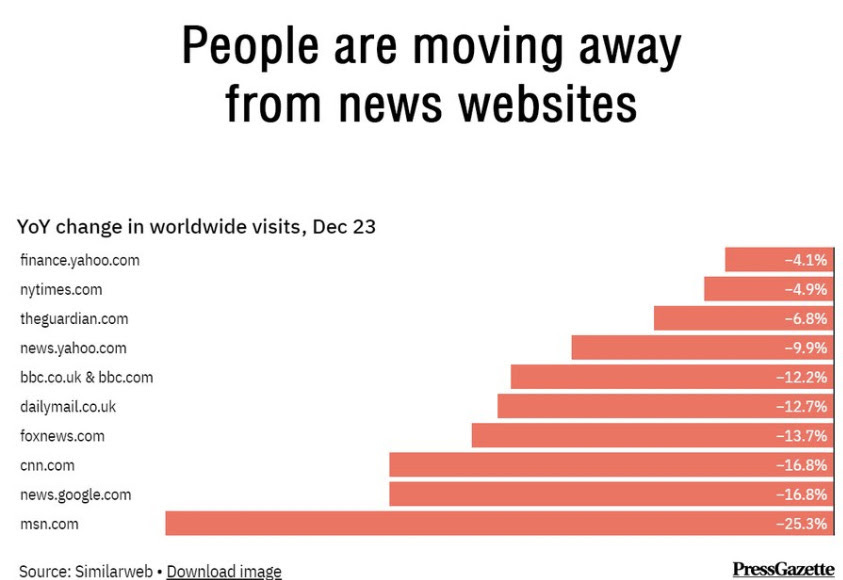

I have written extensively about the perils of social media, especially as they impact kids. I also recently discussed the costs of advertising on traditional TV relative to social media and came to the conclusion TV ads were overpriced. Check out the chart below showing the decline is some of the traditional news websites. We know that TikTok and Instagram traffic are heavy as well. What are the ramifications for how companies advertise? How people get news?

I wrote about college admissions multiple times and in April 2023, penned an a piece on it entitled, “ Kidney Donation and Perfect Scores May Not Be Enough To Get Into College.” This NY Magazine article is entitled, “Inventing the Perfect College Applicant-For $120,000 a year, Christopher Rim promises to turn any student into Ivy bait.” For the past nine years, Rim, 28, has been working as an “independent education consultant,” helping the one percent navigate the increasingly competitive college admissions process — the current round of which ends in February. He started by editing college essays from his Yale dorm room for $50 an hour but now charges the parents of his company’s 190 clients — mostly private-school kids, many of them in New York — $120,000 a year to help them create a narrative he believes will appeal to college-admissions officers. That company, Command Education, currently has 41 full-time staffers, most of whom are recent graduates of top-tier colleges and universities. The Independent Educational Consultants Association estimates that up to 25,000 full- and part-time IECs will be working in the U.S. this year, and the market-research firm IBISWorld estimates it to be a $2.9 billion industry — up from $400 million just a decade ago. So much in the article. Anyone with school-aged kids needs to read it.

I have written about insurance issues and rising costs. This CNBC article outlines the problems with CA insurers with many pulling back. I am sure the massive rainstorms in CA won’t help matters. State Farm and Allstate have paused applications recently in CA. The article suggests that CA homebuyers should consider insurance costs before buying. I would say the same of Florida. Age of home, location, being on the water… can seriously impact your ability to get and cost of insurance. Remember, Lang Insurance is a new sponsor of the Rosen Report and they can provide, property and casualty insurance in all 50 states. I switched to Lang a couple months ago. He did confirm that CA is a tough market but does provide quotes in CA and across the US.

Israel

Heart-pounding video captures moment IDF soldiers take out Hamas terrorist throwing grenades at them

Hamas proposes 3-stage 135-day truce and hostage deal, leading to war’s end – reports

IDF reveals Gaza tunnel, previously used by Hamas officials, with cell for hostages

BBC staffer who called Jewish people ‘Nazis’ and ‘parasites,’ funded ‘holohaux’ gets fired

Other Headlines

Powell insists the Fed will move carefully on rate cuts, with probably fewer than the market expects

Gold prices to hit $2,200 and a ‘dramatic’ outperformance awaits silver in 2024, says UBS

For First Time in Two Decades, U.S. Buys More From Mexico Than China

15% from Mexico and 13.9% from China.

Roblox shares rise 12% after company beats estimates and issues strong guidance

Disney beats earnings estimates, hikes guidance as it slashes streaming losses

Arm shares spike 24% after chip designer gives strong forecast, says AI is increasing sales

New York Community Bancorp stock value set to halve as slump extends

The stock is -64% YTD through Wednesday morning. This is not the only regional bank with large exposure to the hard-hit commercial R/E sector. The KRE Regional Bank ETF is only down 11% YTD. Moody’s cut the NYCB to junk.

Cathie Wood's Ark Invest has destroyed $14 billion in wealth over the past decade, Morningstar says

Allocators are performance chasers. Happens all the time. They allocate to funds that were up huge one year only to find the performance is not repeatable and lose a bunch of money as was the case here. Another great example of this was Paulson.

ESPN, Fox and Warner Team Up to Create Sports Streaming Platform

New service will be available as a stand-alone app, and to Max, Hulu and Disney+ subscribers as part of a bundle

Faulty door panel on Alaska Airlines flight had no bolts installed, NTSB says in preliminary report

How in the hell is this possible?

Finance worker pays out $25 million after video call with deepfake ‘chief financial officer’

Crazy story. He was duped into believing he was seeing his colleagues on video when it was all a deepfake. Every firm best have a more secure plan before sending out wires given the criminals are getting so creative.

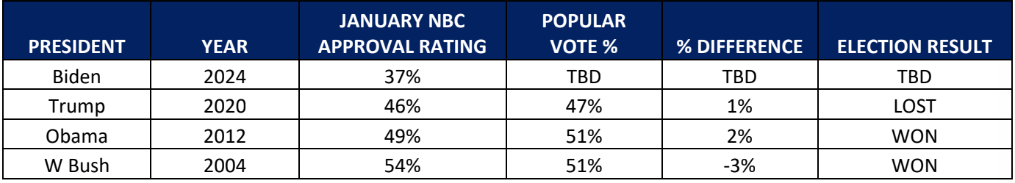

Poll: 20-point deficit on handling economy highlights Biden’s struggles against Trump

Nikki Haley’s fundraising takes off while GOP tries to end her campaign

Nevada primary takeaways: 'None' beats Haley. Trump wasn't on GOP ballot. Biden wins Dems. Haley lost with 32% of the vote while 62% went to “None.”

Border bill co-author Sinema addresses 'real misunderstanding' as House GOP calls it 'DOA'

Chinese migrants now the fastest-growing group trying to cross into the U.S.

You don’t just get to leave China. I am 100% convinced many of these people are spies. A better US border policy is needed.

Migrants who fled after allegedly beating NYC police use stolen phones to buy cars, pools back home

Californians shocked by electric bills after rate hike: 'Like you're getting punished'

Millions of Californians can expect to pay an extra $400 a year on average on utilities. CA has the highest gasoline prices, high electric prices, high natural gas prices, high homeless, high crime, poor public schools, natural disaster galore (including now) and onerous mandates. They also want to pass a wealth tax and raise income taxes on the rich. Remind me again why wealthy people are leaving in droves.

Dartmouth College Once Again Requires Standardized Tests

“I’ve become less convinced that [test-]optional is working for us at Dartmouth,” said Lee Coffin, the school’s dean of admissions. “We’re reanimating the policy based on evidence.”

Calif. tech founders are charging thousands of dollars a call, and getting buyers

Tinder’s and MySpace’s co-founders each offer 60-minute sessions for $2,670, or $44 a minute. Hungry restaurateur, willing to spend? You can get 15 minutes with Sweetgreen’s CEO for $650, or a co-founder for $550. Love sports a little too much? The founders of Bleacher Report and the Athletic do half-hour video calls for $775 and $550, respectively.

I think the entire Satoshi Nakamoto story is amazing but would love to know the true identity of the creator.

Former Trump official Mike Gill dies after being shot during Washington DC carjacking incident

The two suspects — Cleyber Andrade, 19, and Juan Uzcatgui, 23 — are allegedly part of a wider ring whose members are connected to 62 different instances of grand larceny throughout the Big Apple. One question. Why are they still in our country?

Sniper kills robber holding hostages at knifepoint at south Fort Myers Bank of America

People on this island in Italy live to 100—here’s a look at their diet for longevity

Hard to argue with the advice or the results. I went to Sardinia 20 years ago. It is quite beautiful but so insanely expensive it was off-putting. I stayed at the Cala di Volpe. Don’t get me started. When I got to my room, I thought it was a joke based on the price I was paying.

You can fight existing signs of dementia with a healthy lifestyle, a new study suggests

Sitting all day at work boosts risk of early death by 16 percent

Real Estate

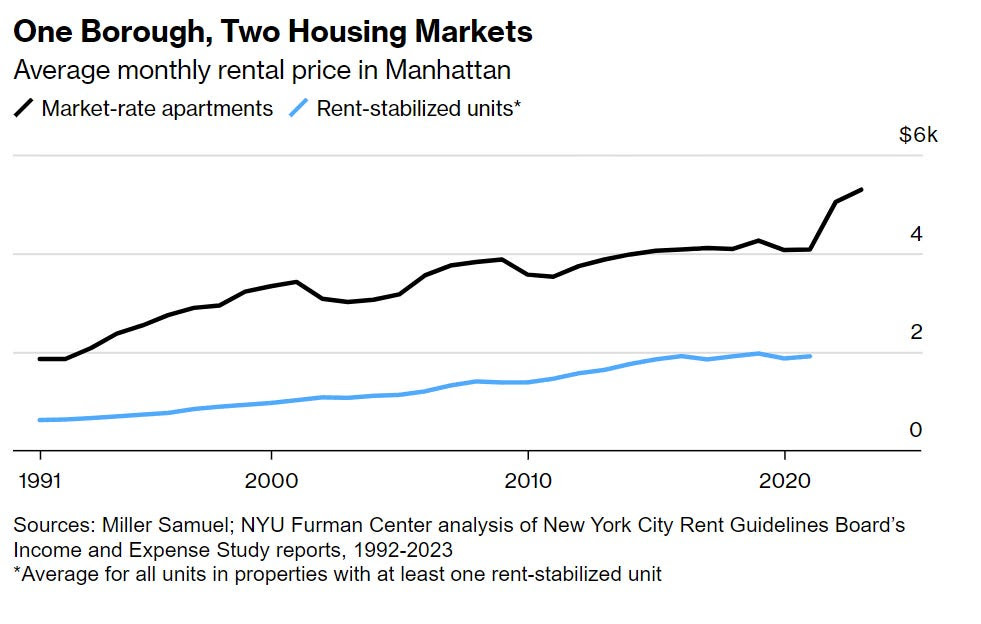

This is a great Bloomberg article about the value destruction due to the idiotic 2019 NY rent regulations. While the value of nonregulated apartments increased by 23% since 2019, rent-stabilized units fell by 34% and many landlords are in trouble. What was meant to protect the tenant has backfired horribly with buildings and units falling into disrepair. The article outlines numerous examples of carnage. Out of the 1,000,000 NYC rent-stabilized apartments, over 40,000 are vacant and that number will continue to increase as the landlords cannot recoup improvements as they did prior to 2019. Landlords rely on rent to cover costs and leaving vacant apartments is a huge hit to owners. Now add huge increases in insurance premiums, higher labor costs, rising R/E taxes and city issuing violations and the problem is compounded. I almost bought a building in 2019 in NYC and very glad I passed. The laws crush the landlords and make the investment far less attractive. Valuations are down in the 50% range in some instances and things appear to be deteriorating unless the 2019 laws are changed. I am not a buyer of NYC apartment buildings in general given the horrific laws against landlords.

The average rate on the popular 30-year fixed mortgage crossed over 7% on Monday for the first time since December, hitting 7.04%, according to Mortgage News Daily. It comes after the rate took the sharpest jump in more than a year Friday, after the January employment report came in much higher than expected. Rates then moved up even more on Monday after a monthly manufacturing report came in high as well.

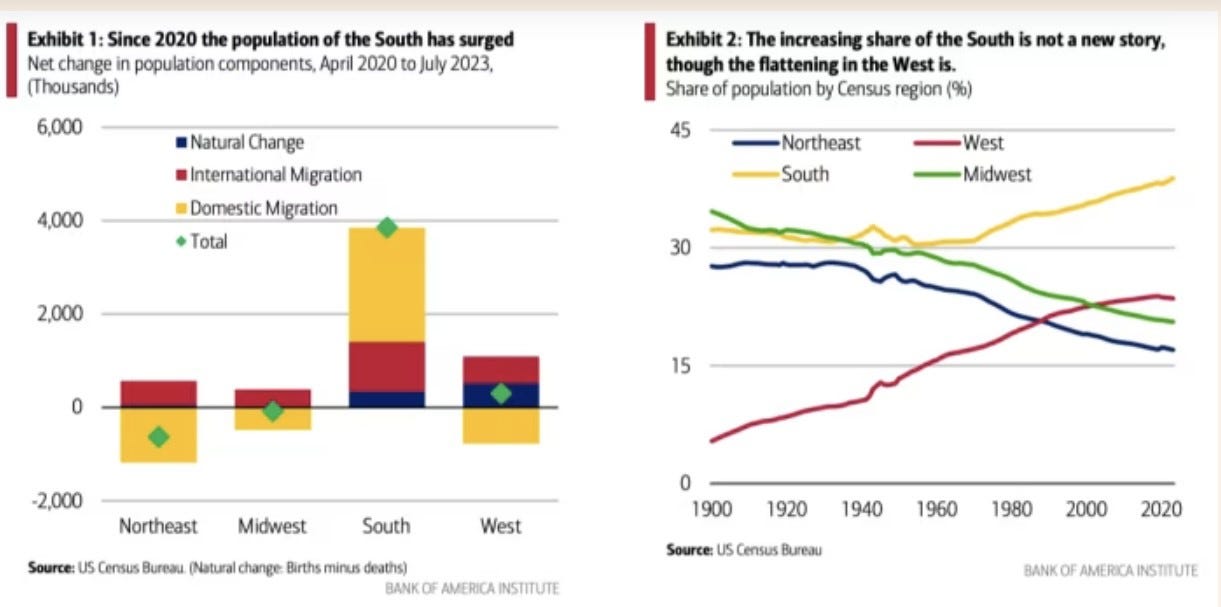

This is an interesting FT article entitled, “Americans Are Giving Up On the West (of America).“ There are amazing charts in the article and the gist is that the share of Americans living in the Western census region is falling for the first time in 75 years. Bank of America suggests it is housing costs driving people out of San Fran and LA. I would suggest that is part of the problem. We cannot ignore policies driving people away (taxes, homeless, crime, cost of living, onerous covid mandates/lockdowns, fires, floods, earthquakes, traffic, highest gas prices in the nation, weak power grid, desire to implement a wealth tax….). It is not just one thing which pushes people from “paradise.” Look at the impact of Musk and Ellison leaving CA does from a tax receipt perspective. Policies matter and the damage caused by lockdowns is undeniable. Given the $68bn deficit and likelihood of higher taxes and wealth taxes, NOTHING could get me to buy in CA and I LOVE it there. I just met with a young man in Vegas who is very impressive and well educated. Venture investor who lived in San Fran and moved with dozens of friends to Vegas during the pandemic. I can tell you that nothing will get him to move back to San Fran, as he loves it in Vegas.

I have been clear that I am not a fan of Adam Neumann and feel his self-dealing ways were unethical. I would never fund anything he does as a result. This Bloomberg article is entitled, “Adam Neumann Explores Buying WeWork Out of Bankruptcy.” I was shocked when Andreessen put in $350mm into Neumann’s new venture, Flow. I recently wrote that it is already running into problems. Why people would back this guy is beyond me. However, it would be incredibly ironic if after being responsible for the demise of WeWork, he came in and bought it cheaply and made it work.

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #654 ©Copyright 2024 Written By Eric Rosen