Opening Comments

My last note was about my favorite TV shows from the 1970s, 80s, and 90s. I received many responses about people’s fond memories of the old shows. Some of the programs people felt I missed included “I Dream of Genie, The Three Stooges, Dallas, Fresh Prince of Bel-Air, One Day at a Time, Kojak, Oprah, The X Files, Murphy Brown, South Park, Melrose Place, Six Million Dollar Man, and others. The most opened links were George Clooney’s Democratic frontrunner in 2028 and 10 questions you should always ask your doctor.

In my last note, I wrote about all the “trapped capital” in private equity. A reader sent me this story about Yale is in the process of selling up to $6bn in private equity exposure, as more investors are struggling with the limited distributions due to lower M&A and IPO access. Now, some schools are faced with the added pressure of reduced funding due to the Trump Administration’s clampdown on some colleges and universities. The article goes into details on other recent PE sales as well. The article outlines the challenges of selling PE stakes, as bid/offer spreads are wide and liquidity is challenged.

As a reminder, the Rosen Report started with 18 readers and has grown 100% by word of mouth and reader sharing. If you like what you read, forward it to a friend or colleague, and they can sign up by simply hitting the “Subscribe Now” button and putting in their email. If you hate what you read, forward it to people you do not like. Either way, I get new readers. It is now read in 50 states and 103 countries, all due to your help. Thank you.

Markets

CNBC Economic Survey

123 Years of GDP in Purchasing Power Parity By Country

Boston “Wealth Spiral”

TSLA Earnings and Musk Return To Work

Florida Residential Slowing

Tesla Homes in Houston Selling Fast

$75mm Chelsea PH with a CRAZY Kitchen+$110mm NYC Condo

$24mm Miami PH

Picture of the Day-Consumer Data

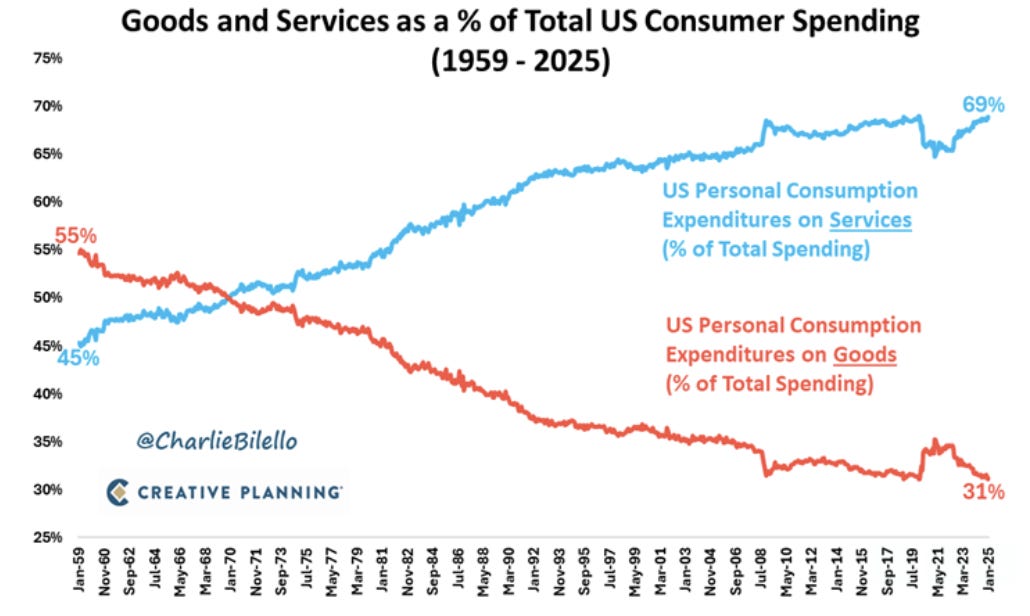

I love the site, Visual Capitalist, and feel they do an amazing job creating informative charts and graphs on interesting topics. I thought the two I included below were telling about America’s $19 trillion consumer economy and the projected largest consumer markets in 2030. Note the growth in China, India, Indonesia, and other markets relative to the more established markets in the US, Japan, and the EU. The last chart was from Charlie Bilello and outlines the growth of US consumption of services while goods demand has plummeted.

You are Only As Strong as Your Weakest Link

I have written about so many topics over the past five years. Many of my theme pieces are meant to entertain, given that the news in the world tends to be depressing. In today’s note, it is a life lesson, as I am spending so much of my time mentoring college students and young professionals. I am often asked questions about careers and what kind of jobs are in the realm of possibility. It got me to thinking about my career and how things went right and wrong. As a result, I am going to tell a story about myself and how failure led me to success.

You often hear coaches say, “We are only as strong as our weakest link.” I agree with that sentiment. However, I am going to take it a step further. When I started my career at Continental Bank in the early 1990s, I was asked to make a presentation about a complex transaction in Latin America despite being a recent graduate from college.

The truth was that I was in over my head and too nervous to ask for help. My big presentation day came, where I was outlining my recommendation, and I was AWFUL. I don’t mean I was bad; it was the single lowest point in my career from the perspective of distance from my goals relative to the outcome. I bombed the presentation, and it was so terrible, I thought I was having a stroke. I have had one panic attack in my life, and it was that day in 1993 in the large conference room on the 4th floor of Continental Bank on LaSalle and Jackson in Chicago.

What went wrong was that I did not fully comprehend the complexity of the restructuring at hand, and truth be told, I was horrible at presenting early in my career. I was embarrassed that I disappointed my boss and myself, and feared I ruined my career. How could anyone take me seriously after that debacle?

My mother had a bunch of good sayings, and one was “A winner never quits, and a quitter never wins.” I was determined to regain the respect of my colleagues and felt I was in control of my destiny. This 30-second video is about why failure is good and how it brings about an internal drive. I agree 100% with the video.

This specific restructuring happened without my input, given my presentation disaster, but I wanted to be prepared for the next one. I started to realize the importance of being intellectually honest with my strengths and weaknesses. I decided to take classes on presentation skills after work, so I would never put myself in the situation to fail so miserably in front of a crowd. There was a program called Toastmasters that helped me gain much-needed confidence in my public speaking.

With countless hours of deliberate practice in front of a mirror and using a handheld voice recorder (pre-smart phone) and the guidance of Toastmasters, my presentation skills improved to the point where it was not a weakness but a core competency. I worked so hard that I made an Achilles heel a strength. I believe that my ability to present myself helped me get promoted faster (made Managing Director by age 28).

Today, I am hired dozens of times a year to do speeches, moderate panels, podcasts, and interviews. I have done keynote speeches in Vegas in front of large crowds and been asked to speak by numerous companies, universities, and funds. I am presenting to a venture capital fund today and a top business school in the country on Monday.

Had I let myself be defined by my presentation failure in 1993, there is a ZERO percent chance I would have been as successful as I was in my career. I have made speeches in Japan in front of 2,000 people and countless other speeches and panels across the globe. I was also on Bloomberg on the Tom Keene Show last summer. No one who attended the 1993 debacle would have thought that was possible.

You are only as strong as your weakest link. Don’t be defined by your failures, and work on your weaknesses to make them strengths. Trust me, focusing on one of my weaknesses changed the trajectory of my life.

Quick Bites

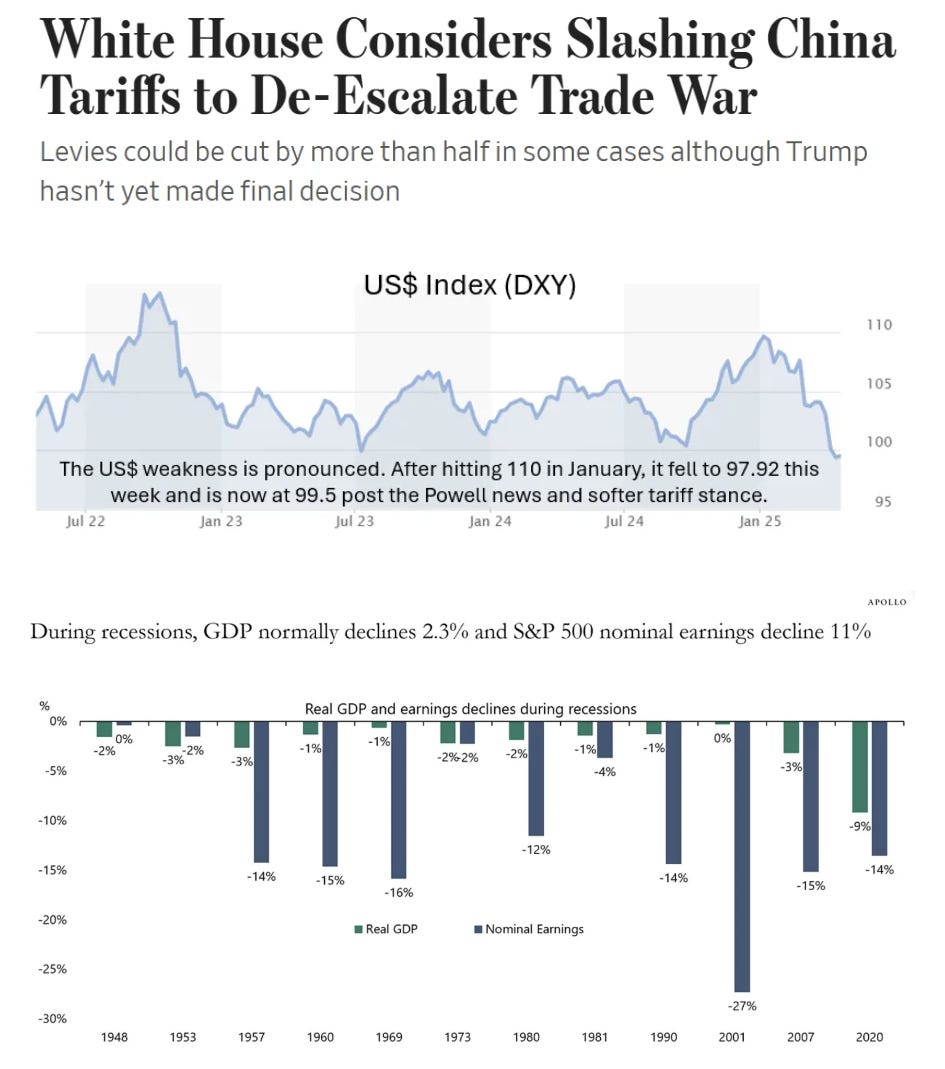

On Monday, stocks sold off again (-2.5%), but in concerning fashion, the 10-year Treasury yield was +9bps to 4.42%, while the US$ continued its slide, going below 98 on the DXY relative to 110 in January. I outline Trump’s attacks on Powell in the Politics section, and that was part of the reason for the weakness in risky assets on Monday. A move in the US$ of this magnitude in such short order is concerning and inflationary. Remember, even goods “manufactured” in the US rely on parts from outside the USA. Interestingly, Bitcoin rallied sharply on Monday despite equity weakness. Gold continued to rally as well up to $3,438 (+3%). On Tuesday, markets rallied sharply (+2.5%) on the headline that Besssent sees de-escalation with China in the “very near future” as the situation is unsustainable. Torsten Slok, chief economist at Apollo, was on CNBC Monday and suggested that if tariffs stay in place, there is a 90% chance of a recession in 2025. On Tuesday night, there was a story that Trump will not fire Powell and markets reacted positively. Then there was another story: China tariffs will “come down substantially.” Wednesday saw broader indices +1-2%, (Nasdaq outperformed) while the 10-year Treasury yield fell 1bp. However, the close in stocks was well off the intraday highs. At one point, the S&P was +182 points on the day and closed +88 points. The US$ rallied back to 99.9 after hitting 97.9 a few days ago. Gold finally fell 3% on Wednesday after being on a tear and closed at $3.3k/oz (+23% YTD). Bitcoin’s wild ride continued and approached $95k on Wednesday. I have reduced my position at these prices.

The CNBC All-America Economic Survey results are out, and the results are not good. The swing from optimism to pessimism on markets was the largest in the survey’s 17-year history. Initially, there was excitement about lower regulations, taxes, and increased M&A/IPO activity, but that quickly deteriorated with tariffs as seen in the chart on the upper left.

I have included some short videos I find fascinating about how economies, currencies, and wealth change over time. This video is 4 minutes long and shows GDP in Purchasing Power Parity (PPP) by country over 123 years. GDP in PPP is a measure that adjusts a country’s GDP by accounting for differences in price levels between countries. The constant changes are fun to watch, and you can see how once dominant economies falter, while others gain traction. In 1901, the British Empire dominated and was 50% larger than the US. The Qing Dynasty, the German Empire, and France rounded out the top 5. The US passed the British Empire in the 1920s, but the fell back to 2nd place post the Great Depression. In 1943/44, Nazi German was #2 behind the US and the British Empire until the end of WWII when Nazi Germany fell off the rankings. In 1950, the US was triple the next country (the Soviet Union), and the Brits were 3rd and less than 1/3rd the size of the US. The Soviets were in 2nd place until the mid-80s, and Japan climbed to #2 by 1988. For me, the biggest takeaway is that just because a country dominates today, it does not mean it will be dominant decades later.

This WSJ article Boston at Risk of ‘Wealth Spiral’ as Harvard Fight Ripples Through Economy is an interesting take on the potential impact to the city due to funding cuts from the Trump Administration. Vacancy rates for life science buildings in Boston were 30% in 2024 and funding cuts could only worsen the situation. The economic turmoil on and off campus has spilled into Cambridge’s pricey housing market too. High-end home buyers there are pulling out of deals, and some would-be sellers are holding off on listings, said Lauren Holleran, a vice president at Gibson Sotheby’s International Realty in Cambridge. Harvard, like nearby MIT, had already enacted a hiring freeze as earlier Trump administration moves raised threats to higher-education funding. On Wednesday, Harvard Medical School leaders said the school was preparing to cut employees and programs, according to the Harvard Crimson. We don’t always consider the unintended consequences of policy. The article outlines the ripple effect that will be felt far and wide in Boston. Trump to yank another billion dollars in Harvard funding in latest blow over school’s antisemitism, admissions defiance. Then this headline hit: Harvard Sues Trump Administration, Says $2.2 Billion Freeze Is Punishment for ‘Protecting Its Constitutional Rights’

I have written extensively about my concerns around Musk being spread too thin with his countless companies and projects, and even did a theme piece, “Musk Man or Machine?” Tesla earnings were announced on 4/22 and net income fell 71% and was well below analysts’ estimates. Additionally, there was a 20% drop in auto-related revenues in the quarter. However, Musk did address DOGE and return to his real job. “Starting next month, I will be allocating far more of my time to Tesla,” the electric car company CEO said on Tesla earnings call. Musk noted that “the major work of establishing” DOGE has been completed and that his “time allocation” to President Trump’s government cost-cutting initiative “will drop significantly” come May. The billionaire tech tycoon, 53, indicated he’s interested in continuing to spend a day or two a week on government matters, “as long as it is useful,” and Trump is amenable to the idea. The stock reacted positively and was +8% despite the earnings miss due to his comments and the overall market sentiment post lower China tariffs and keeping Powell. Tesla stock is -32% YTD and -47% from the 52-week high.

Tariffs

Trump backed off the tariff stance by saying: He’s willing to take a less confrontational approach to trade talks with China, noting that the current 145% tariff on Chinese imports is “very high, and it won’t be that high. ... No, it won’t be anywhere near that high. It’ll come down substantially. But it won’t be zero.”

I presume the adult in the room, Bessent, sat down with Trump and let him know the consequences of staying on the path of vilifying the Fed Chairman and keeping high China tariffs. There is no straight path back to normalcy, but these announcements are a step in the right direction. Lots of damage has been done and a couple of comments by the President will not erase all the carnage and lost confidence by consumers and corporations.

Bessent outlined his plan to restore “equilibrium” to the world financial system on Wednesday.

I thought this was an interesting chart on the US Labor Force over since 1940. Note the exponential growth in the service sector, while manufacturing has actually declined during the period. For perspective, the population in the US in 1940 was 132mm and today it is 340mm.

A reader sent me this chart outlining the decline in labor in China by product. I presume this is a combination of automation and production shifting to Southeast Asia. China lost 75mm manufacturing jobs since 2011.

China vows retaliation against countries that follow U.S. calls to isolate Beijing

China threatens huge car shortages and shutdowns in Trump trade war

Rare earth metals are difficult to extract in a cost-effective and environmentally friendly way, and China currently holds a near monopoly on their processing.

Chinese freight ship traffic to busiest U.S. ports, LA, Long Beach, sees steep drop

Politics

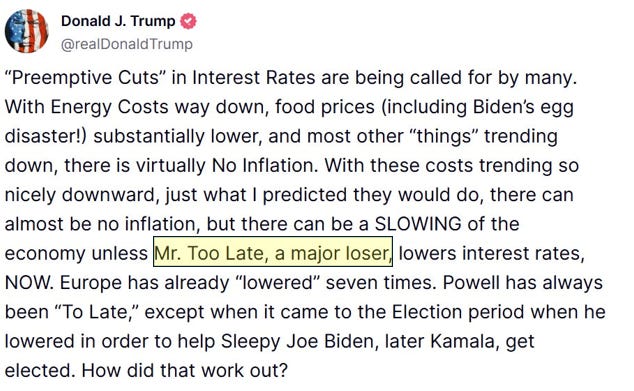

Trump ramps up attacks on Powell, demands ‘loser’ Fed chair lower rates ‘NOW’

I disagree with Trump’s actions on this topic. As I do with any new President, I had high hopes as I always “pull for the pilot.” However, a growing number of Trump Administration policies are turning out to be causing a great deal of damage. Also, it is beneath the office of the President to call anyone a major loser, let alone the Chairman of the Federal Reserve. Trump, you are your own worst enemy. Then this headline came out: Trump now has “no intention” of firing Powell despite the President’s ridiculous remarks just hours prior. Grow up, Mr. President.

Supreme Court temporarily pauses deportations under Alien Enemies Act

Hegseth Said to Have Shared Attack Details in Second Signal Chat

The defense secretary sent sensitive information about strikes in Yemen to an encrypted group chat that included his wife and brother.

Jim Cramer says CEOs are reluctant to talk publicly during 2nd Trump presidency

America’s Second-Richest Elected Official-Acting Like He Wants to Be President

Billionaire Gov. JB Pritzker of Illinois is one of the top Democrats being watched as the party searches for a way out of the political wilderness. Based on the chaos in Chicago, it would be hard for me to take this candidate seriously. High murder rate in Chicago, massive deficits, huge underfunded pensions, high unemployment rate (3rd highest in the nation), high taxes, high property taxes, affordable housing issues, lost companies to other states, lost wealth to other states, worst ranked state at keeping wealthy from moving, high gas prices…

Democratic strategist James Carville called Hogg’s plan “the most insane thing” he’d ever heard. Hogg wants to replace older Democratic incumbents with younger candidates.

Middle East

'F**k Israel, Free Palestine': Anti-Israeli messages shown at Coachella

IDF fires, censures officers who oversaw killing of 15 aid workers in Gaza

New Israel-Gaza ceasefire plan proposed, Hamas source tells BBC

It makes me sick that Israel lets out dozens of Palestinian prisoners for every innocent Israeli civilian released. In January, 2,000 Palestinian prisoners were released for a whopping 33 hostages held in Gaza. How can we have peace in the Middle East if Iran is developing nukes?

Other Headlines

I am all for the wealthy paying more taxes, assuming the government is efficient and spending my hard-earned money wisely. We are so far off from that taking place; I find it challenging to support higher taxes. I would like to see the code cleaned up and make the tax polices easier to understand with fewer loopholes. The top 1% pay over 40% of total taxes, and the top 10% of earners pay 72% of total taxes. In my opinion, we have more of a spending problem than a revenue issue and in order to tackle it, entitlement reform is mandatory. Bessent said Wednesday, “we have a spending problem, not a revenue problem.”

It’s Tax Day: See how many millionaires are in NY and how much in taxes they pay

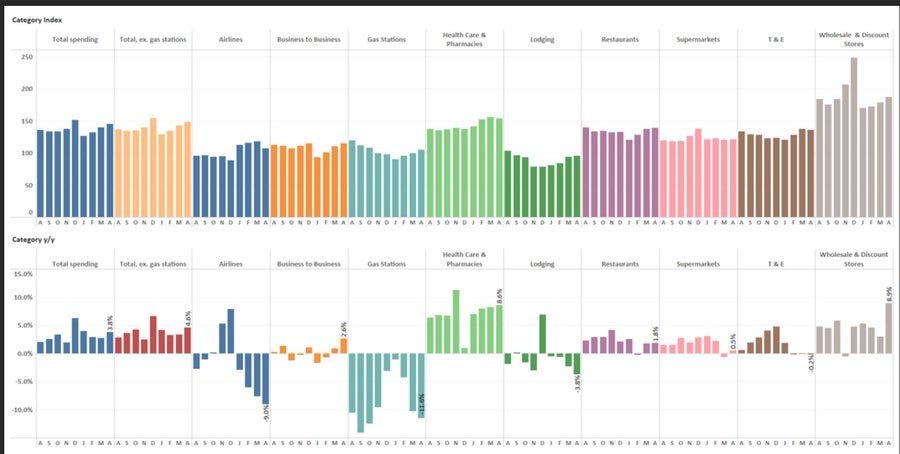

Chase card spend by category in April is wild

Airlines down 9%, lodging down 3.8%, overall T&E negative, restaurants and grocery up .5-2%, and wholesale and discount stores up 8.9%.

Tesla short sellers have made $11.5 billion from this year’s selloff

UAE Cabinet approves first-of-its-kind AI regulatory ecosystem

“This new legislative system, powered by artificial intelligence, will change how we create laws, making the process faster and more precise,” wrote His Highness Sheikh Mohammed bin Rashid Al Maktoum.

Pope Francis, first Latin American pontiff who ministered with a charming, humble style, dies at 88

Bride catches shark while taking wedding photos at beach

I love this woman. She catches a shark while in her wedding dress.

Family-friendly golf course puts cheating couple on blast over parking lot affair

Health

All the health risks of the 8 food dyes the FDA is banning — including cancer and behavioral issues

‘Ozempic feet’ gnarly side effect of weight loss drug exhibited by some celebs

I had not heard of this side effect.

Exercising during this 3-hour window linked to lowest risk of heart disease/stroke

Child Concussion: What To Know If Your Child Takes a Blow To the Head

Marijuana hospital visits linked to dementia diagnosis within 5 years, study finds

A New Study Says This Simple Diet Tweak Could Add Years to Your Life

Real Estate

I have written extensively about Florida residential real estate slowing in parts, and this NY Post article goes into detail. Residential sales are slowing across the country, but the double-digit sales declines and inventory increases across this Sunshine State region — a market that especially heated up in the pandemic years — are pronounced. Condo sales fell in the first quarter of this year in Miami Beach and across the barrier islands, according to a new report by Miller Samuel and Douglas Elliman. The number of listings on the Miami market in March, at 7,653, was up 4.7% from a month earlier, "a bigger increase than normal for this time of the year," according to a recent report by Realtor.com. It was also 47% higher than in March 2024. Meanwhile, homes were also selling slower than at the same time last year, going under contract after an average of 66 days on the market, compared to 53 at the national level. There are still pockets of strength, especially at the higher end, but many markets in Florida are seeing inventories rise, homes sit unsold for longer, price reductions and lower volumes.

A new small community in Houston is selling homes that are powered by Tesla shingles, EV chargers, and Powerwalls. The feverish demand for the dwellings, which have seen inquiries from buyers as far away as Washington state, comes at a difficult time for Tesla, which has seen its stock price plummet in the first quarter of 2025 amid President Donald Trump's tariffs trade war. Of the 11 homes in the community, which was built by Utopia Homes and is located in the Oaks of Shady Acres subdivision, only four are still available. Two are the larger model, which has an asking price of $544,900, while the others are smaller and have a price tag of $524,000—around $179,900 more than Houston's median list price of $365,000. In light of all the vandalism of Tesla dealerships and cars, I wonder what the nut cases will do to a Tesla house? Burn it down? The community better come with 24 hour armed guards!

A Manhattan penthouse with a kitchen designed by celebrity chef Jean-Georges Vongerichten is coming on the market for $75 million and will be one of the priciest listings downtown. The 6,500 foot condo also has 4,600 feet outside. The finishes are ridiculous and views are amazing. However, I do not care for the location in West Chelsea at 551 West 21st Street. It sold for $38mm in 2017, and the owner built it out in grand fashion and spent big bucks. The kitchen is stunning and has an 87-inch dual-oven Lacanche range with brass and enamel finishes. If I designed my kitchen, I would want this stove. Another listing for $110mm hit the market at 111 W 57th St.

Another amazing unit but this one is in Miami. It is bigger than the last one by 50% and 1/3rd the price. A Miami penthouse in One Thousand Museum, the final architectural masterpiece of the late Zaha Hadid, has listed for $24 million. The 51st-floor residence, owned by Loren Ridinger, co-founder and CEO of Market America. It out-sizes units inside owned by billionaire Ken Griffin, Marc Anthony, and David Beckham. The full-floor penthouse spans 10,338 square feet with a 1,200-square-foot patio, offering panoramic views of Biscayne Bay, the Miami skyline, and the Atlantic Ocean.

© 2025 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #780 ©Copyright 2025 Written By Eric Rosen.

Hello Eric, Hope all is well. If you like Lacanche, you will Love Molteni. Lacanche is for individuals. Molteni for pro. I have one, Ducasse, Alleno, Elysee Palace have one. Its the Rolls Royce of ovens. Beautiful. I use 5% of its capacity but love it! Much higher quality than Lacanche. https://www.google.com/search?q=molteni+ovens&oq=molteni+ovens&gs_lcrp=EgZjaHJvbWUyCwgAEEUYExg5GIAEMgcIARAAGO8FMgoIAhAAGIAEGKIEMgoIAxAAGIAEGKIEMgoIBBAAGIAEGKIEMgoIBRAAGIAEGKIE0gEJMzIxMmowajE1qAIIsAIB8QXbbS73vq4HGQ&sourceid=chrome&ie=UTF-8#imgrc=jm2R18_PYZiw7M&imgdii=UyLtmSep6UdxVM