Opening Comments

My last note was about my favorite restaurant in the Hamptons called Cowfish. The most opened links were Tucker Carlson’s assassination conspiracy theory in Forbes and the Jeff Bezos video on the earliest days of Amazon (VERY funny).

I am changing the order of things in the report as a test. Election and Israel/Middle East news are going at the bottom after Real Estate. Let me know what you think.

I have seen a number of Rosen Report hats around town and people have been sending me pictures of people sporting the sexiest hats of all time. They are guaranteed to make you look younger, improve your IQ and be the life of the party. People are getting stopped while wearing the hats by other readers. The power of the Rosen Report is real. If you are one of the lucky few that have the RR swag, send in pictures doing interesting things and I will include some in future reports. I am planning on holding some contests to give out hats to lucky participants.

Pictures of the Day-El Verano Southampton-Mexican Restaurant

Markets

Impact of Slowing Economy on Credit Markets

Munger Investment Principles

Rising Auto Repos

Wealth Migration Data and Maps

Nearly One in Four Sellers are Cutting Price

Biden 5% Rent Cap Proposal

Eviction Data

Pictures of the Day-El Verano Mexican in Southampton, NY

El Verano opened a year ago in Southampton on Windmill Lane. The location has been countless restaurants over the past 20 years, but El Verano should be sticking around a while. El Verano is an upscale Mexican Restaurant owned by Chef Julian Medina and partner Meghan Manzi. The concept is inspired by the summer houses in Mexico, particularly in Cuernavaca and Valle de Bravo, which are considered escape destinations for residents of Mexico City. The positives are the food is quite good and the presentation is remarkable. The dishes are packed with flavor and look like works of art. They have some fun drinks, but the prices are about as full as you can get for Mexican food. I spent over $400 for 4 entrees, 3 appetizers and 3 side orders with zero alcohol and tap water. No dessert. The service was a bit spotty. Overall, I highly recommend the food, but struggle to pay the price for Mexican. Jack had two small steak tacos for $35. A guacamole was $23 (chips were nice and fresh) and a small quesadilla was $35. I would go, but bring your Amex Black Card and enjoy the food despite the fact that it is overpriced. Welcome to the Hamptons. Food-A-, Service B-, Ambiance-B. Price-Offensive for Mexican food.

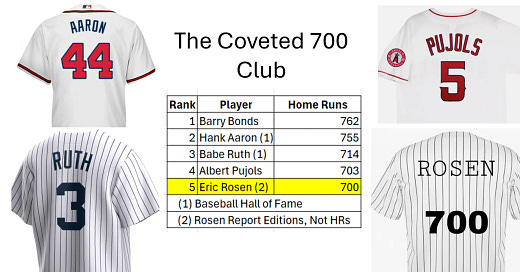

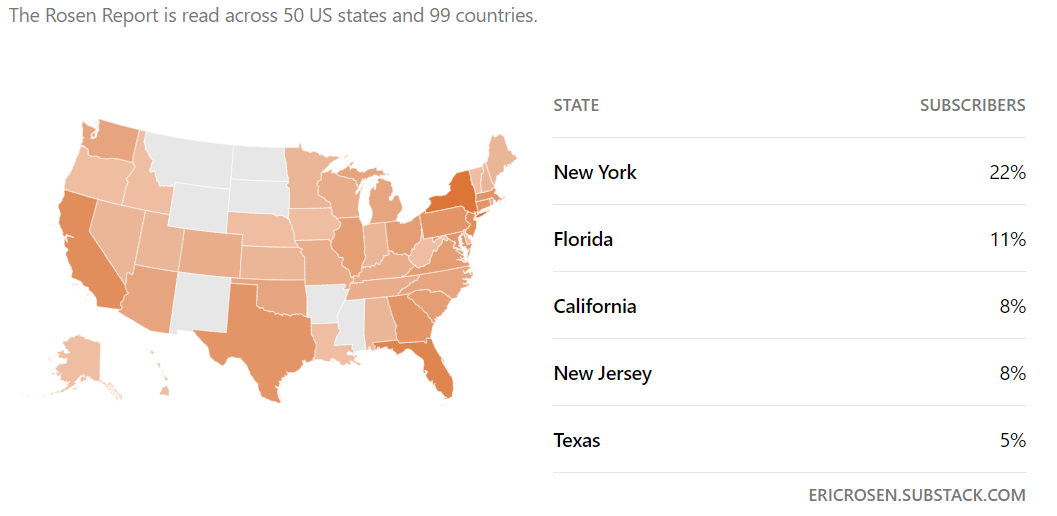

Rosen Report Joins the 700 Club

I wrote the first Rosen Report in February of 2020 after a dozen people who were on my Global Financial Crisis newsletter distribution reached out for my pandemic perspective. I sent my email to 18 people and have never invited another person. The growth has been 100% word of mouth and my readers passing my newsletter to friends, colleagues, clients and family. I am now read in all 50 states (thank you Mr. Alaska for reading) and 99 countries. I receive over 1,000 emails per week from readers with story ideas, questions, and connections.

In baseball, one of the most exclusive clubs is the 700-home run club. Although four players have hit 700 or more home runs, I only count three of them given the steroid area. Aaron and Ruth were elected to the Baseball Hall of Fame and Pujols will be eligible in 2028. My point is the 700 club keeps elite company and I am joining it today with my 700th newsletter. I will admit 700 home runs is a slightly more impressive accomplishment… but only slightly. There is no one who can take credit for something better than I can, so I decided to lump myself into the 700 even though I have always been a weak baseball player. It is arguably my least favorite sport, but I have made the 700 club officially, as you can see below. No one can deny me my full right to this exclusive club. After all, it is in writing now and you can see my official jersey to prove it. I am anxiously awaiting the call for the Baseball Hall of Fame invitation.

Sadly, I do not have access to all my newsletters, as the earliest editions were via email. I have around 450 of them between Substack, Constant Contact and Mail Chimp. I am going to go back a few years to share some of my favorite notes from 2021 and 2022. I included the links so you can read the theme pieces in reports that sound interesting.

May 2021-Morphine Drip

May 2021-The Cobra Effect

May 2021-Druckenmiller vs the Basket Regarding Inflation-I Take Druck

June 2021-Fauci Ouchie-Time to Go

July 2021-Getting Old is for the Birds

July 2021-There Ain’t No Such Thing as a Free Lunch

August 2021-Music & Memories-What Happened to Christine?

October 2021-Adrift

October 2021-The World Has Gone Mad

November 2021-My Waist is Expanding Faster Than Inflation

December 2021-You Had Me at "Clearance Sale"

March 2022-The Night I Talked BBall With Coach K

March 2022-Never Ask Andy Warhol For Advice on Art

May 2022-Foot in Mouth

June 2022-Dimon to the Rescue

June 2022-Zachary, Louisiana. Why?

September 2022-Response Time

September 2022-There are Idiots, Morons, Imbeciles and The Author of the Rosen Report

November 2022-Bad Idea Bunny

December 2022-Iconic Rainmaker-Jimmy Lee-Teaches Me a Lesson

In all seriousness, I want to thank my readers for their loyalty and friendship. I have made so many amazing contacts due to the Rosen Report, and for that I am truly appreciative. I enjoy making new connections and using the power of my network to help people. As I consider doing different things in my career, it is nice to have such amazing connectivity with some of the biggest names in business. I hope you continue to enjoy the Rosen Report and help spread the word.

Quick Bites

All non-bolded text below is excerpted from the cited articles. Bold are my thoughts.

Markets ripped higher on Tuesday but to me the most notable development recently is the improving market breadth. We have seen the Magnificent 7 drive markets with massive outperformance, but the Russell 2000 is now +11%, significantly outperforming the other indices for the first time in a while. On Tuesday, market darlings (Nvidia and Alphabet) were -1%, while the Russell 2000 was +3.5%. Global chip stocks fell sharply with ASML, Nvidia and TSMC hit amid reports of tighter export restrictions from the U.S. and a ramping up of geopolitical tensions. Wednesday, the tech sell-off intensified with the S&P-1.4% and Nasdaq-2.7% while the Russell outperformed down less than 1%. Although Nvidia stock is +144% YTD, it is -13% for the past 5 days and -10% for the past month after it was -6.5% on Tuesday. Bitcoin is back to $65k (+10k in 10 days), after the craziness of the assassination attempt and the odds of a Trump victory. Trump is due to speak at a Bitcoin conference on July 27th in Nashville, as he is considered a “Crypto-friendly” candidate. Gold hit $2,467/oz (all-time high) as rate cuts are more certain.

This is a good Bloomberg article outlining the impact of a slowing economy on the credit markets. Credit markets are breathing a sigh of relief after inflation data showed price pressures are cooling broadly, but a weakening economy poses fresh risks to corporate debt. “For the first time in this post-Covid cycle we are seeing concurrent softness across a bunch of different variables,” Vishwas Patkar, a strategist at Morgan Stanley, said in a phone interview. “We don’t want to see the economy slow too much further from here. If growth is too weak, you start to worry about fundamentals, defaults and downgrades.” “Correlations between equities and credit are breaking down because higher-for-longer interest rates has been a negative for a large number of equities but supportive of credit in general because of yield-seeking investors,” Priya Misra, a portfolio manager at JPMorgan Asset Management, said by phone. Morgan Stanley remains constructive on credit and a more severe US downturn is not its base case, though it is a downside risk, Patkar said. Other investors are rotating out of the US after credit’s strong run this year. Amundi SA, for example, prefers Europe at the moment on valuations, according to a note from the asset manager on Friday.

Charlie Munger of Berkshire Hathaway fame passed away recently but his investing principles remain strong. This article outlines three of them for you.

Munger underscored the significance of having an understanding of the business into which you are putting your money. You should be well aware of how the company functions, its competitive edge and relevant industry dynamics. Munger suggested that investors direct their attention to businesses focused on their "circle of competence" — areas where they possess a considerable understanding and can make informed decisions.

Another point that Munger emphasized is the need for valuation discipline. Even if the company seems outstanding, it’s important not to overpay for its stock and instead focus on quality. He was big on the significance of a “margin of safety” — purchasing securities at a considerably lower cost than their actual value as a hedge against unpredictable market swings.

Having a long-term mindset when it comes to investments can lead to more financial success. Being patient and sticking with good investments for long periods was an important pillar of success for Berkshire Hathaway.

It is hard to maintain discipline in crazy markets. If you follow these three rules, you will be a better investor.

I have written about the rising cost of auto loans and higher delinquency rates. This article suggests that auto repossessions are +23% in the first half of 2024. Repos started moving higher last year and have now exceeded pre-Covid levels, up 14% compared to the first half of 2019. "When you think about the costs for rent and shelter and insurance, all those things hit consumers and they have to choose what they will pay," Jeremy Robb, senior director of economic and industry insights at Cox, told Bloomberg. Robb warned, "More people are getting behind on payments because everything is more expensive."

Other Headlines

Powell indicates Fed won’t wait until inflation is down to 2% before cutting rates

Goldman Sachs tops estimates on better-than-expected fixed income trading

Citigroup tops expectations for profit and revenue on strong Wall Street results

Burberry shares drop 16% after the luxury giant issues profit warning and replaces CEO

Swatch sales, profits slump on weak China demand, hammering shares

Stamp prices increase again this weekend. How much will Forever first-class cost?

The 5 cent increase will mean a price of 73 cents. In 1969, the year I was born, stamps were 6 cents. US inflation since 1969 would have resulted in a stamp price of 53 cents today, so stamp prices have gone up sharply more than the inflation rate. Despite this, the USPS lost $6.5bn in 2023.

Why the current job market has been such a bad match for the college degree and recent grads

The article suggests many jobs require less than a bachelor’s degree.

65-year-old quit his job and emptied his life savings to start a business—now he’s worth $11 billion

This is what differentiates America from most other countries.

Ohio city plunged into housing crisis after 15,000+ migrants arrive: 'Setting us up to fail'

Gov. Newsom signs first-in-nation bill banning schools’ transgender notification policies

AB1955 will stop school districts from notifying parents if their child starts using different pronouns or identifies as a different gender.

Think of the billions of tax revenues lost due to CA policies pushing wealthy people and companies out of the state. Oracle, TSLA, SpaceX, X, Airbnb, Palantir, Schwab, McAfee…..Full list of companies that have left CA in recent years.

Artificial intelligence needs so much power it’s overwhelming the electrical grid

I have written extensively about my reasons why EVs will not have the uptake wanted (price, range, maintenance cost, limited charging stations and the lack of sufficient power grids). This article suggests that AI requires so much power the grids can’t keep up. At 2.9 watt-hours per ChatGPT request, AI queries require about 10 times the electricity of traditional Google queries, according to the Electric Power Research Institute, a nonprofit research firm.

Uber now shows average wait time and cost for rides in thousands of cities

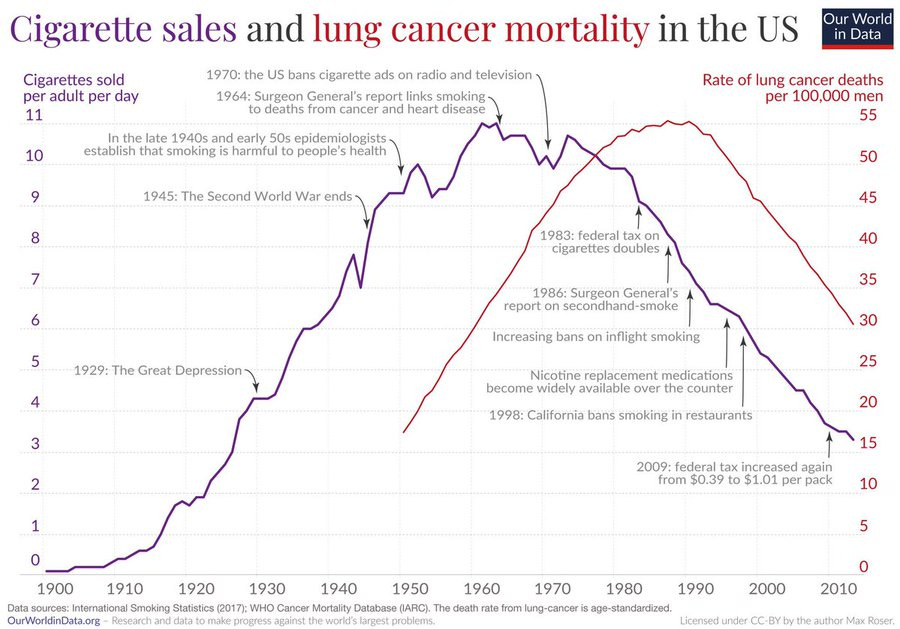

Cigarette sales and lung cancer deaths are the same curve, shifted 25 years.

I have never smoked a cigarette in my life.

With second Wimbledon title, Carlos Alcaraz proves he is heir apparent

Joker is the greatest ever, but he is 37 and Alcaraz is 21 years old. The age difference showed, as Alcaraz looked fresh and had a bounce in his step. I just don’t know how many more rodeos the Joker has left but his greatness cannot be denied. Joker had Federer and Nadal to compete with and there is just not any kind of depth today with the new crew on a relative basis. The big three have a total of 66 majors (Joker 24, Nadal 22 and Federer 20). The new young generation has a long way to go to be mentioned in the same sentence as the Big 3, but I think Alcaraz has the best shot if he stays healthy.

The Paris Olympics is turning into a catastrophic financial flop

These games make no economic sense to me.

Russia tensions explode as Kremlin 'blames NATO for Vladimir Putin assassination plot'

Real Estate

I have written extensively about the wealth migration from Blue states (CA, IL, NY, NJ, CT) to Red states (TX, FL, NV, NC, TN…). The latest IRS stats on migration show a continued move from low-tax to high-tax states – especially for the wealthy. The biggest winner in that shift in 2022 was Florida, which gained a net $36 billion from in-migration. Texas ranked second, with a net gain of $10 billion. On the other side is New York, which lost a net $14 billion from out-migration; Illinois, which lost $10 billion; and New Jersey, with a loss of $5 billion. California, though, took the prize for the biggest loser. It lost a net $24 billion in income in 2022 from out-migration, as the 700,000 Californians who moved out far outpaced the 250,000 who moved in. What are the ramifications for the states losing all that wealth and business that results in sharply lower tax collections? Think of the benefits of the wealthy descending on these states and bringing with them business, employees, and spending a disproportionate amount generating massive sales taxes. Policies matter. Amazing charts.

Interesting Zillow article entitled, “Nearly 1 in 4 sellers cut home prices ,as inventory grows.” The total number of homes on the market has risen throughout the year, ticking up 4% from May to June to stand nearly 23% above last year's low level. While inventory levels are still about 33% below pre-pandemic averages, that's the smallest deficit since the fall of 2020, when the pool of available homes was quickly dropping. Inventory is higher than last year in all of the 50 largest U.S. metropolitan areas except two — New York and Cleveland — and rose month over month in all but five. While sellers still have a slight edge nationally, Zillow's market heat index shows a balanced market may be just over the horizon. Competition is easing fastest in the South; all major Southern markets are either neutral or buyer-friendly, with the exception of Dallas and Raleigh. Clearly affordability, maintenance costs, insurance, and the impact of higher rates are all contributing to the issues.

Biden is proposing a 5% cap on rent increases for apartment buildings of 50 or more units according to this AP article. The policy would impact 20 mm units or about 50% of the rental market. The cap would not be required on newly built units or those that were heavily renovated. In recent months, housing has been a primary contributor to keeping the consumer price index elevated at 3% annually. Inflation has been a fundamental obstacle for Biden politically as he competes against Donald Trump, the former president and Republican nominee. This is a bad idea. If landlords face rising prices on taxes, labor, utilities, maintenance… and cannot pass it on to tenants, they may not be able to pay their mortgages and can lose the buildings to the banks. We have seen what happened in NYC under idiotic rent laws and it is an unmitigated disaster. Why is R/E singled out? Why an arbitrary 5%? What about tying it to the costs to run a building? This seems very political to me and not something I support, despite the fact that I am not an owner of apartment buildings. OER=Owners Equivalent Rent.

Concerning WSJ article about the elevated number of evictions in some markets. Eviction filings over the past year in a half-dozen cities and surrounding metropolitan areas are up 35% or more compared with pre-2020 norms, according to the Eviction Lab, a research unit at Princeton University. This includes Las Vegas, Houston, and in Phoenix, where landlords filed more than 8,000 eviction notices in January. That was the most ever in a single month for the county that includes the Arizona capital. Phoenix eviction-court hearings often run for less than a minute. One judge signed off on an eviction after the tenant admitted to missing two rent payments. Overall, eviction notices were up 15% or more compared with the period before the pandemic for 10 of the 33 cities tracked by the Eviction Lab, which looked at filings over the past 12 months. I spoke with multiple landlords in NYC who cannot evict tenants due to the archaic rent laws and backed-up court system. People don’t pay rent and they won’t leave.

2024 Election

Trump had a crazy week. He got shot, saw his poll #s improve, received key endorsements, has a pledge from Musk for $45mm/month to his Super PAC and the classified documents case was dismissed by a judge. PredictIt now has Trump 68 and Biden 28 as of Wednesday mid-day. I do feel Trump’s clinched fist with a bloodied ear and face will become iconic and used heavily during the campaign.

The more I read about the assassination attempt, the more I am convinced heads must roll with the Secret Service. Check out this headline, “Secret Service boss blames ‘sloped roof’ for not putting sniper team on building used by would-be Trump assassin.” So a 20-year-old who is clearly a bad shot can position himself on the roof, but trained snipers can’t? This was a relatively easy arena to fortify and there were too many mistakes and sloppiness. The Secret Service identified the rooftop used by the gunman as a vulnerability prior to the event. According to this article, the Secret Service did not sweep the shooter’s building and relied on local law enforcement. I am hardly a security expert, and it was obvious to me. Videos show the President’s protection team having spotted the shooter prior to shots being fired. A local cop confronted the shooter and failed to take out him out moments before the assassination attempt unfolded. Now, there is a story that the assassin was spotted on the roof 30 minutes prior to the shooting. How is this humanly possible? Why did they not take him out? What impact will this news have on the election? There are also conflicting reports with respect to requests for additional security being turned down by the Secret Service. I feel a full investigation is warranted and this was an epic security failure.

Trump shooting live updates: Biden says politics must never become ‘a killing field’

I thought Biden did a decent job on Sunday night addressing the country.

Trump picked Ohio Senator, JD Vance as his running mate.

“After lengthy deliberation and thought, and considering the tremendous talents of many others, I have decided that the person best suited to assume the position of Vice President of the United States is Senator J.D. Vance of the Great State of Ohio,” Trump posted on Truth Social. “J.D. honorably served our Country in the Marine Corps, graduated from Ohio State University in two years, Summa Cum Laude, and is a Yale Law School Graduate, where he was Editor of The Yale Law Journal, and President of the Yale Law Veterans Association. J.D.’s book, ‘Hillbilly Elegy,’ became a Major Best Seller and Movie, as it championed the hardworking men and women of our Country. J.D. has had a very successful business career in Technology and Finance, and now, during the Campaign, will be strongly focused on the people he fought so brilliantly for, the American Workers and Farmers in Pennsylvania, Michigan, Wisconsin, Ohio, Minnesota, and far beyond….”

‘I’m a Never Trump guy’: All of J.D. Vance’s Trump quotes that could come back to bite him

There are some incredibly negative comments out of Vance towards Trump as outlined in the link and had mentioned this in prior notes. However, Vance has an impressive educational background, served in the Marine Corps, was in business and a Senator.

Bill Maher Predicts Exact Date That Biden Will Drop Out

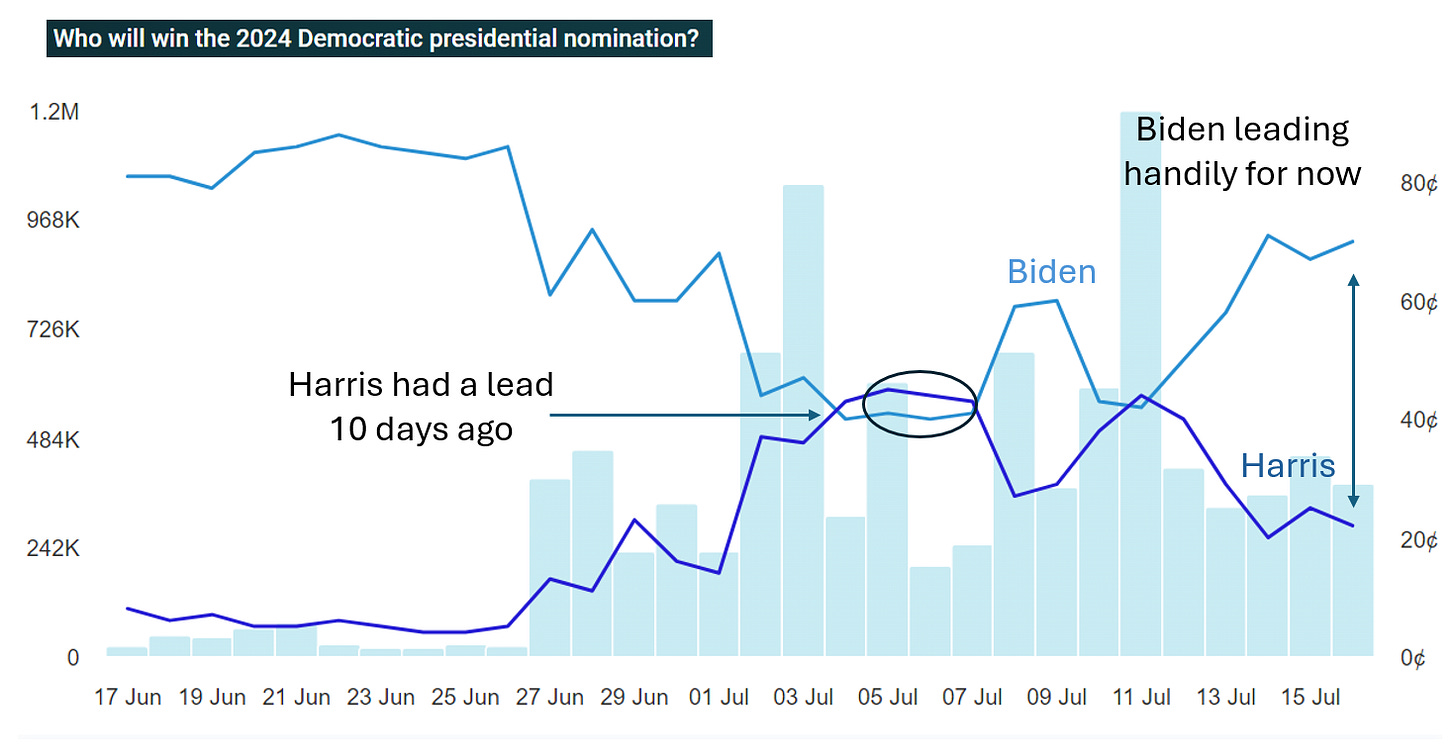

However, the little bit of good news for Biden is he is back to leading on PredictIt as the Democratic nominee. However, a new poll suggests every major Democratic candidate polls better than Biden in key swing states. Now Biden is suggesting if a “medical condition” emerges, he will consider dropping out. Now, Adam Schiff is calling for Biden to drop out.

Trump says he mulls Jamie Dimon for US Treasury, won't try ousting Fed's Powell

Jamie would be incredible. I hope he considers it. Jamie, I am available to be on your staff if you take the job with 100% of my salary to charity. Jamie, remember the tax loophole where Paulson paid no taxes on his GS shares he was forced to sell which is outlined here. That would save you many hundreds of millions in taxes.

Dimon and other Wall Street CEOs react to Trump assassination attempt: ‘Deeply saddened’ by violence

From Charlottesville to Jan 6th and BLM “mostly peaceful” protests, I feel both sides have contributed to hate speech and violence. This short video clip is of Democrats calling to beat, punch, shoot, kill, blow up the White House, assassinate…Trump. Trump himself was called out for his comments about “bloodbath.” And, days before the assassination attempt, Biden said “it is time to put Trump in a bullseye.” We need a more civilized society and should expect BOTH sides to behave better.

Watch Amber Rose's speech at the Republican National Convention

Biden seriously considering proposals on Supreme Court term limits, ethics code, AP sources say

I have no problem with SCOTUS term limits in the 20 year range. I also feel Congress should have term limits.

Israel/Middle East

Israel launches new Gaza strikes after weekend attack kills scores in safe zone

Taliban Takes Americans Hostage, Says Willing To Trade For Gitmo Prisoners

Anti-Israel protesters call for intifada outside Queens synagogue

© 2024 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal, or tax advice. Consult with your lawyers and professional financial advisers. Rosen Report™ #700 ©Copyright 2024 Written By Eric Rosen.

With regard to your article on the post office, it’s the only business that has a monopoly but cannot make money with the monopoly. How does this happen?