For those who celebrate, I wish you a Merry Christmas and Happy New Year. The Rosen Family is on holiday in Mexico for a couple of more days at Nizuc in Cancun. The hotel rooms are fantastic and the pool and beach are nice. The staff is friendly and the guests are incredibly accommodating and friendly. The food is hit and miss and overpriced. The first dinner was quite disappointing and at $650 including 1 drink over priced. However, last night’s dinner was quite good at a decently lower price point. Walking into Nizuc, the lobby is quite impressive as are the sunsets:

My last note was about 6 dinners in 3 nights in NYC and the most opened links were one in five cheating mail in voters and The No. 1 thing to avoid to achieve a ‘real sense of satisfaction’. Today’s note is abbreviated given the holiday.

My battle with COVID was far easier than the last but it took away my appetite for 4 days resulting in -9lbs from my new strain, “Ozempic COVID.” I tested positive on Tuesday and clear on Thursday. I am wearing skinny jeans just in time for Cancun.

I want to thank my loyal readers for consistently reading the Rosen Report. The best part of creating this newsletter has been interacting with readers and learning from your expertise and suggestions. I have enjoyed building the Rosen Report brand and making so many amazing new connections. Please keep ideas and feedback coming to rosenreport@gmail.com.

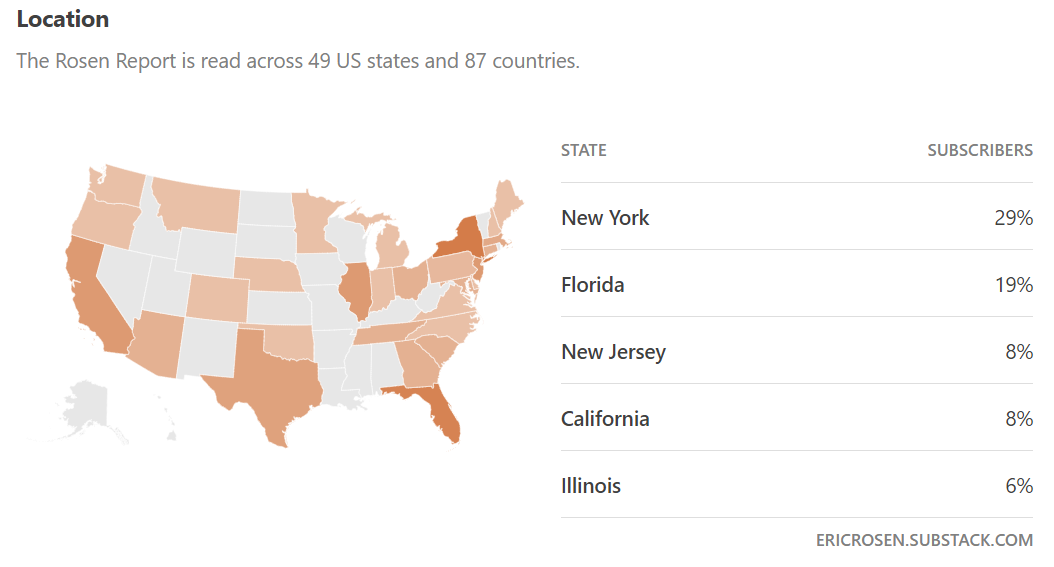

I am excited about my real estate business with Douglas Elliman, the Executive Recruiting roles, Free Summer Internship Program and upcoming Speaking Engagements all born out of the RR. The report is growing and is read in 49 states and 87 countries. Someone please go to Alaska and read it! Just to think, it started with a total of 18 readers in NYC and South Florida in February 2020.

I have a funny video of the day, a short list of news and a brief R/E section in today’s note.

I have attached my favorite Rosen Reports from each month for 2023. Hard to believe another year has gone by and 101 newsletters were written. If you are sitting at the beach or pool or have a plane or car ride, read some of the theme pieces from 2023. There were some fun ones. The most opened within Substack were “The Cost of Luxury Vacations Has Gone Bonkers” and “Follow the Money….To South Florida.” The highest open rates were “Candy Kisses” and “Skiing is for Billionaires.” Enjoy. I felt the short video clip of my interview with Brian Koppelman (Billions creator) talking about adversity was amazing in “How You Respond to Adversity Defines You.” Because it reminds me of my glory days, one major highlight for the year was my surf trip to the Kelly Slater Wave Pool with my buddies that almost had me look like I know what I was doing again. Back one more time in April of 2024 and I am counting the days. Also, Some amazing Fishing in Bahamas and Venice, LA.

Jan

Feb

March

April

May

June

July

August

September

October

November

Video of the Day-Artichoke Dip Gone Wrong-I Cried I was Laughing So Hard

This could be the funniest video I have seen in a while. The reactions of the news anchors’ colleagues who taste what is an awful “improvised” artichoke dip made me cry. She asked how it smells and one guy said, “smells like vinegar” and the other said, “it smells like a barn.” The woman “chef” said, “This did not work out,” yet her colleagues tried the clearly vile dip on air. What ensues is what legends are made of in my opinion. There was no vinegar. The faces are the tasters from the Canadian news show were hysterical. The woman taster is crying, “it burns.” If you do not find this short clip funny, please unsubscribe.

A Few New Stories

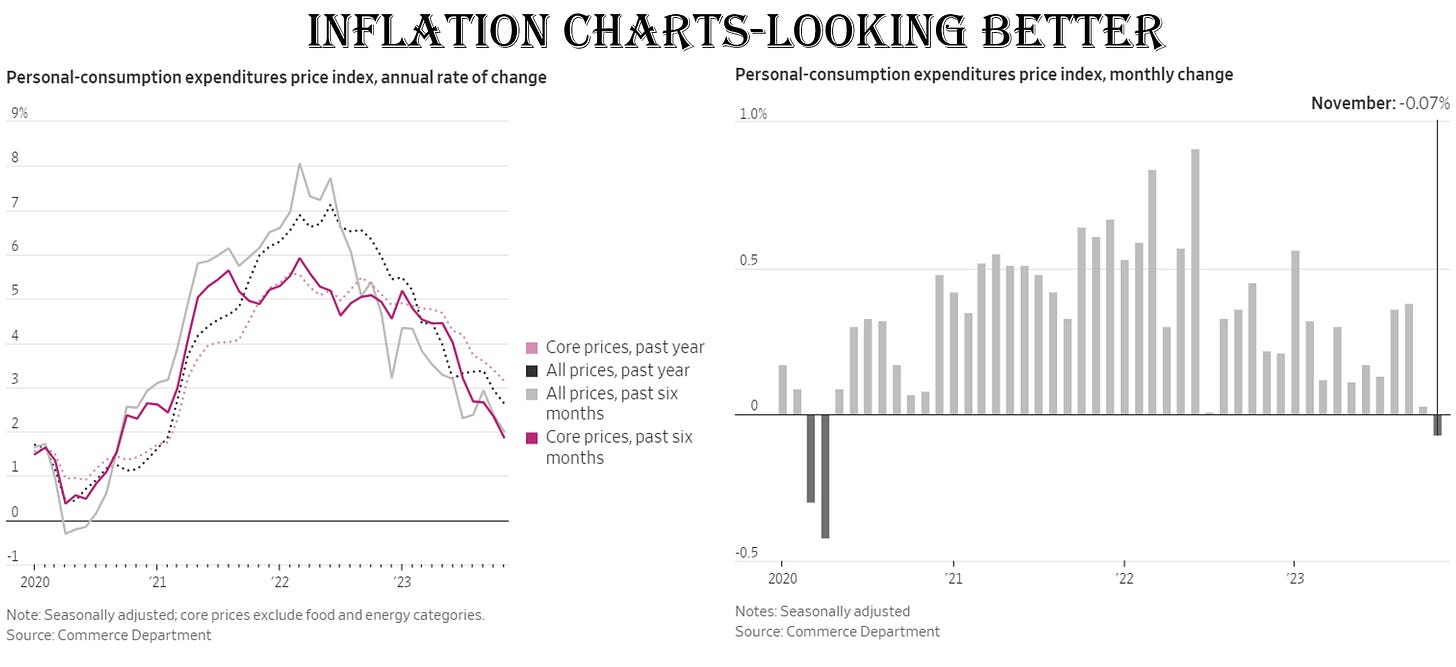

Prices Fell in November for the First Time Since 2020. Inflation Is Approaching Fed Target.

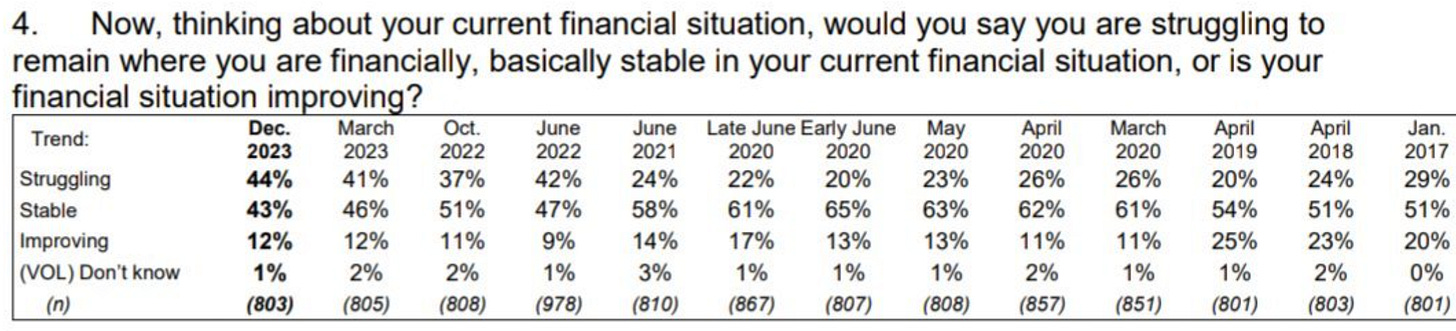

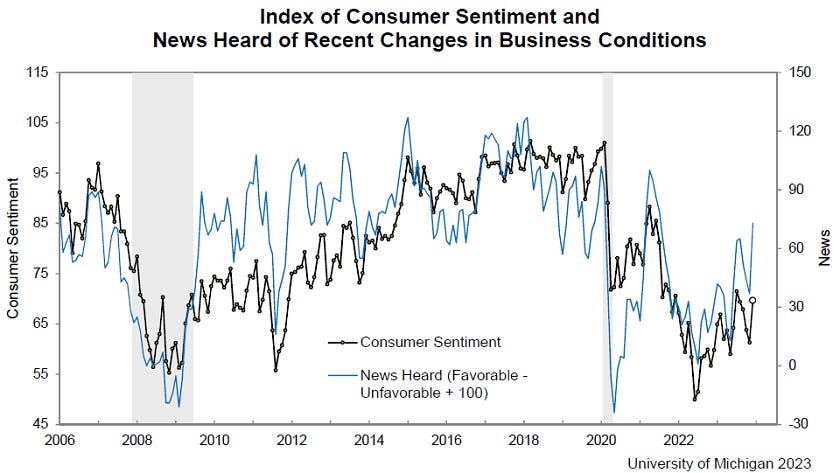

I was critical of the Fed and wrote COUNTLESS pieces in 2021/22 about the ineptitude that lead to runaway inflation. Did the Fed just thread the needle? I honestly did not think it was possible. No, if they make a save, it does not make up for the awful policy decisions, but things look better. Just because prices are stabilizing, we are still far higher than we should have been. Inflation has hit families hard despite wage gains (2nd chart). 62% of Americans are living paycheck to paycheck, as holiday spending, credit card debt rise. However, consumer sentiment ended on a positive note for 2023.

US economist predicts 2024 will bring 'biggest crash of our lifetime'

"Since 2009, this has been 100% artificial, unprecedented money printing and deficits; $27 trillion over 15 years, to be exact. This is off the charts, 100% artificial, which means we're in a dangerous state," Harry Dent told Fox News Digital. "I think 2024 is going to be the biggest single crash year we'll see in our lifetimes." Although I concur that we have seen unprecedented stimulus, free money and printing, I am not convinced we are headed to the “biggest crash of our lifetime.” We need to get spending under control and make tougher decisions around entitlements. We cannot keep running nearly $2 trillion deficits with 3.5% unemployment.

Container rates hit $10,000 as ocean freight inflation soars in Red Sea crisis

CNBC has learned that logistics managers were quoted this morning an ocean freight rate of $10,000 per 40-foot container from Shanghai to the U.K. Last week, rates were $1,900 for a 20-foot container, to $2,400 for a 40-foot container. Truck rates in the Middle East now being quoted are more than double.

Karuna Therapeutics surges 47% after Bristol Myers Squibb announces $14 billion deal

OpenAI in talks to raise new funding at valuation of $100 billion or more

Think of where this could have gone if Altman remained booted out of the company and many senior leaders followed. There needs to be a HBS study done on this one.

Nike sinks 10% after it slashes sales outlook, unveils $2 billion in cost cuts

I wrote 3 years ago that Rudy’s best days were behind him. I commented positively on his contributions as Mayor of NYC and performance during 9-11, but felt he was embarrassing himself in 2020. I used the famous picture of the hair dye running down his face. I received one hell of a hate letter from a reader that was a friend. “How dare you ever question the greatness of Rudy. He has done more for this country in a day than you will do in your lifetime. As a result of your insults, I am unsubscribing…” Well, since this exchange, Rudy was arrested and is facing RICO charges, was ordered to pay $148mm in a defamation case, owes $1mm to the IRS and NY State for unpaid taxes, owes millions to several law firms was sued for abuses of power and sexual assault and harassment and filed for bankruptcy with debts totaling up to $500mm. Rudy is also being sued by Hunter Biden, Dominion and Smartmatic. My former friend, who do you think was right on Rudy, me or you? As an aside, I feel a $148mm judgement was ridiculous for the defamation case against election workers.

I would love to see Harvard lose is tax benefits and this professor and the President should be fired. The fact that the board is sticking with an idiot at what once was an amazing institution is quite concerning. It is becoming increasing the clear that the board tried to cover up the plagiarism probe. The woman who was plagiarized has called for the President’s termination, applications are slowing, major donors are running and Jews are offended. President Gay, do you know what a good leader would do? They would resign in the best interests of a school. You are not the priority. The future of the school should be. Think of the damage you are doing.

I have written extensively that I believe we are not alone and I have offered to be abducted two dozen times. Sadly, this is yet to take place, but hopeful it will soon. Another story with some crap picture of a dot next to Airforce One. It could be a bird, but it is a UFO story that involves Airforce One, so it gets a mention. Aliens, I am in Mexico if you are looking for me. I lost weight due to my bout with COVID, so I look a little lighter than normal. Just abduct me for 48 hours and give me the ability to recall every detail. I have a funny feeling it will be the most opened newsletter of all time.

Mario Carbone on Opening Chateau ZZ's, Major Food Group's First Mexican Restaurant

Note, it is in Miami and NYC and Miami restaurants are close in number for Major Food Group. That is a telling statement on where the money is going. The population of NYC dwarfs Miami.

I am hopeful that the lunacy of overdone DEI programs is coming to a close at companies and colleges/universities.

The model is a biological male that does a lot of modeling as a woman. He is suing his talent agency for saying he was “insufficiently masculine,” ruining his MALE modeling career. Please look at these pictures and tell me you would hire him as a male model. He looks like a pretty female model. Sorry, you cannot have it both ways. I hope you lose your lawsuit. We are living in an absurd world and it is hard not to get frustrated about it.

Iran threatens to close Mediterranean Sea citing US ‘crimes’ in Gaza

Real Estate

In the Royal Palm community in Boca Raton, we are seeing homes stay on the market longer and inventory build-up at the higher end. Having lived in the community for 7 years, I have seen the influx of tri-state families relocate and push up home prices to stratospheric levels. Today, there are 41 homes officially listed for sale and a lot more off market or coming to market. There are 23 homes listed for $14mm or more and 10 listed over $20mm. Remember, in 2017, the year I moved, only 1 house sold more than $10mm. In 2023, 2 homes sold over $20mm and one knockdown (will be turned into 2 homes) sold over $20mm. From $14-20mm, only two homes sold in 2023. The point is simple-prices need to come down to move the inventory. When I moved, the cheapest lots were $1mm or less and now $3mm. New golf course homes were $6mm, now $15mm-19mm. In 2017, new water homes were in the $9-10mm+ range and now can be over $30mm. However, high-end Miami and Palm Beach waterfront seem to be in demand if new and move-in condition. A 5,931 square foot home on Palm Beach Island just sold for $13mm and the prior sale in November of 2020 was $6.9mm. In May of 2017, it sold for just $5.7mm. Remember, I am a realtor at Douglas Elliman Real Estate and have a world class team from Miami to Jupiter to assist in your luxury housing needs.

Aon Center, the third-tallest tower in Los Angeles, has sold for $147.8 million — about 45% less than its last purchase price in 2014 — as office values continue to suffer from high vacancies and financing costs. The sale is the largest office deal this year in downtown Los Angeles, which has been among the hardest-hit US office markets since the pandemic as remote work becomes more popular and escalating interest rates drive down values, wiping out owners’ equity. The sale price works out to about $134 a square foot. The most recent large downtown LA office property to sell was the Union Bank building. That deal closed in March for $104 million, or about $150 a square foot. Think of the impact to the lenders and the new far lower tax receipts based on the significantly lower price. This is happening in many markets across the country. Think of the impact on the budgets in LA, SF, Chicago, NYC, DC….

© 2023 The Rosen Report LLC. All rights reserved. Does not constitute investment, financial, legal or tax advice. Consult with your lawyers and professional financial advisers.

Rosen Report™ #641 ©Copyright 2023 Written By Eric Rosen

Thanks for the kind words. Glad you enjoyed it. Been fun. Keep reading. Happy Nee Year!

Thanks for the note. Networking is key. I have a friend, Scott, with an amazing network. He will never turn down an intro. Always building, cultivating, growing..I did not know this guy, Dent. Thanks for reading.