Opening Comments

It is hard to believe 2022 is coming to a close. We are approaching the three-year anniversary of the Rosen Report, and it has evolved quite a bit from the early days. I want to thank my readers for putting up with me, sending me story ideas, correcting my mistakes and helping me grow my readership. I have learned a great deal from my readers, and I am appreciative.

I am going to see if we can step things up a bit and have hired a consultant to help me professionalize the podcast and newsletter to improve distribution channels. In coming weeks, hopefully, you will notice improvements and would appreciate feedback, as I see if the Rosen Report can continue to improve, evolve and grow. The goal of the report is simple. I want to entertain, educate, and inform my readers and build my network. I scour the world news to find stories that I believe will enrich my readers. They may be a survey or two early next year, and I would appreciate my readers take a few minutes to fill them out so I can continue to improve.

As the year is winding down, a reader/advisor suggested I do a year in review with links to a bunch of old reports as many new readers will have missed them. As a reminder, if you go to Substack.com, you can always find prior Rosen Reports for your review. Given many of you will be on holiday and lounging at the beach or pool, I might suggest reading the title sections of old reports, as there are some good, informative and fun stories. I wrote 98 reports this year through 12/18/22 and over 60 had open rates either side 70%. I took my favorite of the highest opens and have links below to 40 of them. I have many readers on my distribution who do not always receive my reports (including myself) due to some deliver-ability issues.

Next year, I will be using the Rosen Report network more to help with my newsletters and podcasts. For example, I have a cyber-security expert in the network, and we are finalizing a report to help give ideas to protect readers from cyber-attacks. If you are an expert, please reach out so I can ask you questions and get assistance with upcoming pieces and podcasts. If you have story ideas or feedback, let me know.

Have a great and safe holiday. This is my last report for the year given the break and need for a little down time. Happy New Year.

One correction from the last piece. I had a bad link about the Biden proposed boat policy. Check it out here. My boat is 34,’ so if the policy passed, I am clear, but 1 ft larger than mine would have some serious issues. Policy is moronic, but it could actually make my boat go up in value!

Pictures of the Day-Why Go Back to Work?

Year in Review (Select Stores from 2022)

Quick Bites

Markets

Chart of YTD Asset Performance

Wal-Mart CEO on Shoplifting Impact

Stanford Banned Word List

$15k “Fake” Diamond Worth $900k

Other Headlines

Crime Headlines

Real Estate-Expanded Section

Multi-Family Color-Deteriorating Conditions

Homebuilder Sentiment & Correlation to Prices

SFO Commercial Disaster

Other R/E Headlines

Virus/Vaccine-Deterioration Slowing

Pictures of the Day-Why Go Back to Work

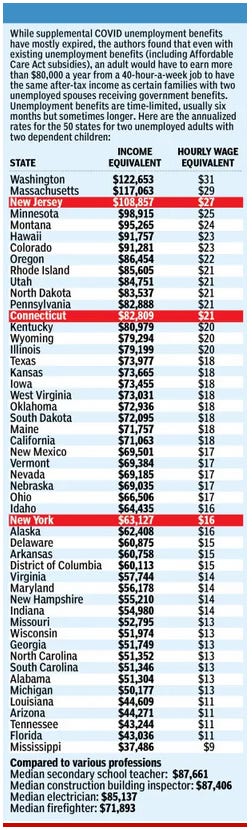

Did you know that families earning half a million dollars a year can receive ObamaCare subsidies? Or that in some states, unemployment insurance benefits can be equivalent to a job with annual pay of $100,000? It’s shocking but true, and it might explain why so many businesses can’t get workers back on the job almost three years after COVID-19 hit these shores. Today there are still at least 3 million fewer Americans working than there were in 2019. There are a lot of white collar layoffs in tech, banking, corporate America, but the blue collar workers are sought after in many industries.

The US has over 10mm job openings according to the US Bureau of Labor Statistics as seen below. We are seeing more White Collar job losses in Tech, Banking, Corporate America, while we are struggling to fill blue collar jobs and the article in this link explains why.

Year In Review

January

February

March

April

May

June

July

August

September

October

November

December

Quick Bites

Stocks jumped Wednesday, rising for a second day, after upbeat earnings reports from two bellwethers raised hopes that corporate earnings may be better than feared even with a potential recession. The Dow jumped 526 points, or 1.6%. The S&P 500 and Nasdaq Composite jumped 1.5% each. Nike surged 13% after beating Wall Street’s expectations for quarterly earnings and revenue. The sports apparel maker also showed progress in its attempt to clear through inventory, posting a decline over the previous quarter. Meanwhile, FedEx gained 5% after reporting earnings per share that beat estimates. The company also shared a slew of cost-cutting plans. Better-than-expected consumer confidence data for December also boosted investor sentiment in the markets, jumping to its highest level since April. Bond yields fell with the 2-year Treasury -5bps to 4.21% (was 4.73% in November) and the 10-year Treasury fell 7bps to 3.68% (was 4.21% in November).

If the market in 2022 was driven by inflation and the Central Bank response with higher rates, I feel 2023 will see inflation moderate sharply and the Fed most likely pivot prior to year end. Earlier in the year, the US Dollar rally was impressive, but it has lost a substantial amount of steam in recent months (2nd Chart) as inflation has slowed in the US and the Fed has lowered the size of rate hikes from 75bps to 50bps. In a related note, global debt which has a negative yield is down to under $700mm (3rd chart) from $18 trillion 2020 given global central bank action. Oil is down, but I am not convinced it stays there given how tight supply is today, reserve levels down sharply, China coming back on line likely and years of under investment. . Gas by me is under $3/gallon now, but I fear it won’t last.

Below is a chart I put together as of the close on 12/20/22 for YTD performance from a host of stocks, indices, ETFs, REITs, Commodities… ranked from best to worst performer by category. Energy was the big winner with 14 out of the top 15 best S&P performers in the energy space. Growth sharply under-performed value YTD, as the large rate hikes force future large cash flows to be discounted and there were some meaningful business slowdowns as well. The clear best sale of the year was the sale of TWTR to Musk for $44bn. One report has it losing $4bn this year, and we are all aware of the chaos, layoffs, missteps, advertiser strike... Given the performance of the space (Meta-65% and Snap-82%), the old TWTR management team deserves a round of applause for the sale @ $54.2. I said months ago, Musk overpaid by $29bn, and people thought I was crazy. I was low. He overpaid by more and keeps discussing bankruptcy, but expects to make 5 times his money on the transaction. Many once high-flying stocks have been slaughtered in the chart below.

I have written about my concerns of soft-on-crime policies and the impact on retailers, consumers, employees, real/estate….Walmart’s CEO warned this month that the uptick in crimes need to end or consumers could see higher prices and even stores shutting down. "Theft is an issue. It’s higher than what it has historically been." He added that if the crime wave is not halted soon and if prosecutors don't bring charges against shoplifters, "prices will be higher, and/or stores will close." Crime has weighed heavily on retailers across the country this year, ballooning to a $100 billion problem, the National Retail Federation reported earlier this year. Walmart competitor Target reported this year that shoplifting incidents have increased 50% year over year, causing $400 million in losses. When District Attorneys decide to not prosecute and give a green light to crime, bad things happen. Law abiding citizens are irreparably harmed with higher prices, store closures and dangerous conditions. Hard-working employees will lose jobs as stores are forced to close.

Stanford University (yes that one) released a guide against “harmful language,” including the word, “American.” I am attaching two articles, one from the NY Post and one from the Stanford Review (Newspaper). I beg you to read these articles. This is coming from one of the greatest academic institutions in the world. You cannot make this crap up if you tried. The list is divided into 10 sections: ableist, ageism, colonialism, culturally appropriative, gender-based, imprecise language, institutionalized racism, person-first, violent, and additional considerations. Lots of words/phrases no longer allowed including: American, immigrant, walk-in-hours, master, blind study, gangbusters, beating a dead horse, hip-hip hooray, addicted, Pocahontas, black box, whitespace, crazy, lame, paraplegic, senile, brave, guru, tribe, straight cakewalk and many others. With all the issues in the world, a powerhouse institution wastes time on this ridiculousness? Why not teach these gifted kids more about engineering, math, computer science, history… rather than push them to put their pronouns on the dorm doors and including them in all introductions as a rule of thumb. The multiple page list of banned language can be found here by category.

Interesting article about a woman who bought a “fake” diamond ring in Europe at effectively a garage sale for $15. After decades someone told her to have it appraised and it ended up selling for over $900k as it was a real 25 carat diamond over 100 years old. Why can’t this ever happen to me?

Other Headlines

Bank of Japan shocks global markets with bond yield shift

The Yen rallied sharply against the US Dollar on the news.

Wells Fargo agrees to $3.7 billion settlement with CFPB over consumer abuses

Elon Musk’s poll results are in: He should step down, Twitter voters say

I love Musk and what he has accomplished for the world, but as I have said multiple times, TWTR has been a dumpster fire, and it continues. 17mm votes and 57.5% suggested he step down as CEO. Of note, he keeps talking about bankruptcy for TWTR. Musk is now actively searching for new CEO.

Latest ‘Twitter Files’ show FBI bullied executives over not reporting ‘state propaganda’ enough

Left and Right MUST be concerned about this story and the role Federal Agencies are playing in the media’s decisions on stories.

Auto executives are less confident in EV adoption than they were a year ago

The survey found 76% are concerned that inflation and high interest rates will adversely affect their business next year.

House Ways and Means Committee votes to release years of Trump’s redacted tax records

I was disappointed that Trump did not disclose taxes like every other President. He should have done so, and his excuses were weak. Reports suggest Trump paid ZERO in taxes in 2020 and reported negative income 4 times in 6 years. Part of this may be explained by his R/E business, but it is clear why he was so adamant against publishing returns; he does not make what he suggests he does in income.

Find me a politician and I will find you a liar. I will say that Biden’s lies about his son’s death, GPA, scholarships, his civil rights arrest, job as a tractor trailer driver, his historic stance in the Senate, his business dealings with his son, the laptop and countless others. One of my favorites was Biden’s misinformation about Amtrak and his conductor friends.

Who Is Rep.-Elect George Santos? His Resume May Be Largely Fiction.

This guy makes Biden look like Honest Abe. Check out the story. Nothing in his resume seems legit. This is a crazy liar who should not be in office. Schools claim there is no record of him. Firms claim he never worked there.

CNN boss Chris Licht slams left-wing 'vitriol' aimed at him

CNN boss Chris Licht slammed liberals for criticizing his move to make CNN less partisan, saying it only makes him more confident about his decisions. The uninformed vitriol, especially from the left, has been stunning.”

Again, academia has swung too far left, and students do not feel comfortable engaging in debate. One student told me the teacher said, “Over 50% of Americans identify as LBTGQ today.” When a student questioned her statement, the teacher lost it.

‘Porch pirates’ stole an estimated 260 million packages in 2021

Blinged-out bishop robbed during sermon hit with fraud and extortion charges

I wrote about this guy months ago. He is accused of ripping off parishioners and lying to the FBI. Who would have thunk it with a bishop dressed in diamonds and Gucci? The “Bling Bishop” has declared his innocence.

South African beach sees 'freak wave' kill 3 swimmers, injure 17

Zelensky lands in US ahead of Biden meeting, address to Congress

Crime Headlines

NYC murders are down but not for women and girls

Murder-11% and shootings -17%, but women and girl murders+12% over 2021 according to the article.

Burglar Shanice Aviles busted at Robert De Niro's NYC townhouse

Suspect in Portage Park mass shooting had been released from prison for prior offense

CRAZY video of an assailant who shot multiple people after being let out of jail. There are real consequences for soft-on-crime policies, and he was out for 3 months. Assailant was previously arrested for robbery, assaulting an officer and home invasion. He was kicked out of a birthday party at a bar and murdered people as a result according to the news story. This link has the shocking video, but I must warn you that it is disturbing. Cold-Blooded killer.

Real Estate

An avid reader who is a partner at an advisory firm who is an expert in multi-family real estate gave me a bunch of nuggets of information on how the space is coming under pressure. Given the rising cost of capital and recent frothy trades from 2021, there may be more banks willing to sell loans and discounted prices due to the alternatives in a rising rate environment.

A portfolio of over 20,000 Class A apartments in the Southeast had a delinquency rate of .5% 18 months ago and it is almost 2% today. The occupancy has gone from 98% to low the 90s this year. The lease trade out was 30-35% higher in 2021 and today, it is flat. This means, when someone moves out who was paying $2,000/month, the new rate in 2021 was $2,700 and now it remains at $2,700, as you are no longer getting the increased rents at the huge rates. The implications are serious as the buyers of multi-family who bought in 2021 assumed high trade outs that are no longer materializing, just as they are paying more on their floating rate debt. This is starting to cause distress in some multi-family units.

6 to 7 months ago, he started feeling a change in multi-family. Rate locks went from a couple hundred thousand to millions. A developer built a multifamily 194 unit class A building in little Havana (Miami) for $43mm to sell at $60mm, completing it in 2021. Leased it up fully in 90 days to people from NY, Chicago and LA. The building went under contract for $96mm in March of 2022 and closed in May at $92mm as the rate move impacted the price or the buyer could not close. Today it would be worth approximately $80mm. To build that building today, it would cost almost $60mm. In the summer of 2022, activity plummeted given sellers were stuck at higher prices, and the impact of rates made buyers go on hold.

An investor sold a portfolio of 2,200 apartment units in the Southeast which were purchased in 2014. The apartments were Class B. They had 15-20 buyers in the final round in March/April of 2022 and asked how they are financing it. Every single one said, “70% LTV floating rate.” If you bought that property at that time, your rate was SOFER+3 which was effectively just over 3% and now it would be closer to 7.4%. If you bought it at a 3% cap rate, you are now losing money, which leads into some of the stress in the multi-family space today

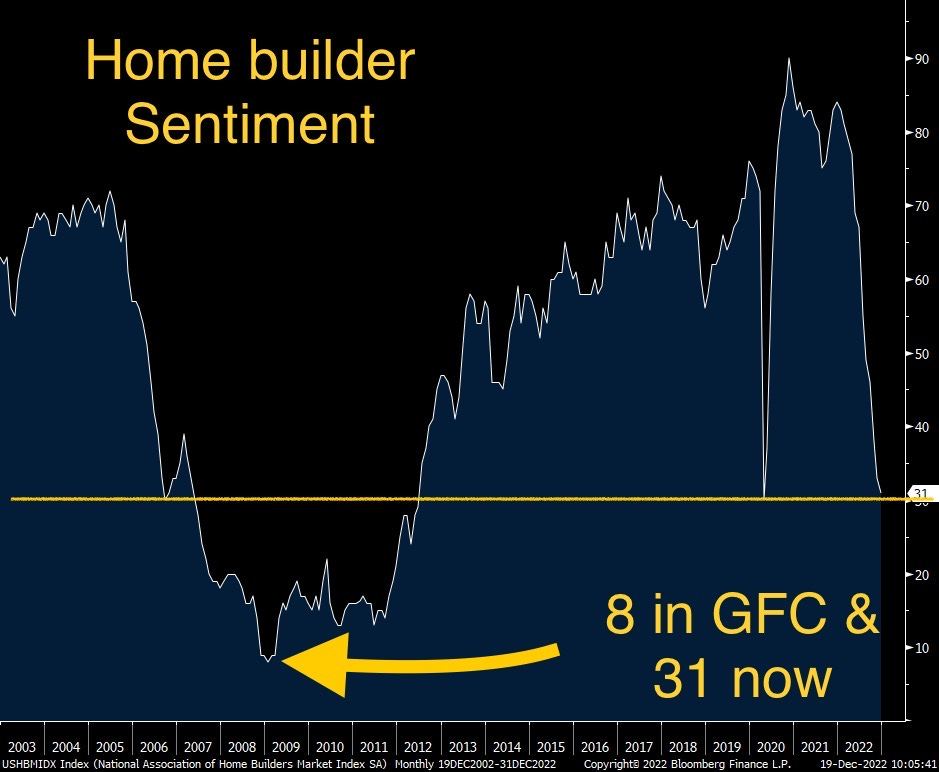

Homebuilder sentiment fell another 2 points to 31 compared with the bottom in April 2020 of 30. It was over 90 in late 2020. During the bottom of the Global Financial Crisis it was 8 as seen in the chart below. However, this recent fall was far faster than prior crashes as can be seen in the near vertical drop in recent months as rates have been increasing in a rapid fashion. “62% of builders are using incentives to bolster sales, including providing mortgage rate buy-downs, paying points for buyers and offering price reduction. But with construction costs up more than 30% since inflation began to take off at the beginning of the year, there is little room for builders to cut prices.” On a positive note, 30 year mortgage rates are approximately 75bps from recent highs as outlined in prior reports. Given the recent reduction in interest rates, coupled with the precipitous drop in sentiment, some are suggesting they expect it to level off in coming months. I could definitely see things begin to stabilize, but not convinced a big snap-back is coming soon. Also of note, you see sentiment bottomed in late 2008/early 2009, but home prices did not trough until early 2012. In my opinion, I feel the housing price bottom will be decently faster than the GFC period due to the massive increase in rates and the steepness of the decline in sentiment over such a short period of time. Home sales fell 7.% in November, the 10th straight month of declines and were down 35.4% year over year.

Bloomberg article on SFO commercial R/E entitled, “Tech’s Bust Delivers Bruising Blow to Hollowed-Out San Francisco.” As mounting signs point to a global recession in 2023, perhaps nowhere in the US stands to struggle more than San Francisco, the center of the technology boom that’s now fast unraveling. Nearly three years into the Covid era, persistent work-from-home habits, inordinately expensive real estate, homelessness and crime are colliding to threaten the city’s growth and its spot among the world’s top-tier metropolises. Thousands of tech layoffs, falling equity values and the crypto meltdown have only deepened the blow to an area long known for innovation and astonishing wealth. Last week, Mayor London Breed said that San Francisco faces a $728 million budget gap over the next two fiscal years because of the slow recovery and tech cutbacks, warning that city departments should find ways to lower costs. Falling office values can hurt property taxes, the city’s biggest revenue source. Articles suggest the next couple years will continue to see deterioration in office vacancy, as 1,300 leases are expiring by 2024. As of 9/30/22, SFO office vacancy was 25.5% according to CBRE and at the start of the pandemic it was 4%. Some SFO sub-markets have vacancy rates well into the 40%+ range.

From my research, I believe Kastle Systems understates the data below, but does it consistently, because it does not have access to all buildings, but a subset.

Other R/E Headlines

Some amazing homes in Sun Valley-$27mm, NYC-$90mm, Palm Beach-$79mm, Beverly Hills-$100mm, Las Vegas-$18mm all listed by Wynn. Great pictures in article.

Mortgage refinance demand surged 6%, as interest rates dropped

Numbers are concerning for the NYC budget.

Virus/Vaccine

Although the data is deteriorating, the rate of growth has slowed in recent days. Is this partially due to the holiday and travel (less testing)? I am not sure.